Climate Pollution Reduction Grants Program:

Formula Grants for Planning

Program Guidance for States, Municipalities, and Air Pollution

Control Agencies

United States Environmental Protection Agency

Office of Air and Radiation

March 1, 2023

2

CLIMATE POLLUTION REDUCTION GRANTS PROGRAM:

FORMULA GRANTS FOR PLANNING

PROGRAM GUIDANCE FOR STATES, MUNICIPALITIES,

AND AIR POLLUTION CONTROL AGENCIES

TABLE OF CONTENTS

1. Overview ....................................................................................................................... 4

2. Statutory Authority ........................................................................................................ 7

3. Justice40 Initiative and Advancing Environmental Justice................................................ 8

4. Eligible Entities ............................................................................................................... 8

5. Allocation of Planning Grant Funds ................................................................................. 9

6. Summary - Schedule and Process .................................................................................. 12

7. Notice of Intent to Participate ...................................................................................... 14

7.1. Overview ......................................................................................................................... 14

7.2. Deadline and Submission Requirements ........................................................................... 15

8. Grant Application Package and Submission Requirements ............................................ 15

8.1. Deadline for Submitting Application Package .................................................................... 16

8.2. Contents of Application Package ...................................................................................... 16

8.3. Grants.gov Application Instructions .................................................................................. 16

8.4 Workplan Requirements .................................................................................................. 17

9. Eligible Activities .......................................................................................................... 23

10. Strategic Plan Linkages, Outputs, Outcomes, Performance Measures ............................ 24

10.1. Linkage to EPA Strategic Plan ........................................................................................... 24

10.2. Outputs ........................................................................................................................... 25

10.3. Outcomes ........................................................................................................................ 25

10.4. Performance Measures .................................................................................................... 26

11. Use of Funds Requirements .......................................................................................... 26

11.1. Federal Matching Funds ................................................................................................... 27

11.2. Expenses Incurred Prior to the Project Period ................................................................... 27

12. Award Administration .................................................................................................. 27

12.1. Applicable Requirements ................................................................................................. 27

12.2. Terms and Conditions ...................................................................................................... 27

12.3. Quality Assurance Project Plan (QAPP) ............................................................................. 28

3

12.4. Procurements .................................................................................................................. 28

12.5. Performance Partnership Grant Agreements .................................................................... 28

12.6. Reporting Requirements .................................................................................................. 28

12.7. Joint Administration of Greenhouse Gas and Zero-Emission Standards for Mobile Sources.28

13. EPA Contacts ................................................................................................................ 29

14. Technical Assistance and Tools ..................................................................................... 29

14.1. Technical Assistance Overview ......................................................................................... 29

14.2. Climate Innovation Teams ................................................................................................ 29

15. APPENDICES ................................................................................................................. 31

15.1. Statutory Text: Section 60114 of the Inflation Reduction Act ............................................. 31

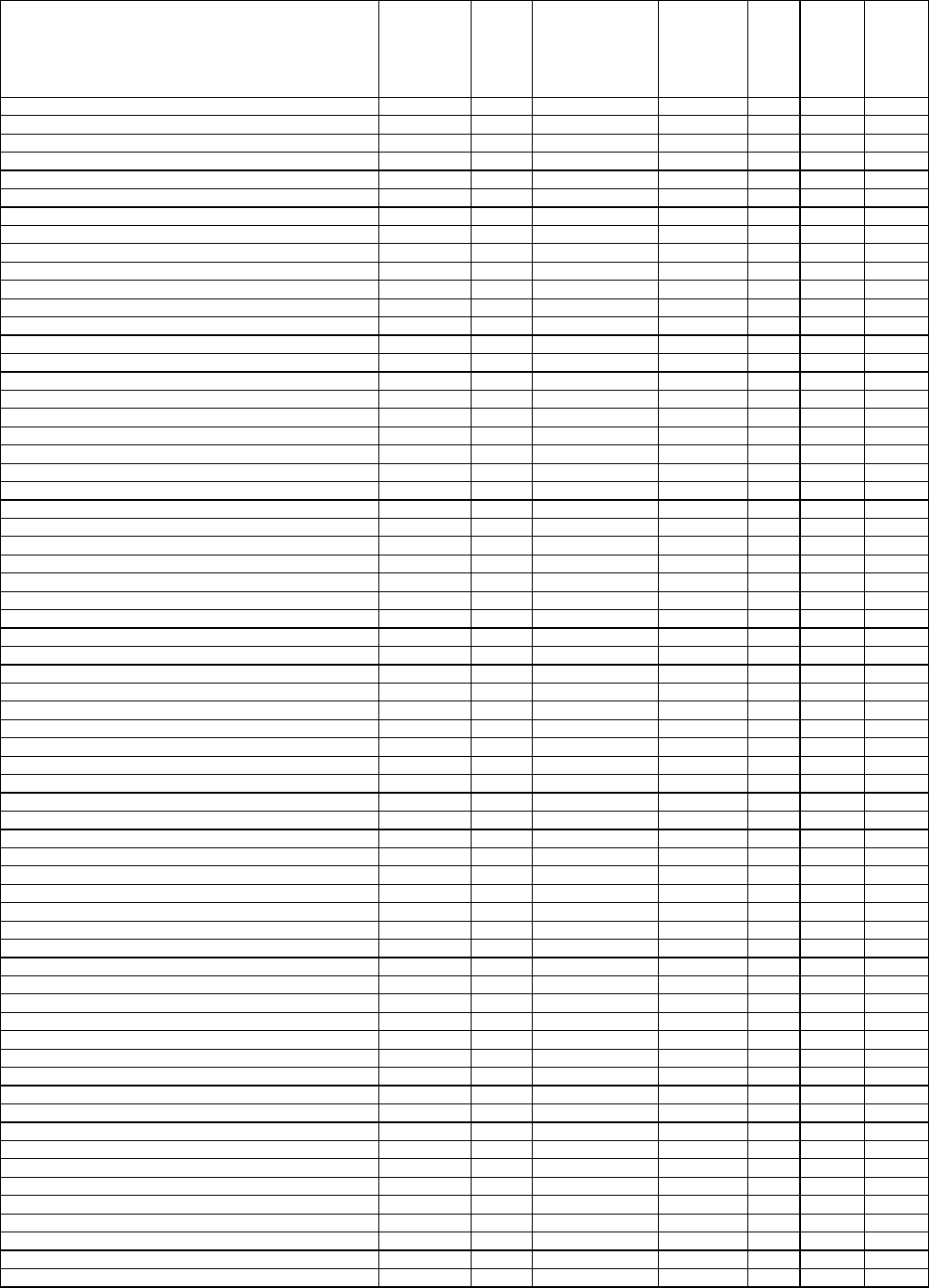

15.2. Formula Allocations ......................................................................................................... 33

15.3. Deliverable Requirements ................................................................................................ 49

4

1. Overview

EPA takes seriously its responsibility to protect human health and the environment as we face

increasingly more harmful impacts of climate change. Across our country communities are

experiencing more deadly wildfires and storm surges, more extreme drought and water

scarcity, and dangerous levels of flooding, among other impacts. The Fourth National Climate

Assessment found that intense extreme weather and climate-related events, as well as changes

in average climate conditions, are expected to continue to damage infrastructure, ecosystems,

and social systems that provide essential benefits to communities. If unchecked, future climate

change is expected to further disrupt many areas of life and exacerbate existing challenges to

prosperity posed by aging and deteriorating infrastructure, stressed ecosystems, and long-

standing inequalities. However, with this challenge comes an opportunity to invest in a cleaner

economy that can spur innovation and economic growth while building more equitable,

resilient communities.

