NEW YORK CITY COUNCIL

FINANCE DIVISION

Tanisha Edwards, Esq.

Chief Financial Officer and

Deputy Chief of Staff

Nathan Toth

Deputy Director

Paul Scimone

Deputy Director

Raymond Majewski

Deputy Director & Chief

Economist

Andrew Wilber

Economist

Hon. Adrienne Adams

Speaker of the Council

Hon. Justin Brannan

Chair of the Committee on Finance

Report on the Fiscal 2023

Preliminary Plan for the

Office of the Comptroller

March 2, 2022

Finance Division Briefing Paper Office of the Comptroller

Table of Contents

Office of the Comptroller Fiscal 2023 Budget Snapshot and Agency Overview ............................ 1

Financial Plan Summary .............................................................................................................. 2

Contract Budget .......................................................................................................................... 3

Departmental Budgets ................................................................................................................ 4

Executive Management .......................................................................................................... 4

First Deputy Comptroller......................................................................................................... 5

Second Deputy Comptroller .................................................................................................... 7

Third Deputy Comptroller ....................................................................................................... 9

Appendices ............................................................................................................................... 11

A: Budget Actions in the Fiscal 2022 November and Fiscal 2023 Preliminary Plans ................ 11

B: Comptroller’s Fiscal 2023 Contract Budget........................................................................ 11

C: Program Areas .................................................................................................................. 12

Executive Management ..................................................................................................... 12

First Deputy Comptroller ................................................................................................... 13

Second Deputy Comptroller ............................................................................................... 14

Third Deputy Comptroller .................................................................................................. 15

D: Pensions System Asset Performance................................................................................. 16

Finance Division Briefing Paper Office of the Comptroller

1

Office of the Comptroller Fiscal 2023 Budget Snapshot and Agency Overview

The Comptroller’s Office consists of over 700 employees serving across four program areas that

contribute to the agency’s oversight role in New York City’s local government. Core elements of the

Comptroller’s responsibilities include:

• Performance and financial audits of all City agencies;

• Fiduciary oversight on the City’s five public pension funds, housing $275 billion in assets;

• Conducting comprehensive oversight of the City’s budget and fiscal condition;

• Reviewing City contracts for integrity and accountability to City procurement laws;

• Resolving claims on behalf and against the City; and

• Setting and enforcing prevailing wage living wage laws.

The chart below outlines the general organization structure for the agency as of the Fiscal 2023

Preliminary Plan, marking the first budget for the newly-elected Comptroller, Brad Lander.

$110.7M FY23 Budget

+$2.1M Over

FY22 Adopted Budget

+$2.8M Over

76.6M in PS Funding

for FY23

783 Budgeted

Headcount

99 Vacancies

$34.1M in OTPS

$28.7M Contract

Budget

81 Contracts

Finance Division Briefing Paper Office of the Comptroller

2

Financial Plan Summary

The Fiscal 2023 Budget for the Office of the Comptroller (Office or Comptroller) totals $110.7 million,

including $76.7 million for Personal Services

1

to fund 783 full-time positions, and $34.1 million for

Other Than Personal Services.

2

Table 1

FY20

FY21

FY22

Preliminary Plan

*Difference

Dollars in Thousands

Actual

Actual

Adopted

FY22

FY23

FY22-FY23

Spending

Personal Services

$70,636

$71,819

$75,007

$74,324

$76,583

$1,575

Other Than Personal Services

33,206

30,327

33,522

33,522

34,071

550

TOTAL

$103,842

$102,146

$108,529

$107,846

$110,654

$2,125

Personal Services

Full-Time Salaried - Civilian

$67,758

$68,555

$72,459

$71,754

$74,034

$1,575

Additional Gross Pay

2,098

2,088

1,888

1,910

1,888

0

Unsalaried

541

1,005

316

316

316

0

Overtime - Civilian

234

169

345

345

345

0

P.S. Other

6

2

0

0

0

0

SUBTOTAL

$70,636

$71,819

$75,007

$74,324

$76,583

$1,575

Other Than Personal Services

Contractual Services

$27,867

$25,549

$28,686

$27,120

$28,706

$20

Other Services & Charges

3,261

2,707

3,005

3,484

3,535

530

Property & Equipment

1,468

1,121

589

1,184

589

0

Supplies & Materials

600

935

655

1,536

655

0

Fixed & Misc. Charges

10

15

587

197

587

0

SUBTOTAL

$33,206

$30,327

$33,522

$33,522

$34,071

$550

TOTAL

$103,842

$102,146

$108,529

$107,846

$110,654

$2,125

Funding

City Funds

$82,583

$81,873

$84,681

$2,098

Other Categorical

12,528

$12,528

$12,528

0

Capital- IFA

13,204

$13,231

$13,231

27,269

Intra City

213

212,854

212,854

0

TOTAL

$103,842

$102,146

$108,529

$107,846

$110,654

$2,125

Budgeted Headcount

748

742

783

783

783

0

*The difference of Fiscal 2022 Adopted Budget compared to Fiscal 2023 Preliminary Budget.

