MEMORANDUM

EXPLAINING THE PROVISIONS

IN

THE FINANCE BILL, 2024

(Clauses referred to are clauses in the Bill)

ºÉiªÉàÉä´É VɪÉiÉä

GOVERNMENT OF INDIA

1

FINANCE (No. 2) BILL, 2024

PROVISIONS RELATING TO

DIRECT TAXES

Introduction

The provisions of Finance (No. 2) Bill, 2024 (hereafter referred to as "the Bill"),

relating to direct taxes seek to amend the Income-tax Act, 1961 (hereafter referred

to as 'the Act'), to continue reforms in direct tax system through tax reliefs, removing

difficulties faced by taxpayers and rationalisation of various provisions. The Bill also

seeks to amend the Black Money (Undisclosed Foreign Income and Assets) and

Imposition of Tax Act, 2015, Chapter VII of Finance (No. 2) Act, 2004 (‘Securities

Trasaction Tax’, STT in short), Chapter VIII of Finance Act, 2016 (‘Equalisation

Levy’) and Prohibition of Benami Property Transaction Act, 1988 (‘Benami Act’).

With a view to achieving the above, the various proposals for amendments are

organized under the following heads:—

(A) Rates of income-tax;

(B) Measures to promote investment and employment;

(C) Simplification and Rationalisation;

(D) Widening and deepening of tax base and Anti-Avoidance;

(E) Tax administration;

DIRECT TAXES

A. RATES OF INCOME-TAX

I. Rates of income-tax in respect of income liable to tax for the assessment

year 2024-25.

In respect of income of all categories of assessees liable to tax for the

assessment year 2024-25, the rates of income-tax have either been specified in

specific sections of the Act (like section 115BAA or section 115BAB for domestic

companies, section 115BAC for individual/HUF/AOP (other than a co-operative

society)/BOI/AJP and section 115BAD or section 115BAE for cooperative societies)

or have been specified in Part I of the First Schedule to the Bill. There is no change

2

proposed in tax rates either in these specific sections or in the First Schedule. The

rates provided in sections 115BAA or 115BAB or 115BAC or 115BAD or 115BAE of

the Act for the assessment year 2024-25 would be same as already enacted.

Similarly rates laid down in Part III of the First Schedule to the Finance Act, 2023,

for the purposes of computation of “advance tax”, deduction of tax at source from

“Salaries” and charging of tax payable in certain cases for the assessment year

2024-25 would now become part I of the first schedule. Part III would now apply for

the assessment year 2025-26.

(1) Tax rates under section 115BAC—

For assessment year 2024-25, as per the provisions of sub-section (1A) of

section 115BAC of the Act, an individual or Hindu undivided family or association of

persons [other than a co-operative society], or body of individuals, whether

incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of

clause (31) of section 2, has to pay tax in respect of the total income at following

rates:

Total Income (Rs) Rate

Up to 3,00,000 Nil

From 3,00,001 to 6,00,000 5%

From 6,00,001 to 9,00,000 10%

From 9,00,001 to 12,00,000 15%

From 12,00,001 to 15,00,000 20%

Above 15,00,000 30%

2. The above mentioned rates shall apply, unless an option is exercised as per

provisions of sub-section (6) of section 115BAC. Thus, rates specified in sub-section

(1A) of section 115BAC of the Act are the default rates.

3. In respect of income chargeable to tax under clause (i) of sub-section (1A) of

section 115BAC of the Act, the income-tax for the assessment year 2024-25 shall be

increased by a surcharge, for the purposes of the Union, computed, in the case of

every individual or Hindu undivided family or association of persons, or body of

3

individuals, whether incorporated or not, or every artificial juridical person referred to

in sub-clause (vii) of clause (31) of section 2 of the Act,-

(i) having a total income (including the income by way of dividend or income

under the provisions of section 111A, section 112 and section 112A of the Act)

exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate of

10% of such income-tax;

(ii) having a total income (including the income by way of dividend or income

under the provisions of section 111A, section 112 and section 112A of the Act)

exceeding one crore rupees but not exceeding two crore rupees, at the rate of

15% of such income-tax;

(iii) having a total income (excluding the income by way of dividend or income

under the provisions of section 111A, section 112 and section 112A of the Act)

exceeding two crore rupees, at the rate of 25% of such income-tax;

(iv) having a total income (including the income by way of dividend or income

under the provisions of section 111A, section 112 and section 112A of the Act)

exceeding two crore rupees, but is not covered under clause (iii) above, at the

rate of 15% of such income-tax;

3.1 In case where the provisions of sub-section (1A) of section 115BAC are

applicable and the total income includes any income by way of dividend or income

under the provisions of section 111A, section 112 and section 112A of the Act, the

rate of surcharge on the income-tax in respect of that part of income shall not exceed

15%.

3.2 Further, in the case of an association of persons consisting of only companies

as its members, and having its income chargeable to tax under sub-section (1A) of

section 115BAC, the rate of surcharge on the income-tax shall not exceed 15%.

3.3 Marginal relief shall be provided in such cases.

Tax rates under Part I of the First Schedule applicable for the assessment year

2024-25

A. Individual, HUF, association of persons, body of individuals, artificial

juridical person.

Paragraph A of Part-I of First Schedule to the Bill provides following rates of

income-tax:—

(i) The rates of income-tax in the case of every individual (other than those

4

mentioned in (ii) and (iii) below) or HUF or every association of persons or

body of individuals, whether incorporated or not, or every artificial juridical

person referred to in sub-clause (vii) of clause (31) of section 2 of the Act

(not being a case to which any other Paragraph of Part I applies) are as

under:—

Up to Rs. 2,50,000 Nil.

Rs. 2,50,001 to Rs. 5,00,000 5%

Rs. 5,00,001 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

(ii) In the case of every individual, being a resident in India, who is of the age

of sixty years or more but less than eighty years at any time during the

previous year,—

Up to Rs. 3,00,000 Nil.

Rs. 3,00,001 to Rs.5,00,000 5%

Rs. 5,00,001 to Rs.10,00,000 20%

Above Rs. 10,00,000 30%

(iii) in the case of every individual, being a resident in India, who is of the age

of eighty years or more at any time during the previous year,—

Up to Rs. 5,00,000 Nil.

Rs. 5,00,001 to Rs.10,00,000 20%

Above Rs 10,00,000 30%

These rates are the same as those applicable for the assessment year 2023-24.

5

B. Co-operative Societies

In the case of co-operative societies, the rates of income-tax have been

specified in Paragraph B of Part I of the First Schedule to the Bill. They remain

unchanged at (10% up to Rs. 10,000; 20% between Rs. 10,001 and Rs. 20,000;

and 30% in excess of Rs. 20,000).

C. Firms

In the case of firms, the rate of income-tax has been specified in Paragraph C

of Part I of the First Schedule to the Bill. They remain unchanged at 30%.

D. Local authorities

The rate of income-tax in the case of every local authority has been specified

in Paragraph D of Part I of the First Schedule to the Bill. They remain unchanged at

30%.

E. Companies

The rates of income-tax in the case of companies have been specified in

Paragraph E of Part I of the First Schedule to the Bill and remain unchanged vis-à-

vis those for the AY 2023-24. In case of domestic company, the rate of income-tax

shall be 25% of the total income, if the total turnover or gross receipts of the

previous year 2021-22 does not exceed four hundred crore rupees and in all other

cases the rate of income-tax shall be 30% of the total income.

2. In the case of company other than domestic company, the rates of tax are the

same as those specified for the AY 2023-24.

(2) Surcharge on income-tax

The rates of surcharge on the amount of income-tax for the purposes of the

Union is the same as that specified for the FY 2022-23. Further, for person whose

income is chargeable to tax under sub-section (1A) of section 115BAC of the Act,

the surcharge at the rate of 37% on the income or aggregate of income of such

person (excluding the income by way of dividend or income under the provisions of

sections 111A, 112 and 112A of the Act) exceeding five crore rupees is not

applicable. In such cases the surcharge is restricted to 25%.

6

(3) Marginal Relief—

Marginal relief has also been provided in all cases where surcharge is

proposed to be imposed.

(4) Education Cess—

For assessment year 2024-25, “Health and Education Cess” is to be levied at

the rate of 4% on the amount of income-tax so computed, inclusive of surcharge

wherever applicable, in all cases. No marginal relief shall be available in respect of

such cess.

II. Rates for deduction of income-tax at source during the financial year (FY)

2024-25 from certain incomes other than “Salaries”.

