HAL Id: hal-02536209

https://cnam.hal.science/hal-02536209

Preprint submitted on 8 Apr 2020

HAL is a multi-disciplinary open access

archive for the deposit and dissemination of sci-

entic research documents, whether they are pub-

lished or not. The documents may come from

teaching and research institutions in France or

abroad, or from public or private research centers.

L’archive ouverte pluridisciplinaire HAL, est

destinée au dépôt et à la diusion de documents

scientiques de niveau recherche, publiés ou non,

émanant des établissements d’enseignement et de

recherche français ou étrangers, des laboratoires

publics ou privés.

’Zero’ Option in Conjoint Analysis:

Silva Ohannessian, Gilbert Saporta

To cite this version:

Silva Ohannessian, Gilbert Saporta. ’Zero’ Option in Conjoint Analysis:: A New Specication of the

Indecision and the Refusal - Application to the Video on Demand Market. 2010. �hal-02536209�

Electronic copy available at: http://ssrn.com/abstract=1596203

1

”ZERO” OPTION IN CONJOINT ANALYSIS :

A new specification of the indecision and the refusal.

Application to the Video on Demand market

Silva OHANNESSIAN

1

Gilbert SAPORTA

2

1

Doctorate Student, Conservatoire national des arts et m´etiers (CNAM), Paris, 5, rue Cavour, 1203

I would like to thank Mr Olivier Monti who has coded and run in Matlab and GiveWin-TSP programs

related to the pairs and products reduction, the aggregate estimation model with the maximum likelihood

and the bayesian approach, i.e. the calculation of estimates through the mode and the standard deviation,

and the graphs.

2

Professor in Statistics, Conservatoire national des arts et m´etiers (CNAM), Paris, 292 rue Saint

Martin, 75141 Paris cedex 03, FRANCE, phone number 0033 1 40 27 22 68, fax 0033 1 40 27 25 4,

Electronic copy available at: http://ssrn.com/abstract=1596203

2

ABSTRACT

This paper undertakes a study about the ”zero” option in c onjoint analysis. The ”zero” option

relates to the no choice of products presented to individuals within the frame of a survey. This

no choice embeds two distinct concepts, the refusal and the conflict. The first represents the

inappreciation of products, while the second is defined by the preference and choice uncertainty.

This work proposes a new econometric specification of the no choice by assuming a mix of utilities

maximisation and ordered response models. This mix only associates utilities with products and

compares them to the ”zero” option thresholds. These comparisons lead to no choice situations

without linking utilities to refusal and conflict.

A study on the Video on Demand market has been conducted. The results are obtained by

applying a bayesian approach in the case of individual models, and the maximum likelihood in

the case of aggregate models. The estimates fit the reality and the significance of the refusal and

the conflict demonstrates the importance of these variables in the decision making process.

Keywords : ”zero” option specification, inappreciation of the products, indecision in the choice,

separation and non convergence, bayesian approach, Monte Carlo simulations, market shares

3

INTRODUCTION

In the conjoint analysis literature, the ”zero” option relates to the no choice due to the inap-

preciation of the scenarios presented within the frame of a survey. However, the econometric

specification of this no choice, called refusal, is rarely tackled. Another type of no choice is the

indecision in the choice making process resulting from the similarities of the scenarios. This

second concept of no choice, labeled conflict, is presented by Tversky and Shafir (1992). The

latter demonstrates that the consideration of the conflict disagrees with the utility maximisation

theory or the rational theory of the choice.

Taking into account these various elements, we propose a new s pecification of the ”zero” option

that integrates the above mentioned concepts, the conflict and the refusal. To respect the unsui-

tability of the utility maximisation with the no choice, no utilities are associated with neither

of the two concepts. Instead, we refer to the notion of ordered response models that governs the

no choice. Our modeling of the ”zero” option is therefore a mix of specification resulting from

the utilities comparison and the ordered response models. This mix associates utilities only with

the products and compares them with the ”zero” option thresholds. These comparisons allow

us to determine the boundaries of no choice situations.

We apply our ”zero” option model to the Video on Demand (VoD) market. The obtained results,

by using a bayesian approach on the individual models and the likelihood maximisation on the

aggregate model, show a good adequation of the model. The estimates are consistent with the

reality and the significance of the refusal and the conflict demonstrates their importance in the

decision making process. Moreover, the use of a bayesian approach for the parameter estimation

gives better results than the widespread penalized likelihood.

SPECIFICATION OF THE ”ZERO” OPTION

Definition and Psychological Concepts Associated with the ”Zero” Option

The ”zero” option as defined in this paper does not totally refer to the notion of no choice

described in the literature. While the latter only considers the case of the inappreciation of

products in the no choice, we also include in this definition the possibility that individuals have

uncertainty in the decision making process. The uncertainty is in fact due to the strong simila-

rities of the goods. Psychological reasons explain this situation of no choice, as we will see below.

Dhar (1997) suggests that one of the frequently mentioned no choice causes is that the consumer

tends not to choose goods when the difference of interest between two alternatives is small. This

result has also been acknowledged by other authors, like Beattie and Barlas (1992), Festinger

(1964) and Janis and Mann (1977) who suggest that a defensive refusal is probably due to the

choice difficulties. Tversky and Shafir (1992) pretend that a no choice is more likely in a sub-

set that does not integrate a dominant alternative rather than when there is a clearly superior

product. Kuhl (1986) and Sjoberg (1980) notice that it is difficult to maintain the intention to

act when there are competitive desires and intentions. Montgomery (1989) states that the indi-

vidual can abandon or delay his choice if he does not find a dominant structure for a promising

alternative. Scholnick and Wing (1988) pretend that a decision situation with a lot of acceptable

alternatives in which none is clearly the best, can confuse someone and lead him to inaction. In

the recent studies, Baron and Ritov (1994), Ritov and Baron (1990) and Spranca, Minsk and

Baron (1991) find a systematic bias towards inaction in the consumer decision m aking process.

4

This no choice principle that refers to the difference of interest does not fit the rational theory

which assumes that the ”zero” option must be chosen when no alternative is attractive or when

there is some advantage for additional detailed research (Karni et Schwarz 1977). On the other

hand, it matchs the psychological research in the field of pre-decision making process that sug-

gests that the consumer refuses to make a decision to avoid a difficult compromise (Tversky

and Shafir (1992)). Tversky and Shafir (1992) call this situation of no choice conflict. Indeed,

according to them the conflict appears when a individual can not make compromise. It results

in that some important and insignificant decisions become difficult. The authors also mention

the complexity to resolve the conflict due to the uncertainty of the inaction consequences and

to the embarrassment caused by the anticipation of the dissonance and the regret.

Tversky and Shafir (1992) are also interested in the differences of theory when the conflict is or

is not to be c onsidered. They demonstrate that the consideration of the conflict does not agree

with the utility maximisation theory or the rational theory of the choice. This observation is due

to the fact that the utility maximisation does not suppose that the ”zero” option can be caused

by a difficulty in the choice. In fact, the utility maximisation assumes that the consumer only

chooses the product with the greatest utility and does not take into account the link between

the consumer decision and the conflict caused by the compromise. B ut the authors declare that

the conflict influences the psychological state of the consumer and therefore his choice. In the

psychological literature this no choice behavior can be e xplained by the fact that individuals

prefer the inaction consequences than the opposite. Indeed, the uncertain consumer prefers not

to choose instead of accepting the choice consequences, e.g. the regret of the purchased product.

In addition, one of the inaction consequences, i.e. the no choice, can be the unavailability of

the product. The psychological theory pretends that individuals prefer to take the risk not to

obtain the product rather than regretting his purchase. As for the utility maximisation, it as-

sumes that this conflict does not influence the no choice because individuals select the option

”no alternatives” only when they do not like the products. However, Tversky and Shafir (1992)

demonstrate the opposite. Indeed, they show with an application that the rational theory of

choice is not respected when there is conflict. In their application, they present alternative pairs

to individuals and an additional option that allow them to delay their choice. They prove with

this example that the proportion of individuals selecting the additional option increases as the

conflict rises. This situation is inverted with the utility maximisation. Therefore, in practice, the

utility maximisation principle is not respected in some situations.

