Management Advisory Report

The Social Security

Administration’s Major

Management and Performance

Challenges During Fiscal Year

2022

A-02-21-51120 November 2022

MEMORANDUM

Date:

November 4, 2022

Refer to:

A-02-21-51120

To:

Kilolo Kijakazi

Acting Commissioner

From:

Gail S. Ennis,

Inspector General

Subject:

The Social Security Administration’s Major Management and Performance Challenges During

Fiscal Year 2022

The Reports Consolidation Act of 2000 (Pub. L. No. 106-531) requires that Federal Inspectors

General summarize and assess the most serious management and performance challenges

facing Federal agencies and the agencies’ progress in addressing them. The Reports

Consolidation Act also requires that the Social Security Administration (SSA) place the final

version of this Statement in its annual Agency Financial Report.

For Fiscal Year 2022, we initially identified the following challenges:

● Improve Service Delivery

● Protect the Confidentiality, Integrity, and Availability of SSA’s Information Systems and

Data

● Modernize Information Technology

● Improve Administration of the Disability Programs

● Improve the Prevention, Detection, and Recovery of Improper Payments

● Respond to the Coronavirus Disease 2019 Pandemic

Through audit work and discussions with SSA’s senior staff, we identified an additional

challenge:

● Manage Human Capital

In the attached document, we define each challenge, outline steps SSA has taken to address

each challenge, and detail the actions SSA needs to take to fully mitigate each challenge.

As some of the challenges are inter-related, progress made in one area could lead to progress

in another. For example, improved human capital resource management and further

modernization of SSA’s information technology would both affect service delivery.

In Fiscal Year 2023, the Office of Audit will continue focusing on these issues and assessing the

environment in which SSA operates. I look forward to working with you to continue improving

SSA’s ability to address these challenges and meet its mission efficiently and effectively.

If you wish to discuss the final report, please contact Michelle L. Anderson,

Assistant Inspector General for Audit.

Attachment

The Social Security Administration’s Major

Management and Performance Challenges During

Fiscal Year 2022

A-02-21-51120

November 2022 Office of Audit Report Summary

Objective

To assess and summarize the most

serious management and performance

challenges facing the Social Security

Administration (SSA).

Background

The Reports Consolidation Act of 2000

(Pub. L. No. 106-531) requires that

Federal Inspectors General

summarize and assess the most

serious management and performance

challenges facing agencies and the

agencies’ progress in addressing

those challenges. The attached report

provides our assessment.

In Fiscal Year 2022 (October 1, 2021 to September 30, 2022),

we focused on the following management and performance

challenges:

● Manage H

uman Capital. SSA mu

st adequately plan to ensure

it has the staff it needs to meet its mission now and in the

future. Read more.

● Improve Service Delivery. SSA needs to address growing

workloads and the expected retirement of experienced

employees as it pursues its mission to deliver quality service to

the public. Read more.

● Protect the Confidentiality, Integrity, and Availability of

SSA’s Information Systems and Data. SSA must ensure its

information systems are secure and sensitive data are

protected. Read more.

● Modernize Information Technology. SSA must continue

modernizing its information technology to accomplish its

mission despite budget and resource constraints. Read more.

● Improve Administration of the Disability Programs.

To better serve its customers, SSA needs to address

increasing pending initial disability claims, reconsiderations,

and continuing disability reviews; identify and reduce barriers to

the disability program; reduce hearings processing times; and

develop better strategies to help disabled beneficiaries return to

work. Read more.

● Improve the Prevention, Detection, and Recovery of

Improper Payments. SSA must be a responsible steward of

the funds entrusted to its care by minimizing the risk of making

improper payments and recovering overpayments when they

occur. Read more.

● Respond to the Coronavirus Disease 2019 Pandemic.

SSA must ensure safety of both employees and visitors while it

resumes in-person services and mitigates backlogs and

declines in workloads caused by the pandemic. Read more.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120)

TABLE OF CONTENTS

Manage Human Capital .............................................................................................................. 1

Improve Service Delivery ............................................................................................................ 5

Protect the Confidentiality, Integrity, and Availability of Information Systems and Data ............... 8

Modernize Information Technology ........................................................................................... 11

Improve Administration of the Disability Programs .................................................................... 13

Improve the Prevention, Detection, and Recovery of Improper Payments ................................. 18

Respond to the Coronavirus Disease 2019 Pandemic .............................................................. 23

– Office of the Inspector General Reports Issued in Fiscal Year 2022 Addressing

Management Challenges .................................................................................... A-1

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120)

ABBREVIATIONS

AFI Access to Financial Institutions

AARPS Appeals and Appointed Representative Processing Services

ASP Agency Strategic Plan

C.F.R. Code of Federal Regulations

CARES Compassionate And REsponsive Service

CDR Continuing Disability Review

COVID-19 Coronavirus Disease 2019

DDS Disability Determination Services

FY Fiscal Year

HCOP Human Capital Operating Plan

iSSNRC Internet Social Security Number Replacement Card

IT Information Technology

ITIP Information Technology Investment Process

OASDI Old-Age, Survivors, and Disability Insurance

OIG Office of the Inspector General

Pub. L. No. Public Law Number

SSA Social Security Administration

SSI Supplemental Security Income

SSN Social Security Number

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 1

MANAGE HUMAN CAPITAL

The Social Security Administration (SSA) must adequately plan to ensure it has the staff it

needs to meet its mission now and in the future as it finds hiring staff harder in a more

competitive job market and when over 40 percent of its workforce will be eligible to retire within

5 years.

Why This is a Challenge

At a recent congressional hearing, SSA reported its growing workload backlogs, including

delays in disability claims processing, were largely due to hiring challenges and higher than

expected staff attrition. As SSA faces staffing challenges, its planning documents lack

descriptions of the hiring and recruitment plans needed to address them.

Hiring and Retention

SSA has approximately 59,000 full-time equivalent staff, which is about 4,000 less staff than it

had 6 years ago (see Figure 1).

Figure 1: SSA’s Staffing

Note: SSA’s end-of-year Fiscal Year (FY) 2022 staffing data were not available before we released this report.

Senior SSA officials, including the Acting Commissioner, reported numerous challenges in

ensuring SSA has the necessary staffing, including insufficient funding over multiple years to

hire the level of staff needed and higher than average attrition rates Agencywide. Per the Acting

Commissioner, as a result of insufficient funding, SSA was “…unable to hire the level of staffing

needed.” She further stated, “…we will need sufficient funds in the coming year to ensure we

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 2

The timing of when SSA receives a budget with the funding to hire, which is often after the

beginning of each FY, can limit SSA from strategically hiring staff during advantageous times of

the year, such as recruiting before students graduate from college and when college campuses

typically hold recruitment and job fairs. Not being able to strategically time when to hire staff

places SSA at risk of not hiring the most qualified candidates as they may have accepted offers

from other employers and are no longer seeking employment opportunities when SSA receives

funding.

Beyond budgeting, senior staff has also noted that fewer candidates are applying for open

positions, including entry-level and managerial positions. For entry-level positions, senior staff

noted possible disadvantages, including less competitive pay when compared to private-sector

employers and fewer workplace flexibilities, like wide-scale remote work options.

For managerial positions, senior staff reported staff is less interested in taking on the

responsibility that comes with managerial positions, particularly after they saw the extra

responsibilities managers shouldered during the pandemic.

SSA recognizes the loss of technical and institutional knowledge through staff attrition is one of

its greatest challenges and may impair succession management and knowledge transfer.

