Weaving It All Together

American International Group, Inc.

2023 Annual Report

PURPOSE & VALUES

Our Purpose is

to discover new

potential by

reimagining

what AIG can

do for you.

Our Values and how

we bring them to life:

TAKE OWNERSHIP

• We set clear expectations

• We are proactive

• We are accountable

SET THE STANDARD

• We deliver quality—always

• We are client-centric

• We lead the industry

WIN TOGETHER

• We are stronger together

• We are aligned

• We are one team

BE AN ALLY

• We strive for inclusion

• We listen and learn

• We speak with our actions

DO WHAT’S RIGHT

• We act with integrity

• We lead by example

• We li up our communities

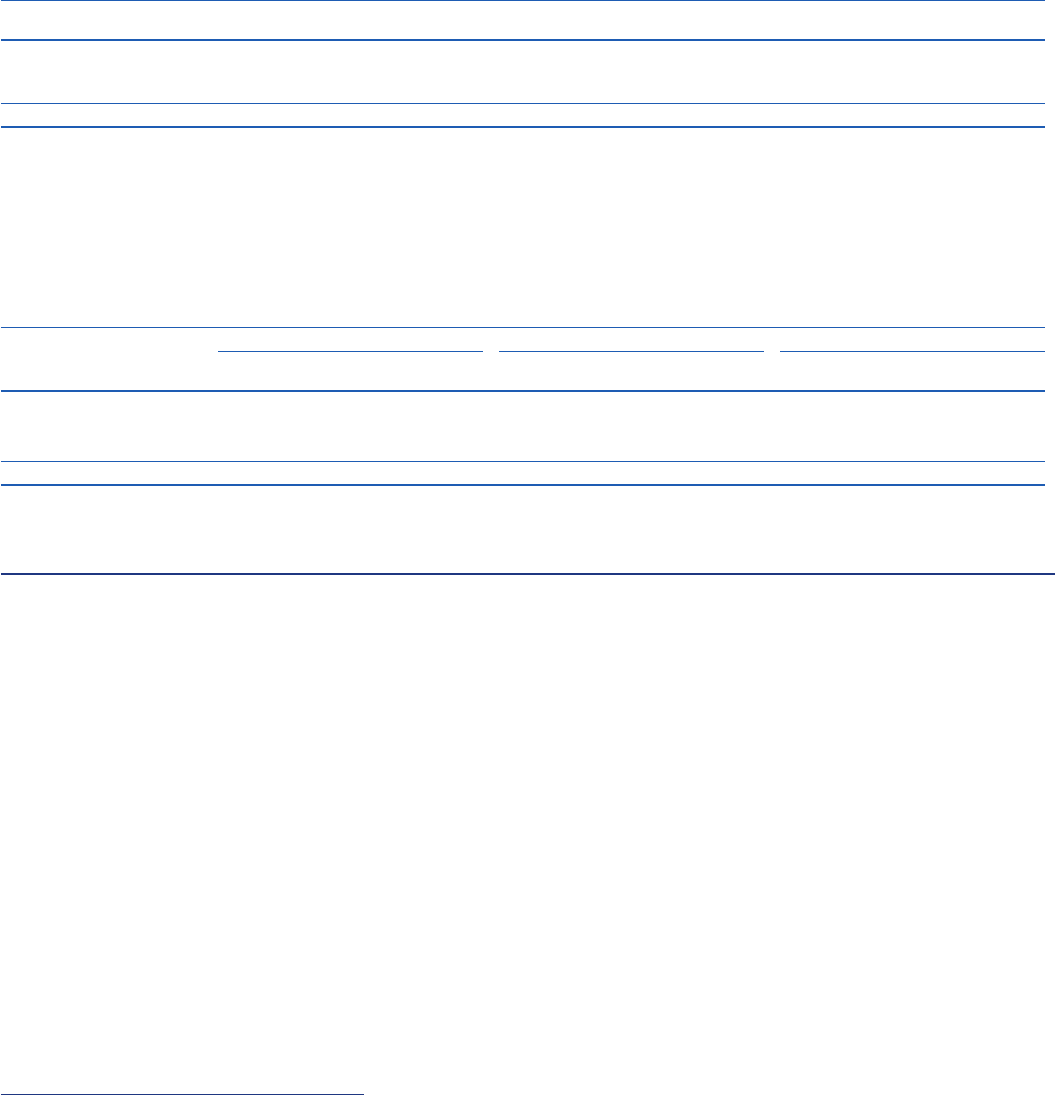

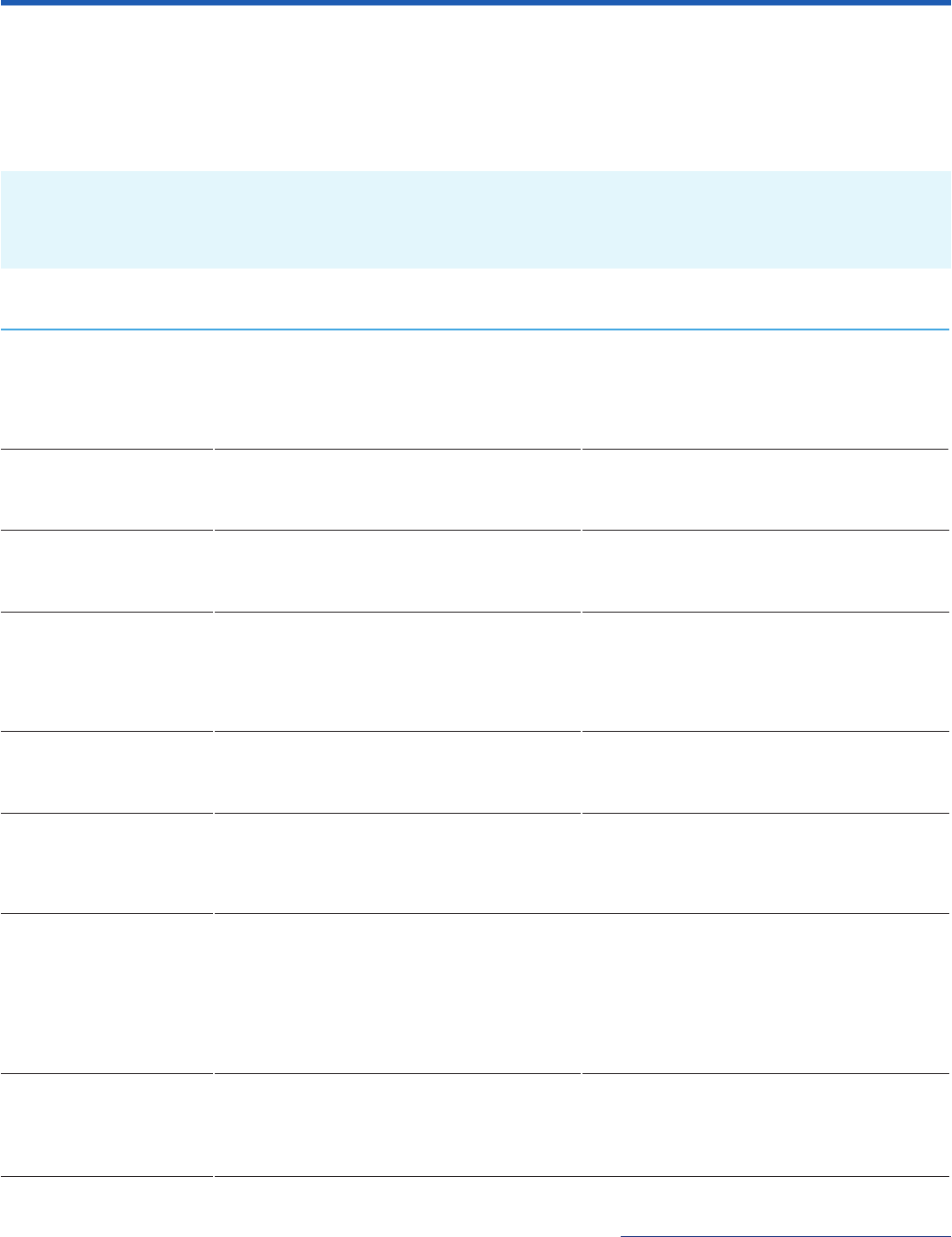

2023 FINANCIAL & STRATEGIC HIGHLIGHTS

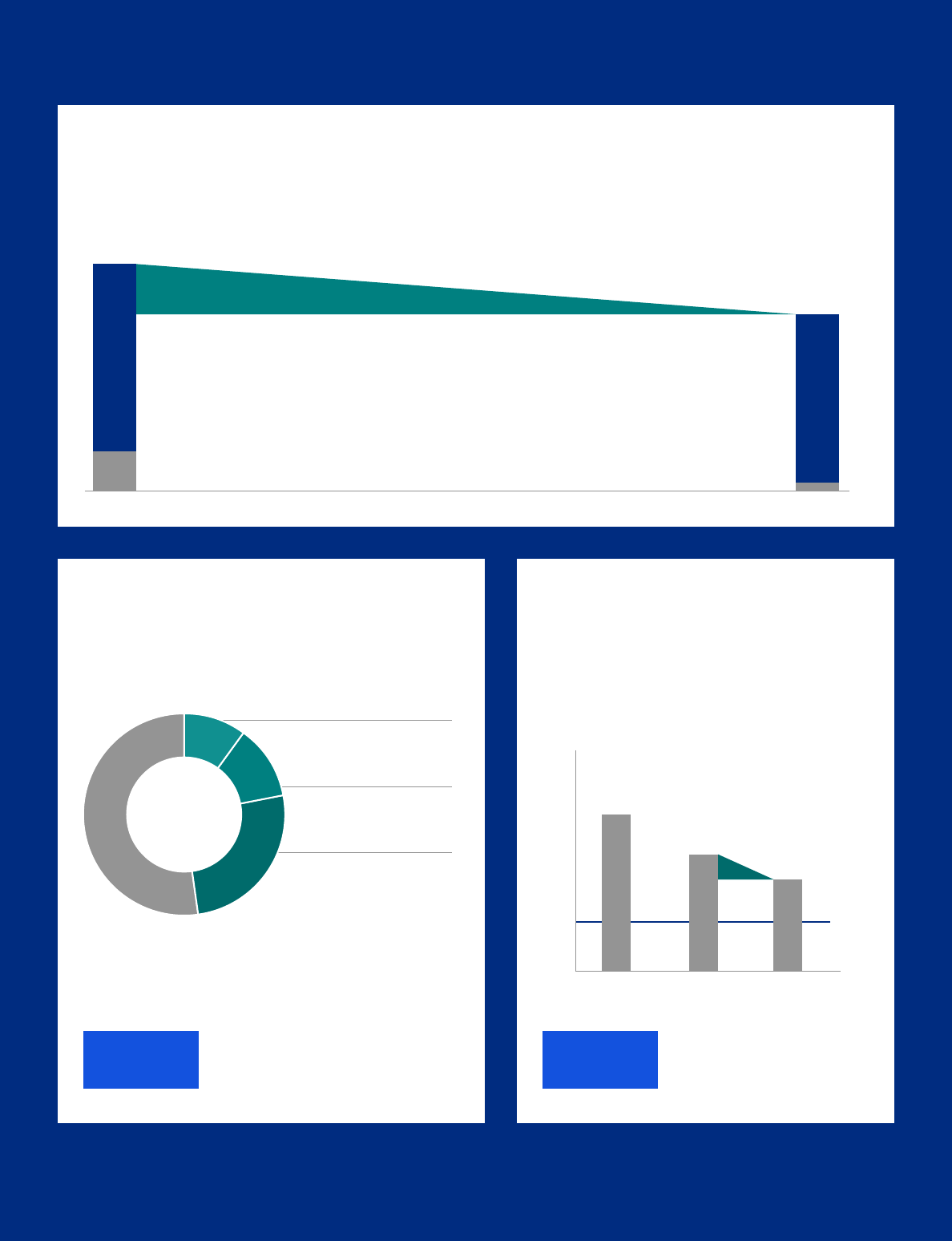

~28-point underwriting profitability improvement and ~$8B underwriting income

increase over seven years

Combined Ratio

118.9

96.0*

90.6

~28 points

improvement

