CONFIDENTIAL

2019-11

Ariba Network guide to invoicing

Ariba Network

© 2019 SAP SE or an SAP aliate company. All rights reserved.

THE BEST RUN

Content

Introducing Ariba Network invoicing.................................................7

Ariba Network invoicing............................................................7

SAP Ariba security practices......................................................8

Invoicing prerequisites..........................................................9

Ariba Network invoicing—buyer’s perspective...........................................10

Viewing invoices..............................................................11

Editing invoices sent from an Invoice Conversion Service.................................11

Ariba Network invoicing—supplier’s perspective..........................................11

Invoice routing methods........................................................12

Ariba Network user permissions..................................................12

Invoice creation process.......................................................... 14

1) Supplier creates invoice.......................................................14

2) Ariba Network validates invoice.................................................15

3) Buyer receives invoice....................................................... 15

4) Supplier reviews invoice status.................................................15

5) Ariba archives invoice........................................................15

Invoice validation............................................................... 16

Additional resources about Ariba Network invoicing.......................................16

Invoice creation................................................................17

Creating invoices................................................................17

Types of invoices.............................................................17

Invoice compliance for contract-based invoices..........................................19

Workow overview for SAP Ariba Buying and Invoicing and SAP Ariba Invoice Management........ 19

Workow overview for Ariba Invoice Automation with SAP Ariba Contract Invoicing..............20

Self-billing invoices..............................................................21

Workow for self billing........................................................ 22

Invoice creation process..........................................................24

General invoice creation compliance features.........................................26

Value-added tax (VAT) compliance features..........................................29

PDF copy of invoices.............................................................32

PDF invoice copy availability.....................................................32

Invoice copy PDF creation...................................................... 33

Invoice PDF generation for suppliers...............................................34

PDF invoice copy attachment to invoices............................................35

Invoice archival options and delivery..................................................35

Automatic delivery............................................................36

2

C O N F ID EN T I A L

Content

Archive zip le contents........................................................36

Download archived invoices from the pending queue....................................37

How to set invoice archiving options for buyers........................................38

How to set invoice archiving options for suppliers......................................38

Long term archiving of tax invoices...................................................38

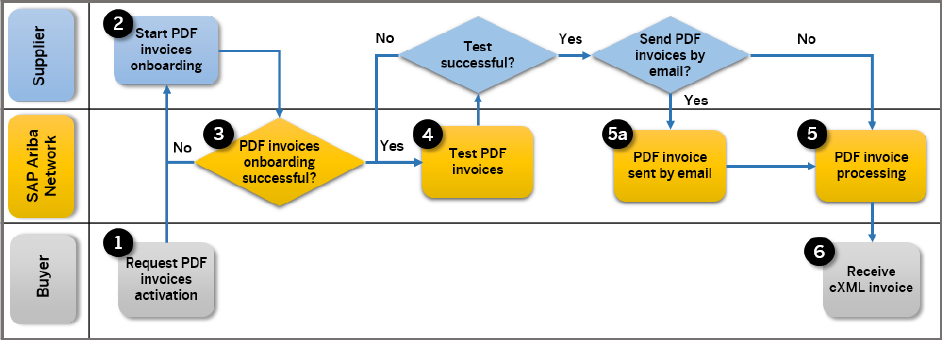

Support for PDF invoices..........................................................40

PDF invoices................................................................43

PDF invoice workows.........................................................45

Uploading and sending PDF invoices...............................................50

Invoice rules..................................................................54

About Ariba Network invoice rules...................................................54

Invoice rule levels............................................................ 54

Invoice rule types.............................................................55

Invoice rule application...........................................................55

Evaluation of default transaction rules..............................................56

Evaluation of supplier group rules.................................................56

Evaluation of country-based invoice rules............................................56

Country-based invoice rules........................................................57

Originating country of an invoice..................................................58

Country-based invoice rules for blanket purchase orders.................................59

Country-based invoice rule to restrict partial credit.....................................59

Country-based invoice rule for automatic invoice creation from receipts......................60

Country-based invoice rules congurable by suppliers.....................................61

Country-based invoice rules available to suppliers..................................... 63

Supplier country-based invoice rules conguration.....................................65

Invoice rule reference............................................................66

General invoice rules..........................................................67

Service sheet rules........................................................... 78

List of allowances and charges................................................... 81

PO invoice elds..............................................................81

PO and non-PO invoice elds....................................................82

Invoice address rules..........................................................84

Blanket purchase order rules.................................................... 85

Invoice payment rules.........................................................85

VAT rules..................................................................86

Online invoice forms...........................................................87

PO and BPO invoice elds...................................................... 88

PO, BPO, and non-PO invoice elds................................................89

Digital signature process........................................................ 91

Digital signature concepts.........................................................91

Content

C O N F ID EN T I A L 3

Digital signing prerequisites........................................................92

Digital signing agreement / mandate process.........................................94

Invoice signing process...........................................................96

Integrity protection for invoice data transmission......................................98

Determination for certicate selection..............................................99

Ariba Network e-signing methods...................................................100

Ariba Network certicate details.................................................100

Ariba Network certicate validity period............................................100

Signature authorization validation................................................100

Separation of hardware and service components......................................101

“On behalf of” supplier to buyer change............................................101

Invoices with le attachments...................................................101

Self-signed invoices for suppliers...................................................102

SAP Ariba Tax Invoicing Framework............................................... 104

SAP Ariba Tax Invoicing Framework prerequisites........................................104

SAP Ariba Tax Invoicing Framework process........................................... 105

Country-specic tax invoicing process.............................................106

Tax invoicing in Brazil........................................................... 106

Brazil tax invoicing process on Ariba Network........................................109

Notications for Brazilian tax invoices..............................................110

Tax invoicing in Mexico...........................................................111

Mexico tax invoice extrinsic elds.................................................111

Addenda..................................................................113

How to upload CFDI and PDF invoices..............................................113

Support for payment receipts (Complemento de Pago)................................. 114

Tax invoicing in Chile............................................................ 116

Chile tax invoicing process using an integrated service provider............................117

External tax invoice handling....................................................118

Tax invoicing in Hungary..........................................................119

Schema update version 1.1......................................................121

Correction and storno invoices.................................................. 122

Technical annulment of NAV invoices in Hungary......................................123

How to set up a regulatory prole for Hungarian suppliers...............................123

How to set up a tax invoice number range...........................................124

How to register NAV information.................................................125

How to opt out of tax invoicing in Hungary.......................................... 126

How to update email notication preference.........................................127

How to annul an invoice........................................................127

Invoice summary reports...................................................... 128

Appendix A - sample XML le sent to NAV.......................................... 129

4

C O N F ID EN T I A L

Content

Appendix B - APIs invoked by Ariba Network.........................................130

Tax invoicing in France...........................................................131

French parascal taxes........................................................131

French tax invoicing audit reports................................................ 132

French Summary List report....................................................133

French Partner File report......................................................134

Conguring French legal entities.................................................136

Viewing French tax invoicing audit reports.......................................... 139

Tax invoicing in India............................................................140

Support for eInvoicing with GST in India............................................140

How to set up a supplier legal prole for tax invoicing in India.............................144

How to create customer (sold to) address...........................................145

How to congure country based invoice rules........................................145

Tax invoicing in UAE.............................................................146

How to congure additional addresses and conrm VAT registration ........................147

Tax invoicing in Italy.............................................................148

Italy specic tax invoicing elds..................................................150

External tax invoice handling....................................................150

Tax invoicing in Malaysia......................................................... 152

Workows for tax invoicing in Malaysia.............................................154

cXML changes for tax invoicing in Malaysia..........................................156

Buyer user tasks............................................................ 156

Supplier user tasks...........................................................157

Tax invoicing in Singapore........................................................ 158

Workow for Singapore invoicing.................................................159

Standard invoice elds for Singapore..............................................160

Tax invoice elds for Singapore GST registered suppliers................................160

Debit Note elds for Singapore GST registered suppliers................................ 161

Credit Note elds for Singapore GST registered suppliers................................162

