Progress Update and

Disbursement Request

Form Instructions

Date Published: 17 February 2022

Date Updated: 21 November 2023

Page 2 of 81

Table of Contents

Abbreviations 4

1 Introduction 6

Context 6

2 General Guidance 7

2.1 PU/DR Reporting Process 7

2.2 PU/DR Structure, Reporting Requirements & Timelines 8

3 Cover Sheet & Summary 9

3.1 Language Selection & Form Legend 9

3.2 General Grant Information & Reporting Periods 9

3.3 Exchange Rates 11

3.4 Executive Summary 11

4 Programmatic Reporting 12

Tab 1.A & Tab 1.B. Impact/Outcome Indicators, Including Disaggregation 12

Tab 1.C & Tab 1.D. Coverage Indicators, Including Disaggregation 14

Tab 1.E. Work Plan Tracking Measures 17

5 Financial Reporting 18

General principles of financial reporting to the Global Fund and key definitions 18

Special Cases 19

Tab 2. Principal Recipient Cash Reconciliation Statement 19

Tab 2A. Opening Cash Balance at Start of IP 20

Table A: Principal Recipient Cash Reconciliation Statement in IP Currency 21

Table B. Schedule of Open Advances in IP Currency 27

Table C. Principal Recipient Financial Commitments & Obligations 28

Table D. Triangulation of Financial Figures 29

Table E. Principal Recipient Bank Statement Balance & Cash In-Transit in IP Currency 31

Table F. Principal Recipient Ineligible Transactions in IP Currency 32

Tab 3. Sub-recipient Cash Reconciliation 34

Tab 4. Total Expenditure 36

Tab 5. C19RM Expenditure 39

Tab 6. Forecast & Disbursement Request 40

Tab 7. Tax Reporting 43

6 Health Product Procurement & Supply Chain Management 45

Table 8.A. Price & Quality Reporting (PQR) 45

Table 8.B. Risk of Stock-Out & Expiry 46

Page 3 of 81

Table 8.C. Quantification & Forecasting (Applicable for reporting only for selected pilot grants as of

period starting 1 July 2023) 49

Table 8.D. Grant Procurement Planning Performance (Applicable for reporting only for selected pilot

grants as of period starting 1 July 2023) 51

Table 8.E. Central Stock Level - Stocked According to Plan (Applicable for reporting only for

selected pilot grants as of period starting 1 July 2023) 53

Table 8.F. Additional information 55

Table 8.G. Value of Pharmaceuticals and Health products in the PQR - LFA use only 56

7 Grant Management 57

Tab 9.A. Grant Requirements 57

Tab 9.B. Mitigating Actions & Management Issues 59

8 Assessment & Sign-Off 60

Tab 10.A. Principal Recipient (PR) Self-Assessment 60

Tab 10.B. Principal Recipient Sign-Off 63

Tab 10.C. LFA Performance Assessment (LFA only) 64

Tab 10.D. LFA Sign Off 68

9 LFA Findings & Recommendations (LFA only) 69

10 PU/DR Annexes 70

Section 1 Annex on PR Financial Commitment, Obligations & Accrued Severances 70

Section 2 Annex on Financial Triggers (Focused Portfolios Only) 71

11. Local Fund Agent Scope of Work 72

11.1 Scope of work 72

11.2 Recommended approach for the review and verification of information 76

11.3 Sources of information 76

12. Overview of Reporting Requirements 77

13. Additional Resources 81

Page 4 of 81

ABBREVIATIONS

▪

AER - Annual Expenditure Report

▪

AFR - Annual Financial Report

▪

AFDD - Annual Funding Decision and Disbursements

▪

AMC - Average Monthly Consumption

▪

ARV - Anti-retroviral

▪

C19RM - COVID-19 Response Mechanism

▪

CCM - Country Coordinating Mechanisms

▪

CMS - Central Medical Store

▪

CT - Country Team

▪

DQA - Data Quality Assessment/Assurance

▪

DQR – Data Quality Review

▪

ELISA - Enzyme-linked Immunosorbent Assay

▪

FCR - Financial Closure Report

▪

GDF - Global Drug Facility

▪

GFS - Grant Financial System

▪

GOS - Grant Operating System

▪

HMIS - Health Management Information Systems

▪

HIV - Human Immunodeficiency Virus

▪

HP-PSCM - Health Product Procurement and Supply Chain Management

▪

HPMT - Health Product Management Template

▪

ICR - Indirect Cost Recovery

▪

IP - Implementation Period

▪

IRM - Integrated Risk Management

▪

KMA - Key Mitigating Action

▪

LFA - Local Fund Agent

▪

LMIS - Logistics Management Information Systems

▪

MOH - Ministry of Health

▪

NGO - Non-Governmental Organization

▪

OIG - Office of the Inspector General

▪

PEPFAR - The President's Emergency Plan for AIDS Relief

▪

PF - Performance Framework

▪

PL - Performance Letter

▪

PP - Global Fund Partner Portal (Partner Portal)

Page 5 of 81

▪

PPM - Pooled Procurement Mechanism

▪

PQR - Price and Quality Report

▪

PR - Principal Recipient

▪

PU/DR - Progress Update and Disbursement Request

1

▪

PU - Progress Update

▪

RSSH - Resilient and Sustainable Systems for Health

▪

SOP - Standard Operating Procedures

▪

SR - Sub-recipient

▪

WPTM(s) - Work Plan Tracking Measure(s)

▪

TB - Tuberculosis

▪

UNAIDS - The Joint United Nations Programme on HIV/AIDS

▪

UNICEF - United Nations Children’s Fund

▪

UNFPA - United Nations Population Fund

▪

VAT - Value Added Tax

▪

VF - Verification Factor

▪

wambo.org - The Global Fund's online procurement platform

▪

WHO - World Health Organization

1

In this document, the term PU/DR is used to refer to PU/DRs, PUs, and Final PUs, unless otherwise specified.

Page 6 of 81

1 INTRODUCTION

This document provides guidance to Principal Recipients (PRs) and Local Fund Agents (LFAs)

on how to complete/review the Progress Update and Disbursement Request (PU/DR).

CONTEXT

To facilitate oversight of Global Fund-supported programs, PRs submit regular updates on

implementation activities, including collecting and collating information from sub-recipients

(SRs). In addition, PRs request funds on an annual basis for the following year of

implementation, i.e., the execution period, plus a buffer period.

PRs use the Progress Update (PU) to report on the latest completed period of program

implementation, the duration of which is defined in the Performance Framework (PF), and the

Disbursement Request (DR) to define financial needs for the coming execution and buffer

periods. Together, they are the Progress Update and Disbursement Request Form, or PU/DR.

In this document, the term PU/DR is used to refer to PU/DRs, PUs, and Final PUs, unless

otherwise specified.

2

Upon Global Fund request, LFAs review the PU/DR submitted by the PR, capturing their

findings and recommendations in the respective sections of the PU/DR. The Global Fund relies

on LFAs, as assurance providers, to verify and confirm that the information provided by the PR

in the PU/DR is complete and accurately represents the expenditures incurred (including for

health products) and programmatic targets achieved.

The Global Fund uses the information provided in the PU/DR to:

▪

Review implementation progress of each grant, including programmatic, financial, Health

Product Procurement and Supply Chain Management (HP-PSCM), risk, governance, and

cross-cutting grant management aspects.

▪

Determine the Performance Rating.

▪

Make Annual Funding Decisions (AFDs) aligned to the performance-based funding

principle of the Global Fund and make related disbursements.

▪

Identify implementation issues and risks and determine appropriate mitigating measures.

▪

Track progress on implementation of grant requirements.

▪

Comply with agreed reporting to the Global Fund Board, donors, and stakeholders,

including on results achieved and use of funding.

2

Reporting requirements vary by report type, portfolio category, and country-specific factors. Please refer to 12. Overview of

Reporting Requirements of this guidance document for further information.