Through the Inflation Reduction Act of 2022 (IRA), Congress provided many tools to pursue

greenhouse gas (GHG) pollution reductions, including the Climate Pollution Reduction Grants

(CPRG) program. In implementing this and many other programs under the Inflation Reduction

Act, EPA seeks to achieve three broad objectives:

• Tackle damaging climate pollution while supporting the creation of good jobs and

lowering energy costs for families.

• Accelerate work to address environmental injustice and empower community-driven

solutions in overburdened neighborhoods.

• Deliver cleaner air by reducing harmful air pollution in places where people live, work,

play, and go to school.

This strategy will allow the country to make the inevitable changes needed to address climate

change and make them opportunities—to revitalize the U.S. energy and manufacturing sectors,

create millions of good-paying jobs throughout the country, and address historic environmental

injustices and inequities. The CPRG program will seek those opportunities in partnership with

states, territories, local governments, and tribes, which are in touch with the needs of their

communities and familiar with the horizons of GHG reduction opportunities for their

economies.

In line with this strategy, EPA is committed to supporting the development and expansion of

state, territory, tribal, and local climate action plans and the expeditious implementation of

investment-ready policies, programs, and projects to reduce GHG pollution in the near term.

Through the CPRG program, EPA will support state, territory, tribal, and local actions to reduce

GHGs and associated criteria and toxic air pollution through deployment of new technologies,

operational efficiencies, and solutions that will transition America equitably to a low-carbon

economy that benefits all Americans.

5

Section 60114 of the Inflation Reduction Act appropriates $5 billion to EPA to support efforts by

states, U.S. territories, municipalities, air pollution control agencies, tribes, and groups thereof

to develop and implement plans to reduce GHGs. This program has two distinct but related

phases:

• Planning grants: The Inflation Reduction Act provides $250 million for eligible entities to

develop plans to reduce GHGs.

• Implementation grants: The Inflation Reduction Act provides $4.6075 billion for grants

to implement measures from the GHG reduction plans developed with planning grant

funding.

1

This guidance is focused specifically on the $250 million program for planning grants, which EPA

will award as cooperative agreements through a noncompetitive process. Cooperative

agreements are similar to grants but entail substantial programmatic involvement between EPA

and the recipient.

2

The term “grant” used throughout this document includes both “grants” and

“cooperative agreements” as defined by 2 CFR 200.1.

At a later date, EPA will issue a separate notice of funding opportunity (NOFO) regarding the

implementation grants, which EPA plans to award under a competitive process. In that notice,

EPA will indicate the funding priorities for the implementation grants.

Overall, this dual-phased CPRG program enables EPA to work in partnership with state,

territory, local, and tribal officials to advance important goals by providing substantial funding

for climate action planning and implementation, while maintaining recipients’ flexibility to

pursue activities tailored to their unique resources, delivery capacity, and mix of key sectors

responsible for emitting and absorbing GHGs (e.g., industry, electricity generation,

transportation, commercial and residential buildings, agriculture, natural and working lands,

and waste and materials management).

EPA will be awarding the $250 million available for planning grants (cooperative agreements) to

states, municipalities, air pollution control agencies, territories and tribes via a formula as

follows:

• $3 million to all 50 states, District of Columbia (DC), and Puerto Rico, for a total of $156

million

• $1 million to each of the 67 most populous metropolitan areas, for a total of $67 million

• $25 million to tribes and tribal consortia and $2 million to U.S. territories (as described

in a separate guidance).

Each state government will be expected to develop a climate action plan or update an existing

plan in collaboration with air pollution control districts and large and small municipalities

1

Three percent of the $4.75 billion in implementation funds are reserved for EPA administrative costs.

2

See EPA’s Funding Instruments and Authorities for additional details.

6

statewide and to conduct meaningful engagement with low income and disadvantaged

communities throughout its jurisdiction.

Municipal governments have authority and responsibility for transportation, waste

management, and energy and water efficiency, all of which affect GHG emissions and

associated co-pollutants. Local air pollution control districts often have responsibility for

reducing air pollution in metropolitan areas. Accordingly, the CPRG program also provides

planning grants for the most populous metropolitan areas nationally. The combined population

of metropolitan areas that are targeted to receive planning funding under this program exceeds

194 million.

3

Smaller, rural, and unincorporated communities will be able to work with their

state governments on climate planning.

The territories of Guam, American Samoa, U.S. Virgin Islands, and the Northern Mariana Islands

as well as federally recognized Indian tribes are also eligible entities; their application process is

detailed in a separate document.

Under the cooperative agreements addressed by this guidance for states, municipalities, and air

pollution control agencies, funding recipients will need to produce and submit three key

deliverables (in addition to meeting standard grant reporting requirements) over the course of

the four-year program period running to 2027:

1. A Priority Climate Action Plan (PCAP), due in early 2024;

4

2. A Comprehensive Climate Action Plan (CCAP), due 2 years from the date of the award;

and,

3. A Status Report, due at the close of the 4-year grant period.

Each of these deliverables is described in detail in Appendix 15.3.

EPA encourages eligible entities to develop or, where applicable, revise their existing climate

plans consistent with the following programmatic priorities:

• Improve understanding of current and future GHG emissions so that state and local

governments can prioritize actions that reduce such emissions and harmful air pollution

(criteria air pollution and toxic air pollutants) where citizens live, work, play, and go to

school, particularly in nonattainment areas for the National Ambient Air Quality

Standards (NAAQS) for criteria air pollutants.

• Adopt and implement ambitious policies and programs to reduce GHG emissions and

accelerate decarbonization across multiple important sectors (e.g., industry, electricity

generation, transportation, commercial and residential buildings, agriculture/natural

3

In the absence of consistent emissions data at the sub-state level, EPA is using population data as a proxy for

identifying the metropolitan areas that are likely to have the highest aggregate emissions of GHG pollution.

4

Applicants for implementation grant funding under the CPRG program will be required to submit a PCAP along

with their application.

7

and working lands, and waste and materials management).

• Collaborate closely with other entities in their state, region, municipality, and/or air

district to develop coordinated plans based on best practices.

• Explore opportunities to leverage sources of funding and financing from the Inflation

Reduction Act of 2022, Bipartisan Infrastructure Law of 2021, American Rescue Plan Act

of 2021, and Creating Helpful Incentives to Produce Semiconductors and Science Act of

2022.

• Stimulate innovative technologies and practices to reduce GHG emissions and

associated co-pollutants in hard-to-abate sectors.

• Prioritize actions and policies that will be durable, replicable, and provide certainty in

pollution reductions.

• Reduce climate pollution while building the clean energy economy in a way that benefits

all Americans, provides new workforce training opportunities, and effectively addresses

environmental injustices in disadvantaged communities.

• Adopt robust metrics and reporting programs to track emission reductions and

important benefits throughout their jurisdiction and in disadvantaged communities.

This document describes how the Agency intends to award and manage CPRG planning grants

for states, municipalities, and air pollution control agencies. This document also describes the

programmatic requirements applicable to all grants awarded through this program to states,

municipalities, and air pollution control agencies. (A separate program guidance is available for

territories and tribes.)

This guidance document explains the key deadlines, framework for preparing applications and

workplans, and submission instructions. Grant recipients shall follow the framework for grants

management, requirements, and reporting using the Uniform Grants Guidance (UGG) under 2

CFR Part 200 and EPA regulations under 2 CFR Part 1500. Some of the statutory provisions

described in this document contain legally binding requirements. However, this document does

not substitute for those provisions or regulations, nor is it a regulation itself. Thus, the

document cannot impose legally binding requirements on EPA, states, or the regulated

community, and it may not apply to all situations.

2. Statutory Authority

Section 60114 of the Inflation Reduction Act, Climate Pollution Reduction Grants (Public Law

117–169, title VI, Aug. 16, 2022, 136 Stat. 2076) amended the Clean Air Act (CAA) by creating

section 137, 42 U.S. Code § 7437, for Greenhouse Gas Air Pollution Plans and Implementation

Grants. Section 137 of the CAA authorizes the EPA to fund climate pollution planning grants and

climate pollution implementation grants to states, air pollution control agencies, municipalities,

tribes, or a group of one or more of these entities.

