Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 1 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

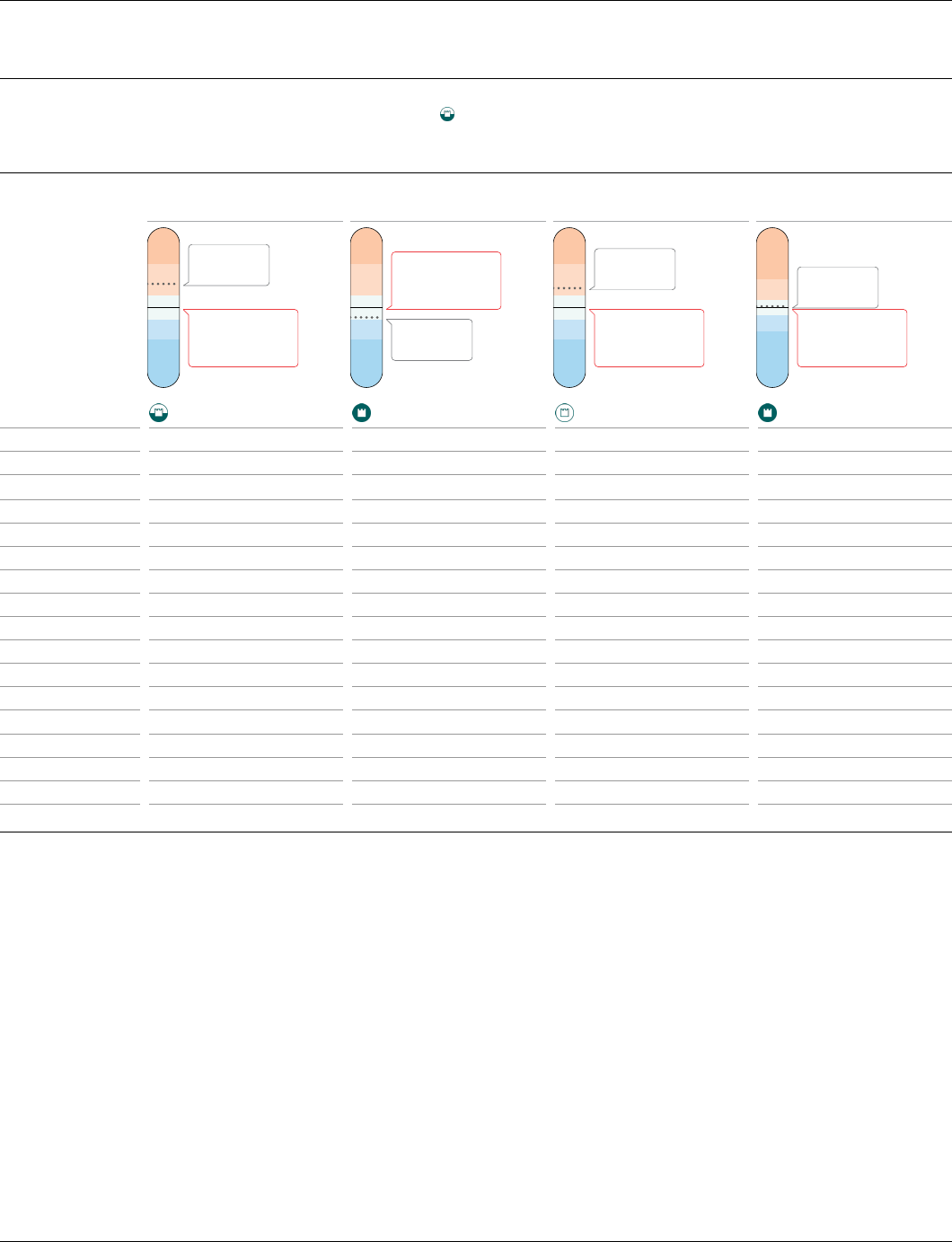

Price vs. Fair Value

0

50

100

150

200

Last Close: 149.15

Fair Value: 115.00

29 Apr 2021 02:24, UTC

Over Valued

Under Valued

2016 2017 2018 2019 2020 YTD

0.87 1.04 0.79 1.33 1.56 1.30 Price/Fair Value

12.15 48.24 -5.12 88.09 81.85 12.73 Total Return %

Morningstar Rating

Total Return % as of 14 Jul 2021. Last Close as of 14 Jul 2021. Fair Value as of 29 Apr 2021 02:24, UTC.

Contents

Business Description

Business Strategy & Outlook (30 Oct 2020)

Bulls Say / Bears Say (28 Apr 2021)

Economic Moat (29 Oct 2020)

Fair Value and Profit Drivers (28 Apr 2021)

Risk and Uncertainty (29 Oct 2020)

Capital Allocation (4 Nov 2020)

Analyst Notes Archive

Financials

Research Methodology for Valuing Companies

Important Disclosure

The conduct of Morningstar’s analysts is governed by Code of Ethics/Code of

Conduct Policy, Personal Security Trading Policy (or an equivalent of), and

Investment Research Policy. For information regarding conflicts of interest, please

visit: http://global.morningstar.com/equitydisclosures.

The primary analyst covering this company does not own its stock.

1

The ESG Risk Rating Assessment is a representation of Sustainalytics’ ESG Risk

Rating.

Apple’s March Quarter Sales Driven to New Highs by Broad-

Based Strength, Especially iPhone and Mac

Business Strategy & Outlook Abhinav Davuluri, CFA, Sector Strategist, 30 Oct 2020

Apple’s competitive advantage stems from its ability to package hardware, software, services, and third-

party applications into sleek, intuitive, and appealing devices. This expertise enables the firm to capture

a premium on its hardware, unlike most of its peers. Despite its admirable reputation, loyal customer

base, and unique products, the consumer hardware space can be unforgiving to firms unable to

consistently satiate the customer’s appetite for more features. Given the short product cycles of Apple’s

products and army of firms targeting its dominance, we do not believe Apple has a wide economic

moat.

Switching costs and intangible assets support Apple's narrow moat. The firm enjoys stellar returns on its

devices by offering a unique user experience with its iOS ecosystem. Contrary to its peers in PCs and

smartphones that rely on open operating systems, Windows and Android, respectively, Apple’s walled

garden approach for its popular iOS allows it to charge a premium for relatively commoditized hardware

not too different from that sold by Samsung, Dell, and others. Customer switching costs are elevated for

Apple users as a non-Apple iOS experience does not exist, unlike computing platforms for the Windows

or Android ecosystems that boast PCs and smartphones from a multitude of firms.

We view the iPhone as a revolutionary product that created the smartphone ecosystem and transitioned

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 2 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

computing habits away from the PC. The robust app store helped foster iPhone adoption and grow

Apple’s user base, with applications ranging from productivity, social media, gaming, music, and so on.

