MASSACHUSETTS

WORKERS’

COMPENSATION

STATISTICAL PLAN

The Workers’ Compensation Rating and

Inspection Bureau of Massachusetts

101 Arch Street, Boston, MA 02110

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

TABLE OF CONTENTS Page i

INTRODUCTION

PART I – UNIT STATISTICAL REPORTING

SECTION I - GENERAL INSTRUCTIONS

A. Unit Statistical Data

B. Validity of the Unit Statistical Report

C. Interstate Experience Rated Risks

D. Whole Dollar Reporting

E. Reinsurance

F. Uncollectible Premiums

G. Group Claim Option

H. Policy Term Greater Than One Year and 16 Days in Length

I. Special Rules for Reporting Disease Experience

J. Experience Under the National Defense Projects Rating Plan

K. Electronic Reporting

L. WCRIBMA Contact

SECTION II – FIRST UNIT STATISTICAL REPORTS AND RE-VALUATIONS

A. Date of Valuation and Filing

B. First Unit Statistical Reports

C. Re-Valuations (Subsequent Unit Statistical Reports)

D. Adjustment of Losses between Valuations

SECTION III – CORRECTIONS

A. Corrections Submitted between Valuations

B. Method of Reporting Corrections

C. Correction Type Code

D. Update Type Code

SECTION IV – HEADER INFORMATION

A. General Information

B. Header Information Data Element Index

C. Header Information Data Elements

1. Carrier Code

2. Policy Number Identifier

3. Exposure State Code

4. Policy Effective Date

5. Report Number

6. Correction Sequence Number

7. Policy Expiration or Cancellation Date

8. Replacement Report Code

9. Business Segment Identifier

10. Correction Type Code

11. State Effective Date

12. Federal Employer Identification Number (FEIN)

13. Three-Year Fixed Rate Policy Indicator

14. Multistate Policy Indicator

15. Interstate Rated Policy Indicator

16. Estimated Audit Code

17. Retrospective Rated Policy Indicator

18. Canceled Mid-Term Policy Indicator

19. Type of Coverage ID Code

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

TABLE OF CONTENTS Page ii

20. Type of Plan ID Code

21. Type of Non-Standard ID Code

22. Losses Subject to Deductible Code

23. Basis of Deductible Calculation Code

24. Deductible Amount Per Claim/Accident

25. Deductible Amount – Aggregate

26. Previous Report Number

27. Previous Correction Sequence Number

28. Previous Carrier Code

29. Previous Policy Number Identifier

30. Previous Policy Effective Date

31. Previous Exposure State Code

SECTION V - EXPOSURE RECORD DATA

A. General Information

B. Exposure Record Data Element Index

C. Exposure Record Data Elements

1. Classification Code (Class Code)

2. Experience Modification Factor (Experience Mod)

3. Experience Modification Effective Date (Mod Effective Date)

4. Rate Effective Date

5. Exposure Amount

6. Premium Amount

7. Manual Rate (WCRIBMA’s filed and approved rate)

8. Split Period Code

9. Update Type Code

10. Exposure Act/Exposure Coverage Code

SECTION VI - LOSS RECORD DATA

A. General Information

B. Loss Record Data Element Index

C. Loss Record Data Elements

1. Classification Code (Class Code)

2. Claim Count

3. Accident Date

4. Claim Number

5. Status Code

6. Injury Type Code

7. Catastrophe Number

8. Incurred Indemnity Amount

9. Incurred Medical Amount

10. Social Security Number

11. Update Type Code

12. Loss Coverage Act

13. Type of Loss

14. Type of Recovery

15. Type of Claim

16. Type of Settlement

17. Jurisdiction State Code

18. Part of Body

19. Nature of Injury

20. Cause of Injury

21. Occupation Description

22. Vocational Rehabilitation Indicator

23. Lump Sum Indicator

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

TABLE OF CONTENTS Page iii

24. Paid Indemnity Amount

25. Paid Medical Amount

26. Claimant’s Attorney Fees Incurred Amount

27. Employer’s Attorney Fees Incurred Amount

28. Paid Allocated Loss Adjustment Expense (ALAE) Amount

SECTION VII – ADDITIONAL REPORTING REQUIREMENTS ON DEATH AND PERMANENT TOTAL CLAIMS

A. Reporting Requirements

SECTION VIII - PENSION TABLES

A. Purpose

B. Non-USL&HW Pension Tables

C. USL&HW Pension Tables

PART II – AGGREGATE FINANCIAL REPORTING

SECTION I - GENERAL INSTRUCTIONS

A. Aggregate Financial Data

B. Cease Writing

C. Group Reporting

D. In Addition to Reports for NCCI or Other Rating Collection Organizations

E. Electronic Reporting

F. Whole Dollar Reporting

G. Reporting Credits

H. Direct Business

I. Policy Term Greater Than One Year and 16 Days in Length

J. M.G.L. Chapter 152 Section 65

K. WCRIBMA Contact

SECTION II – AGGREGATE FINANCIAL REPORTING TIMETABLE

A. Aggregate Financial Call Data Usage / Reporting Schedule

B. Timetable of Key Dates for Data Reporting

SECTION III – AGGREGATE FINANCIAL CALL ACKNOWLEDGMENT FORM

A. Description

B. General Instructions

C. Aggregate Financial Call Acknowledgment Form

SECTION IV – ANNUAL CALLS

POLICY YEAR CALLS – GENERAL INSTRUCTIONS

CALL # 2 – POLICY YEAR CALL

CALL #2A: POLICY YEAR RESIDUAL MARKET CALL

CALL #2C: POLICY YEAR LARGE DEDUCTIBLE CALL

CALL #2D: POLICY YEAR “F” CLASSIFICATION CALL

CALL #2E: POLICY YEAR MARITIME CLASSIFICATION CALL

ACCIDENT YEAR CALLS – GENERAL INSTRUCTIONS

CALL #3 – ACCIDENT YEAR CALL

CALL # 3A – ACCIDENT YEAR RESIDUAL MARKET CALL

CALL # 3C– ACCIDENT YEAR LARGE DEDUCTIBLE CALL

CALL #4: RECONCILIATION REPORT

CALL #5 RESIDUAL MARKET DIRECT WRITTEN PREMIUM

CALL #5A – LARGE DEDUCTIBLE COMPANY LEVEL WRITTEN PREMIUM

CALL #5B – DIRECT WRITTEN PREMIUM

CALL #6: MASSACHUSETTS CALENDAR YEAR EXPENSE DATA

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

TABLE OF CONTENTS Page iv

CALL #6A: INSURANCE EXPENSE EXHIBIT

CALL # 7: LARGE LOSS & CATASTROPHE CALL

PART III – DEFINITIONS

A. Premiums Reported in Statistical Plan

B. Losses and Loss Adjustment Expenses (LAE) Reported in Statistical Plan

C. Claim Categories

D. Expenses

E. Experience Types

F. Class Categories

PART IV – EXAMINATIONS AND RECONCILIATIONS

A. Unit Statistical Reports and Aggregate Financial Data Reconciliations

B. Routine Reviews by the WCRIBMA (Targeted AUP)

C. Routine Engagements by Independent Auditing Firms (Triennial AUP)

PART V - DATA QUALITY COMPLIANCE PROGRAMS

A. Overview

B. Unit Statistical Data Quality Incentive Program (USDQIP)

C. Aggregate Financial Call Acknowledgment Process

D. Aggregate Financial Data Quality Incentive Program (AFDQIP)

E. Examinations and Reconciliations

F. Disciplinary Fine

G. Reporting of Fines to the Massachusetts Division of Insurance

H. Appeal of Penalties Levied under the Data Quality Compliance Programs

PART VI - APPENDICES

APPENDIX I – EXTRAORDINARY LOSS EVENT TABLE

APPENDIX II – STATISTICAL CLASS CODES

APPENDIX III – PENSION TABLES

INTRODUCTION

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Introduction Page 1

INTRODUCTION

The Workers’ Compensation Rating and Inspection Bureau of Massachusetts (WCRIBMA) collects unit

statistical data and aggregate financial data to fulfill its role as the designated rating organization and

statistical agent for the Massachusetts Commissioner of Insurance.

The Massachusetts Commissioner of Insurance issued general instructions, known as the Massachusetts

Workers’ Compensation Statistical Plan (Statistical Plan), on January 2, 1929, for the preparation and

filing of experience with the WCRIBMA on all policies effective in Massachusetts on and after January 1,

1929.

On June 30, 2000 the Massachusetts Commissioner of Insurance ordered that effective immediately Part

I of the Statistical Plan shall relate to the unit statistical data and Part II shall relate to aggregate financial

data.

The Statistical Plan contains the following Parts:

Part I – Unit Statistical Data

• The instructions for the reporting of unit statistical data are contained in “Part I – Unit Statistical

Reporting”.

• Applicability:

o Every insurance company authorized to transact the business of workers’ compensation

insurance within the Commonwealth of Massachusetts shall file with the WCRIBMA complete unit

statistical information in accordance with the instructions contained herein, for:

o every policy with Massachusetts exposure and

o policies where Massachusetts was included on an “if any basis” and subsequently did not

develop Massachusetts exposure.

o If an insurance company is no longer authorized to transact the business of workers’

compensation in Massachusetts, it must continue the reporting of complete unit statistical

information in accordance with the instructions contained herein for all policies written.

o Self-Insurance Groups may contract with the WCRIBMA for purposes of calculating experience

ratings and consequently would have to adhere to the rules for reporting unit statistical data.