Approximately 25,000 SSA employees will be eligible to retire in the next 5 years,

including 15,000 eligible for retirement and 10,000 eligible for early retirement. Also,

SSA spends considerable time training new employees on its complex programs. When new

employees separate, SSA loses the investment it has made in them.

Human Capital Planning

SSA included workforce management as one of its key risks in its Fiscal Year 2022 Enterprise

agencies ensure their human capital management strategies, plans, and practices are

integrated with their strategic plans, performance plans, and goals in those plans.

SSA’s Agency Strategic Plan (ASP), Annual Performance Plans, and Human Capital Operating

Plan (HCOP) covering FYs 2018 – 2022 include limited discussions of the human-capital

strategies needed to ensure it successfully meets its strategic goals and initiatives.

The human capital management strategies in SSA’s HCOP align with some ASP strategic

objectives but not others. For example, the HCOP describes key initiatives that align with the

ASP’s strategic objective of Improving Workforce Performance. However, HCOP does not

include human capital management strategies for the remaining ASP strategic objectives,

including SSA’s initiatives to improve service delivery and accelerate information technology (IT)

modernization. While the HCOP states SSA’s “. . . highest priority and commitment is to

improve service delivery to the public, which includes improving 800-number, hearings, and field

office wait times and modernizing our [IT] as well as our disability policies,” the HCOP does not

describe the human capital management strategies needed to support these priorities.

Federal regulations also require that agencies implement proven strategies and practices to

develop and retain talent. SSA’s ASP, Annual Performance Plans, and HCOP do not describe

a strategic recruitment plan to attract and hire talent as more of its workforce becomes eligible

for retirement and it is experiencing higher than average attrition.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 3

Progress the Social Security Administration Has Made

Hiring and Retention

SSA’s FY 2023 budget requests funding for staffing and overtime to help mitigate the growth in

pandemic-related backlogs by adding more than 4,000 staff in frontline operations and at

disability determination services (DDS). SSA plans to take a number of steps to expand its

recruitment efforts, including the following:

● exploring sessions for potential applicants to advise them on the hiring process;

● training managers, administrative staff, and human-resource specialists on recruitment

strategies, merit promotion, hiring authorities, and flexibilities supporting employees’

tenure (for example, from hire to exit); and

● partnering with companies and universities to build a more diverse pipeline into public

service.

In FY 2021, SSA established an executive-level Succession Planning Governance Board and

staff-level Integration Team. In FY 2022, SSA expanded the responsibilities of the Integration

Team to include researching, developing, and proposing solutions to succession and strategic

workforce planning issues. The Governance Board identified FY 2022 strategic workforce

planning priorities related to key workforce challenges, including strengthening employee

engagement, helping staff effectively navigate the hybrid work environment, and enhancing

workforce flexibility programs. SSA leveraged the Integration Team to benchmark best

practices and develop proposed strategies to mitigate the key workforce challenges.

Human Capital Planning

SSA has begun enhancing its human capital planning, including taking steps to build a strategic

workforce planning business process and framework for Agency-wide implementation.

In response to a FY 2021 Office of Personnel Management review, SSA reported it would align

its upcoming (and not yet released) HCOP with the FYs 2022-2026 ASP and describe its human

capital strategies to address Agency-specific skill and competency gaps.

What the Social Security Administration Needs to Do

● Develop and implement human capital strategies that specifically describe its plans to

attract and hire talent, including the steps SSA will take to address known hiring and

retention challenges.

● Develop and implement human capital strategies that specifically describe how SSA will

acquire the future workforce needed to successfully fulfil its mission, including plans to

address its upcoming retirement wave.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 4

Key Related Links

● SSA, OIG Website – The Social Security Administration’s Human Capital Planning

(A-02-19-50866), September 2022

● SSA Website – Agency Strategic Plan FYs 2022-2026

● SSA Website – Annual Performance Report FYs 2021-2023

● SSA Website – Justification of Estimates for Appropriations Committees FY 2023

● U.S. Congress, Ways and Means Committee Website – Statement for the Record by

Deputy Commissioner Grace Kim, May 2022

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 5

IMPROVE SERVICE DELIVERY

SSA needs to address growing workloads and the expected retirement of experienced

employees as it pursues its mission to deliver quality service to the public.

Why This is a Challenge

In response to the Coronavirus Disease 2019 (COVID-19) pandemic, SSA shifted the way it

served its customers by significantly decreasing in-person field office services from March 2020

to April 2022. While SSA reopened its field offices to walk-in, in-person service in April 2022,

the number of visitors to its offices has not reached pre-pandemic levels. SSA will need to

continue increasing, improving, and ensuring the continuity of its other service methods to meet

its customers’ demand for them, including its national 800-number and online services.

Online services that lessen the need for staff are particularly important as SSA faces staffing

challenges, and many of its employees are reaching retirement age.

Telephone Service

At the start of the pandemic, SSA had separate telephone systems for its national 800-number,

field offices, and Headquarters operations. To accommodate remote operations in response to

the COVID-19 pandemic, SSA augmented its legacy telephone systems that modified

functionality and capacity. In May 2021, SSA began implementing a unified telephone system

to replace the three legacy systems via its Next Generation Telephony Project. When fully

implemented, the Project is expected to improve telephone customer service by merging the

three legacy systems into a single platform that will be more efficient, stable, and functional.

SSA has revised the date it expects to implement the Project multiple times; it now expects the

Project to be implemented by December 2023.

Until the Project is implemented, SSA is relying on its augmented legacy telephone systems,

which has resulted in reduced stability and functionality throughout the pandemic. Heavy call

volumes overwhelmed the platform on numerous occasions and caused service disruptions,

including dropped call queues, dead air calls, misdirected calls, and disconnections.

Online Service

SSA acknowledges advancements in technology provide opportunities to do business differently

and often more efficiently and conveniently. SSA continues exploring ways to enhance the

customer service experience by providing online self-service options, many of which

beneficiaries access through their my Social Security accounts. In FY 2022, SSA registered

over 10 million users for my Social Security accounts. To date, SSA has registered over

72 million users on my Social Security.

While SSA provides the public additional digital services, such as online, remote,

and self-service options, it must do so in a way that maintains a strong commitment to protect its

customers from current and emerging threats including identity theft and scams to steal money

or personal information. SSA must continue strengthening the identity-verification process for

new my Social Security account registrations to protect the public’s personal information and

improve customers’ experiences.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 6

SSA needs to ensure its online services help reduce the need for staff processing. While SSA

created an electronic Supplemental Security Income (SSI) protective filing tool in March 2022 to

allow individuals to submit a request for an appointment to file for benefits and record a

protective filing date, individuals cannot apply for SSI online. SSA senior staff noted that the

SSI online tool did not effectively screen out individuals who were likely not eligible for the SSI

program and that some individuals used the tool to create multiple appointments. As such,

it created more work for field office staff who needed to screen out the duplicate appointments.

Also, the duplicate appointments decreased available appointment slots, which made other

people who needed appointments to have to wait longer for them.

Progress the Social Security Administration Has Made

Telephone Service

In FY 2022, SSA recognized unstable telephone services as one if its enterprise risks.

In response, SSA has worked to reinforce the Next Generation Telephony Project platform’s

ability to absorb the pandemic-related call volumes. SSA plans to complete the transition to the

new telephone platform in FY 2023. When it does, SSA expects to restore features previously

available that it lost – Callback Assistance, Estimated Wait Time, comprehensive management

information – when it augmented its legacy systems in response to the COVID-19 pandemic.