Page 7 of 81

2 GENERAL GUIDANCE

2.1 PU/DR REPORTING PROCESS

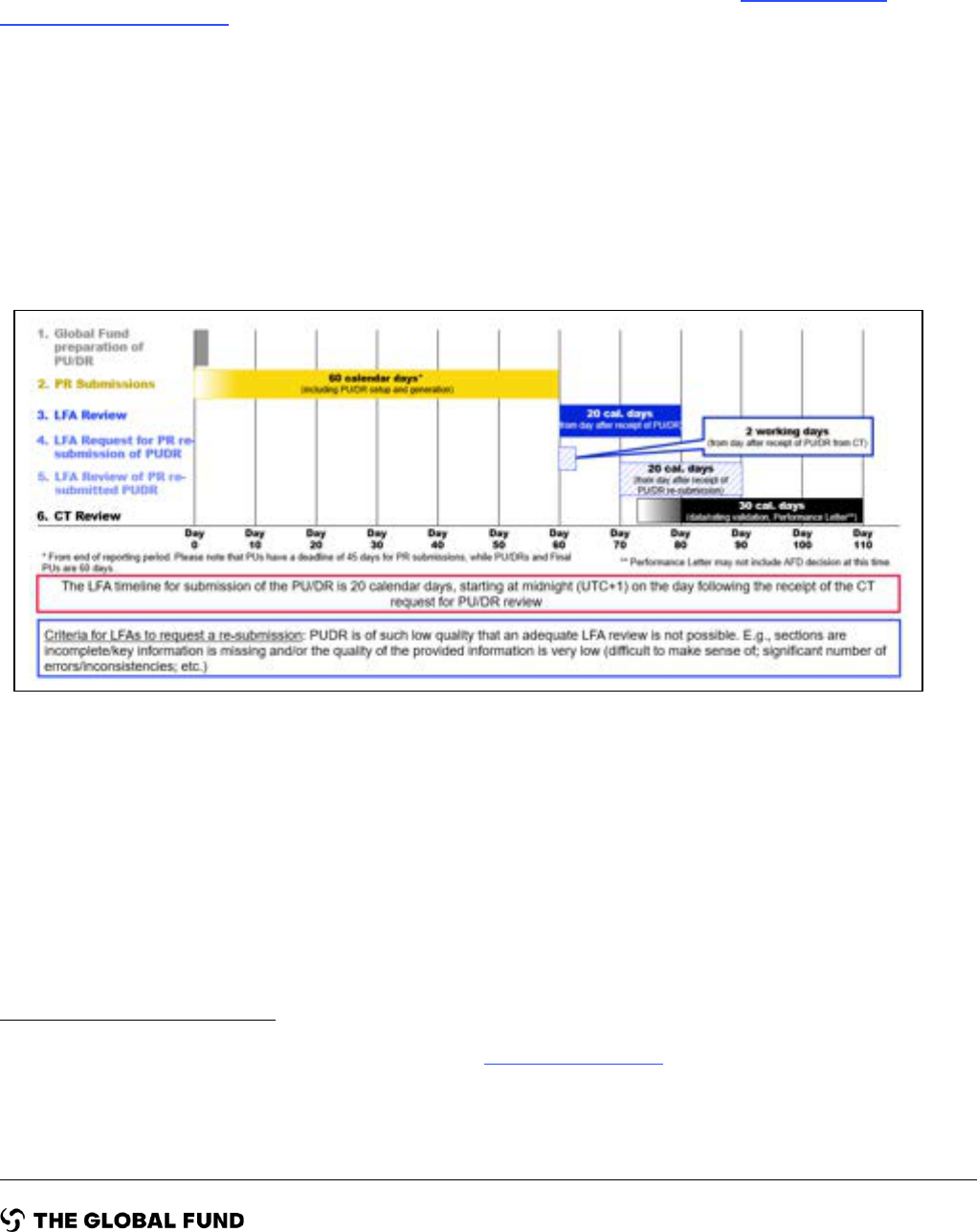

Diagram 1. High-level PU/DR Reporting Process

1. The PU/DR is shared with the PR through the Global Fund Partner Portal (the Portal) as a

downloadable Excel form. It contains pre-populated information from the signed Grant

Confirmation, approved PF, and budget.

2. The PR receives a notification from the Portal to download the PU/DR. The PR completes

the PU/DR and submits it through the Portal by the due date at latest.

3. Following PR submission, the Global Fund reviews the PU/DR. Please note that incomplete

submissions are returned to the PR for further inputs.

4. Upon Global Fund request, the LFA reviews the PU/DR. The LFA receives a Portal

notification to download the form, then verifies the PR-submitted information and completes

the LFA sections as per the defined scope of work. The outcomes of the LFA review,

including recommendations, are confidential and are intended for the Global Fund only.

5. The Global Fund reviews the verified information and consults further with the LFA and/or PR

as needed. The Global Fund validates the verified information in internal Global Fund

systems, completes the Performance Rating, makes an Annual Funding Decision (if

relevant), and determines mitigation measures to identified risks and implementation issues.

6. The Global Fund shares the Performance Rating and Performance Letter with the PR

through the Portal.

Page 8 of 81

2.2 PU/DR STRUCTURE, REPORTING REQUIREMENTS & TIMELINES

The PU/DR consists of thematic and cross-cutting reporting tabs. The required sections depend

on report type,

3

portfolio category,

4

and country-specific factors. Please refer to 12. Overview of

Reporting Requirements of this guidance document for further information.

Reporting frequency is defined in the PF. Generally, the PU covers 6 months. It is reported mid-

year

5

for High Impact and Core portfolios and is usually not required for Focused portfolios. The

Final PU covers the last reporting period of implementation and is required for all portfolios.

The PU/DR is reported at year-end and covers 12 months for Focused portfolios and 6 months

for High Impact and Core portfolios.

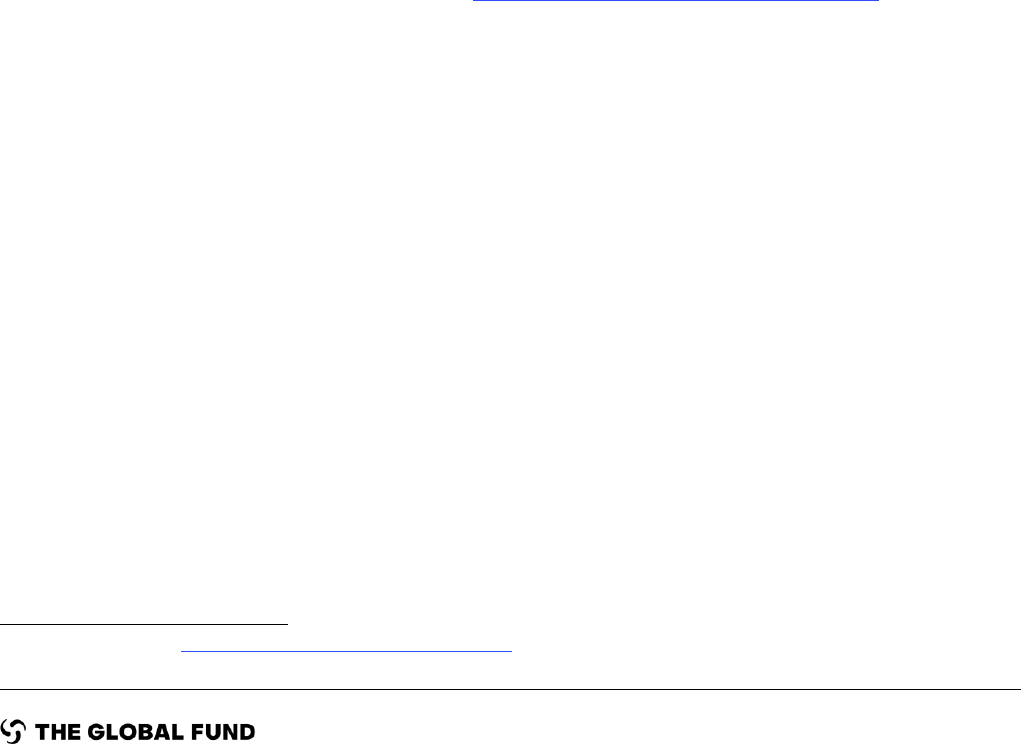

Diagram 2. PU/DR Timelines

3

PU, PU/DR, Final PU.

4

High Impact, Core, Focused portfolio categorization is captured in the Operational Policy Manual.

5

The reporting year may not be aligned to calendar years, depending on the agreed reporting cycle in the PF.

Page 9 of 81

3 COVER SHEET & SUMMARY

3.1 LANGUAGE SELECTION & FORM LEGEND

The PU/DR is available in English, French and Spanish. The language can be selected in the

drop-down menu at the top of the PU/DR Cover Sheet and Summary tab.

Please note: Forms that have been tampered with cannot be integrated into the Global Fund

systems. Tampering refers to modifying the form’s structure, content and/or formulas, or

overwriting pre-populated values. Forms that have been tampered with are rejected and

returned to the PR or the LFA for full resubmission, negatively impacting timely submission and

processing.

PRs and LFAs cannot use Google sheets to edit the PU/DR form as it prevents the import of the

submitted information into the Grant Operating System (GOS).

