A baseline study that will serve as a

benchmark for measurement of the

contributions of farmers’ markets across

Canada and an assessment of trends and

opportunities for growth

National Farmers’ Market

Impact Study 2009 Report

January 2009

National Farmers' Market Impact Study 2009 Report

2

National Farmers’

Market Impact Study

2009 Report

Prepared by:

Experience Renewal Solutions Inc.

With support from:

David J. Connell, PhD,

Assistant Professor, University of Northern British Columbia

Study contracted by: Farmers’ Markets Canada in July 2008

National Farmers' Market Impact Study 2009 Report

3

Acknowledgments

Farmers’ Markets Canada appreciates the support of the following contributors:

Agriculture and Agri-Food Canada

• Farmers’ Markets Canada acknowledges the vital contribution of the federal government, through Agriculture and Agri-Food Canada, in enabling the extensive

original research that underlies this report to be conducted and the report itself, in both official languages, to be produced.

• Agriculture and Agri-Food Canada is pleased to participate in the production of this report. AAFC is committed to working with our industry partners to increase

public awareness of the importance of the agriculture and agri-food industry to Canada. Opinions expressed in this document are those of the consulting firm,

Experience Renewal Solutions, and not necessarily of AAFC nor of Farmers’ Markets Canada and its members.

The Farmers’ Markets and their Managers

• Thank you to all 70 farmers’ markets that agreed to on-site observation and interviewing. The 70 market managers opened their markets to teams of anywhere

from two to six researchers for a full market day. Also, this report would not be possible without the support, understanding and contributions of 282 market

managers who responded to a long national survey. Your contributions are greatly appreciated

The Vendors

• Close to 500 vendors agreed to complete the farmers’ market vendors interview at various locations across Canada. Thank you to all the vendors who set aside

their daily duties to contribute their ideas, thoughts, insights and knowledge about the current condition of farmers’ markets in Canada

The Market Shoppers and Non-Users

• Over 4,400 consumers agreed to participate in the farmers’ market interview at various locations across Canada and on the web. Most of the consumers showed

a great attachment to their local market and were very willing to participate in the interview. Thank you to all of the consumers whose feedback and insights were

essential to the completion of this report

Economic Analyst

• Thanks to Dr. David Connell, of the University of Northern British Columbia, for your tireless and continuing efforts to understand and measure the community,

regional and national economic contributions of farmers’ markets

Farmers’ Markets Canada Board of Directors

• Thank you to the FMC Board of Directors. Their passion, knowledge, dedication and patience have aided in the successful completion of the project

National Farmers' Market Impact Study 2009 Report

4

Table of Contents

5

The State of Farmers’ Markets in Canada – Executive Summary

11

Introduction

77

Market Manager Insights

80

Economic Impacts

55

Vendor Profile

49

Non-User Insights

16

Market Customer Profile

12

Data Collection Methods

8

Fact Sheet – Farmers’ Markets Canada Insights

3

Acknowledgments

National Farmers' Market Impact Study 2009 Report

5

The State of Farmers’ Markets in Canada

Executive Summary 2009

• Farmers’ markets are a great success story for Canada, with strong consumer

and vendor support as evidenced by the growth in attendance and number of

markets. Success is built upon many factors including a desire to return to

healthier, fresher, locally produced products and a strong belief in the integrity

of shopping in the community

• The diversity of market types across the 508 national markets provides

consumers with a large number of alternatives when seeking community

shopping experiences and local products

• Markets offer a vast array of food and non-food items but clearly the largest

demand is for fresh fruits, vegetables and baked goods

• Most customers attend markets regularly and are strong supporters of the

farmers’ market industry. They are highly motivated to purchase fresh, in-

season produce in clean, simple surroundings

• Customer spending across the country is variable with an average daily spend

of approximately $32

• Customers feel a strong sense of community and local pride in attending

farmers’ markets. While the customer base of farmers’ markets parallels the

grocery-purchasing demographics of Canada, the market customer is

uniquely sensitive to the need to support local primary producers (62% feel

this is extremely important, 30% feel it is somewhat important)

• Current customers will increasingly look for more product selection and

convenience in locations, payment options and lifestyle amenities to ensure

their loyalty

National Farmers' Market Impact Study 2009 Report

6

The State of Farmers’ Markets in Canada

Executive Summary 2009

• Farmers’ market vendors are typically primary producers (79%) who achieve a

significant portion of their income from participation in the markets; they also

find a great deal of local support at markets and are attracted by the social

and communal nature of the market experience

• Market vendors are challenged to provide the selection of fresh products

required as primary producers while dealing with issues of labour shortages

and rising costs of production inputs - - they are also seeking extended hours

and days of operations for markets, as well as improved physical amenities

• In some markets there is a growing concern about the role of reseller vendors

who are threatening the economic viability of the primary producer vendor

• Vendors are looking for more support in marketing of their locations through

signage, advertising and website information and would like to attract new

vendors in desired local product categories to increase customer traffic

• Market managers are seeking to develop farmers’ markets business growth by

attracting and promoting more primary producers and increasing the

attractiveness and convenience of the market facilities

• Management and Association opportunities should focus on improving

marketing efforts and making the physical market presence an attractive and

more accessible venue

• Increasing pressures will occur from Health and Safety requirements, parking

needs for vendors and customers and balancing of primary producer

capabilities and customer demands for year-round product selection

National Farmers' Market Impact Study 2009 Report

7

The State of Farmers’ Markets in Canada

Executive Summary 2009

• The majority of national grocery shoppers are not using farmers’ markets.

Non-users are a target growth sector; they express a willingness to become

patrons and are not visiting primarily because of convenience and lack of

awareness issues. Future growth in the sector will require engaging non-users

through increased awareness of benefits, locations and product selection.