See the statutory text for this provision in Appendix 15.1.

8

3. Justice40 Initiative and Advancing Environmental Justice

The Inflation Reduction Act can improve the lives of millions of Americans by reducing pollution

in neighborhoods where people live, work, play, and go to school. Inflation Reduction Act

programs can accelerate environmental justice efforts in communities overburdened by

pollution for far too long and can help states and cities tackle the country’s biggest

environmental challenges while creating jobs and delivering energy security.

Environmental justice (EJ) is the fair treatment and meaningful involvement of all people

regardless of race, color, national origin, or income with respect to the development,

implementation and enforcement of environmental laws, regulations, and policies. Fair

treatment means no group of people should bear a disproportionate share of the negative

environmental consequences resulting from industrial, governmental, and commercial

operations or policies. Meaningful involvement means people have an opportunity to

participate in decisions about activities that may affect their environment and/or health; the

public's contribution can influence the regulatory agency's decision; community concerns will

be considered in the decision-making process; and decision makers will seek out and facilitate

the involvement of those potentially affected.

The CPRG program will advance the goals of the Justice40 Initiative set forth in Executive Order

14008, which aims to deliver 40 percent of the overall benefits of relevant federal investments

to disadvantaged communities. More information on Justice40 at the EPA can be found at:

https://www.epa.gov/environmentaljustice/justice40-epa.

4. Eligible Entities

Section 137(d)(1) of the Clean Air Act defines “eligible entities” under the CPRG program as

states, air pollution control agencies, municipalities, tribes, and groups of one or more of these

entities.

Section 302 of the Clean Air Act defines “states” as including the 50 states, DC, Puerto Rico, U.S.

Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana

Islands. The state funding allocation approach described in this document includes funding for

DC and Puerto Rico. Funding for the remaining four U.S. territories is addressed in a separate

program guidance.

Section 302 of the Clean Air Act defines "municipality" as a city, town, borough, county, parish,

district, or other public body created by or pursuant to State law. Consistent with new section

137(d)(1) of the Clean Air Act, a group of municipalities, such as a council of governments, may

also be considered an eligible entity under this program in some cases.

Consistent with section 302 of the Clean Air Act, the term “air pollution control agency” under

this program includes a state air agency (which could serve as a lead organization or

9

collaborating partner for a state plan), or a local air agency (which could serve as a lead

organization or collaborating partner for a metropolitan area-based plan).

While groups of two or more eligible entities may choose to form a coalition and submit a

single application, one eligible entity must be responsible for the cooperative agreement. A

coalition must identify which eligible organization will be the recipient of the cooperative

agreement; they must also identify if any eligible organization(s) will be subrecipients (i.e.,

“pass-through entity”). Any subawards must be consistent with the definition of that term in 2

CFR 200.1 and comply with EPA’s Subaward Policy. The pass-through entity that administers the

cooperative agreement and subawards will be accountable to EPA for proper expenditure of

the funds and reporting and will be the point of contact for the coalition. As provided in 2 CFR

200.332, subrecipients are accountable to the pass-through entity for proper use of EPA

funding.

This program guidance does not address climate plan funding for tribes. A separate program

guidance document is available for tribal grants. However, in addition to being direct recipients

of planning funding, tribes and tribal consortia can also participate in this program as

collaborating partners in planning efforts managed by lead organizations for states or

metropolitan areas.

5. Allocation of Planning Grant Funds

Under this formula grant program, EPA will provide $223 million to eligible entities addressed in

this program guidance to develop or update climate plans (the remaining $27 million will be

awarded to U.S territories and tribes as described in a separate program guidance document).

The presumptive allocation for states, municipalities, and air pollution control agencies is as

follows:

• $3 million to all 50 states, DC, and Puerto Rico, for a total of $156 million

• $1 million to each of the 67 most populous metropolitan areas, for a total of $67 million.

10

EPA has used 2020 U.S. Census data

5

for metropolitan statistical areas (MSAs)

6

to identify

metropolitan areas eligible for funding. A list of all MSAs based on 2020 U.S. Census data

ranked by population is available in Appendix 15.2.

Because DC is eligible to receive the state level allocation of up to $3 million, the DC

metropolitan area will not receive an MSA based allocation. The DC government is encouraged

to work with its neighboring states to address regional collaboration as appropriate.

Each state, DC, Puerto Rico, and metropolitan area that is eligible for funding must identify and

designate a lead organization to manage grant funds and oversee the climate plan development

process. The lead organization must meet the eligibility requirements in Section 4 “Eligible

Entities.”

• States, DC, and Puerto Rico: To accept these funds, the governor (or DC mayor), or the

governor or DC mayor’s designee, must submit a Notice of Intent to Participate (NOIP)

to EPA by March 31, 2023, that identifies the lead organization for the CPRG planning

grant. For example, the lead organization could be the governor’s office, state

environment or air pollution control agency, or another designated state agency. (See

sample NOIP for states on the EPA CPRG website at: https://www.epa.gov/inflation-

reduction-act/climate-pollution-reduction-grants.) The lead organization will then need

to submit an application, which will include a workplan and budget for the planning

grant, by April 28, 2023.

• Municipalities and air pollution control agencies:

EPA’s formula prioritizes the development of regional climate plans for the most

populous metropolitan areas nationally (as defined by U.S. Census 2020 MSA

population). In general, the climate plan for a metropolitan area should address GHG

emissions and reduction measures throughout the entire metropolitan area. EPA

recommends that the leaders of municipalities and local governments (such as leaders

of cities, counties, and local air pollution control agencies) within and around a

metropolitan area coordinate with each other to identify an eligible lead organization to

administer the planning grant. Applicants from multi-state metropolitan areas are

5

https://www.census.gov/data/tables/time-series/demo/popest/2020s-total-metro-and-micro-statistical-

areas.html.

6

The general concept of an MSA is that of a core area containing a substantial population nucleus, together with

adjacent communities having a high degree of economic and social integration with that core. Metropolitan

statistical areas contain at least one urbanized area of 50,000 or more population. An MSA includes one or more

counties. The Office of Management and Budget (OMB) also delineates New England city and town areas (NECTAs)

as a city/town-based set of areas conceptually similar to county-based MSAs. Metropolitan NECTAs contain at least

one urbanized area of 50,000 or more population, similar to MSAs, but are based on city and town “building

blocks” instead of counties. https://www2.census.gov/geo/pdfs/reference/GARM/Ch13GARM.pdf.

11

expected to conduct planning activities across all states making up the metropolitan

area. The lead organization may sub-award funds to other jurisdictions, academic

institutions, or non-profit organizations to assist in the development of a regional plan in

accordance with EPA grants policy.

To accept these funds, the lead organization for a metropolitan area must submit a

NOIP to EPA by April 28, 2023, and must indicate the MSA that the planning grant will

cover. It is highly recommended that collaborating jurisdictions submit letters(s) along

with the NOIP, indicating their commitment to work with the lead organization on the

metropolitan area plan. (See sample NOIP for metro areas on the EPA CPRG website at:

https://www.epa.gov/inflation-reduction-act/climate-pollution-reduction-grants.) The

lead organization for the metropolitan area will then need to submit an application,

which will include a workplan and budget for the planning grant, by May 31, 2023.

In the event of a lack of agreement among jurisdictions regarding the lead organization

to administer funds for a metropolitan area planning process (e.g., if more than one

entity submits a NOIP to serve as the lead agency for the same area), EPA will first notify

each entity and ask them to come to agreement. If they cannot timely resolve the issue,

EPA will expect the mayor of the largest city in the MSA as determined by the 2020 U.S.