The Fiscal 2023 Preliminary Plan includes only marginal changes to the Comptroller’s budget for Fiscal

2022 and Fiscal 2023. Changes to its budget in Fiscal 2022 result in a net reduction of $684,000, the

sum of a $1 million reduction for across the board PS savings, partially offset by $295,000 added for

collective bargaining with the Office of Staff Analysts (OSA), and a $22,000 increase for the Office’s

1

Personal Services, or PS, refers to budgetary funds intended to pay salaries and benefits for employees of

the agency.

2

Other Than Personal Services category, or OTPS, accounts for budgetary funding used for all other general

operating costs of the agency, including contracts.

Finance Division Briefing Paper Office of the Comptroller

3

Vaccine Incentive program. Changes in its budget for Fiscal 2023 includes just shy of $300,000 for

OSA collective bargaining.

Although the Comptroller’s budget includes only minor changes since adoption, the staff vacancy rate

grew to almost 12 percent in January 2022, compared with 5.2 percent in July 2021. The increase in

unfilled positions most likely corresponds to staff transitioning out of the agency upon the Lander

Administration’s first year in office. More than half of the 58 newly vacant positions belong to the

Bureaus of Asset Management (10 positions), Law and Adjustment (10 positions), and Audit (11

positions). It is unclear if the new administration will hire staff to fill the newly vacant positions in its

budget, or eliminate them from its budget over the next fiscal year.

The Office divides its budget across four departments. Figures 1 and 2 below outline the general uses

of the Office’s budget across its four departments, and its budgetary funding sources.

Contract Budget

New York City’s Charter mandates the preparation of a Contract Budget twice per year to identify

expenditures for the City’s wide net of contractual obligations. The Citywide Contract Budget

accounts for over 45 percent, or $19.2 billion, of the City’s $42 billion OTPS Budget. The Comptroller’s

agency-level Contract Budget accounts for $28.7 million, or 84 percent of its OTPS budget across 81

separate contracts.

Roughly half, or $13.7 million, of the Comptroller’s procurements fulfill agreements with various

financial services providers in its Bureau of Asset Management, an important bureau at the agency

that handles oversight of the City’s five pension funds. Data processing equipment accounts for the

next largest portion of the Office’s contract budget, totaling a little more than $9 million split between

the Bureau of Asset Management ($3 million) and the Bureau of Information Systems & Technology

($6 million). Combined, the financial services and data processing equipment contracts account for

almost 80 percent of the Office’s total contract budget for Fiscal 2023.