Supplier user tasks for Singapore invoicing..........................................162

Buyer user tasks for Singapore invoicing........................................... 163

Tax invoicing in countries that require credit memo creation when discounts are accepted...........164

Timestamp verication of invoices in Japan.........................................165

How to enable the timestamp rule for buyers...........................................166

How to enable the timestamp rule for suppliers.........................................167

How to batch verify timestamped invoices.............................................167

Standard invoice eld reference..................................................169

Invoice header and line item elds.................................................. 169

Invoice eld descriptions.........................................................170

Summary elds (header only)...................................................171

Content

C O N F ID EN T I A L 5

Tax elds..................................................................172

Shipping and shipping cost elds.................................................174

Payment terms elds.........................................................174

Discount elds..............................................................175

Comments and attachments elds................................................175

Advanced pricing details elds...................................................176

Additional elds (header only)...................................................176

Allowances and charges elds...................................................178

Blanket purchase order elds................................................... 178

Line item details for items invoiced from service sheets.................................179

Goods and general service line item details..........................................180

Labor service item details......................................................182

Direct material elds......................................................... 182

Country-specic tax invoice elds................................................183

Invoice status levels.............................................................184

Routing statuses............................................................185

Document statuses..........................................................186

Ariba Network invoice rules and elds............................................. 189

Invoice elds and related rules.....................................................189

Ariba Network global e-invoicing.................................................200

Global e-invoicing requirements....................................................200

Trading partner tax responsibilities and liabilities.....................................200

Revision history..............................................................201

6

C O N F ID EN T I A L

Content

Introducing Ariba Network invoicing

Ariba Network invoicing [page 7]

Ariba Network invoicing—buyer’s perspective [page 10]

Ariba Network invoicing—supplier’s perspective [page 11]

Invoice creation process [page 14]

Invoice validation [page 16]

Additional resources about Ariba Network invoicing [page 16]

Ariba Network invoicing

Ariba Network is a hosted service that enables a company to form relationships with their suppliers and conduct

order and invoicing transactions over the Internet. Buying organizations use Ariba Network to nd suppliers from

which they want to purchase products or services and invite suppliers to form trading relationships. After a supplier

has been enabled on the Ariba Network, the buying organization can view any public catalogs the supplier has

created or receive customer-specic catalogs from their suppliers. Buyers can then place orders, and suppliers in

turn can create order-based invoices.

If the buyer allows, suppliers can also create invoices that are not based on a purchase order or enable a supplier to

punch into the buyer’s invoicing system to create contract-based invoices.

Buyer customers use one of the following invoicing solutions to connect to the Ariba Network:

● An SAP Ariba cloud solution: SAP Ariba Buying and Invoicing or SAP Ariba Invoice Management

● An SAP Ariba on premise solution: Ariba Buyer with the Ariba Invoice module

● Ariba Invoice Automation, which connects an external ERP to the Ariba Network to exchange cXML documents

via one of the supported Ariba Network adapters.

Through Ariba Network, buyers and suppliers can seamlessly integrate their invoicing processes on a single

network.

Introducing Ariba Network invoicing

C O N F ID EN T I A L 7

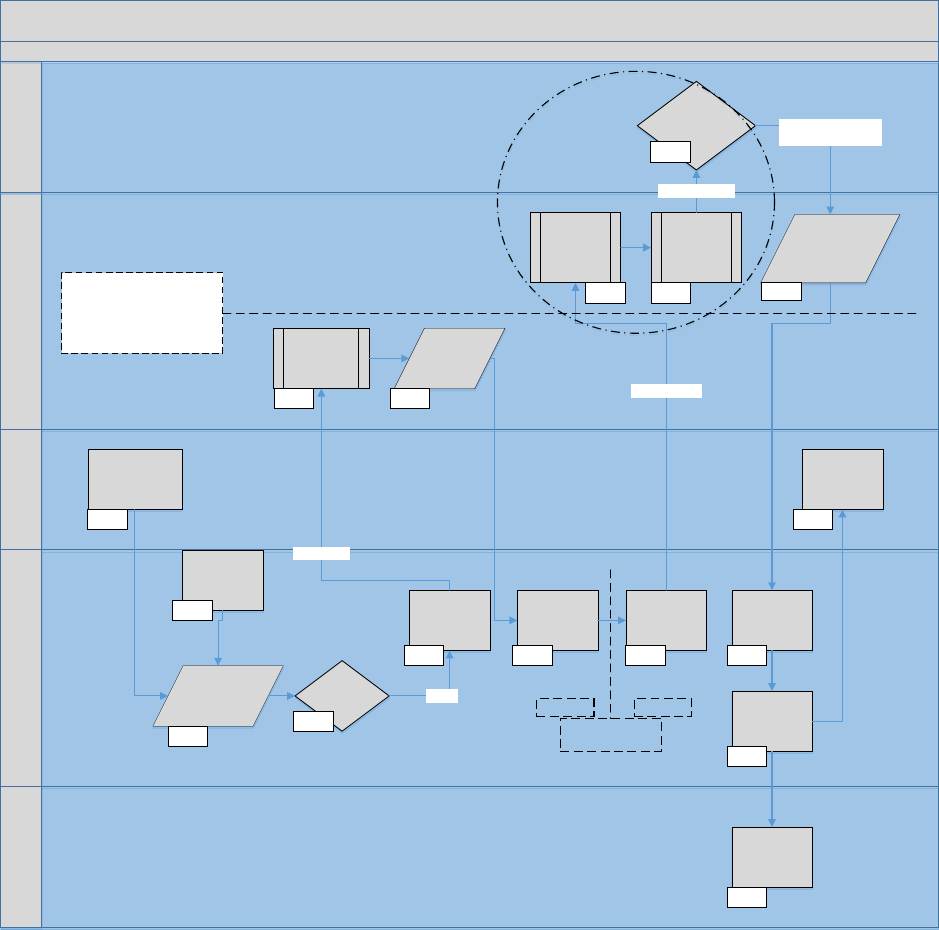

Figure 1: e-Invoice: architecture and services

Suppliers can either create invoices online in their Ariba Network account or submit them electronically from their

external system via cXML or EDI. If suppliers create invoices online, then the account administrator can assign

specic roles to users that allow them to view purchase orders and create invoices.

All invoices regardless how they are submitted to Ariba Network are validated against the specic buyer’s invoicing

rules. Invoices that fail that validation are rejected. Only after they are accepted by Ariba Network are they then

digitally signed (if required based on the From and To country on the invoice).

Once the invoices are validated and signed, they are downloaded to the buyer’s invoicing system for review and

approval. If the buyer nds a discrepancy (e.g. between the expected and actual tax amount or a line item invoice to

purchase order mismatch) they can then dispute or reject the invoice and require the supplier to resubmit a

corrected invoice.

Related Information

Ariba Network user permissions [page 12]

SAP Ariba security practices

The SAP Ariba solution components support general commercial good security practices that ensure

condentiality, security and integrity of the business system. SAP Ariba’s current audit report is the WebTrust

(

http://www.webtrust.org ) seal. SAP Ariba is audited against this standard every six months by an external

independent auditor for its cloud solutions including the Ariba Network.

8

C O N F ID EN T I A L

Introducing Ariba Network invoicing

The certication provides reasonable assurance that, based on the AICPA/CA Trust Services Criteria for Security

Condentiality, Availability and Processing Integrity Criteria:

● the systems are protected against unauthorized access (both physical and logical);

● the systems are available for operation and use as committed or agreed;

● the system processing is complete, accurate, timely and authorized;

● information designated as condential is protected as committed or agreed; and

● SAP Ariba has complied with its commitments regarding security, availability, processing integrity, and

condentiality.

SAP Ariba ensures the integrity of invoice data transmitted between Ariba Network and the SAP Ariba invoicing

solutions through Transport Layer Security (TLS).