Census to determine the lead organization to administer the award to develop climate

plan deliverables for the area.

EPA’s funding set-aside of $67 million for metropolitan areas presumptively will provide

funding to 67 areas. However, EPA recommends that metropolitan areas not on the

initial ranked list of 67 (i.e., MSAs with population lower than the top 67) also submit an

NOIP, as they may become eligible to receive funds if their state declines funding, or if

no eligible entity in a higher population metropolitan area submits a NOIP. See below

for more details.

If a state declines funding:

• If a state declines the $3 million funding, those funds would be made available to the 3

most populous metropolitan areas in that state on the MSA list found in Appendix 15.2

that have submitted a NOIP before the April 28, 2023, deadline. Such areas will not also

be eligible for funding from the national metropolitan area funding pool, regardless of

population size.

• If a state declines funding and no eligible entity is identified as the lead organization for

one of the 3 most populous metropolitan areas in the state, those funds will be made

available to the next most populous metropolitan area in that state on the MSA list in

12

Appendix 15.2 provided that a lead organization from that MSA has submitted an NOIP

before the April 28, 2023, deadline.

• If a state declines funding and there are fewer than three U.S. Census-defined MSAs in

the state, or fewer than three MSAs in the state that have submitted a NOIP by the April

28, 2023, deadline, the remaining funds will be added to the national metropolitan area

funding pool and will be available for the next metropolitan area on the list that timely

submitted an NOIP, regardless of state.

If a metropolitan area declines funding:

• If no eligible entity is identified as the lead organization for a metropolitan area that

qualifies for funding based on population, then those funds would remain in the

national metropolitan area funding pool and would be available for the next

metropolitan area on the national MSA list that timely submitted an NOIP.

A summary of the formula allocations for states and metropolitan areas is provided in Appendix

15.2.

6. Summary - Schedule and Process

While CPRG planning grants will be funded under a non-competitive process, to receive federal

funding, eligible entities are nonetheless subject to certain minimum application requirements

that must be fulfilled by the deadlines described below.

Key Dates for States

• By March 31, 2023, the lead organization for each state, DC, and Puerto Rico must

submit a Notice of Intent to Participate (NOIP) to EPA by email to [email protected]. See

Section 7 for additional information about NOIP submittal requirements.

• By April 28, 2023, the lead organization must submit a complete application, which

includes a workplan and budget for the planning grant, through Grants.gov. These

materials must contain all of the information listed in Section 8 “Grant Application

Package and Submission Requirements.” Interested applicants are strongly encouraged

to contact EPA about their workplan and budget prior to submitting their application.

• By summer 2023, EPA Regional Offices expect to award and administer the planning

grants. The EPA will perform a merit review of each application and process the awards.

Once the awards are processed, recipients will be awarded their funding and can begin

work.

13

Key Dates for Metropolitan Areas

• By April 28, 2023, the lead organization for each metropolitan area must submit a

for additional information about NOIP submittal requirements.

• By May 31, 2023, the lead organization must submit a complete application, which

includes a workplan and budget for the planning grant, through Grants.gov. These

materials must contain all of the information listed in Section 8 “Grant Application

Package and Submission Requirements.” Interested applicants are strongly encouraged

to contact EPA about their workplan and budget prior to submitting their application.

• By summer 2023, EPA Regional Offices expect to award and administer the planning

grants. The EPA will perform a merit review of each application and process the awards.

Once processed, recipients will be awarded their funding and can begin work.

The general schedule and process is illustrated below:

If you plan to submit an application for this program, please note the following:

• To apply for a planning grant (cooperative agreement), the lead organization must have

an active registration in the System for Award Management (SAM.gov), an official

website for doing business with the U.S. government. While this registration includes a

Unique Entity Identifier (UEI), please note that SAM.gov registration is different than

obtaining a UEI only. Obtaining a UEI only validates your organization's legal business

name and address. Please review the Frequently Asked Question on the FSD.gov

website for additional details. All eligible entities should register in SAM.gov now to

ensure they are able to submit an application through Grants.gov. Organizations should

ensure that their SAM.gov registration includes a current e-Business (EBiz) point of

March 1, 2023

• EPA issues

program

guidance

and notifies

all eligible

recipients

March 31, 2023

• State

deadline to

submit

Notice of

Intent to

Participate

April 28, 2023

•State

application

deadline

•Metro area

deadline to

submit

Notice of

Intent to

Participate

May 31, 2023

•Metro

area

application

deadline

Summer 2023

•Funding to

all grantees

is awarded

14

contact name and email address. The EBiz point of contact is critical for Grants.gov

registration and system functionality. Contact the Federal Service Desk for help with

your SAM.gov account, to resolve technical issues, or to chat with a help desk agent:

(866) 606-8220. The Federal Service Desk hours of operation are Monday - Friday 8am -

8pm ET. As of April 2022, the federal government has stopped using the DUNS number

to uniquely identify entities. For more information, please visit

www.sam.gov/content/duns-uei.

• Once their SAM.gov account is active, the lead organization must register in Grants.gov.

Grants.gov will electronically receive your organization information, such as an e-

Business (EBiz) point of contact email address and UEI. Organizations applying to this

funding opportunity must have an active Grants.gov registration. Grants.gov registration

is FREE. If you have never applied for a federal grant before, please review the

Grants.gov applicant registration instructions. As part of the Grants.gov registration

process, the EBiz point of contact is the only person that can affiliate and assign

applicant roles to members of an organization. In addition, at least one person must be

assigned as an Authorized Organization Representative (AOR). Only person(s) with the

AOR role can submit applications in Grants.gov. Please review the training videos “Intro

to Grants.gov-Understanding User Roles” and “Learning Workspace - User Roles and

Workspace Actions” for details on this important process.

Please note that this registration process can take a month or more for new registrants.

Applicants must ensure that all registration requirements are met in order to apply for this

opportunity through Grants.gov and should ensure that all such requirements have been met

well in advance of the application submission deadline.

technical issues with Grants.gov. Applicants who are outside the U.S. at the time of submittal

and are not able to access the toll-free number may reach a Grants.gov representative by

calling +1-606-545-5035. The Grants.gov Support Center is available 24 hours a day, 7 days a

week, excluding federal holidays.

7. Notice of Intent to Participate

7.1. Overview

As noted above, eligible entities that elect to receive CPRG planning grant funding must submit

a NOIP indicating the lead organization that will oversee and be responsible for managing

planning grant funds and coordinating activities and deliverables under the planning grant

program. A sample NOIP is provided online at https://www.epa.gov/inflation-reduction-

act/climate-pollution-reduction-grants#CPRGSampleDocuments.

15

7.2. Deadline and Submission Requirements

All applicants must submit a NOIP by email to C[email protected] according to the following

deadlines:

• The lead organization for a state shall submit the NOIP by March 31, 2023.

• The lead organization for a metropolitan area shall submit the NOIP by April 28, 2023.

Applicants are encouraged to submit the NOIP as early as possible to help expedite EPA’s

administration of the awards process and enable the organization to begin work and

consultation with EPA as needed on development of a workplan to execute the planning grant,

as described in Section 8 of this guidance.

The NOIP from a state, DC, or Puerto Rico should be emailed to [email protected] and must

include an attached letter or memo signed by one of the following authorized officials:

• an official within the relevant governor’s (or DC mayor’s) office, or

• the director of the designated agency.

The NOIP from a metropolitan area should be emailed to [email protected] and must include an

attached letter or memo signed by one of the following authorized officials:

• the office of the chief executive (mayor, county manager, etc.) of the designated lead

municipality in a metropolitan area;

• the director of a local air pollution control agency;

• the director of a designated municipal agency in a metropolitan area; or

• the executive director (or equivalent) of an eligible regional organization selected to

administer a metropolitan area award.