PRs and LFAs are expected to report inaccuracies in pre-populated data as soon as noted to

Country.Support@theglobalfund.org.

3.2 GENERAL GRANT INFORMATION & REPORTING PERIODS

The PU/DR Cover Sheet and Summary contains general grant information – country, disease

component, grant implementation period number, PR name, LFA name, IP start date, and IP

currency.

Page 10 of 81

The cover sheet also outlines reporting period and disbursement request

6

information.

Type of Reporting

Period

Reporting Period

Other Remarks

Current

Programmatic

Reporting Period

Typically:

▪

6 months for High Impact and

Core portfolios.

▪

12 months for Focused

portfolios.

To align grant start date with the

country’s programmatic and fiscal

reporting cycles, the first and last

reporting periods of a grant can be

longer or shorter than 12 months.

The periods immediately follow

those covered by the previous

PU/DR.

Current Financial

Reporting Period

Cumulative

Financial

Reporting Period

Cumulative from the

Implementation Period start

date.

Reporting end date to match the

end date specified under Current

Financial Reporting Period.

Disbursement

Request

Execution Period

A 12-month period during which

approved grant activities are

implemented and grant funds

are disbursed.

7

Typically covers the following year

of the grant and does not include a

buffer period.

Disbursement

Request Buffer

Period

A maximum 6-month period,

following the Disbursement

Request Execution Period, for

which funds are disbursed while

the PR reporting process is

being completed.

The buffer period is added to the

disbursement execution period, for

a maximum of 18-month execution

and buffer period.

6

All dates have the format dd-mmm-yyyy (e.g. 31-Mar-2022).

7

In some cases, an execution period can be six months in high-risk environments.

Page 11 of 81

3.3 EXCHANGE RATES

Expenditures incurred in a currency other than the grant currency are to be translated into the grant

currency using the spot rate applicable on the day of each transaction. If the use of daily rates is

not practical, the average exchange rate (monthly or quarterly) for the reporting period is to be

used. The source and actual exchange rates used in the calculations are to be disclosed. The

exchange rate applied for expenditures (which is inclusive of commitments) is the same rate

applied for converting cash outflows.

Please note: In cases of significant currency rate fluctuations, a separate average exchange rate

is to be calculated each month. Monthly average exchange rates can be obtained or calculated

from the country’s central/national bank or other official sources (e.g., the International Monetary

Fund or other international financial institutions).

3.4 EXECUTIVE SUMMARY

This section is view only and is pre-populated based on PR and LFA entries in subsequent

sections of the PU/DR.

Page 12 of 81

4 PROGRAMMATIC REPORTING

TAB 1.A & TAB 1.B. IMPACT/OUTCOME INDICATORS, INCLUDING

DISAGGREGATION

Impact and Outcome indicators due to be reported during the period, or outstanding from any

previous period, are pre-populated in Tab 1.A, based on the signed PF.

The PR reports results against the current year target based on the report due date in the PF. If an

indicator result is outstanding from the previous period or year, this indicator will appear again in the

current PU/DR. Outstanding indicators without a current year target remain listed until a result is

reported.

In such cases the PR reports:

a. Previous year results against the previous year target.

b. Current year results against the current year target.

The target year refers to the year when the indicator will be measured and is prepopulated from the

PF. For the indicators that are reported using routine reporting systems, the result year must be the

year in which the result was measured and is expected to match the target year. For example, if the

target year is 2022, the result year will be also 2022.

For the indicators reported through surveys, if the measurement is delayed (e.g., the survey data

collection is postponed from 2022 to 2023), the result year is the year when the survey data

collection took place, i.e., 2023. This, however, will not allow for assessment of performance against

the target as the target year and the result year will not match. In such cases, it is advisable to

update the target and the target year (as applicable) in the PF such that the targets match the result

year (year of data collection) through a revision process. The reason for the delay in measurement

is to be noted in the comments box.

The PR additionally provides a performance analysis, including comments on:

▪

Results achieved, including any variations in results from agreed targets.

▪

Data collection method or measurement approaches and data sources for all reported results

listed.

▪

Any other contextual information related to reported results, such as delays to planned

baseline or other surveys, with reasons and a revised timeline in the PR only section of the

PU/DR.

▪

Analysis of trends over time.

Page 13 of 81

Please note: The ‘Value’ column is applicable for grants from the 2017-2019 allocation period,

where baseline values are all included in one cell.

For indicators that require disaggregation (Tab 1.B Impact/Outcome Disaggregation), the category

and required disaggregation is pre-populated.

Specific LFA Requirements

Unless otherwise agreed, LFAs:

▪

Verify PR-reported data for the reporting period as per the PF, based on the relevant data sources, and include any

modifications to PR reported results following LFA verification in the ‘Verified Results’ column, unless specified

otherwise by the Global Fund or indicated in 11 LFA Scope of Work.

▪

Indicate unverified results by selecting ‘not verified’ from the dropdown list and provide an explanation.

▪

Comment on:

o Variations in data sources or data collection methods from agreed measurement approaches.

o Issues with data collection and reporting.

o Completion status for surveys or any delays in implementation.

o Rationale provided by the PR.

Page 14 of 81

o Whether the expected result was not achieved or information on the results achievement was not provided

by the PR.

▪

Conduct additional analysis as relevant.

Refer to 11.1 LFA Scope of Work for further information on LFA review in Focused portfolios.

Tab 1.C & Tab 1.D. Coverage Indicators, Including

Disaggregation

Coverage indicators due to be reported during the period are pre-populated in Tab 1.C, based on

the signed PF.

The PR reports results and ensures:

▪

Consistency with how targets were set in the PF, e.g., if a target was set as ‘non-cumulative

other’, the result is reported this way.

▪

Consistency with target value types, e.g., if a target was set as a

‘numerator/denominator/percentage,’ the result is reported this way.

▪

Reported results are based on the agreed-upon measurement methods, frequency and data

sources, as established in the PF and/or the indicator guidance sheets.

8

For results reported

in the value type ‘numerator/denominator/percentage’ against a target set in the same value

type, the percentage value is used in calculating the achievement ratio automatically.

The PR provides performance analysis, including comments on:

▪

Trends in performance over time.

▪

Reasons for variations in results, such as subnational variations (by regions/districts) or by

type of implementer (e.g., SRs) or by populations reached (e.g., KPs, gender, age groups,

and others).

▪

Reasons for under or overperformance, and corrective actions to address them.

▪

Projections for the next period, including arguments supporting the prospects to maintain,

decline or improve performance for each indicator.

▪

Data quality challenges, if any, and planned action.

▪

Triangulation with consumption data and stock levels for relevant indicators.

8

Refer to the respective indicator guidance sheets available in 13. Additional Resources of this guidance document.

Page 15 of 81

For indicators that require disaggregation (Tab 1.D Coverage Disaggregation), the required

disaggregation is pre-populated, based on the PF.

The PR is required to:

▪

Provide disaggregated results for specific set of coverage indicators by age, sex, gender,

status, and others as indicated.

▪

Include in their performance analysis a discussion of disaggregated results and specific

mitigation measures, including actions to address inequities where required.

Page 16 of 81

Specific LFA Requirements

The LFA verifies that the PR has reported all results that are due for coverage indicators, and the required

disaggregation.

Please note: For Focused portfolios, the LFA is not required to verify the disaggregated results reported. Please

Refer to 11.1 LFA Scope of Work for further information.

The LFA:

▪

Reviews consistency of PR results with how targets were set in the PF and with agreed measurement methods,

frequency and data sources.

▪

Verifies compliance of results with indicator definition as per Global Fund indicator guidance sheets

9

and/or PF

results correspond to the respective reporting period.

▪

Enters verified results. Differences between LFA-verified and PR-reported results must be explained.

▪

Specifies how results for each indicator were verified (e.g., desk review or on-site verification). If other verification

methods were used, the LFA explains the methodology followed.

▪

Indicates any discrepancies between the target accumulation in the PF and the PR-reported results to ensure

results are aligned to the appropriate reporting period.

Recommended review scope for reported results

The LFA:

▪

Undertakes an annual document review of reported results. In agreement with the Global Fund, the review can

be waived for the semi-annual PU if there is a history of good data quality and/or reliable and routine delivery of

programmatic reports. The LFA verifies results against the source (e.g., national reporting system, a report

published by technical partners) and, where applicable, checks consistency with results reported for other

indicators and adjusts, as needed, both the numerator and denominator. If based on estimates, the validity of

the estimate must be verified against the source. If a numerator or denominator used cannot be validated, this

is explained in the review comments.