87.7*

2016

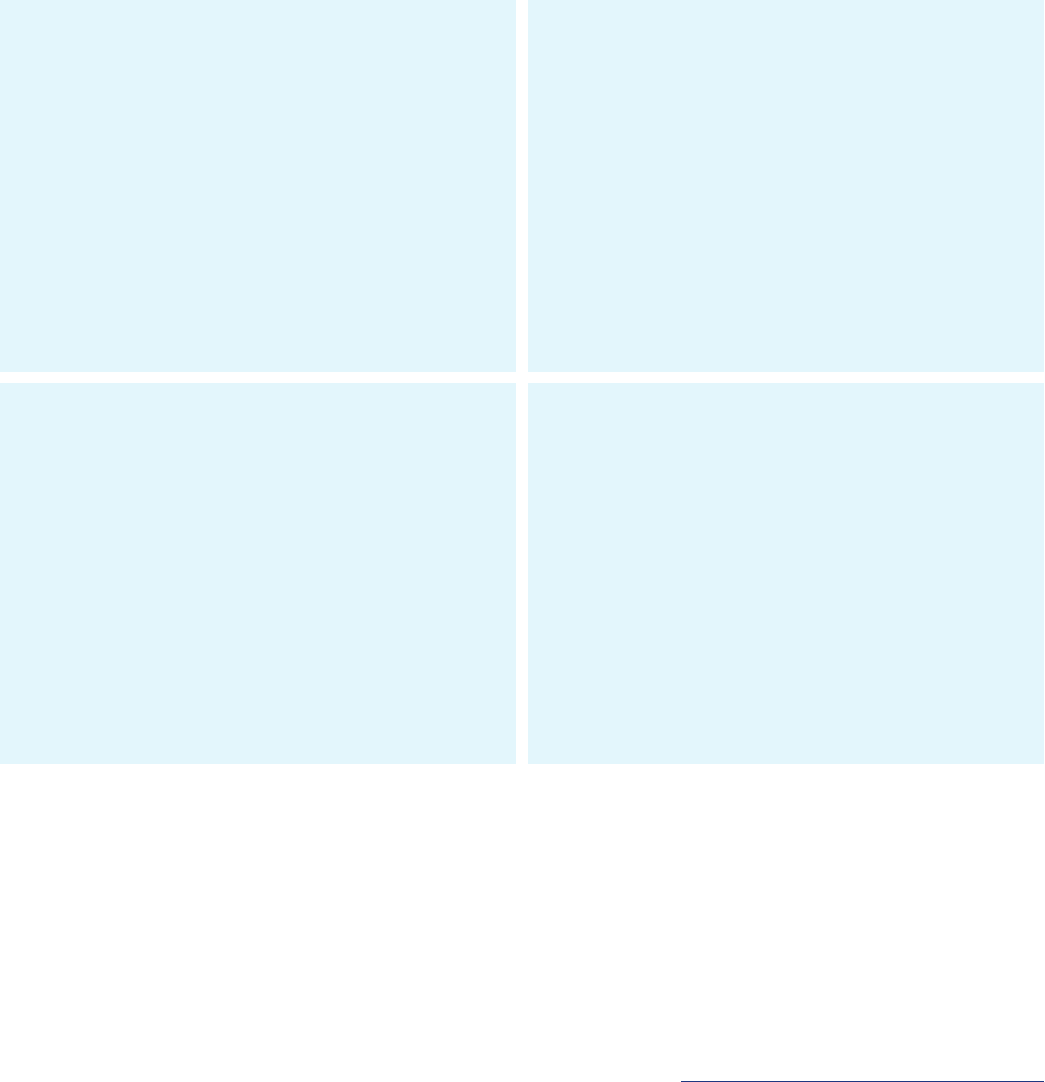

Approaching Corebridge deconsolidation

with 52% remaining stake at year-end

Corebridge Separation Actions

Blackstone Investment

2021

Initial Public Oering

September 2022

Three Secondary

Public Oerings and

Buybacks 2023

$2.9B

cash proceeds from

Secondary Public Offerings

capital to AIG

from Corebridge dividends and

share repurchases in 2023

$1. 4B

2023

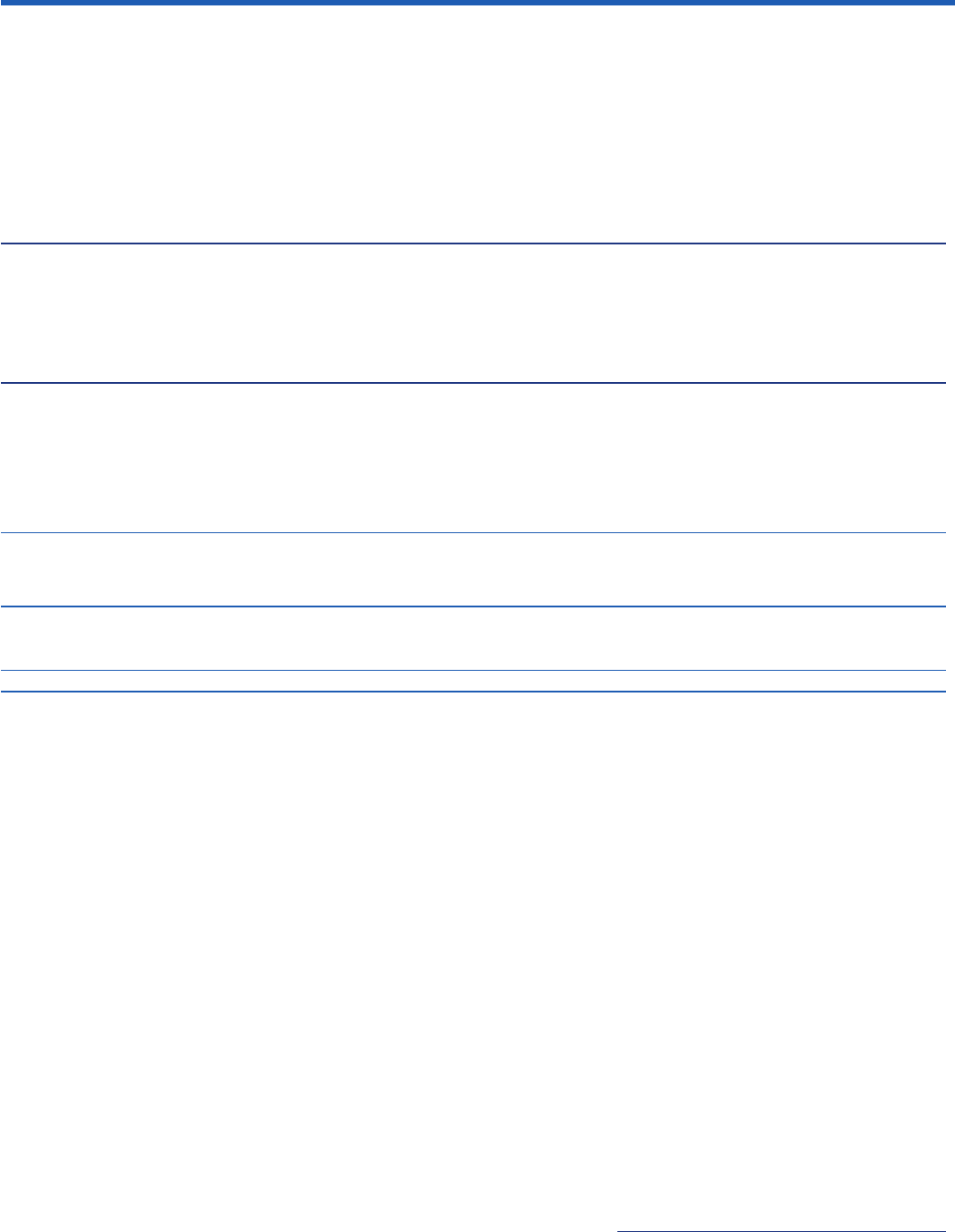

Balanced capital management

supported financial strength,

growth and shareholder

capital return

Common Shares Outstanding

(millions, at year end)

900

800

700

600

500

12. 5%

increase to quarterly

common stock dividend

6%

reduction from

$3B of repurchases

2021 2022 2023

*This is a non-GAAP financial measure. The definition and reconciliation of accident year combined ratio, as adjusted, to the most comparable GAAP measure

are on pages 288 and 289 of this Annual Report and page 68 of the 2023 Form 10-K.