Invoicing prerequisites

The enablement for invoicing in Ariba Network is a buyer-driven process that follows these steps:

1. If the supplier does not have an account on the Ariba Network, they either create an account in Ariba Network

or take ownership of an account that the buyer has pre-enabled for them. No matter how a supplier starts

using the Ariba Network resources, they rst must register and accept the Terms of Use. Acceptance of the

Terms of Use is required for all users of a supplier account, regardless if they are the account administrator or a

user of the supplier company granted access to the account.

The Terms of Use for suppliers is available for review on http://supplier.ariba.com on the bottom of the page.

2. The supplier and buyer establish the trading relationship.

Note

Steps 1 and 2 are recorded with a date (“Network TC Acceptance Date” and “Relationship Status-Last

Update”) and can be downloaded as part of the buyer side “Supplier Account History” report.

3. The buyer congures their Ariba Network account to accept invoices from the supplier and species specic

invoice rules that the supplier-submitted invoices must adhere to. By default, these rules govern invoices from

all suppliers, however buyers can override these rules for specic groups of suppliers or by country.

4. The supplier reviews the buyer-specic invoice rules under “Customer Relationships” details in the supplier

account.

Invoice rules

Buyers must specically allow authorized suppliers to create invoices using the Ariba Network user interface or to

transmit them from their own back end system through the Ariba Network. If a buyer has disabled the invoicing

feature for some suppliers, then those suppliers will not have access to the invoicing functionality when reviewing

the buyer’s purchase orders and they will not be able to enter non-PO invoices for those buyers. If attempts are

made by a supplier to send automated invoices using cXML or EDI, those invoices will be automatically rejected.

After a supplier is authorized to send invoices electronically to a buyer, those invoices will be validated against the

buyer’s congured invoice rules. The rules established on the Ariba Network require that suppliers and buyers

exchange invoices and invoice status updates that contain the specic content for a wide range of requirements,

including VAT compliance. When a supplier user creates invoices in the Ariba Network user interface, the elds and

Introducing Ariba Network invoicing

C O N F ID EN T I A L 9

validations available to them on the user interface are controlled by the invoice rules that the buyer has congured.

If they send invoices through cXML or EDI, the same invoice rules apply and invoices that don’t fulll the specic

criteria set forth by the invoice rules will be rejected.

Testing the invoice process

Test accounts are free Ariba Network accounts that allow buyers and suppliers to test purchase order and invoice

exchange (routing, creation, and processing). These test accounts enable transaction partners to send and receive

test purchase orders and invoices without the risk of actually shipping products or disrupting production

transactions.

Test accounts provide a safe way for new and existing buyers and suppliers to exercise Ariba Network. New buyers

typically spend several days testing their procurement systems and Ariba Network congurations. Similarly, new

suppliers spend several days testing their order receiving system and Ariba Network congurations. Buyers and

suppliers also use test accounts when testing their new trading relationships.

Both buyers and suppliers use test accounts, not production accounts, for this testing. When they are condent

that the purchase order and invoice processes are working, they switch from their test accounts to their production

accounts.

To perform testing, buyers and suppliers must coordinate with each other. Both buyer and supplier must use either

test accounts or production accounts; the two types will not communicate with each other.

For more information on test accounts, see the topic "Using Test Accounts in Ariba Network" in the Product

Documentation > For Administrators section of the Learning Center.

Ariba Network invoicing—buyer’s perspective

After a trading relationship has been established with a supplier in Ariba Network, buyers can download catalogs

from their suppliers and then use their procurement application to generate purchase orders. Procurement

applications send purchase orders to Ariba Network, which either stores them for suppliers to pick up or routes

them to suppliers through one of several protocols. Suppliers can respond with order conrmations, ship notices,

and invoices.

It is the buyer’s responsibility to allow invoicing by setting invoice rules. By enabling the appropriate invoice rules,

buyers can allow suppliers to:

● Create standard invoices against purchase orders.

● Create non-PO invoices and credit memos.

● Create invoices against contracts by accessing the customers’ contract collaboration sites.

Ariba Network automatically routes purchase orders to suppliers through cXML, email, fax, or EDI. Working with an

SAP Ariba representative, buyers can also customize the Ariba Network supplier user interface to allow suppliers to

upload invoices in CSV (comma-separated value) format. Suppliers specify their preferred order routing method,

and Ariba Network takes care of the format, protocol, and delivery details.

10

C O N F ID EN T I A L

Introducing Ariba Network invoicing

Related Information

Invoice rules [page 54]

Viewing invoices

While buyers can view their suppliers’ invoices in their Ariba Network online Inbox, most buyer users review and

approve the invoices in their own invoicing solution. Generally, an account administrator might need to review

invoices that for some reason cannot be downloaded to the buyer’s invoicing solution and then resend stuck

invoices after resolving the issue.

The Invoices section of the Inbox shows details about each invoice, including columns showing the invoice routing

method, origin, and source document (or order type). The transactions list can be congured to show failed

invoices, show or hide columns, group transactions by column, export tables to spreadsheet applications such as

Microsoft Excel, and control the number of transactions displayed (the default is 100).

Buyer users can also use the cXML Viewer at https://service-2.ariba.com/Buyer.aw/ad/displayInvoice to upload

a le containing the cXML invoice to generate a human-readable representation of the actual invoice data.

Editing invoices sent from an Invoice Conversion Service

SAP Ariba invoice conversion services (ICS) solutions facilitate conversion of paper invoices to an electronic format

using a process that includes validation. An invoice conversion service provider receives paper invoices on behalf of

the buying organization and converts them to an electronic format for posting to Ariba Network. Invoices sent from

such service providers are labeled ICS Paper Invoices in the Ariba Network inbox.

Buyers who subscribe to an ICS solution can edit and resubmit unassigned invoices on Ariba Network. An

unassigned invoice is an ICS invoice with an unknown supplier, which means Ariba Network either did not nd a

purchase order matching the invoice or cannot verify the supplier ID.

Buyers can also edit and resubmit ICS invoices rejected by their Ariba Network invoice rules or by their invoicing

application.

Ariba Network invoicing—supplier’s perspective

Suppliers in Ariba Network have two options for generating electronic invoices:

● manually, using the Generate Invoice feature provided in Ariba Network

● programmatically, using cXML or EDI

To generate invoices manually, suppliers do not need to do any special setup once buyers are prepared to receive

invoices. Suppliers can generate invoices and credit memos online in their Ariba Network account, or use their own

systems to generate cXML or EDI invoices and route them through Ariba Network. To generate invoices

programmatically, suppliers must work with buyers to understand their special requirements for invoice

Introducing Ariba Network invoicing

C O N F ID EN T I A L 11

conguration. Also, suppliers must ensure that the date format conforms to the ISO 8601 standard supported by

Ariba Network.

For more information about supplier account conguration for cXML or EDI, see the Conguring document routing

topics in the supplier’s help center.

Invoice routing methods

Suppliers must congure their Ariba Network account to choose the routing method for invoices. The account

administrator or users with the cXML Conguration permission (only for suppliers using cXML), or the Transaction

Conguration permission can set routing methods for invoices.

EDI order routing requires activation by SAP Ariba Customer Support.

Payment remittance options include online (through the Ariba Network Inbox), cXML, or email.

Ariba Network user permissions

Supplier organizations who are authorized to send invoices from their Ariba Network account can enable their

users with the following permissions for invoice transactions:

Permissions

Allows users to...

Inbox Access Work with documents in the Inbox. This includes reviewing purchase orders, generating

one-time purchase order reports, creating order conrmations and ship notices, reviewing

Inbox notications, and downloading transaction audit report.

Grants access to this area:

Inbox

Outbox Access

Work with documents in the Outbox. This includes reviewing invoices including invoices eli

gible for auction, canceling invoices, generating one-time invoice reports, and searching for

specic invoices.

Grants access to this area:

Outbox

Invoice Generation

Create invoices against purchase orders routed to Ariba Network, against purchase orders

not routed to Ariba Network, and/or against contracts. Customers can enable any or all of

these invoicing types. Grants access to this area:

Outbox Invoices

A user assigned to this role must also have a relationship with a customer that accepts in

voices. To assign this permission, the user must also have Inbox Access and Outbox Access

permissions.