▪

Comments on progress to date and explains any significant variance between targets and results and any

deviations from the related work plan activities. The LFA is expected to not copy and paste comments provided

by the PR.

▪

Verifies that the PR’s performance assessment is consistent with agreed targets as set in the PF and ensures

the PR provides the required analysis.

▪

Raises any data quality issues in the comment column next to the specific indicators.

Please note:

▪

The LFA must not change any data values provided by the PR in the PR section of the PU/DR.

▪

The LFA must indicate if results have not been verified and provide an explanation.

▪

Programmatic performance is measured through quantitative indicator rating determined in the Assessment and

Sign-off tab (Refer to Tab 10.C LFA Performance Assessment for further information). The achievement ratio

automatically calculated in the Coverage Indicators tab informs the calculation of the Quantitative Indicator

Rating.

9

Refer to the respective indicator guidance sheets available in the 13. Additional Resources of this guidance document.

Page 17 of 81

TAB 1.E. WORK PLAN TRACKING MEASURES

When grants do not include any coverage indicators, Work Plan Tracking Measures (WPTMs) are

used to assess performance and make annual funding decisions. Some grants may include both

coverage indicators and WPTMs. In this case, both will be reported in the respective section.

For each Workplan Tracking Measure (WPTM), all modules, interventions, activities, milestones, and

criteria for completion for the specific activity and for the period which are due for reporting are pre-

populated, based on the signed PF.

The PR categorizes progress on WPTMs (i.e., milestones and targets for input and process

indicators) by selecting an appropriate value in the Progress Status column:

Specific LFA Requirements

The LFA verifies the PR reported results and self-attributed progress status against the activities and agreed

milestones and assigns a verified progress status.

Implementation progress during the reporting period

Status

No progress against planned milestone or target

Not started

Less than 50% of the milestone or target

Started

50% or more completion of planned milestone or target

Advancing

100% achievement of planned milestone or target

Completed

Page 18 of 81

5 FINANCIAL REPORTING

GENERAL PRINCIPLES OF FINANCIAL REPORTING TO THE GLOBAL FUND AND

KEY DEFINITIONS

The financial reporting section of the PU/DR provides the Global Fund with a minimum set of reliable

information on the implementation of grants. This financial information is important:

▪

To assist grant management: Having financial breakdowns and variance analyses, and

being able to link financial information to programmatic performance, strengthens the ability

to make informed funding and investment decisions (e.g. allocations, annual funding

decisions and disbursements).

▪

To pinpoint areas of financial risk: Tracking expenditures against budgets also enables an

analysis of financial risks across the grant portfolio. For example, where is the largest

proportion of funds being allocated and used? Are the funds being spent in the planned

areas in a timely manner? Are there any bottlenecks that impact absorption and program

implementation (such as in procurement)?, and others.

▪

For external reporting and resource mobilization: Being able to demonstrate the

efficiency of Global Fund investments and that funding is spent in line with the approved

Global Fund grant agreement to achieve maximum impact in the disease program is critical

for external reporting and resource mobilization.

▪

For transparency and accountability: Being able to accurately report on the use of funds to

donors, the general public, and other stakeholders in an efficient and timely manner is one of

the core principles of the Global Fund.

The information reported in the financial sections of the PU/DR is based on the PR’s accounting

and other program records, and on those of SRs. It is supported by relevant breakdowns,

schedules, summaries, and notes based on the financial, accounting and management systems

used.

Supporting documents must be made available for review of the Global Fund and the LFA. Where

applicable, supporting documentation can be included in the annexes.

The PR is not expected to replace existing accounting and financial information systems or create

parallel systems but is required to adapt, as needed, accounting and financial information from

existing systems to meet the Global Fund’s requirements.

Actual expenditures incurred in a currency other than the grant currency are translated into the grant

currency using the spot rate applicable on the day of each transaction. If the use of daily rates is not

practical, the average exchange rate (monthly or quarterly) for the reporting period is used. The

source and actual exchange rates used in the calculations are to be disclosed.

The following definitions apply:

▪

Financial commitment: A current contractual obligation to pay a specified amount against

goods and services already received i.e., the goods/services have been received, however,

the related payment is not yet made (all or partial) either due to delay in/non-receipt of

invoices, use of favorable payment terms or prolonged payment process. Financial

commitments mainly include accounts payable and creditors.

▪

Financial obligation: A current contractual obligation to pay an agreed amount (as per

signed contract and/or Purchase Order) to a third party for the provision of goods/services

Page 19 of 81

at a certain point of time in the future, i.e., goods or services are yet to be received.

The PR is required to share any additional information that can improve understanding of the

reported financial information. The PR is also required to make every possible effort to facilitate the

work of the LFA during its program review and verification process, whether it is done on-site or

remotely.

SPECIAL CASES

If any of the special cases outlined below apply to a grant, the PR explicitly discloses the nature of

the situation and any departures from these guidelines in their PU/DR.

Restatement of financial information reported previously for the same implementation

period, as stipulated in section 3.7 of the Grant Confirmation.

In certain cases, past expenditure and budget information reported in one or several previous

PU/DR(s) need to be updated to correct material errors, such as erroneous exchange rate

assumptions, ineligible transactions

10

or arithmetic errors. Adjustments made in the subsequent

PU/DR to correct the reported cumulative and actual expenditure, disbursements to SRs and budget

amounts can require updating current cash balances. Following such adjustments, the PR is required

to issue an official letter or provide a copy of the note to file duly approved by the accountable official

of the PR to the Global Fund, indicating the correct cumulative and actual cash outflow and budget

amounts, as well as a description of the adjustments and reasons for these adjustments.

Reporting under fiduciary agency (including fiscal agent) arrangements.

Reporting for a grant that utilizes the services of a fiduciary or management agency is no different

from reporting under regular grants managed directly by a PR. All budgets, actual expenditures,

revenues, disbursements, and other financial information related to the grant are to be reported as

though directly managed by the PR, even if, for example, some expenditures and cash balances

are to be found at the fiduciary or management agency level.

TAB 2. PRINCIPAL RECIPIENT CASH RECONCILIATION STATEMENT

The PR Cash Reconciliation Statement (hereinafter referred to as the cash reconciliation statement)

provides information on the program’s cash position as at the reporting period end, showing the

movements in cash (cash inflows and outflows) during the period covered by the PU/DR. The cash

reconciliation report to the Global Fund covers the PR’s cash balance in support of Global Fund

disbursement decisions.

This statement is required to be completed in the currency of the grant, as stipulated in section 3.6 of

the Grant Confirmation. It is to consider disbursements made directly to the PR and on its behalf to

third parties; other income received, including that related to income generating activities; PR

expenditure; and net gains and losses arising from exchange rate fluctuations.

The cash reconciliation statement is required to:

i. Fully reflect all bank accounts owned and held by the PR and SRs (when applicable) for

implementation of grant activities irrespective of physical location and currency denomination

10

For purposes of PU/DR reporting, ineligible transactions include both non-compliant expenditure as defined in section 2.5.1 of the the

Global Fund Guidelines for Grant Budgeting. and/or income, foreign exchange and any other adjustments required to arrive at the

accurate cash position.

Page 20 of 81

of those accounts. It is to also include any grant funds held with fiduciary agents (if

applicable).

ii. Provide information on the PR’s bank statement balances as detailed below.

iii. Include information on open advances at the level of SRs (funds disbursed to SRs and not

yet reported as expenditures), at wambo.org/PPM level (difference between total payments

made and value of goods received) or for other PR advances to staff, suppliers, and others.

Open advances are any cash outflows made for which no corresponding expenditure has

been recognized.

iv. Include financial commitments and financial obligation analyzed between those at their level

and those at the level of their SRs and accrued severance entitlements

11

. For financial

commitments, the PR is required to also provide the balance at the start of the period.

v. Include a section which pulls out information from different sections of the PU/DR form to

enable the triangulation of financial figures. This helps the PR, the LFA and the Global Fund

to appreciate the internal consistency of the information provided and resolve any inaccurate

reporting forthwith.

vi. Provide information on non-compliant expenditure identified under the grant to facilitate

transparency and reporting of these to the Global Fund for data alignment purposes.

In addition, in case of a program continuation (signing of a grant for a subsequent implementation

period with the same PR), the PR is required to report the final cash balance for the previous

implementation period as opening balance for the new implementation period.

For reporting purposes, a distinction is made in the cash reconciliation statement between regular

funds and C19RM funds. Disbursements made by the Global Fund to and on behalf of the PR as

well as cash outflows from the PR’s side are analyzed accordingly.