The choice approach in the conjoint analysis relies on the utility maximisation to estimate the

parameter of the model. But, according to Tversky et Shafir (1992), this principle is inappro-

priate with the introduction of conflict in the model. And yet some authors, like Elrod, Louviere

and Krishnakumar (1992) and Haaijer (1999) who add a series of 0 and/or a constant to the

multinomial model, or like Haaijer (1999) who specifies the no choice by means of neste d models,

base their work on the utility maximisation theory. Therefore, in this paper we model the ”zero”

option by first including the conflict and then by not associating a utility with the no choice but

only with the products.

”Zero” option model, the probabilities and the likelihood function

The model of the no choice presented in the literature use s the principle of utility maximisation

to estimate the parameters. Elrod, Louviere and Krishnakumar (1992) specify the no choice as

another alternative w ith the attributes equal to zero and determine the choice between the pro-

ducts and the option ”zero” by comparing their utilities. Haaijer (1999) consider approximately

the same model than Elrod, Louviere and Krishnakumar (1992) by changing some aspects. He

5

also suggests an estimation of the no choice by a nested model in two steps with the intention

not to suppose the ”zero” option as another alternative. Our specification does not use the prin-

ciple of utility maximisation, it does also not consider the ”zero” option as another alternative

and is formulated in one step. In fact, it is inspired by the censored regression models (tobit

models) that suppose a change of the dependant variable from a certain threshold. In our mo-

del, a comparison between the utilities remains, but it only takes place between the products

utilities, because the ”zero” option is not described by an utility. In fact, our specification mixes

the utilities comparison and the ordered response models.

Another aspect of our specification is the no choice caused by the conflict (Tversky and Shafir

(1992)), while the literature considers only the case associated with the refusal, i.e. the inappre-

ciation of the products.

For the sake of simplification, we will only consider the case of two products and the ”zero”

option caused by both the refusal and the conflict. Therefore, four alternatives are presented

to the individuals, i.e. the product h, the product l, the refusal, denoted by no pro ducts, and

the conflict, denoted by both products. Because of the similarities of the products leading to

the conflict, we can therefore economically translate this situation by near products utilities.

Suppose that an utilities difference of δ

0

does not lead to the conflict and an utility superior to

δ is the minimum to arouse the interest in the products, then our m odel that defines the choice

of the products h, l and the two c oncepts of the ”zero” option, i.e. the refusal and the conflict,

can be plotted as below :

Figure 1

REPRESENTATION OF THE ”ZERO” OPTION MODEL DEFINED BY THE PRODUCTS

h, l, THE REFUSAL AND CONFLICT

where δ represents the threshold defining the refusal, δ

0

the threshold associated with the conflict

and u

h

, respectively u

l

, the utilities associated with the products h, respectively to the products

l. The conjoint analysis literature of the choice model generally expresses the utilities as a

linear function. In our ”zero” option specification, we also apply this hypothesis to the products

utilities. This linearity can be explained by the use of compensatory models in conjoint analysis,

that is a negative utility is compensated by a positive one. Therefore, we assume an additive

form of the utility function.

According to assumptions set above, the utility u

h

, respectively u

l

, is formulated as u

h

=

β

0

x

h

+ ε

h

, respectively u

l

= β

0

x

l

+ ε

l

and the errors ε

h

, respectively ε

l

, are normal with a

6

zero mean and a σ

2

variance.

This illustration and these assumptions allow us to express the structure of the probabilities

associated with each area and used in the log-likelihood function to estimate the model para-

meters. According to the ”zero” option representation, these probabilities can be expressed as

follows :

P (Choice product h) = P (u

h

≥ δ, u

h

≥ u

l

+ δ

0

) (1)

P (Choice product l) = P (u

l

≥ δ, u

h

≤ u

l

− δ

0

) (2)

P (Refus) = P (y = 3) = P (u

h

< δ, u

l

< δ) (3)

P (Conflit) = 1 − P (Choice product h) − P (Choice p roduct l) −P (Refus) (4)

These equations show us that we must know the joint distribution of the errors ε

h

and ε

l

to

proceed. We suppose a bivariate normal distribution and a covariance equal to zero.

The final expressions of the probabilities associated with our ”zero” option model become :

P

h

= P (Choice product h) =1 − Φ

δ − β

0

x

h

σ

− Φ

β

0

(x

l

− x

h

) + δ

0

√

2σ

+ Φ

β

0

(x

l

− x

h

) + δ

0

√

2σ

,

δ − β

0

x

h

σ

;

1

√

2

(1)

P

l

= P (Choice product l) =Φ

β

0

(x

l

− x

h

) − δ

0

√

2σ

− Φ

δ − β

0

x

l

σ

,

β

0

(x

l

− x

h

) − δ

0

√

2σ

; −

1

√

2

(2)

P

R

= P (Refusal) = Φ

δ − β

0

x

h

σ

Φ

δ − β

0

x

l

σ

(3)

P

C

= P (Conf lict) =Φ

δ − β

0

x

h

σ

+ Φ

β

0

(x

l

− x

h

) + δ

0

√

2σ

− Φ

β

0

(x

l

− x

h

) − δ

0

√

2σ

− Φ

β

0

(x

l

− x

h

) + δ

0

√

2σ

,

δ − β

0

x

h

σ

;

1

√

2

− Φ

δ − β

0

x

h

σ

Φ

δ − β

0

x

l

σ

+ Φ

δ − β

0

x

l

σ

,

β

0

(x

l

− x

h

) − δ

0

√

2σ

; −

1

√

2

(4)

With these probabilities, we can express the likelihood function that allows us to estimate the

model parameters :

L =

S

Y

s=1

P

y

hs

h

P

y

ls

l

P

y

Rs

R

P

y

Cs

C

(5)

7

where

y

hs

=

1 when the individual chooses the product h in the subset s

0 otherwise

y

ls

=

1 when the individual chooses the product l in the subset s

0 otherwise

y

Rs

=

1 when the consumer does not like any product in the subset s

0 otherwise

y

Cs

=

1 when the individual is in a conflict situation when facing the

products in the subset s

0 otherwise

The estimates result from the maximisation of the log-likelihood function, i.e. when its derivative

according to the model parameters equals 0. Because of an identification problem, we have to

normalize one of the coefficients. Since the estimates remain true up to a scale parameter, we

can set σ to 1. With this normalization, we define the estimates given a scale parameter.

Separation and non co nvergence of the maximum likelihood

Non linear models with the qualitative dependant variable, like the probit and the logit models,

use the method of the maximum likelihood (ML) to estimate the unknown parameters. This

method does not always end with a solution according to the data. The existence of a solution

is therefore not assured. The absence of solution is frequently observed in small data size, i.e.

inferior to 50 observations.

In the conjoint analysis approach, it is frequent to make estimations in the case of small sample.

This small data size and the use of a ML estimation in the choice models often result in the

absence of solution. This kind of problem does not occur with rating and ranking data because

of the use of ordinary least square (OLS). The choice data estimation by a probit or a logit

model can be either aggregate, or individual. In the aggregate case, the data are large enough

and reveal seldom problems about the existence of solutions. However, the individual estimation

is carried out with a small data size, since the observations represent the number of products

choices per individual. Therefore, because we have to satisfy a proportion of re liable responses,

it is essential to restrict the number of observations. This kind of sample in the case of individual

analysis of preference by a probit or a logit model frequently leads to divergent estimation of

one or several parameters. This divergence of parameters is called the separation.

In addition to the small data size issue, other reasons that lead to the separation exist : the

presence of some independent variables with a high predictive value toward the dependant va-

riable and the small ratio between the number of observations and the parameters(inferior to

10). An e xample of the last reason is the following ratio,

number of observations

number of parameters

=

50

10

= 5 that

is inferior to 10. In fact, this last reason tends to increase the estimation bias of the ML para-

meter according to Bull, Mak and Greenwood (2002). As Firth (1993) mentions in his paper,

the ML estimation bias is generally of the order of O(n

−1

). As we will see later, Firth (1993)

proposes a method, called the penalized likelihood, to remove this bias, later used by Heinze and

Schemper (2002) to resolve the non convergence problems of the ML method associated with the

separation. The non convergence of the maximum likelihood estimation is not always noticed in

most of the softwares. In fact, because of the separation, the estimates could be infinite or very

large. It is explained by the monotonicity of the log-likelihood function. Some softwares only

take into account the convergence of the log-likelihood function despite the infinite estimates

8

and therefore declare the convergence of the model, while it is not the cas e.

