TIPS FOR NAVIGATING ELECTRONIC VERSION OF THE THDA GUIDE:

To search for topics or keywords, click ctrl and select the related section in the Table of Contents.

This Guide contains links to cross-reference subjects contained within.

After clicking on a link, to return to your previous place, use Alt + Back Arrow (Previous View).

Originating Agents Guide

February 1, 2024

Latest Revision: 05.29.2024

THDA Originating Agents Guide Page | i

Revised 02.01.2024

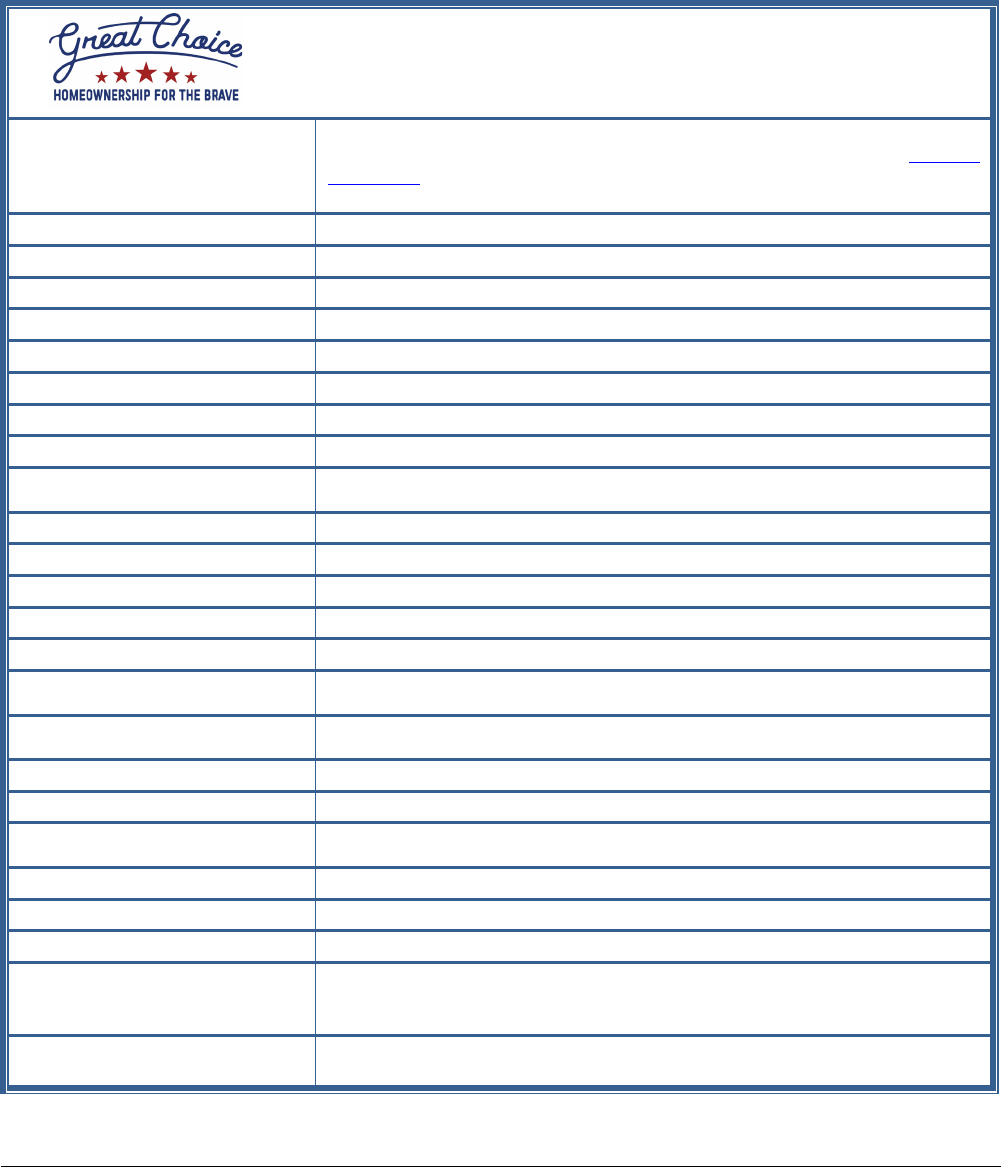

Table of Contents

SECTION I: THDA OVERVIEW ....................................................................................................................................... 1

GUIDE SUMMARY ..................................................................................................................................................... 1

HOURS OF OPERATION AND HOLIDAY SCHEDULE ................................................................................................ 1

SINGLE FAMILY PROGRAMS DIVISION STAFF DIRECTORY ..................................................................................... 1

CURRENT THDA LOAN PROGRAMS ........................................................................................................................ 3

1. Great Choice Mortgage Loan Program (Mortgage Revenue Bond) ....................................................... 3

2. Great Choice Plus Mortgage Program: Down Payment/Closing Cost Assistance Loan ......................... 4

3. Homeownership for Heroes Mortgage Loan Program ................................................................................ 5

4. Homeownership for Heroes Plus Mortgage Loan Program ......................................................................... 6

5. Freddie Mac HFA Advantage® Mortgage Loan Program (Mortgage Backed Securities) .................... 7

6. Freddie Mac HFA Advantage® Plus Mortgage Loan Program (Mortgage Backed Securities) ............. 8

SECTION II: ORIGINATING AGENTS ............................................................................................................................. 9

ORIGINATING AGENT WORKING AGREEMENT ...................................................................................................... 9

CORRESPONDENT RELATIONSHIPS .......................................................................................................................... 9

MAINTAINING ORIGINATING LENDER APPROVAL STATUS .................................................................................. 10

THDA QUALITY CONTROL AND RISK MANAGEMENT ........................................................................................... 11

Prefunding Quality Control Reviews ................................................................................................................ 11

Quality Control Reviews ................................................................................................................................... 11

Early Payment Default Reviews ....................................................................................................................... 12

Loan Level Defects/Findings ............................................................................................................................ 12

Exclusion Lists ..................................................................................................................................................... 12

Information Security Standards ........................................................................................................................ 13

LOAN REPURCHASE ............................................................................................................................................... 13

Repurchase Obligation .................................................................................................................................... 13

Repurchase Price .............................................................................................................................................. 14

Repurchase Procedure .................................................................................................................................... 14

FEES ORIGINATING AGENT MAY EARN ................................................................................................................. 14

SECTION III: QUALIFYING AN APPLICANT ................................................................................................................. 16

ELIGIBILITY OVERVIEW ............................................................................................................................................ 16

ACQUISITION COST LIMITS ..................................................................................................................................... 16

Defining Acquisition Cost ................................................................................................................................. 16

Acquisition Cost Inclusions ............................................................................................................................... 16

Acquisition Cost Exclusions ............................................................................................................................... 17

Current Acquisition Cost and Income Limits by County ............................................................................... 17

MORTGAGE REVENUE BONDS (MRB) INCOME LIMITS, IRS REV. RULING 86-124 ............................................... 17

Defining Household ........................................................................................................................................... 17

Defining MRB Income ....................................................................................................................................... 17

MRB Income Inclusions ..................................................................................................................................... 17