The SR cash reconciliation is also provided (see Tab 3 ‘Sub-Recipient Cash Reconciliation’).

The cash reconciliation statement only covers financial transactions for the grant implementation

period,

12

as stipulated in section 3.7 of the Grant Confirmation.

The PU/DR enables reporting on cumulative financial data for previous periods, transactions

incurred during the current reporting period and adjustments approved by the Global Fund. Upon

validation of the PU/DR, the Global Fund shares a communication with the PR in the form of a

Performance Letter indicating the required adjustments (including any ineligible transactions) for the

PR to take appropriate actions within the stipulated timelines and prior to the submission of the

PU/DR for the next reporting period.

TAB 2A. OPENING CASH BALANCE AT START OF IP

For the continuing PR, for the purpose of calculating the budget utilization ratio, opening cash

balance at the start of the IP needs to be taken into consideration. As such, cash balances rolling

over from the previous IP are reported for all PU/DRs. This information comes from the validated

Financial Closure Report and is confirmed by the Global Fund through the Implementation Letter. It

includes balances at both the PR and SR level.

11

Refer to section 1.1. of the Operational Guidance for Grant Budgeting.

12

Including end-date revisions and closure periods communicated through the relevant Grant Agreement and/or Implementation/Notification

Letters.

Page 21 of 81

Table A: Principal Recipient Cash Reconciliation Statement in IP Currency

This table captures relevant financial data to calculate the PR (including sub-offices of the PR) cash

balance at the end of the reporting period.

Item 1.1 – ‘PR cash balance: beginning of the current financial reporting period’

13

The PR’s opening cash balance for the first PUDR under the current IP is required to correspond to

the FCR-validated cash balance of the previous IP less cash refunds made to the Global Fund after

the financial closure as communicated by the Global Fund in the Implementation Letter in case of a

continuing PR. Otherwise it is nil.

If this opening cash balance coming from the Financial Closure Report (FCR) of the previous

implementation period includes SR cash balances as well, then the portion relating to the SRs is

included as an outflow as part of lines 3.4a and/or 3.4b – PR disbursement(s) to sub-recipients. For

example: if the FCR closing cash balance (as a reminder this refers to the total closing cash balance

for the IP) was of US$1,000 made up of PR cash balance of US$700 and SR cash balance of

US$200 for regular funds and US$100 for C19RM, then section 1.1 shows the full US$1,000 while

the US$200 of regular funds are included under 3.4a - Regular Funds: PR disbursement(s) to sub-

recipients and the US$100 for C19RM is included under 3.4b - C19RM Funds: PR disbursement(s)

to sub-recipients. The PR provides comments under line 1.1 to explain accordingly.

13

The opening cash balance of the first PU represents any available in-country cash balances (PR, SR, procurement agents, etc..) at the

end of the previous implementation period and/or grants that were incorporated as part of the funding available for the current

implementation period.

Page 22 of 81

For subsequent PUDRs, the opening cash balance is to correspond to the prior period’s closing

cash balance as reported by the PR

14

under line 5.1. Any adjustment required as per the validated

figures from the Global Fund is to be reported under other reconciliation adjustments for the current

period and/or processed as justification or reimbursements for ineligible transactions in the current

reporting period. There is to be no restatement of prior period records unless required for audit

purposes.

Item 2. ‘IP Income’

This is to capture all income received under the grant cumulatively for prior periods and the current

period.

Disbursements made by the Global Fund, whether directly to the PR, through PPM / wambo.org, or

directly to third parties, are classified as regular or C19RM.

These disbursements are pre-populated in the PU/DR by the Global Fund. If the PR notices any

discrepancy between the pre-populated data and their accounting records, the PR must reconcile

the disbursement notification letters and statements shared by the Global Fund and include the

comments in the relevant sections of the PU/DR.

Item 2.1a and 2.1b – ‘Disbursement made directly by the Global Fund to the Principal

Recipient’

Direct disbursements made to the PR by the Global Fund for regular (Item 2.1a) or C19RM (Item

2.1b) funds, based on information contained in the disbursement notification letter sent to the PR. If

there are direct disbursements made by the Global Fund to SRs, these are included under these

respective sections. The PR is then required to include as part of lines 3.4a - Regular Funds: PR

disbursement(s) to sub-recipients and 3.4b - C19RM Funds: PR disbursement(s) to sub-recipients

the respective amounts disbursed to the SRs. The notification letters from the Global Fund will

specify the nature and payees for the disbursements.

Item 2.2a and 2.2b – ‘Disbursements made by the Global Fund through PPM / wambo.org’

Direct payments made by the Global Fund through the Pooled Procurement Mechanism /

wambo.org for allocation or C19RM funds. This amount corresponds to the disbursement notification

letters sent to the PR for such payments.

Item 2.3a and 2.3b – ‘Other direct disbursements made by the Global Fund’

Direct payments made by the Global Fund for allocation or C19RM to third parties, as authorized by

the PR (e.g., payments made to the Global Drug Facility or Fiscal Agent). This amount is to match

the disbursement notification letters sent to the PR for such payments.

Please note: Any associated bank charges, currency translation fees and other financial

transactions costs on disbursements cannot be deducted. Instead these are included as

expenditure under ‘Bank charges on disbursements and payments.’

Item 2.4 – ‘Interest received on bank accounts’

This represents income received during the current reporting period from bank accounts held by the

PR as indicated in bank statements.

14

This is to be based on the accounting records and transactions of the PR.

Page 23 of 81

Please note: the grant agreement does not authorize the PR to invest cash in other financial

instruments or in long-term deposits.

15

Funds deposited in an interest-bearing account are to be

available for immediate use for program purposes as needed.

Item 2.5 – ‘Revenue from income-generating activities and other income (e.g., income from

disposal of assets, etc.), if applicable’

This represents additional income arising from the sale of commodities/products and other services,

if applicable (e.g., micro loan interest, and others), as well as other income-generating activities

funded by the program and approved by the Global Fund. It also includes any income outside the

above items which arise outside normal or regular grant activities, e.g. income arising from disposal

of assets, or program specific donations or contributions by third parties.

Item 2.6 – ‘Tax refunds received (e.g., VAT/other tax returns)’

This represents all reimbursements received from tax authorities with respect to taxes incurred in

the current financial reporting period. The amounts refunded, including SR taxes, are linked to

PU/DR Tab 7: Tax Reporting. (Refer to tab 7 Tax Reporting in Financial Reporting of this guidance

document for further details).

Item 2.7 – ‘Total IP Income’

This is automatically calculated based on the financial information entered in the fields above.

Please note: Reimbursements received by the PR from suppliers (PPM / wambo.org or the Global

Drug Facility (GDF)) are to be included under the relevant IP income sections as a negative amount

instead of another income element under section 2.5 or 4.1 of the PR cash reconciliation PU/DR.

Specific LFA Requirements

Guidance on Item 1.1.

The LFA reviews

16

and proposes adjustments as appropriate. Explanations for adjustments for exceptions and

additional context regarding PR-reported information are included in the section ‘For Local Fund Agent Use Only.’

The LFA’s scope of work, unless otherwise agreed with the Global Fund, includes:

▪

Verifying the opening cash balance against the FCR and Implementation Letter, providing comments for identified

deviations, and proceeding to the required adjustments where applicable.

▪

Verifying consistency with previous periods’ information and providing comments for identified deviations.

Guidance on Items 2, 2.1a, 2.1b, 2.2a and 2.2b.

This information is pre-populated and does not require detailed verification. In case the LFA notices any discrepancy

between the pre-populated figures and the PR’s underlying records, the LFA is requested to provide the required

comments where applicable.

Requirements for Items 2.3a, 2.3b. 2.4, 2.5, 2.6, 2.7.

The LFA:

▪

Verifies and validates the accuracy of entries and source documents for interest received on grant income, income

generating activities, and any other sources of income.

▪

Ascertains whether the events, transactions, balances, and other matters disclosed in the cash reconciliation

statement:

o

Are correctly recorded.

o

Have occurred and/or are relevant to the reporting period.

o

Pertain to the entity.

o

Are correctly and accurately disclosed (with regards to amounts).

▪

Provides comments with sufficient details with respect to any adjustments or key considerations made in the report.

15

As stipulated in clause 3.4 (1) (c) of the Grant Regulations (2014) or Global Fund Grant Regulations Version 2 (2023).

16

Review procedures can include but are not limited to the inquiry of management/staff, observation of process/ procedures and

inspection of financial information.