Part II – Aggregate Financial Data

• The instructions, and sample forms for the reporting of aggregate financial data are contained in “Part

II – Aggregate Financial Reporting”.

• Applicability:

o Every insurance company authorized to transact the business of workers’ compensation

insurance within the Commonwealth of Massachusetts shall file with the WCRIBMA complete

aggregate financial data in accordance with the instructions contained herein, on every policy.

o Insurance companies who cease writing workers’ compensation insurance may request to be

exempt from submitting aggregate financial data if their Massachusetts workers’ compensation

direct calendar year earned premium does not exceed $100,000 and their direct calendar year

incurred losses do not exceed $100,000.

o Self-Insurance Groups authorized to transact the business of workers’ compensation insurance

within the Commonwealth of Massachusetts are not required to file aggregate financial data with

the WCRIBMA.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Introduction Page 2

Part III – Definitions

• The definitions for terms associated with reporting unit statistical data and aggregate financial data

are included in “Part III – Definitions”.

Part IV– Examinations and Reconciliations

• Information detailing the reconciliation of unit statistical data and aggregate financial data is outlined

in “Part IV – Examinations and Reconciliations”.

Part V – Data Quality Compliance Programs

The WCRIBMA’s data quality fining processes for unit statistical data and aggregate financial data

are detailed in “Part V – Data Quality Compliance Programs”.

Circular letters announcing changes will be posted on the WCRIBMA’s website.

PART I

UNIT STATISTICAL REPORTING

SECTION I

GENERAL INSTRUCTIONS

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section I

Distributed: August, 2013 GENERAL INSTRUCTIONS

Part I – Unit Statistical Reporting Page 1

PART I – UNIT STATISTICAL REPORTING

SECTION I - GENERAL INSTRUCTIONS

A. Unit Statistical Data

1. Unit statistical data is the exposure, premium, and loss information that is first valued 18 months

after the policy effective date and annually thereafter.

2. WCRIBMA collects, processes, and analyzes unit statistical data for the following purposes:

• Ratemaking

• Experience rating

• Actuarial analysis

3. The classifications, exposure act and rates reported on unit statistical reports must be consistent

with the WCRIBMA’s filed and approved rates.

4. The premiums reported on unit statistical reports must be consistent with the WCRIBMA’s filed

and approved rating procedures.

5. Unit statistical reports should reflect exposures and premiums as of the final audit of the policy. If

the final audit has not been completed, report estimated exposures and premiums pending

completion of the audit.

6. All reported injuries that incurred medical loss, indemnity loss, or allocated loss adjustment

expense must be reported as claims consistent with the carrier’s claim files at the appropriate

valuation date.

B. Validity of the Unit Statistical Report

The unit statistical reports submitted to the WCRIBMA are edited for accuracy and validity including

but not limited to the following criteria:

1. The unit conforms to the rating rules found in the

Massachusetts Workers Compensation and

Employers Liability Insurance Manual, Experience Rating Plan Manual, Retrospective Rating

Plan Manual. Department of Insurance Regulations and Bulletins and other guides and manuals

distributed by or on behalf of the WCRIBMA. Nothing in the Statistical Plan should be construed

to supersede any rules or procedures set forth in the above mentioned manuals.

2. The unit reflects coverage and benefits in accordance with the Massachusetts Workers’

Compensation Law, Federal Employers’ Liability Act (FELA), Merchant Marine Act of 1920

(Jones Act) and United States Longshore and Harbor Workers’ Compensation Act including

Defense Base Act, Civilian Employees of Nonappropriated Fund Instrumentalities Act and Outer

Continental Shelf Lands Act.

3. The statistical class codes and other elements contained on the unit statistical report must

conform to this Statistical Plan.

C. Interstate Experience Rated Risks

For all interstate experience rated risks, a duplicate copy of the Massachusetts experience shall also

be filed with the National Council on Compensation Insurance (NCCI).

D. Whole Dollar Reporting

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section I

Distributed: August, 2013 GENERAL INSTRUCTIONS

Part I – Unit Statistical Reporting Page 2

All dollar amounts should be reported as whole numbers without decimal places. Values to the right

of any decimal place that are greater than or equal to .50 should be rounded upward. Values to the

right of the decimal place that are less than or equal to .49 should be rounded downward.

E. Reinsurance

No deduction is made from premiums and losses for, or as a result of, reinsurance ceded.

Premiums and losses associated with reinsurance assumed by the reporting carriers are excluded

from the experience reported to the WCRIBMA.

F. Uncollectible Premiums

1. For those policies on which an audit has been conducted and the earned premium is known, but

all or some portion thereof is uncollectible, report all earned premiums. Do not reduce reported

premiums for uncollectible premiums.

2. Policies on which a final audit is not possible and therefore the audited earned premium and

exposure is not known, report the estimated earned premium and exposure corresponding to the

term of coverage.

G. Group Claim Option

For policies effective on or after January 1, 2007, it is no longer permissible to group any claims for

unit statistical reporting purposes.

H. Policy Term Greater Than One Year and 16 Days in Length

If the policy term is a multiple of 12 months, the policy term is divided into consecutive 12 month

segments.

If the policy term is not a multiple of 12 months, the policy term is segmented in the same manner as

specified on the Policy Period Endorsement (WC000405). The Policy Period Endorsement identifies

either the first or last segment as the short-term segment, a segment of less than 12 months.

The beginning date for each segment shall be used for determining when losses are to be valued

and when unit statistical reports are due. This is comparable to the use of the policy effective date

for determining when losses are to be valued and when unit statistical reports are due for policies

having a term of no more than one year and 16 days.

Examples:

1. The unit statistical reports on a three-year policy effective on July 1, 2008 shall be filed with the

regular unit statistical reports on policies effective July 2008, July 2009, and July 2010. First unit

statistical report losses shall be valued as of January 1, 2010, January 1, 2011, and January 1,

2012, respectively.

2. The unit statistical reports on a policy covering the period July 1, 2008 to October 1, 2009 with

the first three months specified as the first reporting segment on the policy period endorsement,

shall be filed with the regular unit statistical reports on policies effective July 2008 and October

2008. First unit statistical report losses shall be valued as of January 1, 2010 and April 2010,

respectively.

3. The unit statistical reports on a policy covering the period July 1, 2008 to October 1, 2009 with

the first twelve months specified as the first reporting segment on the policy period endorsement

shall be filed with the regular unit statistical reports on policies effective July 2008, and July

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section I

Distributed: August, 2013 GENERAL INSTRUCTIONS

Part I – Unit Statistical Reporting Page 3

2009. First unit statistical report losses shall be valued as of January 1, 2010 and January 1,

2011, respectively.

Note: A policy issued for a term not longer than one year and 16 days is treated as a one-year

policy.

I. Special Rules for Reporting Disease Experience

1. Specific Disease Loading - Manual rates include premium for the disease exposures covered by

the Standard Policy. The rates for certain class codes contain specific disease loads which may

be removed if approved by the WCRIBMA. If the specific disease load is removed from the rate,

the reported rate should equal the WCRIBMA approved rate less the specific disease load.

Also, associated premiums should reflect the rate reduction resulting from the removal of the

specific disease load.

For more information refer to the

Massachusetts Workers Compensation and Employers Liability

Insurance Manual

2. Supplemental Disease Loading - A supplemental disease loading may be added to a manual

rate applicable to an individual risk if approved by the WCRIBMA. If a supplemental disease

load is added to a rate, the reported rate should equal the WCRIBMA approved rate plus the

supplemental disease load. Also, associated premiums should reflect the rate increase resulting

from the addition of the supplemental disease load.

For more information refer to the

Massachusetts Workers Compensation and Employers Liability

Insurance Manual.

3. Supplemental Disease Rates

Massachusetts Workers Compensation and Employers Liability

Insurance Manual rules provide that the payroll of all employees exposed to (a) a foundry hazard

(except payrolls properly assignable to certain specific codes) or (b) an abrasive or sand blasting

hazard (except for employees rated under a classification where the manual rate provides

coverage for silicosis) must be specifically stated and a special supplementary disease rate shall

be charged on this payroll in addition to the manual rate. The payroll to which the

supplementary disease rate is applicable, together with the manual premium derived from such

charges, shall be assigned to the appropriate statistical class code-either 0065, 0066, 0067, or

0059.

Dust disease losses incurred in connection with payrolls reported under statistical class code

0065, 0066, 0067 or 0059 shall likewise be assigned to the same statistical class code.

4. Disease losses shall be identified in the type of loss field by the appropriate code for disease

loss. Refer to Section VI – Loss Record Data, Subsection C.13

J. Experience Under the National Defense Projects Rating Plan

The experience of policies written under the National Defense Projects Rating Plan shall not be

reported on unit statistical reports.

K. Electronic Reporting

All unit statistical reports must be submitted electronically. The electronic data submission

requirements can be found in the Data Reporting area of the WCRIBMA’s web site

.