Solutions : bayesian approach and penalized likelihood

As mentioned before, there are some solutions to solve the separation issues. In this subsection,

we will only describe the two most widely used methods, i.e. the bayesian approach and the

penalized likelihood.

The penalized likelihood estimation is almost always described for case of the dichotomous logit

model, later extended to multinomial logit models (Bull, Mak and Greenwood, 2002). However,

because our specification relates to a multinomial probit model, nothing guarantees us that the

penalized likelihood is the best alternative to the separation problems. Therefore we also take

into consideration the bayesian approach.

The bayesian approach functions on the principle of the conditional distributions stated by

Bayes. If Y is the dependent variable of the model, X the independent variable matrix and β

the unknown parameters, the Bayes principle defines the conditional law of β as :

law of (β|Y ) =

law of (Y |β) · law of (β)

law of Y

or mathematically,

f(β|Y ) =

f(Y |β)f(β)

f(Y )

(6)

The use of the Bayes approach in a regression model allows to determine the conditional distri-

bution of the parameter β from which we can deduce an estimate. Therefore, since the density of

Y does not depend on the unknown parameters, f (β|Y ) becomes proportional to the following

expression :

f(β|Y ) ∝ f(Y |β)f(β) (7)

In our specification of the ”zero” option we can reformulate the distribution of Y conditional

on β as a function of probabilities, since our dependant variable is qualitative. This conditional

function in the general multinomial model with a dependent variable with H levels can be

written in the following way :

P (Y |β) =

n

Y

i=1

H

Y

h=1

P

y

hi

hi

(8)

where P

hi

= P (y

i

= h) et y

i

=

1 if the individual i choose the alternative h

0 otherwise

Then, the law of β conditional on Y become :

f(β|Y ) ∝ P (Y |β)f (β) ≡

n

Y

i=1

H

Y

h=1

P

y

hi

hi

f(β) (9)

To determine the express ion of f (β|Y ), we have to suppose a distribution for the random co-

efficients vector β, called the prior law. With this in hand, we can express the a posteriori

distribution of β conditional on Y f(β|Y ) and then the mean, the mode or the median of this a

posteriori distribution that correspond to the various ways to estimate the β parameters vector.

9

The most frequently prior distributions cited and used in the literature are the normal distribu-

tion and the Jeffreys prior.

If the number of unknown parameters of the model with n observations is great (r coefficients),

then the normal prior distribution of the r parameters is a multivariate normal law, that is :

f(β) = (2π)

−

n

2

|Σ

β

|

−

1

2

exp

−

1

2

(β −µ

β

)

0

Σ

−1

β

(β −µ

β

)

(10)

This formulation supposes to know the mean vector and variance matrix (µ

β

and Σ

β

) of β. A

suggestion given by Congdon (2001) in Galindo-Garre and al. (2004) paper is ”that, in absence

of prior expectation about the direction or size of covariate effects, flat priors may be approxi-

mated in BUGS by taking univariate normal distributions with mean zero and large variance”.

However, Galindo-Garre and al. (2004) add in their conclusion that this procedure that specifies

high variance is not correct with small samples.

Finally, applying the normal prior formulation above to the a posteriori distribution of f(β|Y )

gives the following expression :

f(β|Y ) ∝

n

Y

i=1

H

Y

h=1

P

y

hi

hi

× (2π)

−

n

2

|Σ

β

|

−

1

2

exp

−

1

2

(β −µ

β

)

0

Σ

−1

β

(β −µ

β

)

(11)

Another prior distribution commonly used in a bayesian approach is the Jeffreys prior. In fact,

this method has the advantage to be invariant to a transformation of parameters. The principle

of the Jeffreys prior is to suppose that the distribution of the β coefficients is proportional to

the Fisher information matrix determinant |I(β)| :

f(β) ∝ |I(β)|

1

2

(12)

This matrix is defined as follows :

I(β) = −E

∂

2

ln P (Y |β)

(∂β)

2

(13)

Since the structure of the function

∂

2

ln P (Y |β)

(∂β)

2

does not depend on Y in the qualitative variable

dependant multinomial model, the mean of this function can therefore be removed :

I(β) = −

∂

2

ln P (Y |β)

(∂β)

2

(14)

By applying the Jeffreys prior to the multinomial model, we obtain the conditional law f(β|Y )

of β that is proportional to :

f(β|Y ) ∝

n

Y

i=1

H

Y

h=1

P

y

hi

hi

×

−

∂

2

ln P (Y |β)

(∂β)

2

1

2

(15)

The penalized likelihood method, originally developed by Firth (1993) to reduce the bias due

to the ML method and later used by Heinze and Schemper (2002) to resolve the estimation

problems due to the separation, is in fact the application of the Jeffreys prior in the bayesian

approach. Indeed, the Firth (1993) method adds the Fisher information matrix determinant to

10

the likelihood function in the following way :

L

∗

(β|Y ) = L(β|Y )|I(β)|

1

2

(16)

With the penalized log-likelihood function :

ln (L

∗

(β|Y )) = ln (L(β|Y )) +

1

2

ln (|I(β)|) (17)

that we maximise according to β :

∂ ln (L

∗

(β|Y ))

∂β

=

∂ ln (L(β|Y ))

∂β

+

1

2

|I(β)|

−1

∂|I(β)|

∂β

= 0 (18)

we obtain the estimation of the model.

One of these procedure properties is that it ensures the uniqueness and the existence of a solu-

tion b e cause of the strict concavity of the log |I(β)| and L(β|Y ) functions, and because of the

upper bound presence on the L(β|Y ) function and the lower bound absence on log |I(β)|. This

property is valid on condition that the matrix of the explanatory variables X is of full rank. It is

an important property in the case of small samples with separation as it allows to obtain finite

estimates.

The expression of the Fisher information matrix and the penalized likelihood method in the case

of qualitative dependent variables is essentially formulated in the literature for the dichotomous

logit model. Thus, this formulation is not useful for our ”zero” option specification. Howeve r,

Bull, Mak and Greenwood (2002) deal with the multinomial logit case in their paper. Indeed,

they extent the Firth (1993) approach to the multinomial logit case by specifying the penalized

likelihood model and the Fisher matrix information in the foolowing way :

I(β) = (X

0

M

MX

M

) (19)

where X

M

= X

0

⊗ I

H

and M is a block diagonal matrix with {m

ihl

} elements, h = 1, . . . , H

alternatives, l = 1, . . . , L alternatives and i = 1, . . . , n :

m

ihl

=

P(y

i

= h)(1 − P(y

i

= h)) h = l

−P(y

i

= h)P(y

i

= l) otherwise

(20)

The penalized likelihood applied to the multinomial model is defined as :

∂ ln (L

∗

(β|Y ))

∂β

=

∂ ln (L(β|Y ))

∂β

− I(β)b

1

(

ˆ

β

MV

)

∗

= 0 (21)

where b

1

(

ˆ

β

MV

)

∗

corresponds to the ML asymptotic bias of order n.

This bias is written in the multinomial model case as :

b

1

(

ˆ

β

MV

)

∗

= −

1

2

I(β)

−1

{X

0

M

Q(X

M

⊗ X

M

)vec(I(β)

−1

)} (22)

where

Q =

P

i

E

i

Q

i

(E

i

⊗ E

i

)

0

,

E

i

= e

i

⊗ I

H

, e

i

is a vector n × 1 only formed of 0 except for the i

th

row,

Q

i

=

P

hlr

q

ihlr

ι

h

(ι

l

⊗ ι

r

)

0

,

11

q

ihlr

=

P(y

i

= h)(1 − P(y

i

= h))(1 − 2P(y

i

= h)) h = l = r

2P(y

i

= h)P(y

i

= l)P(y

i

= r) h 6= l 6= r

−P(y

i

= h)(1 − 2P(y

i

= h))P(y

i

= r) h = l 6= r

−P(y

i

= h)P(y

i

= l)(1 − 2P(y

i

= r)) h 6= r 6= h or r = l

and ι

h

is a vector H × 1 with only 0 except for the h

th

row.