Trial usage among non-users will be dependent on making local market hours

and locations more accessible to time-challenged, health-conscious

consumers

• The future for farmers’ markets in Canada is promising with consumer

demand and interest closely aligned with support for local production and

fresh, healthy food choices

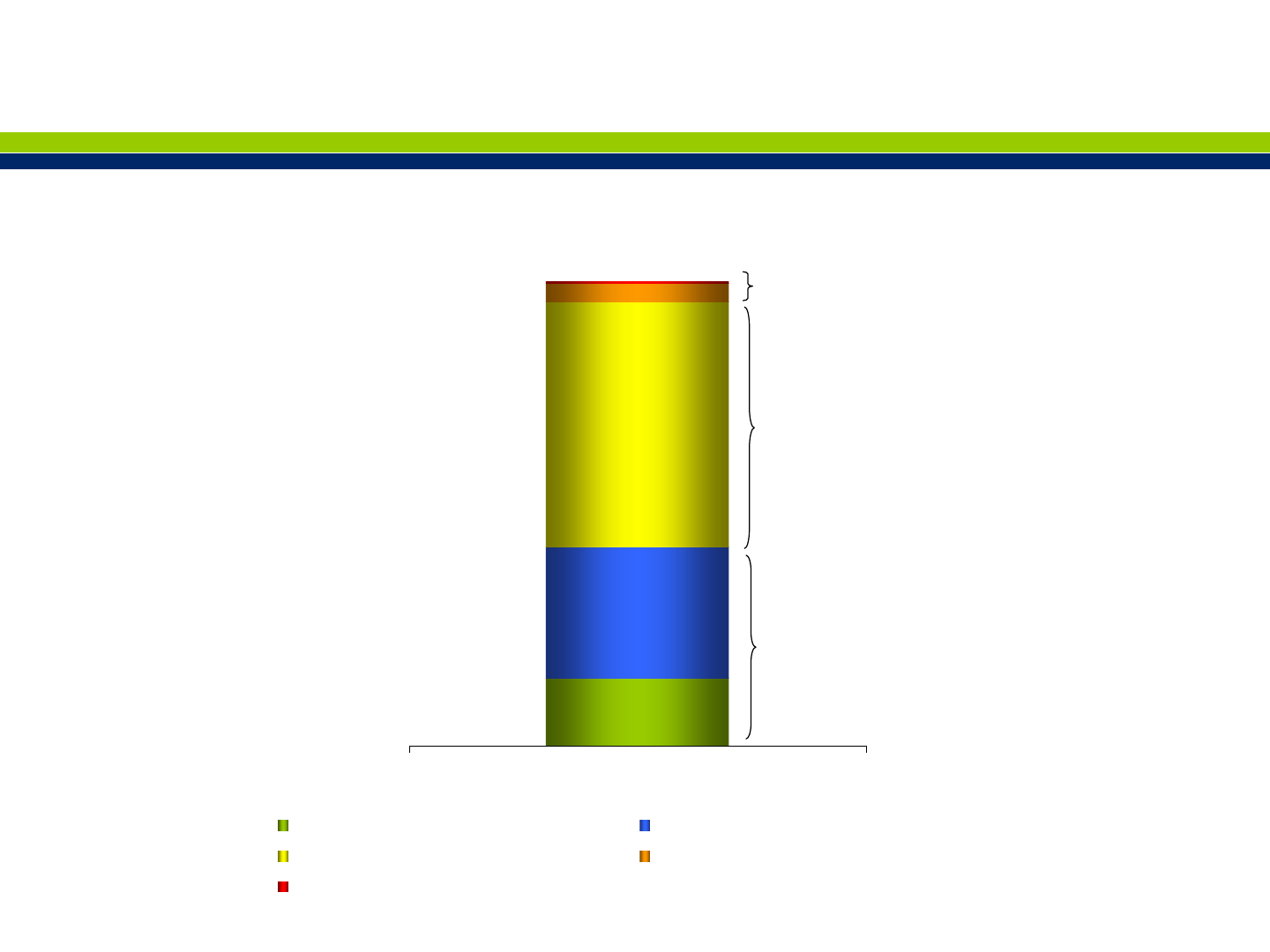

• Farmers’ markets are important contributors to the national economy with

impacts ranging from $1.55 to $3.09 billion annually

National Farmers' Market Impact Study 2009 Report

8

Fact Sheet

HIGHLIGHTS

• Farmers’ markets are strong contributors to the economy and to Canadian communities.

• Farmers’ markets play a key role in the marketing of Canadian agricultural products; they play a significant role in generating farm

incomes.

• Strong growth opportunities in this sector focus on more aggressive marketing and promotion of markets; on encouraging

additional vendors and vendor capabilities; on improved access to labour; and on the development of more and improved

facilities.

• Farmers’ markets across Canada are very popular with their customers; 95% of customers feel the Farmers’ market experience met

or exceeded their expectation

2008 Field Research Summary – Sample Sizes

• There are 508 identified farmers’ markets across ten provinces

• The 2009 Field Research profile:

– 70 farmers’ markets were visited (14% sample)

– 3174 shoppers were interviewed on-site

– 1308 non-users were surveyed online

– 487 vendors were interviewed on-site

– 282 market managers were interviewed by telephone and web

– Traffic counts and vendor audits were taken at surveyed markets

Economic Impact in Canada 2008

• 28 million shopper-visits were made to farmers’ markets in Canada in 2008

• Average in-market spending by principal shoppers is $32 per visit; ranging from $24.50 at small markets to $35.50 at large

markets

• Total farmers’ market direct sales across Canada in 2008 are estimated to be approx $1.03 billion

• The combined national economic impact of farmers’ markets in Canada is estimated in a range between $1.55 billion and $ 3.09

billion

Farmers’ Markets in Canada - Insights

National Farmers' Market Impact Study 2009 Report

9

Fact Sheet

Farmers’ Markets in Canada - Insights

Farmers’ Markets Shopper Profile in 2008

Demographic Highlights

The results showed that, on average:

• 72 % of market shoppers are female and 28% are male, nearly a 2.5:1 ratio

• 70 % of the principal shoppers are 40 and older; 30% of customers are 18-39

• 96 % of shoppers are Canadian born (83%) or have lived in Canada 20 years or more (13%)

Shopping Patterns

• 60 % state that fresh produce is their number one reason for visiting

• 69 % of shoppers use their own car to reach the market and 21% walk

• 67 % of shoppers take less than 15 minutes to get to the market from home

• 48 % of shoppers visit the market regularly (almost once a week)

• 54 % of market shoppers visit the market alone; 46% visit in groups

• 92% of shoppers state that buying directly from a local farmer is either extremely (62%) or somewhat (30%) important

• 25 % of shoppers are new or infrequent users, representing a growth opportunity

Shopper Satisfaction

• 95 % of shoppers find that their market experience meets or exceeds expectation

• 44 % are very satisfied with the variety of products

• 39 % are very satisfied with facilities at the market

• 56 % are very satisfied with the market’s location

• 81% of shoppers believe that food safety practices are better (46%) or about the same (35%) as grocery stores

• Market shoppers are generally pleased with the products they buy at their farmers’ markets but would appreciate more vendors

providing fresh, in-season produce

Non-User Opportunities

• Non-users identify that location, convenience, competitive positioning and variety will attract them to farmers’ markets

National Farmers' Market Impact Study 2009 Report

10

Fact Sheet

Farmers’ Markets in Canada - Insights

Market Profile from Market Manager Reports

• 57 % of markets are open Saturdays; 24% Fridays; 17% Thursdays; 2% other days

• 34 % of markets are open more than 26 days per year; 40% of markets are open between 16 and 25 days

• August is the peak sales month

• 56 % of markets are outdoor; 20% indoor; 24% both indoor and outdoor

• 46 % of markets serve municipalities with populations below 10,000

• Market managers classify 68% of their vendors as primary producers: vendors that sell products that they have produced

• 80 % of market managers report that the number of shoppers has increased (56%) or stayed the same (24%)

• 81% of market managers report that the number of vendors at their markets have increased (48%) or stayed the same (35%)

• 81% of market managers report that the number of primary producer vendors has increased (33%) or stayed the same (48%)

• 91% of markets are funded by vendor/booth rentals

• 68% of market managers report no financial support from governments or associations in the past 5 years

• 86% of markets have not had an economic impact assessment

• At markets reporting insurance policies, the average market premium is $1123 annually; 93% of markets have no claim history

Vendor Profile in 2008

• 42% of vendors achieve over 50% of their farm income from sales at farmers’ markets

• 60 % of vendors sell fresh fruit and/or vegetables

• 79 % of vendors identify themselves as primary producers

• 40 % of vendors sell at only one market

• 79 % of vendors report their business has grown bigger (49%) or stayed the same (30%)

• 71 % of vendors travel less than 50 km to reach the market

• 55 % of vendors report the creation of up to 5 jobs as a result of market participation

• 49 % of vendors serve 100 or more customers on each market day

• 26 % of vendors sell over $1000 on a market day

• Cost of fuel and cost of inputs are major negative factors impacting vendors

• Community and social aspects of the farmers’ markets are a major attraction for vendors

National Farmers' Market Impact Study 2009 Report

11

Introduction

The Organization

• Announced on November 10th, 2008, Farmers’ Markets Canada was formed as a national network for farmers’ markets that will

help support producers, expand the growth of markets and boost rural economies. Farmers’ Markets Canada is proud to announce

their establishment, which will look at national issues impacting farmers’ markets across our country. Canada is a country that is

proud of our agricultural heritage and Farmers’ Markets Canada wants to strengthen that concept through market knowledge and

expansion.

Purpose of this Study

• This study was contracted by Farmers’ Markets Canada to undertake a comprehensive market impact study. Recognizing that data

on farmers’ markets across Canada was limited, this study was developed as a baseline that will serve as a benchmark for

measurement of the contribution of farmers’ markets Canada over time. This study was created around two main areas:

¾ To understand the profile of the shopper at farmers’ markets: demographics, motivations and regional differences to

increase sales and opportunities for the future.

¾ To understand the profile of the vendors at the farmers’ markets: to attract additional vendors and to expand product

offerings and market appeal.

FMC’s Mission Statement:

“Our Vision is a future where every Canadian has easy access to a farmers’ market”

National Farmers' Market Impact Study 2009 Report

12

Data Collection

National Sample Size

Number of Markets Surveyed by Province

9

8

2 3

*36

5

3

1

2 1

* A similar Farmers’ Markets Ontario study was completed in conjunction with the National Farmers’ Market Impact Study. 12 Ontario

markets were included as part of the FMC sample; 24 markets were included as part of the FMO sample – in total, 36 Ontario markets were

surveyed.