It also plans to increase the concurrent call maximum to 18,000 sessions to minimize or

eliminate bottlenecks and increase the maximum queue limit to provide the ability to handle the

higher call demand periods and spikes. The average wait time as of the end of FY 2022 was

33 minutes compared to the average wait time of 14 minutes in FY 2021. SSA’s goal was to

have a 19-minute wait time by the end of FY 2022.

Online Service

SSA stated, in FY 2022, it would enhance the user experience, streamline the online claims

process for its customers, and reduce the amount of contact customers have with a claims

representative when completing an application. SSA also planned to improve the claims status

tracker and online portal design. SSA is expanding online service options for replacing

Social Security number (SSN) cards so the public does not need to visit an office. For example,

adult U.S. citizens who meet certain criteria may apply for a replacement card using the internet

Social Security Number Replacement Card (iSSNRC) online application through their

my Social Security account. In FY 2022, SSA planned to expand iSSNRC to non-participating

states and continue incorporating the name change due to marriage initiative in iSSNRC,

allowing eligible customers to request a replacement SSN card. In FY 2023, SSA plans to

expand the marriage data exchange; integrate the Electronic Verification of Vital Events data

exchange into iSSNRC to verify birth information; and explore more avenues to increase access

and enhance security.

Additionally, SSA is improving the iAppeals online application process for people who appeal an

Agency decision for such non-medical issues as overpayments or Medicare premium rates.

The enhancements will integrate the Medical and Non-Medical iAppeals via an authenticated

claimant and appointed representative portal.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 7

SSA is exploring ways to improve the experience for claimants, their representatives, and its

technicians by developing the Appeals and Appointed Representative Processing Services

(AARPS). AARPS will be an online portal with self-service options for customers and appointed

representatives to electronically accept appointments as well as complete fee agreements,

appeals, registration, and other related workloads. In 2023, the Agency plans to develop and

implement AARPS, incorporating stakeholder input.

SSA updated the electronic SSI protective filing tool on October 1, 2022 to prevent ineligible

individuals from making appointments to apply for SSI. If the tool determines individuals are

ineligible, they receive the following message: “We cannot process your request at this time.

Please try again later, of if you need immediate help to schedule an appointment, please

contact us.” While the update prevents ineligible individuals from making appointments, the

message the tool provides them could lead to increased customer traffic to SSA’s 800-number

or field offices.

What the Social Security Administration Needs to Do

● Continue developing and implementing strategies that will provide quality services to the

public now and in the future and ensure SSA retains institutional knowledge.

● Ensure a successful transition to a stable telephone service that meets its customers’

needs.

● Ensure any electronic applications offered through my Social Security accounts include

an effective authentication process.

Key Related Links

● SSA, OIG Website - Reports related to improving service delivery

● SSA Website - Agency Strategic Plan FYs 2022-2026

● SSA Website - Annual Performance Report for FYs 2021-2023

● SSA Website – SSA’s FY 2023 President’s Budget

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 8

PROTECT THE CONFIDENTIALITY, INTEGRITY, AND

AVAILABILITY OF INFORMATION SYSTEMS AND DATA

SSA must ensure its information systems are secure and sensitive data are protected.

Why This is a Challenge

SSA’s IT supports every aspect of SSA’s mission, whether it is serving the public during

in-person interviews or online, routing millions of telephone calls to its 800-number, or posting

millions of earner wage reports annually. Disruptions to the integrity or availability of

SSA’s information systems would dramatically affect its ability to serve the public and meet its

mission. Also, SSA’s systems contain personally identifiable information, such as SSNs,

which—if not protected—could be misused by identity thieves.

Information Security

SSA continues expanding its online services to improve customer service and developing

systems. It is imperative that SSA have a robust information security program. In its most

recent report

for the Federal Information Security Modernization Act of 2014

(Pub. L. No. 113-283), Grant Thornton LLP determined SSA had established an Agency-wide

information security program. Although the maturity of SSA’s information security program

improved in some areas, Grant Thornton identified several deficiencies that could limit

SSA’s ability to protect the confidentiality, integrity, and availability of its information systems

and data.

Because of weaknesses identified, Grant Thornton concluded SSA’s overall security program

was “Not Effective.” Grant Thornton recommended that SSA strengthen its information security

risk management framework; enhance IT oversight and governance to address these

weaknesses; and adhere to its information security policies, procedures, and controls.

Social Security Number Protection and Earnings Accuracy

The SSN is relied on as an identifier and is valuable as an illegal commodity. Accordingly,

the information SSA houses on every numberholder is desirable to would-be hackers and

identity thieves. Protecting the SSN and properly posting the wages reported under it are

critical to ensuring SSN integrity and eligible individuals receive the full benefits due them.

Accuracy in recording numberholder information is critical because SSA and other agencies rely

on that information to verify employment eligibility, ensure wage reports are processed, and

terminate payments to deceased beneficiaries. Accuracy in recording workers’ earnings is

critical because SSA calculates benefit payments based on individuals’ earnings over their

lifetimes. As such, it is critical that the Agency ensure numberholder information is complete in

its systems as well as SSNs are properly assigned only to those individuals authorized to obtain

them, SSN information be protected once SSA assigns the number, and earnings are accurately

posted and reported under SSNs.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 9

information incorrectly so SSA cannot match the reported earnings to individuals in its records.

The Earnings Suspense File is the record of wage reports on which wage earners’ names and

SSNs fail to match SSA’s records. As of October 2022, the Earnings Suspense File had

accumulated $2.01 trillion in wages and over 396 million wage items for Tax Years 1937

through 2021.

Progress the Social Security Administration Has Made

Information Security

SSA acknowledges it must be mindful of cyber-threats and remain committed to protecting

privacy and security. SSA’s Cybersecurity Strategic Plan 2022-2024 focuses on how it will

safeguard and protect against IT and cyber-security threats by continuing to mature its

cyber-security program. The Plan defines strategic goals and priorities and includes strategies

and initiatives to address IT and cyber-security challenges.

In FY 2022, SSA executed a risk-based approach to strengthen controls over its systems and

address weaknesses. In addition, SSA continued implementing several plans, strategies,

and initiatives to address security gaps.

Social Security Number Protection and Earnings Accuracy

SSA has taken steps to reduce the Earnings Suspense File’s size and growth. The Agency

allows employers to verify the names and SSNs of their employees using the Agency’s online

SSN Verification Service before they report wages to SSA. In FY 2022, employers verified over

226 million SSNs using the SSN Verification Service.

SSA supports the Department of Homeland Security’s E-Verify program, which assists

employers in verifying the employment eligibility of newly hired employees. Through the fourth

quarter of FY 2021, which is the latest data available, the Department of Homeland Security

reported it processed 42.5 million E-Verify cases. Approximately 592,000 (1.39 percent) of

these received a “not authorized to work” response.

What the Social Security Administration Needs to Do

● Address the deficiencies Grant Thornton identified to improve SSA’s ability to protect the

confidentiality, integrity, and availability of its information systems and data.

● Improve wage reporting by informing employers about potential SSN misuse cases,

identifying and resolving employer-reporting problems, re-examining the validity and

integrity checks used to prevent suspicious wages from being posted, and encouraging

greater use of SSA’s employee verification programs.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 10

Key Related Links

● SSA, OIG Website - Reports related to protecting the confidentiality, integrity, and

availability of SSA’s information systems and data

● SSA, OIG Website – Summary of the Audit of the Social Security Administration’s

Information Security Program and Practices for Fiscal Year 2022

● National Institute of Standards and Technology Website - Special Publication 800-63-3,

Digital Identity Guidelines

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 11

MODERNIZE INFORMATION TECHNOLOGY

SSA must continue modernizing its IT to accomplish its mission despite budget and resource

constraints.

