About Income from Form 1040 Wages, Interest, etc.

• Additional resources listed in L< “References” tab

• Review all tips and cautions in the lesson

• Read all examples and sample interviews

• We will review answers to each exercise

2

Objectives – Income from Form 1040 Wages, Interest, etc.

• Compute taxable and nontaxable income

• Distinguish between earned and unearned income

• Report income correctly on Form 1040

• Time Required: 30 minutes

3

Topics

4

• Interest income

• Dividends

• State and local refunds

• Alimony

• Determining taxable a

nd

no

ntaxable inco

me

• R

eporting wages, salaries, tips, etc.

• Scholarship and Fellowship income

Key Terms

Definitions are always available in the L< online Glossary.

• Allocated Tips

• Capital Gain Distributions

• Earned Income

• Gross Income

• Ordinary Dividends

• Taxable Income

• Tax-exempt Income

• Unearned Income

5

Determining Taxable and Nontaxable Income

7

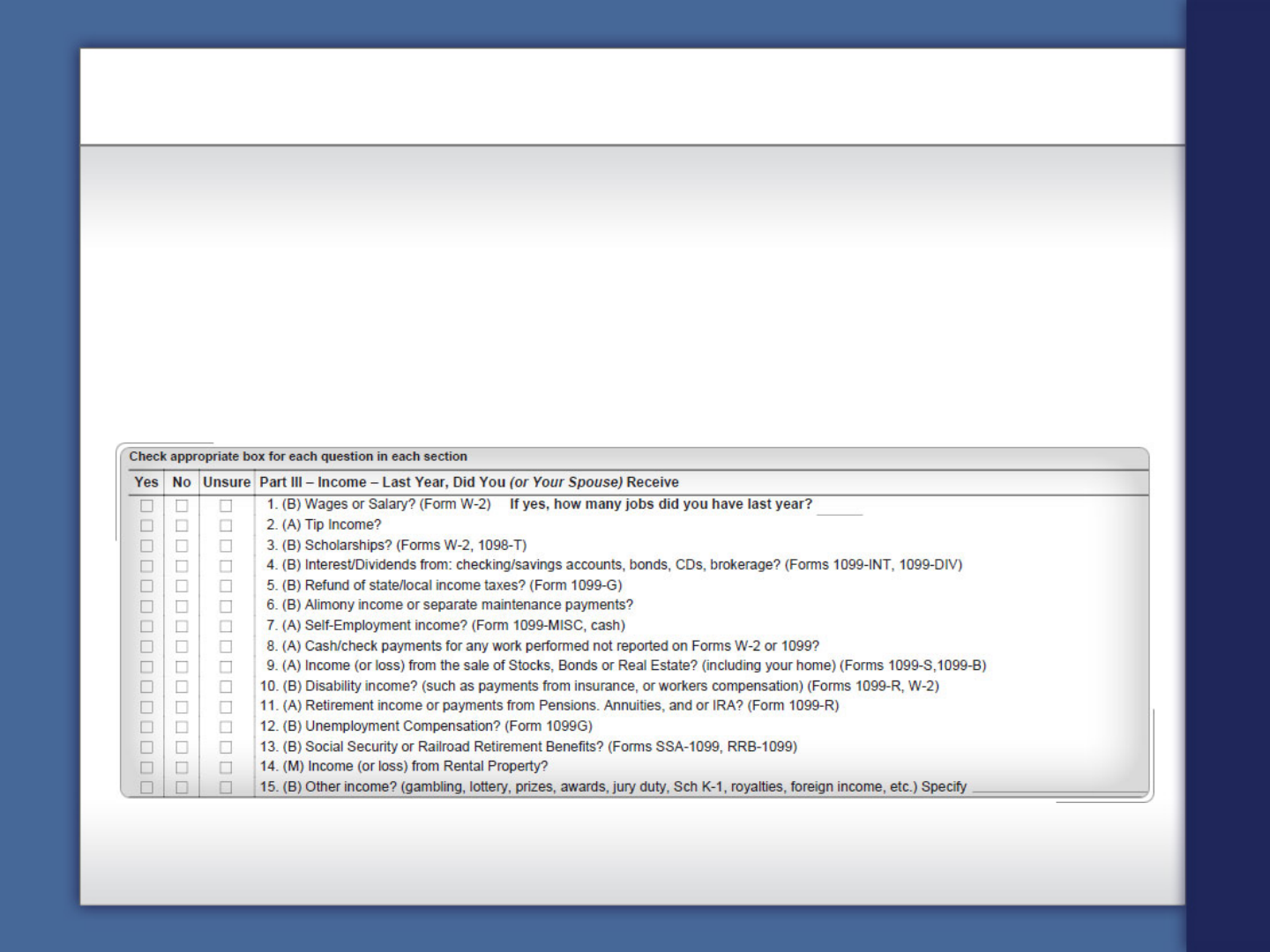

Examples of income items used to determine entries in TaxSlayer.