We foresee Apple's ongoing business coming from existing customers versus new smartphone

adopters. With hardware becoming increasingly commoditized and replacement cycles potentially

elongating in the long term, we expect Apple to focus on newer software and services to augment the

user experience and retain customers. The firm’s additional products and services (Apple Watch, iCloud,

Apple TV+, AirPods, Apple Pay) act as both supplemental revenue opportunities and, more importantly,

critical enhancements to the iOS ecosystem that support Apple’s crown jewel: the iPhone.

Bulls Say Abhinav Davuluri, CFA, Sector Strategist, 28 Apr 2021

u

Between greater smartphone penetration in emerging markets and repeat sales to current customers,

Apple has plenty of opportunity to reap the rewards of its iPhone business.

u

Apple's iPhone and iOS operating system have consistently been rated at the head of the pack in terms

of customer loyalty, engagement, and security, which bodes well for long-term customer retention.

u

We think Apple is still innovating with introductions of Apple Pay, Apple Watch, Apple TV, and AirPods;

each of these could drive incremental revenue, but more crucially help to retain iPhone users over time.

Bears Say Abhinav Davuluri, CFA, Sector Strategist, 28 Apr 2021

u

Apple’s decisions to maintain a premium pricing strategy may help fend off gross margin compression

but could limit unit sales growth, as devices may be unaffordable for many customers.

u

If Apple were to ever launch a buggy software update or subpar services, it could diminish the firm's

reputation for building products that "just work."

u

Apple is believed to be behind firms like Google and Amazon in artificial intelligence, or AI, development

(notably Siri voice recognition), which could be problematic as tech firms look to integrate AI in order to

deliver premium services to customers.

Economic Moat Abhinav Davuluri, CFA, Sector Strategist, 29 Oct 2020

We assign a narrow economic moat rating for Apple that stems from the combination of switching costs

and intangible assets. We think the firm's primary moat source is customer switching costs, as Apple

bolsters the user experience with a cohort of auxiliary products such as iPad, Apple TV, Apple Watch,

AirPods, and so on, and services (iMessage, FaceTime, Apple Pay) that augment Apple's sphere of

influence on the consumer. As current iPhone users are familiar with the iOS environment (Apple-centric

apps, services, and so on), it may take multiple subpar product releases to warrant an exodus to an

Android OS, as these customers are likely loath to leave Apple's seemingly superior walled garden.

Regarding intangible assets, Apple's differentiated user experience via iOS coupled with its expertise in

both hardware and software design allows the firm to more seamlessly build integrated products. We

see no other technology titan with comparable expertise in both hardware and software. In turn, we

Sector Industry

a Technology

Consumer Electronics

Business Description

Apple designs a wide variety of consumer electronic

devices, including smartphones (iPhone), tablets (iPad),

PCs (Mac), smartwatches (Apple Watch), and TV boxes

(Apple TV), among others. The iPhone makes up the

majority of Apple’s total revenue. In addition, Apple

offers its customers a variety of services such as Apple

Music, iCloud, Apple Care, Apple TV+, Apple Arcade,

Apple Card, and Apple Pay, among others. Apple's

products run internally developed software and

semiconductors, and the firm is well known for its

integration of hardware, software and services. Apple's

products are distributed online as well as through

company-owned stores and third-party retailers. The

company generates roughly 40% of its revenue from the

Americas, with the remainder earned internationally.

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 3 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

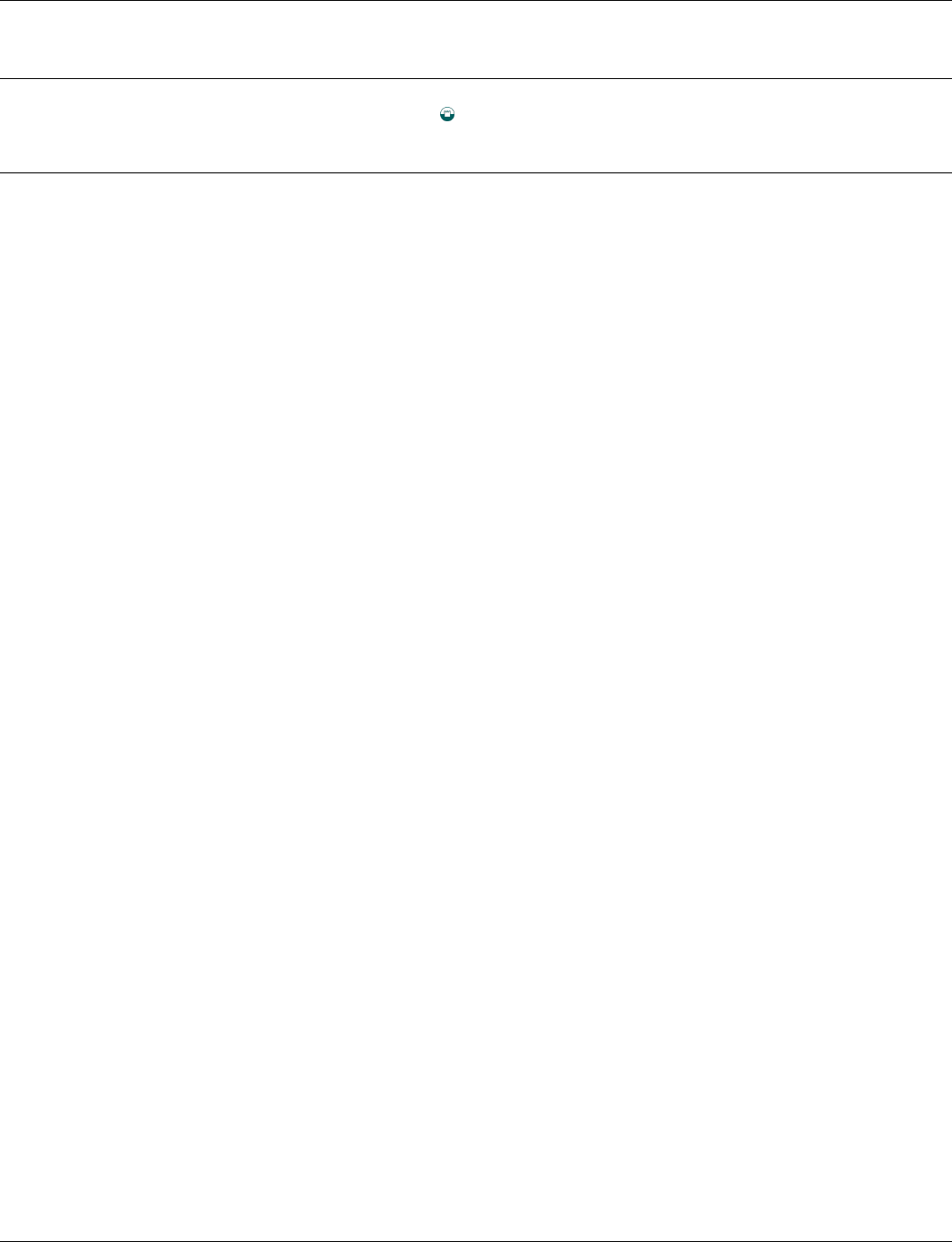

Competitors

Apple Inc AAPL Alphabet Inc Class A GOOGL HP Inc HPQ Microsoft Corp MSFT

Fair Value

115.00

Uncertainty : High

Last Close

149.15

Fair Value

2,925.00

Uncertainty : High

Last Close

2,564.74

Fair Value

23.00

Uncertainty : High

Last Close

28.59

Fair Value

278.00

Uncertainty : Medium

Last Close

282.51

Economic Moat Narrow Wide None Wide

Moat Trend Stable Stable Negative Stable

Currency USD USD USD USD

Fair Value 115.00 29 Apr 2021 02:24, UTC 2,925.00 28 Apr 2021 01:40, UTC 23.00 26 Feb 2021 05:50, UTC 278.00 28 Apr 2021 02:29, UTC