The rates for deduction of income-tax at source during the FY 2024-25 under

the provisions of section 193, 194A, 194B, 194BB, 194D, 194LBA, 194LBB,

194LBC and 195 have been specified in Part II of the First Schedule to the Bill.

2. For sections specifying the rate of deduction of tax at source, the tax shall

continue to be deducted as per the provisions of the relevant sections of the Act.

3. It is proposed that for deduction of income-tax at source on other income in

case of company which is not a domestic company, rates shall be reduced from 40%

to 35%.

4. It is proposed that for deduction of income-tax at source on the incomes in the

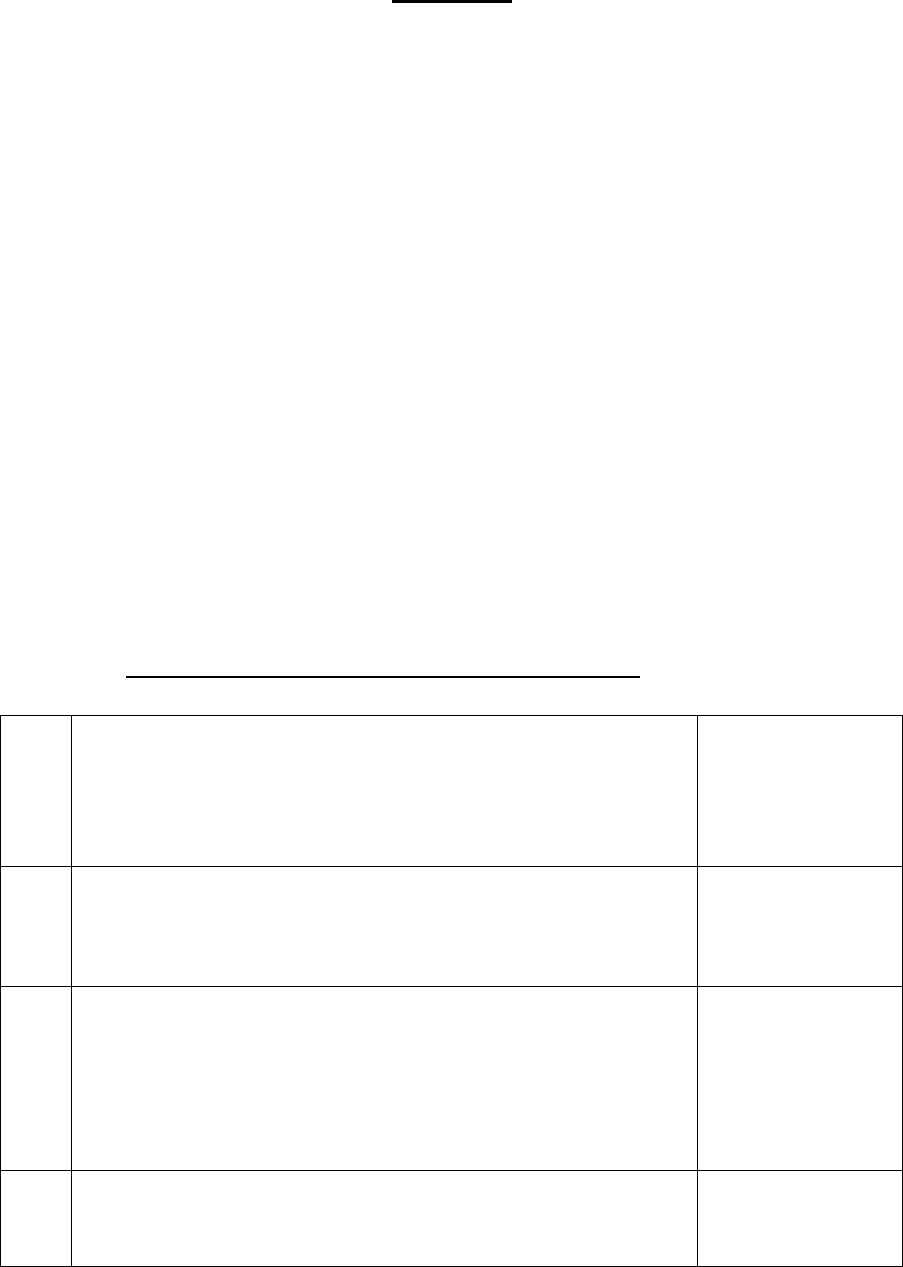

nature of capital gains for non-residents, the rates shall be as per the Table below:

Sl.No.

Income

For transfers taking

place before 23rd

day of July, 2024 /

Rate of TDS

For transfers

taking place on or

after 23rd day of

July, 2024 / Rate

of TDS

(1)

long-term capital

gains referred to in

section 115E

10%

12.5%

7

(2)

long-term capital

gains referred to in

sub-clause (iii) of

clause (c) of sub-

section (1) of section

112

10%

The clause is not

applicable for

transfers on or after

23

rd

July, 2024

(3)

long-term capital

gains referred to in

section 112A

exceeding one lakh

twenty five thousand

rupees

10%

12.5%

(4)

long-term capital

gains [not being long-

term capital gains

referred to in clauses

(33) and (36) of

section 10]

20%

12.5%

(5)

short-term capital

referred to in section

111A

15%

20%

5. Apart from the above, the rates will remain the same as those specified in

Part II of the First Schedule to the Finance Act, 2023, for the purposes of deduction

of income-tax at source during the FY 2024-25.

6. The surcharge on the amount of income-tax for the purposes of the Union is

the same as that specified for the FY 2023-24.

(2) Education Cess—

“Health and Education Cess” shall continue to be levied at the rate of four per

cent. of income tax including surcharge wherever applicable, in the cases of

persons not resident in India including company other than a domestic company.

8

III. Rates for deduction of income-tax at source from “Salaries”, computation

of “advance tax” and charging of income-tax in special cases during the FY

2024-25 (Assessment Year 2025-26).

The rates for deduction of income-tax at source from “Salaries” or under

section 194P of the Act during the FY 2024-25 and also for computation of

“advance tax” payable during the said year in the case of all categories of

assessees have been specified in Part III of the First Schedule to the Bill. These

rates are also applicable for charging income-tax during the FY 2024-25 on current

incomes in cases where accelerated assessments have to be made, for instance,

provisional assessment of shipping profits arising in India to non-residents,

assessment of persons leaving India for good during the financial year, assessment

of persons who are likely to transfer property to avoid tax, assessment of bodies

formed for a short duration, etc. The salient features of the rates specified in the

said Part III are indicated in the following paragraphs-

A. Individual, HUF, association of persons, body of individuals, artificial

juridical person.

With effect from assessment year 2025-26, it is proposed that the following

rates provided under the proposed clause (ii) of sub-section (1A) of section 115BAC

of the Act shall be the rates applicable for determining the income-tax payable in

respect of the total income of a person, being an individual or Hindu undivided

family or association of persons [other than a co-operative society], or body of

individuals, whether incorporated or not, or an artificial juridical person referred to in