• Review Pub 4012, Using TaxSlayer® Pro Online tab, Navigating

TaxSlayer chart

• Tax Forms:

• W-2

• 1099-INT

• 1099-DIV

• 1099-G

Determining Taxable and Nontaxable Income

• Remember: Volunteers probe taxpayers to determine all sources of

income

• Media: Videos & Audio for topic

• FAQ, 1099-DIV Dividend Income

• End of topic – Q & A

8

Reporting Wages, Salaries, Tips, etc.

• TaxSlayer Practice

• Click Income from Federal Section, then click Wages and Salaries

• Complete Form W-2

• To enter tips not shown on Form W-2, click on Other Taxes from

Federal Section, then Tax on Unreported Tip Income

10

Reporting Wages, Salaries, Tips, etc.

• Remember:

• Household employees earning less than $2,200 may not receive a

Form W-2, but the income must be reported

• Self-employed taxpayers who receive tips should include their tips in

gross receipts on Schedule C

• Media: Videos & Audio for topic

• Missing Form W-2 (YouTube video)

• End of topic – Q & A

11

Dividends

• Generally, all dividend

income is reported o

n

F

orm 1040, lines 3a an

d

3b,

Qualified Dividends

and Ordinary Dividends.

• Capital Gains Distribution

s

wi

ll appear on Form 1040

15

Dividends

• Ask taxpayers for their annual brokerage statement if they did not

receive Form 1099-DIV for a dividend

• Schedule B is needed if the taxpayer’s ordinary dividends are greater

than $1,500

• Out of scope: Form 1099-DIV boxes labeled Unrecap. Sec. 1250 gain,

Section 1202 gain, Cash

liquidation distributions,

and Noncash liquidation

distributions

• Media: Videos & Audio

for topic

• FAQ: 1099-DIV Dividend

Income

16

• Will be shown on Form 1099-G

• Report only if:

• Taxpayer i

temized deductions last year, and

• Received a

n income tax benefit.

• Do not report if state sales tax was deducted.

• Taxable refund is reported on Form 1040, Schedule 1

• Click Income from

th

e Federal Section

then state and local

refunds

State and Local Refunds

17

Alimony

• Do not confuse child support payments with alimony

• Where do you get alimony information?

• Ask the taxpayer if they have:

• Post 1984 and pre 2019 divorces

• Post 2018 divorces

• How do you report alimony?

• Form 1040, Schedule 1, if receiving

• Schedule 1 Adjustments to Income section

if paying

• For any divorce or separation instrument executed after December 31,

2018, or modified after that date, alimony and separate maintenance

payments are not deductible by the payor spouse and are not included

in income by the recipient of the payments.

18

Summary

• This lesson covered:

• Income reported on Form 1040 and Schedule 1

• Differentiating taxable and nontaxable income

• Earned and unearned income

• Check your understanding of this lesson by going to Certification Warm

Up on your student landing page

20

Out of Scope for this Lesson:

• Taxpayers with income from the following sources:

• Other gains/losses

• Farm income

• Accrual method for reporting income

• Taxpayers who buy or sell noncovered bonds between interest payment

dates

• Form 1099-INT, with entry in Specified private activity bond interest box

subject to AMT

• Adjustments needed for any of the amounts listed on Form 1099-OID, or if

the taxpayer should have received Form 1099-OID but did not receive one

• Form 1099-DIV, boxes labeled Unrecap. Sec. 1250 gain, Section 1202 gain,

Cash liquidation distributions, and Noncash liquidation distributions

• State or local income tax refunds received in the current tax year for a year

other than the previous tax year

• Alimony/divorce agreements executed before 1985

• Minister tax returns with parsonage/housing allowance

21

Practice

• Select the problems from L< Skills Workout based on your

certification course of study

• Complete the exercise

22