National Farmers' Market Impact Study 2009 Report

13

Markets Visited – Size Categorization

Market Size Definition Small = 0-19 Vendors Medium = 20-39 Vendors Large = 40+ Vendors

Market Province Size

Calgary Farmers' Market Alberta Large

Edmonton Farmers' Market Alberta Large

Bearspaw Lions Farmers' Market Alberta Medium

Claresholm Farmers' Market Alberta Small

Grassroots Farmers' Market Alberta Small

Morinville Farmers' Market Alberta Small

Okotoks Kinsmen Farmers' Market Alberta Small

Rose City Farmers' Market Alberta Small

Kamloops Farmers' Market British Columbia Large

Prince George Farmers' Market British Columbia Large

Trout Lake Farmers' Market British Columbia Large

Coquitlam Farmers' Market British Columbia Medium

Kelowna Farmers' Market British Columbia Medium

Quesnel Farmers' Market British Columbia Medium

Royal City Farmers' Market British Columbia Medium

Vernon Farmers' Market British Columbia Medium

Riley Park Farmers' Market British Columbia Small

Le Marche St. Norbert Farmers' Market Manitoba Large

Fort Whyte Alive Farmers' Market Manitoba Small

Warren Farmers' Market Manitoba Small

Moncton Farmers' Market New Brunswick Large

Sussex Farmers' Market New Brunswick Large

St. John's Farmers' Market Newfoundland Small

Halifax Farmers' Market Nova Scotia Large

Cape Breton Farmers' Market Nova Scotia Medium

Lunenburg Farmers' Market Nova Scotia Small

Guelph Farmers' Market Ontario Large

London Covent Garden Farmers' Market Ontario Large

Ottawa ByWard Market Ontario Large

St. Lawrence Farmers' Market Ontario Large

Stratford Farmers' Market Ontario Large

Your Kitchener Farmers' Market Ontario Large

Barrie Farmers' Market Ontario Medium

Brampton Farmers' Market Ontario Medium

Market Province Size

Brantford Farmers' Market Ontario Medium

Brick Works Farmers' Market Ontario Medium

Burlington Farmers' Market Ontario Medium

Creemore Farmers' Market Ontario Medium

Downtown Georgetown Farmers' Market Ontario Medium

Downtown Sudbury Farmers' Market Ontario Medium

Kingston Farmers' Market Ontario Medium

Newmarket Main Street Farmers' Market Ontario Medium

Orangeville Farmers' Market Ontario Medium

Orillia Farmers' Market Ontario Medium

Port Hope Farmers' Market Ontario Medium

Riverdale Farmers' Market Ontario Medium

Welland Farmers' Market Ontario Medium

Woodstock Farmers' Market Ontario Medium

Bloor/Borden MyMarket Ontario Small

Cambridge Farmers' Market Ontario Small

East York Farmers' Market Ontario Small

Grand Bend Farmers' Market Ontario Small

Horton Farmers' Market Ontario Small

Milton Farmers' Market Ontario Small

Nathan Phillips Farmers' Market Ontario Small

Ottawa Parkdale Market Ontario Small

Pembroke Farmers' Market Ontario Small

Peterborough Wednesday Farmers' Market Ontario Small

SickKids Hospital MyMarket Ontario Small

Simcoe Valley Farmers' Market Ontario Small

St. Catharines Farmers' Market Ontario Small

St. Marys Farmers' Market Ontario Small

Charlottetown Farmers' Market Prince Edward Island Large

Marche Jean Talon Quebec Large

Marche Vieux Port du Quebec Quebec Large

Marche Champetre de Melbourne Quebec Medium

Marche Public de Drummondville Quebec Medium

Marche Centre de Ste-Hyacinthe Quebec Small

Saskatoon Farmers' Market Saskatchewan Small

Tisdale Farmers' Market Saskatchewan Small

National Farmers' Market Impact Study 2009 Report

14

Research Methodology

487

face-to-face

surveys

• % of products sold that are produced by

farmers

• % of income generated by access to

farmers’ markets

• Identify means by which a new national

association might be funded on a

sustainable basis

• Intercepted vendors at various locations

within selected farmers’ market sites

across Canada

• Sample of vendors were interviewed to

gain an understanding of the profile of

the vendors at farmers’ markets

Vendor Survey

ERS In-Experience

Interviewing

1308 online

surveys

• Grocery shopping role(s) in household

• Length of time in Canada

• Location shopped for grocery needs

• Factors encouraging to visit a farmers’

market

• ERS partnered with HOTSPEX (an online

polling company)

• Sample of current market non-customers

across Canada to understand the reasons

why customers do not come to farmers’

markets

Non-Users

Innovative

interviewing

3174

face-to-face

surveys

• Demographics

•Motivators

• Visit frequency

• Purchase characteristics

• Product characteristics

• Regional differences among markets

• Intercepted customers at various locations

within selected farmers’ market sites

across Canada

• Sample of current market customers who

had a market experience were interviewed

to gain an understanding of the profile of

customers at farmers’ markets

Customer

Survey

ERS In-Experience

Interviewing &

Observing

Sample SizeStudy ElementsMethodology

This study took place from July to October, 2008

National Farmers' Market Impact Study 2009 Report

15

Research Methodology

68 Markets

• Estimate of number of people visiting

market

• Conducted traffic counts at selected

locations across Canada

• Traffic counts taken each hour on the

hour for ten minutes at each exiting point

at the market

• Observed market customers entering

market to gain a better understanding of

traffic flow

Traffic Count

ERS In-Experience

Observation

techniques

282 phone

surveys

completed

of 500 Markets

contacted

•Contact Information

• Website Address

• Location

• Open Market Days

• Size of Community

•Trading Area

• History of Market

• Role of Managing Assoc./ Provincial

Assoc./ Provincial Government

• Selling Characteristics

• Called all known market managers from

10 provinces (AB, BC, MB, NB, NF, NS,

QC, PEI, SK)

• Collected contacts for a market database

by searching online for the market

managers’ contact information

• Contacted local municipalities, Chamber

of Commerce or provincial associations if

required

• Interviewed to provide a composite

national profile of farmers’ markets

Market

Manager Survey

ERS Telephone

Interviewing

technique

Sample SizeStudy ElementsMethodology

This study took place from July to October, 2008

National Farmers' Market Impact Study 2009 Report

16

Market Customer Profile

National Farmers' Market Impact Study 2009 Report

17

Customer Demographics by Market Size

Customers Interviewed - Age

0%

5%

8%

16%

25%

15%

22%

9%

6%

13%

17%

14%

30%

19%

<18 18-24 25-29 30-39 40-49 50-64 65+

National Average n= 3174 Canadian Population*

* Source: Statistics Canada, 2006 Census of Population, Statistics Canada catalogue no. 97-551-XCB2006009, Customer Survey

0%

5%

8%

16%

25%

30%

15%

0%

5%

8%

17%

26%

30%

14%

0%

3%

7%

16%

23%

30%

20%

0%

9%

10%

16%

25%

29%

11%

<18

18-24

25-29

30-39

40-49

50-64

65+

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

• Large markets are attracting younger customers while small and medium markets are visited more by seniors

• Market customers are typical grocery customers, ages 25-64

Small size market: 0 -19 vendors

Medium size market: 20-39 vendors

Large size market: 40+ vendors

National Farmers' Market Impact Study 2009 Report

18

Customer Demographics by Origin & Ethnicity

• Markets are not attracting recent immigrants nor non-Caucasian origins – a major future opportunity

Ethnicity of Customers Interviewed

Caucasian,

94%

Other, 6%

A

boriginal/Native,

1%

A

rabic/Middle

Eastern, 1%

East Indian, 1%

Hispanic, 1%

A

frican Canadian,

1%

Asian, 2%

How long have you lived in Canada?