1-Star Price 178.25 4,533.75 35.65 375.30

5-Star Price 69.00 1,755.00 13.80 194.60

Assessment Over Valued 14 Jul 2021 Under Valued 14 Jul 2021 Over Valued 14 Jul 2021 Fairly Valued 14 Jul 2021

Morningstar Rating

QQ

14 Jul 2021 21:18, UTC

QQQQ

14 Jul 2021 21:18, UTC

QQ

14 Jul 2021 21:18, UTC

QQQ

14 Jul 2021 21:18, UTC

Analyst Abhinav Davuluri, Sector Strategist Ali Mogharabi, Senior Equity Analyst Mark Cash, Senior Equity Analyst Dan Romanoff, Equity Analyst

Capital Allocation Standard Standard Standard Exemplary

Price/Fair Value 1.30 0.88 1.24 1.02

Price/Sales 7.87 9.53 0.62 13.47

Price/Book 35.98 7.47 — 15.82

Price/Earning 33.37 34.18 10.14 38.49

Dividend Yield 0.56% — 2.65% 0.78%

Market Cap 2,488.96 Bil 1,743.68 Bil 34.34 Bil 2,127.75 Bil

52-Week Range 89.15—149.57 1,402.15—2,586.53 16.66—36.00 196.25—283.66

Investment Style Large Core Large Growth Mid Value Large Growth

believe this integration allows Apple to build industry-leading devices that command industry-leading

average selling prices, most notably the firm's crown jewel: the iPhone.

Recent survey data shows that iPhone customers are not even contemplating switching brands today.

In a December 2018 survey by Kantar, 90% of U.S.-based iPhone users said they planned to remain loyal

to future Apple devices. A recent survey (as of October 2020) from 451 Research indicates iPhone

customer satisfaction of 98% for iPhone 11, 11 Pro, and 11 Pro Max combined. Also, users of ancillary

products (especially the Watch and AirPods) lose significant functionality when paired with a

smartphone other than the iPhone. Ultimately, we believe that existing iPhone users are relatively

locked in to the iOS ecosystem and interface.

While the Android cohort has attempted to replicate a similar feel of apps, app stores, and integrated

experience, the fragmentation of its key players will likely prevent many loyal iOS users from switching,

at least over a few product cycles. Competitors such as Samsung (Galaxy smartphone) and Google

(Android OS) specialize in hardware and software, respectively, with Samsung boasting leadership in

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 4 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

mobile device units and Google's Android OS serving as the pervasive smartphone OS. Although Apple's

low-double-digit market share in the smartphone space doesn't seem excessive, the firm does enjoy the

lion's share of industry profits. Neither Samsung nor Google has been able to offer a comprehensive and

integrated product like the iPhone, though both have attempted to develop software/operating systems

(Samsung's Tizen OS) and hardware (Google's Pixel smartphone), with mixed results. We believe Apple's

expertise in both hardware and software represents an intangible asset that even the strongest of tech

firms have struggled to replicate.

Although Apple's brand tends to be associated with premium technology gadgets, we don't think it can

support an economic moat in isolation. Specifically, Apple's brand strength is a consequence of its

differentiated hardware and software design, not the cause. We don't think Apple can charge twice the

price of a similar set of hardware solely by sticking an Apple logo on it. Similarly, we suspect that

Apple's brand equity will wane if the firm's products were technologically inferior to competitors over an

extended period of time. As evidence, Nokia was the eighth-most-valuable brand in the world as

recently as 2010, according to Interbrand, before succumbing to the rise of the smartphone.

The active installed base of Apple devices reached 1.5 billion at the end of 2019, up from 1.4 billion a

year prior, showing the strong stickiness Apple has created. However, these switching costs are not

insurmountable, illustrated by the rise and fall of former mobile device titans such as Nokia, Motorola,

and BlackBerry, all of which failed to keep up with smartphone innovation. The short product cycles for

phones and the inability of these firms to sufficiently innovate left each one struggling after the debut of

Apple's iPhone and its subsequent proliferation. Apple is not immune to these pitfalls, as consumer

sentiment for technology gadgets can be unforgiving, with one buggy or subpar product potentially

driving customers to other companies' offerings, which have been increasingly competitive. We have

often seen innovative features arise in the Android ecosystem before Apple, such as OLED screens and

3D sense. These industry dynamics prevent us from assigning a wide moat rating for Apple.

At this point, we do not consider network effects to be a key source of Apple's moat. We acknowledge

that Apple's iOS users gravitate to the App Store to purchase new applications, and the size of Apple's

installed base attracts developers to build new apps for iOS. Apple's integration of hardware and

software also supports its developer networks, as Apple knows that iOS will be loaded on to only a

handful of screen sizes or iPhone models, versus the hundreds of devices and manufacturers that

support Android. This leads to a more fragmented Android ecosystem, which we believe is relatively

harder for developers to support. Apple consistently touts when the majority of its user base is on the

latest operating system, which in turn allows developers to build for the latest version of iOS and know

that their apps are optimized for most of Apple's user base. Nonetheless, the Google Play store that

supports the Android user base also achieves a similar network effect. Ultimately, we view the

hardware and software (device and iOS) as the key differentiators for Apple's moat sources (switching

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 5 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

costs and intangible assets), since the lion's share of applications used by smartphone users are

platform-agnostic, in our view. Even for apps built for iOS first before Android (with the popular video

game Fortnite being one recent example), mobile apps are ultimately built for both platforms in short

order.

Finally, Apple may boast some cost advantages associated with its supply chain, such as pressuring

suppliers or making massive purchases of memory, flash storage, and other key components. However,

these advantages are predicated on the immense forecast volume of Apple's products, and we surmise

these advantages would evaporate if Apple's device production were to diminish. Apple likely could not

build the lowest cost phone in the industry as it has to build iOS, rather than use Android for free. More

important, this is likely a moot point as we think Apple will play at the high end of the market with best-

of-breed components for the foreseeable future—it's been doing so with the Mac for 40 years and

counting.