sub-clause (vii) of clause (31) of section 2:—

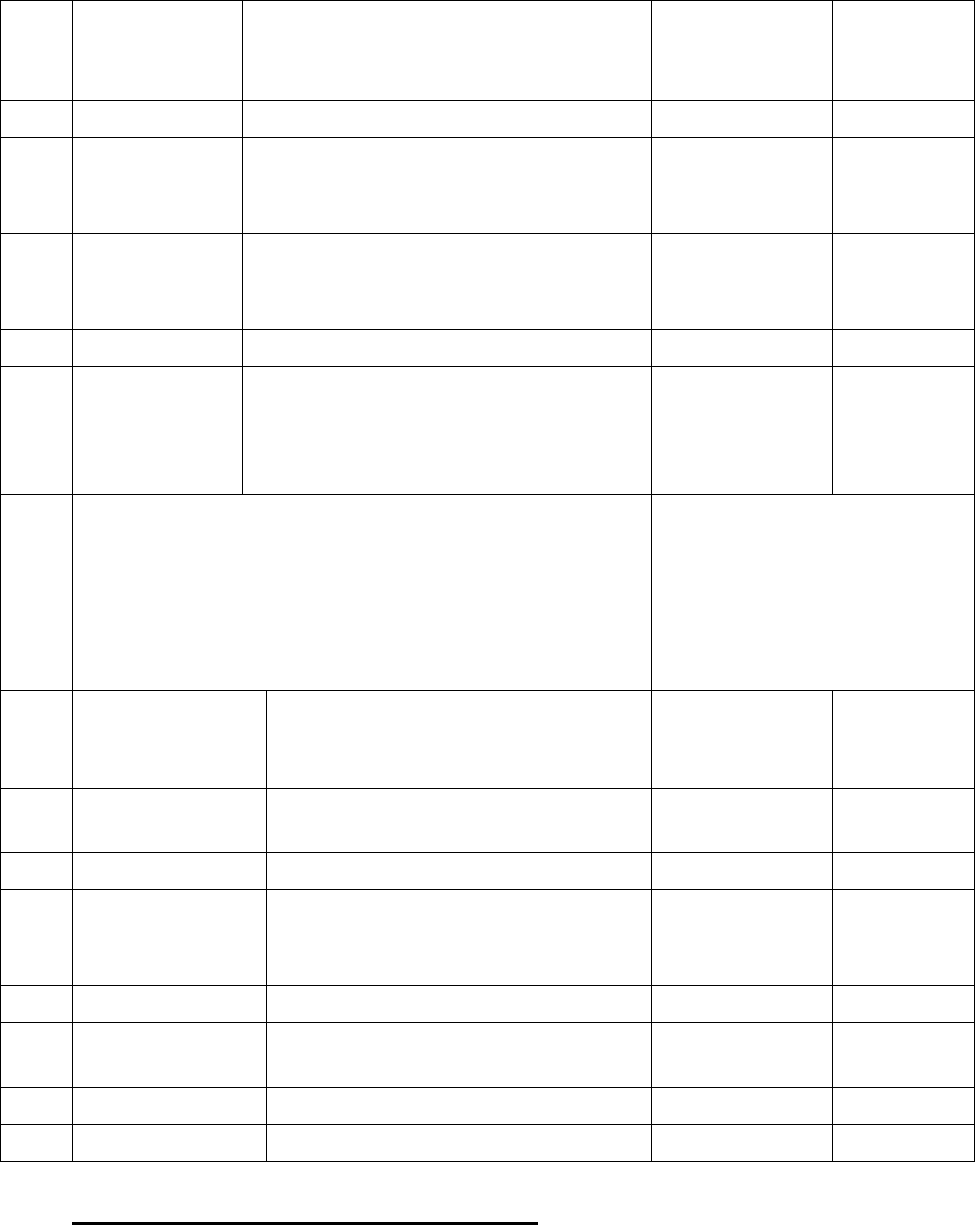

Sl. No.

Total income

Rate of tax

(1)

(2)

(3)

1.

Upto Rs. 3,00,000

Nil

2.

From Rs. 3,00,001 to Rs. 7,00,000

5%

3.

From Rs. 7,00,001 to Rs. 10,00,000

10%

4.

From Rs. 10,00,001 to Rs. 12,00,000

15%

5.

From Rs. 12,00,001 to Rs. 15,00,000

20%

6.

Above Rs. 15,00,000

30%

9

2. However, if such person exercises the option under sub-section (6) of section

115BAC of the Act, the rates as provided in Part III of the First Schedule shall be

applicable.

3. Paragraph A of Part-III of First Schedule to the Bill provides following rates of

income-tax:—

(i) The rates of income-tax in the case of every individual (other than those

mentioned in (ii) and (iii) below) or HUF or every association of persons or

body of individuals, whether incorporated or not, or every artificial juridical

person referred to in sub-clause (vii) of clause (31) of section 2 of the Act

(not being a case to which any other Paragraph of Part III applies) are as

under:—

Upto Rs. 2,50,000 Nil.

Rs. 2,50,001 to Rs.5,00,000 5%

Rs. 5,00,001 to Rs.10,00,000 20%

Above Rs. 10,00,000 30%

(ii) In the case of every individual, being a resident in India, who is of the age

of sixty years or more but less than eighty years at any time during the

previous year,—

Upto Rs. 3,00,000 Nil.

Rs. 3,00,001 to Rs. 5,00,000 5%

Rs. 5,00,001 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

10

(iii) in the case of every individual, being a resident in India, who is of the age

of eighty years or more at any time during the previous year,—

Upto Rs. 5,00,000 Nil.

Rs. 5,00,001 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

4. The amount of income-tax computed in accordance with the preceding

provisions of this Paragraph (including capital gains under section 111A, 112 and

112A), shall be increased by a surcharge at the rate of,—

(a) having a total income (including the income by way of dividend or income

under the provisions of sections 111A, 112 and 112A of the Act)

exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate

of 10% of such income-tax;

(b) having a total income (including the income by way of dividend or income

under the provisions of sections 111A, 112 and 112A of the Act)

exceeding one crore rupees, at the rate of 15% of such income-tax;

(c) having a total income (excluding the income by way of dividend or income

under the provisions of sections 111A, 112 and 112A of the Act)

exceeding two crore rupees but not exceeding five crore rupees, at the

rate of 25% of such income-tax;

(d) having a total income (excluding the income by way of dividend or income

under the provisions of sections 111A, 112 and 112A of the Act)

exceeding five crore rupees, at the rate of 37% of such income-tax;

(e) having a total income (including the income by way of dividend or income

under the provisions of section 111A, 112 and section 112A of the Act)

exceeding two crore rupees, but is not covered under clauses (c) and (d),

shall be applicable at the rate of 15% of such income-tax.

4.1 Provided that in case where the total income includes any income by way of

dividend or income chargeable under section 111A, section 112 and section 112A

11

of the Act, the rate of surcharge on the amount of income-tax computed in respect

of that part of income shall not exceed 15%.

4.2 Provided further that in case of an association of persons consisting of only

companies as its members, the rate of surcharge on the amount of income-tax shall

not exceed 15%.

4.3 Further, for person whose income is chargeable to tax under sub-section (1A)

of section115BAC of the Act, the surcharge at the rate 37% on the income or

aggregate of income of such person (excluding the income by way of dividend or

income under the provisions of sections 111A, 112 and 112A of the Act) exceeding

five crore rupees shall not be applicable. In such cases the surcharge shall be

restricted to 25%.

5. Marginal relief is provided in cases of surcharge.

B. Co-operative Societies

In the case of co-operative societies, the rates of income-tax have been

specified in Paragraph B of Part III of the First Schedule to the Bill. These rates will

continue to be the same as those specified for FY 2023-24. The amount of income-

tax shall be increased by a surcharge at the rate of 7% of such income-tax in case

the total income of a co-operative society exceeds one crore rupees but does not

exceed ten crore rupees. Surcharge at the rate of 12% of such income-tax shall

continue to be levied in case of a co-operative society having a total income

exceeding ten crore rupees.

2. Marginal relief is provided in cases of surcharge.

3. On satisfaction of certain conditions, a co-operative society resident in India

shall have the option to pay tax at 22% as per the provisions of section 115BAD.

Surcharge would be at 10% on such tax. Further, under section 115BAE of the Act, a

manufacturing co-operative society set up on or after 1.4.2023, which commenced

manufacturing or production on or before 31.3.2024 and does not avail of any

specified incentive or deductions, may opt to pay tax at a concessional rate of 15%

for assessment year 2024-25 onwards. Surcharge would be at 10% on such tax.

12

C. Firms

In the case of firms, the rate of income-tax has been specified in Paragraph C

of Part III of the First Schedule to the Bill. This rate will continue to be the same as

that specified for FY 2023-24. The amount of income-tax shall be increased by a

surcharge at the rate of 12% of such income-tax in case of a firm having a total

income exceeding one crore rupees. However, the total amount payable as income-

tax and surcharge on total income exceeding one crore rupees shall not exceed the

total amount payable as income-tax on a total income of one crore rupees by more

than the amount of income that exceeds one crore rupees.

D. Local authorities

The rate of income-tax in the case of every local authority has been specified

in Paragraph D of Part III of the First Schedule to the Bill. This rate will continue to

be the same as that specified for the FY 2023-24. The amount of income-tax shall

be increased by a surcharge at the rate of 12% of such income-tax in case of a

local authority having a total income exceeding one crore rupees. However, the

total amount payable as income-tax and surcharge on total income exceeding one

crore rupees shall not exceed the total amount payable as income-tax on a total

income of one crore rupees by more than the amount of income that exceeds one

crore rupees.

E. Companies

The rates of income-tax in the case of companies have been specified in

Paragraph E of Part III of the First Schedule to the Bill. In case of domestic

company, the rate of income-tax shall be 25% of the total income, if the total

turnover or gross receipts of the previous year 2022-23 does not exceed four

hundred crore rupees and where the companies continue in section 115BA regime.

In all other cases the rate of income-tax shall be 30% of the total income. However,

domestic companies also have an option to opt for taxation under section 115BAA

or section 115BAB of the Act on fulfillment of conditions contained therein. The tax

rate is 15% in section 115BAB and 22% in section 115BAA. Surcharge is 10% in

both cases.