83%

13%

2%

1%

1%

Born in Canada 20 years or more 10-19 years 5-9 years Less than 5 years

National Farmers' Market Impact Study 2009 Report

19

Source: Customer Survey

Customer Demographics by Gender, National Comparison

• Market shopping is dominated by women in all provinces

Customers Interviewed -Gender

28%

72%

23%

77%

30%

70%

32%

68%

41%

59%

27%

73%

22%

78%

28%

72%

30%

70%

36%

65%

26%

74%

Male

Female

National Average n= 3174 Alberta n= 380 British Columbia n= 359

Manitoba n= 53 New Brunswick n= 105 Newfoundland n= 62

Nova Scotia n= 114 Ontario n= 1824 Prince Edward Island n= 50

Quebec n= 200 Saskatchewan n= 27

National Farmers' Market Impact Study 2009 Report

20

What motivated or influenced you to visit this farmers' market?

60%

40%

18%

17%

16%

14%

12%

12%

12%

12%

11%

11%

9%

8%

6%

5%

5%

2%

2%

0%

Freshness of products

Support local farmers, crafters and community

Variety of products

Location - I was in the area

A specific product

Other

Organic products

Friendliness of vendors

Tradition/I always come here/regular shopper

Browsing

Selection of products

Meet friends/socialize

A specific vendor

Word-of-mouth/recommendation

Prices/value

Selection of vendors

Saw a sign/advertisement

Convenient hours

Dining options

I don't know

National Average n= 3174

Motivation to Visit Market

• Fresh products and support for local farmers dominate the reasons for visits

Source: Customer Survey

Other Responses

knowing/controlling what’s in my food, samples,

atmosphere/ambiance, quality, outdoors, gluten-

free, website, sense of community, entertainment,

environmental

National Farmers' Market Impact Study 2009 Report

21

0%

10%

20%

30%

40%

50%

60%

70%

F

r

eshne

s

s of p

r

odu

c

ts

Suppo

r

t local

fa

rm

e

rs, cr

af

ter

s

and

com

mu

n

ity

Variet

y

o

f

products

Location - I was in th

e

ar

e

a

A specifi

c

product

Other

O

rganic pr

od

ucts

Fri

e

ndlines

s o

f ven

d

or

s

T

r

a

dition/

I

always come he

r

e/r

e

gular

s

hopper

B

ro

wsi

n

g

Selecti

o

n

o

f

pro

d

ucts

M

e

e

t f

riend

s

/

s

oci

al

ize

A spe

c

i

f

i

c

v

e

n

d

or

W

o

rd-of-

m

o

u

th

/

r

e

c

o

mme

n

dati

o

n

P

ri

ces/v

alue

Selec

tion o

f

ven

d

ors

Saw a si

gn

/advertisem

e

nt

Convenient h

o

urs

Dining optio

n

s

I do

n

't know

Motivation to Visit Market by Market Size

• Large market visitors are likely to shop for a broader range of reasons

Source: Customer Survey

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

What motivated or influenced you to visit this farmers’ market today?

National Farmers' Market Impact Study 2009 Report

22

Group Shopping Behaviour

• As market size increases, the probability of shopping in groups increases

Source: Customer Survey

Customers Interviewed - Grouping

54%

12%

20%

13%

66%

10%

14%

11%

52%

11%

23%

13%

43%

15%

26%

16%

Individual

Friends

Couple/Spouse

Family

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

National Farmers' Market Impact Study 2009 Report

23

Customer Journey to Market

• 43% of small market customers do not come by car, but visitors to larger markets are more likely to drive

Source: Customer Survey

How did you get to the market today?

69%

4%

21%

4%

1%

57%

5%

32%

5%

2%

79%

2%

15%

3%

1%

73%

7%

16%

3%

1%

Car

Public Transit

Walk

Bike

Other

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

National Farmers' Market Impact Study 2009 Report

24

Customer Journey to Market

• Most markets are visited by local community members but larger markets are more likely to pull from a greater

distance (16% take over 30 minutes to travel to large markets)

Source: Customer Survey

Do you consider yourself a permanent resident, visitor,

cottager or tourist to this particular area?

88%

9%

1%

2%

1%

0%

Permanent resident

Visitor

Cottager

Tourist

Student

Other

National Average n= 3174

67%

21%

6%

2%

4%

73%

17%

5%

2%

3%

73%

19%

4%

2%

3%

55%

28%

9%

2%

5%

<15

15-29

30-44

45-59

60+

Minutes

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

How long did it take you to get to this farmers’ market from home?

National Farmers' Market Impact Study 2009 Report

25

12%

4%

10%

9%

18%

48%

First Time

Rarely (once/year)

Occasionally (2-3

times/year)

Often (once/month)

Frequently (2-3

times /month)

Regularly (almost

once/week)

National Average n= 3174

Frequency of Visitation

Source: Customer Survey

75% have established

frequent visit patterns

25% are new or infrequent

users > conversion

opportunity

• Markets have a large, stable base of regular and frequent visitors

How often do you visit this farmers’ market?

National Farmers' Market Impact Study 2009 Report

26

Grocery Purchasing Habits

Source: Customer Survey

• Farmers’ markets are the second most popular location for customers to buy their groceries. Large markets are

more likely to cater to customers who also shop at organic grocers, health food stores and specialty/ethnic stores

Where do you primarily shop for your grocery needs?

83%

23%

12%

62%

11%

14%

13%

3%

9%

1%

4%

82%

22%

9%

59%

7%

10%

11%

3%

8%

1%

6%

83%

24%

11%

56%

8%

10%

8%

2%

9%

1%

3%

84%

25%

16%

71%

18%

23%

21%

3%

11%

1%

3%

Large grocery store

Small grocery store

Big box retailer

Farmers' market

Organic grocer

Health food store

Specialty/ethnic

Convenience store

Direct from farm

On-line

Other

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

National Farmers' Market Impact Study 2009 Report

27

Farmer Direct Purchase Importance

Source: Customer Survey

Please rank the importance of buying product from an

actual farmer rather than buying product from a

person who buys the produce from a food terminal

or farmer(s) and resells it to you at the market

62%

30%

6%

1%

1%

National Average n= 3174

Extremely important Somewhat important

Neither important nor unimportant Somewhat unimportant

Not at all important

• 92% of shoppers state buying products from an actual farmer as extremely important (62%) or somewhat

important (30%)

National Farmers' Market Impact Study 2009 Report

28

Farmer Direct Purchase Importance

Source: Customer Survey

• National Comparison by Province

Please rank the importance of buying product from an actual farmer rather than

buying product from a person who buys the produce from a food terminal or

farmer(s) and resells it to you at the market

62%

46%

59%

58% 58%

63%

60%

67%

60%

59%

59%

30%

47%

33%

32%

28%

29%

32%

26%

32%

33%

30%

6%

7%

6%

8%

10%

6%

6%

5%

6% 8%

11%

1% 2%

1%

3%

2%

1%

2%

1%

1%

1%

1% 1%

4%

N

a

tiona

l

A

v

erag

e

n=

3

1

74

A

l

b

ert

a

n

= 3

80

B

ritish Colum

b

ia

n

= 3

5

9

M

a

nit

o

ba

n=

53

New

Brun

s

wick n= 105

Ne

wf

ound

l

a

n

d n

=

6

2

N

ov

a

S

c

otia n=

114

Ontario n=

1

824

P

r

ince Edward

Is

land

n= 50

Queb

e

c

n= 20

0

Sa

s

katchewan n

=

27

Extremely important Somewhat important Neither important nor unimportant

Somewhat unimportant Not at all important

National Farmers' Market Impact Study 2009 Report

29

Farmer Direct Purchase Importance

Source: Customer Survey

• Customers at all sizes of markets believe it is important to buy from local producers

Please rank the importance of buying product from an actual farmer rather than

buying product from a person who buys the produce from a food terminal or

farmer(s) and resells it to you at the market

62%

64%

66%

57%

30%

28%

28%

34%

6%

6%

5%

7%

1%

1%

2%

1%

1% 1%

1%

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

Extremely important Somewhat important Neither important nor unimportant

Somewhat unimportant Not at all important

National Farmers' Market Impact Study 2009 Report

30

Market Factor Importance

• The majority of customers believe that fresh, in-season, locally produced products are the most important factors

that markets deliver. The least important factors are certified organic, low price, and nutritional labelling

Source: Customer Survey

Calculated using Top 2 Box – Bottom 6 Boxes on a 10 point scale (removes

passive respondents)

How important are the following to you?