Why This is a Challenge

SSA relies on its IT to serve the public and safeguard SSA programs. Rapid,

continuous technology advancements and the recent national shift to increased virtual services

and communications reinforce the pressing need to modernize SSA. The Agency must

fundamentally rethink how it delivers services, the processes and infrastructure that support that

delivery, and the policies that enable delivery. SSA continues relying on outdated applications

and technologies to process its core workloads (for example, retirement and disability claims)

and knowledge of its dated applications and legacy infrastructure will diminish as developers

retire. Without complete and timely modernization of its legacy systems, the Agency runs the

risk of increased maintenance costs, lack of available support, and decreased capacity to

support business and processing needs.

Information Technology Modernization

SSA must maintain its legacy systems while, in parallel, developing modern replacements to

keep pace with increasing workloads. The Agency had taken an incremental approach to IT

modernization by replacing systems’ components rather than whole systems. However, in its

2017 IT Modernization Plan, SSA acknowledged that this approach had not worked and

committed to invest $691 million through FY 2022 in transformational initiatives and

infrastructure.

In FY 2020, SSA updated its IT Modernization Plan by expanding the scope to include

additional investments in direct service delivery. Under the revised scope, the Agency expected

to spend $863 million on IT modernization through FY 2022, while using much of its IT

funding—nearly $1.9 billion in FY 2022—to operate and maintain existing systems. Despite the

significant resources devoted to modernization, efforts and investments remained incomplete in

FY 2022.

To support its IT modernization, SSA used Agile development, which takes an iterative

approach to incrementally deliver software. While the Agency implemented some appropriate

controls and practices to manage its Agile projects, SSA’s Agile guidance was incomplete,

and projects did not always follow Agile best practices or enforce key controls. In addition,

the Agency did not ensure data from its Agile project management tool were reliable. Finally,

SSA needed to improve Agile training and decision making. Improvements in these areas could

provide SSA and taxpayers greater benefits from the Agile development method,

including higher quality software developed faster and at a lower cost.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 12

Information Technology Investment Process

In 2016, SSA established the Information Technology Investment Process (ITIP) to provide

guidance on selecting, tracking, and managing IT investments. The goal was to optimize IT

investments and ensure those investments were delivered on time and on budget.

ITIP organizes the Office of Systems’ IT investment decision-making process into four phases:

Plan, Select, Control, and Evaluate. However, our audit

noted several issues with ITIP that

could prevent it from supporting strategic decision making and allowing the Agency to plan for,

manage, and implement IT investments as projected. There are investment decisions not

included in the ITIP process. In addition, although SSA verified and compared costs,

functionality impact, and other areas in its post-implementation review reports, it could not

quantify the benefits or calculate the return on investment for all the projects those reports

covered.

Progress the Social Security Administration Has Made

Information Technology Modernization

SSA developed its Digital Modernization Strategy to build on previous modernization efforts and

guide the Agency from FYs 2023 through 2026. Objectives include eliminating investments in

outdated and legacy technology as well as eliminating silos in the technology used to support

core Agency functions by building end-to-end processing systems.

In addition, SSA is adopting an Agile scaling framework that defines roles and establishes

recommended practices. The Agency also planned to provide additional training; develop,

document, and enforce standards for its Agile project management tool; and leverage more of

the tool’s capabilities.

Information Technology Investment Process

In FY 2021, SSA continued the Information Technology Investment Governance Refresh.

Objectives of the Refresh include improving the Agency’s ability to manage its IT investments,

ensuring the Agency’s IT investments support its priorities, and monitoring and reporting

regularly on the realization of investment value and other measures of investment progress and

performance.

What the Social Security Administration Needs to Do

● Prioritize IT modernization activities to ensure available resources lead to improvements

with the greatest impact on SSA’s operations and the service it provides the public.

● Ensure its IT planning and investment control processes are effective.

Key Related Links

● SSA, OIG Website - Reports related to modernizing IT

● SSA Website – SSA’s IT Modernization Plan

● SSA Website – SSA’s IT Modernization Plan, 2020 Update

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 13

IMPROVE ADMINISTRATION OF THE DISABILITY PROGRAMS

To better serve its customers, SSA needs to address increasing pending initial disability claims,

reconsiderations, and continuing disability reviews (CDR); reduce barriers to the disability

program; reduce hearings processing times; and develop better strategies to help disabled

beneficiaries return to work.

Why This is a Challenge

Disabled claimants rely on SSA to quickly process disability applications and reconsideration

requests, make disability determinations, and complete disability-related hearings.

Processing times and the pending workload levels have increased, resulting in disability

claimants waiting longer for decisions on their claims. Also, while SSA has programs to help

disabled beneficiaries return to work, few have done so.

Pending Disability Workloads

In December 2021, we reported that although receipts for initial disability claims,

reconsiderations, and CDRs decreased, processing times and the number of pending cases for

these workloads increased. This indicates claimants were waiting longer for DDSs to make

medical determinations, and the DDSs could not keep pace with the workloads received.

Before the COVID-19 pa

ndemic began, SSA had reduced pending initial disability claims from

almost 708,000 at the end of FY 2012 to approximately 594,000 at the end of FY 2019 and

pending reconsiderations from approximately 198,000 to almost 134,000. However,

DDSs closures in initial response to the pandemic and delayed consultative examinations during

the pandemic, along with DDS examiner attrition of about 25 percent in FY 2022, affected initial

disability claims and reconsideration processing. SSA implemented a temporary hiring freeze in

FY 2022 because of funding constraints, further exacerbating DDS staffing shortages. As of the

end of FY 2022, pending initial disability claims had increased to approximately 941,000,

and pending reconsiderations had increased to almost 234,000, which were 58- and 75-percent

increases, respectively, since the end of FY 2019.

In FY 2018, SSA eliminated the backlog of full medical CDRs. However, in response to the

COVID-19 pandemic, from mid-March through August 2020, SSA suspended processing

medical CDRs that could result in benefit cessation. The number of full medical CDRs SSA

processed decreased from over 713,000 in FY 2019 to approximately 511,000 in FY 2021.

Although SSA increased the number of full medical CDRs it had processed in FY 2022 to over

590,000, a backlog of over 203,000 full medical CDRs remained.

While overall pending initial disability claims increased, SSA continued reporting significant

decreases in SSI disability applications. In FY 2019, SSA received approximately 1.6 million

SSI disability applications. By the end of 2022, SSA had received approximately 1.3 million

such applications, a 19.7-percent decrease from the FY 2019 total. SSA identified concerns

that pandemic operating procedures, such as field office closures for most walk-in services,

may have contributed to reduced applications for individuals who needed help with their claims.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 14

While SSA has continued reducing hearings processing times (see Figure 2) and the number of

pending hearings, it has not achieved its processing time goal of 270 days. As of FY 2022,

the average processing time for hearings was 337 days, and the hearings pending level was

almost 344,000 hearings.

Figure 2: Average Hearings Processing Time

Returning Disabled Beneficiaries to Work

Congress directed SSA to implement programs to help disabled individuals return to work.

To date, these programs have helped only a small percentage of disabled individuals.

For example, the Ticket to Work and Work Incentives Improvement Act of 1999

(Pub. L. No. 106-170) established the Ticket to Work and Self-Sufficiency Program. Under the

Program, SSA provides disabled beneficiaries a Ticket they can assign to qualified

organizations to obtain vocational rehabilitation or employment services.