This methodology of the penalized likelihood maximisation described above is however not im-

plemented in the statistical softwares. Indeed, these programs only propose this approach for the

dichotomous logit model. Its application and its implementation in the logit multinomial case is

difficult and more complex with the probit multinomial model considering the more complicated

expression of the probabilities.

In their paper, Bull, Mak and Greenwood (2002) have implemented their method explained

above with the Gauss programming language. But they uses modified iterative equations pre-

sented in their paper.

The next section will illustrate our ”zero” option specification by applying it to the Video on

Demand (VoD) market. It will describe among other things the relevant attributes selected for

our VoD model, the implementation of the survey by means of design experiments, the processus

of the estimation method used, the estimates and the market shares.

APPLICATION TO THE VIDEO ON DEMAND MARKET

Video on Demand description, relevant characteristics a nd survey

The Video on Demand (VoD) is a website or a television platform that allows people to watch

paying movies, series, etc. when they want and when they decide. To choose the relevant attri-

butes in the creation of a VoD website, we have done s everal research concerning some compli-

cated computer notions to better understand the way that VoD websites work. In the end, we

have decided to describe the VoD website

3

with the following characteristics :

Attribute A : The programmes quantity : 1000 (1), 600 (2)

Attribute B : The composition of the website according to the movies and the series :

100% Movies (1), 75% Movies 25% Series (2), 50% Movies 50% Series (3), 100% Series (4)

Attribute C : The composition of the website according to the novelty of the programmes :

A maximum of movies-series novelties (1)

4

, The half of the maximum novelties and the rest in old pro-

grammes (2), Only old programmes (3)

Attribute D : Tariff : Paying per movies-series (1), Free with advert

5

(2), Subscription (3)

Attribute E : Video hire length at launch : 24 hours (1), 48 hours (2)

Attribute F : Availability of the trailer or the extract : Trailer available (1), Not available (2)

3

These attributes and their levels reflect the characteristics of the VoD at the beginning of our study

in July to November 2007. In January 2007, the questionnaire with the final products was submitted to

the students. We have acknowledged changes in the selected characteristics since then, but not always in

the more important ones.

4

maximum of movies=140 and maximum of series=96 ; these figures represent average numbers among

the providers at the time this research was undertaken

5

except the novelties

12

With these characteristics we elaborate a experiment design that allows us to select some pro-

ducts or combinations of attributes and present them into pairs. The experiment design used is

a D-optimal design. As in Benammou, Saporta and Swissi (2007) a first reduction of the pairs

is done. We also remove the unfeasible products and the pairs of no interest. The application

of the D-optimal experiment design to the remaining pairs and products provide us the basis

to create the 20 choices of the questionnaire that we then submit to our target sample. One

of the essential characteristics used to select our sample was that individuals must have good

computer skills and a fast Internet connection. Therefore, we concentrate on students because

of their acc es s to a powerful connection generally offered by the University, and their assu-

med computer knowledge. With the target defined, we conduct the survey that provides us the

data for the application of our s pecification. A last filter is then applied to focus only on re-

liable questionnaire. Finally, we end up with 74 individuals for our application. The estimation

method used further and the comments of the estimates are described in the subsequent sections.

Bayesian approach

Because of the data separation and the non convergence of the m aximum likelihood estimation

of the individual models, we use another alternative than the ML. The two directions considered

are the penalized likelihood and the bayesian approach. Since the multinomial probit case of the

penalized likelihood is not described in the literature, and that the common statistical softwares

do not implement it, we opt for the bayesian approach. However, in the cases where individuals

only choose two out of the four alternatives in the questionnaire, we decide to estimate these

individual models with the two methods. We later demonstrate that the results associated with

the penalized likelihood do not match the VoD reality, while the bayesian approach shows a

good adequacy.

As for the aggregate model, we use the maximum likelihood estimation. Since the data size

is large enough in the case of the aggregate model, the estimates converge and therefore can

give some information on the bayesian approach in the individual case. Indeed, we can use

this information to derive the mean vector and the variance matrix of the supposed normal

prior distribution. The Jeffreys prior in the bayesian approach is not used in our specification,

because, as said above, it is equivalent to the penalized likelihood maximisation that provides

poorer results than the bayesian approach in the dichotomous case.

Therefore, the estimation of our ”zero” option model is made with a bayesian approach. We

suppose a normal prior with a mean vector and a variance matrix derived from the aggregate

model estimation. The estimation of the model parameters comes from the calculation of the a

posteriori distribution mode. We know that in fact several criteria can be envisaged to estimate

the model parameters, i.e. the mode, the mean and the median. But we opt for the mode, since

we search the maximum of the f (β|Y ) function. The mean is also a good estimator of the maxi-

mum if the distribution is symmetric. But, we do not know if it is the case. Finally, we choose

the mode because it correspond to the maximum for any distributions.

Since the f(β|Y ) a posteriori distribution is not clearly definable, we use the Monte Carlo si-

mulation to calculate the estimates from the mode. The Monte Carlo simulations applied to our

”zero” option specification consist of 10’000 β vectors generated from the multivariate normal

distribution with the mean vector and the variance matrix given by the aggregate estimation

model. These 10’000 samples permit to calculate the values of the f(β|Y ) a posteriori distri-

bution. From all those values, we select the greatest one and we look for the β vector that has

generated this maximum. The values in this vector correspond to the estimates, i.e. the mode.

13

To calculate the standard deviation of the parameters without knowing the distribution of the a

posteriori law, we assume that this standard deviation is equal to the half of the length between

the first and the last quantile (25% and 75%) of the observations of the a posteriori distribution,

i.e. the 25% of the observations above and below the mode. To this end, we generate values from

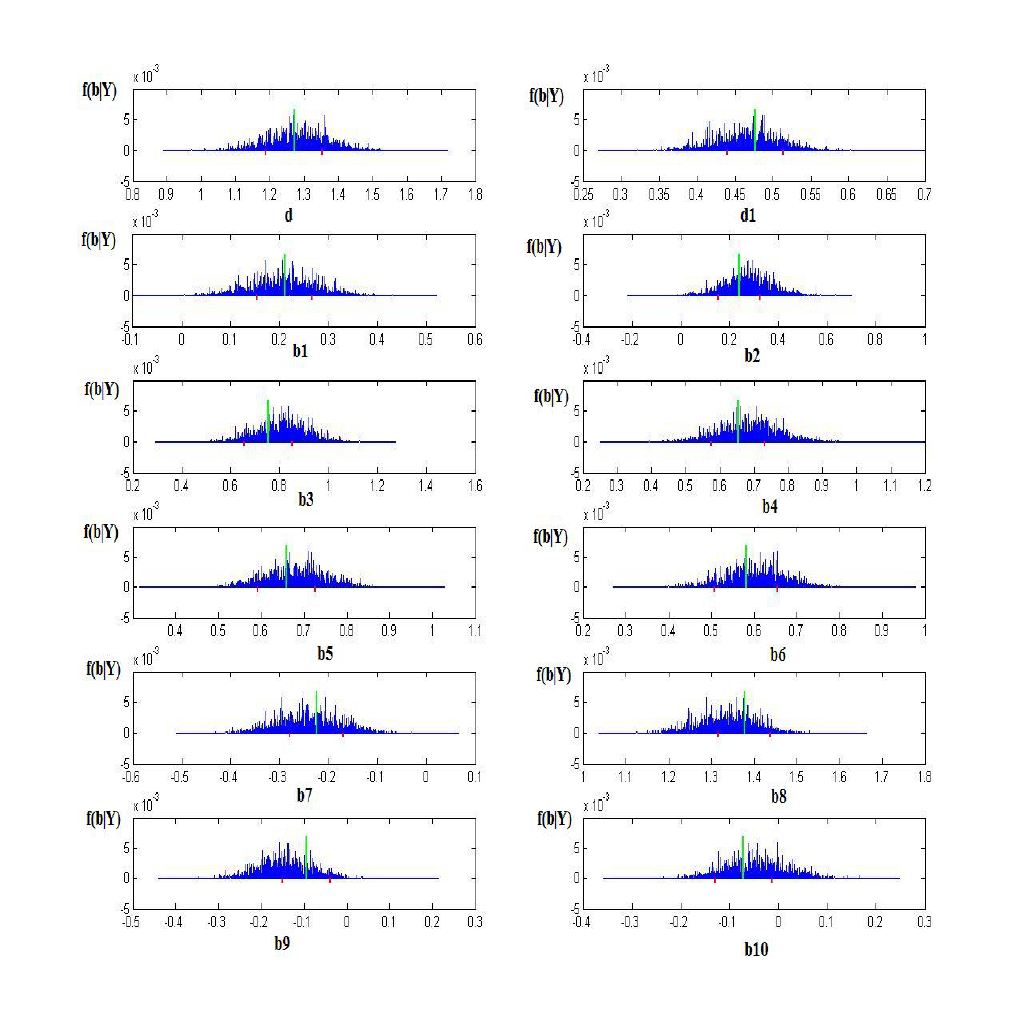

the f (β|Y ) a posteriori distribution that we sort and plot according to each parameter of β, i.e.