Data file formats are found in the

Workers Compensation Insurance Organizations (WCIO) Data

Specifications Manual.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section I

Distributed: August, 2013 GENERAL INSTRUCTIONS

Part I – Unit Statistical Reporting Page 4

L. WCRIBMA Contact

All correspondence, including questions and requests for additional information on these calls,

should be directed to:

Data Operations Department – WCRIBMA

101 Arch Street, Fifth Floor

Boston, MA 02110

Phone: (617) 439-9030

Fax: (617) 439-6055

Email: DataOperations@wcribma.org

PART I

UNIT STATISTICAL REPORTING

SECTION II

FIRST UNIT STATISTICAL REPORTS

AND

RE-VALUATIONS

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section II

Distributed: August, 2013 FIRST UNIT STATISTICAL REPORTS AND RE-VALUATIONS

Part I – Unit Statistical Reporting Page 1

SECTION II – FIRST UNIT STATISTICAL REPORTS AND RE-VALUATIONS

A. Date of Valuation and Filing

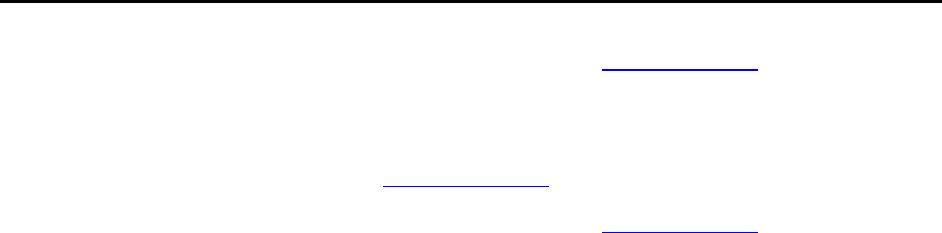

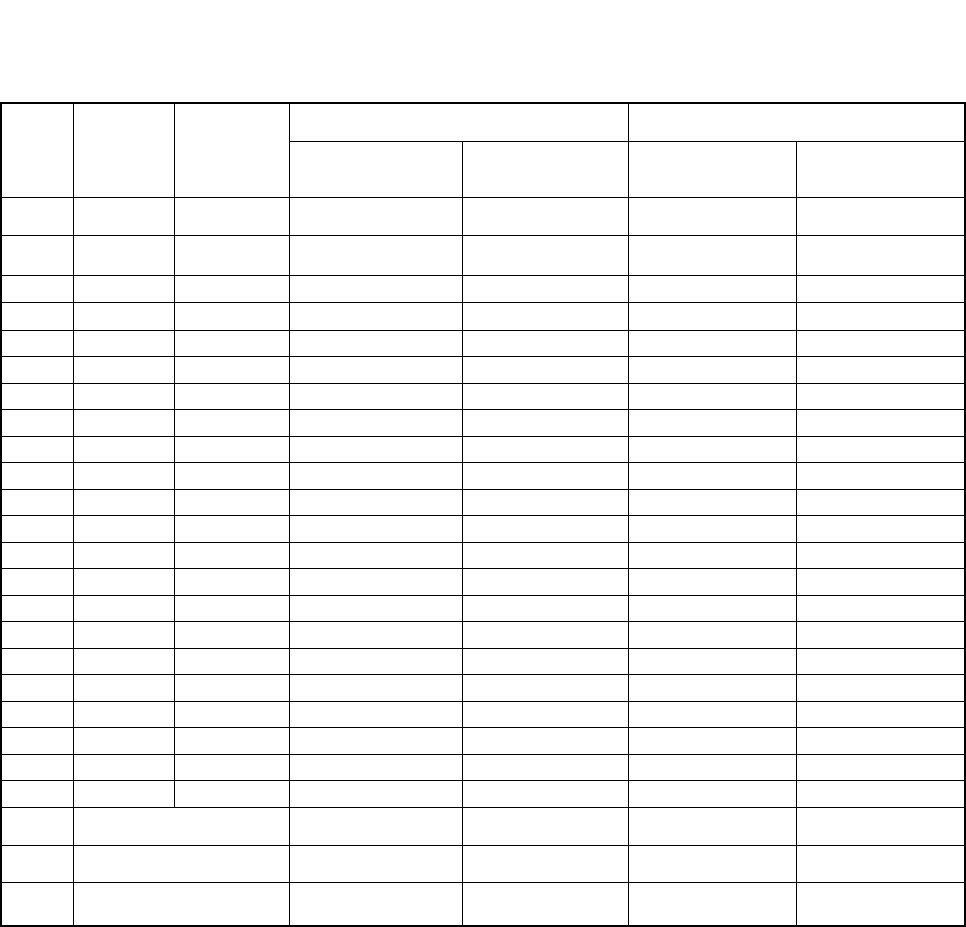

Unit statistical reports are valued and due as follows:

Unit

Statistical

Report

Level

Number of

months since

policy (or

segment)

effective

month

Due at

WCRIBMA

(in months)

Delinquent and

Fined on First

day of the

following month

Data Reported

Exposure Loss

First 18 20 21st X X

Second 30 32 33rd X

Third 42 44 45th X

Fourth 54 56 57th X

Fifth 66 68 69th X

Sixth 78 80 81st X

Seventh 90 92 93rd X

Eighth 102 104 105th X

Ninth 114 116 117th X

Tenth 126 128 129th X

B. First Unit Statistical Reports

1. The premium and losses of each policy are first valued as of eighteen (18) months after the

policy effective month and reported no later than twenty (20) months after the policy effective

month.

2. Update Type Code

• All exposure and loss records on first unit statistical reports must contain an update type

code as follows:

Code Description

R

Each record reported on first unit statistical reports must use code

“R” only.

C. Re-Valuations (Subsequent Unit Statistical Reports)

1. Subsequent unit statistical reports are re-valuations of losses and are required when:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section II

Distributed: August, 2013 FIRST UNIT STATISTICAL REPORTS AND RE-VALUATIONS

Part I – Unit Statistical Reporting Page 2

• The prior unit statistical report contained open claim(s).

• One or more claims reported as closed on the prior unit statistical report has since

reopened.

• Previously unreported claim(s) have become known.

• There are changes in the loss valuation of one or more claims.

2. Subsequent unit statistical reports of losses are reported in the same manner as loss

corrections as described in Section III - Corrections

.

3. Update Type Code

• All loss records on re-valuations must contain an update type code as follows:

Code Description

P

To delete a record from a previous unit statistical report use

update type code “P” only.

R

To add a data record that was not previously reported use update

type code “R” only.

P, R

To revise previously reported data:

• use update type “P” to delete the record

• use update type “R” to add a record with the revised data.

• For claims becoming non-compensable or closed without payment, or claims reflecting

received recovery, the “R” record must be reported so that information is coded in the

loss condition fields.

D. Adjustment of Losses between Valuations

Losses cannot be revised between two valuations because of departmental or judicial decision or

because of developments in the nature of the injury, except as listed in

Section III - Corrections,

Subsection A.

PART I

UNIT STATISTICAL REPORTING

SECTION III

CORRECTIONS

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 1

SECTION III – CORRECTIONS

A. Corrections Submitted between Valuations

Corrections are to be submitted between valuations for only the following situations.

1. Errors (Header Records, Exposure Records and Loss Records)

An error occurs whenever the standards specified in

Section I – General Instructions,

Subsection B are not met.

Upon identification of an error by either the WCRIBMA or the carrier on a previously

submitted unit statistical report, a correction report must be immediately filed.

The WCRIBMA routinely requests verification of reported data. In response to these

verification requests the WCRIBMA expects corrections or acceptable explanations that

confirm the data as accurate and reported in accordance with the Statistical Plan.

For loss records, corrections must be submitted for all previous unit statistical report levels

(valuations) that contain the error.

2. Formerly Self-Insured’s Deposit Adjustments (Exposure Record)

If any of the formerly self-insured’s rating plan deposit is returned to the insured, then a

correction to the first unit statistical report must be submitted when the deposit is returned.

3. Completion or Change in the Audit (Exposure Record)

Corrections to the first unit statistical report must be submitted whenever an audit is revised,

or upon completion of the audit when the first unit statistical report was submitted based on

estimated exposure.

4. Non-Compensable Claims (Loss Record)

a. Non-Compensable Claims Definition

A claim is determined to be non-compensable if:

• There is an official ruling denying benefits under the Workers’ Compensation Law.

• A claimant fails to file for benefits during the period of limitation allowed by the

Workers’ Compensation Law.

• The claimant fails to prosecute his/her claim following carrier’s denial of the claim.

b. Non-Compensable Claims Reporting

If a claim is determined to be non-compensable prior to the first unit statistical report

valuation, do not report the claim. If a claim is determined to be non-compensable after

the first unit statistical report valuation, a correction report must be submitted within 60

days of such determination for all report levels (valuations) to revise the

Type of

Settlement Code to “05” (non-compensable). All report levels (valuations) whether at the

first unit statistical reporting or by correction should reflect accurate amounts paid by the

carrier net of recovery, if any.

5. Recovery from Second Injury Fund (Loss Record)

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 2

a. Second Injury Fund Definition

The Second Injury Fund is established to reimburse the carriers when a subsequent

injury is caused by or made substantially greater due to the combined effects of physical

impairment, or previous accident, disease or congenital condition.

b. Second Injury Fund Reporting

Correction reports may be required for previously submitted unit statistical reports where

the previously reported incurred losses exceed the incurred loss net of a second injury

fund reimbursement and valued at the time of the second injury fund reimbursement.

When such a second injury fund reimbursement is received subsequent to the reporting

of the first unit statistical report but before the sixth unit statistical report’s due date, a

correction report must be filed.

When a second injury fund reimbursement is received on or after the sixth unit statistical

report’s due date, no correction report is required.

Note: If a claim is subject to second injury fund reimbursement prior to the submission of

the first unit statistical report, the loss amounts on the originally submitted first unit

statistical report should have been reported net of the second injury fund

reimbursement. Therefore, no correction would be needed.