While SSA has set goals to increase the number of participating beneficiaries, few eligible

beneficiaries have used their Tickets for vocational or employment services. Specifically,

approximately 3 percent of Ticket-eligible beneficiaries assigned their Tickets or placed them

in-use in FY 2022, similar to the percent of individuals who assigned their Tickets in recent

years (see Figure 3). Further, in October 2021, we reported

that 62 percent of the beneficiaries

we reviewed had unsuccessful work outcomes after they received vocational rehabilitation.

These beneficiaries did not find the services helpful. Some indicated they did not receive

sufficient help from the vocational rehabilitation agencies or counselors.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 15

Figure 3: Percent of Ticket-eligible Beneficiaries with Tickets Assigned or In-use

For di

sabled individuals who return to work, SSA offers work incentives that make it possible for

them to work and still receive benefits. SSA identifies and applies work incentives during work

CDRs. In September 2022, we reported SSA made errors on work CDRs that involved

incentives for an estimated 31,000 beneficiaries, which resulted in over $553 million in

questionable benefit payments.

Progress the Social Security Administration Has Made

Pending Disability Workloads

In response to the COVID-19 pandemic, SSA limited in-person services to appointment-only for

certain critical-need situations though it continued processing and prioritizing initial disability

claims. In April 2022, SSA resumed in-person services, including serving visitors who did not

have appointments. SSA indicated it is taking steps to improve its disability processes, such as

making additional disability forms available online; increasing consultative examination

availability, including virtually; and recruiting additional providers.

SSA is also working to restore program-integrity workloads, including medical CDRs,

to pre-pandemic levels. In part, SSA is working with the DDSs to understand the underlying

reasons for attrition, as the loss of experienced employees significantly affected the Agency’s

ability to complete program-integrity workloads. To address hiring challenges, SSA developed a

national workgroup, which made recommendations to improve hiring practices, including using

different platforms, such as social media. SSA anticipates it will eliminate the CDR backlog in

FY 2023 by increasing processing capacity to handle more reviews, with SSA planning to

process approximately 700,000 CDRs in FY 2023.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 16

In March 2021, SSA began a national public outreach campaign to raise awareness of its

disability programs and improve access for people facing barriers, such as language,

medical conditions, or inadequate Internet access. Outreach efforts included enlisting third

parties to work with people facing barriers and promote SSA programs on paid social media,

television, and radio advertising. SSA also established a new Agency Priority Goal to address

the decline in disability applications received during the pandemic and improve equity in the SSI

program through increased outreach and improved benefit delivery. In March 2022,

SSA implemented an online option that enables individuals and third parties to express their

intent to file for SSI. While SSA increased outreach, the number of SSI applications continued

to decline.

In January 2016, SSA issued the Compassionate And REsponsive Service (CARES) plan to

address the growing number of pending hearings and increased wait times. In April 2019,

SSA released the 2018-2019 CARES plan, which noted that SSA expected to reach the

270-day average processing time goal in FY 2021, which it did not do. To address hearing

office closures in response to the COVID-19 pandemic, SSA offered claimants telephone and

online video hearings and established a public-facing Website

to educate claimants and

representatives on the hearing options available during the pandemic. As we reported in

July 2022, from the start of the pandemic through March 2022, SSA held almost

808,000 hearings, most of which were via telephone, and over 40,000 online video hearings.

SSA postponed hearings for claimants who declined telephone or online video hearings until it

could resume in-person hearings. In November 2020, the Government Accountability Office

reported

that, early in the pandemic, “. . . about 1 in 4 claimants were declining phone hearings.

In October 2020, about 1 in 10 claimants were declining phone hearings…” (from page 239 of

the Government Accountability Office report). Though SSA offered claimants telephone and

video hearings, it resumed in-person hearings in March 2022, focusing on individuals who have

been waiting for a hearing because they declined telephone and online video hearings or were

experiencing certain circumstances like homelessness. Despite pandemic-related challenges,

SSA further reduced the average hearing wait time and pending hearings to their lowest levels

in over a decade and plans to reach its processing time goal by the end of FY 2023.

Returning Disabled Beneficiaries to Work

SSA has a number of resources to assist disabled beneficiaries in returning to work,

including having Work Incentive Liaisons in each field office to provide advice and information

about work-incentive provisions and employee-support programs to individuals with disabilities

and outside organizations that serve those with disabilities. SSA also has Area Work Incentives

Coordinators who conduct public outreach on work incentives in their local areas, train SSA field

office staff on employment support programs, and monitor disability work-issue workloads in

their areas. SSA provides grants to community-based organizations to provide disabled

beneficiaries free access to work incentives planning and assistance. This assistance includes

access to Community Work Incentives Coordinators who work with disabled beneficiaries to

help them understand their benefits and the effect work has on those benefits, what they need

to report to SSA, and provide ongoing support as disabled beneficiaries’ transition back to work.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 17

What the Social Security Administration Needs to Do

● Renew its focus on reducing and eliminating the initial disability claims, reconsideration,

and CDR backlogs.

● Continue partnering with DDSs to address staffing shortages caused by attrition and

hiring challenges.

● Continue recruiting additional consultative examination providers and increase

consultative examination availability, including virtual examinations.

● Improve access to the disability program and monitor the impact of outreach to

individuals facing barriers to SSA’s programs.

● Implement and monitor the CARES initiatives designed to improve timeliness and

reduce the hearings backlog.

● Continue creating new opportunities for returning beneficiaries to work and ensure

measurement of costs, savings, and effectiveness are part of the design of such

initiatives.

Key Related Links

● Government Accountability Office Website – COVID-19: Urgent Actions Needed to

Better Ensure an Effective Federal Response (GAO-21-191), November 2020

● SSA, OIG Website - Reports related to improving the administration of the disability

programs

● SSA Website – SSA’s Information for People Helping Others

● SSA Website – SSA’s CARES plan

● SSA Website – SSA’s CARES plan, 2018-2019 update

● SSA Website – The Work Site

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 18

IMPROVE THE PREVENTION, DETECTION, AND RECOVERY OF

IMPROPER PAYMENTS

SSA must be a responsible steward of the funds entrusted to its care by minimizing the risk of

making improper payments and recovering overpayments when they occur.

Why This is a Challenge

SSA is responsible for issuing over $1 trillion in benefit payments annually. Even the slightest

error in the overall payment process can result in millions of dollars in improper payments.

Improper payments can be overpayments, when SSA pays someone more than they are due,

or underpayments, when SSA pays someone less than they are due. Per its most recent

estimates available, SSA estimates it made approximately $7.4 billion in improper payments in

FY 2021: $6 billion in overpayments and $1.4 billion in underpayments.

Management of Payment Workloads

Improper payments may occur when SSA makes mistakes in computing payments or fails to

obtain or act on available information. For example, in FY 2022, we:

● Concluded

SSA employees incorrectly input student information on beneficiaries’

records, which resulted in SSA underpaying an estimated 14,470 beneficiaries

approximately $59.5 million.

● Estimated SSA could have avoided approximately 73,000 overpayments totaling more

than $368 million if it had effective controls over benefit-computation accuracy.

SSA’s automated systems could not compute benefit payments due in certain situations,

and the Agency did not provide employees with a comprehensive tool to use when they

had to manually calculate them. Without adequate automation tools, employees can

make errors.