the refusal, the conflict thresholds and the parameters associated with each level of attribute. In

the appendix 1, we present this graphs for one of the individual models which corresponds to a

person who has chosen at least once each of the four alternatives in the questionnaire. Then we

locate the values of f (β|Y ) corresponding to 25% above and below the f (β|Y ) values associated

with the mode (red lines, appendix 1). We report the values of β ass ociated with the f (β|Y )

of the 25% below and above the mode (green line, appendix 1) to compute the length of each

parameter. The standard deviation corresponds to the half of this length.

The results and the comments of our ”zero” option model by a bayesian approach are given in

the next subsection.

Results and comments

We distinguish the results depending on the overall number of alternatives chosen by an indivi-

dual throughout the questionnaire. For example, if an individual has only selected the options

product h, l and the refusal, the dependent variable is then described with three levels rather

than four. In this case, the individual has not been in a conflict situation along the 20 questions.

Others cases with less than the four levels for the dependent variable also occurred during the

survey. We only present the results of one individual belonging to a sub-sample representing each

case of the dependent variable levels. The comments for a specific sub-sample are valid for all

individuals belonging to it. The individual results are comprised of the estimates, the standard

deviations and the importance of each attribute that are calculated according to the following

equation :

importance of the attribute i =

(maximum − minimum)

of the estimates in the attribute i

P

i

(maximum − minimum)

of the estimates in the attribute i

In the model where people only choose the product h and l without being in a conflict and a

refusal situation, the results of the individual 22 is presented in the appendix 2, table A1.

In this table, we notice that the signs of attribute levels fit expectations. Indeed, the results

demonstrate a preference for the hire length of 48 hours, a quantity of 1000 programmes and

the free access to videos with adverts. Additionally, a website with a maximum of novelties and

a composition of 75% of movies and 25% of series prevails in the individual choices. As for the

trailer, it is not essential in the selection of a VoD website. The attributes that affe ct mainly

the choice of Video on Demand website are the composition according to movies and series,

according to the nove lty of the programmes and the tariff. Indeed, according to the percentage

of importance, thes e attributes are determinant in the Video on Demand website selection. On

the other hand, the quantity of the programmes, the hire length or the availability of the trailers

do not have any importance in the website choice.

The standard deviations are reasonable relative to the estimates, as they are inferior to the

estimated values of the unknown parameters. Finally, we can say that as a whole the es timation

results with the bayesian approach of this individual are satisfactory.

14

The results of the other individuals of this type of model are similar. Therefore, all the com-

ments above can be applied to them. It will be identical when we will present and comment the

other situations according to the dependent variable levels . The same reasoning applies to the

other types of model where the similarities of results across individuals enable us to present and

comment tables for only one individual per model type.

Since the mo del with the explained variable corresponding to the choice of product h and l is

dichotomous, we can also apply the penalized likelihood maximisation. As some softwares like

S-Plus contain the implementation of this estimation procedure, we decide to test it to compare

the results with the bayesian approach since the literature generally re comm ends it in the case

of dichotomous logit model. Thus, we want to know if the properties of the penalized likelihood

estimation suit to our ”zero” option probit specification.

The penalized likelihood estimates of the individual 22 with S-Plus are in the appendix 2, table

A2.

The results derived from the penalized likelihood maximisation are not c onsistent in terms of

signs. For example, the individual 22 shows a negative utility for the level 1000 of the catalogue

attribute, while the level 600 is positive. Yet, it is more likely that the individual 22 prefer to

have 1000 programmes in a VoD website than 600. Additionally, the individual seems to prefer

the paying VoD website to the free one with advert. This observation is also questionable. Also

the video hire length does also not reflect the reality, since its sign shows a preference for the

level 24h rather than 48h.

Moreover, the standard deviations are higher that the estimates. This fact reveals a bad ade-

quacy of the penalized likelihood approach when applied to our ”zero” option sp e cification.

Therefore, the bayesian approach is clearly a better choice.

In the model where the four alternatives are at least chosen once, the results of the bayesian

method are given for the individual 2 in the appendix 3, table A3.

We generally notice that the signs of the co effi cients of this sub-sample as well as their magni-

tude reflect the VoD reality. Besides, the standard errors are appropriate in relative to the size

of the estimates. Indeed, in the case of ordered attributes like the programmes quantity, the hire

length and the tariff between a paying and a free website, it seems logical that an individual

prefer the greatest number of programmes or hire length as well as a website with free videos

rather than having to pay for it. With these bayesian estimates we observe that the level 24h of

the attribute hire length, respectively the level 600 of the attribute quantity, is systematically

inferior to the level 48h, respectively the level 1000 or negative, while 48h, respectively 1000, is

positive. The same asse rtion is possible for the levels free and paying as well as for the levels

free and subscription of the attribute tariff. Indeed, the value of the level free is systematically

superior to the level paying, respectively to the level subscription. Additionally, the subscription

option does not seem to be preferred to the paying one.

The conflict and the refusal coefficients are significant for all individuals of this sub-sample, since

the ratio between the estimates and the standard deviation is large enough (largely greater than

15

2). Indeed, the ratio of the individual 2 is :

refusal ratio =

1.271

0.083

= 15.299

conflict ratio =

0.476

0.036

= 12.929

The significance of the results for the conflict variable confirms the uncertainty of the behaviour

of the consumer facing similar products. Therefore, the introduction of the conflict leads to ad-

ditional information as to the consumer preferences and thus allows to improve the accuracy of

the estimates.

Another general observation concerning this sub-sample is that the attributes with the highest

and most significant importance are the composition, the level of novelties and the tariff. There-

fore, a website offering movie trailers, a great hire length and a great catalogue will not represent

a dec isive product for the consumer. On the contrary, a quantity of programmes close to what

can be found in a video club, the free movies and series (except for the novelties), or a correct

composition of movies and series affect more the consumer behavior in the Video on Demand

choice.

These various assertions demonstrate that our ”ze ro” option model better reflect the real consu-

mer preference and allow us to conclude that the bayesian approach yield consistent and si-

gnificant results in the case of data separation. Additionally, the conflict alternative in the

questionnaire offers people another aspect of the decision making process that exist in reality,

since this option is significant and chosen by a number of individuals. The addition of the conflict

therefore provides supplementary information to the notion of refusal existing in the literature.

In addition to the two previous model types, the dataset also contains individuals having selected

only three options, respectively two, among the four available. The three alternatives model,

respectively the two alternatives model, are, either the product h, l and the refusal, or the

product h, l and the conflict, respective ly the product h and the refusal. We will not comm ent

the results for these sub-samples, as they converge to what has already been said about the four

alternative model. The case of the product h and the refusal option (individual 62) has been

supposed consistent because the individual gives the correct answer to the test question (choice

21

6

) and that his answers are not random.

Additionally, since the variable of this model is dichotomous, we also try to estimate it with the

penalized likelihood maximisation in S-Plus. Unfortunately, this method does not work, since

the X

0

X matrix is not of full rank.

