Broadband Strategic Plan

Sierra County, New Mexico

May 11, 2020

Finley Engineering

CCG Consulting

Sierra County Broadband Strategic Plan

Page 2

Table of Contents

Page

Project Description ................................................................................................................................... 3

Executive Summary .................................................................................................................................. 4

Findings ...................................................................................................................................................... 6

Recommendations / Strategic Plan ........................................................................................................ 11

I. Market Analysis ................................................................................................................................... 14

A. Providers, Products, and Price Research .................................................................................. 14

B. Surveys / Interviews ................................................................................................................. 23

C. Broadband GAP Analysis ........................................................................................................ 29

1. The Gap in Broadband Speeds ........................................................................................... 29

2. The Gap in Broadband Availability ................................................................................... 46

3. The Gap in Broadband Affordability ................................................................................. 48

4. The Computer Gap ............................................................................................................. 51

5. The Gap in Broadband Skills ............................................................................................. 52

6. Future Broadband Gaps ...................................................................................................... 53

7. The Consequences of the Broadband Gaps ........................................................................ 56

II. Engineering Design and Cost ............................................................................................................ 64

A. Existing Provider Analysis....................................................................................................... 64

B. Network Design........................................................................................................................ 69

C. The Technology........................................................................................................................ 82

D. Competing Technologies ......................................................................................................... 85

III. Financial Projections...................................................................................................................... 100

A. Operating Models ................................................................................................................... 100

B. Services Considered ............................................................................................................... 107

C. Financial Assumptions ........................................................................................................... 110

D. Expense Assumptions ............................................................................................................ 121

E. Financial Results .................................................................................................................... 124

IV. Other Issues ..................................................................................................................................... 140

A. Funding for Broadband Networks .................................................................................... 140

B. Partnering Potential ................................................................................................................ 154

C. Our Recommendations / Strategic Plan ................................................................................. 162

EXHIBIT I: Service Areas of the Incumbent Telephone Companies .............................................. 175

EXHIBIT II: Summary of Financial Results ..................................................................................... 176

Sierra County Broadband Strategic Plan

Page 3

PROJECT DESCRIPTION

Finley Engineering and CCG Consulting were hired to create a Broadband Strategic Plan for Sierra

County. The original RFP that defined the project set the following goals:

The selected firm shall be responsible for the development of a broadband master plan for the

County of Sierra, NM. The purpose of this Broadband Plan is to provide a comprehensive

evaluation of existing broadband conditions and potential solutions to problems, both now and in

the future throughout the entire county. This evaluation should include a comprehensive inventory,

accurate simulation, problem area identification and problem source/cause, and a comprehensive

list of capital improvement projects, including costs and funding mechanisms, designed to address

the broadband deficiencies.

Sierra County is a rural community with limited-to-no broadband

services

Project scope of work shall include:

• To have clear communication on projects.

• Establish a professional relationship with staff.

• Assess available broadband/fiber optic studies and master plans, GIS Data, or other.

• Data collection including limited survey, as required to verify existing conditions.

•

This project will identify current

broadband infrastructure in rural county.

•

Identify gaps in service areas and identify infrastructures, hospitals, and

schools.

•

Needs to provide broadband services to county-wide businesses and users.

• Preparation of an overall model for the entire county-designs, installs and operations

• Preparation of a Local Capital Improvement Plan (ICIP) program that includes budget

estimates for proposed improvements.

• Recommended prioritization of ICIP projects.

We believe this report is responsive to all the requirements identified in the goals and the project scope of

work.

Sierra County Broadband Strategic Plan

Page 4

EXECUTIVE SUMMARY

Finley Engineering and CCG Consulting submit this Broadband Strategic Plan that provides our findings

and recommendations for bringing better broadband to Sierra County, New Mexico. The stated goal of

the County in awarding the project is to “provide a comprehensive evaluation of existing broadband

conditions and potential solutions to problems, both now and in the future throughout the entire county.”

The first phase of the study was to look at the need for broadband in the county. We tackled that task in

two ways. We first communicated with residents and businesses through surveys, speed tests, and

interviews to understand the broadband needs in the county. We also drove extensively through the county

to identify the facilities used to provide existing broadband. Our two firms have worked extensively with

rural communities all over the country and we observed almost immediately that the county has some of

the worst broadband conditions we’ve witnessed anywhere. Outside of the county seat of Truth or

Consequences and the town of Elephant Butte, which have broadband provided by a cable TV network,

there is almost no broadband anywhere else in Sierra County that meets even the FCC’s outdated definition

of broadband as being a connection of at least 25/3 Mbps. The overwhelming and universal response we

got through our market outreach was that homes and businesses are desperate for better broadband.

We were asked to specifically identify the broadband gaps in the county. We went about this in a number

of different ways. For example, we compare the broadband situation in Sierra County to other places in

the US and other places in New Mexico. We discuss the various broadband gaps we witnessed during our

research and our public outreach. This includes things like the urban / rural gap mentioned above. We

discuss the homework gap where students without home broadband don’t perform as well in school. We

discuss the computer gap where homes without computers don’t do as well as homes with them. We look

at the broadband speeds available in the county today and compare them to other places. We discuss a

number of ideas for overcoming the various identified broadband gaps.

Finally, we created our own version of a broadband map showing the speeds we think are available in the

county today – which differs significantly from the FCC maps that overstate the broadband in the county.

Unfortunately, the faulty FCC maps are used by the FCC when determining the areas that are eligible for

federal broadband grants. We discuss steps you might consider to get the FCC maps corrected.