Fair Value and Profit Drivers Abhinav Davuluri, CFA, Sector Strategist, 28 Apr 2021

Our fair value estimate is $115 per share. Our estimate implies a forward GAAP P/E ratio of 22 times. In

fiscal 2021, we expect total revenue to be up 31% thanks to strength in Mac and iPad sales related to

work- and learning-from-home trends and the 5G iPhone 12 launch. With the iPhone 12 coming out in

October 2020 (fiscal first-quarter 2021) instead of September 2020 (fiscal fourth-quarter 2020), we think

Apple is poised for strong iPhone sales in the first half of fiscal 2021. We expect services to grow at a

11% CAGR over the next five years, while wearables also maintains strong double-digit growth.

Following a robust growth year in fiscal 2021, we believe iPhone sales will record modest growth, with

double-digit services growth driving total revenue growth in the mid-single digits.

We expect gross margins to remain in the high-30s, thanks to Apple’s exceptional premium pricing

strategy and stable iPhone margins. The firm recently began disclosing product and services gross

margins, and we anticipate product gross margins tracking in the low-30s and services gross margins

hovering around 65%. Although we think the higher-margin services segment will grow nicely, we

foresee lower-margin other products, such as the Apple Watch, serving as an offset. However, these

other products remain vital to Apple being able to lock in iPhone customers with the likes of AirPods,

Watches, and other accessories that sell at a notable premium to non-Apple counterparts. The shift to

internally designed ARM-based chips in lieu of chips from Intel for Apple's Mac PCs should help improve

Mac margins. To remain king of the hill in the premium smartphone market, we model higher research

and spending as Apple drives innovation and potentially ventures into new frontiers. We expect

operating margins to remain in the mid-20s.

Risk and Uncertainty Abhinav Davuluri, CFA, Sector Strategist, 29 Oct 2020

As one of the largest firms in the world, Apple is susceptible to competitive threats from capable

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 6 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

behemoths with significant resources. Over the course of its iPhone-fueled decade of dominance,

Samsung, Microsoft, Google, and others have taken their best shots at Apple, with fleeting success.

Consumer hardware is inherently prone to cutthroat competition as short-product cycles and customers

hungry for greater features make market leadership difficult to sustain. Although Apple has done well

with its walled garden approach with iOS, the firm competes with Chinese OEMs at the low and midtier

as well as tech titans such as Samsung across the entire spectrum of smartphones.

Furthermore, we suspect that many customers are holding on to their phones longer as premium

devices are more than good enough for today’s needs (web browsing, media streaming, social media)

and potentially tomorrow’s (virtual/augmented reality). Analogous to the decline of PCs (with current

PCs more than adequate for most applications), Apple faces the possibility of smartphone unit

stagnation or even declines once emerging markets saturate or consumers gravitate to mid-tier devices.

Should it be unable to innovate, the firm may lose its ability to charge premium prices for hardware that

is no longer indistinguishable from many comparable devices.

Some competitors are willing to sell hardware at essentially cost to drive revenue or stickiness in other

business segments. A notable example is Amazon with its multitude of products including its Echo smart

speaker, Fire TV, Prime Music, Kindle Fire, and Prime Video to attract and retain Prime customers.

Should these devices supersede their iOS counterparts, Apple's devices may be at risk. A recent focus

on AI assistants such as Google Now and Amazon Alexa has also put pressure on Apple’s Siri that has

fallen behind its peers in efficacy. Herein lies another area Apple may face headwinds if consumers

further prioritize voice-recognition capabilities.

Capital Allocation Abhinav Davuluri, CFA, Sector Strategist, 4 Nov 2020

We view Apple’s stewardship rating as Standard. Tim Cook became CEO in August 2011 after

cofounder, longtime CEO, and visionary Steve Jobs stepped down from the CEO role before passing

away in October 2011. Cook was considered Jobs' right-hand man and served in various operations

roles with Apple before becoming COO in 2005. Although Jobs' death was a blow to the firm, as he was

a one-of-a-kind leader and creative mind, Apple is not lacking in capable leaders. Arthur Levinson,

former chairman and CEO of Genentech, is chairman of Apple's board of directors. Jeff Williams serves

as COO of Apple and would be our best bet to replace Cook as CEO.

We think Apple’s recent level of technological innovation has been adequate, though it has likely faced

an unreasonably high bar for expectations after the debut of the iPhone. Many of the firm’s recent

innovations have been in software and services within iOS such as Apple Pay, as well as under-the-

hood improvements in semiconductors, rather than revolutionary, ubiquitous devices like the iPod or

iPhone. We like how the firm designs its own chips for the CPU and artificial intelligence (A-series bionic

neural engine), as this can create a better user experience since Apple also designs the operating

system and can appropriately tailor the CPU or neural engine to its needs. Going forward, we expect the

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 7 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

firm to also design its own GPU, which should enable performance differentiation.

Products like the Apple Watch, AppleTV, AirPods and HomePod don’t move the needle in isolation, but

should drive incremental earnings growth to Apple. More importantly, these products will make it more

challenging for iPhone users to leave the iOS ecosystem, in our view. Although the Apple Watch has

had mixed results at the outset, we don’t view it as a miss just yet, given similar slow starts for the iPad

and iPhone.

Although Apple maintains sterling brand recognition and has 1.5 billion active devices (as of December

2019), it has made a few missteps under Cook that skeptics would argue wouldn’t have happened

under Jobs. Apple made a poor decision to part ways with Google Maps in iOS 6 and launch Apple

Maps with a bevy of bugs and errors, leading to a formal apology. More recently, Apple is being

investigated by the U.S. government as the firm purposefully slowed down iOS on older devices. While

the firm claims that it was to protect the user from sudden phone shutdowns, many fear that Apple was

implementing planned obsolescence of their devices, in order to get customers to upgrade.

In terms of capital allocation, we applaud Cook's decision to initiate dividend and stock buyback

programs, as well as take on debt in order to fund such programs when most of its cash was trapped

overseas. As of September 2020, Apple was authorized to purchase up to $225 billion of stock through

its share repurchase program, of which $168.6 billion had been utilized. Apple continues to strive to

achieve a net cash neutral position over time.

Perhaps more important, we think Apple's frugality in terms of acquisitions is quite admirable. Apple's

strategy of focusing on smaller, tuck-in deals and developing products in house, rather than splashy but

questionable deals like Microsoft's purchase of Skype or Google's foray into hardware by acquiring

Motorola Mobility and Nest, appears to have served investors quite well in recent years. Even Apple's

$3.0 billion acquisition of Beats Music and Beats Electronics represented only a tiny portion of the firm's

total cash balance.

Apple has also done a good job of attracting topnotch talent to the company, such as former Burberry

CEO Angela Ahrendts to run Apple’s retail and online stores. However, we note Ahrendts recently

stepped down with head of HR Deirdre O'Brien taking over the role. We are comfortable that these hires

have strengthened Apple’s bench in the unlikely event of Cook departing the company, and each hire

likely has aided in Apple’s efforts to build and deliver the Apple Watch and perhaps future products as

well. All the while, Apple’s ongoing operations continue to generate operating margins and cash flow

well above its peers in various hardware industries, which bodes well for future free cash flow for

investors.