A metropolitan area NOIP must include a clear statement indicating which MSA the lead

organization is representing.

If a state, DC, Puerto Rico, or group of officials representing a metropolitan area elects to

decline funding, EPA requests that notification of this declination be provided via email to

[email protected] as well. This information will help EPA with administration of the program.

8. Grant Application Package and Submission Requirements

Although planning grants are being awarded through a non-competitive process, each lead

organization must submit an application package through Grants.gov consisting of a workplan,

budget, and required federal forms in order for EPA to disburse funds.

16

8.1. Deadline for Submitting Application Package

All applicants must submit a complete application package through Grants.gov according to the

following deadlines. These materials must contain all of the information listed in Sections 8.2

and 8.4. Applicants are strongly encouraged to contact EPA about their funding request and

workplan prior to submitting their application.

• The lead organization for a state shall submit a complete application by April 28, 2023.

• The lead organization for a metropolitan area shall submit a complete application by

May 31, 2023.

EPA will review submitted application packages and will contact applicants to discuss any

needed corrections or address any questions.

8.2. Contents of Application Package

The application package must include all the following materials in Grants.gov:

• Project Narrative Attachment Form (Narrative Workplan)

o Narrative

o Budget Detail. See EPA’s How to Develop a Budget website.

• Standard Form (SF) 424, Application for Federal Assistance

• Standard Form (SF) 424A, Budget Information

• EPA Form 5700-54, Key Contacts Form

• Grants.gov Lobbying Form, Certification Regarding Lobbying

• EPA Form 4700-4, Pre-award Compliance Review, See EPA’s Applicant Tips for

Completing Form 4700-4

• Other Attachments Form – Optional Supporting Materials

o Letters of commitment

o Resumes

8.3. Grants.gov Application Instructions

The lead organization’s authorized official representative (AOR) must submit the complete

application package electronically to EPA by following the instructions available on Grants.gov.

The application package must contain the required forms and documents (workplan and

budget) listed above. EPA will provide additional instructions upon receipt of the lead

organization’s NOIP.

17

8.4 Workplan Requirements

8.4.1 Overview

The application package must include a high-quality, narrative workplan for executing the

planning grant. The workplan is a critical component of the application package, as it describes

the applicant’s proposed approach for developing each of the three deliverables identified in

Section 1 and described more fully below. The workplan also must include a discussion of

planned interagency coordination and stakeholder engagement, outputs, outcomes, and

performance measures. EPA recommends workplans not exceed 15 pages.

8.4.2 Planning Grant Deliverables

As noted in Section 1, under the CPRG planning grants, funding recipients will produce and

submit three deliverables (in addition to meeting standard grant reporting requirements) over

the course of the 4-year program period running to 2027:

1. A Priority Climate Action Plan (PCAP), due March 1, 2024;

7

2. A Comprehensive Climate Action Plan (CCAP), due 2 years from the date of the award

(summer-fall 2025); and,

3. A Status Report, due at the close of the 4-year grant period (summer-fall 2027).

Therefore, for each deliverable, the applicant’s workplan must describe:

• the applicant’s general approach to developing all required elements of the deliverable;

• the entities responsible for completing each element;

• a schedule with milestones for developing the deliverable.

Applicants may describe in their workplans how they expect to draw from previously developed

climate action plans to help satisfy the required elements of each deliverable. For example,

applicants may describe how an existing climate action plan will inform the identification of

measures for the PCAP, how a CCAP funded through a planning grant award could extend or

expand the work completed in a previously developed climate action plan, or how existing or

updated climate metrics and emissions monitoring and reporting could inform the Status

Report.

For more detail on the elements of each deliverable, please review Appendix 15.3.

7

Applicants for implementation grant funding under the CPRG program will be required to submit a PCAP along

with their application. This is a required deliverable under the CPRG planning grants, regardless of whether a

funding recipient plans on applying for CPRG implementation grants in the future.

18

• Key Deliverable #1: Priority Climate Action Plan (PCAP)

The initial deliverable is a Priority Climate Action Plan (PCAP), a narrative report due on

March 1, 2024, that includes a focused list of near-term, high-priority, implementation-

ready measures to reduce GHG pollution and an analysis of GHG emissions reductions that

would be achieved through implementation. These initial plans can focus on a specific

sector or selected sectors, and do not need to comprehensively address all sources of GHG

emissions and sinks

8

in the jurisdiction. The PCAP must include:

o A GHG inventory;

o Quantified GHG reduction measures;

o A low-income and disadvantaged communities benefits analysis; and,

o A review of authority to implement.

Planning grant recipients are encouraged, but not required, to include additional analyses in

their PCAP such as GHG emissions projections, GHG reduction targets, a benefits analysis

(for the full geographic scope and population covered by the plan), a plan for leveraging

other federal funding, and a workforce planning analysis. A PCAP may draw from or

reference an existing climate action plan or plans for the geographic area covered, such as

an existing state climate, energy, or sustainability plan.

8

Carbon “sinks” are resources that absorb or sequester carbon dioxide from the atmosphere. In the U.S.

greenhouse gas emissions inventory, these sinks are referred to as the Land Use, Land-Use Change, and Forestry

(LULUCF) sector. These resources include forests, coastal wetlands, agricultural soils, trees in urban areas, and

landfilled yard trimmings and food scraps.

19

• Key Deliverable #2: Comprehensive Climate Action Plan (CCAP)

The second deliverable is a Comprehensive Climate Action Plan (CCAP) due 2 years from the

date of award of the planning grant. The CCAP should touch on all significant GHG

sources/sinks and sectors present in a state or metropolitan area, establish near-term and

long-term GHG emission reduction goals, and provide strategies and identify measures to

achieve those goals. Each CCAP must include:

o A GHG inventory;

o GHG emissions projections;

o GHG reduction targets;

o Quantified GHG reduction measures;

o A benefits analysis for the full geographic scope and population covered by the

plan;

o A low-income and disadvantaged communities benefits analysis;

Preparing the PCAP to Be Positioned to Compete for Implementation Grants

The PCAP is a pre-requisite for competing in the second phase of the CPRG program in the

future, which will competitively award $4.6 billion for implementation. Any future

application for an implementation award under the CPRG will need to include a PCAP that

describes the programs, policies, measures, and projects the entity will carry out with the

implementation grant funding. A PCAP also may include additional measures that will not

be part of an implementation grant application. In the NOFO for the implementation

grants, EPA will indicate the funding priorities for those implementation grants.

Note that an entity that did not directly receive a planning grant may apply for an

implementation grant provided that the measures they propose for funding are covered by

a PCAP. Collaborating partners who developed joint plans or regionally based plans would

retain eligibility for implementation funds, regardless of who administered the planning

grant. Municipalities and air pollution control agencies will also be eligible for funding for

measures identified in their state’s or metropolitan area’s plan for implementation at their

level. Tribes can also partner with a neighboring state or metropolitan area. EPA

anticipates providing implementation grants with a wide range of funding levels, with the

largest grant awards potentially exceeding $100 million depending on the quality of the

application and its adherence to the grants competition criteria.

States must coordinate with municipalities and air pollution control agencies within their

state to include priority measures that are implementable by those entities. States are

further encouraged to similarly coordinate with tribes. In all cases, the lead organization for

a state or metropolitan area PCAP funded through the CPRG program must make the PCAP

available to other entities for their use in developing an implementation grant application.

20

o A review of authority to implement;

o A plan to leverage other federal funding; and,

o A workforce planning analysis.

All planning grant recipients will be expected to conduct a comprehensive climate action

plan development process. Jurisdictions with existing climate plans may use planning grant

funds to update or expand their existing plans to reflect, for example, recent changes in

technologies and market forces, potential leveraging of other funding opportunities (e.g.,

under the Inflation Reduction Act, Bipartisan Infrastructure Law, or other sources),

9

new

program areas and opportunities for regional collaboration, or inclusion of analyses to

estimate benefits including those flowing to low income and disadvantaged communities.