Finally, we present the results of the aggregate model that we use d as an a priori information

for the bayesian approach. These results come from the application of the maximum likelihood

estimation adapted to include each of the models that correspond to the number of alternatives

selected in the questionnaire, into a grouped model to get an overall result. In others words,

we combine the different models into a unique one to obtain the estimation of the unknown

parameters β =

d d1 β

1

. . . β

10

. Indeed, in this aggregate estimation, we associate the

corresponding model and the log-likelihood function with each sub-sample and then make a

6

This question has an obvious answer and is used to assess the consistency of the other answers.

16

grouped estimation of all these models. The results of this aggregate ”zero” option model esti-

mation is presented in the table A4 of the appendix 4.

The aggregate model estimation is carried out on a homogenous population, since all students

are from the same University, in the same degree. Hence, they come from the same social en-

vironment and are approximately in the same age bracket. With heterogenous population, we

should have first created homogenous groups and estimated the model parameters for each group.

The table A5 of the appendix 5 gives the estimates of the model parameters without the refe-

rence level that we have removed to obtain a (X

0

X) full rank matrix. In this table, we show

their t-statistics and their p-values. The estimates of the reference variable are obtained through

the assumption associated with the conjoint analysis, i.e. the com pensation model that is ma-

thematically translated as the sum of the levels of each attribute equal to zero. The reference

variables are in fact the last levels of each attribute :

– catalogue : 600

– website composition : 100% Series

– composition of novelties : only old videos

– tariff : subscription

– hire length : 48 hours

– trailer : none

The aggregate model estimation shows that the concept of ”zero” option, the refusal and the

conflict, are significant. Indeed, their t-statistics are equal 11.638 for the refusal and 8.825 for

the conflict (appendix 5). These values are large enough to conclude with the significance of

these parameters, as confirmed by the 0 p-values. Therefore, the conflict and the refusal offer an

additional explanation to the consumer preference choices of the VoD market and are not irre-

levant in this kind of preference analysis. According to the refusal estimated value, individuals

appreciate products with an utility superior to 1.308, and according to the conflict estimate the

products with an utility difference inferior to 0.471 lead to an uncertainty in the consumer choice.

The attributes of greatest importance are the website composition, the level of novelties and the

tariff. The latter influences significantly the consumer decision making process. The variable of

the highest importance is the website composition. Then, comes the level of novelties, and finally

the tariff. It is suprising that the individuals does not consider the tariff as the most important

characteristic. It means that a well-designed website can be successful even it is paying. However,

the magnitude of the level ”free with advert” is higher than the others, i.e. the composition and

the level of novelties. Therefore, the value associated with the free website has a strong influence

in the calculation of the product utility that contains this level.

As for the quantity of programmes in the catalogue, the hire length and the availability of the

trailer, they are all not conclusive in the VoD website choice according to their importance value.

Additionally, the negative sign of the trailer level shows that this service is more unfavorable

than the opposite. It must be noticed however that the importance value of this variable is not

significant.

The sign and the magnitude of the estimated c oefficients are consistent with the expected reality.

Indeed, for ordered attributes like the quantity of programmes and the hire length, the estimates

are negative for the lower values and positive for the higher ones. Therefore, the lower value of

the hire length (24h), respectively the quantity of programmes (600), is smaller than the highest

one, i.e. 48h for the hire length, res pectively 1000 for the quantity of programmes. The same

17

observation is made between the free and the paying or subscription levels. Indeed, it makes

sens that the parameters associated with the paying or the subscription tariff are lower than

the free video. The estimation results of the coefficients of that attribute tariff reflect this reality.

The estimates for the website composition variable demonstrate preferences in decreasing order

for the level ”75% Movies and 25% Series”, the level ”50% Movies and 50% Series”, and finally

the level ”100% Movies”. Creating a website with only series does not appeal the VoD consumer.

A maximum of novelties is an important criterion in the website choice. However, half of the

novelties available in video clubs is, in terms of satisfaction, close to the maximum of this no-

velties level. On the other hand, a website with only old programmes does not really reflect the

consumer preference in the Video on Demand.

Generally, the estimation results of the ”zero” option aggregate model are c onsistent and satis-

factory from a s tatistical and economic point of view. They reflect well the reality of the Video

on Demand preference. They demonstrate the significance and the importance of the uncertainty

in the choice of similar products (conflict) as well as the indifference of some other VoD web-

sites (refusal). These results allow finally to create VoD websites that better suit the individual

preferences.

In the last subsection, we present the calculation of the market shares for some actual websites

and for an ideal one created based on the estimation results.

Purchase probabilities and market shares

The aggregate e stimation results of our ”zero” option model allow us to determine the attribute

levels that influence the selection of the VoD website. From this information, we create the ideal

website that would satisfy the most. They are made up of the following characteristics :

– Catalogue : 1000 programmes

– Composition : 75% Movies 25% Series

– Novelty : maximum

– Tariff : free advert

– Hire length : 48h

– Availability : none

The aim of the Ideal website creation is in fact to calculate the market shares related to existant

VoD websites. The most popular in France with a composition of movies and series only are

Canalplay and TF1Vision. We select the levels that describe the Canalplay and TF1Vision

websites in order to make them as close as possible to their characteristics from July to November

2006. Some levels are a bit different and inexistant in our level selection, so we opted for the

closer one. For example, TF1Vision in summer 2006 proposed one of their own series free. But,

since most of the programmes are paying, we decide to select the level paying of the attribute

tariff for this website. All the information about the following characteristics are collected from

computer magazines and through direct visit of these websites from July 2006 to November

2006. Thus, Canalplay and TF1Vision are composed of the following levels attributes :

Canalplay

– Catalogue : 1000 programmes

– Composition : 100% Movies

18

– Novelty : half

– Tariff : paying

– Hire length : 24h

– Availability : none

TF1Vision

– Catalogue : 600 programmes

– Composition : 75% Movies 25% Series

– Novelty : half

– Tariff : paying

– Hire length : 24h

– Availability : trailer

According to these website characteristics we can now calculate the individual purchase pro-

babilities in the first place, and the market shares in the second place. The market shares are

deduced either from the individual model or from the aggregate model.

From the individual estimations, we associated with each attribute level for each website their

corresponding estimates. The appendix 8 shows an example for a given individual. The same

procedure is applied to each individual. Then, we calculate the utility u

i

associated with each

website i for each individual by summing the corresponding estimates. The utilities values are

useful to determine the individual purchase probabilities. To this end, two approaches are used,

i.e. the Bradley-Terry-Luce and the logit method. The following equations define them :

Bradley-Terry-Luce :

u

i

P

i

u

i

(23)

logit :

exp(u

i

)

P

i

exp(u

i

)

(24)

Thus, we calculate for each individual the purchase probability according to the Bradley-Terry-

Luce and logit equations. From these values (74 individuals), we observe that they are generally

largely higher for the Ideal website than for the others. Moreover, it seems that both the Canal-

play and TF1Vision websites share out evenly the VoD market since their individual purchase

probabilities are very similar in a market comprised of these three websites

7

.

With these purchase probabilities per individual, we calculate the market shares of each website

by averaging the probabilities :

Market shares =

P

purchase probabilities

individual number (74)

(25)

The market shares derived from the Bradley-Terry-Luce and logit methods are as follows :

Market shares in %

Canalplay TF1Vision Ideal

Bradley-Terry-Luce 16.479 16.127 67.392

logit 7.686 7.568 84.744

7

For example, the Bradley-Terry-Luce probabilities purchases for the individual 2 are : Canalplay

16.77%, TF1Vision 15.65% and Ideal 67.56%. The logit results are : Canalplay 7.85%, TF1Vision 7.45%

and Ideal 84.69%. We will not give the values of the others individuals as they are very similar.

19

We reach the same conclusions as with the individual purchase probabilities, i.e. the Ideal sce-

nario offers much higher market shares than Canalplay or TF1Vision whose respective market

shares are very similar.

However, the market shares calculated with the individual purchase probabilities does not take

into account the refusal and the conflict. We consider these situations only with the aggregate

market share calculation. The reason is that we can only obtain the aggregate utilities of the

websites with the aggregate model and compare them to the refusal and conflict thresholds. In

the individual case we can not have the correct aggregate utilities considering the incomparable

measurement scales.