12 C O N F ID EN T I A L

Introducing Ariba Network invoicing

Permissions Allows users to...

Contract Access Access the SAP Ariba invoicing site for customers that support it, and review contracts and

create invoices against contracts. Grants access to this area:

Inbox Contracts

To assign this permission, you must also assign the Inbox Access permission.

Transaction Conguration

Congure the account for electronic transactions. This includes specifying requirements

and/or preferences for routing and responding to purchase orders, order request mes

sages, cancel orders, order response documents, and invoices.

Grants access to these areas:

Account Settings Electronic Order Routing

Account Settings

Electronic Invoice Routing

Routing Overrides

Override document routing method settings for incoming documents by the buying organi

zation or customer group. This permission is available for Business, Integrated, and Enter

prise Package Members only.

Grants access to this area:

Account Settings Customer Relationships (Override Routing link only)

To assign this permission, the user must also have the Customer Administration permis

sion.

cXML Conguration

Congure the SAP Ariba account for cXML transactions, including specifying the cXML

version supported, the authentication method, prole URL, punchOutSetupRequest URL,

and pricing updates.

Grants access to this area:

Account Settings Electronic Order Routing cXML Setup

Note: Users also need the Transaction Conguration permission to access this area.

Invoice Report Administration

Create, delete, modify, run, and download invoice reports. Grants access to this area:

Reports (invoice report type only)

Introducing Ariba Network invoicing

C O N F ID EN T I A L 13

Invoice creation process

Use the following diagram to understand the workow of how an invoice is created and then managed by Ariba

Network

, the supplier, and the buyer throughout its lifecycle:

Figure 2: High-level invoice creation process

1) Supplier creates invoice

A supplier creates an invoice in one of two ways:

● by posting a cXML (via HTTPS) or EDI message (via VAN or AS2), at which point the invoice data is directly

transmitted to the Ariba Network, or

● by logging in to their Ariba Network account and then using the Generate Invoice feature to create an online

invoice form (PO Invoice, Non-PO Invoice or Credit Memo). Alternately, a supplier can upload a CSV le with

invoice data.

14

C O N F ID EN T I A L

Introducing Ariba Network invoicing

2) Ariba Network validates invoice

Ariba Network processes the invoice as follows:

● The invoice data is converted into cXML; Ariba Network validates it using buyer-specied and standard rules.

● If the invoice fails validation [page 16], it is rejected and Ariba Network sends an email notication to the

supplier.

● Supplier reviews errors, corrects invoice data and then resubmits.

● If required, Ariba Network electronically signs the invoice and stores the signature along with a verication

protocol.

● The invoice is made available for download or is pushed to the buyer’s system.

3) Buyer receives invoice

The buyer manages the invoice within their invoicing solution as follows:

● The buyer receives (or downloads) the invoice and begins the process of invoice reconciliation.

● If errors occur, the Invoice History page displays the status and reason.

● Ariba Network tracks and logs status changes and sends notications to the supplier.

4) Supplier reviews invoice status

Based on the result of the invoice reconciliation, the supplier manages the invoice in Ariba Network as follows:

● The supplier reviews status updates.

● In case of errors, the supplier corrects invoice data, which might result in credit notes and /or new invoices.

5) Ariba archives invoice

After successful completion of the invoice reconciliation process, the invoice is scheduled for payment. Next, Ariba

Network manages the invoice as follows:

● If congured, the buyer and supplier can archive their invoices in ZIP format.

● Buyer and supplier can downloaded the archives manually or congure their Ariba Network account to deliver

them automatically using HTTPS post.

Introducing Ariba Network invoicing

C O N F ID EN T I A L 15

Invoice validation

Ariba Network validates invoices according to the buyer-congured rules and rejects invoices that do not pass

validation. Invoice validation depends on how a supplier generates invoices:

● Online—Ariba Network validates online invoices during data entry and displays onscreen messages for any

errors that must be corrected. Ariba Network enforces validation of customer invoice rules by customizing the

online display of editable and read-only content.

● cXML—Ariba Network validates cXML invoices against the cXML DTD to ensure proper format and syntax. If

the invoice passes syntax validation, the supplier receives a cXML response with a 201 status. If the invoice fails

validation, the supplier receives a 500 status and details of the errors. Then, Ariba Network validates them

against the buyer’s invoice rules.

● CSV—Ariba Network converts CSV invoices to cXML. Ariba Network will provide suppliers with the necessary

templates for formatting CSV invoices. Ariba Network checks the CSV invoices against the buyer’s invoice

format during the import process. If the invoice does not have the proper format, Ariba Network issues a

detailed error message. After successful import, Ariba Network converts the invoices to cXML and validates

them against the buyer’s invoice rules.

● EDI—Ariba Network validates EDI invoices against the ANSI X12 or EDIFACT standard. If the invoice passes

validation, Ariba Network issues a positive Functional Acknowledgement. If the invoice fails validation, Ariba

Network issues a negative Functional Acknowledgment with details of the errors. It then converts invoices to

cXML and validates them against the buyer’s invoice rules.

Buyers can use purchase order control keys to override invoice rules. For instance, buyers can use control keys to

allow their suppliers to create invoices directly from service orders without a service sheet.

Suppliers can review the rules that have been specied by the buyer for invoice transactions in the Customer

Details page of their Ariba Network account (Customer Relationships > Customer Details).

Additional resources about Ariba Network invoicing

For more information about Ariba Network and the invoicing features available to suppliers and buyers, refer to the

following product documentation:

Available for buyer users:

● Ariba Network buyer administration guide

● Ariba Network guide to invoice conversion

● Ariba Network cXML solutions guide

Available for supplier users:

● Account settings and prole conguration topics

● Conguring document routing topics

● Ariba Network cXML solutions guide

● Creating and managing invoices, credit memos, and debit memos topics

16

C O N F ID EN T I A L

Introducing Ariba Network invoicing

Invoice creation

Creating invoices [page 17]

Invoice compliance for contract-based invoices [page 19]

Self-billing invoices [page 21]

Invoice creation process [page 24]

PDF copy of invoices [page 32]

Invoice archival options and delivery [page 35]

Long term archiving of tax invoices [page 38]

Support for PDF invoices [page 40]

Creating invoices

Ariba Network supports the creation, validation, and routing of electronic invoices and credit memos. These

invoices are detailed statements of products delivered or services rendered, and associated charges for one or

more purchase orders or contracts. Ariba Network supports invoicing for material items (goods), general service

items labor service items, and service items that require a service sheet.

See the following for more information:

● For information about invoicing rules, see Invoice rules [page 54].

● For more information on how invoicing rules aect the available elds in invoice forms, see Ariba Network

invoice rules and elds [page 189].

● For suppliers: For information about how to create and manage invoices, see the Creating and managing

invoices topics.

Types of invoices

Ariba Network supports the creation of the numerous types of invoices.

Invoice type Description

Material Also called purchase order-based, these are standard invoices routed through Ariba Net

work that do not contain any service lines (lines that require a service sheet).

Service Another type of standard invoice, these are based on service sheets that suppliers create

from service lines in service purchase orders routed through Ariba Network. Service sheets

and service invoices can include both services and material goods.

Invoice creation

C O N F ID EN T I A L 17

Invoice type Description

Lean Service These are invoices routed through Ariba Network. A single invoice can be created for all the

Lean Service line items in a purchase order.

Non-PO These invoices reference purchase orders that were not routed through Ariba Network.

Non-PO invoices also allow suppliers to invoice purchase orders that have expired and

been deleted, or to generate an invoice that does not have a corresponding purchase order.

Non-PO invoices can be issued to a buying organization even if the supplier doesn’t already

have an active trading relationship with the buying organization. In that case, the buyer

provides the supplier with buyer customer code to allow sending a non-PO invoice (quick

enablement through invoice).

Credit memo A credit memo represents an amount owed to a buyer by a supplier, typically from an ear

lier transaction such as a purchase order or a contract invoice. The amount due is a nega

tive number.