AIG 2023 ANNUAL REPORT 1

LETTER TO SHAREHOLDERS

Dear AIG

Shareholder:

2023 was a year of

exceptional achievement

for AIG. In this letter to

our shareholders, I am

very pleased to share the

continued progress that

AIG has made on our

strategic repositioning as

well as our operational

capabilities, along with

our financial results, all of

which were outstanding.

Last year was a continuation of our multi-year

journey to become a top-performing global insurance

company wherein we accelerated our progress on a

number of important initiatives while simultaneously

driving improved underwriting profitability, strengthening

our balance sheet and returning capital to shareholders.

As a result of all that we accomplished in 2023, we

finished the year with very strong parent liquidity of

$7.6 billion. We have maintained significant financial

flexibility, continued to execute on our capital

management strategy, reduced debt by $1.4 billion and

returned approximately $4 billion to AIG shareholders

through $3 billion of common stock repurchases and

$1 billion of dividends, including a 12.5% increase in

the common stock dividend in the second quarter

of 2023. Last year, we reduced our common shares

outstanding by 6%, and by 16% since year-end 2021,

during which time we also reduced the financial

debt and hybrids on AIG’s balance sheet, excluding

Corebridge Financial, Inc., by over 50% or over

$11 billion. Our insurance company subsidiaries remain

strongly capitalized in order to continue supporting

organic growth where opportunities exist.

We entered 2024 with strong momentum, investing in

both our colleagues, who are our greatest asset, and

our businesses for sustainable profitable growth, while

also positioning AIG to further sell down our ownership

position of Corebridge, and we will continue to

execute on our balanced capital management

strategy. We have introduced AIG Next, our future

state operating structure that will create value by

weaving together a leaner, more unified company.

2023 Highlights

In many ways, 2023 was our best year yet. The

tremendous progress we have made enabled us to

build on the foundational capabilities that we cultivated

over the last several years, and as a result, we continue

to deliver sustained and improved performance.

2 AIG 2023 ANNUAL REPORT

PETER ZAFFINO

Chairman & Chief Executive Officer

American International Group, Inc. (AIG)

AIG is now recognized as a leading global insurer in

an environment of increasing global complexity,

socio-political disruption and escalating risk.

In 2023, we delivered exceptional underwriting

profitability and our best underwriting performance

in recent times. We surpassed our 2022 results with

underwriting income increasing 15% year-over-year

to $2.3 billion and our full-year 2023 combined ratio

improving 130 basis points year-over-year to 90.6%.

The strength of our performance can be seen in our

bottom-line results, with net income of $3.9 billion,

or $4.98 per diluted share, and adjusted aer-tax

income* of $4.9 billion, or $6.79 per diluted share,

up 33%, which drove our 2023 Return on Common

Equity to 8.6% and Adjusted Return on Common

Equity (Adjusted ROCE)* to 9.0%, an increase of nearly

200 basis points year-over-year as we approach our

10%+ Adjusted ROCE* target.

Our General Insurance results were driven by

continued strong underwriting, with high client

retention and new business, as well as risk-

adjusted rate increases above loss cost trends

across our portfolio. In 2023, Global Commercial

Lines had substantial renewal retention of 88%

in its in-force portfolio, as well as very strong new

business performance. Having worked to reposition

the business over the last several years, Global

Commercial is now one of the most respected

portfolios in the industry.

The significant benefit of our disciplined deployment

of our risk framework could be seen across our

businesses. To highlight a few, Lexington and Global

Specialty delivered outstanding performance in

2023, as we remained very focused on investing to

accelerate their growth and continue to deliver strong

underwriting profitability. Lexington grew its net

premiums written** by 17% year-over-year.

underwriting income increase

2022-2023

15%

improvement in 2021 and 2022

compared to prior year

$1B

AIG 2023 ANNUAL REPORT 3

“In many ways, 2023 was our best year yet. The

tremendous progress we have made enabled

us to build on the foundational capabilities that

we cultivated over the last several years, and as

a result, we continue to deliver sustained and

improved performance. AIG is now recognized

as a leading global insurer...”

Growth was driven by historically high retention

and $1 billion of new business. Global Specialty,

which includes businesses in marine, energy, trade

credit and aviation, grew its net premiums written**

10% year-over-year, driven by 88% retention and

approximately $750 million of new business.

Our results reflect our focus on carefully managing

volatility in both our underwriting and investments.

In 2022, we fundamentally shied our investment

strategy and that is reflected in our results. Our

improved strategic asset allocation guidelines and a

SUSTAINABLE, PROFITABLE GROWTH IN

GLOBAL COMMERCIAL LINES 20182023

$1.4T

gross limits reduction

underwriting income improvement

$4.5B

higher interest rate environment resulted in returns

increasing approximately 25% year-over-year.

Life & Retirement had a record sales year, increasing

its premiums and deposits* by 26% to over $40billion

across its four businesses, driven by growth in

its broad suite of spread products. In addition, it

improved its adjusted pre-tax income* by 15% to

$3.8billion. This improvement was driven by earnings

growth in Individual Retirement and Institutional

Markets that benefited from growth in general

account products and base spread expansion.

Last year, we successfully executed on several

divestitures, including Validus Reinsurance, Ltd.

(Validus Re) and Crop Risk Services, Inc. (CRS),

and the strategic repositioning of Private Client

Select to an independent Managing General Agent

platform. These actions simplified our portfolio,

reduced volatility, allowed us to accelerate our

capital management strategy and helped us unlock

significant value for AIG shareholders. We also made

continued progress towards Corebridge’s operational

separation, another major strategic milestone.

We completed three secondary oerings of

Corebridge in 2023 that generated approximately

$2.9 billion in proceeds, and we worked with

Corebridge on the divestiture of Laya Healthcare

4 AIG 2023 ANNUAL REPORT

AIG CHAIRMAN & CEO PETER ZAFFINO

discusses AIG’s strategic milestones and the

future of risk on Bloomberg’s “The David

Rubenstein Show: Peer-to-Peer Conversations.”

and announced the sale of their UK Life business,

which is targeted to close in the second quarter of

2024. Last year, AIG received $1.4 billion of capital

from Corebridge through $385 million of regular

dividends, $688 million of special dividends and

$315million of share repurchases. At the end of 2023,

our ownership stake in Corebridge was approximately

52%, and we expect to continue reducing

our ownership and eventually deconsolidate

Corebridge in 2024, subject to market conditions.

For several years, we have focused on the strategic

repositioning of AIG through improved underwriting

profitability and the simplification of our portfolio.

While we continue to focus on areas to improve our

underwriting, the remediation of our portfolio is

largely behind us.

Our Path to Industry Leadership

The remediation actions we have taken over the

last several years were part of a complex series of

carefully orchestrated strategic initiatives executed

with tremendous discipline.

Among the many foundational issues we

encountered at the beginning of our turnaround

journey was the bottom-decile underwriting

performance and the urgent need to instill a culture

of underwriting excellence that would produce more

predictable, profitable and less volatile results over

the long term. Some examples of the significant

progress we achieved are outlined below.

• We hired hundreds of experienced underwriters

and claims experts to supplement our existing

capabilities in order to reposition the global

portfolio, reducing gross limits by over $1.4 trillion

in aggregate and reducing limits deployed on a

single risk, while also implementing cumulative rate

increases on our gross portfolio of 60% since 2018.

• We changed underwriting authorities across

the globe, developed best practices and closely

aligned our underwriting limit deployment.

• We established a more prudent and sustainable

reserving philosophy, addressing early on reserve

inadequacy in certain lines, and overhauled our

claims and actuarial operations.

• We architected and implemented a strategic

reinsurance program from the ground up,

representing a vastly dierent approach by

eectively managing and protecting our balance

sheet, mitigating both severity and frequency of

loss, and fostering an eective partner ecosystem

both in terms of its quality and breadth.

The results have been truly remarkable. In the years

2008–2018, AIG’s cumulative underwriting losses

totalled more than $30 billion and in stark contrast,

today, we generate a very strong annual underwriting

profit, which was over $2 billion in each of 2022

and2023.

AIG 2023 ANNUAL REPORT 5

— —

—

“The results have been truly remarkable. In the

years 2008–2018, AIG’s cumulative underwriting

losses totalled more than $30billion and in stark

contrast, today, we generate a very strong annual

underwriting prot, which was over $2 billion in

each of 2022 and 2023.”

Since 2016, we have delivered an outstanding

improvement on our full-year combined ratio of

over 2,800 basis points. By 2022, we achieved our

target of a full-year, sub-90 accident year combined

ratio, as adjusted,* following 18 consecutive quarters

of improvement. I am particularly proud of the

sustainability of our improved results.

The extraordinary improvement in AIG’s gross

underwriting performance has enabled outstanding

reinsurance outcomes, and this remains the case

even in the current environment of heightened

risk and reinsurers’ increased discipline. The need

for eective ventilation of risk, enhanced with

reinsurance, is essential to commercial insurance

providers, and this philosophy dierentiates AIG.

Dissenting views in the market emerged in 2023 on

the importance of reinsurance. We continue to believe

it is a critical component to an underwriting strategy

which demonstrates consistency in reinsurance

purchasing to reflect the current portfolio.