Figure 1

Figure 2

First Deputy

Comptroller

46%

Third Deputy

Comptroller

32%

Second

Deputy

Comptroller

18%

Executive

Management

4%

FY23 Departmental Budgets

City Funds

77%

Other

Categorical

11%

Capital IFA

12%

FY23 Budgetary Sources

Finance Division Briefing Paper Office of the Comptroller

4

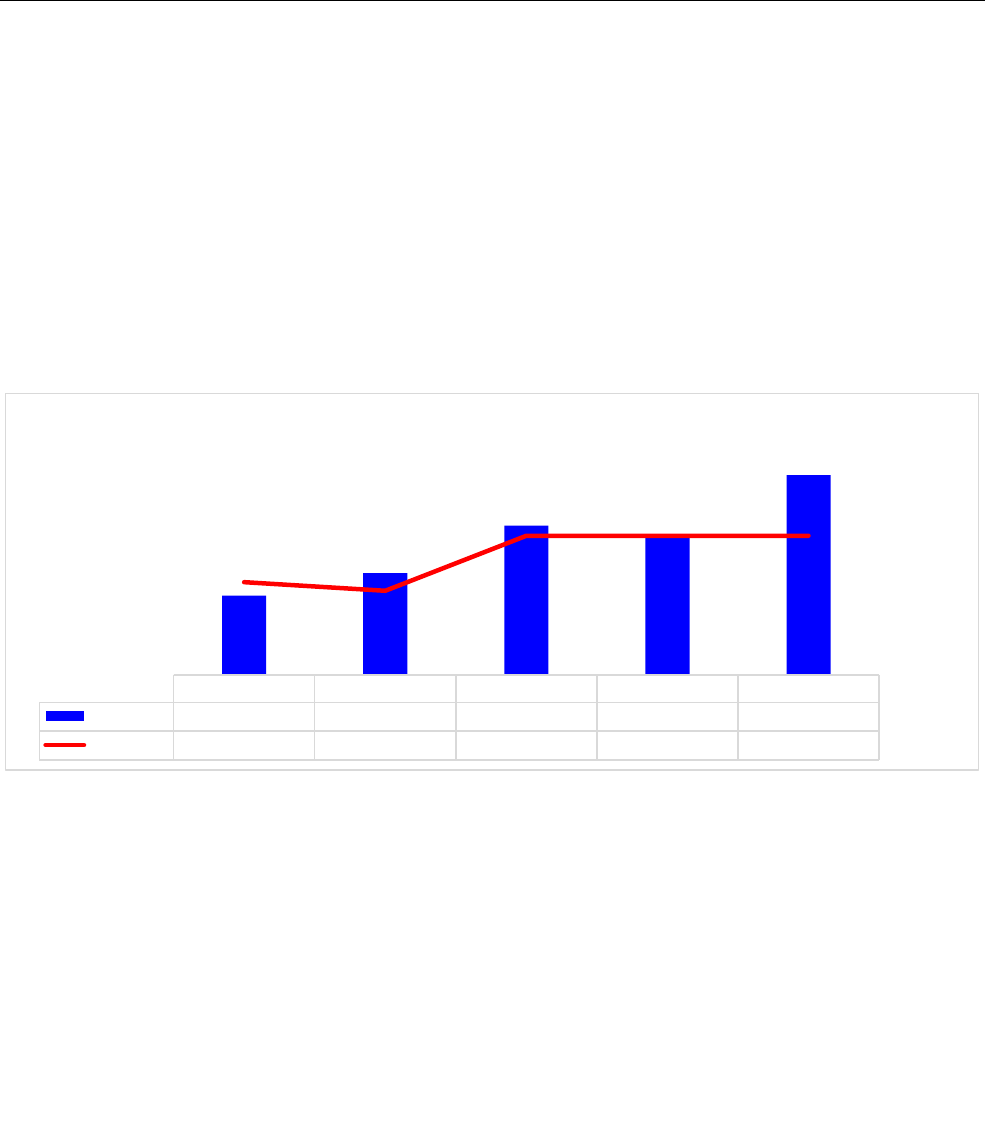

Figure 3

Departmental Budgets

The Comptroller’s Office consists of four departments: Executive Management, First Deputy

Comptroller, Second Deputy Comptroller, and Third Deputy Comptroller. Each department holds

several distinct bureaus contributing to the Office’s role in the City’s government. The following

section provides a brief description of each department’s overall function, while detailing the role of

each bureau and corresponding budget. Appendix C provides a funding summary for each

department.

Executive Management

The Comptroller’s Executive Management (EM) department houses the Office’s executive personnel,

with a budget comprised of mostly PS funding for 34 full-time positions. The proposed budget for the

EM department totals $4.4 million for Fiscal 2023, including $4.2 million in PS funding and $150,916

in OTPS. Figure 4 provides a breakdown of the EM department’s actual PS expenditures and

headcount for Fiscal 2020-2021, as well as its PS budget and headcount from the Fiscal 2022

Preliminary and Adopted Budgets, and the Fiscal 2023 Preliminary Budget. As of January 2022, the

EM department was operating at a 23.5 percent staff vacancy rate with 26 positions filled, compared

with an 8.8 percent vacancy rate around the same time last year.

Figure 4

All Other $1,359

Professional Services $4,577

Data Processing Equipment $9,040

Investment Costs

$13,729

79 Percent of Comptroller's Fiscal 2023 Contract Budget Comprised of Investment Manager and

Data Processing Equipment Contracts

(Dollars in Thousands)

FY20 Actual FY21 Acutal FY22 Adopted FY22 Prelim FY23 Prelim

PS

3,628 3,453 3,954 3,762 4,212

Headcount

31 29 34 34 34

26

28

30

32

34

36

$0

$1,000

$2,000

$3,000

$4,000

$5,000

(Dollars in Thousands)

Executive Management PS Budget and Headcount

PS Headcount

Finance Division Briefing Paper Office of the Comptroller

5

First Deputy Comptroller

The First Deputy Comptroller (FDC) oversees several operations critical to the Office’s role in the audit

and oversight of the City’s budget and financial management. Specific bureaus under the purview of

the FDC include Accountancy, Administration, Audit, Engineering, Budget, Public Affairs, Press Office,

Information Systems & Tech, and Public Policy. The FDC’s budget totals $50.6 million for Fiscal 2023,

which includes $40.2 million in PS funding for 448 full-time positions, and $10.4 million in OTPS. The

figure below gives a breakdown of the FDC’s actual PS expenditures and headcount for Fiscal 2020-

2021, as well as its budgeted headcount from the Fiscal 2022 Preliminary and Adopted Budgets, and

the Fiscal 2023 Preliminary Budget. As of January 2022, the FDC was operating at a 9.8 percent staff

vacancy rate with 404 positions filled, compared with a 3.8 percent vacancy rate around the same

time last year.