If the allocation between incurred indemnity and incurred medical of the second injury

fund reimbursement is not specified, then the net incurred loss must be divided between

indemnity and medical in the same proportions as the gross incurred indemnity and

medical amounts. The net incurred loss would be calculated as follows:

Net Incurred Loss = Gross Incurred Loss – Second Injury Fund Reimbursement

Additionally, if a correction report is required and the previously reported paid losses

exceed the net paid loss valued at the time of the second injury fund reimbursement,

previously reported paid losses must be corrected. If the allocation between paid

indemnity and paid medical of the second injury fund reimbursement is not specified,

then the net paid loss must be divided between indemnity and medical in the same

proportions as the gross paid indemnity and medical amounts. The net paid loss would

be calculated as follows:

Net Paid Loss = Gross Paid Loss – Second Injury Fund Reimbursement

Note: The trigger for determining if a correction report is required is based on the incurred

loss and not the paid loss.

Corrections must be submitted within 60 days of the second injury fund reimbursement.

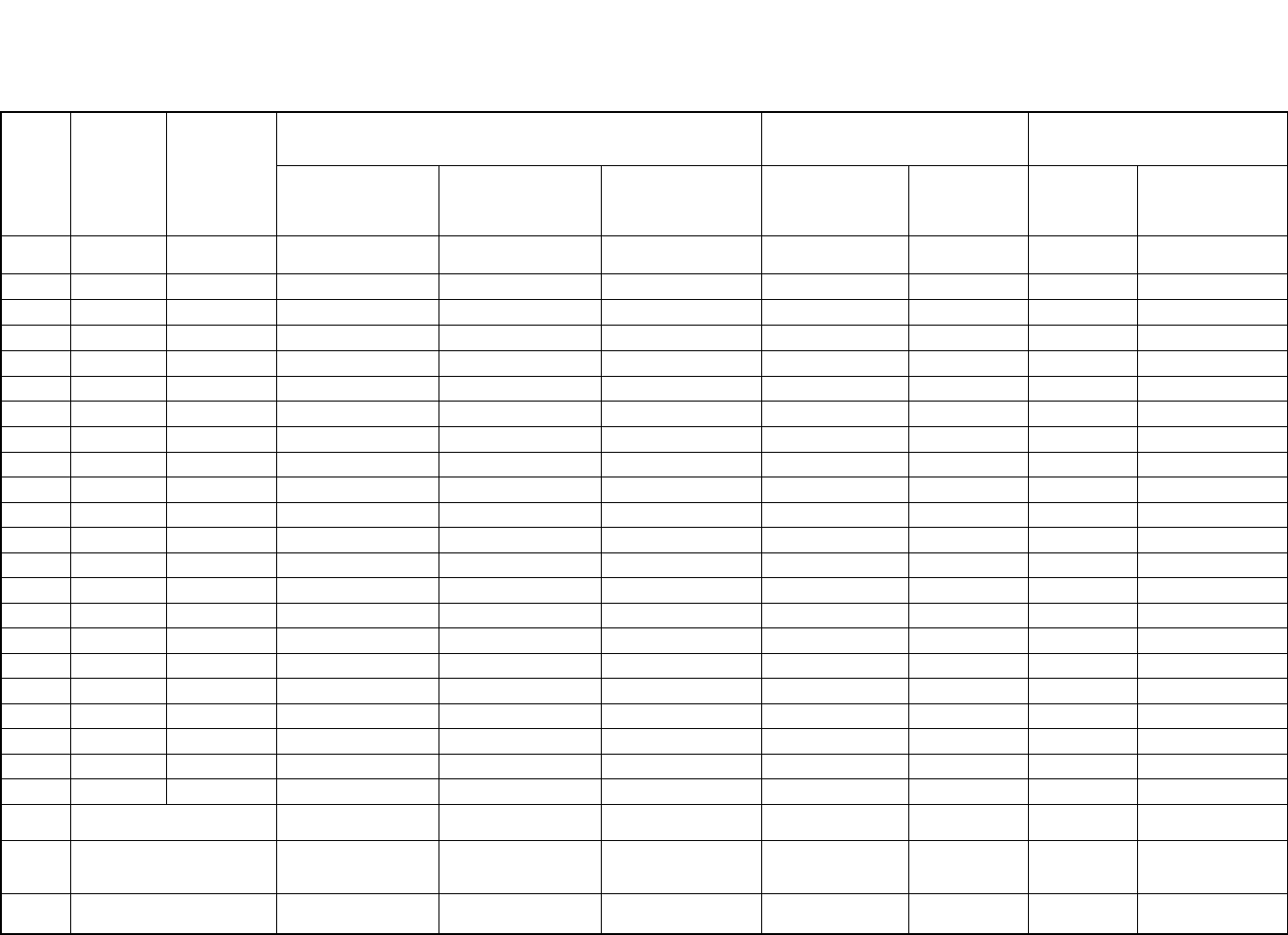

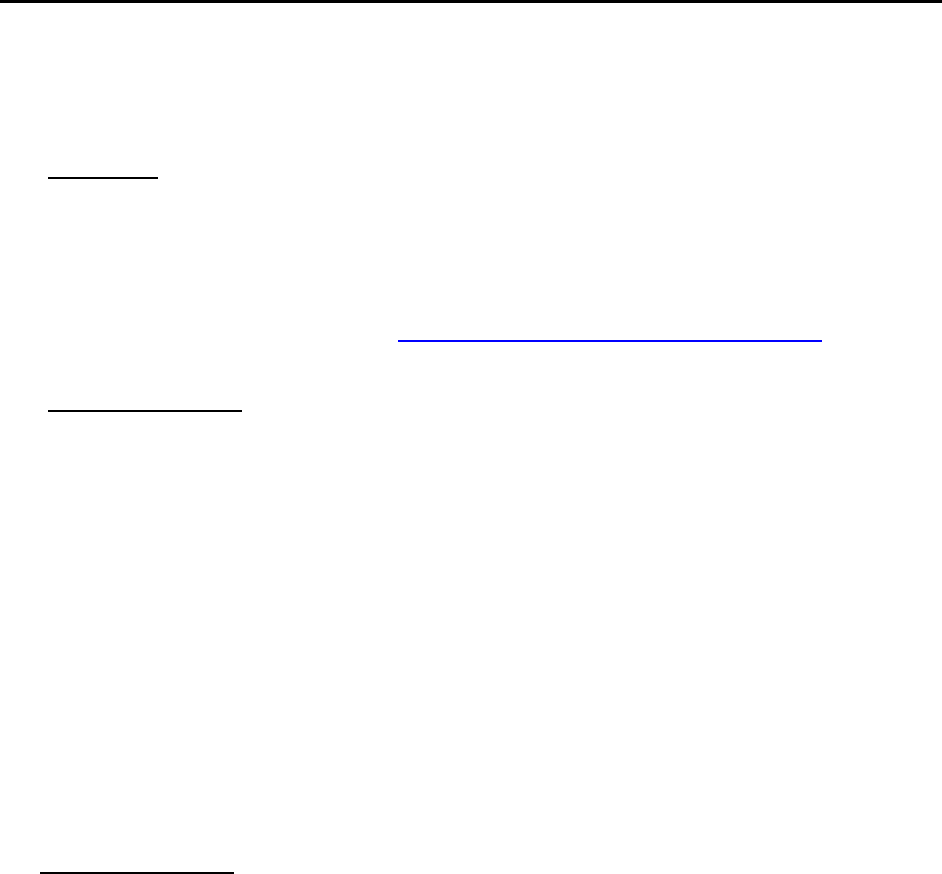

c. Second Injury Fund Example

Assumptions: The following is a reporting example where the carrier submitted a claim

on a first, second and third unit statistical report and second injury fund reimbursement

was received between the third and fourth unit statistical reports. The reported loss

amounts and the loss amounts valued at the time of the second injury fund

reimbursement are as follows:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 3

Incurred Losses Paid Losses

Valuation

Point

Gross

Indemnity

Gross

Medical

Reimbursement

Received

Net

Incurred

Loss

Gross

Indemnity

Gross

Medical

Reimbursement

Received

Net

Paid

Loss

1

st

Report 15,000 15,000

30,000 10,000 9,000

19,000

2

nd

Report 35,000 25,000

60,000 20,000 18,000

38,000

3

rd

Report 40,000 26,000

66,000 28,000 22,000

50,000

Date of SIF

Reimbursement

43,000 27,000

20,000

50,000 35,000 25,000

20,000

40,000

As of a date between the valuation date of the third unit statistical report and the

valuation date of the fourth unit statistical report, the carrier received a second injury fund

reimbursement in the amount of $20,000.

The allocation of the second injury fund reimbursement between indemnity and medical

was not specified.

Process: The carrier was required to perform the following steps to determine firstly if

correction reports were required for any report level, and, secondly the proper allocation

of the second injury fund reimbursement to indemnity loss and medical loss for both

incurred and paid amounts.

Step 1:

Determine if the second injury fund reimbursement is received on or after the 6th unit

statistical report’s due date. If not continue to Step 2. If so, no correction report is

required.

Step 2:

Determine which unit statistical reports are subject to correction by identifying those unit

statistical reports where the previously reported incurred losses exceed the net incurred

losses at the time of the second injury fund reimbursement.

Note: The determination of which unit statistical reports are subject to correction is based

only on incurred losses and not paid losses.

The incurred loss of $30,000 for the first report does not exceed the net incurred loss of

the claim at time of the second injury fund reimbursement which is equal to $50,000. No

correction report is needed.