Page 24 of 81

Item 3. IP Cash Outflows

This item comprises expenditure on cash basis in the period of the PU and cumulatively for prior

periods, split between regular and C19RM funds, except for bank charges on disbursements and on

payments, which are to be reported together.

Item 3.1a and 3.1b – ‘Principal Recipient Expenditure (including payments and other advance

payments)’

These represent the cash outflows attributable to activities implemented by the PR to be funded

under the regular budget (Item 3.1a) and C19RM budget (Item 3.1b), respectively. It also includes

indirect and any overhead

17

amounts paid under the grant.

Item 3.2a and 3.2b – ‘PPM / wambo.org payments made by the Global Fund on behalf of the

PR’

The same data as provided in 2.2a and 2.2b above is automatically populated.

Item 3.3a and 3.3b – ‘Payments to other third parties by the Global Fund on behalf of the

Principal Recipient’

The same data as provided in 2.3a and 2.3b above is automatically populated.

Item 3.4a and 3.4b – ‘Principal Recipient disbursement to Sub-Recipients’

This includes all disbursements made to SRs by the PR during the reporting period for activities to

be funded under the regular budget (Item 3.4a) and C19RM budget (Item 3.4b), respectively. In the

case of a first reporting under the new IP, these lines also include SR cash balances forming part of

the opening cash balance under line 1.1. Additionally, any direct disbursements made by the Global

Fund to SRs are included under the respective lines. Refunds from SRs to PR cannot be included

as other income but rather are deducted from the disbursement made.

Please note: Payments made for goods or services to be rendered by suppliers as per valid

purchase orders/contracts and as per agreed grant agreement budget and work plan are to be

17

The Indirect Cost Recovery (ICR) is calculated based on actual expenditure incurred by the PR and disbursements to SRs (excluding any

commitments). When refunds are received from SRs, the PR need to apply an adjustment on ICR on the refund received to reflect the

accurate ICR amount.

Page 25 of 81

accounted for as advances and reflected in the cash reconciliation statement as PR expenditure

(i.e., under item 3.1a or 3.1b).

Item 3.5 – ‘Bank charges on disbursements and payments’

These include all fees arising from the PR’s normal banking relationship for transactions involving

receipt (e.g., disbursement received from the Global Fund) and payments for grant activities, as

indicated in the PR’s bank statements (e.g., commission on turnover, transfer fee, and others).

Item 3.6 – ‘Total IP Cash Outflows’

This is automatically calculated based on the information entered in the fields above.

Item 4. Reconciling Adjustments: (PR and SRs)

This item captures adjustments required in reconciling the cash balance of the PR.

These adjustments have been categorized as follows:

Item 4.1 – ‘Other reconciliation adjustments (including for previous financial reporting

periods)’

These mainly include, but are not limited to, changes arising from prior periods’ financial information

(i.e., any of the elements of grant income and expenditure above, impacting the calculation of PR

cash balance) emanating from correction of errors, inaccurate posting or new information available.

This amount can be positive or negative depending on the nature of the adjustments. The PR is

required to also include or consider adjustments that were validated, cleared, and officially

communicated by the Global Fund in Performance Letters covering prior periods.

Item 4.2 – ‘Net exchange gains/losses on translation of balances’

Specific LFA Requirements

Requirements for Items 3 (Items 3.1a – 3.6).

The LFA verifies that grant cash outflows consist of compliant expenditures and provide details/analysis

on exceptions to eligibility as part of budget variance analysis. The LFA also provides comments with

sufficient details with respect to any adjustments or key considerations made in the report.

In case the LFA identifies non-compliant expenditures, these are adjusted in the reported expenditures

and identified under item 10.1. However, since the cash outflow has already occurred, no adjustments

can be made to cash outflows.

Page 26 of 81

This adjustment is to consider foreign exchange, gains or losses from translating closing non-grant

currency balances (functional and/or other currencies) to grant reporting currency balances at the

end of the PU period. Where there is an overall net loss in foreign currency translation,

18

this is

recorded as a negative value.

Please note: In an environment of depreciating (or devaluing, if applicable) local currency versus

grant currency, it is recommended that funds disbursed by the Global Fund be held in the grant

currency up to the point of utilization for program purposes.

Item 4.3 – ‘Total reconciling adjustments’

Automatically calculated based on the information entered in the fields above.

Item 5. Total cash balance: end of the current financial reporting period.

Items 5.1 – ‘Total cash balance in-country’

Closing cash balance at the PR level reported in grant currency is a calculated field. It is translated

at the spot exchange rate as of the end date of the reporting period (in the event the cash is held in

non-grant currency). The foreign exchange adjustment derived from the translation is entered in

Item 4.2 of the cash reconciliation. It represents total cash balances whether regular or C19RM.

Please note: The closing cash balance is derived as the PR opening cash balance, adding the total

grant income for the period minus total outflows of funds on a cash basis and adding reconciling

adjustments for the period.

18

In the event disbursements are made by the Global Fund in local currency, the PR will be informed by the Global Fund of the applicable

exchange rate to convert transactions in the grant currency.

19

Refer to sections 2.5.1 of the Global Fund Guidelines for Grant Budgeting.

Specific LFA Requirements

For item 4 (4.1 – 4.3) and Item 5 (5.1), the LFA:

▪

Recommends and explains adjustments to the reported figures due to identified non-compliant transactions

as appropriate.

19

▪

Verifies that all prior period adjustments including those officially communicated to the PR by the Global Fund

have been accurately entered in the reporting period and are backed by adequate supporting documents. In

event there was no adequate supporting documentation available, the LFA captures the findings in the LFA

Findings and Recommendations tab. Please Refer to 9. LFA Findings and recommendations for further

information.

▪

Verifies the accuracy of computations for ‘net exchange gain/losses arising from foreign exchange

translations’ with reference to applicable closing spot rates used with reference to official central bank spot

rate or other applicable interbank rate.

▪

Verifies accuracy and consistency of closing cash balances (PR and SR, the latter of which on special request

by the Global Fund), ensuring that the spot exchange rate is reasonable with reference to official central bank

spot rate or other applicable inter-bank rate and that the amounts agree with updated cash book balances

from month end bank reconciliations.

▪

Verifies the reasonableness of exchange rates used to convert period and cumulative expenditures into the

grant currency.

▪

Provides comments with sufficient details with respect to any adjustments or key considerations made in the

report.

Page 27 of 81

Table B. Schedule of Open Advances in IP Currency

Open advances are cash outflows for which no corresponding expenditure has been recognized by

the PR. Three levels of aggregation of open advances are provided under Table B with respect to

SRs, PPM / wambo.org advances and PR advances for local procurement or staff advances, for

instance.

▪

Sub-recipient Advances: funds advanced by the PR for which the respective expenditure

has not yet been validated by the PR. The information in this section of the PU/DR comes

directly from the Tab 3. Sub-recipient(s) cash reconciliation.

▪

PR Procurement Advances (PPM and others): relate to PPM / wambo.org advances only.

Payments made to other suppliers directly by the Global Fund such as GDF, Cepheid, and

others are included under ‘PR Other Advances’ section. They represent the differences

between total disbursements made by the Global Fund and the value of goods received in-

country as confirmed by the PR.

▪

PR Other Advances: these relate to other advances, which include but are not limited to

advances provided to staff for travel-related costs, advances to local suppliers, payments

made to GDF and other direct payments, funds balances sitting in mobile money platforms

and prepayments for goods and services. The PR is required to submit to the Global Fund

and for the LFA to review, the required schedules supporting the reported amount of other

advances.

Item 6.1 – ‘Open advances at the beginning of the current financial reporting period’

The PR’s open advances balance at the beginning of the current financial reporting period for the

first progress report is required to be nil.

For subsequent reports, it is to correspond to the prior period’s closing balance as reported by the

PR under item 6.8.

Item 6.2 – ‘Disbursements made through PPM / wambo.org’

The same data as provided in 2.2a and 2.2b above is automatically populated.

Item 6.3 – ‘Other direct disbursements made by the GF’

The same data as provided in 2.3a and 2.3b above is automatically populated.

Item 6.4. – ‘Disbursements to sub-recipient(s) and other suppliers’

These are cash outflows at the PR level in favor of the respective service providers.

Page 28 of 81

Item 6.5. – ‘Less: value of goods and services delivered against open advances’

The value of goods and services delivered during the current financial reporting period for which an

advance was recorded is reported here. It corresponds to the value of advances liquidated during

the current financial reporting period.

Item 6.6. – ‘Sub-recipient(s) other income’

These constitute income arising from regular grant activities as covered in the grant confirmation’s

budget, such as income generating activities and bank interest income. This can also include

income arising outside normal grant activities, such as realized proceeds from the approved

disposal of grant assets.