There are four types of credit memos: PO-based header level credit memos, PO-based

line-level credit memos, non-PO credit memos, and dynamic discounting credit memos.

Line-level credit memos can be based on a change in quantity or a price adjustment (price

decrease).

Line-level debit memo

Line-level debit memos represent an amount owed to a supplier by a buyer from an earlier

transaction. Line-level debit memos are always due to a price adjustment (price increase).

Blanket purchase order based A blanket purchase order (BPO) is a type of contract that buyers create that forms an

agreement to spend a specic amount with a supplier for critical items or services. If the

blanket purchase order is used to purchase specic items (item level BPO), and the cus

tomer has not enabled their invoicing site or the BPO for collaborative invoicing, then sup

pliers can create an invoice directly from the BPO the same way as they can from a regular

purchase order. If the BPO is a catalog, supplier level or commodity contract, and the buy

ers are either not using an SAP Ariba invoicing solution, or are using an SAP Ariba invoicing

solutions for which collaborative invoicing has been disabled, then suppliers can view the

BPO, but must create a non-PO invoice with the contract ID as reference to invoice against

the BPO.

Contract-based A buying organization using an SAP Ariba invoicing solution can allow collaborative invoic

ing for suppliers. In that case, suppliers punch in to the buyer’s invoicing solution to either

create the entire invoice in the buyer’s invoicing site, or they punch in to retrieve the con

tract information and add items from the contract to the invoice, but nalize the invoice in

and submit the invoice from the Ariba Network - just as a standard invoice. If suppliers cre

ate the entire invoice in the buyer’s invoicing site, Ariba Network compliance rules do not

apply, since the supplier is subject to the invoicing processes and rules congured for the

buyer’s invoicing solution.

Self billing Ariba Network can automatically transmit self-billing invoices to suppliers and buyers

based on data in purchase orders, scheduling agreements, and goods receipts using an au

tomated process.

18 CO N F I D E N TI AL

Invoice creation

Related Information

Invoice compliance for contract-based invoices [page 19]

Self-billing invoices [page 21]

Invoice compliance for contract-based invoices

This feature is only available to buying organizations that use either SAP Ariba Buying and Invoicing or SAP Ariba

Invoice Management as their invoicing solution. In addition, buyers must congure their invoicing solutions and

their Ariba Network account to allow suppliers to create compliant contract invoices.

This feature is also available as an optional add-on to buyers using Ariba Invoice Automation. In that case, contract

agents use the SAP Ariba site to dene the contracts, and suppliers punch in to the contract site to retrieve

information about the contract and add items from the catalog to the invoice, but the invoice is routed directly to

the buyer’s ERP system.

Invoice Compliance for Contract-based Invoices allows suppliers to create contract-based invoices on the Ariba

Network:

● Suppliers initiate and nish a contract-based invoice on Ariba Network using an already familiar user interface

and process.

● Suppliers access the buyer’s invoicing site transparently to retrieve the contract and add items from the

catalog.

● The appropriate invoice rules are applied when the invoice is submitted to ensure that the nal invoice

complies with the buyer’s invoicing rules. This means errors on invoices are detected before the buyer receives

the invoice, which facilitates improved electronic invoice and payment processing.

● For countries that require a digital signature, the invoice is digitally signed if the buyer account has been

enabled for digital signing.

Workow overview for SAP Ariba Buying and Invoicing and SAP Ariba Invoice Management [page 19]

Workow overview for Ariba Invoice Automation with SAP Ariba Contract Invoicing [page 20]

Workow overview for SAP Ariba Buying and Invoicing and

SAP Ariba Invoice Management

The following describes the workow between suppliers on Ariba Network and the buyer’s SAP Ariba Buying and

Invoicing or SAP Ariba Invoice Management site:

1. Suppliers initiate the contract-based invoice creation from Ariba Network by selecting the customer for which

they are creating the contract-based invoice. If the customer has multiple procurement applications, they

select the business unit address whose contracts they want to access by the Bill To address ID and the contact

person.

2. Ariba Network automatically transfers the supplier user to the buyer’s SAP Ariba invoicing site, where the

supplier user selects the contract and enters the invoice number, invoice date, and the Sold To Email (email of

Invoice creation

C O N F ID EN T I A L 19

person who requested the goods or services). Depending on the contract specication, the Sold To Email

address might be defaulted from the contact person on the contract.

3. The supplier user is then returned to the familiar Create Invoice page to enter additional invoice header

information.

4. To add items to the invoice, the supplier user is again transferred to the buyer’s SAP Ariba invoicing site to

select the items from the catalog. If allowed, they can also add non-catalog items.

5. Depending on the contract conguration, the supplier might enter accounting information.

6. The line items are validated against the contract line items, and the contract’s pricing terms are applied. If any

discrepancies are found, the supplier receives an error message to correct the information.

7. The supplier user is returned to Ariba Network.

8. To make changes to the items on the invoice, the supplier user is transferred back to the buyer’s SAP Ariba

invoicing site. If allowed, the supplier user can change the unit price on the invoice. This eectively overrides

the pricing terms dened in the contract for the item. For example, if a catalog level contract is dened with a

10% discount for all items, and the supplier changes the unit price of an item on the invoice, that price will be

the nal price used on the invoice.

9. On theAriba Network, the supplier user completes the invoice by adding other header elds and adds any

comments, attachments, tax, shipping or special handling line items either at the invoice header or at the line

item level.

10. The supplier user can always return to the buyer’s site to retrieve additional items, change a contract header

elds such as the Sold To Email, or edit or delete existing line items on the invoice. They can also change the

contract, which eectively deletes the current invoice and starts a new invoice.

11. When the supplier submits the invoice, Ariba Network does a nal validation against the buyer’s invoicing rules

and sends the invoice to SAP Ariba Buying and Invoicing or SAP Ariba Invoice Management.

12. In SAP Ariba Buying and Invoicing or SAP Ariba Invoice Management, the invoice is reconciled and then

approved for payment if no invoice exceptions are found or all invoice exceptions are resolved.

Workow overview for Ariba Invoice Automation with SAP

Ariba Contract Invoicing

1. Suppliers initiate the contract-based invoice creation from Ariba Network by selecting the customer for which

they are creating the contract-based invoice.

2. Ariba Network transfers the supplier user to the buyer’s SAP Ariba Contract Invoicing site, where the supplier

user selects the contract, enters the invoice number and invoice date, and species the requester (person

whom the services or goods were sold to). Depending on the contract specication, the requester might be

defaulted from the contact person on the contract.

3. The supplier user is then returned to the familiar Create Invoice page to enter additional invoice header

information.

4. The supplier user selects the line items to be invoiced from the catalog. If allowed, they can also add non-

catalog items.

5. Depending on the contract conguration, the supplier might enter accounting information.

6. The line items are validated against the contract line items and the contract’s pricing terms are applied. If any

discrepancies are found, the supplier receives an error message to correct the information.

7. The supplier user is returned to Ariba Network.

8. If allowed, the supplier user can change the unit price on the invoice. This eectively overrides the pricing

terms dened on the contract for the item. For example, if a catalog level contract is dened with a 10%

20

C O N F ID EN T I A L

Invoice creation

discount for all items, and the supplier changes the unit price of an item on the invoice, that price will be the

nal price used on the invoice.

9. On Ariba Network, the supplier user completes the invoice by adding other header elds as well as any

comments, attachments, tax, shipping, or special handling line items either to the invoice header or on line

item level.

10. The supplier user can always return to the buyer’s SAP Ariba contract invoicing site to retrieve additional items

or to edit or delete existing line items on the invoice.

11. When the supplier submits the invoice, Ariba Network does a nal validation against the buyer’s invoicing rules.

If the invoice passes the validation rules, it is digitally signed (if required) and sent as a cXML invoice to the

buyer’s ERP system.