THDA Originating Agents Guide Page | ii

Revised 02.01.2024

MRB Income Exclusions ..................................................................................................................................... 18

RESIDENCE REQUIREMENT ..................................................................................................................................... 19

THREE YEAR REQUIREMENT .................................................................................................................................... 19

Permitted Ownership Interests ......................................................................................................................... 20

Prohibited Ownership Interests ........................................................................................................................ 20

Veteran Exemption ........................................................................................................................................... 21

NEW MORTGAGE REQUIREMENT .......................................................................................................................... 21

TARGETED AREAS ................................................................................................................................................... 21

Census Tracts ..................................................................................................................................................... 21

CURRENT TARGETED AREAS .................................................................................................................................. 22

SECTION IV: OTHER THDA PROGRAM REQUIREMENTS ........................................................................................... 23

ELIGIBLE APPLICANTS ............................................................................................................................................. 23

PROPERTY ELIGIBILITY ............................................................................................................................................. 23

Eligible Property ................................................................................................................................................. 23

Appraisals ........................................................................................................................................................... 25

Acceptable Amount of Land .......................................................................................................................... 25

ELIGIBLE LOAN TYPES AND TERMS ......................................................................................................................... 26

Types of Loans ................................................................................................................................................... 26

Maximum Loan-To-Value Ratios ...................................................................................................................... 26

Maximum Loan Amount ................................................................................................................................... 26

Security ............................................................................................................................................................... 27

Loan Payment Terms ........................................................................................................................................ 27

Prepayment Penalty ......................................................................................................................................... 28

Late Charge ...................................................................................................................................................... 28

Origination Fee .................................................................................................................................................. 28

Assumptions ....................................................................................................................................................... 28

FEDERAL RECAPTURE ............................................................................................................................................. 28

FEDERAL RECAPTURE TAX REIMBURSEMENT ......................................................................................................... 28

SECTION V: PROCESSING AND CREDIT UNDERWRITING REQUIREMENTS .............................................................. 30

OVERVIEW .............................................................................................................................................................. 30

Rates and Rate Locks ....................................................................................................................................... 30

Disclosures .......................................................................................................................................................... 30

Credit Scores and Debt Ratio .......................................................................................................................... 30

Homebuyer Education ..................................................................................................................................... 31

Age of Credit Documents ................................................................................................................................ 32

Non-Purchasing Spouse.................................................................................................................................... 32

Co-signers .......................................................................................................................................................... 32

ASSETS ..................................................................................................................................................................... 32

Substantial Liquid Assets ................................................................................................................................... 32

Gift Letter ........................................................................................................................................................... 33

THDA Originating Agents Guide Page | iii

Revised 02.01.2024

VERIFICATIONS ....................................................................................................................................................... 33

Employment Verifications ................................................................................................................................ 33

Sole-Proprietorship Verifications ...................................................................................................................... 33

Partnership Verifications ................................................................................................................................... 33

Limited Partnership Verifications ...................................................................................................................... 33

Subchapter S Corporation Verifications ......................................................................................................... 33

Corporation Verifications ................................................................................................................................. 33

Deposit Verifications ......................................................................................................................................... 33

Veteran Status ................................................................................................................................................... 34

FHA 203(h) Proof of Destruction of Residence ............................................................................................... 34

DEBTS, OBLIGATIONS AND OTHER EXPENSES ....................................................................................................... 34

Remaining Debt Payments .............................................................................................................................. 34

Payday Loans or Undisclosed Debt ................................................................................................................ 34

Bankruptcy (Chapter 7 and Chapter 13) ....................................................................................................... 34

Previous Default................................................................................................................................................. 34

Child Support and Alimony Obligations ......................................................................................................... 35

Judgments ......................................................................................................................................................... 35

Federal or State Tax Liens, Tax Arrearages ..................................................................................................... 35

Collections ......................................................................................................................................................... 35

Co-Signed/Authorized User Debt .................................................................................................................... 35

Child Care Expense .......................................................................................................................................... 35

Establishing / Re-establishing Credit ................................................................................................................ 35

SECTION VI: SUBMITTING AN APPLICATION FILE TO THDA ...................................................................................... 36

OVERVIEW .............................................................................................................................................................. 36

REQUIRED DOCUMENTS ........................................................................................................................................ 36

Underwriting Submission Checklist ................................................................................................................... 36

Application Declaration ................................................................................................................................... 36

Veteran Exemption Application Declaration................................................................................................. 36

Seller Declaration .............................................................................................................................................. 36

Tax Returns ......................................................................................................................................................... 36

Notice to Applicants Federal Recapture Requirements ............................................................................... 37

Grants/Down Payment Assistance Approval Letters .................................................................................... 37

Transmittal Summary (Conventional and USDA/RD) ..................................................................................... 37

Agency Loan Approval .................................................................................................................................... 37

Loan Application and Addendums (URLA & 92900A) .................................................................................. 37

Supplemental Consumer Information Form (SCIF, FORM1103) .................................................................... 37

Positive Identification ........................................................................................................................................ 38

Credit Report ..................................................................................................................................................... 38

Final Divorce Decree/Marital Dissolution; Court Ordered Child Support; SSI or Other Assistance ........... 38

THDA Originating Agents Guide Page | iv

Revised 02.01.2024

Verification of Employment; Most Recent Pay Stub; Form Evidencing Telephone Verification of Prior

Employment; Self-Employment ........................................................................................................................ 38

Documentation for Veteran Exemption ......................................................................................................... 38

Original Certificate of Title or Original Manufactured Certificate of Origin (Manufactured Home) ........ 38

Verification of Deposit or Bank Statements for Previous Two Months .......................................................... 39

Sales Contract ................................................................................................................................................... 39

FHA Conditional Commitment ........................................................................................................................ 39

Appraisal ............................................................................................................................................................ 39

Flood Notification .............................................................................................................................................. 39

Loan Estimate .................................................................................................................................................... 39

Title Commitment .............................................................................................................................................. 39

Hazard Insurance .............................................................................................................................................. 40

DOCUMENTING NEW CONSTRUCTION FOR CUSTOM BUILT HOMES ................................................................. 40

Documentation Required ................................................................................................................................ 40

Manufactured Housing .................................................................................................................................... 40

Borrower Obtains Construction Loan .............................................................................................................. 40

THDA UNDERWRITING DECISIONS ......................................................................................................................... 40

THDA Underwriting Results ................................................................................................................................ 40

Rejections ........................................................................................................................................................... 40

COMMITMENTS....................................................................................................................................................... 41

Application Approval ....................................................................................................................................... 41

Commitment Term ............................................................................................................................................ 41

Commitment Conditions .................................................................................................................................. 41

Satisfying THDA Commitment Conditions ....................................................................................................... 41

Update of Application or Commitment ......................................................................................................... 41

Loan Amount or Program Type Changes ....................................................................................................... 41

Commitment Delivery ....................................................................................................................................... 42

Void Commitments ........................................................................................................................................... 42

FUNDING THDA LOANS .......................................................................................................................................... 43

SCHEDULING LOAN CLOSINGS............................................................................................................................. 43

SECTION VII: CLOSING A THDA LOAN ..................................................................................................................... 44

OVERVIEW .............................................................................................................................................................. 44