Figure 5

Bureau of Accountancy

The Bureau of Accountancy’s budget for Fiscal 2023 totals $7.1 million to fund 92 full-time positions,

and does not include OTPS funding.

The Bureau of Accountancy sets the City’s accounting directives, and manages all aspects of the City’s

financial accounting and reporting, including systems for centralized accounting, internal control and

budgeting. It also prepares a number of annual reports on the City’s financial position, including the

Annual Comprehensive Financial Report and Popular Annual Financial Report, containing the City’s

Charter-mandated audited financial statements. Other tasks of the Bureau include reconciling more

than 100 City bank accounts, providing investment accounting for the City’s pension funds, servicing

the City’s general obligation debt, and approving vendor information.

Bureau of Administration

The Bureau of Administration’s Fiscal 2023 budget totals $7.7 million, including $4.2 million in PS

funding for 45 full-time positions, and $3.4 million in OTPS funding. The Bureau of Administration

supports the work of other bureaus, including management of the Office’s capital and operating

budgets, human resources functions, procurement and payment activity, facilities management, and

information systems support.

FY19 Actual FY20 Actual FY21 Adopted FY21 Prelim FY22 Prelim

PS

$37,959 $38,373 $39,251 $39,062 $40,177

Headcount

432 429 448 448 448

400

410

420

430

440

450

460

470

$36,500

$37,000

$37,500

$38,000

$38,500

$39,000

$39,500

$40,000

$40,500

Headcount

Dollars in Thousands

FDC's PS Budget and Headcount

Finance Division Briefing Paper Office of the Comptroller

6

Bureau of Audit

The Fiscal 2023 budget for the Bureau of Audit totals $14.5 million in PS funding for 173 full-time

employees, and no OTPS funding. Through the Bureau of Audit, the Comptroller fulfills its City

Charter mandate to audit City agencies and financial transactions.

The Bureau of Audit conducted 56 audits and special reports over the course of Fiscal 2021 on topics

such as revenue and cost savings, asset management, service delivery and program performance, and

information technology. A complete list of the Comptroller’s audits and reports can be found at

https://comptroller.nyc.gov/reports/.

Bureau of Engineering

The Bureau of Engineering’s Fiscal 2023 Budget totals $3.4 million, consisting entirely of PS funding

for 32 full-time positions. The Bureau of Engineering aids the Comptroller’s Office in technical

consulting on engineering matters. In this capacity, it holds the responsibility to negotiate and

recommend the disposition of contract disputes and claims between the City and its contractors. It

also reports on liability and damages to the Bureau of Law and Adjustment to be used in damage tort

claims.

The Fiscal 2023 Budget for the Bureau of Budget, comprised entirely of PS funding, totals $2.3 million

to support 16 full-time positions. The Bureau of Budget monitors and reports on the City’s financial

position by evaluating the City’s revenue collection, expenditures, capital program, debt capacity, and

the health of the local economy.

Bureau of Public Affairs and Press Office

The Bureau of Public Affairs and the Press Office have a budget totaling $2.4 million for Fiscal 2023

supporting 29 full-time positions. The Bureau of Public Affairs serves as the Office’s primary liaison

to the public, the Mayor’s Administration, and authorities at the State, federal, and local levels.

Through management of the Community Action Center, the Bureau fields complaints from the public

regarding inadequate government services throughout the City.

The Press Office circulates information and reports produced by the agency, fields questions from

news outlets, manages the Office’s social media accounts, and prepares written communications on

behalf of the Office.

Bureau of Information Systems & Technology (IT)

The Bureau of IT’s Fiscal 2023 budget totals $12.4 million, including $5.4 million in PS funding to

support 54 full-time positions, and $7 million in OTPS funding. The Bureau of IT maintains more than

120 software applications for the Office’s internal operations.

Bureau of Public Policy

The Fiscal 2023 budget for the Bureau of Public Policy totals $848,598 in PS funding for seven positions

with no OTPS funding. The Bureau of Public Policy generates policy recommendations and initiatives

on a collection of topics critical to the City’s overall health, including education, infrastructure,

economic development, housing, healthcare, procurement, transportation, public safety, and

immigration.