2023 TRANSACTIONS

Repositioning AIG’s portfolio of businesses and separating a U.S.-focused Corebridge

AUGUST

Common Stock

Dividend Increase

6 AIG 2023 ANNUAL REPORT

JUNE

— Corebridge Secondary Public Oering

— Corebridge Special Dividend

— Corebridge Share Repurchase from AIG

JULY

— AIG Sale of Crop Risk Services

— AIG Formation of Private Client

Select MGA Partnership

— AIG Quarterly

SEPTEMBER

— Corebridge Agreement

to Sell UK Life Business

—

We balance disciplined underwriting aligned to the

evolving market with the strategic use of reinsurance

to mitigate unpredictable outcomes. 2023 was

a particularly challenging year for the insurance

industry in which natural catastrophe insured loss

activity remained at the forefront, with a record-

setting 37 events that exceeded $1 billion of insured

loss, and the sixth year out of the last seven with total

insured losses exceeding $100 billion.***

Building long-term relationships with our reinsurance

partners has been key to repositioning AIG. Insurers

cannot reverse social and economic inflation.

However, we are in control of how we anticipate

and respond to the impact of these changes to

the forward-looking landscape, including how we

manage our underwriting through coverage provided,

limits deployed, attachment points and pricing.

One area of increased focus throughout the industry

has been casualty insurance. The heightened

attention is driven by the increased impacts of

rising economic and social inflation, litigation

funding, mass tort events and other external forces

2023 AIG

WOMEN’S

OPEN WINNER

LILIA VU

celebrates

her championship

victory.

that increase average severity trends through both

legal costs and higher jury awards throughout the

industry. Our business is not immune from social

inflation, but we anticipated it early and we took

action by preempting the evolving changes in the

market and using reinsurance strategically to mitigate

unpredictable outcomes. We are very pleased with

our existing portfolio and we are well positioned to

be able to prudently take advantage of opportunities

that exist in the current marketplace.

OCTOBER NOVEMBER DECEMBER

— Corebridge Special Dividend — Corebridge Secondary Public Oering

— AIG Sale of Validus Re — Corebridge Share Repurchase from AIG

— Corebridge Secondary Public Oering

AIG 2023 ANNUAL REPORT 7

— Corebridge Sale of

Laya Healthcare

AIG’s global Casualty portfolio represents 14% of

General Insurance net premiums written in 2023, with

significant reduction in limits across our Casualty

lines. In North America Casualty, our gross limit

for our Excess Casualty portfolio, including lead

umbrella, has decreased by over 50% since 2018

and our average limit size has also reduced by over

50%. Average lead attachment points, which protect

us from frequency and lower severity losses, have

more than doubled since 2018. We have been closely

assessing loss trends in these lines for several years,

before Casualty rates accelerated in 2023.

In addition to our underwriting improvement, our

journey has entailed a substantial transformation

of our operations, including investments in

“By weaving together

the best of AIG

across our businesses,

operations, functions

and technology, we are

reinforcing a strong

foundation that will

serve us on our journey

for years to come.”

foundational capabilities to modernize our

infrastructure, improve end-to-end processes

and capture and utilize data more eectively.

We performed a significant amount of diligence

in 2019 to design and launch an operational

program, AIG 200, which we accelerated during

the global pandemic. The complexity and scale

of this undertaking was significant, but the results

were meaningful — we substantially improved our

company and we achieved $1 billion of cost savings.

Our improved performance and strategic initiatives

have supported our substantial capital management

accomplishments. From 2018 through 2023, AIG has

completed over $40 billion of capital management

actions, consisting of dividend payments, share

repurchases and debt reduction.

In addition to returning capital to shareholders

and reducing shares outstanding, we have focused

methodically on both reducing debt load and debt

leverage. Since year-end 2021, we have reduced AIG’s

outstanding debt by over 50%, or more than $11 billion.

We have reduced AIG’s financial debt and hybrids

from $23.1 billion at year-end 2018 to $10.3 billion

at year-end 2023. Our total debt plus preferred to

total capital ratio excluding accumulated other

comprehensive income* improved by 4.5 points from

28.8% in 2018 to 24.3% in 2023. We expect further

improvement towards our low 20% target range upon

the deconsolidation of Corebridge.

AIG’s insurance subsidiaries continue to have

suicient capacity to allow for growth where there is

the greatest opportunity for risk-adjusted returns. The

strength of capital in the subsidiaries has improved

substantially, with a U.S. Pool risk-based capital

ratio of under 400% at year-end 2018 moving up to

over 460% at 2023, and all of our Tier 1 international

insurance subsidiaries are at or above our target

capital ranges. The U.S. subsidiaries are now set up as

ordinary dividend payers, bringing financial flexibility

we did not have before.

8 AIG 2023 ANNUAL REPORT

AIG 2023 ANNUAL REPORT

AIG COLLEAGUES

participate in an early career

professional development event.

Looking to 2024 and Beyond

Given the volatility and uncertainty of the global

economic, political and social environment,

the insurance industry landscape will likely

evolve in the coming years, while playing a very

important role. As in past cycles, these conditions

may lead to a marketplace that is prepared for

disruption. In 2024, our highest priority remains

underwriting excellence. We expect 2024 to be

another landmark year, in which our ownership

of Corebridge will most likely fall below 50% and

we no longer consolidate our results, enabling us

to be a simpler company that will focus on our

commercial and personal insurance businesses.

We will continue to execute our capital management

strategic priorities — we allocate capital thoughtfully

to focus on growth where we see potential for

stronger risk-adjusted returns. We believe a

strategy of high-quality growth will deliver more

value to our stakeholders in the short, medium

and long term. With our continued focus on debt

management, we will continue returning capital

to shareholders through share repurchases and

dividends, along with pursuing any compelling

strategic acquisitions should the opportunity emerge.

Guiding our pursuit of excellence in 2024 will be

the execution of our primary objective, AIG Next,

a program that will create a slimmer, less complex

company with the appropriate infrastructure and

capabilities for the size of business we will be post

Corebridge deconsolidation.

As part of AIG Next, we are creating a leaner parent

company with a target cost structure of 1% to 1.5%

of net premiums earned, while further positioning

AIG for the future by operationalizing enterprise-

wide standards and driving global consistency and

local relevance across our end-to-end systems.

Overall, we expect the simplification and eiciencies

created through AIG Next to generate $500 million

of sustained annual run rate savings and to incur

approximately $500 million of one-time spend to

achieve these savings. These savings will allow us

to make meaningful progress toward achieving an

Adjusted ROCE* in excess of 10%.

AIG 2023 ANNUAL REPORT 99

Three-year Total Shareholder

Return outperforming the S&P 500

92.1%

We are making investments in the implementation

of large language models and artificial intelligence

to complement our underwriters in providing deeper

insights and improve decision-making, enabling us

to create a better and dierentiated experience for

our clients and partners. We are using technology to

respond to a greater number of submissions, faster,

in markets of particular potential and launching new

products that reflect how we thoughtfully listen to

clients and distribution partners.

We believe that creating a better and dierentiated

experience for our colleagues is essential to our

progress in raising our standards of client service. We

are fostering a committed and inclusive culture by

encouraging focused discussions on our Values and

behaviors that guide how we collaborate, how we

lead teams and how we treat each other.

We are instilling a “learn-it-all” culture that inspires

continuous learning, improvement and collaboration.

A key premise of a “learn-it-all” culture is openness to

new ideas and professional challenges. An impressive

depth of talent lies within AIG which fosters

agility and enables us to draw from all parts of our

company to identify and encourage movement to fill

key roles. This in turn provides accelerated learning,

development and career enhancement opportunities

as we retain and attract top talent and help our

colleagues discover their full potential.

By weaving together the best of AIG across our

businesses, operations, functions and technology,

we are reinforcing a strong foundation that will serve

us on our journey for years to come. Our ability to

execute has enabled us to deliver sustained strong

financial results. While we don’t talk enough about

our ability to execute, it remains one of our best

attributes. Our high-quality outcomes on multiple

complex initiatives has accelerated our progress and

created a more focused and simplified AIG that is well

positioned for the future.

Thanks to the tremendous commitment and

contributions of our AIG colleagues around the

world, and the support of our Board of Directors, our

industry leadership and distinct market advantages

are being recognized by our clients, distribution

partners and stakeholders. AIG is positioned for

growth and well-placed to help our customers,

partners and stakeholders navigate an increasingly

complex global risk environment.

As I enter my seventh year at AIG, I have never been

more optimistic about our opportunities in the future

and our momentum to becoming a top-performing

global company.

Sincerely,

Peter Zaino

Chairman & Chief Executive Oicer

American International Group, Inc. (AIG)

*Refers to financial measure not calculated in accordance with generally accepted accounting principles (non-GAAP); definitions of

non-GAAP measures can be found on pages 46-47 of the 2023 Form 10-K and page 288 of this Annual Report. The reconciliations to

their closest GAAP measures can be found on pages 63, 64, 68 of the 2023 Form 10-K and page 289 of this Annual Report.

**Net premiums written on a comparable basis reflects year-over-year comparison on a constant dollar basis adjusted for the

International lag elimination. Refer to page 289 for more detail.

***Aon. 2024 Climate and Catastrophe Insight, January 23, 2024.

10 AIG 2023 ANNUAL REPORT

TOP, FROM LEFT: James (Jimmy) Dunne III; Linda A. Mills; Vanessa A. Wittman;

Peter R. Porrino; John (Chris) Inglis; W. Don Cornwell BOTTOM, FROM LEFT:

James Cole, Jr.; Paola Bergamaschi; John G. Rice; Peter Zaffino; Diana M. Murphy

Board of Directors

Peter Zafino

Chairman & Chief Executive

Oicer, AIG

Paola Bergamaschi

Former Global Banking and

Capital Markets Executive at

State Street Corporation,

Credit Suisse and

Goldman Sachs

James Cole, Jr.

Chairman & Chief Executive Oicer

of The Jasco Group, LLC; Former

Delegated Deputy Secretary of

Education and General Counsel of

the U.S. Department of Education;

Former Deputy General Counsel

of the U.S. Department of

Transportation

W. Don Cornwell*

Former Chairman of the Board

& Chief Executive Oicer,

Granite Broadcasting Corporation

James (Jimmy) Dunne III

Vice Chairman and Senior Managing

Principal, Piper Sandler Co.