In July 2019, Intel announced it agreed to sell its 5G smartphone modem business to Apple for $1

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 8 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

billion. This is the second largest acquisition by Apple (after Beats for $3 billion in 2014). We had been

expecting such a deal since Intel announced its plans to exit the 5G modem business following the

resolution of the dispute between Apple and Qualcomm earlier in 2019. We believe this deal validates

Apple’s strategy of trying to bring as much chip development in-house as feasible, though we don’t

expect the firm to replace Qualcomm’s 5G modems in future iPhones for at least a few years.

Analyst Notes Archive

Corporate Tax Hikes Are Very Likely to Come for U.S. Equities Preston Caldwell, Equity Analyst, 11

May 2021

We expect a U.S. corporate tax hike to be passed this year. Our probability-weighted forecast is an

increase in the statutory tax rate to 26% from 21% currently. Our equity analysts will be incorporating

the new tax rate into their valuation models over the coming weeks, but our preliminary analysis

suggests a mid-single-digit impact to the average U.S. equity valuation.

President Joe Biden has unveiled a $2 trillion infrastructure plan that he plans to pay for largely with

increases in corporate taxes. While there are other plausible sources of revenue, these will likely be

needed for other spending priorities, so we believe there is a high probability that Congress will pass an

increase in corporate taxes this year, effective in 2022.

Biden's proposal is to increase the corporate tax rate to 28% from the current 21% (but below the 35%

before the Tax Cuts and Jobs Act of 2017). Our probability-weighted estimate is a new corporate

business tax rate of 26%, which incorporates an 80% probability that any tax increase is passed at all.

Conditional on an increase passing, we've penciled in an 80% probability that Biden's proposed 28% is

passed versus a 20% probability that the increase is limited to 25%.

We’ve simulated the impact of various tax rate changes on valuations for our covered U.S. equities. For

the average U.S. equity, the impact of the statutory tax rate increase to 26% from 21% generates a 2.7%

fall in valuation. If rates increase to the full 28% as proposed, that generates a 3.8% fall in valuation.

Apple’s March Quarter Sales Driven to New Highs by Broad-Based Strength; Raising FVE to $115

Abhinav Davuluri, CFA, Sector Strategist, 29 Apr 2021

Apple reported fiscal second quarter results ahead of our expectations, led by the iPhone segment. The

firm did not provide guidance the last four quarters and once more refrained from offering specific

financial expectations due to uncertainty regarding COVID-19. Apple’s iPhone revenue grew 66% year

over year to $47.9 billion, thanks to the new 5G iPhone 12 family. Although we anticipate strong double-

digit iPhone growth in 2021, we think growth rates will moderate in the coming years. We are raising

our fair value estimate for narrow-moat Apple to $115 per share from $98 as we incorporate a stronger

near-term outlook due to the current 5G iPhone cycle and ongoing work- and learning-from-home

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 9 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

dynamics bolstering Mac and iPad segments. Nonetheless, we think shares are currently overvalued, as

we think recent growth trends could be unsustainable past 2021.

Second quarter revenue was up 54% year over year thanks to growth in iPhone (66%), iPad (79%), Mac

(70%), services (27%), and wearables, home, and accessories (25%). We note the iPhone segment

benefited from a delayed iPhone 12 launch and all segments faced an easier year-over-year compare

due to the March 2020 quarter being negatively impacted by COVID-19. On the services front, Apple

now enjoys over 660 million paid subscribers to its various services, up 145 million from a year ago.

Greater China sales were up 88% year over year, which we attribute primarily to the new 5G iPhone.

Gross margin of 42.5% was up 270 basis points sequentially due to a strong product mix and favorable

foreign exchange rates.

Management anticipates strong double-digit year over-year-growth for the June quarter, though the

seasonal sequential decline from the March quarter will be greater than prior years. Meanwhile, supply

constraints are expected to have a $3 billion to $4 billion negative impact on sales in the June quarter.

Apple’s iPhone 12 Launch Propels December Quarter Sales to Record Heights; Raising FVE to $98

Abhinav Davuluri, CFA, Sector Strategist, 28 Jan 2021

Apple reported fiscal first-quarter results ahead of our expectations led by the iPhone segment. The firm

did not provide guidance the last three quarters and once more refrained from offering specific financial

expectations due to uncertainty regarding COVID-19. Apple’s iPhone revenue grew 17% year over year

to a quarterly record $65.6 billion, thanks to the new 5G iPhone 12 family. Although we anticipate

strong double-digit iPhone growth in 2021, we think growth rates will moderate in the coming years.

We are raising our fair value estimate for narrow-moat Apple to $98 per share from $85 as we

incorporate a stronger near-term outlook due to the current 5G iPhone cycle and ongoing work- and

learning-from-home dynamics bolstering Mac and iPad segments. Nonetheless, we think shares are

currently overvalued, as we think recent growth trends could be unsustainable past 2021.

First-quarter revenue was up 21% year over year thanks to growth in iPhone (17%), iPad (41%), Mac

(21%), services (24%), and wearables, home, and accessories (30%). Apple’s active installed base of

iPhones is now over 1 billion, while its overall installed base of active devices surpassed 1.65 billion

during the quarter. On the services front, Apple now enjoys over 620 million paid subscribers to its

various services, up 140 million from a year ago. Greater China sales were up 57% year over year, which

we attribute primarily to the new 5G iPhone, though management was adamant their iPad and Mac

units also fared well in the region. Gross margin of 39.8% was up 160 basis points sequentially due to a

higher mix of services and strong leverage from higher sales.

Management anticipates year-over-year growth for the March quarter, though the services business

faces a difficult year-over-year comparison. Meanwhile, we expect the Mac and iPad segments to begin

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 10 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

decelerating in a few quarters, following a stretch of robust growth due to COVID-19-related working-

and learning-from-home.

Apple’s Mac and iPad Sales Remain Bolstered by Work-From-Home Trend in Q4; Raising FVE to $85

Abhinav Davuluri, CFA, Sector Strategist, 30 Oct 2020

Apple reported fiscal fourth-quarter results ahead of our expectations led by Mac and iPad segments.

The firm did not provide guidance the last two quarters and again refrained from offering specific

guidance due to uncertainty regarding COVID-19. CEO Tim Cook expects iPhone revenue to grow in the

December quarter despite the new iPhone 12 being launched a couple of weeks later in the quarter,

though he did not specify the magnitude of growth. Meanwhile, all other products and services are

expected to grow in the double digits.

We are raising our fair value estimate for narrow-moat Apple to $85 per share from $71 as we

incorporate a stronger near-term outlook for the Mac and iPad segments due to ongoing work- and

learning-from-home dynamics. Nonetheless, we think shares are currently overvalued, as we think

recent growth trends could be unsustainable as we enter 2021.

Fourth-quarter revenue was up 1% year over year thanks to growth in iPad (46%), Mac (29%), services

(16%), and wearables, home, and accessories (21%). Management noted the iPad and Mac segments

remained supply constrained, which bodes well for these business lines in the December quarter.