Self-billing invoices

Ariba Network can automatically transmit self-billing invoices to suppliers and buyers based on data in purchase

orders, scheduling agreements, and goods receipts using an automated process called Evaluated Receipt

Settlement (ERS). The buyer creates a self-billing invoice in an external business system and sends it to the

supplier over Ariba Network.

The ERS/self-billing process supports the following features:

● An agreement is presumed to exist outside Ariba Network between buyer and supplier approving the usage of

ERS/self-billing.

● The buyer transfers ERS/self-billing data from the ERP system to Ariba Network and makes sure all country-

required mandatory content is included on self-billing documents.

● If applicable, the Ariba Network adds country-specic signatures to the cXML self-billing document based on

the supplier’s location (country) and optionally creates a human-readable PDF based on the cXML data.

● A self-billing invoice is labeled “Self-Billing” in the user interface and in the human-readable PDF.

● Ariba Network sends signed self-billing invoices to the buyer’s account.

● Ariba Network sends signed self-billing invoices to the supplier’s account and noties that supplier.

● Suppliers can download self-billing invoices through their network accounts or optionally congure their

accounts to receive them through email.

● ERS/self-billing is available for the following countries: Australia, Austria, Belgium, Czech Republic, Denmark,

France, Germany, Greece, Hungary, Italy, Netherlands, Poland, Romania, Slovakia, Spain, Sweden, Switzerland,

UK, and USA.

● Based on the buyer’s and supplier’s conguration, self-billing documents optionally can be archived using the

Ariba Network long-term document archiving feature.

Prerequisites

To use this feature, a buyer must have an ERS/self-billing agreement in place with a supplier.

Invoice creation

C O N F ID EN T I A L 21

Limitations

Suppliers: This feature is not supported for supplier organizations that have the standard account capability

enabled.

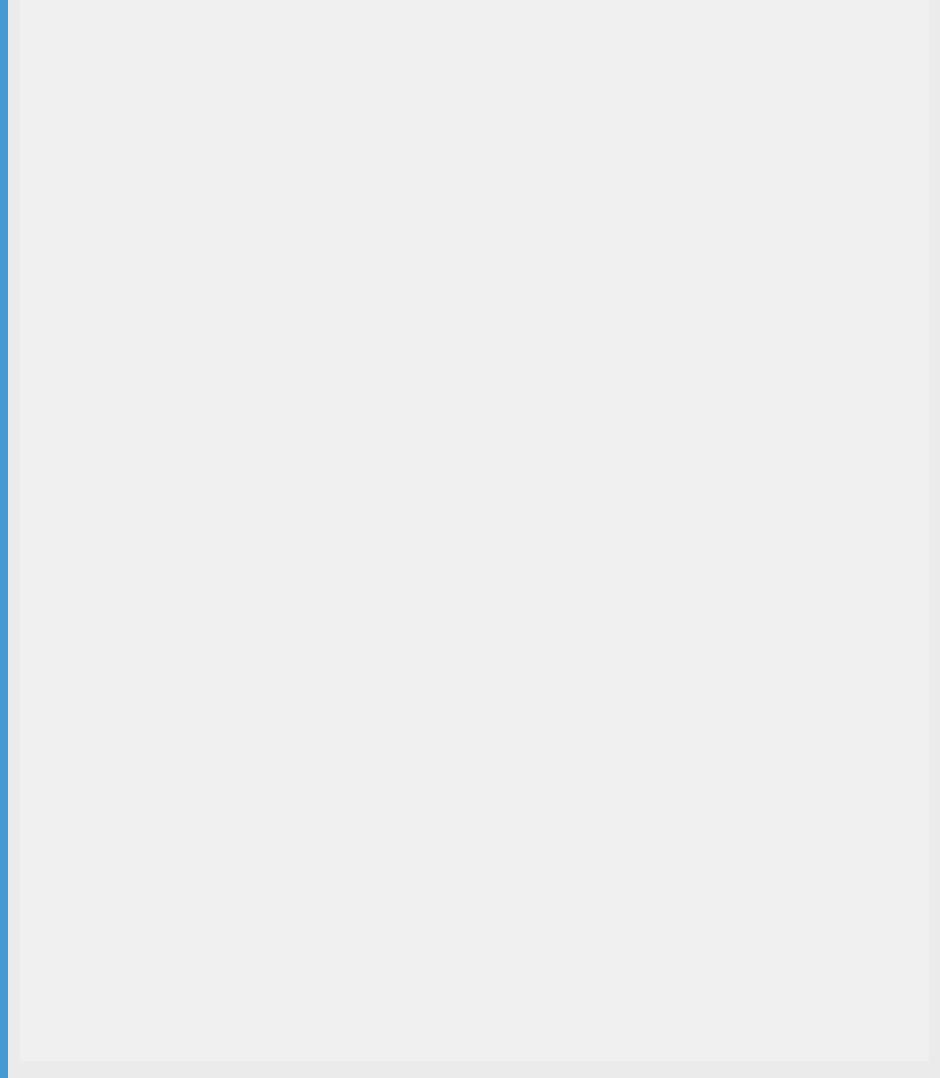

Workow for self billing

The following describes the workow for a self-billing process:

1. The buyer and supplier enter a written agreement on ERS/self-billing.

2. The buyer creates an order with the ERS ag in the buyer's ERP, which sends the order to the supplier on Ariba

Network.

3. Optionally, the supplier sends an order conrmation to the buyer.

4. Optionally, the supplier sends a ship notice to the buyer.

5. Outside Ariba Network, the supplier ships material or provides services to the buyer.

6. The buyer creates a goods receipt in the ERP.

7. The buyer creates a self-billing invoice in the ERP, which sends it to Ariba Network.

Ariba Network makes the self-billing invoice available to the supplier through the user interface, cXML, and

PDF.

8. Optionally, the buyer and supplier can archive the self-billing invoice.

22

C O N F ID EN T I A L

Invoice creation

Figure 3: Workow process for self billing

Invoice creation

C O N F ID EN T I A L 23

Invoice creation process

The following diagram shows the invoice creation process and interaction between the supplier, buyer, and Ariba

Network:

Invoice Process

Ariba

Network

Invoice Issuer SupplierInvoice Receiver (Buyer)

Invoice submitted/

posted as cXML, EDI

Supplier logs in

and creates

online invoice or

uploads CSV data

Correction of

Invoice Data

Invoice Data

Validation

cXML Invoice

Generated

(incl.eSigning)

Invoice

Archiving

Invoice

Receiving and

Processing

Invoice Status

Invoice Status

Update (Online)

Correction of

Invoice Data

Invoice

Archiving

Payment

etc.

cXML: via Https

EDI: VAN or AS2

If invalid:

Failure email

Valid

Download

cXML Invoice Download via Https

Status posting

Email Notification

IP 01.1

IP 01.2

IP 03.1

IP 02 IP 03.2

IP 04

IP 05

IP 08.2

IP 06

IP 03.1

IP 07

Start cXML or EDI

Start Online

Figure 4: Invoice creation process

Process point

What happens Related information

IP 01.1 Supplier posts a cXML (via HTTPS) or EDI message (via VAN or AS2) -

the invoice data is directly transmitted to the Ariba Network without hu

man intervention.

● Standard invoice

eld reference [page

169]

IP 01.2 Supplier logs into their account and uses either the online invoice entry

form to create a PO-based invoice, a service invoice, a non-PO invoice, or

a credit memo; or uploads a CSV le with invoice data.

● Standard invoice

eld reference [page

169]

24 C O N F ID EN T I A L

Invoice creation

Process point What happens Related information

IP 02 Invoice data is converted into a cXML invoice message and validated on

the Ariba Network against the invoice rules dened by the buyer for the

supplier, supplier group, or invoice country of origin:

● If invalid data is received the invoice is rejected and an email is sent

to the supplier.

● If the data passes all validations, the invoice creation process contin

ues with step IP 03.2.