The incurred loss of $60,000 for the second report does exceed the $50,000 net incurred

loss of the claim at time of the second injury fund reimbursement. A correction report is

needed.

The incurred loss of $66,000 for the third report does exceed the $50,000 net incurred

loss of the claim at time of the second injury fund reimbursement. A correction report is

needed.

Step 3:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 4

Revise the third unit statistical report – Incurred Losses

Allocate the net incurred loss of $50,000 based on gross incurred indemnity and incurred

medical at the time of recovery:

Corrected Incurred Indemnity: $50,000 x ($43,000 / $70,000) = $30,714

Corrected Incurred Medical: $50,000 x ($27,000 / $70,000) = $19,286

Step 4:

Revise the third unit statistical report – Paid Losses, if necessary

If the previously reported paid loss on the third unit statistical report exceeds the $40,000

net paid loss of the claim at time of the second injury fund reimbursement, the previously

reported paid loss amounts must be corrected.

In this case, the previously reported paid loss of $50,000 exceeds $40,000, the net paid

loss of the claim at time of the second injury fund reimbursement. Therefore, the

correction report must contain corrected paid loss amounts.

Allocate the net paid loss of $40,000 based on paid indemnity and paid medical at the

time of recovery:

Corrected Paid Indemnity: $40,000 x ($35,000 / $60,000) = $23,333

Corrected Paid Medical: $40,000 x ($25,000 / $60,000) = $16,667

Step 5:

Revise the second unit statistical report – Incurred Losses

As with the correction of the third report, allocate the net incurred loss of $50,000 based

on gross incurred indemnity and incurred medical at the time of recovery:

Corrected Incurred Indemnity: $50,000 x ($43,000 / $70,000) = $30,714

Corrected Incurred Medical: $50,000 x ($27,000 / $70,000) = $19,286

Step 6:

Revise the second unit statistical report – Paid Losses, if necessary

Since the previously reported paid loss on the second unit statistical report, $38,000,

does not exceed, $40,000, the net paid loss of the claim at time of the second injury fund

reimbursement, the previously reported paid loss amounts do not require correction.

Step 7:

Prepare the correction report to the second and third unit statistical reports to include the

necessary corrected loss amounts and also report the claim with Type of Recovery

Code

“02”.

Note: For a claim that was previously reported as closed which needs to be corrected

due to a second injury fund reimbursement, the corrected paid amounts should be equal

to the corrected incurred amounts.

6. Receipt of Successful Subrogation Recovery from a Third Party (other than from Second

Injury Fund) (Loss Record)

a. Successful Subrogation Recovery Reporting

Correction reports may be required for previously submitted unit statistical reports where

the previously reported incurred losses exceed the incurred loss net of a successful

subrogation

recovery and valued at the time of the subrogation recovery. When such a

successful subrogation recovery is received subsequent to the reporting of the first unit

statistical report but before the sixth unit statistical report’s due date, a correction report

must be filed.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 5

When a subrogation recovery is received on or after the sixth unit statistical report’s due

date, no correction report is required.

Note: If a claim is subject to subrogation recovery prior to the submission of the first unit

statistical report, the loss amounts on the originally submitted first unit statistical report

should have been reported net of subrogation. Therefore, no correction would be

needed.

Note: If the costs associated with pursuing subrogation recovery exceed the subrogation

recovery amount, no correction reports are required.

If the allocation between incurred indemnity and incurred medical of the subrogation

recovery less costs associated with pursuing the subrogation recovery is not specified,

then the net incurred loss must be divided between indemnity and medical in the same

proportions as the gross incurred indemnity and medical amounts. The net incurred loss

would be calculated as follows:

Net Incurred Loss = Gross Incurred Loss – (Subrogation – Recovery Expense)

Additionally, if a correction report is required and the previously reported paid losses

exceed the net paid loss valued at the time of the subrogation recovery, previously

reported paid losses must be corrected. If the allocation between paid indemnity and

paid medical of the subrogation recovery less costs associated with pursuing the

subrogation recovery is not specified, then the net paid loss must be divided between

indemnity and medical in the same proportions as the gross paid indemnity and medical

amounts. The net paid loss would be calculated as follows:

Net Paid Loss = Gross Paid Loss – (Subrogation – Recovery Expense)

Note: The trigger for determining if a correction report is required is based on the incurred

loss and not the paid loss.

Corrections must be submitted within 60 days of the subrogation recovery.

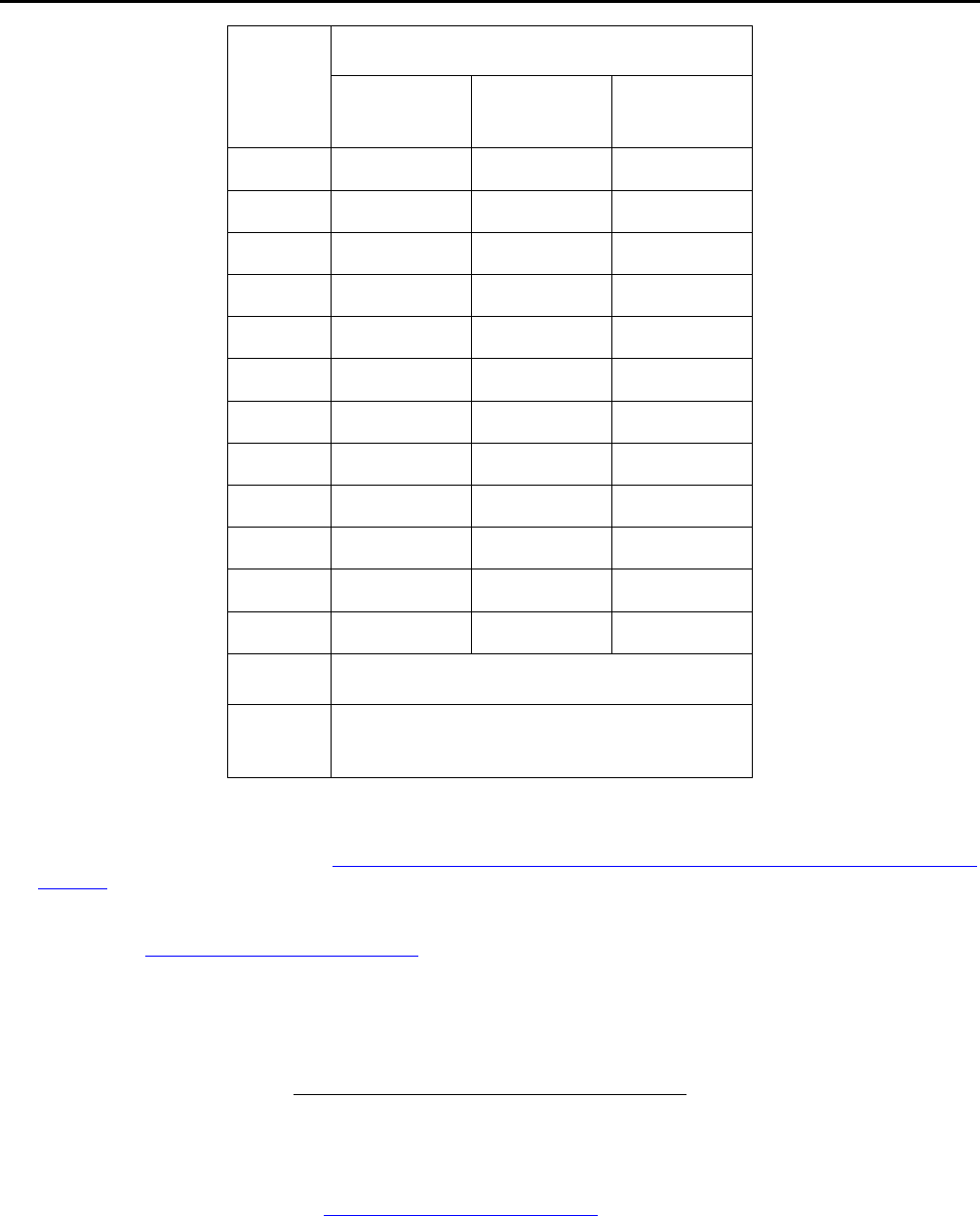

b. Subrogation Recovery Example

Assumptions: The following is a reporting example where the carrier submitted a claim

on a first, second and third unit statistical report and successful subrogation recovery was

received between the third and fourth unit statistical reports. The reported loss amounts

and the loss amounts valued at the time of the subrogation recovery are as follows:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 6

Incurred Losses Paid Losses

Valuation

Point

Gross

Indemnity

Gross

Medical

Subrogation

Recovery

Less

Recovery

Expenses

Net

Incurred

Loss

Gross

Indemnity

Gross

Medical

Subrogation

Recovery

Less

Recovery

Expenses

Net

Paid

Loss

1

st

Report 15,000 15,000

30,000 10,000 9,000

19,000

2

nd

Report 35,000 25,000

60,000 20,000 18,000

38,000

3

rd

Report 40,000 26,000

66,000 28,000 22,000

50,000

Date of

Subrogation

Recovery

43,000 27,000 15,000 55,000 35,000 25,000 15,000 45,000

As of a date between the valuation date of the third unit statistical report and the

valuation date of the fourth unit statistical report, the carrier received a subrogation

recovery in the amount of $20,000.

At the time when the carrier received the $20,000 subrogation recovery, the carrier had

spent $5,000 in legal expenses to pursue the subrogation.

The allocation of the subrogation recovery between indemnity and medical was not

specified.