John (Chris) Inglis

Senior Strategic Advisor, Paladin

Capital Group; Former U.S. National

Cyber Director and White House

Cybersecurity Advisor

Linda A. Mills

President, Cadore Group, LLC;

Former Corporate Vice President

of Operations, Northrop Grumman

Corporation

Diana M. Murphy

Managing Director,

Rocksolid Holdings, LLC

Peter R. Porrino

Former Executive Vice President

& Chief Financial Oicer,

XL Group Ltd

John G. Rice

Lead Independent Director, AIG;

Former Non-Executive Chairman,

GE Gas Power; Former Vice Chairman,

GE; Former President & Chief

Executive Oicer, GE Global Growth

Organization

Vanessa A. Wittman

Former Chief Financial Oicer,

Glossier, Inc.

*In accordance with AIG’s Corporate Governance Guidelines, Mr. Cornwell’s service on the Board will expire on the day of the 2024 Annual Meeting.

AIG 2023 ANNUAL REPORT 11

Executive Leadership Team

Peter Zaino

Chairman & Chief

Executive Oicer

Don Bailey

EVP, Chief Executive Oicer,

North America Insurance

Tom Bolt

EVP, Chief Risk Oicer

Ed Dandridge

EVP, Chief Marketing &

Communications Oicer

Ted Devine

EVP, Chief Administrative Oicer

Charlie Fry

EVP, Reinsurance and

Risk Capital Optimization

Rose Marie Glazer

EVP, General Counsel and

Interim Chief Human Resources

& Diversity Oicer

Jon Hancock

EVP, Chief Executive Oicer,

International Insurance

David McElroy

EVP, Chairman,

General Insurance

Roshan Navagamuwa

EVP, Chief Information Oicer

Sabra Purtill

EVP, Chief Financial Oicer

Chris Schaper

EVP, Global Chief

Underwriting Oicer

Jennifer Silane

EVP, Chief of Sta to

AIG Chairman & CEO

Peter Zaino

Claude Wade

EVP, Chief Digital Oicer

and Global Head of

Business Operations

Kevin Hogan (not pictured)

Chief Executive Oicer,

Corebridge Financial

STANDING, FROM LEFT: Don Bailey; Jennifer Silane; Peter Zaffino; Rose Marie Glazer; Ted Devine

SEATED, FROM LEFT: Sabra Purtill; Roshan Navagamuwa; Chris Schaper; Tom Bolt; Claude Wade;

Jon Hancock; David McElroy; Charlie Fry; Ed Dandridge

12 AIG 2023 ANNUAL REPORT

☑ ☐

☑

☑ No ☐

☑

☐

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

——————————

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-8787

American International Group, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

13-2592361

(I.R.S. Employer Identification No.)

1271 Avenue of the Americas, New York, New York

(Address of principal executive offices)

10020

(Zip Code)

Registrant’s telephone number, including area code: (212) 770-7000

——————————

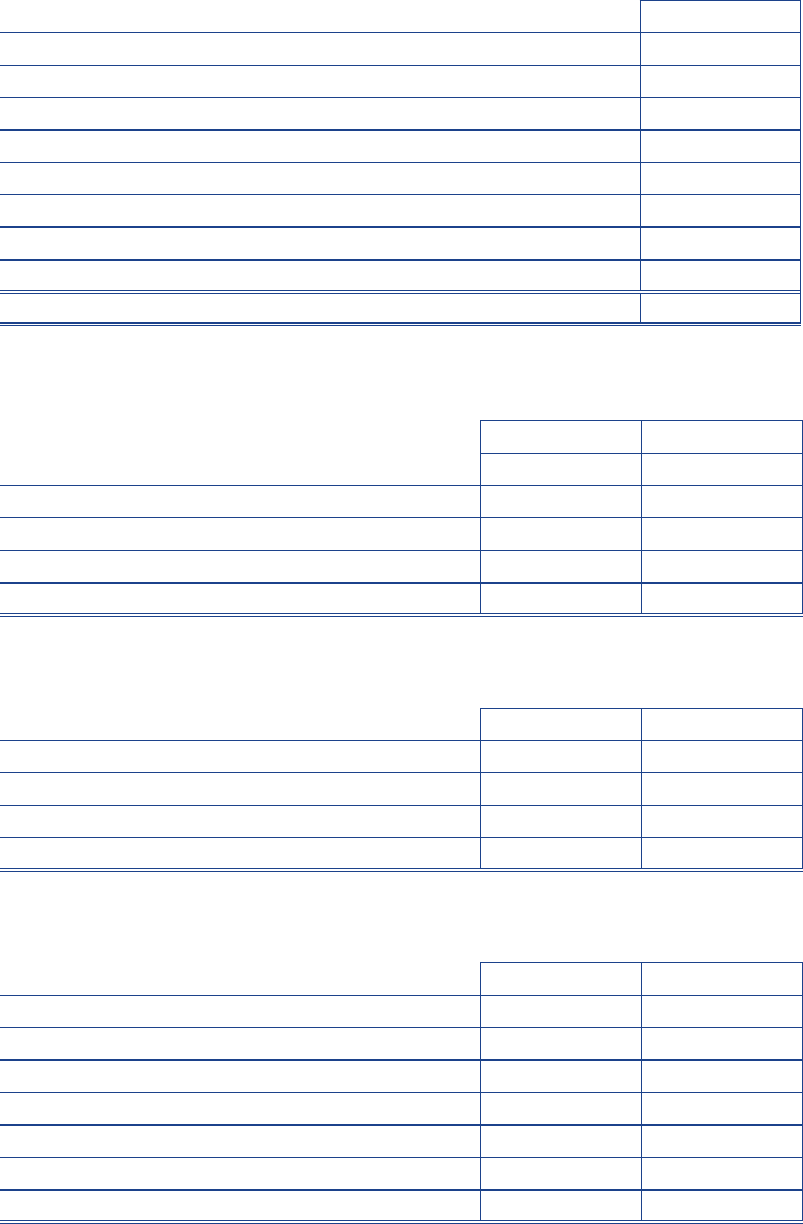

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

Common Stock, Par Value $2.50 Per Share AIG New York Stock Exchange

4.875% Series A-3 Junior Subordinated Debentures AIG 67EU New York Stock Exchange

Depositary Shares Each Representing a 1/1,000th Interest in a Share of

Series A 5.85% Non-Cumulative Perpetual Preferred Stock AIG PRA New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

——————————

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such

files). Yes No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the

filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2023, the aggregate market value of the registrant's voting and nonvoting common equity held by nonaffiliates was approximately

$36,903,000,000.

As of February 8, 2024, 680,953,652 shares of the registrant's Common Stock, $2.50 par value per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Document of the Registrant

Portions of the registrant’s definitive proxy statement for the 2024 Annual Meeting of Shareholders

Form 10-K Reference Locations

Part III, Items 10, 11, 12, 13 and 14

AMERICAN INTERNATIONAL GROUP, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

FORM 10-K

Item Number Description Page

Part I

ITEM 1 Business 2

• Our Global Business Overview 2

• Operating Structure 4

• How We Generate Revenues and Profitability 5

• Human Capital Management 5

• Regulation 7

• Available Information about AIG 14

ITEM 1A Risk Factors 15

ITEM 1B Unresolved Staff Comments 37

ITEM 1C Cybersecurity 38

ITEM 2 Properties 40

ITEM 3 Legal Proceedings 40

ITEM 4 Mine Safety Disclosures 40

Part II

ITEM 5

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities 41

ITEM 6 [Reserved] 42

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations 43

• Cautionary Statement Regarding Forward-Looking Information and Factors That May Affect Future Results 43

• Use of Non-GAAP Measures 46

• Critical Accounting Estimates 48

• Executive Summary 57

• Consolidated Results of Operations 60

• Business Segment Operations 65

• Investments 86

• Insurance Reserves 96

• Liquidity and Capital Resources 104

• Enterprise Risk Management 114

• Glossary 122

• Acronyms 124

ITEM 7A Quantitative and Qualitative Disclosures About Market Risk 124

ITEM 8 Financial Statements and Supplementary Data 125

Reference to Financial Statements and Schedules 125

ITEM 9 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 259

ITEM 9A Controls and Procedures 259

ITEM 9B Other Information 260

ITEM 9C Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

Part III

ITEM 10 Directors, Executive Officers and Corporate Governance

ITEM 11 Executive Compensation 262

ITEM 12 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 262

ITEM 13 Certain Relationships and Related Transactions, and Director Independence 262

ITEM 14 Principal Accountant Fees and Services 262

Part IV

ITEM 15 Exhibits and Financial Statement Schedules 263

ITEM 16

Form 10-K Summary 267

Signatures 268

AIG | 2023 Form 10-K 1

260

261

Part I

ITEM 1 | Business

Creating Value through

Profitable Growth and a

Culture of Underwriting and

Operational Excellence

Sustaining Industry

Leadership Momentum

American International Group, Inc. (NYSE: AIG)

is a leading global insurance organization. AIG provides insurance solutions that help

businesses and individuals in approximately 190 countries and jurisdictions protect their

assets and manage risks through AIG operations and network partners.

AIG is building on its industry leadership and is positioned to become a top-performing

company recognized for the value it provides stakeholders in an environment of

profound, complex and dynamic risk. In 2023, AIG delivered an outstanding year,

producing financial, strategic and operational achievements that demonstrate continued

strength in executing multiple, complex initiatives simultaneously and with quality.

In this Annual Report, unless otherwise mentioned or unless the context indicates otherwise, we use the terms “AIG,” the “Company,”

“we,” “us” and “our” to refer to American International Group, Inc., a Delaware corporation, and its consolidated subsidiaries. We use

the term “AIG Parent” to refer solely to American International Group, Inc., and not to any of its consolidated subsidiaries.

About AIG

World-Class Insurance Franchises

that are among the leaders in their

geographies and segments, providing

differentiated service and expertise.

Breadth of Loyal Customers

including millions of clients and

policyholders ranging from multi-national

Fortune 500 companies to individuals

throughout the world.

Broad and Long-Standing

Distribution Relationships

with brokers, agents, advisors, banks and

other distributors strengthened through

AIG’s dedication to quality.