As for the market shares computed from the aggregate model, we obtain them by calculating

the scenario utilities from the aggregate maximum likelihood estimates :

Utilities Refusal

Canalplay TF1Vision Ideal δ

0.749 1.021 3.053 1.308

These estimated utilities can be used to determine the products that are not appreciated by the

consumers. On the other hand, the utility differences can be used to detect a conflict situation :

Difference Conflict

Canalplay-Tf1Vision Canalplay-Ideal TF1Vision-Ideal δ

0

0.271 2.303 2.031 0.471

According to the tabulated values, we notice that the Canalplay and TF1Vision websites are in

the refusal area since their utilities are inferior to δ. Therefore, in a market where the Canalplay,

TF1Vision and Ideal websites coexist, the Canalplay and TF1Vision products are not selected by

the consumers and only the Ideal VoD website represents an interesting option leading to 100%

market shares. Additionally, according to the values of the differences, it seems that Canalplay

and TF1Vision products create difficulties to decide between them because of their similarities.

Indeed, the difference between the Canalplay and TF1Vision websites is inferior to the δ

0

value

that represents the conflict.

A 100% market share does not provide any information about the Canalplay and TF1Vision

influences on the Video on Demand market. So we decide to calculate the purchase influences

in a market with only Canalplay and TF1Vision. Because we only compare two sce narios in

our market, with the equations (1), (2), (3) and (4) we can directly calculate the Canalplay,

TF1Vision, refusal and conflict probabilities

8

.

By inserting in the above mentioned equations the estimates resulting from the aggregate maxi-

mum likelihood estimation, we obtain the following results :

Probabilities

Canalplay TF1Vision Refusal Conflict

0.186 0.291 0.436 0.085

We observe that the refusal probability is high but way below 100%, i.e. it does not suppose

that the Canalplay and TF1Vision products are not appreciated by the consumers. Indeed,

they have market shares superior to 0% when they coexist in a same market. In fact, on 100

8

where σ is set to 1 to take into account the parameters identification.

20

individuals, 19 select C analplay, 29 TF1Vision, 44 do not like the products and 8 do not reach

any decision about their website preferences. To take into account refusal and conflict situations,

we still must transform these probabilities to obtain the real market shares. Indeed, the 44%

in the refusal area do e s not correspond to potential customers and therefore must be excluded

from the market share calculations. The 8% are shared out evenly among the Canalplay and the

TF1Vision products because of the consumer uncertainty. Because the refusal probability has

been removed, we must readjust the Canalplay and TF1Vision probabilities to obtain a sum of

probabilities equal to 100% in the following way :

Probability with conflict

Canalplay TF1Vision

0.186+0.0428 0.291+0.042

=0.229 =0.334

Sum of the probabilities with conflict

0.563

Market shares

Canalplay TF1Vision

0.229

0.563

=

0.334

0.563

=

0.407 0.592

This method that takes account of the refusal and the conflict shows that in a market where

there are only individuals interested in the Canalplay and TF1Vision websites, the market shares

reach 40.71% for Canalplay and 59.29% for TF1Vision. The market shares of TF1Vision website

are here higher than Canalplay. This result demonstrates that the refusal and the conflict are

a source of additional information in the behavioral understanding of the decision making pro-

cess. Indeed, our ”zero” option specification allows us, for the market shares calculation, to take

only into account the potential consumers and to insert people who hesitate in their choices.

Therefore, our market shares truly represent the consumers that are potentially ready to buy

the type of products proposed.

CONCLUSION

In this paper, we present a new specification of the ”zero” option defined in the literature as an

inappreciation of products (refusal) and that is not tackled in details. Additionally, we add to

this refusal a new element, called conflict. The latter takes into account the c ase of uncertainty

during the decision making process due to similarities in the products. Our specification relates

to a model of pair comparisons to which we add the two concepts of the ”zero” option, i.e. the

refusal and the conflict. Indeed, the addition of the refusal, respectively the conflict, is done

by adding to the pair comparison the option ”I do not like any product”, respectively ”I like

both products”. Our model is in fact a mix of the ordered response and the utility comparison

models. The utility comparison model is implemented by defining the products with an utility

and by comparing them. As for the ordered response model, it is used to describe the refusal and

the conflict by thresholds that are compared to the products utilities. The reason of this models

mix is that the utility maximisation do es not consider the conflict in its estimation process.

Additionally, an utility associated with the no choice is not really interpretable as it would be

for products.

Because our ”zero” option model is specified by a probit choice s tructure, we estimate the unk-

nown parameters with the maximum likelihood m ethod. This procedure can run into convergence

troubles with small data size leading to the divergence of the model. We can resolve it by using

21

other alternatives. The two that we have presented in our paper are the bayesian approach and

the penalized likelihood estimation.

To illustrate our ”zero” option model, we undertake an application to the Video on Demand

(VoD) websites. We analyse our specification in the individual and aggregate case. The aggregate

model is estimated with the maximum likelihood. The same approach is not possible with the

individual case because of the small data size leading to infinite estimates of the model. To solve

it we use the bayesian approach. The results are satisfactory from a statistical and economic

point of view. It shows a strong influence of the website composition in terms of movies and se-

ries, the novelties level as well as the hiring cost. For the tariff, the free video with advert prevail

over the paying or subscription option. The consumers also prefer a VoD website composition

with 75% Movies and 25% Series. They do not like websites with only old programmes. They

prefer a mix with the new and old videos with a slight preference for the composition with a

maximum of novelties. The services like the trailer availability, the programmes quantity and

the hire length are not significant.

As for the refusal and the conflict, our application shows that the parameters associated with

the no choice are significant. Therefore, the conflict and the refusal addition is really important

because of the supplemental information it conveys about the individual behavior in the decision

making process.

According to our empirical example we demonstrate that the bayesian approach in the di-

chotomous case offers better results from a statistical and economic point of view than the

widespread penalized likelihood estimation. The latter that is recommended in the literature

for the dichotomous logit model with data separation does not have the same effect with our

probit specification. Therefore, our decision to use a bayesian approach has been conclusive and

demonstrates that the penalized likelihood is not adapted to every model.

We also calculate the market shares of two existing French VoD websites, Canalplay and TF1-

Vision, that are compared to one that is created in such a way that it reflects the consumer

preferences. In a market with those three websites, we observe that the existing ones are in the

refusal area. This means that they are not appreciated by the consumers. Additionally, had they

been selected, they are too similar and lead to uncertainty of choice about these products. The

introduction of the conflict has therefore an advantage as illustrated in this example in that it en-

ables competitors whose offer is similar, to come up with this little something that will make the

difference. For example, if one of the websites offers a gift or an additional free service, it could

orientate the consumer towards its VoD website. We also test the market with only the existing

French websites, Canalplay and TF1Vision. The market shares show a preference for TF1Vision.

In conclusion, we have specified a ”zero” option model that includes the refusal and the conflict

and have demonstrated the importance to insert the conflict in the decision making process

model. An interesting analysis that has not been conducted in this work is to compare our

specification to others like the pair comparison model without the refusal and the conflict, or

the pair comparison model with the refusal only and vice versa. From an econometric and coding

point of view, other perspectives could be implemented, like a logit specification of our ”zero”

option model that could be estimated with the bayesian and the penalized likelihood approaches

to define which one gives better results. With this end in view, the maximum penalized likelihood

should be available in a commercial software. The programming of this procedure could be in

fact very interesting for the users.

The extension of our ”zero” option model to a triple comparison of the products with the inser-

22

tion of the refusal and the conflict could also be of interest. However, the graphical construction

would be more complex as well as the development of the probabilities associated with the five

alternatives proposed in the questionnaire.

23

APPENDIX

Appendix 1

Figure A1

GRAPHS OF THE A POSTERIORI GENERATE DISTRIBUTION (f (β|Y )) FOR EACH

MODEL PARAMETER

where d correspond to the refusal threshold denoted in the text δ, d1 to the conflict threshold

denoted in the text δ

0

and b1 − b10 to the parameter β

1

− β

10

the parameters associated with

each level of each attribute.