Finance Division Briefing Paper Office of the Comptroller

7

Second Deputy Comptroller

The Second Deputy Comptroller (SDC) oversees several functions contributing the Office’s role in

various key areas of both internal and Citywide operations. Specific bureaus under the umbrella of

the SDC include Economic Development, Law & Adjustment, Contract Administration, General

Counsel, and Labor Law. The SDC’s budget totals $19.6 million for Fiscal 2023, which includes $15.3

million in PS funding to support 165 full-time positions, and $4.2 million in OTPS. Figure 6 gives a

breakdown of the SDC’s actual PS budget and headcount for Fiscal 2020-2021, as well as its budgeted

headcount from the Fiscal 2022 Preliminary and Adopted Budgets, and the Fiscal 2023 Preliminary

Budget. As of January 2022, the SDC was operating at a 10.3 percent staff vacancy rate with 165

positions filled, compared with a near-zero percent vacancy rate around the same time last year.

Figure 6

Bureau of Economic Development

The Fiscal 2023 budget for the Bureau of Economic Development is comprised entirely of PS funding,

totaling $724,876 for six full-time positions. The Bureau of Economic Development employs the

Office’s authority to create sustainable economic growth and development opportunities throughout

the City. The Bureau plays an important role in the oversight of the City’s agencies tasked with

generating economic development for the City and makes recommendations for economically

targeted investments.

Bureau of Law and Adjustment

The Bureau of Law and Adjustment’s Fiscal 2023 budget totals $10.8 million, including $6.5 million in

PS funding to support 75 full-time positions, and $4.2 million in OTPS funding. The City’s Charter gives

the Comptroller sole authority in settling claims on behalf or against the City before a lawsuit is filed.

The Bureau of Law and Adjustment oversees all of the Office’s resolution and settlement claims. A

large part of the Bureau’s work includes the investigation of false claims and referral of fraudulent

claims to the District Attorney.

In Fiscal 2021, the City spent $618 million on judgments and claims, with the Comptroller approving

roughly $27.4 million in affirmative settlements. Affirmative settlements refers to money paid to the

City based on claims against others. In collaboration with City agencies, the Comptroller also collected

$7.1 million from claimants who had settlements from the City and outstanding obligations to the

City for public assistance or child support. Demonstrating efforts to increase compensation from New

FY19 Actual FY20 Actual FY21 Adopted FY21 Prelim FY22 Prelim

PS

$14,288 $14,284 $15,284 $15,184 $15,143

Headcount

169 165 165 165 165

130

135

140

145

150

155

160

165

170

175

$13,600

$13,800

$14,000

$14,200

$14,400

$14,600

$14,800

$15,000

$15,200

$15,400

Headcount

Dollars in Thousands

SDC PS Budget and Headcount

Finance Division Briefing Paper Office of the Comptroller

8

Yorkers who damage City property, the Comptroller collected roughly $1.8 million from property

damage-related affirmative claims. Lastly, in collaboration with the State’s Attorney General and

Office of Victims Services, the Office office collected $1.8 million from convicted persons to flow

through to corresponding victims.

3

Bureau of Contract Administration

The Fiscal 2023 budget for the Bureau of Contract Administration totals $3.1 million for 34 full-time

positions, and nothing budgeted for OTPS. The Bureau of Contract Administration manages the

Office’s oversight role in the City’s procurement process. The Bureau registers contracts and

purchase agreements, including franchise, revocable consent, and concession agreements financed

through the City’s treasury or with money from the City’s budget. Prior to a contract with the City

receiving legal implementation, the City Charter requires the Comptroller’s Office to register the

contract within 30 days from the date it was submitted for registration. Over the course of the

Stringer Administration, the Council received complaints from agencies and providers that contracts

were often rejected at the tail end of the Comptroller’s 30-day registration period, further extending

the amount of time before providers received payment for services.

In Fiscal 2021, The Bureau of Contract Administration registered a total of 11,857 new contract

actions, down from 13,390 new contract actions in Fiscal 2020. In addition to the new contract

actions, the Bureau also registered 51,847 modifications, 821 agency master agreement task orders,

and 113,045 purchase orders.

4

Office of the General Counsel

The Fiscal 2023 budget for the General Counsel’s Office totals $1.9 million in PS funding to support

11 full-time positions. The General Counsel’s Office advises the Comptroller on legal matters related

to its mandates and operations, and provides legal guidance related to investment activity and

pension issues pursuant to the Comptroller’s role as fiduciary of the City’s five public pension funds.

The General Counsel also oversees the Bureau of Labor Law’s enforcement of prevailing and living

wage requirements, and the Bureau of Law and Adjustment’s role in settling and adjusting claims.

Bureau of Labor Law

The Bureau of Labor Law’s Fiscal 2023 budget totals $2.3 million in PS funding for 29 full-time

positions. The Bureau of Labor Law sets and enforces both prevailing wage and benefit rates for

workers employed on public works projects and building/service contracts for City agencies. Each

year, the Bureau investigates regulatory violations of prevailing wage and benefit rates, and brings

enforcement proceedings to the Office of Administrative Trials and Hearings. The Bureau also

conducts outreach and distributes educational materials specific to compliance with prevailing wage

and benefits rates regulation.