Process: The carrier was required to perform the following steps to determine firstly if

correction reports were required for any report level, and, secondly the proper allocation

of the subrogation recovery to indemnity loss and medical loss for both incurred and paid

amounts.

Step 1:

Determine if subrogation was successful subrogation. In other words, did the

subrogation recovery exceed the costs associated with pursuing the subrogation?

If subrogation recovery exceeds the expenses associated with pursuing recovery

(recovery expenses), a correction report may be required. Move to Step 2.

If subrogation recovery does not exceed the expense associated with pursuing recovery,

no correction report is required. Stop here.

Step 2:

Determine if the subrogation recovery is received on or after the sixth unit statistical

report’s due date. If not continue to Step 3. If so, no correction report is required and

stop here.

Step 3:

Determine which unit statistical reports are subject to correction by identifying those unit

statistical reports where the previously reported incurred losses exceed the net incurred

losses at the time of the subrogation recovery. Net incurred loss should be calculated as:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 7

Net Incurred Loss = Gross Incurred Loss – (Subrogation – Recovery Expenses)

Note: The determination of which unit statistical reports are subject to correction is based

only on incurred losses and not paid losses.

The incurred loss of $30,000 for the first report does not exceed the net incurred loss of

the claim at time of the subrogation recovery which is equal to $55,000. No correction

report is needed.

The incurred loss of $60,000 for the second report does exceed the $55,000 net incurred

loss of the claim at time of the subrogation recovery. A correction report is needed.

The incurred loss of $66,000 for the third report does exceed the $55,000 net incurred

loss of the claim at time of the subrogation recovery. A correction report is needed.

Step 4:

Revise the third unit statistical report – Incurred Losses

Allocate the net incurred loss of $55,000 based on gross incurred indemnity and incurred

medical at the time of recovery:

Corrected Incurred Indemnity: $55,000 x ($43,000 / $70,000) = $33,876

Corrected Incurred Medical: $55,000 x ($27,000 / $70,000) = $21,214

Step 5:

Revise the third unit statistical report – Paid Losses, if necessary

If the previously reported paid loss on the third unit statistical report exceeds the $45,000

net paid loss of the claim at time of the subrogation recovery, the previously reported paid

loss amounts must be corrected. Net paid loss should be calculated as:

Net Paid Loss = Gross Paid Loss – (Subrogation – Recovery Expenses)

In this case, the previously reported paid loss of $50,000 exceeds $45,000, net paid loss

of the claim at time of the subrogation recovery. Therefore, the correction report must

contain corrected paid loss amounts.

Allocate the net paid loss of $45,000 based on paid indemnity and paid medical at the

time of recovery:

Corrected Paid Indemnity: $45,000 x ($35,000 / $60,000) = $26,250

Corrected Paid Medical: $45,000 x ($25,000 / $60,000) = $18,750

Step 6:

Revise the second unit statistical report – Incurred Losses

As with the correction of the third report, allocate the net incurred loss of $55,000 based

on gross incurred indemnity and incurred medical at the time of recovery:

Corrected Incurred Indemnity: $55,000 x ($43,000 / $70,000) = $33,876

Corrected Incurred Medical: $55,000 x ($27,000 / $70,000) = $21,214

Step 7:

Revise the second unit statistical report – Paid Losses, if necessary

Since the previously reported paid loss on the second unit statistical report, $38,000,

does not exceed the $45,000 net paid loss of the claim at time of the subrogation

recovery, the previously reported paid loss amounts do not require correction.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 8

Step 8:

Prepare the correction report to the second and third unit statistical reports to include the

necessary corrected loss amounts and also report the claim with Type of Recovery

Code

“03”.

Note: For a claim that was previously reported as closed which needs to be corrected

due to a subrogation recovery, the corrected paid amounts should be equal to the

corrected incurred amounts.

7. Aggravated Inequity (Loss Record)

An aggravated inequity is a claim that closes between the valuation date and the next rating

effective date for an amount less than the amount valued previously. The necessary

correction report is to be submitted upon the WCRIBMA’s request or once the carrier

determines that the difference between the previously reported incurred losses and the final

paid losses constitutes an aggravated inequity, whichever comes first. See the

Experience

Rating Plan Manual for more information.

8. Extraordinary Loss Event (Loss Record)

Corrections must be submitted for all unit statistical reports when it has been determined that

one or more claims should be reported with a catastrophe code identifying an extraordinary

loss event. (Refer to Section VI – Loss Record Data, Subsection C.7 for a definition of

Extraordinary Loss Event

Claims).

B. Method of Reporting Corrections

1. Correction reports

Correction reports can be used to change previously reported data and must be reported with

a sequence number greater than “0” for a given unit statistical report level. Refer to

Section

IV – Header Information, Subsection C.6.

2. Replacement reports

Replacement reports can be used to completely replace a previously submitted unit. Refer to

Section IV – Header Information, Subsection C.8

.

3. Deletions of Entire Units

Entire units (reports or correction reports) can be deleted only by sending a written request to

the Data Operations Department via email (DataOperation[email protected]

) or to the following

address:

Data Operations Department

WCRIBMA

101 Arch Street, 5th Floor

Boston, MA 02110

The reason for the request must be specified.

C. Correction Type Code

The correction type code identifies the type of correction report being submitted and is applicable

only to correction reports.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 9

Code Description

H

Header Record Correction:

• Link Data Elements

• Non-Link Data Elements

E

Exposure Record Correction (first unit statistical reports only)

L Loss Record Correction – Not an Aggravated Inequity

A

Loss Record Correction – Aggravated Inequity

This type of correction cannot be reported on a multiple record type.

M

Corrections to Multiple Record Types - Combinations of corrections

to header, exposure, or loss record. Aggravated inequity corrections

must be reported separately.

1. Header Corrections – Link Data Elements

Link data is the set of elements which uniquely identifies a unit.

a. The link data elements are:

• carrier code

• policy number identifier

• exposure state code

• policy effective date

• report number

• correction sequence number

b. For corrections to link elements use correction type code “H”. There are two separate and

distinct fields that should be used in the correction of each link element. For example,

there are both policy number and previous policy number fields. To correct a policy

number, the revised policy number is inserted in the policy number field, and the policy

number as it appeared on the prior unit(s) is inserted in the previous policy number field.

• A carrier cannot revise report number or correction sequence number. If a situation

arises that requires modification of these fields, contact the WCRIBMA Data

Operations department at DataOperations@wcribma.org

.

• Link data corrections are applied directly to each individual unit statistical report. If

three unit statistical reports (1st, 2nd, and 3rd) have already been submitted and an

error in the link data is discovered, then corrections for all three unit statistical reports

are necessary. A link data correction to only one of the previously filed unit statistical

reports will cause that corrected report to either match (link) with another policy and

set of unit reports, or to become “unmatched”.

If a correction report is submitted with link data that don’t match our records, then the

correction cannot be correctly applied to the WCRIBMA’s data base. Invalid carrier

code, policy number, policy effective date, report number or exposure state on a

correction report will cause the correction to be rejected or incorrectly applied to

previously submitted data. The carrier must replace or amend these correction

reports.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section III

Distributed: August, 2013 CORRECTIONS

Part I – Unit Statistical Reporting Page 10

2. Header Corrections – Non-Link Data Elements

a. The policy/header non-link data elements eligible for carrier update as header corrections

are:

• policy expiration date

• risk identification number

• replacement report code

• business segment identifier

• correction type code

• state effective date

• federal employer identification number

• three-year fixed rate policy indicator

• multistate policy indicator

• interstate rated policy indicator

• estimated audit code

• retrospective rated policy indicator

• canceled mid-term policy indicator

• type of coverage identification code

• type of plan identification code

• type of non-standard identification code

• losses subject to deductible code

• basis of deductible calculation code

• deductible amount per claim/accident

• deductible amount – aggregate

b. For corrections to all non-link header data elements use correction type code “H” or “M”.

c. Non-link data corrections are to be reported on corrections to first unit statistical reports

only.

D. Update Type Code

• All exposure and loss records on correction reports must contain update type code as

follows:

Code Description

P

To delete a record from a previous unit statistical

report use

update type code “P” only.

R

To add a data record that was not previously reported use update

type code “R” only.

P, R

To revise previously reported data:

• use update type “P” to delete the record

• use update type “R” to add a record with the revised data.

• For claims becoming non-compensable or closed without payment, or claims reflecting

received recovery, the “R” record must be reported so that information is coded in the loss

condition fields.

PART I

UNIT STATISTICAL REPORTING

SECTION IV

HEADER INFORMATION

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 1

SECTION IV – HEADER INFORMATION

This section is organized into the following components:

• General Information

• Header Information Data Element Index

• Header Information Data Elements

A. General Information

The header information is data that are specific to the coverage of the policy. These elements

include the link data which connect all records to a unit and each unit to a policy.

B. Header Information Data Element Index

Header information requires the full reporting of all fields.