-11%

-8%

-7%

3%

25%

28%

34%

34%

36%

37%

43%

47%

68%

77%

Low price

Certified Organic

Clear and effective labelling of nutritional content

Attractive product presentation/displays

Clean and easily accessible market facilities (seating area,

washrooms, parking)

Natural but not certified products (i.e. wild, grain fed, not sprayed)

Support for animal welfare (the use of animals in food/research as

long as unnecessary suffering is avoided)

Wide variety of products

Product packaging that is environmentally friendly or recyclable

Conveniently located and easily accessible from my home

Fair trade products (made by someone who gets fair wage and fair

treatment)

Friendly service

Locally produced products

Fresh, in-season products

National Average n=3174

National Farmers' Market Impact Study 2009 Report

31

Satisfaction with Market Delivery of Key Factors

Source: Customer Survey

Calculated using Top 2 Box – Bottom 6 Boxes on a 10 point scale (removes

passive respondents)

• Customers are satisfied that their market provides fresh, local products delivered in convenient locations with

attractive displays and friendly service

How satisfied are you with how this market delivers on the following?

yg

20%

20%

26%

31%

32%

34%

38%

39%

44%

47%

56%

63%

65%

68%

15%

16%

19%

28%

27%

32%

35%

40%

40%

47%

58%

64%

64%

70%

20%

18%

26%

31%

30%

35%

38%

44%

42%

45%

59%

64%

66%

70%

24%

28%

35%

34%

38%

35%

41%

34%

49%

48%

52%

59%

63%

63%

Low price

Clear and effective labelling of nutritional content

Certified Organic

Product packaging that is environmentally friendly or recyclable

Fair trade products (made by someone who gets fair wage and fair

treatment)

Support for animal welfare (the use of animals in food/research as

long as unnecessary suffering is avoided)

Natural but not certified products (i.e. wild, grain fed, not sprayed)

Clean and easily accessible market facilities (seating area,

washrooms, parking)

Wide variety of products

Attractive product presentation/displays

Conveniently located and easily accessible from my home

Locally produced products

Friendly service

Fresh, in-season products

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

National Farmers' Market Impact Study 2009 Report

32

Market Factor Importance vs. Satisfaction

Source: Customer Survey

• Satisfaction aligned to the importance customers feel for key factors will drive opportunity for the industry.

Customers place more importance on fresh and local products than is currently being delivered – an opportunity.

Calculated using Top 2 Box – Bottom 6 Boxes on a 10 point scale (removes

passive respondents)

20%

26%

20%

47%

39%

38%

34%

44%

31%

56%

32%

65%

63%

68%

-11%

-8%

-7%

3%

25%

28%

34%

34%

36%

37%

43%

47%

68%

77%

Low price

Certified Organic

Clear and effective labelling of nutritional content

Attractive product presentation/displays

Clean and easily accessible market facilities

(seating area, washrooms, parking)

Natural but not certified products (i.e. wild, grain fed,

not sprayed)

Support for animal welfare (the use of animals in

food/research as long as unnecessary suffering is

avoided)

Wide variety of products

Product packaging that is environmentally friendly or

recyclable

Conveniently located and easily accessible from my

home

Fair trade products (made by someone who gets

fair wage and fair treatment)

Friendly service

Locally produced products

Fresh, in-season products

Satisfaction Importance

National Farmers' Market Impact Study 2009 Report

33

Impact of Fresh, In-Season Products

• National Comparison of Importance versus Satisfaction with delivery of fresh/seasonal by province

Source: Customer Survey

68%

70%

73%

69%

55%

56%

53%

67%

61%

72%

85%

77%

77%

80%

91%

76%

74%

76%

77%

76%

77%

78%

National Average n= 3161

Alberta n= 380

British Columbia n= 359

Manitoba n= 53

New Brunswick n= 105

Newfoundland n= 62

Nova Scotia n= 114

Ontario n= 1811

Prince Edward Island n= 50

Quebec n= 200

Saskatchewan n= 27

Satisfaction Importance

Yellow = Opportunity Areas

Calculated using Top 2 Box – Bottom 6 Boxes on a 10 point scale (removes

passive respondents)

National Farmers' Market Impact Study 2009 Report

34

Impact of Locally Produced Products

• National Comparison of Importance versus Satisfaction with delivery of local products by province

Source: Customer Survey

63%

67%

68%

65%

57%

50%

50%

61%

59%

69%

81%

68%

58%

69%

79%

64%

77%

75%

69%

66%

77%

74%

National Average n= 3161

Alberta n= 380

British Columbia n= 359

Manitoba n= 53

New Brunswick n= 105

Newfoundland n= 62

Nova Scotia n= 114

Ontario n= 1811

Prince Edward Island n= 50

Quebec n= 200

Saskatchewan n= 27

Satisfaction Importance

Yellow = Opportunity Areas

Calculated using Top 2 Box – Bottom 6 Boxes on a 10 point scale (removes

passive respondents)

National Farmers' Market Impact Study 2009 Report

35

Did you make a purchase today?

If not, do you intend to make a purchase today?

Intend to

Purchase

11%

Don't Intend to

Purchase

3%

No

14%

Yes

86%

Purchase Intent Profile

• 97% of market customers have made or intend to make a purchase at the market

Source: Customer Survey

National Farmers' Market Impact Study 2009 Report

36

What are your reasons for not purchasing or intending to purchase today?

5%

18%

69%

1%

7%

12%

9%

67%

3%

3%

3%

28%

63%

0%

9%

0%

18%

79%

0%

9%

Price

Couldn't find what I wanted

Wasn't planning on buying

anything just browsing

Did not take credit or debit

cards

Other

National Average n= 99 Small n= 31 Medium n= 33 Large n= 35

Reasons for Not Purchasing

• Small market customer purchasing is more likely to be impacted by price

• Large markets are more impacted by non-purchaser browsing

Source: Customer Survey

Other Responses

staying at hotel, can buy at grocery store, lack of

money, have my own garden, long walk home, I do

not have a cooler

National Farmers' Market Impact Study 2009 Report

37

Can you identify the categories of products you have purchased

or intend to purchase today?

75%

58%

34%

9%

9%

8%

7%

7%

5%

5%

5%

3%

2%

1%

Vegetables

Fruits

Baked goods

Eggs

Snack bars/restaurants

Dairy products

Specialty food

Herbs

Tea/coffee

Honey

Jams jellies preserves

Spreads and dips

Candy

Maple products

National Average n= 3174

Products Purchased -- Fruit/Vegetables/Other Food Categories

Source: Customer Survey

National Farmers' Market Impact Study 2009 Report

38

Products Purchased -- Meat/Fish

Source: Customer Survey

Can you identify the categories of products you have purchased

or intend to purchase today?

18%

3%

3%

Meat/meat products

Fish

Smoked meat

National Average n= 3174

National Farmers' Market Impact Study 2009 Report

39

Can you identify the categories of products you have purchased

or intend to purchase today?

9%

4%

3%

2%

1%

1%

1%

1%

0%

0%

Fresh Flowers

Other

Arts/crafts

Jewellery

Woolen and knitted

products

Bedding plants

Alternative medicines

Wood products

Pottery

Leather goods

National Average n= 3174

Products Purchased -- Non-Food

Source: Customer Survey

National Farmers' Market Impact Study 2009 Report

40

$32.06

$23.68

$30.56

$42.99

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

In-Market Spending

Source: Customer Survey

Average =

$32.06

Average =

$32.06

3%

30%

12%

2%

46%

3%

4%

$0 $1-20 $21-40 $41-60 $61-80 $81-100 $101+

Spend

% of customer

s

National Average n= 3174

• Customers spent/intend to spend an average of $32.06. Small and medium market customers spend less and large

market customers spend more than average

How much did you spend or do you intend to spend

at this farmers’ market today?

How much did you spend or do you intend to spend

at this farmers’ market today?