In Fiscal 2021, the Bureau of Labor Law assessed more than $5.6 million in underpayments and

interest against City contractors and assessed over $138,000 in civil penalties against those

contractors. Additionally, the Bureau opened 50 new cases, resolved 51 cases, and debarred three

contractors from New York State and City public works for egregious conduct.

5

3

Annual Comprehensive Financial Report of the Comptroller for the Year ended June 30, 2021.

4

New York City Office of the Comptroller. “Annual Summary Contracts Report for the City of New York.” 30 January

2021, https://comptroller.nyc.gov/reports/annual-contracts-report/.

5

Annual Comprehensive Financial Report of the Comptroller for the Year ended June 30, 2021.

Finance Division Briefing Paper Office of the Comptroller

9

Third Deputy Comptroller

The Third Deputy Comptroller’s (TDC) department houses the Asset Management function of the

Comptroller’s Office. The TDC’s budget totals $36.1 million for Fiscal 2023, which includes $16.8

million in PS funding to support 136 full-time positions, and $19.3 million in OTPS. The figure below

gives a breakdown of the TDC’s actual PS budget and headcount for Fiscal 2020-2021, as well as its

budgeted headcount from the Fiscal 2022 Preliminary and Adopted Budgets, and the Fiscal 2023

Preliminary Budget. As of January 2022, the TDC was operating at a 17.6 percent staff vacancy rate

with 112 positions filled, compared with an 11 percent vacancy rate around the same time last year.

Figure 7

Bureau of Asset Management

The City’s pension system consists of five separate pension funds – the New York City Employees’

Retirement System, the Teachers’ Retirement System, the New York City Board of Education

Retirement System, the New York City Police Pension Fund, and the New York City Fire Pension Fund

– all of which offer a defined benefit plan for the City’s workforce. Through the Bureau of Asset

Management (BAM), the Comptroller employs a considerable portion of its custodial mandate of the

City’s pension system. Notably, BAM engages with the board of each of the five pension funds to

provide advisory on investment strategy and the performance of almost $275 billion in pension assets

managed by a network of more than 300 contracted investment managers. Figure 8 on the next page

details the portfolio allocation of pension assets as of December, 2021.

Over the course of Fiscal 2021, portfolio assets in the pension system returned an astounding 25.8

percent compared with 4.4 percent the year before. Since the actuary assumes an annual return of

6.8 percent per year in its funding plan, the Fiscal 2021 asset gains greatly reduces the amount

required for the City to fund the statutorily required pension contribution across the Financial Plan.

Refer to Appendix D for performance information by asset class against corresponding benchmarks.

FY19 Actual FY20 Actual FY21 Adopted FY21 Prelim FY22 Prelim

PS

$14,764 $15,344 $16,651 $16,598 $16,846

Headcount

120 117 136 136 136

90

95

100

105

110

115

120

125

130

135

140

$13,500

$14,000

$14,500

$15,000

$15,500

$16,000

$16,500

$17,000

$17,500

Headcount

Dollars in Thousands

TDC PS Budget and Headcount

Finance Division Briefing Paper Office of the Comptroller

10

Figure 8

*All other contains hedge funds, infrastructure, cash, real estate investment trusts, international fund of funds, and global

equity

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000

*All Other

Private Real Estate

Emerging Markets

Private Equity

Alternative Credit

WORLD ex USA

Fixed Income

U.S. Equity

More Than 56 Percent of the New York City Retirement System Portfolio Comprised of US

Equities and Fixed Income

Finance Division Briefing Paper Office of the Comptroller

11

Appendices

A: Budget Actions in the Fiscal 2022 November and Fiscal 2023 Preliminary Plans

Dollars in Thousands

FY 2022

FY 2023

City

Non-City

Total

City

Non-City

Total

Comptroller's Budget as of the Adopted 2022 Budget

$82,584

$25,946

$108,530

$84,409

$25,946

$110,355

Fiscal 2023 Preliminary Plan Actions

Vaccine Incentive (New Needs)

22

0

22

0

0

0

PS Savings (PEG)

(1,000)

0

(1,000)

0

0

0

Subtotal Other Adjustments

($979)

$0

($979)

$0

$0

$0

Fiscal 2022 November Plan Actions

OSA Collective Bargaining

268

27

295

273

27

299

Subtotal - Other Adjustments

$268

$27

$295

$273

$27

$299

TOTAL, All Changes

($711)

$27

($684)