Grantees with previously developed climate action plans will be able to integrate their

previous planning experience into the CCAP. For example, if a recent plan has included a

robust stakeholder process, that prior planning experience could address the engagement

requirements outlined in this guidance and the scope of additional engagement could be

built around the new updated elements of the plan. However, if a prior planning process

left out important elements described in this guidance, the updated plan would need to

address those.

• Key Deliverable #3: Status Report

The third deliverable for states, municipalities, and air pollution control agencies is a Status

Report due at the end of the 4-year planning grant period. This report should include:

o The implementation status of the quantified GHG reduction measures included in

the CCAP;

o Any relevant updated analyses or projections supporting CCAP implementation; and,

o Next steps and future budget/staffing needs to continue CCAP implementation.

Planning grant recipients are encouraged to include updates to emissions analyses, GHG

reduction measures, or other items as needed to reflect recent and forecasted changes in

programs and emissions at the time the Status Report is prepared (i.e., by mid-2027).

8.4.3 Coordination and Engagement

The workplan should describe the applicant’s proposed approach to interagency and

intergovernmental coordination and their plan for public and stakeholder engagement in the

development of all deliverables.

9

For example, the Clean Ports Program under IRA section 60102 also provides grants or rebates for climate action

plans for ports in metropolitan areas.

21

• Interagency and Intergovernmental Coordination

Lead agencies should coordinate with other appropriate agencies and offices within their

own government in the development and adoption of the three deliverables. For example,

climate planning efforts should involve agencies with responsibilities in different program

areas, including environmental protection, energy, utilities, transportation, housing, waste

management, and land use planning.

Each workplan should include:

o A description of how interagency coordination would be conducted, such as through

a combination of in-person and virtual meetings with reasonable opportunities to

provide input on preliminary and/or draft products; and,

o A process and schedule for agencies to identify existing and new measures that

would lead to GHG reductions and meet other related goals.

State Requirements

Ongoing coordination as much as possible among state agencies, air pollution control

agencies, and municipalities is expected for the development of the PCAP and over the

duration of the cooperative agreement. States are encouraged to similarly coordinate with

tribes. A state workplan must include:

o A description of the expected process for coordinating/collaborating with a variety

of entities within the state (i.e., air pollution control agencies, municipalities, and

tribes), including those that are not directly receiving their own planning cooperative

agreement funding; and,

o A description of any sub-awards that are expected to be issued to air pollution

control agencies, municipalities, tribes, or other organizations.

The interagency collaboration process is intended to result in the identification and

inclusion of priority measures in the state PCAP that can be implemented by collaborating

entities. Sub-awards, including sub-awards to air pollution control agencies, municipalities,

and tribes, are allowed under this funding award, subject to terms and conditions, and may

be used to support planning efforts for those entities.

Because the District of Columbia has no internal sub-state jurisdictions, they are

encouraged to coordinate with the Virginia, Maryland, and West Virginia jurisdictions

making up the metropolitan area.

22

Metropolitan Area Requirements

Climate plans for metropolitan areas should also be developed with regional coordination

as much as possible, and applicants are encouraged to coordinate with geographically

proximate tribes as appropriate. Workplans must describe:

o The existing or planned roles and relationships of the partnering jurisdictions and

the process for developing joint work products; and,

o Any sub-awards that are expected to be issued to partnering jurisdictions.

Sub-awards to partners are allowed under this funding award, subject to terms and

conditions. Letters of support/commitment from partners are encouraged.

• Public and Stakeholder Engagement

State and metropolitan area lead organizations must involve stakeholder groups and the

public in the process for developing the PCAP and CCAP. Potential stakeholders include

urban, rural, and underserved or disadvantaged communities as well as the general public,

governmental entities, federally recognized tribes, Port Authorities, labor organizations,

community and faith-based organizations, and private sector and industry representatives.

The workplan should:

o Describe how public and stakeholder engagement would be conducted (such as

through a combination of in-person and/or virtual meetings with reasonable

opportunities to provide input on preliminary products);

o Discuss how information on the PCAP and CCAP development processes will be

made available to the public in a transparent manner, such as through in-person and

virtual meetings, public websites, listservs, and social media;

o Describe the approach to identifying low-income and disadvantaged communities,

conducting meaningful engagement including communicating with low income and

disadvantaged communities about emissions reductions in those areas, and

identifying their priorities; and,

o Describe an approach for early and frequent engagement with low-income and

disadvantaged communities and how that engagement will inform the low-income

and disadvantaged communities benefits analysis.

23

Grantees should ensure their approach for identifying disadvantaged communities is

consistent with relevant guidance from the Executive Office of the President.

10

Grantees are

strongly encouraged to use the Climate and Economic Justice Screening Tool (CEJST 1.0 or

higher; https://screeningtool.geoplatform.gov/en/). EPA is in the process of developing

methodologies to track and report the benefits (and any disbenefits) flowing to low income

and disadvantaged communities, and such methodologies can be used by grant recipients

as appropriate in developing a PCAP or CCAP.

8.4.4 Additional Workplan Requirements

The workplan must include a discussion of:

• The environmental outputs and outcomes to be achieved under the planning grants as

well as performance measures for tracking them. More detail about outputs, outcomes,

and performance measures is available in Section 10.

• The applicant’s interest in participating in any Climate Innovation Teams (participation is

optional and more fully described in Section 14.2). Applicants interested in participating

in one or more Climate Innovation Teams should include in the workplan a brief

description of their expected participation, including identifying personnel who may

participate, identifying topics of interest, and should include any anticipated costs in

their budget narrative.

• An annual narrative budget for each year of the grant award that adheres to federal

budget categories and guidelines.

Additional guidance and resources are available in the Program Guidance Appendices and on

EPA’s CPRG website to assist in workplan development. Technical assistance as described in

Section 14 will also be available to recipients throughout the 4-year cooperative agreement

period.

Sample workplans, timelines, and budgets are available on the CPRG website.

9. Eligible Activities

CPRG planning grant funds are restricted to projects that are directly related to the

development, updating, or evaluation of state or metropolitan plans to reduce climate pollution

(i.e., to reduce GHG emissions and/or enhance carbon sinks). In general, funds may be used for:

10

See July 20, 2021, memorandum M-21-28 from Executive Office of the President entitled, “Interim

Implementation Guidance for the Justice40 Initiative.” See also January 27, 2023 memorandum M-23-09 from

Executive Office of the President entitled, “Addendum to the Interim Implementation Guidance for the Justice40

Initiative, M-21-28, on using the Climate and Economic Justice Screening Tool (CEJST).”

24

• Staffing and contractual costs necessary to develop the deliverables identified in this

document;

• Planning and implementing meetings, workshops, and convenings to foster

collaboration among and between levels of government, the public, and key

stakeholders;

• Outreach and education for stakeholders and members of the public;

• Subawards to municipalities, air pollution control agencies, regional planning

organizations, non-governmental organizations (NGOs), academic institutions, etc.;

• Modeling and analytical costs, including purchase or licensing of software, data, or

tools;

• Studies, assessments, data collection, etc., needed to develop the required

deliverables;

• Evaluation and metrics -tracking activities;

• Training and staff capacity-building costs;

• Supplies (e.g., office supplies, software, printing, etc.);

• Incidental costs related to the above activities, including but not limited to travel,

membership fees, and indirect costs; and/or,

• Other allowable activities as necessary to complete the required deliverables.

10. Strategic Plan Linkages, Outputs, Outcomes, Performance Measures

Pursuant to Section 6.a. of EPA Order 5700.7A1, “Environmental Results under EPA Assistance

Agreements,” EPA must link proposed cooperative agreements with the Agency’s Strategic

Plan.