Apple’s iPhone sales were understandably down 21% year over year due to the iPhone 12 delay. Apple

now has over 585 million paid subscribers to its various services, up 135 million from a year ago, and the

firm expects 600 million subs by Dec 2020. Although Greater China was the region most impacted by the

absence of the new iPhones for the quarter (total revenue down 29% year over year), non-iPhone sales

grew double digits. Gross margin of 38.2% was up 20 basis points sequentially due to a higher mix of

services.

Management was optimistic revenue from Greater China would grow in the first quarter, particularly as

5G is more mature in the region. We anticipate iPhone revenue for fiscal 2021 will be up in the low

teens, though the late launch may shift some sales from the December quarter to the March quarter.

Apple Launches 5G iPhone As Expected; Other Enhancements Relatively Lackluster; No Change to

FVE Abhinav Davuluri, CFA, Sector Strategist, 14 Oct 2020

On Oct. 13, Apple held its annual product showcase, where the firm announced the launch of four new

iPhone models: the iPhone 12, iPhone 12 mini, iPhone 12 Pro, and iPhone 12 Pro Max. All devices in the

“12” family are 5G-compatible. The base iPhone 12 model was priced at $799, which is $100 more

expensive than the equivalent iPhone 11 launched in 2019, which we attribute to the costly 5G modem

and RF content. Taking the $699 slot is the smaller iPhone 12 mini with a 5.4” screen. While we suspect

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 11 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

the 5G capability and updated cameras (the Pro variant boasts a LIDAR scanner to autofocus in low-

light) will be major draws for many customers, we think market expectations for iPhone sales in the

coming quarters may be too aggressive. We are maintaining our $71 fair value estimate for narrow-

moat Apple, and we view shares as overvalued at current levels.

Battery life continued to expand, thanks to the new A14 Bionic chip, which is manufactured on TSMC’s

5-nanometer process technology that leverages EUV lithography. For the A14, Apple claims a 50%

performance advantage over any other competing mobile chip, though we were surprised by a lack of

color on power efficiency. For 5G, the firm claimed up to 4Gbps download and 200Mbps upload speeds

in ideal conditions. We doubt most users will experience these speeds anytime soon, as the 5G ramp is

still in the early innings.

The iPhone 12 Pro and 12 Pro Max will start at $999 and $1,099, respectively, in line with the starting

prices of their equivalents from 2019. The Pro models both feature larger screens than their

predecessors, with the Pro and Pro Max going from 5.8” and 6.1” to 6.5” and 6.7”, respectively. The Pro

has three cameras (ultra-wide, wide, and telephoto), with the Pro Max having even better cameras. The

emphasis on camera features is consistent with other Android-based smartphone vendors that have

been also adding additional cameras and claiming superiority to Apple devices in the picture quality

department.

With New iPhone Delayed Until October, Apple Launches New Watch and iPad at Annual Event

Abhinav Davuluri, CFA, Sector Strategist, 15 Sep 2020

On Sept. 15, Apple held its annual product showcase where it announced the launch of a new Apple

Watch and iPad. The iPhone was notably absent from the event, as COVID-19-related delays have

pushed back the launch of Apple’s crown jewel to October. On the services front, the firm detailed its

Apple One offering that bundles iCloud, Apple Music, TV+, Arcade, News+, and Fitness+ for $29.95 per

month (and a skinnier version without Fitness and News at $14.95). We expect the firm to continue

pushing the “as-a-service” model for both its products and software to solidify its recurring revenue

streams. Our fair value estimate remains $71 per share for the firm. While narrow-moat Apple remains

well positioned in the near term given the upcoming 5G iPhone and stronger outlook for Mac and iPad

segments due to the ongoing work- and learning-from-home dynamics, we recommend prospective

investors wait for a wider margin of safety before investing in Apple.

The Apple Watch Series 6 was the first product discussed, with the most noteworthy feature being its

ability to measure blood oxygen levels using both red and infrared light. The new watch includes a new

S6 processor with up to 20% faster performance relative to the prior generation. The price point is the

same as the last variant: starting at $399 with the cellular model at $499. Similar to the cheaper iPhone

SE, Apple also announced an Apple Watch SE starting at $279. We expect these new products to help

Apple sustain its recent stretch of double-digit wearables growth.

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 12 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

On the iPad front, the firm updated its entry-level variant starting at $329 as well as the iPad Air with its

latest A14 Bionic processor (made on TSMC’s 5-nanometer process) and starting at $599. In addition to

the normal performance hike (40% from prior generation), Apple is also embracing USB-C for its charge

port (similar to the iPad Pro). K

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 13 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