Expedite Loan Documents ............................................................................................................................... 44

LOAN COMMITMENT ............................................................................................................................................. 44

REQUIRED LOAN DOCUMENTS ............................................................................................................................. 44

Loan Documents ............................................................................................................................................... 44

Due Dates .......................................................................................................................................................... 45

Late Charges ..................................................................................................................................................... 45

TITLE POLICY ........................................................................................................................................................... 45

Warranty Deed .................................................................................................................................................. 45

THDA Originating Agents Guide Page | v

Revised 02.01.2024

Termite Inspection/Treatment Certificate ...................................................................................................... 46

Hazard Insurance .............................................................................................................................................. 46

Flood Certification and Flood Insurance ........................................................................................................ 47

Escrow for Repairs or Completion of Construction ........................................................................................ 47

Properties Affected by a Disaster .................................................................................................................... 48

Documentation Requirements for Properties Affected by a Disaster ..................................................... 48

Closing Disclosure.............................................................................................................................................. 49

Verbal Verification of Employment (VVOE) ................................................................................................... 49

Name Affidavit .................................................................................................................................................. 49

Power of Attorney ............................................................................................................................................. 49

OTHER REQUIREMENTS ........................................................................................................................................... 49

Close In The Name Of ....................................................................................................................................... 49

Non- Purchasing Spouse................................................................................................................................... 49

Rescission ........................................................................................................................................................... 49

Net Funds “To Borrower” ................................................................................................................................... 49

Principal Reduction ........................................................................................................................................... 50

Original Certificate of Title or Original Manufactured Certificate (MCO) of Origin (Manufactured Home)

............................................................................................................................................................................ 50

Affidavit of Affixation (Manufactured Home) ................................................................................................ 50

Warranty Deed .................................................................................................................................................. 50

CLOSING COSTS .................................................................................................................................................... 50

Closing Costs and Fees a THDA Borrower May Pay ....................................................................................... 50

SECTION VIII: SHIPPING A CLOSED THDA LOAN ...................................................................................................... 52

ORIGINATION AGENT OBLIGATIONS .................................................................................................................... 52

SHIPPING ADDRESS ................................................................................................................................................ 52

DELIVERY DEADLINES ............................................................................................................................................. 52

FAILURE TO MEET DELIVERY DEADLINES ................................................................................................................ 53

REQUIRED DOCUMENTS FOR A COMPLETE CLOSED LOAN FILE ........................................................................ 53

Closed Loan Submission Checklist ................................................................................................................... 53

Original Note ..................................................................................................................................................... 54

Original Note Great Choice Plus Form ............................................................................................................ 54

Original Recorded Deed of Trust ..................................................................................................................... 54

Deed of Trust-Great Choice Plus ..................................................................................................................... 54

Affidavit of Affixation (Manufactured Home) ................................................................................................ 54

Title Insurance Policy/Endorsements ............................................................................................................... 54

Warranty Deed .................................................................................................................................................. 54

Closing Disclosure.............................................................................................................................................. 55

Great Choice Loan Allowable Fees ................................................................................................................ 55

Hazard Insurance .............................................................................................................................................. 55

Termite Inspection/Treatment Certificate (when applicable) ..................................................................... 55

THDA Originating Agents Guide Page | vi

Revised 02.01.2024

Flood Insurance (when applicable) ................................................................................................................ 55

Commitment Conditions .................................................................................................................................. 55

MIC/LGC; USDA/RD 3555-17, or As Applicable .............................................................................................. 55

Final Loan Application and 92900A (URLA) .................................................................................................... 56

SERVICING PROCEDURES ...................................................................................................................................... 56

Service Release Premium ................................................................................................................................. 56

Tax Service Fee .................................................................................................................................................. 56

Changing Fees/Compensation ....................................................................................................................... 56

Tax and Insurance Escrow ................................................................................................................................ 56

Volunteer Mortgage Loan Servicing Directory .............................................................................................. 56

Payments Received After Purchase ............................................................................................................... 57

Payments Received Prior to Purchase ............................................................................................................ 57

Service Transfer After First Payment Due Date ............................................................................................... 57

SECTION IX: THDA FORMS AND INSTRUCTIONS ........................................................................................................ 58

Application Declaration HO-0450 Veteran Exemption Application Declaration HO-0460 (If Applicable)

............................................................................................................................................................................ 58

Notice to Applicants Federal Recapture Requirements HO-0448 ............................................................... 59

Seller Declaration HO-0451 .............................................................................................................................. 59

Underwriting Submission Checklist HO-0549 ................................................................................................... 59

Affidavit of Affixation RV-F1322101 .................................................................................................................. 59

Legally Enforceable Obligation Letter HO-0476 ............................................................................................ 59

Closed Loan Submission Checklist HO-0541 ................................................................................................... 59

THDA Rider HO-0440 .......................................................................................................................................... 59

Request for Loan Purchase with Acknowledgement and Certification HO-0444 ...................................... 60

Great Choice Plus/HFA Advantage Plus Amortizing Subordinate Note (Payment) Form #3295 ............. 60

Great Choice Plus/HFA Advantage Plus With Deferred Subordinate Note (No Payment) Form #3296 .. 60

Great Choice Plus/HFA Advantage Plus Subordinate Deed of Trust Form #3800.43 ................................. 60

SECTION X: FREDDIE MAC HFA ADVANTAGE® CONVENTIONAL PROGRAM ...................................................... 61

OVERVIEW .............................................................................................................................................................. 61

HFA Advantage & HFA Advantage Plus ........................................................................................................ 61

ELIGIBLE BORROWER .............................................................................................................................................. 61

Ownership Interest ............................................................................................................................................ 61

ELIGIBLE PROPERTIES .............................................................................................................................................. 62

PURCHASE PRICE LIMIT .......................................................................................................................................... 62

QUALIFYING INCOME LIMIT ................................................................................................................................... 62

FIRST MORTGAGE LOAN TERMS AND GUIDELINES .............................................................................................. 62

Loan Types/Investor Feature Identifiers (IFIs) .................................................................................................. 62

Maximum LTV/CLTV .......................................................................................................................................... 62

Transaction Type ............................................................................................................................................... 63

Mortgage Loan Rates and Reservations ........................................................................................................ 63

THDA Originating Agents Guide Page | vii

Revised 02.01.2024

Rate Locks and Extension Fee ......................................................................................................................... 63

UNDERWRITING ...................................................................................................................................................... 63

Freddie Mac HFA Advantage® ....................................................................................................................... 63

Freddie Mac Resources .................................................................................................................................... 63

Private Mortgage Insurance (PMI) .................................................................................................................. 64

Discount Points/Assumable/Escrow Waivers/Temporary Buydown ............................................................. 64

DOWN PAYMENT ASSISTANCE (HFA Advantage Plus) ....................................................................................... 64

Lender Advance ............................................................................................................................................... 65

Compliance Issues ............................................................................................................................................ 65

Limitations on Down Payment Assistance ...................................................................................................... 65

TRID ......................................................................................................................................................................... 66

Loan Estimate .................................................................................................................................................... 66

Closing Disclosure.............................................................................................................................................. 66

LENDER PROCESS ................................................................................................................................................... 66

Application and Reservation ........................................................................................................................... 66