$273

$27

$299

Comptroller's Budget as of the Preliminary 2023 Budget

$81,874

$25,973

$107,846

$84,682

$25,973

$110,654

B: Comptroller’s Fiscal 2023 Contract Budget

Dollars in Thousands

Category

FY22

Adopted

Number of

Contracts

FY23

Preliminary

Number of

Contracts

Investment Costs

13,729,258

41

13,729,258

41

Data Processing Equipment Maintenance

9,039,573

5

9,039,573

5

Prof. Services - Other

3,553,000

2

3,553,000

2

Prof. Services - Computer Services

1,024,354

2

1,024,354

2

Printing Services

480,530

5

480,530

5

Contractual Services - General

434,137

4

434,137

4

Training Program for City Employees

190,336

3

190,336

3

Temporary Services

89,817

5

109,817

6

Office Equipment Maintenance

50,998

3

50,998

3

Cleaning Services

36,635

2

36,635

2

Telecommunications Maintenance

25,000

2

25,000

2

Security Services

24,227

3

24,227

3

Maintenance and Repairs - General

4,500

2

4,500

2

Maintenance and Repairs - Motor Vehicle Equip

3,203

1

3,203

1

Prof. Services - Legal Services

0

0

0

0

TOTAL

28,685,568

80

28,705,568

81

Finance Division Briefing Paper Office of the Comptroller

12

C: Program Areas

Executive Management

FY20

FY21

FY22

Preliminary Plan

*Difference

Dollars in Thousands

Actual

Actual

Adopted

FY22

FY23

FY22-FY23

Spending

Personal Services

Full-Time Salaried - Civilian

$3,403

$3,277

$3,845

$3,653

$4,103

$258

Additional Gross Pay

113

8

10

11

10

0

Unsalaried

113

168

67

67

67

0

Overtime - Civilian

0

0

32

32

32

0

Subtotal

$3,628

$3,453

$3,954

$3,762

$4,212

$258

Other Than Personal Services

Contractual Services

65

54

45

68

65

20

Property & Equipment

46

39

40

41

40

0

Supplies & Materials

25

2

35

32

35

0

Other Services & Charges

7

2

11

10

11

0

Subtotal

143

97

131

151

151

20

TOTAL

$3,771

$3,550

$4,085

$3,913

$4,363

$278

Funding Source

City Funds

$4,085

$3,913

$4,363

$278

Budgeted Headcount

31

29

34

34

34

0

*The difference of Fiscal 2022 Adopted Budget compared to Fiscal 2023 Preliminary Budget.

Finance Division Briefing Paper Office of the Comptroller

13

First Deputy Comptroller

FY20

FY21

FY22

Preliminary Plan

*Difference

Dollars in Thousands

Actual

Actual

Adopted

FY22

FY23

FY22-FY23

Spending

Personal Services

Full-Time Salaried - Civilian

$36,060

$36,186

$37,352

$37,149

$38,278

$926

Additional Gross Pay

1,328

1,405

1,508

1,521

1,508

0

Unsalaried

368

589

197

197

197

0

Overtime - Civilian

145

137

185

185

185

0

Other Salaried

53

54

10

10

10

0

P.S. Other

6

2

0

0

0

0

Subtotal

$37,959

$38,373

$39,251

$39,062

$40,177

$926

Other Than Personal Services

Contractual Services

6,564

6,387

6,845

6,058

6,845

0

Other Services & Charges

2,325

1,856

2,411

2,298

2,407

(4)

Contractual Services - Professional

Services

1,060

560

497

397

497

0

Property & Equipment

1,028

404

251

382

251

0

Supplies & Materials

540

907

448

1,297

448

0

Fixed & Misc. Charges

8

13

0

0

0

Subtotal

$11,524

$10,126

$10,451

$10,431

$10,447

($4)

TOTAL

$49,484

$48,499

$49,703

$49,493

$50,625

$922

Funding

City Funds

40,748

40,528

41,660

912

Capital- IFA

8,742

8,752

8,752

10

Intra City

213

213

213

0

TOTAL

$49,484

$48,499

$49,703

$49,493

$50,625

$922

Budgeted Headcount

Full-Time Positions

432

429

448

448

448

0

*The difference of Fiscal 2022 Adopted Budget compared to Fiscal 2023 Preliminary Budget.