●

Invoice rules [page

54] for a list of

available invoice

rules and recom

mendations for their

conguration

● Foreign currencies

[page 27]

● Invoice addresses

and validation [page

26]

● Value-added tax

(VAT) compliance

features [page

29]

IP 03.1

Supplier reviews the error message and corrects the invoice data, for ex

ample by resubmitting online created invoices. Suppliers can edit a failed

or rejected invoice and resubmit it to the buyer for approval instead of go

ing through the PO ip process and re-entering data.

●

Supplier product

documentation

(

Creating and man

aging invoices, credit

memos, and debit

memos

topics)

IP 03.2

Ariba Network electronically signs the invoice and stores the signature

along with a verication protocol. At this point the invoice is considered

issued as a formal legal document and neither suppliers nor buyers can

modify the invoice.

●

Invoice dates and

date of issue [page

26]

● Invoice creation

[page 17]

IP 04

The buyer ERP system receives or downloads the invoice and reconcilia

tion occurs. If there are technical errors, the reason and status is availa

ble in the invoice history and notications are sent to the supplier.

● Invoice history [page

28]

● Notication frame

work [page

27]

● Overdue documents

[page 26]

IP 05

The buyer ERP system sends the result of the invoice reconciliation back

to the Ariba Network to update the invoice status, including comments

from the invoice reviewer.

● Routing statuses

[page 185]

● Document statuses

[page

186]

● Invoice history [page

28]

IP 06

Ariba Network tracks and logs the status change and may send email no

tication to the supplier.

● Notication frame

work [page 27]

IP 07 Supplier reviews status updates. If there are discrepancies or errors de

tected as a result of the buyer’s invoice reconciliation process, the sup

plier might have to correct the invoice by either submitting a credit

memo or creating a new invoice.

●

Supplier product

documentation

(

Creating and man

aging invoices, credit

memos, and debit

memos

topics)

Invoice creation

C O N F ID EN T I A L 25

Process point What happens Related information

IP 08.2 Buyers and suppliers downloads the signed invoices and move them into

their archives

● Invoice archival op

tions and delivery

[page

35]

General invoice creation compliance features

Invoice dates and date of issue

In some countries, the invoice is considered issued when explicit data-level methods have been applied for integrity

and authenticity protection, for example, when the invoice is electronically signed. In such cases, receipt of the

invoice by the buyer is not required to consider the invoice issued. In other countries, the invoice is considered

issued only when it has become available to the buyer.

In Ariba Network, if digital signatures are applied to meet country-specic requirement, the point of invoice issue is

the date and time of the invoice after the invoice has passed the business rules and after it has been digitally

signed. The issue date, which is a timestamp on the document after it has been signed, is the date that matters in

the parties’ relationship with tax authorities. Upon issue, the invoice may no longer be disposed of or altered and

both supplier and buyer are responsible for guaranteeing its integrity and authenticity until the end of the storage

period.

The invoice date is the date that matters in the relationship between the buyer and the supplier. For example,

payment terms calculations are generally based on the invoice date.

As a best practice, SAP Ariba recommends that suppliers set the current date as the invoice date. Buyers can

mitigate the risk of a dierent issue and invoice date by setting the rule Allow invoices to be back-dated the

specied number of days to zero, which means that Ariba Network will reject any invoice with an invoice date

earlier than the current date. However, this might not be practical depending on the supplier’s backend system

integration, where any signicant delay in transmitting invoices might then mean that entire invoice batches are

rejected by Ariba Network.

Overdue documents

For documents in the “Pending Queue” that Ariba Network has not been able to post or that were not downloaded

to the buyer’s invoicing system for more than three days, Ariba Network sends an email notication that lists the

unacknowledged documents in an email attachment to the buyer. After the buyer has removed those documents

from the pending queue, they can resend them either manually or automatically. Deleting a document from the

pending queue does not delete it from Ariba Network, the document remains accessible in the Inbox.

Invoice addresses and validation

For invoice compliance, Ariba Network allows buying organizations to use invoicing rules to specify whether values

must be provided for the following addresses: Sold To, Bill To, From, Ship To, Ship From, and Remit To.

26

C O N F ID EN T I A L

Invoice creation

Ariba Network invoices support up to six standard addresses:

● Issued By (the From address)

● Customer (the Sold To address)

● Bill To

● Ship From

● Ship To

● Remit To

The Sold To and the Bill To addresses are usually the same, although Sold To is more important for VAT purposes.

Buyers can require that Ariba Network validate whether Sold To information on invoices matches Bill To information

on purchase orders (or Sold To information, if available). This rule applies only to invoices against a single purchase

order.

Buyers can also use invoicing rules to congure multiple Sold To addresses with address details, optional

associated VAT ID and/or Sold To Address ID. Buyers can then establish business rules that validate the Sold To on

a supplier’s invoice against the list of Sold To addresses & VAT IDs. Buyers can specify that only Name, ISO Country,

and VAT ID are used to validate the Sold To address or that the complete address is used for validation.

Foreign currencies

Ariba Network checks to see if invoice data uses a currency that diers from the currency of the Ship To address. In

that case, a second currency for tax amounts and for the exchange rate can be stored in the cXML invoice. Only one

exchange rate is stored per invoice and therefore the same Ship To country must be used on each single invoice.

If Ship To details are provided at line item level, then as a best practice buyers and suppliers are advised to ensure

that the country of the Ship To addresses and the Sold To address match on the purchase order or invoice.

The cXML invoice supports a currency conversion rate eld. For online invoice entry it defaults to the exchange rate

from a daily Bloomberg feed (the rates are gathered by Bloomberg from multiple pricing sources). The exchange

rate is used to calculate the tax amounts in the local Ship To currency and is stored as a second value in the cXML

invoice. As some tax authorities require that the exchange rate is to be retrieved from locally published rates, users

can update the defaulted exchange rate.

Incoming invoice data (cXML, EDI or CSV) is validated if the tax information is specied in the currency of the Ship

To information. If the tax information is specied at the invoice header level, and there are multiple Ship To

countries at line item level, Ariba Network does not validate local tax currencies.

Notication framework

Ariba Network can send automatic notications by email when certain events aect the supplier and buyer

account. Users can use these notications to monitor activities and debug problems with their account and

transmitted messages.

Invoice creation

C O N F ID EN T I A L 27

Invoice notications for suppliers (email and Outbox)

● An invoice is undeliverable or its status has been changed.

Invoice rejection reason banner for suppliers

● In the table of invoices in the supplier’s Outbox, the invoice status is shown as Rejected for every rejected

invoice. When the supplier opens any rejected invoice, a notice appears at the top of the Invoice Detail tab

summarizing the reason for the rejection. If the invoice was rejected by a buyer’s rule, the notice explains what

the rule requires. If the buyer rejected the invoice manually, and wrote or chose an explanation for the rejection,

the message shows the explanation. The supplier might then edit the invoice to comply with the buyer’s rules

or requests, and might resubmit the invoice.

● If the supplier tries to resubmit a credit memo, a message tells the supplier this is not allowed, and no response

button appears in the banner.

Invoice notications for buyers (email and Inbox)

An invoice has arrived or been updated by a supplier.

● Duplicate Invoice: A supplier sent multiple invoices with the same amount and date.

● (Email only) Pending Queue: The buyer has documents in their Inbox that Ariba Network has not been able to

download to their system for more than three days.

● (via scheduled report) Failed Invoices: the reports contain information about failed or rejected invoices over a

maximum range of one week. The buyer can generate a report daily, weekly, or for any week specied. The

report includes the reasons why the invoices failed or were rejected

Invoice history

The History page of an invoice reports the key moments and statuses in the life cycle of the invoice, such as:

● Date the invoice data is received

● Timestamp for when the e-Signature and the From and To details are requested

● Signature timestamp

● Verication timestamp

● Buyer receipt timestamp.

○ cXML Invoice is pushed to the buying organization

○ cXML Invoice is added to the download queue (the buying organization uses a scheduled download)

● Conrmation of successful (or failed) receipt by the buying organization.

● Invoice status feedback (such as information, rejections, approval, payment status).