External Data

Preventing improper payments is more advantageous than recovering them since the Agency

has to expend additional resources to recover the overpayments or process additional

payments to rectify underpayments. Wages and income, resources, and living arrangements

are a few of the factors that affect Old-Age, Survivors and Disability Insurance (OASDI) or SSI

eligibility and payment amounts. Beneficiaries and recipients are required to report to SSA any

change in circumstances that may affect their benefits; however, they do not always fully

comply. Obtaining data from external sources, such as other Federal agencies, state agencies,

and financial institutions, is critical to preventing and detecting improper payments.

While SSA has made progress implementing data exchanges to reduce its reliance on

beneficiaries self-reporting information; it still has work to do. While some of the challenges the

Agency encounters when it enters into data exchanges are beyond its control, the Agency could

improve its process by implementing a centralized system for administering data exchanges and

considering pursuing legislative changes allowing for it to obtain the data it needs.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 19

To address SSI improper payments related to resources, SSA implemented the Access to

Financial Institutions (AFI) program in June 2011. AFI verifies alleged bank account balances

with financial institutions and searches for undisclosed accounts at geographically relevant

locations based on the claimant’s address. SSA uses AFI when it processes initial SSI

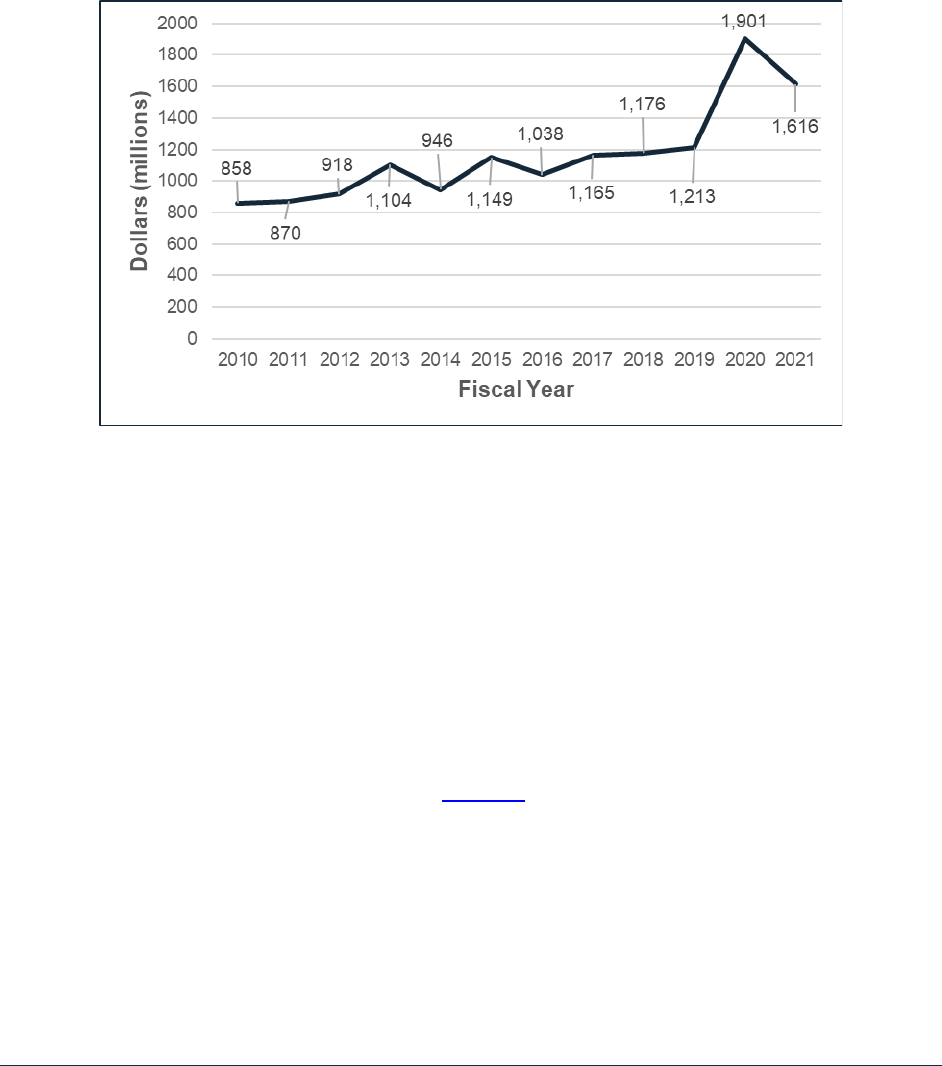

applications and periodic eligibility redeterminations. As shown in Figure 4, overpayments

related to financial accounts increased from FYs 2010 to 2021.

Figure 4: SSI Financial Account Overpayment Deficiency Dollars

FYs 2010 Through 2021

In FY

2021, SSA determined the expanded use of AFI was not feasible because of a broad

range of legal, technical, operational, and contractual barriers, but it plans to re-visit this issue in

FY 2023. Deficiency dollars have generally increased since the implementation of the AFI

program. Although AFI works as designed, the ability to check accounts retrospectively does

not completely prevent or reduce improper payments. Tools such as AFI identify errors, but the

SSI program continues to rely heavily on recipients reporting changes timely to prevent errors.

Recovery

When SSA determines it has underpaid a beneficiary, it will pay the beneficiary the amount

owed. Once SSA determines it has overpaid an individual, it attempts to recover the

overpayment. However, because of a systems-design limitation, SSA does not capture and

track OASDI overpayments that are scheduled for collection beyond FY 2049. If SSA does not

resolve this limitation by the end of 2029, we estimate

more than 203,000 beneficiaries will have

nearly $2.5 billion in untracked overpayments.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 20

According to SSA, in FY 2022, it recovered over $4.7 billion in overpayments at an

administrative cost of $0.06 on average for every dollar collected. Still, at the end of the FY,

SSA had a $21.6-billion uncollected overpayment balance (see Figure 5).

Figure 5: FY 2021 Overpayment Recovery

$21.6 billion not recovered

$4.7 billion

recovered

Progress the Social Security Administration Has Made

In FY 2019, SSA established the Improper Payment Prevention Team to address improper

payments; it has developed strategies to determine the underlying causes of payment errors,

develop corrective action plans, and determine cost-effective actions. In FY 2022,

SSA continued monitoring the progress of mitigation strategies and corrective actions.

Management of Payment Workloads

SSI non-medical redeterminations, which are periodic reviews of such non-medical eligibility

factors as income and resources, are an important program-integrity tool. SSA estimated that,

over 10 years, the non-medical redeterminations it conducted in FY 2022 would yield,

on average, a return on investment of about $3 of net Federal program savings per $1 budgeted

for dedicated program integrity funding, including SSI and Medicaid program effects. However,

according to SSA, budgetary constraints determine how many redeterminations it conducts

each year.

Through completed CDRs, SSA periodically verifies whether individuals are still disabled and

eligible for disability payments. SSA has estimated that, over the next 10 years, the CDRs it

conducted in FY 2022 will yield, on average, net Federal program savings of roughly $9 per

$1 budgeted for dedicated program integrity funding, including OASDI, SSI, Medicare,

and Medicaid effects.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 21

According to SSA, changes in a person’s wages are a leading cause of improper payments in

the Disability Insurance and SSI programs. SSA uses a number of sources to verify wage

amounts, such as pay stubs submitted by beneficiaries, recipients, or representative payees

and annual earnings data from the Internal Revenue Service. Individuals can also report wage

information electronically to SSA through its online, mobile, or telephone wage reporting

applications or my Social Security account. However, verifying wages is generally a manual

process, and SSA employees continue relying heavily on individuals to accurately report wages.

SSA is working toward an automated information exchange with payroll data providers that

would automatically match against SSA records to verify wages timely without additional manual

verification.