Highly Engaged Global Workforce of more than 25,000

colleagues committed to excellence who are providing

insurance solutions that help businesses and individuals in

approximately 190 countries and jurisdictions protect their

assets and manage risks through AIG operations and network

partners.

Balance Sheet Strength and Financial Flexibility

as demonstrated by approximately $45 billion in shareholders’

equity and AIG Parent liquidity sources of $12.1 billion as of

December 31, 2023.

AIG | 2023 Form 10-K 2

ITEM 1 | Business

As a leading global property, casualty and specialty insurance organization, we are results oriented and believe that focusing on how

we achieve positive outcomes creates an aligned and inclusive culture that enables further progress. Unifying under one set of clear

and directive Purpose and Values empowers AIG colleagues to be conduits of positive change – delivering exceptional client service,

enhanced shareholder value and a better experience for everyone we serve.

AIG’s five Values guide our actions:

• Take ownership: we set clear expectations, we are proactive, we are accountable

• Set the standard: we deliver quality—always, we are client-centric, we lead the industry

• Win together: we are stronger together, we are aligned, we are one team

• Be an ally: we strive for inclusion, we listen and learn, we speak with our actions

• Do what’s right: we act with integrity

, we lead by example, we lift up our communities

2023 Highlights and 2024 Priorities

Execution of Multiple, Highly Complex Strategic

Initiatives

Repositioned AIG’s portfolio of businesses for sustainable,

profitable growth with the divestitures of Validus Reinsurance,

Ltd. (Validus Re) and Crop Risk Services, Inc. (CRS) and the

transfer of Private Client Select to an independent Managing

General Agent platform

Closed sale of Validus Re, including AlphaCat Managers Ltd.

and the Talbot Treaty reinsurance business, for $3.3 billion in

cash including pre-closing dividend

Closed sale of CRS for gross proceeds of $234 million

United General Insurance and AIG Parent leadership teams

and their organizations

Debuted AIG Next, creating a leaner future-state business

model and establishing enterprise-wide standards to drive

better outcomes for all stakeholders

Strong Performance Resulting from Significant

Improvement in Underwriting Income

General Insurance achieved $2.3 billion in underwriting

income, up 15 percent year over year

2023 combined ratio of 90.6 compared to 91.9 in 2022,

and sub-100 in every quarter of 2023

2023 accident year combined ratio, as adjusted

(a)

of 87.7

improved 1.0 point compared to 88.7 in 2022

Continued Balanced Capital Management

Supporting Financial Strength, Growth and

Shareholder Return

Repurchased $3.0 billion of AIG's common stock,

par value $2.50 per share (AIG Common Stock)

and paid $1.0 billion of dividends

Reduced weighted average diluted shares outstanding by

8 percent, reaching 725.2 million shares

Increased quarterly common stock dividend payments by

12.5 percent $0.36 per share during the second quarter of

2023

Reduced general borrowings by $1.4 billion

Continued Progress Towards Deconsolidation

and Separation of Corebridge Financial, Inc.

(Corebridge)

AIG sold 159.75 million shares of Corebridge common stock

in secondary public offerings with gross proceeds of

$2.9 billion

Corebridge repurchased 17.2 million shares of its common

stock from AIG for an aggregate purchase price of

$315 million

Corebridge distributed dividends on Corebridge common

stock totaling $1.1 billion to AIG

AIG’s ownership of Corebridge reduced to 52.2 percent as of

December 31, 2023

Corebridge closed the sale of Laya Healthcare Limited

(Laya) for €691 million ($731 million) and announced the

sale of AIG Life Limited (AIG Life) for consideration of

£460 million

(a) Non-GAAP measure – for reconciliation of non-GAAP to GAAP measure, see Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results

of Operations (MD&A).

AIG | 2023 Form 10-K 3

ITEM 1 | Business

Operating Structure

AIG reports the results of its businesses through three segments – General Insurance, Life and Retirement and Other Operations.

General Insurance consists of two operating segments – North America and International. Life and Retirement consists of four

operating segments – Individual Retirement, Group Retirement, Life Insurance and Institutional Markets. Other Operations is primarily

comprised of corporate, our institutional asset management business and consolidation and eliminations.

For additional information on our business segments, see Part II, Item 7. MD&A – Business Segment Operations and Note 3 to the

Consolidated Financial Statements, and for information regarding the separation of Life and Retirement, bankruptcy filing of AIG

Financial Products Corp. and the sale of Validus Re, CRS, AIG Life and Laya, see Note 1 to the Consolidated Financial Statements.

Business Segments

General Insurance

General Insurance is a leading provider of insurance

products and services for commercial and personal insurance

customers. It includes one of the world’s most far-reaching

property casualty networks. General Insurance offers a broad

range of products to customers through a diversified,

multichannel distribution network. Customers value General

Insurance’s strong capital position, extensive risk

management and claims experience and its ability to be a

market leader in critical lines of the insurance business.

General Insurance includes the following major operating

companies : National Union Fire Insurance Company of

Pittsburgh, Pa. (National Union); American Home Assurance

Company (American Home); Lexington Insurance Company

(Lexington); AIG General Insurance Company, Ltd.; AIG Asia

Pacific Insurance, Pte, Ltd.; AIG Europe S.A.; American

International Group UK Ltd.; Talbot Holdings Ltd. (Talbot);

Western World Insurance Company and Glatfelter Insurance

Group (Glatfelter).

Life and Retirement

Life and Retirement is a unique franchise that brings together a broad

portfolio of life insurance, retirement and institutional products offered through

an extensive, multichannel distribution network. It holds long-standing, leading

market positions in many of the markets it serves in the U.S. With its strong

capital position, customer-focused service, breadth of product expertise and

deep distribution relationships across multiple channels, Life and Retirement

is well positioned to serve growing market needs.

Life and Retirement includes the following major operating companies:

American General Life Insurance Company (AGL); The Variable

Annuity Life Insurance Company (VALIC); The United States Life

Insurance Company in the City of New York (U.S. Life) and AIG Life.

Other Operations

Other Operations primarily consists of income from assets held by AIG Parent and other corporate subsidiaries, deferred tax assets related to

tax attributes, corporate expenses and intercompany eliminations, our institutional asset management business and results of our consolidated

investment entities, General Insurance portfolios in run-off as well as the historical results of our legacy insurance lines ceded to Fortitude

Reinsurance Company Ltd. (Fortitude Re).

AIG | 2023 Form 10-K 4

ITEM 1 | Business

How We Generate Revenues and Profitability

We earn revenues primarily from insurance premiums, policy fees and income from investments.

Our expenses consist of policyholder benefits and losses incurred, interest credited to policyholders, commissions and other costs of

selling and servicing our products, interest expense and general operating expenses.

Our profitability is dependent on our ability to properly price and manage risk on insurance and annuity products, including

establishing loss reserves, to manage our portfolio of investments effectively and to control costs through expense discipline.

For additional information on loss reserves and prior year loss development, see Part II, Item 7. MD&A – Critical Accounting

Estimates – Loss Reserves, Part II, Item 7. MD&A – Insurance Reserves – Liability for Unpaid Losses and Loss Adjustment Expenses

(Loss Reserves), and Note 13 to the Consolidated Financial Statements.

For additional information on investment strategies, see Part II, Item 7. MD&A – Investments – Investment Strategies.

Human Capital Management

Our people are our greatest strength. To this end, we place significant focus on human capital management; namely retaining,

developing and attracting high caliber talent and fostering an inclusive environment in which we actively seek and embrace diverse

thinking.

Our Compensation and Management Resources Committee of the Board of Directors (CMRC) is responsible for overseeing human

capital management practices and programs, including retention, talent development, compensation and benefits, and diversity, equity

and inclusion. Management periodically reports to the CMRC on our various human capital management initiatives and metrics.

At December 31, 2023, we had approximately 25,200 employees based in approximately 50 countries, of which 32 percent are

located in North America, 44 percent are in the Asia Pacific region and the remaining 24 percent are in the European, Middle East and

Africa (EMEA region) and Latin America.

We believe that we foster a constructive and healthy work environment for our employees. The key programs and initiatives that are

designed to attract, develop and retain our diverse workforce include:

Competitive Compensation and Benefits. W

e seek to align compensation with individual and Company performance and provide

the appropriate market-competitive incentives to attract, retain and motivate employees to achieve outstanding results.

Management and the CMRC engage the services of third-party compensation consultants to help monitor the competitiveness of our

incentive programs. W

e provide a performance-driven compensation structure that consists of base salary and, for eligible

employees, short- and long-term incentives. We also offer comprehensive benefits to support the health, wellness, work-life balance

and retirement preparedness/savings needs of our employees, including subsidized health care plans, life and disability insurance,

wellness and mental health benefits, legal assistance plan, paid time off, paid volunteer time off, 2:1 matching grants for eligible

charitable donations, parental and bonding leave and both matching and Company 401(k) contributions for eligible employees.

Health and Safety. The health and safety of our employees is a priority. Occupational safety and health is a shared responsibility

between employees and corporate stakeholders, which we implement through our Global Safety and Environment policy. We take

appropriate measures to prevent workplace injuries and illnesses, to provide a safe and healthy work environment, and to meet

regulatory and duty of care responsibilities regarding the health, safety and welfare of employees engaging in AIG business activities.

We offer numerous benefits and wellness programs focused on the physical, social and financial wellness of our employees. Nearly

every country in which we operate has an Employee Assistance Program (EAP), which provides employees with confidential

counselling, mental health resources and information to help employees and their dependents through times of stress and anxiety. In

many countries where local market and regulations permit, our EAP and other programs also offer work-life balance assistance,

eldercare advice, bereavement support, and legal and financial guidance.

The AIG Compassionate Colleagues Fund (the Fund) enables the Company and its employees to provide direct relief to help eligible

colleagues overcome unforeseen financial hardships. The Fund has helped more than 1,600 employees overcome serious financial

hardships and disasters. In each of 2021, 2022 and 2023, AIG made a $2 million contribution to the Fund, and additional amounts

were contributed by our colleagues through voluntary donations and our 2:1 matching grants program. Employees in approximately

23 countries have contributed to the Fund and employees in 11 countries have received relief.