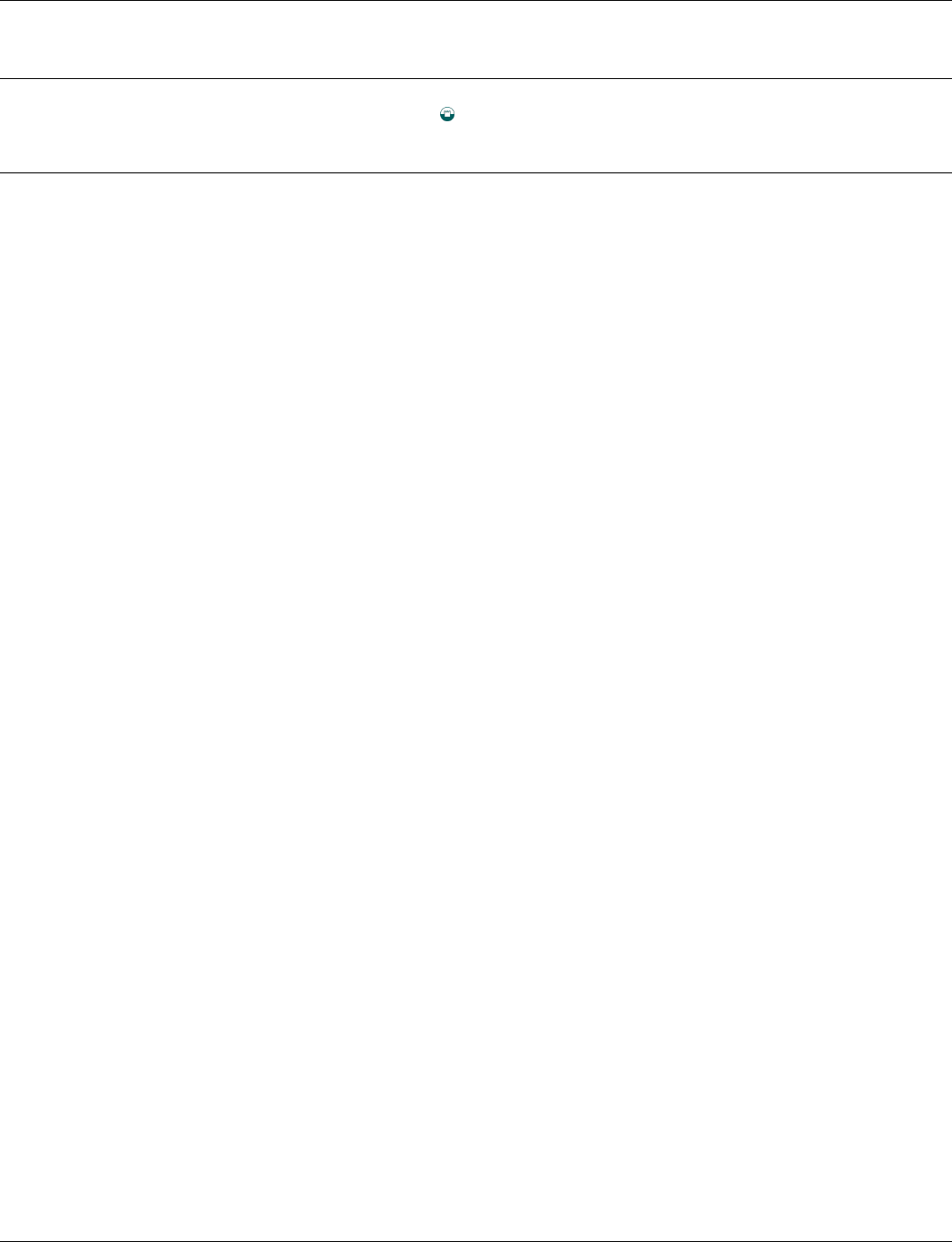

Competitors Price vs. Fair Value

Alphabet Inc Class A GOOGL

0

1000

2000

3000

4000

Fair Value: 2,925.00

28 Apr 2021 01:40, UTC

Last Close: 2,564.74

Over Valued

Under Valued

2016 2017 2018 2019 2020 YTD

0.94 0.96 0.80 1.03 0.89 0.88 Price/Fair Value

1.86 32.93 -0.80 28.18 30.85 46.34 Total Return %

Morningstar Rating

Total Return % as of 14 Jul 2021. Last Close as of 14 Jul 2021. Fair Value as of 28 Apr 2021 01:40, UTC.

HP Inc HPQ

0

10

20

30

40

Last Close: 28.59

Fair Value: 23.00

26 Feb 2021 05:50, UTC

Over Valued

Under Valued

2016 2017 2018 2019 2020 YTD

0.93 1.11 0.82 1.08 1.23 1.24 Price/Fair Value

29.60 45.20 0.13 3.65 23.17 17.84 Total Return %

Morningstar Rating

Total Return % as of 14 Jul 2021. Last Close as of 14 Jul 2021. Fair Value as of 26 Feb 2021 05:50, UTC.

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 14 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Microsoft Corp MSFT

0

100

200

300

400

Last Close: 282.51

Fair Value: 278.00

28 Apr 2021 02:29, UTC

Over Valued

Under Valued

2016 2017 2018 2019 2020 YTD

0.99 0.96 0.78 1.02 0.95 1.02 Price/Fair Value

14.65 40.22 20.75 57.12 42.37 27.52 Total Return %

Morningstar Rating

Total Return % as of 14 Jul 2021. Last Close as of 14 Jul 2021. Fair Value as of 28 Apr 2021 02:29, UTC.

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 15 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Apple Inc

AAPL

QQ

14 Jul 2021 21:18, UTC

Last Price Fair Value Estimate Price/FVE Market Cap Economic Moat

TM

Moat Trend

TM

Uncertainty Capital Allocation ESG Risk Rating Assessment

1

149.15 USD

14 Jul 2021

115.00 USD

29 Apr 2021 02:24, UTC

1.30

2.49 USD Tril

14 Jul 2021

Narrow Stable High Standard

;;;;;

7 Jul 2021 05:00, UTC

Morningstar Historical Summary

Financials as of 31 Mar 2021

Fiscal Year, ends 30 Sep 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD TTM

Revenue (USD Bil) 108 157 171 183 234 216 229 266 260 275 201 325

Revenue Growth % 66.0 44.6 9.2 7.0 27.9 -7.7 6.3 15.9 -2.0 5.5 33.9 21.4

EBITDA (USD Bil) 36 59 57 62 85 73 77 87 82 81 68 103

EBITDA Margin % 33.3 37.7 33.4 33.8 36.2 34.0 33.4 32.8 31.5 29.5 34.0 31.7

Operating Income (USD Bil) 34 55 49 53 71 60 61 71 64 66 61 89

Operating Margin % 31.2 35.3 28.7 28.7 30.5 27.8 26.8 26.7 24.6 24.2 30.4 27.3

Net Income (USD Bil) 26 42 37 40 53 46 48 60 55 57 52 76

Net Margin % 24.0 26.7 21.7 21.6 22.9 21.2 21.1 22.4 21.2 20.9 26.1 23.5

Diluted Shares Outstanding (Bil) 26 26 26 24 23 22 21 20 19 18 17 17

Diluted Earnings Per Share (USD) 0.99 1.58 1.42 1.61 2.31 2.08 2.30 2.98 2.97 3.28 3.08 4.47

Dividends Per Share (USD) 0.00 0.09 0.41 0.45 0.50 0.55 0.60 0.68 0.75 0.80 0.41 0.82

Valuation as of 30 Jun 2021

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Recent Qtr TTM

Price/Sales 3.5 3.1 3.1 3.7 2.6 3.0 3.9 3.0 5.2 8.5 7.2 7.2

Price/Earnings 14.6 12.1 14.1 17.1 11.4 13.9 18.4 13.2 24.7 40.5 30.7 30.7

Price/Cash Flow 10.1 8.9 9.7 11.3 7.5 9.7 14.0 10.2 19.7 28.8 23.6 23.6

Dividend Yield % — 1.0 2.1 1.67 1.93 1.93 1.45 1.79 1.04 0.61 0.61 0.61

Price/Book 4.9 3.9 4.1 5.8 4.9 4.7 6.4 7.0 14.2 34.1 33.0 33.0

EV/EBITDA 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Operating Performance / Profitability as of 31 Mar 2021

Fiscal Year, ends 30 Sep 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD TTM

ROA % 27.1 28.5 19.3 18.0 20.5 14.9 13.9 16.1 15.7 17.3 15.9 23.2

ROE % 41.7 42.8 30.6 33.6 46.3 36.9 36.9 49.4 55.9 73.7 77.9 103.4

ROIC % 41.0 42.0 26.1 26.2 31.3 22.0 19.9 24.4 25.8 30.1 28.3 40.1

Asset Turnover 1.1 1.1 0.9 0.8 0.9 0.7 0.7 0.7 0.7 0.8 0.6 1.0

Financial Leverage

Fiscal Year, ends 30 Sep 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Recent Qtr TTM