In their narrative workplan, applicants must adequately describe environmental outputs and

outcomes to be achieved under cooperative agreements (EPA Order 5700.7A1, Environmental

Results under Assistance Agreements). Applicants should include specific statements describing

the environmental results of the proposed project in terms of well-defined outputs and, to the

maximum extent practicable, well-defined outcomes that will demonstrate how the project will

contribute to the EPA Strategic Plan priorities described in Section 10.1.

10.1. Linkage to EPA Strategic Plan

The activities to be funded under this announcement support EPA’s Fiscal Year (FY) 2022-2026

Strategic Plan. Awards made under this announcement will support Goal 1, “Tackle the Climate

Crisis” Objective 1.1, “Reduce Emissions that Cause Climate Change,” of EPA’s Strategic Plan.

Applications must be for projects that support this goal and objective. For more information see

EPA's FY 2022-2026 Strategic Plan.

25

10.2. Outputs

The term “output” means an environmental activity, effort and/or associated work product

related to an environmental goal and objective that will be produced or provided over a period

of time or by a specified date. Outputs may be quantitative or qualitative but should be

measurable during a cooperative agreement funding period. Expected outputs from the CPRG

planning grants include, but are not limited to, development of the following:

• Priority Climate Action Plan (PCAP);

• Comprehensive Climate Action Plan (CCAP); and,

• Status Report.

Other potential outputs may include, but are not limited to:

• Number of community members participating in plan development;

• Meetings, events, stakeholder sessions, etc.; and/or,

• Dissemination of project/technology information via list serves, websites, journals and

outreach events.

Progress reports and a final report will also be required outputs, as specified in Section 12.6 of

this document.

10.3. Outcomes

The term “outcome” means the result, effect or consequence that will occur from carrying out

an environmental program or activity that is related to an environmental or programmatic goal

or objective. Outcomes may be environmental, behavioral, health-related or programmatic in

nature, but should also be quantitative. They may not necessarily be achievable within a

cooperative agreement funding period.

Expected outcomes from the projects to be funded under this announcement should include,

but are not limited to:

• Tons of pollution (GHGs and co-pollutants) reduced over the lifetime of the measures

identified in the PCAP and the CCAP;

• Tons of pollution (GHGs and co-pollutants) reduced annually; and,

• Tons of pollution (GHGs and co-pollutants) reduced with respect to low-income and

disadvantaged communities.

Other potential outcomes may include, but are not limited to:

• Improved staff capacity to implement policies to address climate change;

• Enhanced community engagement;

26

• Improved ambient air quality;

• Health benefits achieved;

• Increased public awareness of project and results; and/or,

• Creation of high-quality jobs with an emphasis on workers from underserved

populations.

10.4. Performance Measures

The applicant should develop performance measures and metrics they expect to use to track

progress of the proposed activities. These measures and metrics must be described in their

application. Such performance measures will help gather insights and will be the mechanism to

track progress concerning successful processes and output and outcome strategies and will

provide the basis for developing the Status Report deliverable. The description of the

performance measures should directly relate to the project’s outputs and outcomes, including

but not limited to:

• Overseeing sub-recipients, and/or contractors and vendors;

• Tracking and reporting project progress on expenditures and purchases; and,

• Tracking, measuring, and reporting accomplishments and proposed

timelines/milestones.

The following are questions to consider when developing output and outcome measures of

quantitative and qualitative results:

• What are the measurable short-term and longer-term results the project will achieve?

• How will the grant recipient measure progress in achieving the expected results

(including outputs and outcomes) and use resources effectively and efficiently?

11. Use of Funds Requirements

For guidance on developing budget narratives, please see:

• https://www.epa.gov/sites/default/files/2019-05/documents/applicant-budget-

development-guidance.pdf

• https://www.epa.gov/sites/default/files/2018-

05/documents/recipient_guidance_selected_items_of_cost_final.pdf

The budget narrative must detail funding expenditures that demonstrate adherence to

applicable requirements related to federal matching funds and expenses incurred prior to the

project period, as described below.

27

11.1. Federal Matching Funds

Applicants are not required to provide a cost-share or matching funds for the CPRG funding.

No funds awarded under the Program shall be used for matching funds for other federal grants.

Leveraging is encouraged, as noted in Section 8.4. “Workplan Requirements.”

11.2. Expenses Incurred Prior to the Project Period

The allowability of pre-award costs are governed by 2 CFR §200.458 and 2 CFR §1500.8. Pre-

award costs are those incurred prior to the effective date of the Federal award directly

pursuant to the negotiation and in anticipation of the Federal award, where such costs are

necessary for efficient and timely performance of the scope of work. Such costs are allowable

only to the extent that they would have been allowable if incurred after the date of the Federal

award and only with the written approval of the Federal awarding agency. EPA defines pre-

award costs as costs incurred prior to the award date, but on or after the start date of the

project/budget period. Under EPA’s interpretation of 2 CFR §200.309, all eligible costs must be

incurred during the budget/project period as defined by the start and end date shown on the

cooperative agreement award to receive EPA approval. This policy is implemented in a grant-

specific Term and Condition entitled “Pre-award Costs.” No funds awarded under the Program

shall be used for reimbursement of previous efforts prior to the project/budget period. All costs

incurred before EPA makes the award are at the recipient's risk. EPA is under no obligation to

reimburse such costs if for any reason the recipient does not receive a Federal award or if the

Federal award is less than anticipated and inadequate to cover such costs.

12. Award Administration

12.1. Applicable Requirements

The requirements of 2 CFR Part 200 (OMB Uniform Grant Guidance) and 2 CFR Part 1500 (EPA

Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal

Awards) apply to this cooperative agreement funding.

12.2. Terms and Conditions

General administrative and programmatic terms and conditions applicable to EPA cooperative

agreements under the CPRG planning grants program may be viewed at

https://www.epa.gov/grants/grant-terms-and-conditions. EPA Headquarters will provide EPA

Regional Offices with a list of terms and conditions that will also be applicable to the program.

EPA Regional Office teams will ensure that all applicable terms and conditions are included.

28

12.3. Quality Assurance Project Plan (QAPP)

Awards funded under the CPRG planning grants program may include the collection of

environmental data and may require the development of a Quality Assurance Project Plan

(QAPP). EPA Regional Offices will determine if a QAPP is required based on the workplan

submitted. The structure of the QAPP is intended to step through the thought process of

planning a project, as well as to provide a framework for documenting the plan. A QAPP is

prepared as part of the project planning process and should be completed and approved before

data collection is started. For more information, visit: www.epa.gov/quality/quality-assurance-

project-plan-development-tool.

12.4. Procurements

When procuring property and services under a Federal award, a recipient must follow

requirements as described in 2 CFR Part 200 and here: https://www.epa.gov/grants/best-

practice-guide-procuring-services-supplies-and-equipment-under-epa-assistance.

12.5. Performance Partnership Grant Agreements

Funds awarded under this program are not eligible for inclusion with a Performance

Partnership Grant.

12.6. Reporting Requirements

The following reports are required in addition to the three deliverables due under the CPRG

planning cooperative agreements. These reports are required to be submitted by all CPRG

planning funds recipients:

• Quarterly performance progress reports are required, including grant fund reporting

elements and summaries of the project activity and status of outputs during the

reporting period. Quarterly reports are due 30 days after the end of the reporting

period.

• The final report must include a high-level summary of activities completed during the

grant project period, copies of all deliverables, a synopsis of outputs and outcomes

achieved, and a financial summary of expenditures during the grant period. The final

report shall be submitted to EPA within 120 calendar days of the project/budget period

end date.

12.7. Joint Administration of Greenhouse Gas and Zero-Emission Standards for Mobile

Sources.