NO. DATA ELEMENT PAGE

23 Basis of Deductible Calculation Code 7

9 Business Segment Identifier 5

18 Canceled Mid-Term Policy Indicator 5

1 Carrier Code 2

6 Correction Sequence Number 3

10 Correction Type Code 5

25 Deductible Amount – Aggregate 7

24 Deductible Amount Per Claim/Accident 7

16 Estimated Audit Code 5

3 Exposure State Code 2

12 Federal Employer Identification Number 5

15 Interstate Rated Policy Indicator 5

22 Losses Subject to Deductible Code 6

14 Multistate Policy Indicator 5

4 Policy Effective Date 3

7 Policy Expiration or Cancellation Date 4

2 Policy Number Identifier 2

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 2

NO. DATA ELEMENT PAGE

28 Previous Carrier Code 7

27 Previous Correction Sequence Number 7

31 Previous Exposure State 8

30 Previous Policy Effective Date 8

29 Previous Policy Number Identifier 8

26 Previous Report Number 7

8 Replacement Report Code 4

5 Report Number 3

17 Retrospective Rated Policy Indicator 5

11 State Effective Date 5

13 Three-Year Fixed Rate Policy Indicator 5

19 Type of Coverage ID Code 6

21 Type of Non-Standard ID Code 6

20 Type of Plan ID Code 6

C. Header Information Data Elements

1. Carrier Code

Report the code assigned to the reporting company by NCCI.

2. Policy Number Identifier

Report the code that uniquely identifies the policy under which experience occurred excluding

blanks, punctuation marks, and special characters. The policy number identifier should

include the complete policy number as set forth on the Policy Information Page plus any

applicable prefixes or suffixes and must remain the same throughout the life of the policy.

3. Exposure State Code

Report code “20” for Massachusetts. If anything other than “20” is reported, it will be rejected.

4. Policy Effective Date

a. Standard term policies (up to one year and 16 days):

Report the month, day and year upon which the policy became effective.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 3

b. Extended term policies (more than one year and 16 days and up to three years):

• If the policy term is a multiple of 12 months, segment the policy term into consecutive

12 month periods. For each segment, report the beginning date of the segment in the

policy effective date field.

• If the policy term is not a multiple of 12 months, segment the policy term in

accordance with the policy period endorsement. For each segment, report the

beginning date of the segment in the policy effective date field.

5. Report Number

Report the code that corresponds to the loss valuation month.

Code

Unit Statistical

Report Level

Number of months

since policy or

segment effective

month

1 First 18

2 Second 30

3 Third 42

4 Fourth 54

5 Fifth 66

6 Sixth 78

7 Seventh 90

8 Eighth 102

9 Ninth 114

A Tenth 126

6. Correction Sequence Number

Report the sequential number that corresponds to the number of correction reports submitted

for a particular unit statistical report level. Use “1” through “9”, then “A” through “Z” as

correction sequence numbers for a unit statistical report level.

Report “0” in correction sequence number if original unit statistical report level submission.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 4

Examples:

Unit Statistical

Report

Level

Correction Sequence

Number

Original 1

st

USR

1

0

Original 2

nd

USR

2

0

First Correction to 2

nd

USR

2

1

Second Correction to 2

nd

USR

2

2

Third Correction to 2

nd

USR

2

3

Original 3

rd

USR

3

0

-

-

-

-

-

-

First Correction to 9

th

USR

9

1

Second Correction to 9

th

USR

9

2

-

-

-

-

-

-

Ninth Correction to 10

th

USR

A

9

Tenth Correction to 10

th

USR

A

A

7. Policy Expiration or Cancellation Date

a. Standard term policies (up to one year and 16 days):

• Non-cancelled policies

Report the month, day and year upon which the policy expired.

• Cancelled policies

Report the cancellation date as the expiration date.

b. Extended term policies (more than one year and 16 days and up to three years):

• Non-cancelled policies

o If the policy period is a multiple of 12 months, segment the policy into

consecutive 12 month periods. For each segment, report the ending date of the

segment in the policy expiration or cancellation date field.

o If the policy period is not a multiple of 12 months, segment the policy period in

accordance with the policy period endorsement. For each segment, report the

ending date of the segment in the policy expiration or cancellation date field.

• Cancelled policies

o Report the cancellation date as the expiration date of the segment in which the

Note: For cancelled policies, the policy segment during which the cancellation is

effective is the last segment for which unit data should be reported. For example,

if a three year policy is cancelled during the second segment, unit data is only to

be reported for the first and second segments.

c. For a multi-state policy with Massachusetts exposure(s), the mid-term deletion of

Massachusetts is considered to be a Massachusetts cancellation and is reported as such

on Massachusetts unit statistical reports.

8. Replacement Report Code

When replacing a previously submitted unit statistical report enter code “R” in the

replacement report code field. For all unit statistical reports other than replacements this field

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 5

should be blank. Submission of a replacement will delete previously reported unit statistical

reports from the WCRIBMA’s data base. Replacements can be submitted for unit statistical

reports which are accepted, rejected or failed. A replacement unit statistical report can be

used instead of a correction report.

9. Business Segment Identifier

Carriers, at their option, may report a business segment identification number.

For additional

information refer to Circular Letter 2159

.

10. Correction Type Code

Report the code that indicates the type of correction report being submitted. See

Section III –

Corrections, Subsection C for a list of correction type codes.

11. State Effective Date

Report the endorsement effective date if the Massachusetts coverage was endorsed mid-

term, otherwise zero-fill the field.

12. Federal Employer Identification Number (FEIN)

Report the Federal employer identification number of the insured as shown on the Policy

Information Page. If the policy has been endorsed to change the FEIN, report the FEIN from

the latest endorsement.

13. Three-Year Fixed Rate Policy Indicator

Y = Policy is a three-year fixed rate policy.

N = Policy is not a three-year fixed rate policy.

14. Multistate Policy Indicator

Y = If more than one state is listed in Item 3A of the Policy Information Page.

N = If only Massachusetts is listed in Item 3A of the Policy Information Page.

15. Interstate Rated Policy Indicator

Y = Policy is interstate rated in accordance with the Experience Rating Plan Manual

.

N = Policy is not interstate rated.

16. Estimated Audit Code

Y = Policy has estimated exposure(s).

N = Policy does not have estimated exposure(s).

U = Uncooperative. The insured has not cooperated with the carrier for purposes of auditing

exposure(s).

17. Retrospective Rated Policy Indicator

Y = Policy is retrospectively rated as defined in the Retrospective Rating Plan Manual

.

N = Policy is not retrospectively rated.

18. Canceled Mid-Term Policy Indicator

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 6

Y = Policy term has been shortened by a cancellation and not subsequently reinstated.

For extended term policies, report “Y” only for the policy segment in which the

N = Policy is full term and policy has not been canceled, or if the policy was canceled, it was

reinstated on the cancellation date.

19. Type of Coverage ID Code

Report the code that indicates the type of coverage.

Code Description

01

Standard Workers Compensation Policy other than “05” &

“09”

05

Large Risked Rate

d Option / Large Risk Alternative Rating

Option

09

Non-Standard Workers Compensation coverage (used only

in conjunction with other than code “01” in the Non-standard

Type ID Code)

20. Type of Plan ID Code

Report the code that indicates the type of plan.

Code Description

01 Voluntary Policy

02 Normal Assigned Risk Policy

05

Assigned Risk Policy written under Massachusetts Voluntary

Direct Assigned Risk Program

21. Type of Non-Standard ID Code

Report the code that indicates the type of workers compensation policy.

Code Description

01

Standard Workers Compensation

99 Self-Insured Groups

22. Losses Subject to Deductible Code

Report the code that identifies the type of losses subject to the deductible.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 7

Code Description

00 No Deductible

01

Medical – Deductible applies to the medical portion of the

loss only.

02

Indemnity –

Deductible applies to the indemnity portion of

the loss only.

03

Medical & Indemnity –

Deductible applies to the total of

medical and indemnity portions of the loss.

23. Basis of Deductible Calculation Code

Report the code that identifies the type of deductible being reported.

Code Description

00 No Deductible

01

Per Claim –

The deductible amount applies to each claim

arising from the policy and there is no aggregate deductible.

09

Per Accident and Policy (Aggregate) – The deductible amount

applies to each accident up to an aggregate limit and there is

no per claim deductible.

10

Per Claim and Policy (Aggregate) –

The deductible amount

applies to each claim up to an aggregated limit and there is no

per accident deductible.

12 Variable – Carrier program not described above.

24. Deductible Amount Per Claim/Accident

Report the maximum loss amount by claim or accident to be paid by the insured, if

applicable, as defined by the deductible program.

25. Deductible Amount – Aggregate

Report the maximum loss amount for all claims to be paid by the insured, if applicable, as

defined by the deductible program.

26. Previous Report Number

Not applicable to Massachusetts. If a unit statistical report has been accepted with the wrong

report number, contact the WCRIBMA to arrange for the deletion of the incorrect unit

statistical report and the replacement with a proper report number.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section IV

Distributed: August, 2013 HEADER INFORMATION

Part I – Unit Statistical Reporting Page 8

27. Previous Correction Sequence Number

Not applicable to Massachusetts. If a unit statistical report has been accepted with the wrong

correction sequence number, contact the WCRIBMA to arrange for the deletion of the

incorrect unit and replacement with proper correction sequence number.

28. Previous Carrier Code

• This field only applies to correction reports.

• In the previous carrier code field, report the incorrect carrier code that was previously

submitted.

• In the carrier code field, report the correct carrier code.

29. Previous Policy Number Identifier

• This field only applies to correction reports.

• In the previous policy number identifier, report the incorrect policy number identifier that

was previously submitted.

• In the policy number identifier field, report the correct policy number identifier.

30. Previous Policy Effective Date

• This field only applies to correction reports.

• In the previous policy effective date, report the incorrect policy effective date that was

previously submitted.

• In the policy effective date, report the correct policy effective date.

31. Previous Exposure State Code

• This field only applies to correction reports.

• In the previous exposure state code, report the exposure state code “20”.

• In the exposure state code field, report a non-Massachusetts code.

• The result will be that the unit is dropped from the WCRIBMA’s data base.