Commitment Compliance Package .............................................................................................................. 66

Purchase Compliance Package ..................................................................................................................... 66

COMPENSATION AND FEES ................................................................................................................................... 67

Lender Compensation ..................................................................................................................................... 67

Allowable Fees .................................................................................................................................................. 67

Non Delivery Fee ............................................................................................................................................... 67

CLOSING/DELIVERY INFORMATION ...................................................................................................................... 67

Uniform Closing Dataset (UCD) ....................................................................................................................... 67

4506-C ................................................................................................................................................................ 67

Delivery of Mortgage Loans ............................................................................................................................. 67

Loan Quality Advisor ......................................................................................................................................... 68

Uniform Loan Delivery Dataset (ULDD) ........................................................................................................... 68

Original Mortgage Notes.................................................................................................................................. 68

Non-Delivery Fee ............................................................................................................................................... 69

Final Document Delivery .................................................................................................................................. 69

SERVICING .............................................................................................................................................................. 69

HAZARD & FLOOD INSURANCE ............................................................................................................................. 69

PROPERTIES AFFECTED BY A DISASTER .................................................................................................................. 69

HOMEBUYER EDUCATION ...................................................................................................................................... 69

SECTION XI THIRD PARTY ORIGINATION (TPO) CHANNEL ........................................................................................ 70

WHOLESALE LENDER RESPONSIBILITIES ................................................................................................................. 70

WHOLESALE LENDER REQUIREMENTS .................................................................................................................... 70

TERMINATION OF A TPO ........................................................................................................................................ 70

THDA Originating Agents Guide Page | 1

Revised 02.01.2024

SECTION I: THDA OVERVIEW

GUIDE SUMMARY

This Originating Agents Guide amends and replaces the Originating Agents Guide dated

January 2021 (the “Prior Guide”) and, together with all subsequent revisions, modifications or

updates (the “Guide”) provided by the Tennessee Housing Development Agency (“THDA”),

contains information about THDA loan programs and specific requirements for qualifying

applicants, submitting, closing, and delivering loans for THDA.

The Prior Guide shall apply to all THDA approved loans locked on or prior to January 31, 2024,

and this Guide shall apply to all THDA approved loans locked on or after February 1, 2024.

THDA may revise, modify or update this Guide from time to time and will notify Originating

Agents (“Lender”) of such changes. THDA may provide notice of changes by posting such

changes to its web site at www.thda.org

.

HOURS OF OPERATION AND HOLIDAY SCHEDULE

The Single Family Programs Division hours of operation are 7:00 a.m. until 4:30 p.m. Central Time,

Monday through Friday. Rate lock desk is available 9:00 a.m. until 5:30 p.m. Central Time on all

THDA business days. The Single Family Programs Division will be closed on official State holidays

which are as follows:

New Year’s Day

Presidents’ Day

Good Friday

Memorial Day

Juneteenth

Independence Day

Labor Day

Veteran’s Day

Thanksgiving Day and Friday After*

Christmas Day**

New Year’s Eve

*THDA will be closed on the Friday after Thanksgiving Day.

**Other holidays around Christmas may be announced later.

SINGLE FAMILY PROGRAMS DIVISION STAFF DIRECTORY

The Single Family Programs Division of THDA has day-to-day operational control of the

origination and closing of THDA mortgage loans. All correspondence should be directed to:

Single Family Programs Division

Tennessee Housing Development Agency

502 Deaderick Street, Third Floor

Nashville, TN 37243

THDA Toll-Free…………………………… 800-228-8432

Single Family Information Line ............ 615-815-2100

Single Family Ask Desk ......................... Email: sfask@thda.org

Volunteer Mortgage Loan Servicing .. 844-865-7378

Volunteer Mortgage Loan Servicing .. Email: custserv@volservicing.com

THDA Originating Agents Guide Page |2

Revised 07.01.2024

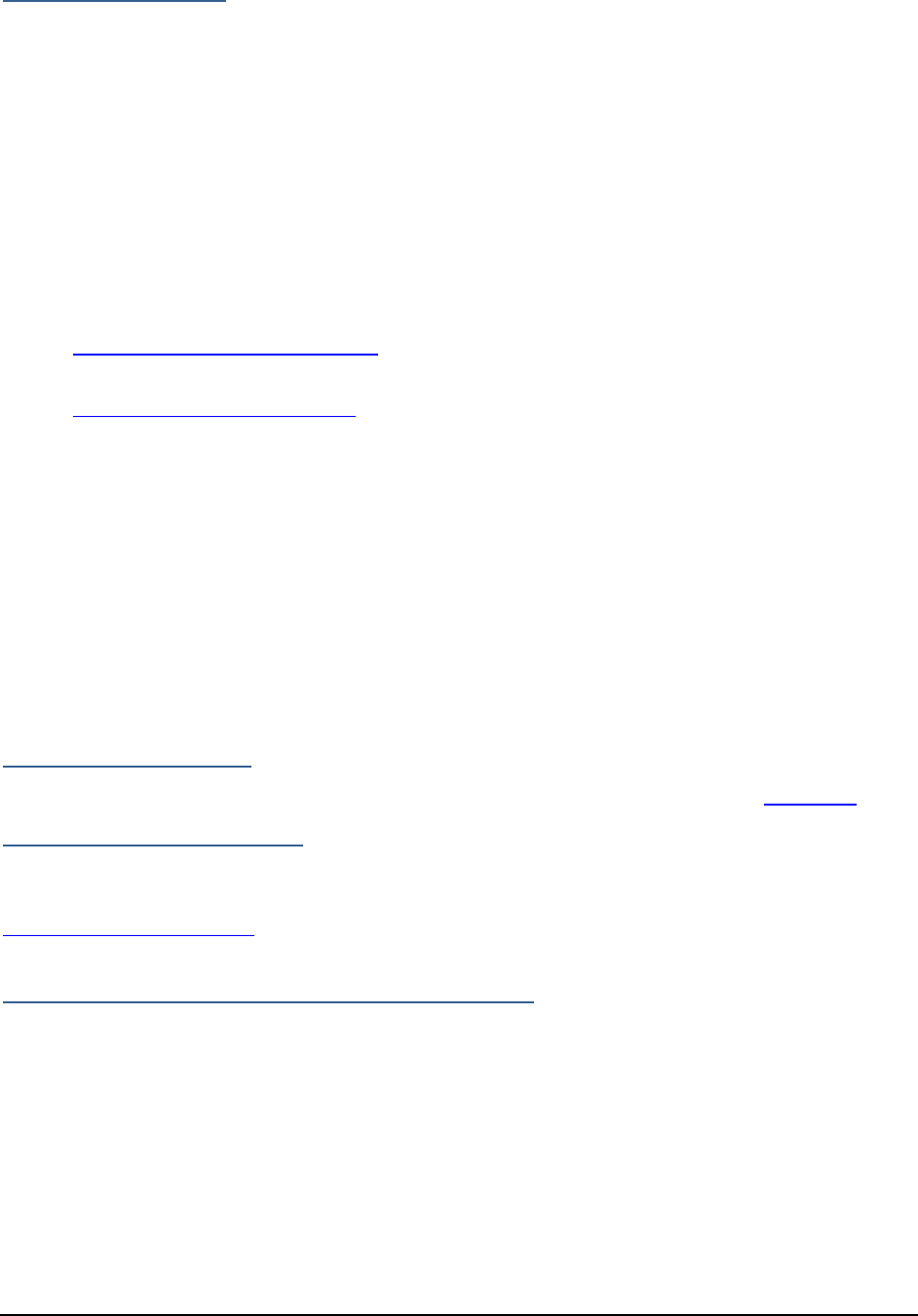

THDA STAFF PHONE EMAIL

Lindsay Hall, Chief Operating Officer of Single Family Programs 615-815-2080 [email protected]