Each entry in the invoice history contains a comment explaining the action that was performed, an internal process

and process ID that performed the change, and a timestamp. Depending on the action performed on the invoice,

28

C O N F ID EN T I A L

Invoice creation

the comments eld can contain additional status information, for example if the buyer system detected a

discrepancy between the purchase order and the invoice that led to an invoice exception.

The following shows some examples of information tracked in the invoice history comment eld:

Sample Invoice Receiving and Signing Comments

The invoice was successfully received.

Digital signature is requested for this document with From country DE and To country DE

This document has been digitally signed.

This document has been digitally veried.

Sample Invoice Status Update Comments

The invoice status has been successfully updated to Processing by <buyer>

The invoice status has been successfully updated to Processing by <buyer>.

Description: Header Level Exceptions: Invoice Unmatched

Ariba Invoice is unable to match a purchase order to the invoice of amount _119.00 EUR.

The invoice status has been successfully updated to Approved by <

buyer>.

Value-added tax (VAT) compliance features

Law reference for exempt trade

In most countries, a law reference and explanation is required for tax exempt trades. For example, in the EU invoices

for all reverse charge trades need additional statements indicating that the liability for the payment of VAT is

reversed to the recipients. In Ariba Network, suppliers use the Tax Detail, Description, and Law Reference elds in

the invoice to capture the explanation and law references.

Support for 0% VAT tax rate

Suppliers who submit invoices in Ariba Network can indicate through the tax invoice entry eld Exempt Detail if a

zero percent VAT rate is zero-rated or exempt. Zero-rated goods or services are taxable, but the tax rate is zero.

Exempt goods and services are exempt from taxation.

Buyers can control if Exempt Detail is a required or optional invoice eld through an invoicing rule. To force

suppliers to provide a reason for a zero percent VAT tax rate, buyers must enable the rule Require explanation for

zero-rate VAT.

Fiscal (tax) representatives

When a supplier sells services or manufactured taxable goods in a country where they are neither established nor

resident, they must appoint a scal representative who becomes jointly and severally liable for the supplier. In this

Invoice creation

C O N F ID EN T I A L 29

case, the scal representative’s name and address must be included on the invoice. If the scal representative pays

VAT in another EU member state, then their VAT identication number must also be included on the invoice. Ariba

Network provides standard invoice elds to capture this information.

Non-domestic trade

For non-domestic trade scenarios, all elds required on invoices for trade between two EU countries (intra-EU

trade) or for trade where at least one non-EU country is involved (cross-border trade) are available and covered by

standard invoice elds.

In both intra-EU and cross-border trade, buyers may be required to comply with a range of country-specic

requirements. SAP Ariba recommends seeking the advice of a local tax expert when engaging in either of these

practices.

The requirements for each of these scenarios are generally as follows:

Intra-EU Trade: When products or services are sold from suppliers in one EU country to a buyer in a dierent EU

country, the supplier uses a zero-rate VAT on the invoice if the buyer can provide a valid VAT ID. The buyer, in turn,

must then declare local VAT associated with their acquisition of products or services to the appropriate tax

authority (reverse charge) and can then reclaim this amount, provided all tax requirements for tax reclaim are met.

If services are purchased, the supplier is also required to clearly note, on the invoice, that the tax liability is with the

buyer.

While digital signatures are required for domestic trade, for intra-EU trade the requirements for digital signing are

more ambiguous. Therefore, SAP Ariba takes a conservative approach and signs based on both countries - the

From and To country.

Cross-Border Trade: Invoices can also be exchanged for cross border trade of products or services that occur either

from a supplier in an EU country to a buyer in a non-EU country, or vice versa. From a VAT perspective it is however

more important to document the cross-border delivery and receiving of goods or services—the invoice builds only

one part of the documentation. In cases of product trade a customs declaration is required and appropriate taxes

and customs fees for import/export must be paid.

30

C O N F ID EN T I A L

Invoice creation

VAT ID related rules

The table below displays the invoice elds that are impacted by VAT ID related Ariba Network invoices rules. Yes

indicates that the eld must always be provided; No indicates that the eld is optional, but can be made required

via invoicing rules or other conditions.

Requirement for

Trade Type

Domestic

Intra-EU Cross-Border Related Invoice Rules

Supplier VAT ID Yes Yes No

● Require supplier's VAT

ID.

● Default Supplier VAT

ID can be specied in

Supplier Prole

● Display text boxes for

buyer and supplier

VAT IDs in invoice

headers.

Buyer VAT ID

Normally not, but

some countries do

Yes No

● Require customer's

VAT ID.

● Default Company VAT

ID can be specied

● Display text boxes for

buyer and supplier

VAT IDs in invoice

headers.

● Require your compa

ny's VAT ID only for in

tra-EU trade.

VAT Details

Yes Yes No

● Require suppliers to

provide tax informa

tion in invoice headers

or line items.

● Require suppliers to

provide VAT informa

tion in invoice headers

or line items.

● Require VAT details

only for domestic and

intra-EU trade.

● Require explanation

for zero rate VAT.

● Require supply date

when VAT is chosen as

tax category.

VAT Amount in Local Currency

Yes Yes No Require tax amounts in lo

cal currency

Invoice creation

C O N F ID EN T I A L 31

PDF copy of invoices

Ariba Network provides buyers and suppliers with a PDF copy of invoices, which is a fast and easy method to create

human readable invoice copies in bulk if requested by a tax authority.

All EU countries and certain other countries require that taxable entities produce records in a human readable form

for visual inspection to tax authorities within a reasonable time frame. The PDF invoice copy includes all invoice

details as well as digital signature information. PDF invoice copy is an optional feature that requires enablement

through SAP Ariba Customer Support.

The PDF rendering includes the text “Copy of Invoice - Not A Tax Invoice” to clarify to tax authorities, buyers, and

suppliers that the cXML invoice remains the legal document.

The Ariba Network generates the PDF invoice copy in the language of the supplier's locale (which is the preferred

language congured for the account administrator). The following languages are supported:

●

Brazilian Portuguese

● Danish

● Dutch

● English

● French

● German

● Greek

● Hungarian

● Italian

● Japanese

●

Korean

● Norwegian

● Polish

● Romanian

● Russian

● Simplied Chinese

● Spanish

● Swedish

● Traditional Chinese

● Turkish

Note

If the supplier's locale is not supported for PDF invoice creation, Ariba Network creates the PDF invoice copy in

English.

Suppliers can also create a PDF version of a submitted invoice in the Ariba Network. For more information, see

Invoice PDF generation for suppliers [page 34].

PDF invoice copy availability

PDF invoice copies are available to suppliers and buyers as follows:

For suppliers

If enabled for PDF invoice copy, suppliers can access a PDF invoice copy through the archival process as part of the

archive invoice zip le.

Suppliers can also create a PDF [page 34] version of a submitted invoice in the Ariba Network.

32

C O N F ID EN T I A L

Invoice creation

For buyers

Depending on the SAP Ariba invoicing solution, buyers have multiple options for PDF invoice copy enablement:

● Buyers can generate and access PDF invoice copies through the archival process as part of the archive invoice

zip le. This option is available to all buyers regardless of their installed invoicing solution.

● PDF invoice copy attachment is supported using the following Ariba invoicing solutions:

○ Ariba Invoice Automation

○ SAP Ariba Invoice Management

○ SAP Ariba Contract Invoicing

Note

With SAP Ariba Invoice Management and SAP Ariba Contract Invoicing, an attachment to the outbound

invoice reconciliation document includes a copy of the cXML tax invoice, PDF invoice copy of the cXML tax

invoice, all supplier-provided invoice attachments, and the country-specic XML invoice (for invoices for

Brazil, Mexico, and Colombia). By default, invoice reconciliation documents don't include attachments, but

customers can enable this functionality through SAP Ariba Customer Support.

● PDF invoice copy attachment is supported using the Ariba Network adapter for SAP NetWeaver or the Ariba

Network adapter for Oracle Fusion Middleware.

● With customization, PDF invoice copy attachments can also be utilized by Ariba Invoice on premise customers

and Ariba Invoice Automation customers using a custom adapter.

Invoice copy PDF creation