13

2. In the case of a company other than a domestic company, it is proposed that

the rates of tax shall be reduced from 40% to 35%, on income other than income

chargeable at special rates, specified in respective sections of Chapter XII of the

Act.

3. Surcharge at the rate of 7% shall continue to be levied in case of a domestic

company (except those opting for taxation under section 115BAA and section

115BAB of the Act), if the total income of the domestic company exceeds one crore

rupees but does not exceed ten crore rupees. Surcharge at the rate of 12% shall

continue to be levied, if the total income of the domestic company (except those

opting for taxation under section 115BAA and section 115BAB of the Act) exceeds

ten crore rupees.

4. In case of companies other than domestic companies, the existing surcharge

of 2% shall continue to be levied, if the total income exceeds one crore rupees but

does not exceed ten crore rupees. Surcharge at the rate of 5% shall continue to be

levied, if the total income of the company other than domestic company exceeds

ten crore rupees.

5. It is proposed that the surcharge shall not apply on advance tax / tax

computed on income of specified fund (referred to in clause (c) of the Explanation

to clause (4D) of section 10) that is chargeable under clause (a) of sub-section (1)

of section 115AD of the Act.

6. Marginal relief is provided in surcharge in all cases.

7. In other cases [including sub-section (2A) of section 92CE, 115QA, 115R,

115TA or 115TD], the surcharge shall be levied at the rate of 12%

8. For FY 2024-25, additional surcharge called the “Health and Education Cess

on income-tax” shall be levied at the rate of 4% on the amount of tax computed,

inclusive of surcharge (wherever applicable), in all cases. No marginal relief shall

be available in respect of such cess.

[Clauses 2, 37 & the First Schedule]

Increase in Standard Deduction and deduction from family pension for tax-

payers in tax regime

The existing provision of clause (ia) of section 16 of the Act provides that a

14

deduction of fifty thousand rupees or the amount of the salary, whichever is less,

shall be made before computing the income under the head “Salaries”.

2. Further, the existing provision of clause (iia) of section 57 of the Act provides

that in the case of income in the nature of family pension, a deduction of a sum

equal to thirty-three and one-third per cent of such income or fifteen thousand

rupees, whichever is less, shall be made before computing the income chargeable

under the head "Income from other sources".

3. With the aim of encouraging and incentivizing taxpayers (specially the

salaried taxpayers) to shift to the new tax regime, it is proposed to insert a proviso

after clause (ia) of section 16 to provide that in a case where income-tax is

computed under clause (ii) of sub-section (1A) of section 115BAC of the Act, the

provisions of this clause shall have effect as if for the words “fifty thousand rupees”,

the words “seventy five thousand rupees” had been substituted.

4. It is also proposed to insert a proviso in clause (iia) of section 57 to provide

that in a case where income-tax is computed under clause (ii) of sub-section (1A) of

section 115BAC of the Act, the provisions of this clause shall have effect as if for

the words “fifteen thousand rupees”, the words “twenty five thousand rupees” had

been substituted.

5. These amendments will take effect from the 1st day of April, 2025, and will

accordingly apply to assessment year 2025-26 and subsequent assessment years.

[Clauses 10 & 24]

Increase in amount allowed as deduction to non-government employers and

their employees for employer contribution to a Pension Scheme referred in

section 80CCD

Section 36 of the Act pertains to other deductions allowed while computing

the income under the head ‘Profits and gains of business or profession’. Clause

(iva) of sub-section (1) of said section states that any sum paid by the assessee as

an employer by way of contribution towards a pension scheme, as referred to in

section 80CCD of the Act, on account of an employee, to the extent it does not

exceed ten per cent of the salary of the employee in the previous year, shall be

allowed as a deduction to the employer.

15

2. It is proposed to amend clause (iva) of sub-section (1) of section 36 of the

Act, to increase the amount of employer contribution allowed as deduction to the

employer, from the extent of 10% to the extent of 14% of the salary of the employee

in the previous year.

3. Section 80CCD deals with deduction in respect of contribution to pension

scheme of Central Government. Sub-section (2) of section 80CCD states that any

contribution by the Central Government or State Government or any other employer

to the account of an employee referred to in sub-section (1), shall be allowed as a

deduction as does not exceed ––

(a) 14% (where such contribution is made by the Central Government or State

Government); and

(b) 10% (where such contribution is made by any other employer)

of the employees’ salary in previous year.

4. It is proposed to amend sub-section (2) of section 80CCD of the Act, to

provide that where such contribution has been made by any other employer (not

being Central Government or State Government), the employee shall be allowed as

a deduction an amount not exceeding 14% of the employee’s salary. This is being

increased only in the case where the employee’s salary is chargeable to tax under

sub-section (1A) of section 115BAC of the Act.

5. The amendments will take from the 1st day of April, 2025 and will

accordingly apply from assessment year 2025-2026 onwards.

[Clauses 12 & 25]

B. MEASURES TO PROMOTE INVESTMENT AND EMPLOYMENT

Tax incentives to International Financial Services Centre

International Financial Services Centre (IFSC) is a jurisdiction that provides

financial services to non-residents and residents, to the extent permissible under

the current regulations, in any currency except Indian Rupee. In order to promote

the development of world-class financial infrastructure in India, several tax

concessions have been provided to units located in IFSC, under the Act, over the

past few years.

16

2. In order to further incentivize operations from IFSC, it is proposed to make

the following amendments:

(A) Item (I) of sub-clause (i) of clause (c) of Explanation to clause (4D) of

section 10, to be amended to expand the ambit of specified funds which

can claim exemption under the said section, to include retail funds and

Exchange Traded Funds in IFSC. Specified funds shall now include funds

established or incorporated in India in the form of a trust or a company or

a limited liability partnership or a body corporate, which have been

granted a certificate as a retail scheme or an Exchange Traded Fund and

are regulated under the International Financial Services Centres Authority

(Fund Management) Regulations, 2022, made under the International

Financial Services Centres Authority (IFSCA) Act, 2019 and satisfy such

conditions as may be prescribed.

(B) Specified income of Core Settlement Guarantee Funds set up by

recognised clearing corporations in IFSC, is proposed to be exempted by

amending the definition of “recognised clearing corporation” and

“regulations” in the Explanation to the clause (23EE) of section 10 of the

Act. The definition of “recognised clearing corporation” shall now include

recognised clearing corporation as defined in clause (n) of sub-regulation

(1) of regulation 2 of the IFSCA (Market Infrastructure Institutions)

Regulations, 2021 made under the IFSCA Act, 2019. The definition of

“regulations” shall now include the IFSCA (Market Infrastructure

Institutions) Regulations, 2021.

(C) Section 68 of the Act provides that where any sum is found to be credited

in the books of an assessee maintained for any previous year, and the

assessee offers no explanation about the nature and source thereof or the

explanation offered by him is not, in the opinion of the Assessing Officer,

satisfactory, the sum so credited may be charged to income-tax as the

income of the assessee of that previous year.

(i) Finance Act, 2023 amended the provisions of section 68 so as to

provide that the nature and source of any sum, whether in form of

loan or borrowing, or any other liability credited in the books of an

17

assessee shall be treated as explained only if the source of funds

is also explained in the hands of the creditor or entry provider.

However, this additional onus of proof of satisfactorily explaining

the source in the hands of the creditor, would not apply if the

creditor is a well regulated entity, i.e., it is a Venture Capital Fund

(VCF) or Venture Capital Company (VCC) registered with SEBI.

Section 68 accordingly makes a reference to the definition of

VCF/VCC in the Explanation to clause (23FB) of section 10.

(ii) It is now proposed to extend the relaxation in place for VCFs

registered with SEBI, to those VCFs which are regulated by IFSCA.

It is therefore, proposed to amend the definition of VCF in the

Explanation to clause (23FB) of section 10, to include VCFs in

IFSC.

(D) Section 94B of the Act puts in place a restriction on deduction of interest

expense in respect of any debt issued by a non-resident, being an

associated enterprise of the borrower. It applies to an Indian company, or

a permanent establishment of a foreign company in India, who is a

borrower. If such person incurs any expenditure by way of interest or of

similar nature exceeding one crore rupees which is deductible in

computing income chargeable under the head "Profits and gains of

business or profession", the interest deductible shall be restricted to the

extent of thirty per cent. of its earnings before interest, taxes, depreciation

and amortisation so as to avoid thin capitalisation of a corporate entity. At

present, the provisions of this section do not apply to Indian companies or

permanent establishments of foreign companies which are engaged in the

business of banking or insurance or such class of non-banking financial

companies as may be notified by the Central Government. It is now

proposed that the provisions of this section shall not apply to finance

companies, located in IFSC, as defined in clause (e) of sub-regulation (1)

of regulation 2 of the IFSCA (Finance Company) Regulations, 2021 made

under the IFSCA Act, 2019, which satisfy such conditions and carry on

such activities as may be prescribed.