Rhonda Ronnow, Director of Loan Operations, Single Family

Programs

615-815-2111 rronnow@thda.org

Jennifer Green, Assistant Director of Loan Operations, Single Family 615-815-2087 [email protected]rg

Sheila Gunsell, Underwriting Manager 615-815-2089 [email protected]g

Jayna Johnson, Homebuyer Education Manager 615-815-2019 [email protected]

Chuck Pickering, Mortgage Funding Manager 615-815-2086 [email protected]

Russell Catron, Program Development & Administration Coordinator 615-815-2186 rcatron@thda.org

Amber Holland, SFLO Administrative Coordinator 615-815-2094 aholland@thda.org

Rhonda Ellis, Mortgage Loan Specialist, Processing 615-815-2103 [email protected]

Bryan Yoshino, Senior Mortgage Loan Underwriter 615-815-2114 [email protected]

Joseph Uvanni, Senior Mortgage Loan Underwriter 615-815-2092 juv[email protected]g

Kay Leyhew, Senior Mortgage Loan Underwriter 615-815-2112 kleyhew@thda.org

Kelly Murph, Senior Mortgage Loan Underwriter 615-815-2099 kmurph@thda.org

Paulie Crone, Mortgage Loan Underwriter 615-815-3981 pcrone@thda.org

Samantha Thacker, Mortgage Loan Underwriter 615-815-3983 sthacker@thda.org

Shannon Ward, Mortgage Loan Coordinator, Closing 615-815-2084 sward@thda.org

Jennifer Carpenter, Senior Mortgage Loan Closer 615-815-3991 jcarpenter@thda.org

Olivia Rodriguez, Mortgage Loan Closer, Final Documents 615-815-3992 [email protected]

Stephen Chinique, Loan Specialist, Post-Closing 615-815-2107 schinique@thda.org

Wendee Luman, Mortgage Loan Specialist, Final Documents 615-815-2110 wluman@thda.org

Katina Brewer, Mortgage Loan Specialist, Final Documents 615-815-2083 kbrewer@thda.org

Sharayah Shattuck, Document Delivery and Shipping Coordinator

Mortgage Loan Specialist, Final Documents

615-815-2089 [email protected]g

Laura Medico, Mortgage Document Delivery/ Shipping Coordinator 615-815-3993 lmedico@thda.org

Mandy Garman, Housing Education Training Coordinator 615-815-2161 mgarman@thda.org

Yvonne Hall, Housing Education Grants Coordinator 615-815-2228 yhall@thda.org

Kendra Love, HUD Housing Education Counselor- West TN 615-815-2138 klov[email protected]rg

Montrice Brown-Miller, HUD Housing Education Counselor-Middle TN 615-815-2137 mbrown[email protected]

Angela Hall, HUD Housing Education Counselor- East TN 615-815-2088 ahall@thda.org

LiSandra McLaurine, Housing Education Resource Specialist 615-815-2085 [email protected]

Toumie Parrot, Customer Account Manager-Middle Tennessee 615-815-2122 tparrot@thda.org

Rebekah Bicknell, Customer Account Manager-East Tennessee 615-815-2121 r[email protected]

Juanita Hamilton, Customer Account Manager-West Tennessee 615-815-2190 jhhami[email protected]g

THDA Originating Agents Guide Page | 3

Revised 02.01.2024

CURRENT THDA LOAN PROGRAMS

THDA offers the following mortgage loan programs:

• Great Choice • Great Choice Plus

• Homeownership for Heroes • Homeownership for Heroes Plus

• Freddie Mac HFA Advantage® • Freddie Mac HFA Advantage Plus®

1. Great Choice Mortgage Loan Program (Mortgage Revenue Bond)

This loan is secured by a first mortgage with the option of down payment and closing cost

assistance. (See Great Choice Plus for details).

Great Choice Mortgage Loan Program

Eligible Borrower/First Time

Homebuyer Rule

Borrower must not have an interest in their primary residence within 36

months of application unless the property to be financed with the loan is

in a targeted area (See THDA website for targeted areas.)

Assumable

Subject to Qualifying

Interest Rate

Posted on THDA Website

Loan Term

30 years

Loan Types

FHA, VA, USDA/RD,(Agency) and Uninsured Conventional Portfolio

Max Loan Amount

Varies

Down Payment As Required by Loan Type

Max MRB Income

Varies by County

Max Acquisition Cost $400,000

Eligible Properties

Single Family 1-4 unit (1 must be owner occupied), condos, PUD,

townhomes, HUD approved manufactured homes

Homebuyer Education

Required

AUS Requirements

DU, LPA, or GUS

Manual Underwriting

Allowed; See THDA Guidelines

Min. Credit Score

640

Max Debt-to-Income Ratio

45%

Max LTV

Subject to FHA, VA, & USDA/RD (Agency) guidelines. Conventional loans

78% LTV or less (uninsured portfolio)

Min. Investment/Required Reserves

As Required by Loan Type

Mortgage Insurance

As Required by Loan Type

Occupancy

Owner Occupied within 60 days of Closing

Additional Documentation/Forms

Seller Declaration, Application Declaration, Recapture Disclosure

Pre-Payment Penalty

No Penalty

Subject to Recapture

Yes; Eligible for Recapture Reimbursement Program

Escrows

Required; Waivers not Permitted

Allowable Fees to be charged

Reasonable and customary fees up to $1400. Origination fee based

on rate sheet and product offering at the time the loan is locked;

rate lock extension fees charged to the lender by THDA can be

charged.

Lender Compensation

Based on rate sheet and product offering at the time the loan is locked.

THDA Originating Agents Guide Page | 4

Revised 02.01.2024

2. Great Choice Plus Mortgage Program: Down Payment/Closing Cost Assistance Loan

This MRB loan offers a choice for down payment and closing cost assistance, one offering has

deferred payments and the other has a low interest rate with monthly payments. Both are

secured by a second deed of trust and only available with the THDA Great Choice first

mortgage loan. The Great Choice Plus Loan Payment is at an interest rate the same as the first

mortgage, monthly payments amortized over a 30 year term, and the loan amount is up to 5%

of the sales price (maximum loan amount of $15,000). The Great Choice Plus Loan-Deferred

(no payment) is a flat up to $6,000 at a 0% interest rate, 30 year term, and must be repaid if

the home is refinanced or sold.