National Farmers' Market Impact Study 2009 Report

41

In-Market Spending

Source: Customer Survey

• Spending appears higher in provinces with large markets

$32.06

$53.10

$31.48

$45.68

$21.48

$26.06

$45.16

$27.67

$34.81

$30.20

$20.63

National Average n= 3174 Alberta n= 380 British Columbia n= 359

Manitoba n= 53 New Brunswick n= 105 Newfoundland n= 62

Nova Scotia n= 114 Ontario n= 1824 Prince Edward Island n= 50

Quebec n= 200 Saskatchewan n= 27

How much have you spent or do you plan to spend

at this farmers’ market today?

National Farmers' Market Impact Study 2009 Report

42

Additional Spending in Region

Source: Customer Survey

How much additional shopping or eating are you planning on doing while

in this area of town today?

$18.44

$14.14

$18.34

$19.80

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

How much additional shopping or eating are you planning on

doing while in this area of town today?

60%

9%

6%

2%

18%

4%

1%

$0 $1-20 $21-40 $41-60 $61-80 $81-100 $101+

Spend

% of customers

National Average n= 3174

Average =

$18.44

How much additional shopping or eating are you planning on

doing while in this area of town today?

60%

9%

6%

2%

18%

4%

1%

$0 $1-20 $21-40 $41-60 $61-80 $81-100 $101+

Spend

% of customers

National Average n= 3174

• Most customers plan to spend additional money shopping or eating after their visit to the farmers’ market

National Farmers' Market Impact Study 2009 Report

43

Additional Spending in Region

Source: Customer Survey

How much additional shopping or eating are you planning on doing while

in this area of town today?

$18.44

$20.73

$24.03

$11.32

$21.73

$20.05

$19.74

$17.18

$29.79

$13.24

$5.74

National Average n= 3174 Alberta n= 380 British Columbia n= 359

Manitoba n= 53 New Brunswick n= 105 Newfoundland n= 62

Nova Scotia n= 114 Ontario n= 1824 Prince Edward Island n= 50

Quebec n= 200 Saskatchewan n= 27

•By Province

National Farmers' Market Impact Study 2009 Report

44

Average Spend by Type of Customer

Source: Customer Survey

• Cottagers/Seasonal Residents are big spenders

$32.11

$31.50

$41.43

$31.38

Permanent Resident n= 2777 Visitor n= 277 Cottager n= 28 Tourist n= 53

How much have you spent or do you intend to spend

at this farmers’ market today?

National Farmers' Market Impact Study 2009 Report

45

Impact of Debit, Credit, ATM on Purchase

Source: Customer Survey

• 18-28% of customers feel that electronic cash/ payment systems on-site would have a positive impact on

spending

24%

19%

21%

18%

24%

20%

28%

23%

I would have spent more

money if there was a

debit/credit card machine

available at each

vendor/stall

I would have spent more

money if there was an

ATM machine available at

this farmers' market

% Strongly Agree / Agree

National Average n= 3174 Small n= 1155 Medium n= 1000 Large n= 1019

National Farmers' Market Impact Study 2009 Report

46

Food Safety Perception

• Most customers believe that markets have better/the same food safety practices than grocery stores

Source: Customer Survey

46%

35%

12%

6%

Farmers' market

practices are better

than the grocery

store

Grocery store

practices are about

the same as the

farmers' markets

No opinion/I don't

care/it doesn't

matter to me

Grocery store

practices are better

than the farmers'

markets

National Average n= 3174

What is your perception of farmers’ market food safety

in relation to grocery store practices?

National Farmers' Market Impact Study 2009 Report

47

14%

28%

53%

4%

National Average n= 3174

Significantly exceeded my expectations Exceeded my expectations

Met my expectations Below my expectations

Significantly below my expectations

People who visit frequently know

what to expect

Meeting Expectations

• Adding new or unexpected elements to markets will aid in “surprising” loyal customers and improving the overall

experience

Source: Customer Survey

Very low customer disappointment

Healthy number of positive

experiences

How did your experience at this farmers’ market

meet your expectations today?

National Farmers' Market Impact Study 2009 Report

48

Suggestions for the Market

Source: Customer Survey

33%

17%

11%

8%

8%

8%

7%

7%

7%

5%

5%

4%

4%

4%

3%

2%

1%

29%

Cannot think of any changes needed

More vendors/more selection

Open additional days

Open longer hours

Open all year round

Improved parking access

Place to sit down and relax

Place to sit and have a coffee and a snack

Cheaper prices

Better washrooms

Greater variety of soft goods

Indoor facilities

Live entertainment

ATM available in the market

Greater variety of food products

Individual vendors accepting credit or debit cards

Different location

Other

National Average n= 3174

Most Popular

Suggestions

Least Popular

Suggestions

More vendors/

More selection:

Bigger market,

more variety of

products/produce

offered

*”Other” responses differed greatly by market

• Varied responses based on individual market conditions – many customers suggested more selection and

more open hours

What suggestions do you have for improving this farmers’ market?

Open Additional

Days:

More days during the

week, different days

throughout the week

than currently

scheduled

National Farmers' Market Impact Study 2009 Report

49

Non-User Insights

National Farmers' Market Impact Study 2009 Report

50

Non-User Profile

Source: Non-User Survey

• Users = those who regularly, frequently, often OR occasionally visit a farmers’ market

• Non-Users = those who rarely OR never visit a farmers’ market

* Source: Statistics Canada, 2006 Census of Population, Statistics Canada catalogue no. 97-551-XCB2006009, Customer Survey

What province do you live in?

0%

1%

2%

2%

3%

3%

9%

11%

20%

48%

0%

2%

2%

3%

3%

4%

11%

13%

23%

39%

Prince Edward Island

Newfoundland and Labrador

New Brunswick

Nova Scotia

Saskatchewan

Manitoba

Alberta

British Columbia

Quebec

Ontario

Non-Users n=1308 Total Canada

In what country were you born?

0%

0%

0%

0%

0%

0%

0%

0%

0%

0%

1%

1%

2%

5%

88%

Philippines

Do not know

Viet Nam

Portugal

Poland

China, People's Republic of

Germany

Italy

India

I would rather not say

Hong Kong

United States

United Kingdom

Other

Canada

Non-Users n=1308

National Farmers' Market Impact Study 2009 Report

51

Non-User Demographics

Source: Non-User Survey

Respondents skewed female as they

were pre-qualified prior to completing

the survey for the following:

¾ Had to be primarily responsible

or shared responsibility for their

household grocery shopping

¾ Had to be over the age of 17

¾ Had to have never visited a

farmers’ market or only visited

once or twice

• Non-User profile differs from Market Shopper: 10% more males/ younger median age

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0-17 18-24 25-44 45-64 65+

Age Group

Non-Users n=1308 Users n=3207 Canadian Population

Non-User Gender

(n=1308)

38%

62%

Male Female

National Farmers' Market Impact Study 2009 Report

52

Usual Grocery Shopping Destination

Source: Non-User Survey

• Non-users were slightly more likely to use supermarkets in contrast to farmers’ market users who engage

many alternate food sources such as health food stores, markets, farms and organic grocers

To what extent are you responsible for grocery shopping in

your household?

0%

35%

65%

Someone else is

primarily responsible for

grocery shopping in my

household

I share the responsibility

with another member of

my household

I am primarily

responsible for grocery

shopping in my

household

Non-Users n=1308

1%

1%

1%

2%

4%

5%

10%

13%

30%

34%

79%

Organic Grocer

Directly from a farm

Farmers' Market

Health Food Store

Other

Specialty/Ethnic Food Store or Market

Convenience Store

Small Grocery Store

Big Box Retailer (such as Costco, Wal-Mart)

Independent Grocer (IGA, Foodland, etc.)

Supermarket (National Brand such as Loblaws,

Maxi-Maxi Plus, No Frills, etc.)

Non-Users n=1308

Where do you usually shop for your grocery needs?

National Farmers' Market Impact Study 2009 Report

53

Reasons for Not Visiting Farmers’ Markets

Source: Non-User Survey

• Location, awareness and convenience are key reasons for not visiting

Opportunities

to Attract New

Users

What are your reasons for not visiting farmers' markets?