18

3. These amendments will take effect from the 1st day of April, 2025 and will,

accordingly, apply in relation to the assessment year 2025-26 and subsequent

assessment years.

[Clauses 4 & 28]

Amendment of Section 56 of the Act

Section 56 of the Act is related to Income from other sources.

2. Vide Finance Act, 2012, a new clause (viib) was inserted in sub-section (2) of

section 56 to provide that where a company, not being a company in which the

public are substantially interested, receives, in any previous year, from any person

being a resident, any consideration for issue of shares, if the consideration received

for issue of shares exceeds the face value of such shares, the aggregate

consideration received for such shares exceeding such fair market value shall be

chargeable to income tax under the head “Income from other sources”.

3. It has been decided by the Government to sun-set the provisions of clause

(viib) of sub-section (2) of section 56 of the Act. Consequent to said decision,

amendment to clause (viib) of sub-section (2) of section 56 of the Act is being carried

out to provide that the provisions of this clause shall not apply from the assessment

year 2025-26.

4. This amendment is proposed to be made effective from the 1st day of April,

2025, and shall accordingly apply from assessment year 2025-26.

[Clause 23]

Promotion of domestic cruise ship operations by non-residents

Certain amendments have been proposed to promote the cruise-shipping

industry in India. The aim is to make India an attractive cruise tourism destination,

to attract global tourists to cruise shipping in India and to popularise cruise shipping

with Indian tourists. Participation of international cruise-ship operators in this sector

will encourage development of this sector and enable access to international best

practices.

2. In order to provide clarity, certainty and simple structure for the business of

cruise-shipping, which may be operating as multi-layer entities, the following is

19

proposed. A presumptive taxation regime is being put in place for a non-resident,

engaged in the business of operation of cruise ships, alongwith exemption to

income of a foreign company from lease rentals, if such foreign company and the

non-resident cruise ship operator have the same holding company.

3. It is, therefore, proposed to insert a new section 44BBC, which deems twenty

per cent of the aggregate amount received/ receivable by, or paid/ payable to, the

non-resident cruise-ship operator, on account of the carriage of passengers, as

profits and gains of such cruise-ship operator from this business. Applicability of this

section, will be subject to prescribed conditions.

4. Provisions of section 44B relating to presumptive taxation for shipping

business of non-residents, shall therefore, no longer apply to cruise-ship business.

5. Further, the lease rentals paid by a company which opts for presumptive

regime under section 44BBC (‘the first company’), shall be exempt in the hands of

the recipient company, if such company is a foreign company and such recipient

company and the first company are subsidiaries of the same holding company. This

is proposed to be done by insertion of a new clause (15B) in section 10. Subsidiary

company and holding company have been defined in the Explanation to this new

clause. This exemption shall be available upto assessment year 2030-31.

6. These amendments will take effect from the 1st day of April, 2025 and will,

accordingly, apply in relation to the assessment year 2025-26 and subsequent

assessment years.

[Clauses 4, 16 & 17]

C. SIMPLIFICATION AND RATIONALISATION

Introduction of block assessment provisions in cases of search under section

132 and requisition under section 132A

Vide Finance Act, 2021 the provisions of section 153A and section 153C of

the Act were amended to provide that the said provision shall only apply to search

and seizure proceedings under section 132 or requisition under section 132A of the

Act initiated on or before 31.03.2021. The separate regime for search assessments

20

was abolished and such assessments were subsumed into the reassessment

provisions. Further, sections 147, 148, 149, 151 and 151A of the Act were also

amended to provide that in case of search, survey or requisition initiated or

conducted on or after the 1st April, 2021, it shall be deemed that the Assessing

Officer (AO) has information which suggests that the income chargeable to tax has

escaped assessment in the case of the assessee for the three assessment years

immediately preceding the assessment year relevant to the previous year in which

the search is initiated or requisition is made or any material is seized or

requisitioned. Further, if the AO has information which suggests that the income

escaping assessment, represented in the form of asset, amounts to or is likely to

amount to fifty lakh rupees or more, notice under section 148 can be issued if ten

years have not elapsed from the end of the relevant assessment year.

2. Searches conducted by the Income-tax Department are important means for

unearthing black money. However, it has been gathered from the field formations

that there are multiple problems that are arising under the present scheme of

search assessment under section 148 of the Act. The absence of any legal

requirement for consolidated assessments in search cases has led to a situation

where every year only the time-barring year is reopened in the case of the searched

assessee. This results in staggered search assessments for the same search and

consequentially, the searched assessee may be engaged in the search assessment

process for almost up to ten years. This is time-consuming process which escalates

the litigation cost for the taxpayer as well as for the department. For the duration of

such period, legal position on an issue may undergo change, leading to different

additions in different years, on the same issue. Moreover, since such a long

duration is involved, there is a possibility of change of opinion with respect to the

line of enquiry. Further, due to such staggered assessments, coordinated

investigation is not feasible in search cases.

3. In order to make the procedure of assessment of search cases cost-

effective, efficient and meaningful, it is proposed to introduce the scheme of block

assessment for the cases in which search under section 132 or requisition under

section 132A has been initiated or made. The main objectives for the introduction of

this scheme are early finalization of search assessments, coordinated investigation

during search assessments and reduction in multiplicity of proceedings.

21

3.1 It is proposed to amend the provisions of Chapter XIV-B of the Act, to

provide the following for assessment of search cases:

(i) Where on or after the 1st day of September, 2024, a search is initiated under

section 132, or books of account, other documents or any assets are

requisitioned under section 132A, in the case of any person, the Assessing

Officer shall proceed to assess or reassess the total income of such person

in accordance with the provisions of the said Chapter.

(ii) The ‘block period’ shall consist of previous years relevant to six assessment

years preceding the previous year in which the search was initiated under

section 132 or any requisition was made under section 132A and shall

include the period starting from the 1st of April of the previous year in which

search was initiated or requisition was made and ending on the date of the

execution of the last of the authorisations for such search or date of such

requisition.

(iii) Regular assessments for the block period shall abate. There will be one

consolidated assessment for the block period. Till block assessment is

complete, no further assessment/reassessment proceeding shall take place

in respect of the period covered in the block.

(iv) The Assessing Officer shall assess the ‘total income’ of the assessee,

including the undisclosed income which shall include any money, bullion,

jewellery or other valuable article or thing or any expenditure or any income

based on any entry in the books of account or other documents or

transactions, where such money, bullion, jewellery, valuable article, thing,

entry in the books of account or other document or transaction represents

wholly or partly income or property which has not been or would not have

been disclosed for the purposes of this Act, or any expense, deduction or

allowance claimed under this Act which is found to be incorrect.

(v) The undisclosed income falling within the block period, forming part of the

total income, shall be computed in accordance with the provisions of this Act,

on the basis of evidence found as a result of search or survey in

consequence of such search or requisition of books of account or other

documents and such other materials or information as are either available

22

with the Assessing Officer or come to his notice by any means during the

course of proceedings under the said Chapter.

(vi) The assessment in respect of any other person shall be governed by the

provisions of section 158BD, which provides that where the Assessing

Officer is satisfied that any undisclosed income belongs to or pertains to or

relates to any person, other than the person with respect to whom search

was made or whose books of account or other documents or any assets

were requisitioned, then, any money, bullion, jewellery or other valuable

article or thing, or assets, or expenditure, or books of account, other

documents, or any information contained therein, seized or requisitioned

shall be handed over to the Assessing Officer having jurisdiction over such

other person and that Assessing Officer shall proceed under section 158BC

against such other person and the provisions of the said Chapter shall apply

accordingly.

(vii) The tax shall be charged at sixty per cent for the block period, as per

section 113 of the Act. The proviso to section 113 has been amended to

provide that the tax chargeable under this section shall be increased by a

surcharge, if any, which may be levied by any Central Act. However,

presently, no surcharge is proposed for income chargeable to tax for the

block period. No interest under the provisions of section 234A, 234B or 234C

or penalty under the provisions of section 270A shall be levied or imposed

upon the assessee in respect of the undisclosed income assessed or

reassessed for the block period.

(viii) Penalty on the undisclosed income of the block period as determined

by the Assessing officer shall be levied at fifty per cent of the tax payable on

such income. No such penalty shall be levied if the assessee offers

undisclosed income in the return furnished in pursuance of search and pays

the tax along with the return.