Great Choice Plus Mortgage Loan Program (DPA) Options

Eligible Borrower/First Time

Homebuyer Rule

Must Qualify and Obtain THDA Great Choice Loan

Assumable

Not Allowed

Interest Rate

Same as First Mortgage for Payment Option: 0% for Deferred Option

Loan Term

30 years for all DPA Options

Loan Types

FHA, VA, USDA/RD (Agency), and Uninsured Conventional Portfolio

Max Loan Amount

Up to 5% of sales price for payment option, maximum loan amount of

$15,000: up to $6,000 for deferred option

Down Payment

N/A

Max MRB Income

Varies by County

Max Acquisition Cost

$400,000

Eligible Properties

Same as First Mortgage

Homebuyer Education

Required

AUS Requirements

DU, LPA, or GUS

Manual Underwriting

Allowed; See THDA Guidelines

Min. Credit Score

640

Max Debt-to-Income Ratio

45%

Max CLTV

Subject to FHA, VA, & USDA/RD (Agency) Guidelines. Uninsured

Conventional Loans 100% CLTV

Min. Investment/Required Reserves

No

Mortgage Insurance

N/A

Occupancy

Owner Occupied within 60 days of Closing

Additional Documentation/Forms

THDA provided Note and Deed of Trust

Pre-Payment Penalty

Balance due in full upon first mortgage payoff, assumption, or refinance

Subject to Recapture

No

Escrows

Required; Waivers not Permitted

Allowable Fees to be charged

Recording fee, prepaid interest, mortgage tax fee

, settlement fee of up to

$200

Lender Compensation

Not Paid on Second Mortgage

THDA Originating Agents Guide Page | 5

Revised 02.01.2024

3. Homeownership for Heroes Mortgage Loan Program

This loan program is offered to qualified members of the United States Military, National Guard,

Veterans, eligible spouses of Veterans, State and Local Law Enforcement Officers, EMTs and

Paramedics, and Firefighters. A 50 basis point rate reduction will apply to the Great Choice

loan, based on the current rate at time of loan rate lock. The loan is secured by a first mortgage

with the option of down payment and closing cost assistance (see Homeownership for Heroes

Plus for more details).

Homeownership for Heroes Mortgage Loan Program

Eligible Borrower/First Time

Homebuyer Rule

Same as Great Choice or the borrower meets the Veteran’s exemption for

first time homebuyer requirement (See THDA OA Guide for Veteran

Exemption). Must be currently employed in TN or military/Veteran. Must

have license/certifications in profession listed above or military LES/DD214.

Assumable

Subject to Qualifying

Interest Rate

Posted on THDA Website

Loan Term

30 years

Loan Types

FHA, VA, USDA/RD (Agency), and Uninsured Conventional Portfolio

Max Loan Amount

Varies

Down Payment

As Required by Loan Type

Max MRB Income Varies by County

Max Acquisition Cost

$400,000

Eligible Properties

Single Family 1-4 unit (1 must be owner occupied), condos, PUD,

townhomes, HUD approved manufactured homes

Homebuyer Ed

Required

AUS Requirements

DU, LPA, or GUS

Manual Underwriting

Allowed; See THDA Guidelines

Min. Credit Score

640

Max Debt-to-Income Ratio

45%

Max LTV

Subject to FHA, VA, & USDA/RD (Agency) Guidelines. Conventional Loans

78% LTV or less

Min. Investment/Required

Reserves

As Required by Loan Type

Mortgage Insurance

As Required by Loan Type

Occupancy

Owner Occupied within 60 days of Closing

Additional Documentation/Forms

Seller Declaration, Application Declaration, Recapture Disclosure, License or

Certification, DD-214 or DD- 4

Pre-Payment Penalty

No Penalty

Subject to Recapture

Yes; Eligible for Recapture Reimbursement Program

Escrows Required; Waivers not Permitted

Allowable Fees to be charged Reasonable and customary fees up to $1400. Origination fee

based on rate

sheet and product offering at the time the loan is locked;

rate lock extension

fees charged to the lender by THDA can be charged.

Lender Compensation

Based upon the rate sheet and

product offering at the time the loan is

locked.

THDA Originating Agents Guide Page | 6

Revised 02.01.2024

4. Homeownership for Heroes Plus Mortgage Loan Program

This MRB loan offers a choice for down payment and closing cost assistance, one offering

has deferred payments and the other has a low interest rate with monthly payments. Both

are secured by a second deed of trust. Loan options are available only with the

Homeownership for Heroes first mortgage loan. Heroes Plus Loan with payment is at an

interest rate the same as the first mortgage, up to 5% of the sales price (maximum loan

amount of $15,000), and monthly payments amortized over a 30 year term. Heroes Plus

Loan-deferred (no payment) is a flat up to $6,000 at a 0% interest rate, 30 year term, and

must be repaid if the home is refinanced or sold.

Homeownership for Heroes Plus Mortgage Loan Program

(DPA) Options

Eligible Borrower/First Time

Homebuyer Rule

Must Qualify and Obtain THDA Homeownership for Heroes Loan

Assumable

Not Allowed

Interest Rate

Same as First Mortgage for Payment Option: 0% for Deferred Option

Loan Term

30 years for all DPA Options

Loan Types

Conventional

Max Loan Amount

Up to 5% of sales price for payment option, maximum $15,000 loan

amount: up to $6,000 for deferred option

Down Payment

N/A

Max MRB Income

Varies by County

Max Acquisition Cost

$400,000

Eligible Properties

Same as First Mortgage

Homebuyer Ed

Required

AUS Requirements

DU, LPA, or GUS

Manual Underwriting

Allowed; See THDA Guidelines

Min. Credit Score

640

Max Debt-to-Income Ratio

45%

Max CLTV

Subject to FHA, VA, & USDA/RD (Agency) Guidelines

Min.

Investment/Required

Reserves

No

Mortgage Insurance

N/A

Occupancy

Owner Occupied within 60 days of Closing

Additional

Documentation/Forms

THDA provides Mortgage Note and Deed of Trust

Pre-Payment Penalty

Balance due in full upon first mortgage payoff, assumption, or refinance

Subject to Recapture

No

Escrows

Required; Waivers not Permitted

Allowable Fees to be charged

Recording fee, prepaid interest, mortgage tax fee

, settlement fee of up

to $200

Lender Compensation

Not Paid on Second Mortgage

THDA Originating Agents Guide Page | 7

Revised 05.22.2024

5. Freddie Mac HFA Advantage® Mortgage Loan Program (Mortgage Backed Securities)

This MBS program is designed for low and moderate income borrowers. HFA Advantage

offers an insured conventional mortgage loan secured by a first mortgage with the option

of down payment and closing cost assistance (see HFA Advantage Plus for more details).

Maximum CLTV limit of 105%. See Section X

.