Finance Division Briefing Paper Office of the Comptroller

14

Second Deputy Comptroller

FY20

FY21

FY22

Preliminary Plan

*Difference

Dollars in Thousands

Actual

Actual

Adopted

FY22

FY23

FY22-FY23

Spending

Personal Services

Additional Gross Pay

$281

$335

$210

$215

$210

$0

Full-Time Salaried - Civilian

13,897

14,128

14,894

14,641

15,091

197

Overtime - Civilian

76

28

35

35

35

0

Unsalaried

30

157

12

12

12

0

Subtotal

$14,284

$14,649

$15,150

$14,902

$15,347

$197

Other Than Personal Services

Contractual Services - Professional Services

3,187

3,501

3,353

3,529

3,353

0

Contractual Services

139

629

127

186

127

0

Property & Equipment

66

76

68

119

68

0

Other Services & Charges

33

27

(116)

44

18

134

Supplies & Materials

6

2

65

8

65

0

Fixed & Misc. Charges

2

2

2

2

2

0

Fixed & Misc. Charges - Judgments & Claims

0

0

585

195

585

0

Subtotal

3,432

4,237

4,083

4,083

4,217

134

TOTAL

$17,717

$18,886

$19,234

$18,985

$19,565

$331

Funding

City Funds

14,771

14,506

15,085

314

Capital- IFA

4,463

4,479

4,480

17

TOTAL

$0

$0

$19,234

$18,985

$19,565

$331

Budgeted Headcount

Full-Time Positions - Civilian

165

167

165

165

165

0

*The difference of Fiscal 2022 Adopted Budget compared to Fiscal 2023 Preliminary Budget.

Finance Division Briefing Paper Office of the Comptroller

15

Third Deputy Comptroller

FY20

FY21

FY22

Preliminary Plan

*Difference

Dollars in Thousands

Actual

Actual

Adopted

FY22

FY23

FY22-FY23

Spending

Personal Services

Full-Time Salaried - Civilian

$14,345

$14,909

$16,357

$16,302

$16,552

$195

Additional Gross Pay

376

340

161

164

161

0

Unsalaried

30

90

40

40

40

0

Overtime - Civilian

13

4

93

93

93

0

Subtotal

$14,764

$15,344

$16,651

$16,598

$16,846

$195

Other Than Personal Services

Contractual Services - Financing

16,140

13,640

13,729

13,729

13,729

0

Other Services & Charges

897

822

700

1,132

1,100

400

Contractual Services

496

667

3,362

2,425

3,362

0

Property & Equipment

329

602

229

642

229

0

Contractual Services - Professional Services

216

111

728

728

728

Supplies & Materials

29

24

108

200

108

0

Subtotal

18,106

15,866

18,856

18,856

19,256

400

TOTAL

$32,870

$31,210

$35,507

$35,454

$36,102

$595

Funding

City Funds

22,978

22,926

23,573

595

Other Categorical

12,528

12,528

12,528

0

TOTAL

$0

$0

$35,507

$35,454

$36,102

$595

Budgeted Headcount

120

117

136

136

136

0

*The difference of Fiscal 2022 Adopted Budget compared to Fiscal 2023 Preliminary Budget.

Finance Division Briefing Paper Office of the Comptroller

16

D: Pensions System Asset Performance

Asset Class

Return

Benchmark

Benchmark Index

US Equity

44.1%

44.2%

Russell 3000

REITS

0

0

Dow Jones US Select Real Estate Securities

World ex-US Equity

40.1%

34.8%

MSCI World ex-USA Investable Market Net

Dividends

Emerging Markets Equity

47.8

40.9%

MSCI Emerging Markets

International Fund of Funds/Emerging

Managers

39%

37.2%

MSCI ACWI ex USA IMI Net Dividend

Global Equity

42.1%

39.3%

MSCI ACWI

Fixed Income

Core Fixed Income

(1.7%)

(1.9%)

Bloomberg Barclays Aggregate

Treasury Inflation-Protected Securities

6.4%

6.5%

Bloomberg Barclays Capital US TIPS

Convertible Bonds

22.9%

48.0%

Bank of America Merrill Lynch All U.S.

Convertibles ex-Mandatory

Fixed Income Developing Managers

1.9%

(0.3%)

Bloomberg Barclays Aggregate

Economically Targeted Investments

0.68%

(0.33%)

Bloomberg Barclays Aggregate

Alternative Credit

High-Yield Bonds

15.6%

15.3%

Barclays US High Yield 2% Issuer-Capped

Opportunistic Fixed Income

22.0%

14.0%

JP Morgan Global High Yield and Credit

Suisse US Leveraged Loan

Private Equity (IRR)

11.5%

14.7%

Russell 3000 + 300 basis points

Real Estate (Since inception IRR)

8.1%

9.0%

Russell 3000 and Barclays U.S. Aggregate

Hedge Funds

Police

11.4%

19.4%

HFRI Fund of Hedge funds index +1%

Fire

11.5%

19.4%

HFRI Fund of Hedge funds index +1%

Infrastructure (Since inception IRR)

12.0%

10.6%

Russell 3000 and Barclays U.S. Aggregate

*Returns through July 30, 2021