0%

1%

3%

5%

6%

9%

10%

14%

17%

23%

30%

48%

The food products are not fresh enough

The variety of arts and craft products at my local

farmers' market is too limited

I prefer to buy at a store with food from my home

country

The variety of food products at my local farmers'

market is too limited

Other

The parking at my local farmers' market is not

very good

The food products are too expensive

My local farmers' market does not have

convenient hours of business

I don't have time to shop at a farmers' market

I like to do all of my shopping at one place

I am not aware of a farmers' market in my area

A farmers' market is not conveniently located

close to me

Non-Users n=1308

National Farmers' Market Impact Study 2009 Report

54

Factors Encouraging Farmers’ Market Visitation

Source: Non-User Survey

• Location, convenience, competitive pricing and variety will attract new customers

Calculated using Top 2 Boxes – Bottom 6 Boxes on a 10 point scale

(removes passive respondents)

-71%

-60%

-50%

-41%

-29%

-28%

-25%

-19%

-13%

-11%

-8%

-3%

5%

12%

22%

30%

33%

Entertainment

A large variety of arts and crafts items

A market dedicated to organically grown food products

A market accessible by public transportation

Attractive facilities

Food from my home country

A website that helps me locate a farmers' market

More information about products offered at local farmers' markets

A market where vendors speak my language

Other

More information about local markets close to my home

Convenient parking

A market dedicated to locally produced food products

A large variety of food items

Convenient days and hours of operation

Competitive pricing (comparable or cheaper than the grocery store)

A market conveniently located in my neighborhood

Non-Users n=1308

How likely would each of the following factors encourage you to visit a farmers’ market?

National Farmers' Market Impact Study 2009 Report

55

Vendor Profile

National Farmers' Market Impact Study 2009 Report

56

Vendor Products

Source: Vendor Survey

• Percent of vendors selling product categories

Observed Vendor Category

37%

23%

15%

12%

9%

8%

7%

4%

4%

4%

3%

2%

2%

2%

2%

2%

2%

2%

1%

1%

1%

1%

1%

1%

1%

0%

0%

0%

0%

0%

Vegetables

Fruits

Baked Goods

Arts/Crafts

Meat/Meat Products

Fresh Flowers

Jams Jellies Preserves

Honey

Jewellery

Specialty Food

Herbs

Eggs

Woolen and Knitted Products

Bedding Plants - Seedlings

Dairy Products

Maple Products

Wood Products

Smoked Meat

Fish

Other

Snack bars/Restaurants

Tea/Coffee at-home consumption

Candy

Alternative Medicines

Soap

Spreads and Dips

Photography

Candles/Beeswax

Leather Goods

Pottery

National Average n= 487

National Farmers' Market Impact Study 2009 Report

57

Vendor Profile by Production Type

Source: Vendor Survey

• 79% of vendors identified themselves as “Primary Producers”

What percentage of the products that you sell at the market have you grown

yourself?

5%

5%

6%

84%

under 25%

25-49.99%

50-74.99%

75%+

National Average n= 446

Has this increased, decreased or stayed the same since last year?

17%

5%

65%

13%

Increased

Decreased

Stayed the same

New vendor

National Average n= 436

Primary Producer = A vendor who sells agricultural products, food, arts

and crafts that they have produced

Producer/Dealer = a vendor who sells agricultural products, food, arts

and crafts that they have produced but who often sells items bought from

local producers or wholesalers

Reseller = A vendor who only sells products bought from local producers

or wholesalers

What t

y

pe of vendor/seller would

y

ou consider

y

ourself?

79.2%

12.3%

8.4%

Primary Producer Producer/Dealer Reseller

National Farmers' Market Impact Study 2009 Report

58

Vendor Profile by Production Type by Province

Source: Vendor Survey

What percentage of the products that you sell at the market, have you grown yourself?

5%

5%

2%

7%

6%

9%

5%

5%

0%

7%

8%

4%

36%

6%

5%

2%

8%

7%

18%

84%84%

95%

100%

80%

100%

85%

84%

100%

36%

100%

n= 446n= 37n= 43n= 10n= 15n= 8n= 13n= 286n= 5n= 22n= 7

National

Average

AlbertaBritish

Columbia

ManitobaNew

Brunswick

NewfoundlandNova ScotiaOntarioPrince Edward

Island

QuebecSaskatchewan

under 25% 25-49.99% 50-74.99% 75%+

National Farmers' Market Impact Study 2009 Report

59

Vendor Profile by Production Type by Province

Source: Vendor Survey

Has this increased, decreased or stayed the same since last year?

17%

38%

47%

0%

12%

32%

5%

8%

0%0%0%

6%

14%

65%

43%

42%

92%

72%

36%

13%

11%

11%

10%

13%

88%

8%

11%

20%

18%

0%

14%

0% 0% 0%

20%

0%

13%

0%0%

87%

0%

80%

86%

70%

n= 436n= 37n= 38n= 10n= 15n= 8n= 13n= 281n= 5n= 22n= 7

National

Average

AlbertaBritish

Columbia

ManitobaNew

Brunswick

NewfoundlandNova ScotiaOntarioPrince

Edward

Island

QuebecSaskatchewan

Increased Decreased Stayed the same New vendor

National Farmers' Market Impact Study 2009 Report

60

Vendor Profile by Frequency of Sales by Province

• 95% of vendors sell “weekly” while in-season

95%

100%

84%

91%

100%

75%

100%

97%

100%

88%

100%

Yes

National Average n= 486 Alberta n= 40 British Columbia n= 45

Manitoba n= 11 New Brunswick n= 15 Newfoundland n= 8

Nova Scotia n= 14 Ontario n= 317 Prince Edward Island n= 5

Quebec n= 24 Saskatchewan n= 7

Do you sell at this farmers’ market every week?

National Farmers' Market Impact Study 2009 Report

61

Number of Markets Attended

• 40% of vendors only sell at one market - - the rest attend more than one

Source: Vendor Survey

21%

18%

7%

5%

1%

7%

40%

21%

19%

8%

7%

2%

12%

31%

20%

16%

7%

5%

1%

5%

48%

24%

21%

6%

5%

1%

2%

41%

1

2

3

4

5

6+

Just this one

National Average n= 487 Small n= 178 Medium n= 198 Large n= 111

How many other farmers’ markets do you attend?

National Farmers' Market Impact Study 2009 Report

62

Number of Markets Attended

• National Comparison – wide variation between provinces

Source: Vendor Survey

21%

28%

16%

27%

47%

71%

16%

80%

29%

43%

18%

25%

22%

9%

33%

14%

16%

20%

17%

43%

7%

5%

16%

13%

13%

7%

4%

5%

18%

11%

4%

4%

14%

1%

3%

7%

1%

7%

10%

13%

9%

40%

13%

22%

55%

88%

14%

49%

46%

7%

n= 487n= 40n= 45n= 11n= 15n= 8n= 14n= 318n= 5n= 24n= 7

National

Average

AlbertaBritish

Columbia

ManitobaNew BrunswickNewfoundlandNova ScotiaOntarioPrince Edward

Island

QuebecSaskatchewan

1 2 3 4 5 6+ Just this one

How many other farmers’ markets do you attend?

National Farmers' Market Impact Study 2009 Report

63

Vendor Income Trending

Source: Vendor Survey

• Most vendors state that their business is increasing; a positive sign since vendors are deriving a significant portion

of their income from farmers’ market activities.

49%

7%

30%

13%

47%

9%

30%

14%

46%

4%

35%

15%

59%

10%

20%

10%

Grown bigger

Become smaller

Stayed the same

New vendor

National Average n= 478 Small n= 173 Medium n= 197 Large n= 108

33%

25%

16%

26%

44%

20%

14%

22%

28%

27%

19%

26%

27%

28%

15%

31%

under 25%

25-49.99%

50-74.99%

75%+

National Average n= 449 Small n= 166 Medium n= 185 Large n= 98

In broad terms, can you estimate the percentage of your total farm

income that is derived from your participation in farmers’ markets? Is it …

Over the past year, has your business at farmers’ markets …

National Farmers' Market Impact Study 2009 Report

64

Distance Travelled to Market

• 71% of vendors travel less then 50 km but many vendors are traveling large distances to participate

Source: Vendor Survey

71%

17%

11%

1%

1%

71%

14%

14%

1%

1%

70%

19%

10%

1%

1%

73%

17%

9%

0%

1%

0-50km

50-100km

101-500km

501-1000km

>1000km

National Average n= 482 Small n= 175 Medium n= 197 Large n= 110

What is the typical distance you travel to get to this farmers’ market? (in kms)

National Farmers' Market Impact Study 2009 Report

65

Job Creation

Source: Vendor Survey

• 55% of vendors report the creation of up to 5 jobs as a result of market participation

32%

55%

8%

3%

2%

1%

24%

59%

10%

4%

2%

1%

43%

49%

6%

1%

1%

0%

27%

58%

7%

3%

3%

2%

0

1-5

6-10

11-15

16-20

20+

National Average n= 478 Small n= 177 Medium n= 194 Large n= 107

How many jobs have been created from your participation in this farmers’ market?