Freddie Mac HFA Advantage® Mortgage Loan Program

Eligible Borrower/First Time

Homebuyer Rule

First Time Homebuyer Not Required

Assumable

Per Freddie Mac Guidelines

Interest Rate

Posted on THDA Website

Loan Term 30 years

Loan Types

Freddie Mac HFA Advantage

Max Loan Amount

Varies

Down Payment

3%

Max MRB Income

Varies by County

Max Acquisition Cost

$400,000

Eligible Properties

See Eligible Properties

Homebuyer Ed

Required

AUS Requirements

LPA Only

Manual Underwriting

Not Allowed

Min. Credit Score

Per Freddie Mac Guidelines

Max Debt-to-Income Ratio

Per Freddie Mac Guidelines

Max LTV 97%

Min. Investment/Required

Reserves

Per Freddie Mac Guidelines

Mortgage

Insurance

<80% AMI

18% coverage greater than 95%-97%

16% coverage greater than 90%-95%

12% coverage greater than 85%-90%6% coverage greater than 80%-

85%

>80% AMI

Per Freddie Mac Guidelines

Occupancy

Owner Occupied within 60 Days of Closing

Pre-Payment Penalty

No Penalty

Subject to Recapture

No

Escrows

Required; Waivers not Permitted

Allowable Fees to be charged

Reasonable and customary fees up to $1400. Origination fee based

on rate sheet and product offering at the time of the rate lock; rate

lock extension fees charged to the lender by THDA can be charged.

Lender Compensation

Based on the rate sheet and product offering at the time

of the rate lock.

THDA Originating Agents Guide Page | 8

Revised 05.22.2024

6. Freddie Mac HFA Advantage® Plus Mortgage Loan Program (Mortgage Backed

Securities)

This MBS loan offers a choice for down payment and closing cost assistance, one offering

has deferred payments and the other has a low interest rate with monthly payments. Both

are secured by a second deed of trust. This loan is available only with the HFA Advantage

first mortgage loan. The HFA Advantage Plus with Payment is at an interest rate the same

as the first mortgage, monthly payments amortized over a 30 year term, and up to 5% of

the sales price (maximum $15,000 loan amount). The HFA Advantage Plus with No

Payment is up to $6,000 at a 0% interest rate, 30 year term, and must be repaid if the

home is refinanced or sold.

Freddie Mac HFA Advantage® Mortgage Loan Program

(DPA) Options

Eligible Borrower/First Time

Homebuyer Rule

Must Qualify and Obtain Freddie Mac HFA Advantage® Loan

through

THDA

Assumable

Not Allowed

Interest Rate

Same as First Mortgage for Payment Option: 0% for Deferred Option

Loan Term

30 years for all DPA Options

Loan Types

Conventional

Max Loan Amount

Up to 5% of sales price for payment option, maximum $15,000 loan

amount: up to $6,000 for deferred option

Down Payment

N/A

Max MRB Income

Varies by County

Max Acquisition Cost

$400,000

Eligible Properties

See Eligible Properties

Homebuyer Ed

Required

AUS Requirements

LPA only

Manual Underwriting

Not Allowed

Min. Credit Score

Per Freddie Mac Guidelines

Max Debt-to-Income Ratio

Per Freddie Mac Guidelines

Max LTV

105% max CLTV

Min.

Investment/Required

Reserves

No

Mortgage Insurance

N/A

Occupancy

Owner Occupied within 60 days of Closing

Additional Documentation/Forms

FNMA/FHLMC Multi-state Note and Deed of Trust in the name of

the Originating Agent

Pre-Payment Penalty

Balance due in full upon first mortgage payoff, assumption, or refinance

Subject to Recapture

No

Escrows

Required; Waivers not Permitted

Allowable Fees to be charged

Recording fee, prepaid interest, mortgage tax fee

, settlement fee up to

$200

Lender Compensation Not Paid on Second Mortgage

THDA Originating Agents Guide Page | 9

Revised 02.01.2024

SECTION II: ORIGINATING AGENTS

To be approved as a Tennessee Housing Development Originating Agent, the lender

must meet the qualifications as listed on our website.

THDA uses an online data portal through Comergence by Optimal Blue

to process new

lender applications. Lenders should visit the THDA website to review the application

process. No documents should be overnighted or emailed to THDA unless requested.

Approved Originating Agent’s staff must complete required THDA training prior to being

authorized to originate loans. Training includes all aspects of the loan origination process.

ORIGINATING AGENT WORKING AGREEMENT

The written agreement between an Originating Agent and THDA, which must be

executed before any loan applications will be accepted by THDA for processing (the

“Working Agreement”), contains the basic contractual agreements between the

Originating Agent and THDA. The Working Agreement sets forth general terms under

which the Originating Agent is authorized to act on behalf of THDA.

The Working Agreement also incorporates the contents of this Guide, prior guides, and

other written instructions that may be issued by THDA to provide instruction and direction

in the daily operation of THDA’s programs. THDA has separate working agreements for

the MRB program and the MBS program.

CORRESPONDENT RELATIONSHIPS

Each Originating Agent is responsible for originating, processing, underwriting, closing,

post-closing, submitting the documents to THDA, and insuring all THDA loans are in

accordance with the guidelines and procedures stated in the Originating Agents Guide,

the appropriate Agency requirements, and all regulatory requirements of the following:

• Real Estate Settlement Procedures Act (RESPA);

• Regulation X;

• Equal Credit Opportunity Act (ECOA);

• Regulation B;

• Fair Credit Reporting Act (FCRA);

• Regulation V;

• Truth in Lending Act (TILA);

• Regulation Z;

• Fair Housing Act;

• Homeowners Protection Act of 1998;

• Flood Act;

• Consumer Financial Protection Bureau (CFPB);

• Any other applicable federal and state laws and regulations.

Applications that are originated by a third party and/or brokered applications, are

eligible to be submitted to THDA upon written approval of THDA.

Applications originated by one Originating Agent that are transferred to another

Originating Agent for submission to THDA must be re-verified in the receiving Originating

Agent’s name prior to submission to THDA.

THDA Originating Agents Guide Page | 10

Revised 02.01.2024

The Originating Agent who originated, processed, closed, insured, and delivered a

particular loan to THDA must directly assign the Deed of Trust securing the loan to THDA.

Insurance or guaranty certificates may not contain the name of any entity other than the

Originating Agent or THDA as the beneficiary of the insurance or guaranty.

MAINTAINING ORIGINATING LENDER APPROVAL STATUS

After initial approval, each Originating Agent will be required to meet the following

specified requirements to maintain their status as an approved THDA Originating Agent.

A. Insurance and Net Worth Requirements – Maintain required fidelity bond, errors

and omissions insurance and net worth requirements.

B. Audited Financial Statements – Must provide THDA with financial recertification

documentation, as required by HUD. Financial statement shall include a balance

sheet, an income statement, and a statement of retained earnings, all related

notes and the opinion of an independent Certified Public Accountant as to the

correctness of those statements.

C. Information Security – Lender must provide current information security policy.

Written notice must also be provided to document any information security

incident or breaches that have taken place in the past three years.

D. Minimum Origination Volume – Originate no fewer than 6 first mortgage loans

which are purchased by THDA during the first twelve months and each full

calendar year thereafter, unless otherwise approved by THDA. Consideration of

lesser volume will be given in underserved or rural areas. Lenders deactivated due

to minimum origination volume not being met will be considered for renewal

during the following renewal period.

E. Notification of Organizational Changes – Provide written notice to THDA of any

major organizational changes contemplated, including but not limited to:

• Resignation or replacement of senior management personnel.

• Resignation or replacement of designated THDA delegated staff.

• Mergers, acquisitions or corporate name change.

• Change in savings and loan association charter to become banking

association.

• Change in financial position.

• Any reorganization, which centralizes or decentralizes a primary function

(i.e. underwriting, closing or post-closing).