External Data

SSA has successfully entered into data exchanges with Federal and state partners to help

identify and prevent improper payments. For example, SSA created an information exchange

agreement that allows states to disclose to the Agency account statements related to

distributions and account balances of all Stephen Beck, Jr., Achieving a Better Life Experience

Act of 2014 (Pub. L. No. 113-295) accounts. The Stephen Beck, Jr., Achieving a Better Life

Experience Act of 2014 aimed to ease financial strains individuals with disabilities face by

making tax-free savings accounts available to cover qualified disability expenses. As of

FY 2022, SSA had secured agreements and received data from most states.

Recovery

To collect overpayments, SSA uses internal debt-collection techniques, such as payment

withholding and billing, as well as external collection techniques authorized by the Debt

Collection Improvement Act of 1996 (Pub. L. No. 104-134) for OASDI debts and the Foster Care

Independence Act of 1999 (Pub. L. No. 106-169) for SSI debts. These techniques include the

Treasury Offset Program and administrative wage garnishment.

In January 2021, SSA partnered with the Department of the Treasury’s Pay.gov team to

implement SSA’s first on-line repayment option for overpaid individuals. This option allows

individuals to repay overpayments via credit or debit cards or automated clearing house

transactions (that is, directly from checking or savings accounts). Additionally, in July 2021,

SSA implemented a second option to allow overpaid individuals to use their bank’s online bill

pay features to make a one-time or recurring automated clearing house draft from a bank

account using a personal computer or mobile telephone.

What the Social Security Administration Needs to Do

● Address the root causes of improper payments to prevent their occurrence.

● Expand efforts to collect data from reliable third-party sources that would aid SSA in

mitigating discrepancies that can occur when beneficiaries or recipients self-report

information.

● Identify and prevent improper payments through automation and data analytics.

SSA needs to use available data to better identify changes that affect beneficiaries’ and

recipients’ benefit payments.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 22

Key Related Links

● SSA, OIG Website - Reports related to improving the prevention, detection, and

recovery of improper payments

● Federal Payment Accuracy Website – PaymentAccuracy.gov

● SSA Website – Pay an Overpayment

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 23

RESPOND TO THE CORONAVIRUS DISEASE 2019 PANDEMIC

SSA must continue adjusting to changing health conditions and COVID-19 pandemic-related

guidance as it provides more in-person service after the re-entry to its field offices.

Why This is a Challenge

In response to the COVID-19 pandemic, SSA changed the way it served its customers and

evolved its service methods as related guidance on the response to the pandemic changed.

SSA has reopened its field offices to walk-in, in-person service, which requires that SSA shift

staff who had been teleworking back to the offices to provide increased in-person service.

SSA must effectively manage its shift to more in-person service, ensuring it continues meeting

changing pandemic-related guidance and ensuring the safety of its staff and customers.

Changing Operations

From mid-March 2020 to April 6, 2022, SSA limited its in-person field office service to

appointments for certain critical-need situations and served most of its customers through its

online and telephone services. Our audit work f

ound that SSA had challenges during this

period. We concluded SSA could not accurately account for all employees and the public who

entered its offices during the period of limited in-person service and some managers expressed

concerns about their increased work in the office and their ability to perform that work in addition

to their normal managerial duties. Some office managers believed SSA leadership prioritized

the health and safety of bargaining employees over management/non-bargaining-unit

employees.

With the increased use of electronic services, SSA primarily relied on its customers to submit

s

upporting paperwork by mail. In July 2021, we issued an interim report t

o alert SSA of the

exponential increases in the amounts of incoming and outgoing mail to field offices and our

concerns with the oversight and internal controls over mail processing. We determined SSA

had no performance metrics or management information on the volume of incoming, outgoing,

or pending mail. Consequently, the Agency did not have sufficient information to enable it to

adjust staffing levels to ensure mail was processed timely. SSA also lacked comprehensive

policies and procedures to track and return original documents—including driver’s licenses,

birth certificates, passports, and naturalization documents—that customers provide as proof of

eligibility for benefits or an SSN card.

Each year, SSA receives and processes millions of benefit claims and requests for post-

entitlement and post-eligibility reviews. These workloads, which are addressed by SSA’s

nation-wide network of field offices, teleservice centers, and processing centers, were

significantly affected by the pandemic. In April 2021, SSA’s Commissioner reported that

bottlenecks and service deterioration occurred because of the abrupt changes in SSA’s

operations. Other audit work

c

oncluded that SSA received and processed fewer OASDI and

SSI claims during the COVID-19 period of April 2020 to March 2021 compared to the prior-year

period (April 2019 to March 2020). While SSA received fewer of these claims, the pending

levels for these workloads increased.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 24

Field Office Re-entry

On April 7, 2022, SSA resumed walk-in, in-person services in its field offices. To handle this,

SSA reduced the amount of telework provided to staff, most of whom had moved to full telework

in March 2020 in response to the pandemic. SSA continued allowing employees to telework 2

days a week to ensure a sufficient capacity in offices. At the same time, SSA saw an increase

in the number of employees who requested reasonable accommodations to delay their re-entry

to the field offices.

Because of health and safety protocols related to COVID-19, such as limited lobby space to

maintain social distancing and prescribed office capacity, SSA offices may not have been able

to accommodate all customers in its office lobbies. The media reported long customer wait

times and lines outside of some SSA office buildings where customers were exposed to harsh

weather conditions, such as extreme heat. The media further reported that SSA advised people

to make appointments for field office visits over the telephone or online, but some customers

claimed their attempts to contact SSA to make an appointment were unsuccessful.

Progress the Social Security Administration Has Made

Changing Operations

In response to concerns about its mail processing, SSA released an action plan in August 2021

and a Business Process Document for handling mail in September 2021. SSA’s plan:

(1) outlined timeliness metrics for processing mail received and returning primary evidence

documents; (2) required that offices account for all mail and track certain major workloads;

and (3) required that regional offices monitor the status of mail handling in their region and

implement remediation plans for offices not meeting the metrics.

To address declining claim submissions, in March 2022, SSA implemented a new electronic

option that enables individuals and third parties to express their intent to file for SSI and other

benefits. This tool protects the earliest date SSA may use to pay benefits if applicants are

eligible for SSI or Social Security benefits. Additionally, SSA is working to streamline its SSI

application so it can be accessible online.

To address the decline in SSI claim receipts during the pandemic, SSA established a new

priority goal to improve equity in its SSI program through increased outreach and improved

benefit delivery. To that end, SSA used targeted outreach and media campaigns to raise

awareness about its benefit programs to eligible groups, including homeless individuals,

seniors, children, and adults with disabilities.

Field Office Re-entry

In August 2022, the Chairman and Ranking Member of the House Committee on Ways and

Means requested a response from SSA on the long lines outside the Agency's field offices and

how the Agency was responding to long customer wait times and exposure to the weather.

SSA responded that, for those offices with visitors who needed to wait outside, it provided

access to its bathrooms and water fountains and, when possible, added outdoor canopies and

fans. SSA further noted it reconfigured its waiting areas to allow more people to enter its

air-conditioned offices. SSA also expanded the use of mobile check-in for customers with

appointments and notified them on their mobile telephones when it was ready to serve them,

allowing the customers to wait in their vehicles or nearby facilities.