Debt/Capital % — — 12.1 20.6 30.9 37.0 42.0 46.7 50.4 60.2 61.1 —

Equity/Assets % 65.8 67.1 59.7 48.1 41.1 39.9 35.7 29.3 26.7 20.2 20.5 —

Total Debt/EBITDA — — 0.3 0.6 0.8 1.2 1.5 1.3 1.3 1.4 1.8 —

EBITDA/Interest Expense — — 419.4 161.0 115.3 50.4 33.0 26.9 22.9 28.2 52.3 39.1

Morningstar Analyst Historical/Forecast Summary as of 28 Apr 2021

Financials

Estimates

Fiscal Year, ends 26 Sep 2019 2020 2021 2022 2023

Revenue (USD Bil) 260 275 359 373 385

Revenue Growth % -2.0 5.5 30.7 3.8 3.3

EBITDA (USD Bil) 76 77 117 115 114

EBITDA Margin % 29.4 28.2 32.6 30.9 29.6

Operating Income (USD Bil) 64 66 104 102 102

Operating Margin % 24.6 24.2 29.0 27.4 26.6

Net Income (USD Bil) 55 57 89 86 87

Net Margin % 21.2 20.9 24.7 23.2 22.5

Diluted Shares Outstanding (Bil) 19 18 17 17 17

Diluted Earnings Per Share(USD) 2.97 3.28 5.13 5.06 5.13

Dividends Per Share(USD) 0.75 0.80 0.85 0.91 0.99

Forward Valuation

Estimates

2019 2020 2021 2022 2023

Price/Sales 3.8 7.2 6.9 6.7 6.5

Price/Earnings 18.9 35.3 29.1 29.5 29.1

Price/Cash Flow 16.9 26.8 23.7 25.5 26.0

Dividend Yield % 1.34 0.69 0.57 0.61 0.66

Price/Book — — — — —

EV/EBITDA 13.2 25.7 21.8 22.1 22.3

Morningstar Equity Analyst Report | Report as of 15 Jul 2021 15:25, UTC | Reporting Currency: USD | Trading Currency: USD | Exchange: NASDAQ

Page 16 of 19

© Morningstar 2021. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or

accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or

other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in

part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research

Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Please see important disclosures at

the end of this report.

ß

®

Research Methodology for Valuing Companies

Morningstar Equity Research Star Rating Methodology

Overview

At the heart of our valuation system is a detailed projec-

tion of a company’s future cash flows, resulting from our

analysts’ research. Analysts create custom industry and

company assumptions to feed income statement, balance

sheet, and capital investment assumptions into our glob-

ally standardized, proprietary discounted cash flow, or

DCF, modeling templates. We use scenario analysis, inde-

pth competitive advantage analysis, and a variety of other

analytical tools to augment this process. Moreover, we

think analyzing valuation through discounted cash flows

presents a better lens for viewing cyclical companies,

high-growth firms, businesses with finite lives (e.g.,

mines), or companies expected to generate negative

earnings over the next few years. That said, we don’t dis-

miss multiples altogether but rather use them as support-

ing cross-checks for our DCF-based fair value estimates.

We also acknowledge that DCF models offer their own

challenges (including a potential proliferation of estim-

ated inputs and the possibility that the method may miss

shortterm market-price movements), but we believe these

negatives are mitigated by deep analysis and our

longterm approach.

Morningstar’s equity research group (”we,” “our”) be-

lieves that a company’s intrinsic worth results from the

future cash flows it can generate. The Morningstar Rating

for stocks identifies stocks trading at a discount or premi-

um to their intrinsic worth—or fair value estimate, in

Morningstar terminology. Five-star stocks sell for the

biggest risk adjusted discount to their fair values, where-

as 1-star stocks trade at premiums to their intrinsic worth.

Four key components drive the Morningstar rating: (1) our

assessment of the firm’s economic moat, (2) our estimate

of the stock’s fair value, (3) our uncertainty around that

fair value estimate and (4) the current market price. This

process ultimately culminates in our singlepoint star rat-

ing.

1. Economic Moat

The concept of an economic moat plays a vital role not

only in our qualitative assessment of a firm’s long-term

investment potential, but also in the actual calculation of

our fair value estimates. An economic moat is a structural

feature that allows a firm to sustain excess profits over a

long period of time. We define economic profits as re-

turns on invested capital (or ROIC) over and above our es-

timate of a firm’s cost of capital, or weighted average

cost of capital (or WACC). Without a moat, profits are

more susceptible to competition. We have identified five

sources of economic moats: intangible assets, switching

costs, network effect, cost advantage, and efficient scale.

Companies with a narrow moat are those we believe are

more likely than not to achieve normalized excess returns

for at least the next 10 years. Wide-moat companies are

those in which we have very high confidence that excess

returns will remain for 10 years, with excess returns more

likely than not to remain for at least 20 years. The longer

a firm generates economic profits, the higher its intrinsic

value. We believe low-quality, no-moat companies will

see their normalized returns gravitate toward the firm’s

cost of capital more quickly than companies with moats.

When considering a company's moat, we also assess

whether there is a substantial threat of value destruction,

stemming from risks related to ESG, industry disruption,

financial health, or other idiosyncratic issues. In this con-

text, a risk is considered potentially value destructive if its

occurrence would eliminate a firm’s economic profit on a

cumulative or midcycle basis. If we deem the probability

of occurrence sufficiently high, we would not characterize

the company as possessing an economic moat.

To assess the sustainability of excess profits, analysts per-

form ongoing assessments of the moat trend. A firm’s

moat trend is positive in cases where we think its sources

of competitive advantage are growing stronger; stable

where we don’t anticipate changes to competitive ad-

vantages over the next several years; or negative when

we see signs of deterioration.

2. Estimated Fair Value

Combining our analysts’ financial forecasts with the

firm’s economic moat helps us assess how long returns

on invested capital are likely to exceed the firm’s cost of

capital. Returns of firms with a wide economic moat rat-

ing are assumed to fade to the perpetuity period over a

longer period of time than the returns of narrow-moat

firms, and both will fade slower than no-moat firms, in-

creasing our estimate of their intrinsic value.

Our model is divided into three distinct stages:

Stage I: Explicit Forecast

In this stage, which can last five to 10 years, analysts

make full financial statement forecasts, including items

such as revenue, profit margins, tax rates, changes in

workingcapital accounts, and capital spending. Based on

these projections, we calculate earnings before interest,

after taxes (EBI) and the net new investment (NNI) to de-

rive our annual free cash flow forecast.

Stage II: Fade

The second stage of our model is the period it will take

the company’s return on new invested capital—the re-

turn on capital of the next dollar invested (“RONIC”)—to

decline (or rise) to its cost of capital. During the Stage II

period, we use a formula to approximate cash flows in

lieu of explicitly modeling the income statement, balance

sheet, and cash flow statement as we do in Stage I. The

length of the second stage depends on the strength of

the company’s economic moat. We forecast this period to

last anywhere from one year (for companies with no eco-

nomic moat) to 10–15 years or more (for wide-moat com-

panies). During this period, cash flows are forecast using

four assumptions: an average growth rate for EBI over the

period, a normalized investment rate, average return on

new invested capital (RONIC), and the number of years

until perpetuity, when excess returns cease. The invest-

ment rate and return on new invested capital decline un-