AIG | 2023 Form 10-K 5

ITEM 1 | Business

Talent Development. Equipping our people with the skills and capabilities to be successful and contribute to AIG is another priority.

We do this by giving our employees access to meaningful tools and resources to assist in their professional development no matter

where they are in their career paths.

AIG offers numerous learning opportunities to support the development of its employees. All online learning programs are accessible

through a global learning management system, Your Learning Journey. Through these programs, employees can increase their

insurance and business knowledge, build critical job skills and earn continuing education credits.

Alongside online courses, AIG offers a series of live, interactive learning opportunities designed to reinforce the Company's culture of

excellence. These programs focus on providing employees with a strong foundation of core skills including communication,

collaboration, coaching, change agility and problem solving.

Managers and leaders are critical in developing AIG’s talent for organizational success. To assess leadership skills and capabilities,

we use distinct leadership assessment tools, including 360 degree feedback, which develops self-awareness and builds personalized

leadership development goals. Our Leading Transformation program enhances our senior leaders’ ability to navigate and drive

change and transformation to successfully achieve business objectives and build culture.

In addition to live courses and online training, AIG also offers tuition and certification training reimbursement to encourage employees

to enhance their education and skills.

The Company also places significant importance on promoting internal talent and succession planning. Accordingly, we use a globally

consistent streamlined process to support succession planning and talent development for each of our functions and operating

segments. This approach helps identify a pipeline of diverse talent for positions at all levels of the organization and the actions

needed to support their development. In 2023, 33 percent of all our open positions were filled with internal talent.

Diversity, Equity and Inclusion (DEI). At AIG, we strive to create an inclusive workplace that provides equal opportunities for all

colleagues. We believe in building a culture where everyone is valued and celebrated for who they are and where all perspectives are

welcome. As of December 31, 2023, 54 percent of our global workforce were female and 34 percent of our U.S. workforce is ethnically

diverse.

AIG sponsors over 110 Employee Resource Groups (ERGs), which are groups of employees who come together based on a shared

interest in a specific identity in 45 countries to enhance allyship and inclusion across the organization. AIG’s global ERG network

spans 13 different dimensions of diversity and is open to all employees. The ERGs are key to fostering an inclusive workplace that

provides a safe space for colleagues to engage, learn, give back to our communities, and provide feedback from their perspective to

the business. The ERGs also support and advise company practices and programs to drive a committed culture of belonging and

deliver company value, as well as serve as an incubator for developing future leaders. AIG also provides DEI learning opportunities to

create awareness and educate on inclusive leadership, allyship, cross-cultural dynamics and fostering inclusion, including DEI

microlearning and sessions on authentic leadership.

AIG | 2023 Form 10-K 6

ITEM 1 | Business

Regulation

GENERAL

Our (re)insurance subsidiaries are subject to extensive regulation and supervision in the jurisdictions in which our (re)insurance

businesses are located or operate. Insurance regulatory authorities in those jurisdictions are the primary regulators for those

businesses; however, our operations are subject to regulation by many different types of regulatory authorities, including insurance,

securities, derivatives and investment advisory regulators in the United States and abroad.

Insurance regulators, other regulatory authorities, law enforcement agencies, and other governmental authorities from time to time

make inquiries and conduct examinations or investigations regarding our compliance, as well as compliance by other companies in

our industry, with applicable laws. In addition, regulation, legislation and administrative policies that are not limited in application solely

to the insurance market may significantly affect the insurance industry and certain of our operations, including regulation, legislation

and administrative policies related to privacy, cybersecurity, government sanctions, pensions, age and sex discrimination, financial

services, securities, taxation and climate change. See Item 1A. Risk Factors – Regulation – "Our businesses are heavily regulated

and changes in laws and regulations may affect our operations, increase our insurance subsidiary capital requirements or reduce our

profitability".

We expect that the U.S. and international regulations applicable to us and our regulated entities will continue to evolve for the

foreseeable future. See Item 1A. Risk Factors – Regulation – "New laws and regulations or new interpretations of current laws and

regulations, both domestically and internationally, may affect our businesses, results of operations, financial condition and ability to

compete effectively".

FINANCIAL, MARKET CONDUCT & CORPORATE GOVERNANCE OVERSIGHT

The method of insurance regulation of our (re)insurance subsidiaries varies, but generally has its source in statutes that delegate

regulatory and supervisory powers to a state insurance official (in the United States) or another governmental agency (outside the

United States). The regulation and supervision relate primarily to the financial condition of the (re)insurers, corporate conduct and

market conduct activities. In general, such regulation is for the protection of policyholders rather than the creditors or equity owners of

these companies. Financial, market conduct and corporate conduct oversight varies by jurisdiction, but can include activities such as:

(a) approval of policy language and rates;

(b) advertising practices;

(c) establishing minimum capital and liquidity requirements;

(d) licensing of insurers and their agents;

(e) requiring registration and periodic reporting by (re)insurance companies that are licensed in the jurisdiction;

(f) evaluating and, in some cases, requiring regulatory approval of, certain transactions between (re)insurance company subsidiaries

and their affiliates;

(g) imposing restrictions and limitations on the amount of dividends or other distributions payable by a (re)insurance company;

(h) enforcing rules related to outsourcing of material functions;

(i) requiring deposits of securities for the benefit of policyholders;

(j) establishing requirements for acceptability of reinsurers and credit for reinsurance;

(k) establishing requirements for reserves; and

(l) enterprise risk management (including technology risk management) and corporate governance requirements.

Our (re)insurance subsidiaries are generally subject to laws and regulations that prescribe the type, quality and concentration of

investments they can make and permissible investment practices, such as derivatives, securities lending and repurchase

transactions. In non-U.S. jurisdictions, our (re)insurance subsidiaries may also be subject to laws requiring certain amounts and types

of local investment. In addition, certain affiliates of our (re)insurance affiliates are themselves subject to laws and regulations

concerning the investment advisory and investment management services they provide to our (re)insurance subsidiaries and other

clients with respect to such investments.

Insurance laws in many jurisdictions also provide that no person, corporation or other entity may acquire control of an insurance

company, or a controlling interest in (or prescribed percentage of capital of) any direct or indirect parent company of an insurance

company, without the prior approval of, or notice to, such insurance company’s domiciliary insurance regulator.

AIG | 2023 Form 10-K 7

ITEM 1 | Business

As a holding company with no significant business operations of its own, AIG Parent depends on dividends from our subsidiaries to

meet our obligations. U.S. state insurance laws typically provide that dividends in excess of certain prescribed limits are considered to

be extraordinary dividends and require prior approval or non-disapproval from the applicable insurance regulator. Outside the U.S.,

(re)insurers, subject to certain exceptions, are permitted to pay dividends subject to maintaining prescribed capital and solvency

requirements and ensuring that dividends are made out of profits/retained earnings.

Further, as part of their regulatory oversight processes, insurance regulators conduct periodic examinations of our (re)insurance

subsidiaries. Such examinations can cover a broad scope of the (re)insurance subsidiary’s operations, including the financial strength

of the (re)insurance subsidiary; sales, marketing and claims handling practices; risk management; capital and liquidity management;

and information technology operations (including emerging technology risks).

Insurance and securities regulators and other law enforcement agencies and attorneys general also, from time to time, make

inquiries, issue data calls and conduct examinations or investigations regarding compliance with insurance and other laws or for

informational purposes that can be company-specific or part of a broader industry-wide effort.

There can be no assurance that any noncompliance with such applicable laws, regulations or guidance would not have a material

adverse effect on our business or results of operations.

REGULATORY REGIMES

United States

States

At the state-level, the National Association of Insurance Commissioners (NAIC) is a standard-setting and regulatory support

organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S.

territories. The NAIC is not a regulator, but, with assistance from the NAIC, state insurance regulators establish standards and best

practices, conduct peer reviews and coordinate regulatory oversight. Model laws and regulations promulgated by the NAIC only

become effective in a state once formally adopted by such state and are subject to revision by each state. Examples of NAIC models

adopted, in substantial part, by all states include:

• The Risk-Based Capital (RBC) for Insurers Model Act, which incorporates an RBC formula calculated in accordance with

instructions updated annually by the NAIC that is designed to measure the adequacy of an insurer’s total adjusted capital, as

calculated pursuant to the RBC formula, in relation to certain risks inherent in its business, and authorizes certain regulatory

actions regarding insurers whose RBC levels fall below specific thresholds. The NAIC has adopted, or is considering, several

changes impacting how RBC is calculated, including initiatives aimed at a comprehensive review of the RBC investment

framework as well as a proposed modeling methodology to determine RBC for collateralized loan obligations and other structured

securities to reduce reliance on the use of rating agency ratings. The RBC levels of each of our U.S. domiciled (re)insurance

companies exceeded each of these specific thresholds as of December 31, 2023. In addition to RBC requirements, the insurance

laws of our domiciliary states prescribe certain minimum capital and surplus requirements for insurance companies. If any of our

(re)insurance entities fell below prescribed levels of statutory capital and surplus, it would be our intention to provide appropriate

capital or other types of support to that entity. For additional information, see Part II, Item 7. MD&A – Liquidity and Capital

Resources – Liquidity and Capital Resources of AIG Parent and Subsidiaries – Insurance Companies.

• The Insurance Holding Company System Regulatory Act and the Insurance Holding Company System Model Regulation (together,

the Holding Company Models) include: provisions authorizing insurance commissioners to act as global group-wide supervisors for

internationally active insurance groups and participate in international supervisory colleges; standards for transactions between a

domestic (re)insurance company and its affiliates and regulatory approval requirements for certain of such transactions;

requirements for obtaining regulatory approval for acquiring control of a domestic (re)insurance company; and the requirement that

the ultimate controlling person of a U.S. insurer file an annual enterprise risk report with its lead state regulator identifying risks

likely to have a material adverse effect upon the financial condition or liquidity of its licensed insurers or the insurance holding

company system as a whole, among other requirements. The New York State Department of Financial Services (NYDFS) is AIG’s

lead U.S.-state regulator, and leads AIG’s Supervisory College meetings, which consist of AIG’s key global regulatory bodies.