(ix) The time-limit for completion of block assessment of the searched assessee

shall be twelve months from the end of the month in which the last of the

authorisations for search under section 132, or requisition under section

132A, was executed or made. The time-limit for completion of block

23

assessment of any other person shall be twelve months from the end of the

month in which the notice under section 158BC in pursuance of section

158BD, was issued to such other person. However, an exclusion of nearly

six months shall be available in respect of period from date of search to the

date of handing over of seized material to the Assessing Officer.

(x) Where any evidence found as a result of search or requisition relates to any

international transaction or specified domestic transaction referred to in

section 92CA, pertaining to the period beginning from the 1st day of April of

the previous year in which last of the authorisations was executed and

ending with the date on which last of the authorisations was executed, such

evidence shall not be considered for the purposes of determining the total

income of the block period and such income shall be considered in the

assessment made under the other provisions of this Act.

(xi) The notice under clause (a) of sub-section (1) of section 158BC requiring the

searched assessee to furnish his return of income for the block period, as

well as the order of assessment for the block period shall be issued or

passed, as the case may be, with the previous approval of the Additional

Commissioner or the Additional Director or the Joint Commissioner or the

Joint Director.

(xii) The provisions of section 144C of the Act shall not apply to any

proceeding under the said Chapter.

4. This amendment will take effect from the 1st day of September, 2024.

[Clauses 32, 43, 49, 76 & 85]

Rationalisation of provisions relating to assessment and reassessment under

the Act

The Finance Act, 2021 amended the procedure for assessment or

reassessment of income in the Act with effect from the 1st April, 2021. The said

amendment modified, inter alia, section 148, section 149 and also introduced a new

section 148A in the Act.

24

2. The existing provisions of section 148 of the Act provide the procedure for

issuance of notice to initiate assessment or reassessment or recomputation under

section 147 of the Act. The existing provisions of the said section also provide details

of what constitutes ‘information’ for the purposes of issuance of notice. The said

section further provides the instances in which the Assessing Officer (AO) would be

deemed to have information in order to initiate the assessment or reassessment

proceedings.

3. The existing provisions of section 148A of the Act provide the procedure to be

followed by AO before issuance of notice under section 148 of the Act, including

conducting inquiry, providing an opportunity of being heard to the assessee, and

passing an order prior to reopening of a case. The said section also provides the

circumstances in which such procedure does not apply.

4. Further, the existing provisions of section 149 of the Act provide the time limits

for issuance of notice under section 148 and computation of the period of limitation

under various circumstances. Furthermore, the existing provisions of section 151 of

the Act mandates to obtain sanction from the specified authority, for issuance of

notice under section 148 or section 148A of the Act.

5. In this regard, multiple suggestions have been received regarding the

considerable litigation at various fora arising from the multiple interpretations of the

provisions of aforementioned sections. Further, representations have been received

to reduce the time-limit for issuance of notice for the relevant assessment year in

proceedings of assessment, reassessment or recomputation.

6. Hence, it is proposed to rationalize the aforementioned reassessment

provisions. It is expected that the new system would provide ease of doing business

to taxpayers as there is a reduction in time limit by which a notice for assessment or

reassessment or re-computation can be issued. The salient features of the proposed

amendments are as follows:-

(i) It is proposed to substitute section 148 of the Act so as to provide that before

making the assessment, reassessment or recomputation under section 147

and subject to the provisions of section 148A, the Assessing Officer shall

issue a notice to the assessee, along with a copy of the order passed under

sub-section (3) of section 148A determining it to be a fit case, requiring him to

25

furnish within such period as may be specified, not exceeding a period of

three months from the end of the month in which such notice is issued, a

return of his income or the income of any other person in respect of whom he

is assessable under this Act. Further, it is proposed to provide that no notice

under this section shall be issued unless there is information with the

Assessing Officer which suggests that the income chargeable to tax has

escaped assessment in the case of the assessee for the relevant assessment

year.

Any information in the case of the assessee emanating from survey

conducted under section 133A, other than under sub-section (2A) of the said

section, on or after the 1st day of September, 2024, is proposed to be added

to the definition of ‘information’ with the Assessing Officer which suggests that

the income chargeable to tax has escaped assessment.

It is further proposed to provide that where the Assessing Officer has

received information under the scheme notified under section 135A, no notice

under section 148 shall be issued without prior approval of the specified

authority.

(ii) It is further proposed to substitute the section 148A so as to provide that

where the Assessing Officer has information which suggests that income

chargeable to tax has escaped assessment in the case of an assessee for the

relevant assessment year, he shall, before issuing any notice under section

148, provide an opportunity of being heard to such assessee, by serving upon

him a notice to show cause as to why a notice under section 148 should not

be issued in his case, and such notice shall be accompanied by the

information which suggests that income chargeable to tax has escaped

assessment in his case for the relevant assessment year. Thereafter, on

receipt of notice under sub-section (1), the assessee may furnish his reply,

within such time, as may be specified in such notice.

The Assessing Officer shall, on the basis of material available on

record and taking into account the reply of the assessee furnished under sub-

section (2), if any, pass an order with the prior approval of the specified

authority under sub-section (3) of section 148A, determining whether or not it

is a fit case to issue notice under section 148.

26

It is further proposed that the provisions of this section shall not apply

in the case of an assessee where the Assessing Officer has received

information under the scheme notified under section 135A pertaining to

income chargeable to tax escaping assessment for any assessment year in

his case.

(iii) The time limitation for issuance of notice under section 148A and section 148

of the Act is proposed to be provided in section 149 of the Act as follows:

in normal cases, no notice under sections 148A shall be issued if three

years have elapsed from the end of the relevant assessment year.

Notice beyond the period of three years from the end of the relevant

assessment year can be taken only in a few specific cases;

in normal cases, no notice under section 148 shall be issued if three

years and three months have elapsed from the end of the relevant

assessment year. Notice beyond the period of three years and three

months from the end of the relevant assessment year can be taken

only in a few specific cases;

in specific cases, where as per the information with the Assessing

Officer, the income escaping assessment amounts to or is likely to

amount to fifty lakh rupees or more, notice under section 148A can be

issued beyond the period of three years but not beyond the period of

five years from the end of the relevant assessment year;

in specific cases, where the Assessing Officer has in his possession

books of account or other documents or evidence related to any asset

or expenditure or transaction or entry (or entries) which reveal that the

income chargeable to tax, which has escaped assessment amounts to

or is likely to amount to fifty lakh rupees or more, notice under section

148 can be issued beyond the period of three years and three months

but not beyond the period of five years and three months from the end

of the relevant assessment year.

(iv) It is proposed to substitute the section 151 so as to provide that specified

authority for the purposes of sections 148 and 148A shall be the Additional

Commissioner or the Additional Director or the Joint Commissioner or the

Joint Director.

27

(v) It is proposed to amend the section 152 of the Act so as to provide that where

a search has been initiated under section 132 or requisition is made under

section 132A or a survey is conducted under section 133A [other than under

sub-section (2A)] on or after the 1st day of April, 2021 but before the 1st day

of September, 2024, the provisions of section 147 to 151 shall apply as they

stood immediately before the commencement of the Finance (No. 2) Act,

2024.

(vi) It is also proposed to amend the section 152 of the Act so as to provide that

where a notice under section 148 has been issued or an order under clause

(d) of section 148A has been passed, prior to the 1st day of September, 2024,

the assessment, reassessment or recomputation in such case shall be

governed as per the provisions of sections 147 to 151, as they stood prior to

their amendment by Finance (No. 2) Act, 2024.

7. This amendment will take effect from the 1st day of September, 2024.

[Clauses 44, 45, 46 & 47]

Rationalisation of provisions relating to period of limitation for imposing

penalties

Section 275 of the Act provides for the period of limitation for imposing

penalties. Sub-section (1) of the said section, inter-alia, states that no order imposing

a penalty shall be made in a case where the relevant assessment order or other

order is the subject-matter of an appeal before the Joint Commissioner (Appeals) or

the Commissioner (Appeals) under section 246 or section 246A, respectively, or

before the Appellate Tribunal (ITAT) under section 253, after the expiry of the

financial year in which the proceedings, in the course of which action for the

imposition of penalty has been initiated, are completed, or six months from the end

of the month in which the order of the JCIT(A) or the CIT(A) or, as the case may be,

the Appellate Tribunal is received by the Principal Chief Commissioner or Chief

Commissioner or Principal Commissioner or Commissioner, whichever period

expires later. Similarly, at three other places in the said section, for the purposes of

limitation, the date of receipt of order passed by appellate authority is given as, ‘date

of receipt of order in the office of Principal Chief Commissioner or Chief

Commissioner or Principal Commissioner or Commissioner’.