PART I

UNIT STATISTICAL REPORTING

SECTION V

EXPOSURE RECORD DATA

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section V

Distributed: August, 2013 EXPOSURE RECORD DATA

Part I – Unit Statistical Reporting Page 1

SECTION V - EXPOSURE RECORD DATA

This section is organized into the following components:

• General Information

• Exposure Record Data Element Index

• Exposure Record Data Elements

A. General Information

• The exposure record data elements are used to report the class, coverage, exposure, manual

rate, and premiums.

• For most first unit statistical reports, the experience modification effective date and rate

effective date will not change during the policy term. When multiple modification effective

dates or rate effective dates apply during a policy term, this may cause split periods. When

this occurs, the full policy term’s exposure and manual premiums must be split for each

period reflecting a change in the experience modification effective date and/or rate effective

date.

• For split policy periods, the prorated exposure and prorated premiums for the first split (split

period code “0”) correspond to the first period, and the prorated exposure and prorated

premiums for the second split (split period code “1”) correspond to the second period. Any

additional split periods are treated in the same manner.

B. Exposure Record Data Element Index

NO. DATA ELEMENT PAGE

1 Classification Code 2

3 Experience Modification Effective Date 2

2 Experience Modification Factor 2

5 Exposure Amount 2

10 Exposure Act/Exposure Coverage Code 4

7 Manual Rate 3

6 Premium Amount 3

4 Rate Effective Date 2

8 Split Period Code 3

9 Update Type Code 4

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section V

Distributed: August, 2013 EXPOSURE RECORD DATA

Part I – Unit Statistical Reporting Page 2

C. Exposure Record Data Elements

1. Classification Code (Class Code)

Report the code(s) corresponding to the classification(s) assigned to the insured according to

the Massachusetts Workers Compensation and Employers Liability Insurance Manual

or the

statistical class codes defined in Appendix II – Statistical Class Codes. If no exposure

develops on a policy, use statistical class code 1111.

For any classification code, there cannot be more than one exposure record per unit with the

same manual rate, experience modification, rate effective date, exposure coverage code and

experience modification effective date.

2. Experience Modification Factor (Experience Mod)

For exposure(s) that are subject to application of an experience modification, report the

experience modification factor used to develop the premium.

For exposure(s) not subject to experience rating, report “0000”.

3. Experience Modification Effective Date (Mod Effective Date)

For exposure(s) subject to experience rating, report the date on which the experience mod is

applicable.

The Massachusetts Workers Compensation and Employers Liability Insurance Manual

rules

relating to anniversary rating dates may require that a policy’s exposure(s) be divided into

split periods. If this occurs, it is necessary to indicate the date on which the experience rating

is applicable for each split period.

The Experience Rating Plan Manual

contains rules that restrict the retroactive application of

an experience mod which consequently result in a policy’s exposure(s) being divided into split

periods. If this occurs, it is necessary to indicate the date on which the experience mod is

applicable for each split period.

Additionally midterm changes in coverage can create the need for split periods. An example

of this would be a midterm change to employer’s liability limits. For a split period being

reported due to a midterm change in coverage, report the date on which such change in

coverage is effective.

Note: For the first split period, a date prior to the policy effective date may be reported if the

anniversary rating date is prior to the policy effective date.

4. Rate Effective Date

Report the effective date of the WCRIBMA rate revision that is applicable to the exposure

record. This date can be prior to the policy effective date.

5. Exposure Amount

Report the exposure amount that is applicable to the exposure records as follow:

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: January 1, 2015 Section V

Distributed: December, 2014 EXPOSURE RECORD DATA

Part I – Unit Statistical Reporting Page 3

a. No-Exposure Developed

• If a policy does not develop any Massachusetts exposure, report zero for the

exposure amount on the exposure record containing statistical class code 1111 in the

class code field.

b. Payroll Exposure

• Report the payroll amount. Do not divide the payroll by 100.

• Report exposures for supplemental disease loads (statistical class codes 0059, 0065,

0066, 0067, 0133, 0179)

Note: The statistical class codes 0133 and 0179 were discontinued effective as of

January 1, 2008.

• Report exposures for Non-Ratable Elements (statistical class codes 0771, 7445,

7453).

c. Non-Payroll Exposure

• Per Capita Classifications(statistical class codes 0908, 0909, 0912 and 0913):

Report the number of employees covered, based on the duration of coverage. An

employee covered under a per capita class code for a period of one year must be

reported as an exposure of 1.0. If an employee is covered for a period other than one

year, the reported exposure should be calculated by dividing the number of days of

coverage by 365, and rounding the result to the nearest tenth of a year. For example,

if an employee is covered for 130 days, the exposure amount will be equal to 0.4

(=130/365 rounded to the nearest tenth).

6. Premium Amount

Report the premium amount corresponding to each classification.

• No-Exposure Developed

Premium Amount = $0

• Payroll Exposure

Premium Amount = (Exposure Amount ÷ 100) x WCRIBMA’s filed and approved rate

• Non-Payroll Exposure

Premium Amount = Exposure Amount x WCRIBMA’s filed and approved rate

• Other Premiums

This premium shall be reported under the appropriate statistical class code. Refer to the

Massachusetts Premium Algorithm

.

7. Manual Rate (WCRIBMA’s filed and approved rate)

For each classification report the WCRIBMA’s filed and approved rate. Do not report the

carrier’s specific rate that may reflect deviations.

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section V

Distributed: August, 2013 EXPOSURE RECORD DATA

Part I – Unit Statistical Reporting Page 4

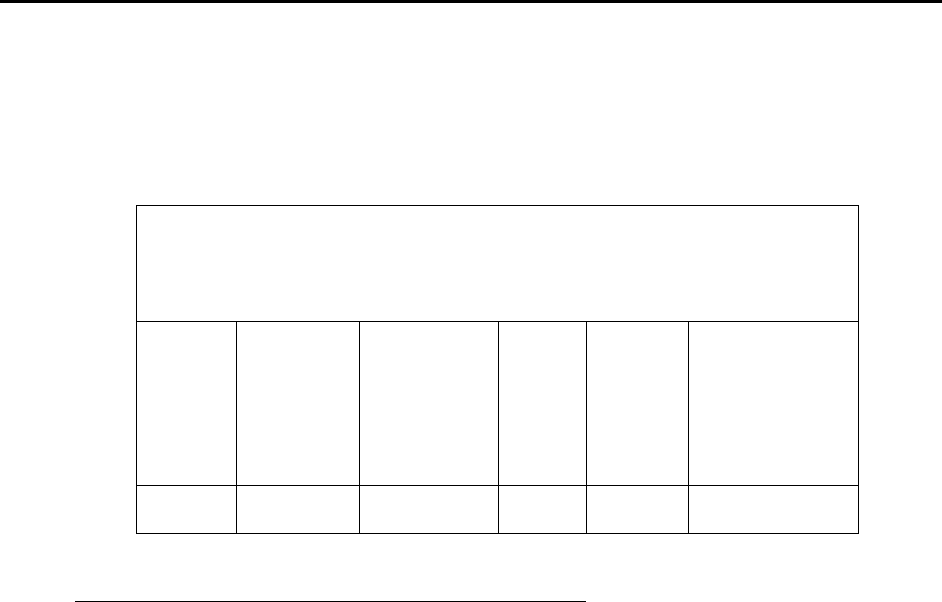

8. Split Period Code

Report the code used to indicate changes in manual rates or rating factors during policy

period. For policies with no change in manual rates or rating factors, enter "0". For policies

with changes in manual rates or rating factors, refer to the following table:

Split

Period

Split

Period Code

1

st

0

2

nd

1

3

rd

2

4

th

3

5

th

4

6

th

5

7

th

6

8

th

7

9. Update Type Code

Report the code that identifies the type of update.

Code

Description

P Previously Reported Record

R Revised Record

• Both update type codes require the full reporting of all fields.

• For additional information refer to

Section II – First Unit Statistical Report and Re-

Valuations, Subsection B.2, Section II – First Unit Statistical Report and Re-Valuations,

Subsection C.3, Section III – Corrections, Subsection D.

10. Exposure Act/Exposure Coverage Code

Code

Description

00 For use with Statistical Class Codes*

01 State Act or Federal Act Excluding USL&HW

02

USL&HW “F” Classes or USL&HW coverage on Non “F” Classes

* Note: An exposure act/exposure coverage code is required for all exposure records.

Statistical class codes can be coded as “00”, or the act (law) governing the policy.

PART I

UNIT STATISTICAL REPORTING

SECTION VI

LOSS RECORD DATA

MASSACHUSETTS WORKERS’ COMPENSATION

STATISTICAL PLAN

Effective: August 14, 2013 Section VI

Distributed: August, 2013 LOSS RECORD DATA

Part I – Unit Statistical Reporting Page 1

SECTION VI - LOSS RECORD DATA

Section VI of the Unit Statistical Reporting is organized into the following components:

• General Information

• Loss Record Data Element Index

• Loss Record Data Elements

A. General Information

The loss records contain the information specific to the benefit (claim) paid or case reserved for

injuries covered by the policy.

B. Loss Record Data Element Index

NO. DATA ELEMENT PAGE

3

Accident Date

2

7

Catastrophe Number

3

20

Cause of Injury Code

8

2

Claim Count

2

4

Claim Number

2

26

Claimant’s Attorney Fees Incurred Amount

8

1

Classification Code

2

27

Employer’s Attorney Fees Incurred Amount

8

8

Incurred Indemnity Amount