• The Risk Management and Own Risk and Solvency Assessment Model Act, which requires that insurers maintain a risk

management framework, conduct an internal own risk and solvency assessment of the insurer’s material risks in normal and

stressed environments, and submit annual Own Risk and Solvency Assessment (ORSA) summary reports to the insurance group’s

lead U.S.-state regulator.

• The Corporate Governance Annual Disclosure Model Act (CGAD), which requires insurers to submit an annual filing regarding their

corporate governance structure, policies and practices.

• And, specific to our life insurance subsidiaries, the NAIC's new Valuation Manual, which contains a principle-based reserving

(PBR) approach to life insurance company reserves. PBR is designed to tailor the reserving process to more closely reflect the

risks of specific products rather than the factor-based approach employed historically.

AIG | 2023 Form 10-K 8

ITEM 1 | Business

The NAIC also provides standardized insurance industry accounting and reporting guidance through the NAIC Accounting Manual,

which establishes statutory accounting principles applicable to (re)insurance companies. Statutory accounting principles promulgated

by the NAIC may be modified by individual state laws, regulations and permitted practices granted by our domiciliary insurance

regulators.

The NAIC has undertaken a multi-pronged effort to determine whether additional standards, safeguards or disclosures are required in

connection with certain investments by U.S. insurance companies, including related party investments, structured securities and other

complex assets.

In December 2020, the NAIC amended the Holding Company Models to incorporate a Liquidity Stress Testing (LST) requirement for

large life insurers based on a set of scope criteria and a Group Capital Calculation (GCC) requirement. These amendments require

the ultimate controlling person of every U.S. insurer that is scoped into the LST framework to submit LST results to the insurance

group’s lead state insurance regulator on an annual basis. In addition, these amendments require the ultimate controlling person of

every U.S. insurer to submit GCC reports to the insurance group’s lead state insurance regulator on an annual basis unless an

exemption applies. The provisions of the December 2020 amendments to the Holding Company Models that authorize the GCC and

LST were signed into law by New York State in August 2023, making AIG formally subject to them beginning in 2024.

U.S. states have state insurance guaranty associations in which insurers admitted in the state are required by law to be members.

Member insurers may be assessed by the associations for certain obligations of insolvent insurance companies to policyholders and

claimants. The aggregate assessments levied against us have not been material to our financial condition in any of the past three

years.

Federal

At the U.S. federal level, AIG is impacted by the activities of policymakers and by the laws and regulations enforced by various federal

agencies.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank), signed into law in 2010, brought about extensive

changes to financial regulation in the United States and established the Federal Insurance Office (FIO) to serve as the central

insurance authority in the federal government. While not serving a regulatory function, FIO performs certain duties related to the

business of insurance and has authority to collect information on the insurance industry and recommend prudential standards. In

addition, FIO monitors market access issues, represents the United States in international insurance forums and has authority to

determine if certain regulations are preempted by covered agreements. FIO’s approval is required to subject a financial company

whose largest U.S. subsidiary is an insurer to the special orderly liquidation process outside the federal bankruptcy code,

administered by the FDIC pursuant to Dodd-Frank. U.S. insurance subsidiaries of any such financial company, however, would remain

subject to rehabilitation and liquidation proceedings under state insurance laws.

FIO also assists the Secretary of the Treasury in administering the U.S. Terrorism Risk Insurance Act (TRIA), enacted in 2002 to

support insurance coverage for certain terrorist acts in the U.S. The program was continued under the Terrorism Risk Insurance

Program Reauthorization Act of 2019 (TRIPRA) through December 31, 2027 and is intended to provide reinsurance coverage from

the federal government in limited circumstances for certified acts of terrorism that exceed a certain threshold of industry losses.

Title I of Dodd-Frank established the Financial Stability Oversight Council (Council), which is authorized to determine that certain

nonbank financial companies be designated as nonbank systemically important financial institutions (SIFIs) subject to supervision by

the Board of Governors of the Federal Reserve System and enhanced prudential standards. Designation by the Council of any

nonbank SIFI is subject to certain statutory and regulatory standards and to the Council’s guidance. The Council may also

recommend that state insurance regulators or other regulators apply new or heightened standards and safeguards for activities or

practices that insurers or other nonbank financial services companies engage in.

Title V of Dodd-Frank authorizes the United States to enter into covered agreements with foreign governments or regulatory entities

regarding the business of insurance and reinsurance. On September 22, 2017, the U.S. and the European Union (EU) entered into

such an agreement, and on December 18, 2018, the U.S. signed a covered agreement with the United Kingdom (UK), which is similar

to the agreement with the EU. Under the agreements, AIG is supervised at the worldwide group level only by its relevant U.S.

insurance supervisors, and generally does not have to satisfy EU Solvency II group capital, reporting and governance requirements

for its worldwide group. The covered agreements also require various U.S. reinsurance collateral reforms, which have now been

adopted by all U.S. states.

Title VII of Dodd-Frank provides for significantly increased regulation of, and restrictions on, derivatives markets and transactions that

have affected various activities of insurance and other financial services companies, including (i) regulatory reporting for swaps,

including security-based swaps, (ii) mandated clearing through central counterparties and execution through regulated swap

execution facilities for certain swaps (other than security-based swaps) and (iii) margin and collateral requirements.

AIG | 2023 Form 10-K 9

ITEM 1 | Business

International

In the UK, the Prudential Regulation Authority (PRA) is the lead prudential supervisor for our UK insurance operations and the

Financial Conduct Authority has oversight of AIG’s insurance operations for consumer protection and competition matters.

In the EU, various Directives and Regulations affect our international (re)insurance operations. The Luxembourg insurance regulator,

the Commissariat aux Assurances, is the insurance regulator for AIG Europe SA, which serves our European Economic Area (EEA)

and Swiss policyholders. In addition, financial companies that operate in the EU are subject to a range of regulations enforced by the

national regulators in each member state in which that firm operates. Solvency II governs the insurance industry’s solvency framework

for the EU, including minimum capital and solvency requirements, governance requirements, risk management and public reporting

standards.

AIG’s operating (re)insurance subsidiaries in Bermuda are regulated by the Bermuda Monetary Authority (BMA). Bermuda’s Insurance

Act 1978, the applicable Codes of Conduct and related regulations impose solvency and liquidity standards and auditing and reporting

requirements on Bermuda (re)insurance companies and grant the BMA powers to supervise, investigate and intervene in the affairs of

(re)insurance companies. A variety of requirements and restrictions are imposed on our Bermuda operating (re)insurance subsidiaries

including: periodic financial reporting; corporate governance framework; solvency and financial performance; compliance with

minimum enhanced capital requirements; and minimum solvency margins and liquidity ratios (the latter for general business

(re)insurers); and limitations on dividends and distributions.

The Monetary Authority of Singapore (MAS) supervises AIG’s insurance subsidiary in Singapore. It has broad authority under the

Insurance Act 1966 to regulate insurance business in Singapore as well as insurers, insurance intermediaries and related institutions.

Our Singapore insurance operations are subject to minimum capital and solvency requirements as well as financial reporting,

corporate governance and conduct of business requirements. The MAS has authority to conduct inspections and investigations on

insurers and to administer sanctions for regulatory non-compliance. Our Singapore insurance subsidiary holds insurance entities in

the Asia Pacific region. The MAS holds the Chief Executive of the Singapore insurance subsidiary principally responsible for the

management and conduct of the business of the subsidiary, including the business of its subsidiaries and overseas branches.

The Japan Financial Services Agency (JFSA) regulates AIG’s operating insurance subsidiaries and insurance holding company in

Japan. The JFSA has extensive authority under the Insurance Business Act and related regulations to oversee licensing, sales

practices, business conduct, investments, reserves and solvency, amongst other matters. Our Japanese insurance operations are

required to maintain a minimum solvency margin ratio (SMR), which is a measure of capital adequacy. The failure to maintain an

appropriate SMR, or comply with other similar indicators of financial health, could result in the JFSA imposing corrective actions on

our operations.

FSB and IAIS

The Financial Stability Board (FSB) consists of representatives of national financial authorities of the G20 countries. The FSB is not a

regulator but is focused primarily on promoting international financial stability. The FSB has issued a series of frameworks and

recommendations to address such issues as systemic financial risk, financial group supervision, capital and solvency standards,

effective recovery and resolution regimes, corporate governance including compensation, and a number of related issues associated

with responses to the financial crisis.

The International Association of Insurance Supervisors (IAIS) represents insurance regulators and supervisors of more than 200

jurisdictions (including regions and states) in nearly 140 countries and seeks to promote globally consistent insurance industry

supervision. The IAIS is not a regulator, but one of its activities is to develop insurance regulatory standards for use by local

authorities across the globe. For example, the IAIS has adopted ComFrame, a Common Framework for the Supervision of

Internationally Active Insurance Groups (IAIGs). ComFrame assists regulators in addressing an IAIG’s risks by providing supervisory

standards for areas such as group supervision, governance and internal controls, enterprise risk management, and recovery and

resolution planning. We currently meet the criteria set forth to identify an IAIG, and the NYDFS, as our group-wide supervisor, has

publicly disclosed us as an IAIG on the IAIS’ register of IAIGs.

In addition, the FSB has charged the IAIS with developing a framework for measuring and mitigating systemic risks posed by the

insurance sector, and in response the IAIS developed an enhanced set of supervisory policy measures for the assessment and

mitigation of systemic risk in the insurance sector (Holistic Framework), with implementation beginning in 2020. The Holistic

Framework recognizes that systemic risk can emanate from specific activities and exposures arising from either sector-wide trends or

concentrations in individual insurers. In light of the IAIS adoption of the Holistic Framework, the FSB decided in December 2022 to

discontinue the annual identification of Global Systemically Important Insurers in favor of instead applying the Holistic Framework to

inform the FSB’s consideration of systemic risk in insurance.