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) 25

SSA updates its Workplace Safety Plan to incorporate the latest guidance from the Centers for

Disease Control and Prevention and the Occupational Safety and Health Administration on

protecting workers. For example, in September 2022, SSA updated the Plan to note that

members of the public seeking service or benefits who are fully vaccinated will not be required

to social distance while awaiting service, and those not fully vaccinated will be advised to

distance from others while waiting. However, the Plan further noted that SSA will not ask

individuals seeking a public service or benefit about their vaccination status.

SSA’s Website provides information to the public on what it can expect when it visits a field

office. Per the Website, everyone must wear a face mask, and the public may be asked to wait

individuals who do not have an appointment should expect long lines, especially during the

busiest times, such as Mondays and the first week of the month.

What the Social Security Administration Needs to Do

● Keep the public and its employees aware of the status of the COVID-19 Workplace

Safety Plan 2.2 and how it plans to provide customer service safely during the re-entry

process.

● Continue addressing the decline in OASDI and SSI claims.

● Pursue automation and other options to improve mail intake and processing.

● Expand capabilities for employees and the public to securely correspond electronically.

● Update the policies and business processes needed to ensure the security of,

and reduce reliance on, original documents customers mail to SSA as proof of eligibility

for benefits or an SSN card.

● Continue to address the long wait times for customers waiting outside of SSA offices due

to health and safety protocols for COVID-19, including addressing customers’ reported

inability to successfully schedule appointments over the telephone or online.

Key Related Links

● SSA, OIG Website – Reports related to the COVID-19 pandemic

● SSA Website – Coronavirus (COVID-19) Updates

● SSA Website – COVID-19 Workplace Safety Plan 2.2

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) A-1

– OFFICE OF THE INSPECTOR GENERAL REPORTS ISSUED

IN

FISCAL YEAR 2022 ADDRESSING MANAGEMENT CHALLENGES

Report

Related Management Challenge(s)

Human

Capital

COVID-19 Disability

Improper

Payments

Service

Delivery

Secure

Information

Modernize

IT

The Social Security Administration’s Enumeration Services During the

COVID-19 Pandemic (A-15-21-51015), September 30, 2022

Numident Death Alerts (A-06-21-51086), September 30, 2022

Summary of the Audit of the Social Security Administration's Information

Security Program and Practices for Fiscal Year 2022 (A-14-22-51179),

September 30, 2022

Analysis of State Workers’ Compensation Data

(A-02-22-51180),

September 29, 2022

Follow-up on Controls Over Special Payment Amount Overpayments for

Title II Beneficiaries (A-09-19-50794), September 29, 2022

Supplemental Security Income Recipients Receiving Social Security

Administration Payments in Accounts Outside the United States

(A-06-22-51153), September 29, 2022

Work Review Determinations for Disabled Beneficiaries (A-07-21-51012),

September 29, 2022

The Social Security Administration’s Human Capital Planning

(A-02-19-50866), September 26, 2022

The Social Security Administration’s Challenges and Successes in

Obtaining Data to Determine Eligibility and Payment Amounts

(A-01-21-51029), September 23, 2022

Follow-up on Processing Internal Revenue Service Alerts for

Supplemental Security Income Recipients (A-03-18-50277),

September 20, 2022

The Social Security Administration’s Oversight of Disability Determination

Services’ Financial Management (A-15-21-51117), September 20, 2022

Match of Utah Death Information Against Social Security Administration

Records (A-06-21-51030), September 19, 2022

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) A-2

Report

Related Management Challenge(s)

Human

Capital

COVID-19 Disability

Improper

Payments

Service

Delivery

Secure

Information

Modernize

IT

The Social Security Administration’s Information Technology Investment

Process (A-14-18-50437), September 12, 2022

Data Files Provided to the Internal Revenue Service as Part of the Third

Round of Economic Impact Payments (A-06-21-51095),

September 9, 2022

Development of the Preliminary Claims System (A-14-20-50912),

August 30, 2022

Lump-sum Death Payments to Survivors of Wage Earners with No Death

Information on the Numident (A-06-21-51088), August 30, 2022

Agile Software Development at the Social Security Administration

(A-14-20-50947), August 24, 2022

Spouses and Widow(er)s Who Have Unverified Pensions

(A-13-17-50161), August 24, 2022

The Office of Hearings Operations’ Use of Video and Telephone Hearings

(A-05-18-50615), July 15, 2022

Comparing the Social Security Administration’s Workload Statistics During

the COVID-19 Pandemic to Prior Years (A-05-21-51062), July 14, 2022

Social Security Beneficiaries Who Have Direct Payment While Receiving

Veterans Affairs’ Benefits Through a Representative Payee

(A-01-18-50380

), July 8, 2022

The Social Security Administration’s Appeal Council Workloads

(A-12-20-50986), June 30, 2022

Match of Railroad Retirement Board Death Information Against Social

Security Administration Records (A-06-20-51007), June 3, 2022

Incorrect Old-Age, Survivors, and Disability Insurance Benefit Payment

Computations that Resulted in Overpayments (A-07-18-50674),

May 26, 2022

The Social Security Administration’s Mail Processing During the COVID-19

Pandemic (A-08-21-51115), May 13, 2022

The Social Security Administration’s Compliance with the Payment

Integrity Information Act of 2019 in Fiscal Year 2021 (A-15-21-51121),

May 11, 2022

SSA’s Major Management and Performance Challenges in FY 2022 (A-02-21-51120) A-3

Report

Related Management Challenge(s)

Human

Capital

COVID-19 Disability

Improper

Payments

Service

Delivery

Secure

Information

Modernize

IT

Follow-up on Deceased Beneficiaries and Recipients with No Death

Information on the Numident (A-09-20-50936), May 4, 2022

Students Whose Benefits Were Erroneously Terminated When They

Reached Age 18 (A-09-19-50823), April 22, 2022

Safety of Employees and Visitors Since March 2020

(Congressional Response Report) (A-15-21-51103), February 24, 2022

The Social Security Administration’s Expansion of Health Information

Technology to Obtain and Analyze Medical Records for Disability Claims

(A-01-18-50342

), January 3, 2022

Beneficiary and Recipient Data Provided to Support Issuance of Economic

Impact Payments Authorized by the American Rescue Plan Act of 2021

(A-06-21-51061

), December 13, 2021

Comparing the Social Security Administration’s Disability Determination

Services’ Workload Statistics During the COVID-19 Pandemic to Prior

Years (A-01-21-51038

), December 1, 2021

The Social Security Administration’s Telephone Service Performance

(Congressional Response Report) (A-05-20-50999), November 29, 2021

Deceased Beneficiaries in Suspended Payment Status (A-08-19-50800),

November 22, 2021

The Social Security Administration’s Compliance with the Digital

Accountability and Transparency Act of 2014 (A-15-20-50917),

November 5, 2021

The Social Security Administration’s Information Security Program and

Practices for Fiscal Year 2021 (A-14-20-50958), October 20, 2021

The Social Security Administration’s Information on the Office of

Management and Budget’s Information Technology Dashboard

(A-14-18-50435

), October 15, 2021

Beneficiaries Who Received Vocational Rehabilitation Services

(A-02-18-50544), October 13, 2021

Mission: The Social Security Office of the Inspector General (OIG) serves the

public through independent oversight of SSA’s programs and operations.

Report: Social Security-related scams and Social Security fraud, waste, abuse,

and mismanagement, at oig.ssa.gov/report.

Connect: OIG.SSA.GOV

Visit our website to read about our audits, investigations, fraud alerts,

news releases, whistleblower protection information, and more.

Follow us on social media via these external links:

Twitter: @TheSSAOIG

Facebook: OIGSSA

YouTube: TheSSAOIG

Subscribe to email updates on our website.