24

Appendix 2

Table A1

RESULTS FROM THE BAYESIAN APPROACH OF THE MODEL WITH ONLY TWO OF

THE FOUR ALTERNATIVES SELECTED (THE PRODUCT h AND l)

Individual 22

Variable Utility Standard Error Importance

(% Utility Range)

Catalogue : 1000 0.173 0.069 4.32%

Catalogue : 600 -0.173 0.069

Composition : 100% Movies 0.315 0.095 33.82%

Composition : 75% Movies 25% Series 0.858 0.102

Composition : 50% Movies 50% Series 0.676 0.076

Composition : 100% Series -1.850 0.274

Novelty : max 0.702 0.061 25.46%

Novelty : half 0.633 0.059

Old : max -1.336 0.121

Tariff : paying -0.224 0.054 31.54%

Tariff : free advert 1.375 0.059

Tariff : subscription -1.150 0.113

Hire length : 24h -0.120 0.052 2.99%

Hire length : 48h 0.120 0.052

Availability : trailer -0.073 0.059 1.84%

Availability : None 0.073 0.059

25

Table A2

RESULTS FROM THE PENALIZED LIKELIHOOD APPROACH OF THE MODEL WITH

ONLY TWO OF THE FOUR ALTERNATIVES SELECTED (THE PRODUCT h AND l )

Individual 22

Variable Utility Standard Error Importance

(% Utility Range)

Catalogue : 1000 -0.792 1.127 9.52%

Catalogue : 600 0.792 1.127

Composition : 100% Movies -0.626 1.960 36.76%

Composition : 75% Movies 25% Series -1.976 1.890

Composition : 50% Movies 50% Series -1.528 1.754

Composition : 100% Series 4.131 5.605

Novelty : max -2.172 1.411 37.07%

Novelty : half -1.816 1.141

Old : max 3.988 2.553

Tariff : paying 0.334 1.273 5.42%

Tariff : free advert -0.579 1.045

Tariff : subscription 0.245 2.319

Hire length : 24h 0.698 1.119 8.31%

Hire length : 48h -0.698 1.119

Availability : trailer 0.242 1.092 2.89%

Availability : none -0.242 1.092

Likelihood ratio test=9.925 on 10 df, p=0.447, n=20

26

Appendix 3

Table A3

RESULTS FROM THE BAYESIAN APPROACH OF THE MODEL WITH THE FOUR

ALTERNATIVES SELECTED (THE PRODUCT h, l, THE REFUSAL AND THE

CONFLICT)

Individual 2

Variable Utility Standard Error Importance

(% Utility Range)

Refusal : δ 1.271 0.083

Conflict : δ

0

0.476 0.036

Catalogue : 1000 0.210 0.056 5.55%

Catalogue : 600 -0.210 0.056

Composition : 100% Movies 0.240 0.084 31.63%

Composition : 75% Movies 25% Series 0.751 0.097

Composition : 50% Movies 50% Series 0.654 0.078

Composition : 100% Series -1.645 0.260

Novelty : max 0.658 0.067 25.05%

Novelty : half 0.581 0.073

Old : max -1.240 0.140

Tariff : paying -0.224 0.054 33.39%

Tariff : free advert 1.377 0.060

Tariff : subscription -1.153 0.114

Hire length : 24h -0.094 0.056 2.48%

Hire length : 48h 0.094 0.056

Availability : trailer -0.071 0.058 1.88%

Availability : None 0.071 0.058

27

Appendix 4

Table A4

RESULTS FROM THE MAXIMUM LIKELIHOOD ESTIMATION OF THE AGGREGATE

MODEL

Aggregate model

Variable Utility Standard Error Importance

(% Utility Range)

Refusal : δ 1.308 0.112

Conflict : δ

0

0.471 0.053

Catalogue : 1000 0.212 0.085 3.14%

Catalogue : 600 -0.212 0.085

Composition : 100% Movies 0.262 0.121 35.51%

Composition : 75% Movies 25% Series 0.800 0.128

Composition : 50% Movies 50% Series 0.676 0.112

Composition : 100% Series -1.597 0.362

Novelty : max 0.690 0.090 29.71%

Novelty : half 0.625 0.088

Old : max -1.315 0.178

Tariff : paying -0.235 0.079 23.49%

Tariff : free advert 1.350 0.081

Tariff : subscription -1.115 0.160

Hire length : 24h -0.114 0.078 3.39%

Hire length : 48h 0.114 0.078

Availability : trailer -0.053 0.082 1.58%

Availability : None 0.053 0.082

28

Appendix 5

Table A5

RESULTS FROM THE MAXIMUM LIKELIHOOD ESTIMATION OF THE AGGREGATE

MODEL WITHOUT THE ATTRIBUTE REFERENCE LEVELS

CONVERGENCE ACHIEVED AFTER 19 ITERATIONS

618 FUNCTION EVALUATIONS

Standard

Parameter Estimate Error t-statistic P-value

D 1.308 0.112 11.638 [0.000]

D1 0.471 0.053 8.825 [0.000]

B1 0.212 0.085 2.493 [0.013]

B2 0.262 0.121 2.163 [0.030]

B3 0.800 0.128 6.239 [0.000]

B4 0.676 0.112 6.009 [0.000]

B5 0.690 0.090 7.659 [0.000]

B6 0.625 0.088 7.080 [0.000]

B7 -0.235 0.079 -2.965 [0.003]

B8 1.350 0.081 16.615 [0.000]

B9 -0.114 0.078 -1.450 [0.147]

B10 -0.053 0.082 -0.648 [0.516]

where

D Refusal

D1 Conflict

B1 Catalogue : 1000

B2 Composition : 100% Movies

B3 Composition : 75% Movies 25% Series

B4 Composition : 50% Movies 50% Series

B5 Novelty : max

B6 Novelty : half

B7 Tariff : paying

B8 Tariff : free advert

B9 Hire length : 24h

B10 Availability : trailer

29

Appendix 6

Table A6

ESTIMATES AND UTILITIES OF THE CANALPLAY WEBSITE

Individual 2

Canalplay Attributes Levels Estimates

Catalogue 1000 0.210

Composition 100% Movies 0.240

Novelty half 0.581

Tariff paying -0.224

Hire length 24h -0.094

Availability none 0.071

Utility u

i

i=Canalplay Sum of the estimates 0.785

=Canalplay website utility

for the individual 2

Individual purchase

u

i

i

u

i

(Bradley-Terry-Luce) 16.773%

probabilities in %

exp(u

i

)

i

exp(u

i

)

(logit) 7.850%

Table A7

ESTIMATES AND UTILITIES OF THE TF1VISION WEBSITE

Individual 2

TF1Vision Attributes Levels Estimates

Catalogue 600 -0.210

Composition 75% Movies 25% Series 0.751

Novelty half 0.581

Tariff paying -0.224

Hire length 24h -0.094

Availability trailer -0.071

Utility u

i

i=TF1Vision Sum of the estimates 0.733

=TF1Vision website utility

for the individual 2

Individual purchase

u

i

i

u

i

(Bradley-Terry-Luce) 15.657%

probabilities in %

exp(u

i

)

i

exp(u

i

)

(logit) 7.451%

Table A8

ESTIMATES AND UTILITIES OF THE IDEAL WEBSITE

Individual 2

Ideal Attributes Levels Estimates

Catalogue 600 0.210

Composition 75% Movies 25% Series 0.751

Novelty half 0.658

Tariff paying 1.377

Hire length 24h 0.094

Availability trailer 0.071

Utility u

i

i=Ideal Sum of the estimates 3.163

=Ideal website utility

for the individual 2

Individual purchase

u

i

i

u

i

(Bradley-Terry-Luce) 67.568%

probabilities in %

exp(u

i

)

i

exp(u

i

)

(logit) 84.697%

30

REFERENCES

(2000), ”Preference Structure Measurement : Conjoint Analysis and Related Techniques : A

Guide for Designing and Interpreting Conjoint Studies”, Second Edition, Intelligest

Altman M., Gill J., and McDonald M. P. (2004), ”Numerical issues in statistical computing

for the social scientist”, Chapter 10 : Convergence Problems in Logistic Regression, Allison P.,

Wiley