28

2. Suggestions have been received from the field formations that the reference

to the office of Principal Chief Commissioner of Income-tax, Chief Commissioner of

Income-tax and Principal Commissioner of Income-tax poses ambiguity for the

purposes of calculation of the number of days for imposition of penalties as a

consequence of the orders referred to in the said section. Therefore, it is proposed to

amend section 275 of the Act to omit the reference to the date of receipt of order by

the Principal Chief Commissioner or Chief Commissioner.

3. This amendment will take effect from the 1st day of October, 2024.

[Clause 83]

Amendment in provisions relating to set off and withholding of refunds

Section 245 of the Act relates to set off and withholding of refund in certain

cases. The Finance Act, 2023 has integrated section 241A and section 245 (as they

existed prior to their amendment) into a single provision of section 245 of the Act.

Presently, section 245 of the Act empowers the Assessing Officer (AO) to adjust the

refund (or a part of the refund) against any tax demand that is outstanding from the

taxpayer. Further, where refund becomes due to a person but the assessment or

reassessment proceeding is pending in his case, then, the Assessing Officer may,

with the approval of the Principal Commissioner of Income-tax or Commissioner of

Income-tax, withhold the refund till the date on which such assessment or

reassessment is completed. Moreover, no additional interest on refund under section

244A of the Act is payable to the assessee for the period beginning from the date on

which such refund is withheld and ending with the date on which

assessment/reassessment is made.

2. Sub-section (2) of section 245 of the Act provides that where a part of the

refund is set off under the provisions of sub-section (1), or where no such amount is

set off, and refund becomes due to a person and the Assessing Officer having

regard to the fact that proceedings for assessment or re-assessment are pending in

the case of such person, is of the opinion that the grant of refund is likely to

adversely affect the revenue, he may, for reasons to be recorded in writing and with

the previous approval of the Principal Commissioner of Income-tax or Commissioner

of Income-tax, withhold the refund up to the date on which such assessment or

reassessment is made.

29

3. From the bare reading of the provision, it is seen that there are two

requirements which the Assessing Officer is supposed to fulfill. One is that he should

form opinion that the grant of refund is likely to adversely affect the revenue and the

second is that he has to record the reasons in writing for withholding the refund. The

second condition of recording of reasons takes care of the first condition as even if

an opinion is formed, it has been expressed in terms of reasons recorded in writing.

Thus, for the phrase “is of the opinion that the grant of refund is likely to adversely

affect the revenue”, the phrase “he may, for reasons to be recorded in writing and

with the previous approval of the Principal Commissioner of Income-tax or

Commissioner of Income-tax” is proposed to be retained. Further, the period of

withholding the refund ‘up to the date of assessment’ is inadequate as the demand

itself becomes due after thirty days of the date of assessment. Hence, the period of

withholding of the refund is proposed to be extended up to sixty days from the date

on which such assessment or reassessment is made.

4. Consequential amendment is also required in section 244A of the Act to allow

non-payment of additional interest up to the date till which such refund is withheld

under the provisions of sub-section (2) of section 245 of the Act.

5. This amendment will take effect from the 1st day of October, 2024.

[Clause 72 & 73]

Rationalisation of the time-limit for filing appeals to the Income Tax Appellate

Tribunal

Section 253 of the Act lays down the provisions for filing an appeal with the

Income Tax Appellate Tribunal (ITAT) against an order passed by the Joint

Commissioner of Income-tax (Appeals), Commissioner of Income-tax (Appeals)

[CIT(Appeals)], the Principal Chief Commissioner of Income-tax, the Chief

Commissioner of Income-tax, the Principal Commissioner of Income-tax, or the

Commissioner of Income-tax. The ITAT is the second appellate authority in the

income-tax appellate hierarchy.

2. The sub-section (1) of the said section details the types of orders passed

under various sections of the Act against which an aggrieved assessee may appeal

to the Appellate Tribunal. Clause (a) of the said sub-section provides that any

assessee aggrieved by any order passed by a Deputy Commissioner (Appeals)

before the 1st day of October, 1998 or, as the case may be, a Commissioner

30

(Appeals) under section 154, section 250, section 270A, section 271, section 271A,

section 271AAB, section 271AAC, section 271AAD, section 271J or section 272A

may appeal to the Appellate Tribunal.

2.1 Section 158BFA of the Act is an interest and penalty provision under Chapter

XIV-B of the Act for imposition of penalty on undisclosed income for the block period

in a case where search has been initiated under section 132 of the Act. However, as

the reference to the same has not been inserted in sub-section (1) of section 253 of

the Act, an aggrieved assessee cannot appeal against such penalty orders passed

by Commissioner (Appeals). Accordingly, it is proposed to amend clause (a) of sub-

section (1) of section 253 to include the reference of section 158BFA therein

3. As per the provisions of sub-section (3) of the said section, appeals to the

ITAT are to be filed ‘within sixty days of the date on which the order sought to be

appealed against is communicated to the assessee or to the PCIT/CIT, as the case

may be’. Appeals to the ITAT are generated mainly by orders passed by the CIT

(Appeals), which is now through ITBA. In the new Faceless Appeal dispensation, the

CIT (Appeals) upload the orders on a day-to-day basis rather than the erstwhile

practice of sending a monthly/fortnightly ‘bunch’ of orders to the jurisdictional PCIT.

Such an upload amounts to electronic communication to the PCIT. This, in turn,

means that the limitation for filing appeal to the ITAT would fall on a daily basis

making it difficult for the PCIT and the Assessing Officer to track the same.

4. In view of the foregoing, it is proposed to amend sub-section (3) of section

253 to provide that the appeal before the ITAT may be filed within two months from

the end of the month in which the order sought to be appealed against is

communicated to the assessee or to the Principal Commissioner or Commissioner,

as the case may be.

5. This amendment will take effect from the 1st day of October, 2024.

[Clause 78]

Rationalisation of the provisions of Charitable Trusts and Institutions

I. Merger of trusts under first regime with second regime

The Act puts in place two main regimes for trusts or funds or institutions to

claim exemption. The first is contained in the provisions of sub-clause(s) (iv), (v), (vi)

or (via) of clause (23C) of section 10. The second is contained in the provisions of

31

sections 11 to 13 of the Act. The provisions of the respective regimes lay down the

procedure for filing application for approval/ registration, the conditions subject to

which such approval/ registration shall be granted or can be withdrawn etc.

2. As both the regimes intend to grant similar benefit, the procedure and

conditions across the two regimes have been aligned, over the last few years, vide

successive Finance Acts.

3. In order to take forward the process of simplification of procedures and to

reduce administrative burden, it is proposed that the first regime be sunset and

trusts, funds or institutions be transited to the second regime in a gradual manner.

4. It is, therefore, proposed that:

Applications seeking approval or provisional approval under sub-clauses (iv),

(v), (vi) or (via) of clause (23C) of section 10, and filed on or after 1st October,

2024, shall not be considered.

Applications filed under these sub-clauses before 1st October, 2024, and

which are pending would be processed and considered under the extant

provisions of the first regime itself.

Approved trusts, funds or institutions would continue to get the benefit of

exemption, as per the provisions of sub-clauses (iv), (v), (vi) or (via) of clause

(23C) of section 10, till the validity of the said approval.

They would be eligible to apply for registration, subsequently, under the

second regime. Amendments have accordingly been proposed in section 12A.

Certain eligible modes of investment, under the first regime (viz. those

specified in clause (b) of third proviso to clause (23C) of section 10) shall be

protected in the second regime, by way of amendment in section 13.

5. These amendments will take effect from the 1st day of October, 2024.

[Clauses 4, 6 & 9]

II. Condonation of delay in filing application for registration by trusts or

institutions

A trust or institution desirous of seeking registration under section 12AB is

inter alia required to apply within timelines specified in clause (ac) of sub-section (1)

of section 12A.

32

2. It has been noted that at times trusts or institutions are unable to file

application within specified timelines. In case a trust or institution is unable to apply

within time specified, it may become liable to tax on accreted income as per

provisions of Chapter XII-EB of the Act. A situation of permanent exit of trust or

institution from the exemption regime may also arise.

3. It is proposed that the Principal Commissioner/ Commissioner may be

enabled to condone the delay in filing application and treat such application as filed

within time. The delay may be condoned if he considers that there is a reasonable

cause for the same.