National Farmers' Market Impact Study 2009 Report

66

Customers Served/ Growth

Source: Vendor Survey

• 51% of vendors serve between 50 and 199 shoppers each market day, a number which vendors believe is

increasing!

On an average day, how many shoppers would you estimate that you serve?

(unaided)

8%

18%

26%

25%

12%

12%

10%

22%

27%

27%

14%

13%

10%

21%

30%

27%

12%

7%

7%

14%

30%

34%

14%

31%

under 25

25-49

50-99

100-199

200-299

300+

National Average n= 478 Small n= 153 Medium n= 184 Large n= 83

In the past 2 years, do you feel the # of shoppers at your site on an average

day increased or decreased?

50%

9%

27%

15%

50%

8%

27%

15%

45%

9%

30%

16%

59%

9%

22%

11%

Increa sed

Decreased

Stayed the same

New vendor

National Average n= 481 Small n= 175 Medium n= 195 Large n= 111

National Farmers' Market Impact Study 2009 Report

67

Average Daily Sales Trending

Source: Vendor Survey

• 26% of vendors sell over $1000 worth of product each market day

• 67% of vendors sell between $100 and $999 worth of product each market day

On an average day, what would you estimate your sales to be? (unaided)

6%

38%

29%

16%

7%

3%

0%

7%

35%

30%

19%

7%

2%

0%

7%

43%

29%

13%

6%

2%

0%

1%

33%

29%

20%

9%

8%

1%

under $100

$100-$499.99

$500-$999.99

$1000-$2499.99

$2500-$4999.99

$5000-$9999.99

$10000+

National Average n= 431 Small n= 161 Medium n= 178 Large n= 92

In the past 2 years, has the value of your sales on an average day increased

or decreased?

50%

7%

29%

14%

48%

6%

32%

15%

45%

7%

32%

16%

63%

8%

20%

10%

Increased

Decreased

Stayed the same

New vendor

National Average n= 468 Small n= 174 Medium n= 189 Large n= 105

National Farmers' Market Impact Study 2009 Report

68

Debit/Credit/ATM Interests

Source: Vendor Survey

• 7% of vendors take credit cards, 5% debit cards. 27% of vendors believe they would sell more if they had a credit/debit facility

• 53% of vendors believe that an ATM in or near the market would lead to higher sales

I would have sold more products if there was a debit/credit card machine

available for each vendor

11%

15%

10%

38%

26%

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

National Average n= 465

21%

32%

8%

21%

18%

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

National Average n= 336

I would have sold more products if there was an ATM machine

available at this farmers’ market

Do you accept credit or debit cards for purchases? (unaided)

7%

5%

96%

Credit Card

Debit Card

Cash only

National Average n= 487

National Farmers' Market Impact Study 2009 Report

69

Negative Factors Impacting Vendors

Source: Vendor Survey

• Cost of fuel and other inputs are negative factors impacting vendors – shortage of labour was also frequently

mentioned

To what extent are each of the following factors negatively impacting your business

(on a scale of 1 to 5 where 1 is not impacting and 5 is very significantly impacting - averages)

3.3

3.1

2.6

2.3

2.3

2.1

2.1

2.0

1.7

Cost of fuel

Cost of other inputs

(feed,fertilizer)

Cost of packaging

Farm/business taxes

Food safety regulations

(proce ssing)

Food safety regulations

(selling)

Product marketing issues

Labeling regulations

Urban encroachment

National Farmers' Market Impact Study 2009 Report

70

Vendor Pleasure Points

Source: Vendor Survey - Coded Verbatim Comments

• Vendors are attracted to the community and social aspects of farmers’ market participation

What do you like best about this market? What do you think works well?

25%

25%

20%

17%

16%

14%

14%

12%

7%

7%

6%

6%

6%

5%

3%

2%

1%

1%

Friendly

Community

Design

Location

Atmosphere

Traffic Flow

Variety

Social

Convenient Days/Hours

Management

Authentic

Face-to-face

Sales

Quality

Outdoors

Parking

Marketing Efforts

Market Growth

National Average n= 487

National Farmers' Market Impact Study 2009 Report

71

Vendor Pleasure Points

Community

‘”[The market] attracts a lot of people, [has] lots of events,

musicians, community. [It’s] consistent, well-organized. The

location [and] vendor spots can be reserved.”

Medium Market,

British Columbia

“There is a limit on each category. Everyone comes out in the

community and the market is located in a good location.”

Medium Market, British Columbia

“You get to market your product to people you would not

normally see. I like being around the other vendors; I can talk to

people and share ideas.”

Small Market, Alberta

“Parking is great. it is a nice market and in a way it is good we

don't have tourists, locals coming on a regular basis, supply is

great convenient demand and size of market. it is fun for the

most part.”

Small Market, Ontario

Location

“I like that it is open year round and that it is open indoors and

that I only work 3 days a week.”

Large Market, Alberta

“I love the location, lots of amenities, [and] eclectic group of

people. The group of farmers that are there stay true to the

ideology of farming.”

Small Market, Ontario

‘”The location is great; located near natural surroundings. And

there is lots of open space.”

Medium Market, Ontario

Design

“I don't have to set up a tent - the awning is permanent. [There

are] lots of friends here and getting to meet people.”

Small

Market, Saskatchewan

“That I can leave my stuff set up all week.”

Large Market, New

Brunswick

“There is lots of parking. I can unload everything easily, there is

plenty of room between the vendors, the customers are also

family oriented and the management is good.”

Medium Market,

British Columbia

Friendly

“Storage and [the] help with table set-up.”

Small Market, Alberta

“Atmosphere – [it’s] like a small village where friends can get

together. The close relationships that are built with customers.”

Large Market, British Columbia

“Friendliness, quality of products - organic, local. The support

from the community, and the location.”

Medium Market, British

Columbia

“I enjoy the one on one time i get to have with my customers.”

Large Market, Alberta

‘”I like the signage to get here. It was very easy. Volunteers were

here ready to help and the market manager walks around giving

all vendors water.”

Medium Market, British Columbia

Source: Vendor Survey

•“In their own words”

National Farmers' Market Impact Study 2009 Report

72

Vendor Pain Points

Source: Vendor Survey - Coded Verbatim Comments

• Market design and parking are key issues for vendors

What do you like least about this market? What do you think doesn't work well?

12%

8%

8%

7%

7%

7%

7%

5%

5%

4%

3%

3%

2%

2%

2%

1%

1%

1%

1%

Design

Parking

Outdoors

Management

Variety

Inconvenient Days/Hours

Location

Traffic Flow

Marketing efforts

Unloading

Inter-Vendor Relationships

Crowding

Authenticity

Atmosphere

Sales

Cleanliness

Community Support

Cost

Activities

National Average n= 487

Outdoors:

Sales:

weather

elements/effects, too

cold, too hot,

weather causing less

traffic, etc.

poor sales, price-

related issues (i.e.

price instability

among vendors,

price-cutting, etc.

National Farmers' Market Impact Study 2009 Report

73

Vendor Pain Points

Design

“[It] needs a seating place. We need to have a permanent site,

more vehicles (out-of-market site). Power and water should be

available to everyone.”

Small Market, Alberta

“Too many browsers just having a ‘Sunday outing’.”

Medium

Market, Alberta

“Not owning this space. 2 or 3 times a year they would have

other events at this spot and we could be forced to stop. I would

prefer a permanent space.”

Medium Market, Ontario

“Money is not accessible in that there is no cash machine.”

Medium Market, Quebec