EPA is considering administering the Inflation Reduction Act section 60105(g) “Greenhouse Gas

and Zero-Emission Standards for Mobile Sources” $5 million grant program for states that are

29

adopting and implementing such standards pursuant to CAA section 177 under the future

notice of funding opportunity for implementation grants under the CPRG program. Eligible

states that are potentially interested in the Inflation Reduction Act section 60105(g) grant

program should consider such standards in the development of their PCAP under the CPRG

program.

13. EPA Contacts

All questions regarding the CPRG program should be submitted to [email protected]. A list of

“Frequently Asked Questions” is also available on the CPRG program website.

14. Technical Assistance and Tools

14.1. Technical Assistance Overview

EPA is committed to providing ongoing technical assistance to cooperative agreement

recipients under the CPRG program. EPA has established a webpage for this program that

includes a technical assistance section with links to many resources that can be helpful to

eligible entities in developing planning cooperative agreement applications and deliverables.

These resources include EPA’s state-level GHG emissions inventory and inventory tools; tools

for estimating air quality changes and health benefits associated with criteria and toxic air

pollutant emission reductions resulting from GHG reduction strategies; and other resources.

EPA will explore additional opportunities for providing ongoing technical assistance through

webinars, training workshops, and the Climate Innovation Teams described in the next section.

For more information, please visit https://www.epa.gov/inflation-reduction-act/climate-

pollution-reduction-grants#CPRG-ToolsandTechnicalResources.

14.2. Climate Innovation Teams

EPA intends to organize a set of Climate Innovation Teams (CITs) that focus on key topics of

interest to cooperative agreement recipients. Through these CITs, EPA can provide training and

technical assistance to funding recipients as well as create opportunities for peer-to-peer

technical assistance, peer collaboration and mentoring, and sharing of case studies, best

practices, and lessons learned. Through participation in one or more teams, planning grant

recipients will have the opportunity to:

• Coordinate efforts on one or more topic area(s) of their choice;

• Receive technical assistance and subject matter expertise on a range of topics;

• Participate in multi-jurisdictional convenings with national and local experts and

stakeholders; and,

• Leverage other support to help jurisdictions increase the impact of their other Inflation

Reduction Act or Bipartisan Infrastructure Law-funded work.

30

The initial group of CITs may address topics such as:

• Climate planning process and approach

• Leveraging funding from other federal, state, and private sector sources

• Estimating emission reductions and program benefits in disadvantaged communities

• Stakeholder engagement

• Sector-based strategies

• Workforce development.

EPA will finalize the initial set of CITs and consider forming additional teams based on the

interests and needs of cooperative agreement recipients. EPA anticipates most CIT meetings

will take place virtually (i.e., via webinars, trainings, peer collaboration, etc.) and occur every 1-

3 months. An optional, in-person annual meeting of cooperative agreement recipients may also

be organized depending on available resources and participant interest.

31

15. APPENDICES

15.1. Statutory Text: Section 60114 of the Inflation Reduction Act

SEC. 60114. CLIMATE POLLUTION REDUCTION GRANTS.

The Clean Air Act is amended by inserting after section 136 of such Act, as added by section

60113 of this Act, the following:

SEC. 137. GREENHOUSE GAS AIR POLLUTION PLANS AND IMPLEMENTATION GRANTS.

(a) Appropriations.

(1) Greenhouse gas air pollution planning grants. In addition to amounts otherwise

available, there is appropriated to the Administrator for fiscal year 2022, out of any

amounts in the Treasury not otherwise appropriated, $250,000,000, to remain available

until September 30, 2031, to carry out subsection (b).

(2) Greenhouse gas air pollution implementation grants. In addition to amounts otherwise

available, there is appropriated to the Administrator for fiscal year 2022, out of any

amounts in the Treasury not otherwise appropriated, $4,750,000,000, to remain available

until September 30, 2026, to carry out subsection (c).

(3) Administrative costs. Of the funds made available under paragraph

(2), the Administrator shall reserve 3 percent for administrative costs necessary to carry out

this section, to provide technical assistance to eligible entities, to develop a plan that could

be used as a model by grantees in developing a plan under subsection (b), and to model the

effects of plans described in this section.

(b) Greenhouse gas air pollution planning grants. The Administrator shall make a grant to at

least one eligible entity in each State for the costs of developing a plan for the reduction

of greenhouse gas air pollution to be submitted with an application for a grant under

subsection (c). Each such plan shall include programs, policies, measures, and projects that will

achieve or facilitate the reduction of greenhouse gas air pollution. Not later than 270 days

after the date of enactment of this section [August 16, 2022], the Administrator shall publish a

funding opportunity announcement for grants under this subsection.

(c) Greenhouse gas air pollution reduction implementation grants.

(1) In general. The Administrator shall competitively award grants to eligible entities to

implement plans developed under subsection (b).

(2) Application. To apply for a grant under this subsection, an eligible entity shall submit to

the Administrator an application at such time, in such manner, and containing such

32

information as the Administrator shall require, which such application shall include

information regarding the degree to which greenhouse gas air pollution is projected to be

reduced in total and with respect to low-income and disadvantaged communities.

(3) Terms and conditions. The Administrator shall make funds available to a grantee under

this subsection in such amounts, upon such a schedule, and subject to such conditions

based on its performance in implementing its plan submitted under this section and in

achieving projected greenhouse gas air pollution reduction, as determined by

the Administrator.

(d) Definitions. In this section:

(1) Eligible entity. The term “eligible entity” means—

(A) a State;

(B) an air pollution control agency;

(C) a municipality;

(D) an Indian tribe; and

(E) group of one or more entities listed in subparagraphs (A) through (D).

(2) Greenhouse gas. The term “greenhouse gas” means the air pollutants carbon dioxide,

hydrofluorocarbons, methane, nitrous oxide, perfluorocarbons, and sulfur hexafluoride.

33

15.2. Formula Allocations

Table 1: Formula Grant Allocations for States, District of Columbia, and Puerto Rico

STATE

FORMULA

ALLOCATION

EPA REGION

Alabama

$ 3,000,000

4

Alaska

$ 3,000,000

10

Arizona

$ 3,000,000

9

Arkansas

$ 3,000,000

6

California

$ 3,000,000

9

Colorado

$ 3,000,000

8

Connecticut

$ 3,000,000

1

Delaware

$ 3,000,000

3

District of Columbia

$ 3,000,000

3

Florida

$ 3,000,000

4

Georgia

$ 3,000,000

4

Hawaii

$ 3,000,000

9

Idaho

$ 3,000,000

10

Illinois

$ 3,000,000

5

Indiana

$ 3,000,000

5

Iowa

$ 3,000,000

7

Kansas

$ 3,000,000

7

Kentucky

$ 3,000,000

4

Louisiana

$ 3,000,000

6

Maine

$ 3,000,000

1

Maryland

$ 3,000,000

3

Massachusetts

$ 3,000,000

1

Michigan

$ 3,000,000

5

Minnesota

$ 3,000,000

5

Mississippi

$ 3,000,000

4

Missouri

$ 3,000,000

7

Montana

$ 3,000,000

8

Nebraska

$ 3,000,000

7

Nevada

$ 3,000,000

9

New Hampshire

$ 3,000,000

1

New Jersey

$ 3,000,000

2

New Mexico

$ 3,000,000

6

New York

$ 3,000,000

2

North Carolina

$ 3,000,000

4

North Dakota

$ 3,000,000

8

Ohio

$ 3,000,000

5

Oklahoma

$ 3,000,000

6

34

STATE

FORMULA

ALLOCATION

EPA REGION

Oregon

$ 3,000,000

10

Pennsylvania

$ 3,000,000

3

Puerto Rico

$ 3,000,000

2

Rhode Island

$ 3,000,000

1

South Carolina

$ 3,000,000

4

South Dakota

$ 3,000,000

8

Tennessee