• Opening or closing of offices originating THDA loans (include address,

phone number and branch manager's name).

F. Compliance with THDA Requirements – Maintain compliance with THDA policies,

procedures, rules, and regulations as stated in this Origination Agent Guide and

subsequent notifications. Comply with terms and conditions contained in the

Purchase Agreement.

G. Acceptable Loan Performance – Originate loans resulting in a delinquency rate

determined to represent an acceptable risk to THDA.

THDA Originating Agents Guide Page | 11

Revised 05.29.2024

H. Lender Performance – If a lender’s performance or that of an employee of the

lender is identified as presenting a significant risk to THDA, THDA reserves the right

to impose any of the following restrictions:

• Lender or individual placed on probationary status,

• Suspension of loan locking privileges for up to 12 months,

• Retention of lender compensation,

• Debarment from the THDA program for up to 3 years.

Appeal for suspension or debarment can be made in writing to the Director of

Single Family Loan Operations or Chief Operating Officer. In addition to the written

request, supporting documentation should be provided.

I. Early Loan Payoff – THDA will monitor the early loan payoff reports and reserves the

right to impose fees or reimbursements for excessive early payoffs.

J. Fees – Pay applicable renewal fee.

K. Quality Control Plan – Originating Agents must have a QC Plan that meets FHA,

VA, USDA, and Freddie Mac (“Agency Loans”) requirements. The Originating

Agent must maintain and update its QC Plan as needed to ensure it is fully

compliant with all applicable requirements at all times. Provide copies of any

notification forwarded to an insure/guarantor for violations of law or regulations,

false statements or program abuses by the Originating Agent, its employees or any

other party to the transaction as required under the respective Quality Control

plan submitted to THDA. An updated QC Plan will be requested as part of the

recertification process

L. Reconsideration of Value- Originating Agents must have policies and procedures

implemented that meet Agency requirements. The Originating Agent must

maintain and update as needed to ensure it is always fully compliant with all

applicable requirements. A copy of the policy or an attestation may be requested

as part of the recertification process.

THDA QUALITY CONTROL AND RISK MANAGEMENT

Prefunding Quality Control Reviews

THDA is implementing a preclosing quality control review process. When an Originating

Agent’s file is selected for preclosing review, the following condition will be reflected on

the file “This loan has been selected for a prefunding QC review. Additional conditions

may apply.” Any additional conditions required by the QC review must be submitted by

the OA to THDA. The loan cannot close until the time the OA is provided with a

commitment from THDA.

Quality Control Reviews

THDA will perform a monthly Quality Control review of no less than 10% of loans purchased

by THDA. The selection will include random and discretionary loans. The OA will be

notified of any defects at the loan level. The defects are a balance between THDA’s risk

management, insure/guarantor’s risk management, and best practices of quality

assurance business processes. The Originating Agent will submit any loan level

documentation requested by THDA to clear necessary defects.

THDA Originating Agents Guide Page | 12

Revised 02.01.2024

Early Payment Default Reviews

THDA considers Early Payment Defaults (EPD) as any mortgage that becomes delinquent

within the first year. THDA requires Originating Agents review all EPD on a monthly basis.

In addition to the Originating Agent using Neighborhood Watch to assist with identifying

FHA EPD, THDA will provide to the Originating Agent’s contact on record the EPD loans

identified monthly by THDA’s Servicing Department. Loans identified as EPD must be

reviewed immediately to prevent loan(s) from becoming 60 days delinquent in the first 6

months or 90 days delinquent in the first 12 months.

With the exclusion of first payment defaults, THDA will require a quality control performed

on all EPD loans with a delinquency status of 60 days in the first 6 months or 90 days in the

first 12 months. EPD within the first 6 months will be the OA’s responsibility to conduct a

Quality Control review which meets the standards as outlined in the OA’s Quality Control

Plan. OA must complete the initial Findings report within 60 days of the date notified by

THDA and provide THDA a summary of the report. OA will have 30 days from the initial

findings report to mitigate any findings and provide final finding report to THDA, if

necessary. THDA will conduct a quality control for all EPD loans 90 days delinquent in the

first 12 months. First payment defaults are subject to be repurchased.

An OA who fails to respond within the above timeline for EPD may be suspended from

reserving and/or submitting new loan applications to THDA.

Loan Level Defects/Findings

THDA will notify OA of any loan level defect(s) identified during any QC review performed

by THDA.

THDA will request a response and remedy for the defect(s). Potential remedies:

• Mitigating Documentation

Defects may be mitigated with the OA’s submission of additional documentation

which adequately addresses the defect/finding.

• Indemnification

When all alternatives have been exhausted and the loan is not in violation of any

items listed in the loan repurchase obligation, OA may resolve defects and findings

by indemnifying THDA against the risk of financial losses by signing a 5 year or Life

of Loan Indemnification agreement. With the execution of an indemnification, OA

is expected to comply with all terms of the agreement, which includes returning

all loan level Service Release Premium to THDA and paying an administrative fee

of $1,500.

The OA must report any Findings of fraud or material misrepresentation to THDA

immediately. An OA who fails to respond within a reasonable time to THDA inquiries or

requests for documentation may be suspended from reserving and/or submitting new

loan applications to THDA.

Exclusion Lists

THDA requires all parties involved in the loan process to be screened against the

appropriate exclusion lists. This includes employment listed in the QC plan for hiring

procedures and all parties involved in the loan process to meet Exclusion List guidelines

as set by the Agency. Exclusion lists include, but are not limited to: The Limited Denial of

Participation (LDP) list, General Services Administration (GSA), Freddie Mac Exclusionary

List (FMEL) and The Office of Foreign Assets Control (OFAC).

THDA Originating Agents Guide Page | 13

Revised 02.01.2024

THDA will maintain a list for any debarred or suspended lenders or individuals from THDA’s

mortgage loan program.

Information Security Standards

With the ever increasing focus on cyber security and the risk it poses to organizations that

house and use Personal Identifiable Information in the course of their normal business,

THDA requires that Originating Agents meet certain Information Security Standards.

THDA’s Information Technology Department will assess the Originating Agent’s

Information Security Policies for industry best practices on protecting against

cybersecurity threats and protecting customer data.

These requirements / best practices include:

1.

The Originating Agent is a US-based company with no offshore IP.

2.

The Originating Agent maintains a policy against password sharing.

3.

The Originating Agent maintains a clean desk policy.

4.

The Originating Agent maintains appropriate controls and disciplinary action for

policy violations or mishandling of customer data.

5.

The Originating Agent facilitates a cybersecurity training program for its employees,

minimally, on an annual basis.

6.

The Originating Agent employs data encryption practices for confidential data in

transit and at rest. This includes encryption practices for confidential information sent

via email, portals, SFTP sites, etc.

LOAN REPURCHASE

Repurchase Obligation

THDA, in its sole discretion, may refuse to purchase any loan, and may require an

Originating Agent to repurchase any loan(s) when any of the following exist:

1. Commitment conditions are not satisfied or loan did not close in accordance to

terms of the Commitment; or

2. The Originating Agent fails to deliver any documents required by the Guide or

pursuant to any condition of purchase by THDA, all in form and substance as

required by THDA or by State and Federal statutes and regulations, and