Item 6.7. – ‘Sub-recipient(s) refunds’

This represents the refunds received (if any) from the SR(s) during the reporting period. However, if

adjustment in 3.4. was already made then the same adjustment is not shown in 6.7.

Item 6.8. – ‘Open advances at the end of the current financial reporting period’

This is automatically calculated based on the information entered in the fields above.

Specific LFA Requirements

For Items 6 (6.1 – 6.8) the LFA:

▪

Completes the respective fields based on the information reviewed at PR level. It is not required to proceed with

a detailed review of each SRs’ underlying records unless requested by the Global Fund.

▪

Reviews the completeness and accuracy of the value of goods and services delivered during the reporting period

as reported by the PR to determine the closing balance of open advances for PPM / wambo.org.

▪

Reviews the completeness and accuracy of the reported amount of other advances and includes comments

wherever applicable on the ageing of such advances, the timely liquidation thereof into expenditures and any

other relevant information.

Table C. Principal Recipient Financial Commitments & Obligations

Financial commitments and financial obligations as defined above

20

arising at PR and SR levels are

to be recorded here together with the amount of accrued severance entitlements.

Item 7.1a and 7.1b – ‘Total financial commitments’

20

Refer to 5. Financial reporting section of the document

Page 29 of 81

In addition to the closing balance of financial commitments arising at PR and SR level (where

applicable), the PR is required to include the corresponding amount for the previous financial

reporting period. For the first report, the amount for the previous financial reporting period must be

nil.

Item 7.2a, 7.2b and 7.2c – ‘Financial obligations and accrued severance’

Balances at the end of the current financial reporting period are reported here.

Please note that for accrued severance entitlements, where applicable, the PR is required to report

on the cumulative balance at the end of each financial reporting period.

Item 7.4

21

– ‘Total financial commitments & financial obligations’

This is the total amount of items 7.1a to 7.2c, above.

Item 7.5 – ‘Uncommitted cash balances’

This is for information purposes only and is calculated as the difference between PR cash balance

in-country and total financial commitments and obligations.

Please note: Table 2C is meant for disclosure, triangulation and analytical purposes only and does

not impact the calculation of the PR’s cash balance.

Table D. Triangulation of Financial Figures

21

Previously used category 7.3 has been retired and is no longer in use.

22

Refer to 5. Financial reporting, Special cases of the document

Specific LFA Requirements

For items 7 (7.1 – 7.5), the LFA verifies the reasonableness of the amounts disclosed as PR financial commitments

and other financial obligations in accordance with the applicable PR accounting principles and with reference to the

definitions

22

on financial commitments and obligations. This includes assurance that these commitments and other

obligations have third party supporting documents and represent goods and services rendered or expected to be

rendered with reference to the currently approved grant budget, annual funding decisions and associated

disbursements made to the PR. SR financial commitments and obligations are verified based on the SR reports

collected by PR. It is not required to verify other supporting documents at SR level.

Page 30 of 81

The objective of triangulation is to ensure completeness and accuracy of financial information

presented in the PU/DR. It involves the reconciliation of the closing cash balance in Tab 2: Principal

Recipient Cash Reconciliation with Tab 4: Total Expenditure, taking into consideration financial

commitments and open advances. For more details, see Tabs 2 and 4 of the PU/DR and the

relevant sections of the guidance.

Please note: All figures are automatically calculated based on inputs in other sections. Space for

comments is provided. Triangulation differences must be investigated and explained.

Population of items:

Item 8.1 – ‘PR cash balance: beginning of the current financial reporting period’: PR cash

balance at the start of the financial reporting period from item 1.1.

Item 8.2 – ‘Open advances: beginning of the current financial reporting period’: sum of item

6.1 – open advances at the level of the SRs, PPM / wambo.org and other PR advances.

Item 8.3 – ‘Total IP income’: item 2.7 – total of disbursements and other income for the current

financial reporting period.

Item 8.4 – ‘Total expenditure per PR expenditure report’: total expenditure for the current

financial reporting period as per Tab 4: Principal Recipient Total Expenditure.

Item 8.5 – ‘Net change in total financial commitments from previous year’: difference between

the current financial reporting period and the previous reporting period for items 7.1a and 7.1b.

Item 8.6 – ‘Open advances at the end of the current financial reporting period’: sum of item 6.8

– open advances at the level of the SRs, PPM / wambo.org and other PR advances.

Item 8.7 – ‘Total reconciling adjustments’: populates from item 4.3 – total reconciling

adjustments.

Item 8.8 – ‘Total expected PR closing cash balance’: calculates opening cash balance at PR

level (8.1), the open advances (8.2) plus all disbursements made to and on behalf of the PR (8.3),

minus all expenditures recognized (8.4) and adjusted for net change in financial commitments (8.5),

open advances at the end of the period (8.6) and reconciling adjustments (8.7).

Item 8.9 – ‘PR cash balance’: item 5.1, the calculated in-country cash balance at the level of the

PR.

Item 8.10 – ‘Triangulation variance to be reconciled or reimbursed by PR’: item 8.8 – total

expected PR closing cash balance, minus item 8.9 – total cash balance in country. Examples of the

justified triangulation variances include:

- SR income.

- SR net exchange gain or loss from translation of balances.

- Open ineligibles.

- Refund of taxes.

- SR refunds (excluding SR refunds to the PR).

Specific LFA Requirements

For items 8 (8.1 – 8.10): This section is a compilation of information provided elsewhere in the PUDR. The analysis

of the variances and any recommended adjustment are required to be made in the respective sections.

Page 31 of 81

Table E. Principal Recipient Bank Statement Balance & Cash In-Transit in IP

Currency

This section provides financial information on PR bank statement balances, cash in transit during

the current PU period and cash in transit falling outside that period

23

(i.e., falling in the disbursement

request period).

Item 9.1 – ‘Principal Recipient Cash Balance as per bank statements’

The PR is requested to furnish the Global Fund with the bank statement balance as at the PU period

end for analytical purposes only as part of determining annual funding and subsequent

disbursement decisions. These balances are for bank accounts maintained in grant currency and for

those in other currencies (including local currency) translated into grant currency using the prevailing

official spot exchange rate.

In the case of a comingled account, provision of the grant allocated bank balance is required and is

referred to as ‘fund balances’ and indicated as such in the comments field.

Item 9.2 – ‘Bank reconciliation net amount’

Reflecting the bank reconciliation statement balance, this represents the cash balance as reported

under line 9.1, which is adjusted for reconciling items, such as unpresented checks or bank charges

not booked in the PR’s accounting.

Item 9.3 – ‘Cash in-transit for the current financial reporting period’

This is automatically calculated based on information provided in Tab 6: Forecast and Disbursement

Request.

Item 9.4 – ‘Cash in-transit after the current financial reporting period’

23

This information is included if the PR has received disbursement notification before the PU/DR submission due date to the Global Fund,

otherwise, the information is not required.

Note: while the cash received by the SR is recorded in the triangulation, the SR income is not (the SR(s) other income

amount (recorded under 2B 6.6) is not included in 2D 8.3 Total IP income). Further, certain elements such as ineligibles

or refunds which impact the cash reconciliation across different reporting periods may create triangulation difference

for the reporting period. To address this, the LFA is expected to include in the comments section that the triangulation

difference relates to the justified variances.

Page 32 of 81

This is automatically calculated based on information provided in Tab 6: Forecast and Disbursement

Request.

Please note: The PR must include all commitments and outstanding payments in the disbursement

forecast, as cash balances

and cash in-transits are deducted from the disbursement forecast.

Specific LFA Requirements

Guidance on Items 9 (9.1 – 9.4).

The LFA verifies:

▪

The reported PR bank statement balance against official bank statements.

▪

That a bank reconciliation statement has been prepared by the PR for the financial reporting period closing

cash position.

▪

That cash in transit amounts are accurate with reference to disbursement notification letters for disbursements

to the PR and to third parties on behalf of the PR, ensuring they relate to the periods as explained above.

Table F. Principal Recipient Ineligible Transactions in IP Currency

This section of the cash reconciliation statement is meant for the tracking of ineligible transactions to

ensure transparency and alignment on potential recoverable amounts as at the reporting period end

date, arising from expenditures which have been declared as ineligible during the current

implementation period of the grant and formally communicated through Performance,

Implementation or Notification Letters.

Item 10.1 – ‘Ineligible transactions validated for the current financial reporting period’

Relates to identified expenditure in the current reporting period deemed non-compliant by the PR

based on the guidelines on ineligible transactions.