4. These amendments will take effect from the 1st day of October, 2024.

[Clause 6]

III. Rationalisation of timelines for funds or institutions to file applications

seeking approval under section 80G

Section 80G of the Act, inter alia, provides for the grant of approval to certain

funds or institutions for receiving donation. Deduction is available for donations to

approved funds or institutions, in the hands of the assessee making such donations.

2. The first proviso to sub-section (5) of section 80G provides timelines for filing

application for approval, for funds or institutions referred to in sub-clause (iv) of

clause (a) of sub-section (2) of section 80G. The second proviso lays down the

procedure for processing the same. It has been noted that at times funds or

institutions are unable to file application within specified timelines. A situation of

unintended permanent exit of fund or institution from section 80G approval may also

arise.

3. It is proposed to amend the first and second provisos to rationalise the

timelines for filing applications for approval.

4. These amendments will take effect from the 1st day of October, 2024.

[Clause 26]

IV. Rationalisation of timelines for disposing applications made by trusts or

funds or institutions, seeking registration for exemption under section 12AB or

approval under section 80G

Applications seeking registration under section 12AB, filed by trusts or

institutions, are required to be processed by the Principal Commissioner or

33

Commissioner within a period of six months from the end of the month in which the

application was received.

2. Similarly, the applications of funds or institutions referred to in sub-clause (iv)

of clause (a) of sub-section (2) of section 80G, seeking approval are required to be

processed by the Principal Commissioner or Commissioner within a period of six

months from the end of the month in which the application was received.

3. For better administration and monitoring, it is proposed to rationalise timelines

for disposing applications made by trusts or funds or institutions to six months from

the end of the quarter in which the application was received.

4. Thus, where provisionally registered/ approved trusts or funds or institutions

apply for registration/ approval or where registered/ approved trusts or funds or

institutions apply for further registration/ approval under section 12AB or section

80G, as the case may be, the order granting registration/ rejecting application shall

be passed before expiry of the period of six months from the end of the quarter in

which the application was received.

5. These amendments will take effect from the 1st day of October, 2024.

[Clauses 7 & 26]

V. Merger of trusts under the exemption regime with other trusts

When a trust or institution which is approved / registered under the first or

second regime, as the case may be merges with another approved / registered entity

under either regime, it may attract the provisions of Chapter XII-EB, relating to tax on

accreted income in certain circumstances.

2. It is proposed that conditions under which the said merger shall not attract

provisions of Chapter XII-EB, may be prescribed, to provide greater clarity and

certainty to taxpayers. A new section 12AC is proposed to be inserted for this

purpose.

3. These amendments will take effect from the 1st day of April, 2025.

[Clause 8]

VI. Inclusion of reference of clause (23EA), clause (23ED) and clause (46B) of

section 10 in sub-section (7) of section 11

Sub-section (7) of section 11 of the Act lays down that registration under

section 12AB shall become inoperative, if the trust or institution is approved / notified

34

under clause (23C), (23EC), (46) or (46A) of section 10. Such trust or institution has

a one-time option to apply to make its registration under section 12AB operative.

Thus, a trust or institution may choose the provisions under which it seeks to claim

exemption.

2. It is proposed to amend sub-section (7) of section 11 of the Act to include

reference of clause (23EA), clause (23ED) and clause (46B) of section 10 of the Act,

to enable trusts under the second regime to claim exemption under the above-noted

specific clauses of section 10.

3. These amendments will take effect from the 1st day of April, 2025.

[Clause 5]

Rationalisation and Simplification of taxation of Capital Gains

The taxation of capital gains is proposed to be rationalized and simplified.

There are three components to this simplification. Firstly, it is proposed that there will

only be two holding periods, 12 months and 24 months, for determining whether the

capital gains is short-term capital gains or long term capital gains. For all listed

securities, the holding period is proposed to be 12 months and for all other assets, it

shall be 24 months. Accordingly, amendment is proposed in clause (42A) of section

2 of the Act. Thus units of listed business trust will now be at par with listed equity

shares at 12 months instead of earlier 36 months. The holding period for bonds,

debentures, gold will reduce from 36 months to 24 months. For unlisted shares and

immovable property it shall remain at 24 months.

2. Secondly, the rate for short-term capital gain under provisions of section 111A

of the Act on STT paid equity shares, units of equity oriented mutual fund and unit of

a business trust is proposed to be increased to 20% from the present rate of 15% as

the present rate is too low and the benefit from such low rate is flowing largely to

high net worth individuals. Other short-term capital gains shall continue to be taxed

at applicable rate.

2.1 The rate of long-term capital gains under provisions of various sections of the

Act is proposed to be 12.5% in respect of all category of assets. This rate earlier was

10% for STT paid listed equity shares, units of equity-oriented fund and business

trust under section 112A and for other assets it was 20% with indexation under

35

section 112. However, an exemption of gains upto 1.25 lakh (aggregate) is proposed

for long-term capital gains under section 112A on STT paid equity shares, units of

equity oriented fund and business trust, thus, increasing the previously available

exemption which was upto 1 lakh of income from long term capital gains on such

assets. For bonds and debentures, rate for taxation of long-term capital gains was

20% without indexation. For listed bonds and debentures, the rate shall be reduced

to 12.5%. Unlisted debentures and unlisted bonds are of the nature of debt

instruments and therefore any capital gains on them should be taxed at applicable

rate, whether short-term or long-term. It is proposed accordingly.

2.2 Thus, unlisted debentures and unlisted bonds are proposed to be brought to

tax at applicable rates by including them under provisions of section 50AA of the Act.

This amendment in section 50AA shall come into effect from the 23rd day of July,

2024.

3. Thirdly, simultaneously with rationalisation of rate to 12.5%, indexation

available under second proviso to section 48 is proposed to be removed for

calculation of any long-term capital gains which is presently available for property,

gold and other unlisted assets. This will ease computation of capital gains for the

taxpayer and the tax administration.

4. Parity in taxation between resident and non-resident assesses: To bring parity

of taxation between residents and non-residents, corresponding amendments to

section 115AD, 115AB, 115AC, 115ACA and 115E are being made to align the rates

of taxation in respect of long-term capital gains proposed under section 112A and

112 and rates of short term capital gains proposed under section 111A.

5. Further, consequential amendments to align the withholding tax provisions

with the substantive provisions to give effect to the proposed changes in rates of

capital gains tax are being made under section 196B and 196C.

6. These proposals are proposed to be given effect immediately i.e. with effect

from the 23rd of July, 2024.

[Clauses 3, 20, 21, 29, 30, 31, 33, 34, 35, 36, 38, 63 & 64]

Amendment to definition of Specified Mutual Fund under section 50AA

The Finance Act, 2023 had introduced special taxation regime of deemed short term

capital gains taxation for Market Linked Debentures and Specified Mutual Funds by

36

way of introduction of section 50AA of the Act. The gains in such cases were to be

taxed as Short-term Capital Gain irrespective of period of holding. The requirement

of investment of not more than 35% in equity shares has also impacted other funds

which are not debt-oriented funds, but invest below 35% in equity shares. Such

funds which are adversely impacted include Exchange Traded Funds (ETFs), Gold

Mutual Funds and Gold ETFs. In the case of Fund-of-Funds (FoFs) as well, wherein

the underlying fund further invests in other instruments, there is ambiguity as to

whether they will be considered Specified Mutual Funds as defined in section 50AA.

Thus, a need to re-define the term “Specified Mutual Funds” for the purposes of

Section 50AA, to provide clarity regarding the proportion of investment being made

in terms of debt and money market instruments, and also to clarify the investment

requirements in the case of Fund-of-Funds (FoFs) had arisen. Representations from

multiple stakeholders were received seeking clarity and revision. It is thus proposed

to amend the definition of “Specified Mutual Fund” under clause (ii) of Explanation of

section 50AA to provide that a specified mutual fund shall mean a mutual fund:

(a) a Mutual Fund by whatever name called, which invests more than sixty five

per cent of its total proceeds in debt and money market instruments; or

(b) a fund which invests sixty five per cent or more of its total proceeds in units of

a fund referred to in sub-clause (a).

The above amendment under clause (ii) of Explanation of section 50AA is proposed

to be brought into effect from 1st day of April, 2026 and shall be applicable from AY

2026-27 onwards.

[Clause 21]

Rationalisation of Tax Deducted at Source rates

There are various provisions of Tax Deduction at Source (TDS) with different

thresholds and multiple rates between 0.1%, 1%, 2%, 5%, 10%, 20%, 30% and

above. To improve ease of doing business and better compliance by taxpayers, the

TDS rates are proposed to be reduced. However, no change would occur with

respect to sections such as TDS on salary, TDS on virtual digital assets, TDS on