24

Item 10.2 – ‘Ineligible transactions from previous financial reporting periods for which

justification was approved by the Global Fund’

This is pre-populated from the Global Fund’s Recoveries Module.

Item 10.3 – ‘Reimbursement of ineligible transactions from previous financial reporting

periods’

24

Based on the guidelines on ineligible transactions contained in section 2.5.1 of the Global

Fund Guidelines for Grant Budgeting.

Page 33 of 81

This is pre-populated from the Global Fund’s Recoveries Module and reflects transactions for which

the PR has provided a physical refund to the grant bank account or transferred the funds directly to

the Global Fund.

Item 10.4 – ‘Cumulative ineligible transactions for the implementation period’

This is the sum of all ineligible transactions since the start of the current implementation period and

is pre-populated from the Global Fund’s Recoveries Module.

Item 10.5 – ‘Open ineligible amounts receivable’

Represents the value in IP currency of ineligible transactions as of the end of the reporting period. It

is automatically calculated based on the information entered in the fields above.

Item 10.6 – ‘Net recoverable amount from recoveries module’

For information purposes only, this field shows the balance of recoverable amounts as identified in

the Global Fund’s Recoveries Module. Any differences between 10.5 and 10.6 are reconciled by the

Global Fund and may be communicated to the PR in the Performance Letter upon resolution.

Item 11 – ‘Validated / Unvalidated net cash recoverable’

This shows the net cash available in country after taking into consideration confirmed and newly

identified non-compliant transactions, for information purposes only.

25

This requirement to be in line with the guidance under Section 2.5.1 of the Global Fund Guidelines for Grant Budgeting.

Specific LFA Requirements

Guidance on Items 10 - 11.

The LFA is required to report transactions considered to be non-compliant for the current financial reporting period,

with sufficient details.

25

Page 34 of 81

TAB 3. SUB-RECIPIENT CASH RECONCILIATION

To support annual funding decisions and decisions on cash transfer needs, the PR provides

financial data on the management of SR advances. These are the balances as per the PR’s

books and records, which can differ from the actual balances at individual SR levels due to timing

of validation of SR reports and cut-off periods, etc. It is sufficient for the PR to report on the

balances as per its books and records.

The SR cash reconciliation statement captures the reconciliation of funds provided to SRs at a

given PU period end date. SR open advances are defined as disbursements made to SRs and

other SR income less SR expenditures validated and recorded by the PR in its records as fully

liquidated amounts (i.e., recognized officially as SR expenditure by the PR in its own records).

To ensure financial control over resources at the disposal of SRs, the Global Fund strongly

recommends that the PR establishes advance accounting principles for disbursements made to

SRs for program implementation. Although disbursements made to SRs are treated as ‘cash-

outflow’ for purposes of PU/DR reporting, it is important that the PR includes SRs’ expenditure in

their records upon verification and/or validation of SR reports (including verification by assurance

providers).

In certain instances, where ‘zero-cash or restricted cash policy’

26

is in place, the PR is required to

report payments made under such policies as actual disbursements to SRs (Item 3.4a and Item

3.4b of the PR cash reconciliation statement) and also treat them as SR expenditure in the SR

cash reconciliation section (columns 4 and 6).

If adequate controls and risk mitigation measures are in place, the PR is required to apply a risk-

based approach for the verification of SRs’ expenditure, and verification can be performed on a

sample basis.

Sample expenditure verification can also be performed by the LFA or other assurance providers

depending on the country context.

1.

Sub-recipient Name: the SR(s) for which financial details are being given. Where there are

a significant number of SR(s) involved in the implementation of the grant and to simplify the

reporting process, the PR can be authorized by the Global Fund to input ‘Other’ to group

SRs that have managed a cumulative budget below US$50,000 as at the end of the PU

reporting period.

2.

Cumulative Sub-recipient expenses for previous financial reporting periods at the

Principal Recipient level: the cumulative expenditure amount validated by the PR and

entered into its accounting records derived from amounts previously disbursed to SRs as at

the end of the previous PU reporting period.

3.

Sub-recipient(s) Open Advances at Principal Recipient Level: open balances from the

previous PU period regarding advances provided to SRs that are yet to be validated and/or

booked as grant expenditure as part of the PR’s regular accounting closure process.

27

4.

Disbursements made by the Principal Recipient or directly by the Global Fund during

the current financial reporting period: all direct disbursements made by the PR to SRs

during the PU/DR reporting period and direct disbursements made by the Global Fund to the

26

Such policies imply that the PR makes direct payments on behalf of the SRs.

27

The Global Fund strongly recommends a monthly closing of accounts by all implementers and recipients of funding.

Page 35 of 81

SRs. These are cash outflows at the PR level, which impact the cash balance, however, they

do not constitute expenditure in the form of payments for goods and services. This amount is

to fully reconcile and correspond to the amount reported in item 3.4a and 3.4b (i.e., ‘PR

disbursement to SRs’) in the PR cash reconciliation statement.

5.

Other Income during the Current Financial Reporting Period: constitutes income arising

from regular grant activities as covered in the grant confirmation’s budget, such as income

generating activities and bank interest income. This can also include income arising outside

normal grant activities, such as realized proceeds from the approved disposal of grant

assets.

6.

Expenditure validated by Principal Recipient during the current financial reporting

period: expenditure accepted and/or validated by the PR as SR expenditure for the PU/DR

reporting period, following a formal process of verifying supporting documents

28

of

expenditure transactions.

7.

Refunds Received from Sub-recipient: Refunds received (if any) from the SR(s) during the

reporting period.

8.

Sub-recipient Closing Balance at Principal Recipient Level: Open SR advances

maintained by the PR as at PU period end date. It represents expenditure which is yet to be

officially validated, cleared and recognized by the PR in its accounting records; funds for

activities which are yet to be implemented by the SR; and/or savings from activities

implemented. It does not require any direct input from the PR and is the product of points 3

through 7 above.

9.

Actual Sub-recipient(s) Cash Balance (if applicable): to be filled in by the PR upon proper

verification and validation of SR cash balances as at the reporting period. In all cases, the

PR is required to have oversight mechanisms in place to provide assurance on

reasonableness of SR expenditure and cash balances.

10. Variances on Sub-recipient(s) Balances: does not require any direct input from the PR

and is the difference between the closing balance at PR level in respect to open SR

advances and actual SR cash balances. The PR is required to ensure that it takes all steps

necessary to ensure that this variance is kept to a reasonably low level by ensuring proper

oversight of SR(s) expenditure, timely disbursements, and reporting.

Specific LFA Requirements

Only if requested by the Global Fund, the LFA reviews and reports this section of the PU/DR.

The LFA review is based on the documents available at the PR level, e.g., SR reports collected by PR. The LFA does

not review other documents at SR level unless specifically requested by the Global Fund. Depending on risk factors,

LFA financial verification work can include site visits to SRs in addition to verifying PR-held financial information on

SRs.

29

The LFA verifies:

▪

Consistency of cumulative SR expenses for prior periods with the amounts reported in the previous PU/DR.

▪

Correspondence of SR open advances to both closing balances for the previous PU/DR reporting period and

PR’s underlying books and records.

28

The verification of SR expenditure is based on a risk-based approach and can be performed on a sample basis in cases when

adequate controls and risk mitigation measures are in place.

29

For further information refer to the section 11.2 Recommended approach for the review and verification of information.

Page 36 of 81

▪

Correspondence of the reported PR disbursements to SRs, notifications sent to SRs and amounts entered in

PR’s accounting records for advances, which form the basis for the entry made on items 3.4a and 3.4b of the

PR cash reconciliation statement.

▪

Completeness and accuracy of ‘other income’ reported at the level of SRs.

▪

Accuracy and support for amounts booked by the PR (by way of expenditure returns from SRs, with

supporting documents such as delivery notes, invoices, payment vouchers, receipts, and others) as

constituting validated SR expenditures, and also accuracy of closing SR open advances reported by the PR.

▪

Reasonableness of reported SR cash balance, including recommending adjustments to these balances where

there is inaccuracy, provided the PR has been requested to provide SR cash balance information in the

column.

▪

‘Actual SR Cash Balance (if applicable)’. Where a PR elects to provide SR cash balance information, the LFA

reviews upon request of the Global Fund.

▪

The adequacy of underlying systems and oversight controls in the management of SR advances by the PR.

TAB 4. TOTAL EXPENDITURE

The purpose of PR expenditure reporting is to enhance the overall expenditure analysis of Global