The next phase of the study quantified the cost of bringing broadband to the county. Finley Engineering

estimated the cost of building fiber to reach all parts of the county. For now, the engineering is summarized

in two parts—the cost of building to just Truth or Consequences and Elephant Butte and the cost to build

to the rural areas outside those two cities. Finley Engineering undertook the engineering analysis in such

a way that they could generate the cost for building to any portion of the county if an ISP wants to consider

coming to Sierra County. We think this might be one of the most important parts of our product, since

knowing the cost of building a network is generally the number one question for any ISP considering

serving there.

As we were writing this report, The Rural Utility Service (RUS) that administers broadband grants on

behalf of the Department of Agriculture announced that Sacred Wind Communications of Yatahey, NM

has filed for a grant under the ReConnect grant program to build broadband in parts of the Sierra County.

There are no guarantees that they will win this grant, but if they are successful it would mean bringing

fiber broadband to a section of the county—a great first step towards solving the rural broadband problem.

Sierra County Broadband Strategic Plan

Page 5

This wouldn’t change any of the recommendations we’ve made in this report but would focus your

attention on the areas that will not be getting fiber as a result of this grant.

Next, CCG Consulting created financial models that reflect the potential profitability for an ISP operating

a broadband business in Sierra County. In the report we summarize these opportunities in three ways –

serving just the rural areas, serving just Truth or Consequences and Elephant Butte, and serving the whole

county. Just like with the Finley Engineering analysis, we could modify our work to fit some smaller

footprint if an ISP is interested. These studies include assumptions that we think are representative for

estimating the revenues and the costs from operating a broadband business.

We were not surprised to find out that grants would be required to finance construction in the rural parts

of Sierra County. That was fully expected, and we’ve never seen a rural area where customer revenues

fully support the cost of fiber without some grant assistance. Our analysis shows that if the customer

penetration rate in the rural areas is 70%, then the needed grant would need to cover about 65% of the cost

of the network. That percentage of needed grant is also pretty normal; we’ve studied rural places where

the grant funding would have to be much higher. We also demonstrated that if more than 70% of

households will buy broadband that the amount of grant funding required is less – at an 80% customer

penetration rate the level of needed grant funding drops to 54%. Finally, we demonstrated that if an ISP

is willing to build fiber to everywhere in Sierra County that the profitability from serving in the more

densely populated parts of the county lowers the needed amount of grant assistance.

We conclude the report by providing a strategic plan in the form of a list of specific recommendations that

Sierra County should consider after getting this report. The most obvious next step is to share this report

with ISPs. This study is going to answer a lot of questions about serving in Sierra County and might bring

interest from an ISP that might not have otherwise considered coming to the county. There are a number

of other recommendations talking about ways that Sierra County can address the various broadband gaps.

Sierra County Broadband Strategic Plan

Page 6

FINDINGS

Following are our primary finding:

Existing Providers and Market Rates. The current broadband providers in Sierra County today are two

incumbent telephone companies (Windstream and CenturyLink), an incumbent cable company (TDS),

two WISPs – fixed wireless ISPs (Wi-Power and Fastwave), and two satellite broadband companies

(Viasat and HughesNet). Some rural homes get home broadband using the cellular broadband from

AT&T, Verizon, and T-Mobile, which recently merged with Sprint. Residents can also by satellite TV

from DirecTV and Dish Networks. We looked at the key products and prices currently offered by the

existing broadband providers.

Quality of Broadband. The broadband in Truth or Consequences and Elephant Butte is typical of what

is available in county seat towns in rural counties. The cable modem service from TDS today delivers 100

Mbps broadband and the DSL from Windstream in the towns is much faster than what is available in the

rural parts of Sierra County. There are complaints that broadband in the towns is sometimes inconsistent,

but overall, there are reasonable alternatives for broadband. However, when looking even just a few years

into the future, this broadband is not going to be adequate. The first way that the current broadband will

likely begin feeling inadequate is with upload speeds.

Our two firms work all over the country and the broadband in the rural areas of Sierra County is among

the worse we have ever witnessed. The alternatives in the rural parts of the county are extremely slow

DSL with few homes seeing broadband speeds over 5 Mbps, fixed wireless broadband that can be a little

faster than DSL (but not always), or satellite broadband that can have decent speed but which has high

latency (delays) and small monthly data caps. The broadband in the rural area is not sufficient to support

people working from home, for students to do schoolwork from home, or for businesses to operate

normally. One of the most common complaint from rural businesses is the inability to consistently process

credit cards. That’s a function that requires low bandwidth but a steady upstream data path for the duration

of a credit card transaction. To make matters worse, rural broadband in the county is expensive,

particularly considering the poor bandwidth quality.

It’s worth noting that all the problems with the quality of broadband were magnified during the COVID-

19 crisis as employees and students tried to function from home.

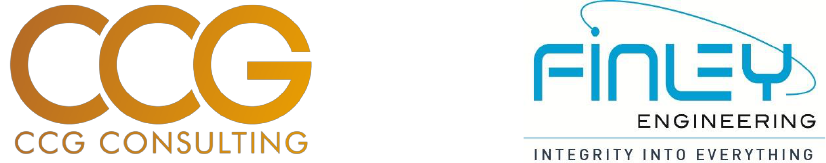

The Study Areas. We studied three different study areas. The first was the two cities of Truth or

Consequences and Elephant Butte. The second was comprised of all the rural areas outside of the two

cities. The last scenario looked at bringing fiber to everybody in Sierra County. Finley Engineering

undertook the network design in such a way that they could help interested ISPs look at other study areas

comprising some smaller portion of the county.

Fiber Network Design. Finley Engineering considered several technologies before designing a

reasonably efficient network for each of the scenarios studied. The chosen network design uses Passive

Optic Network (PON) technology on fiber to bring gigabit broadband to every home and business in the

county. The network design also allows any large customers to be serviced using Active Ethernet

technology that can deliver dedicated bandwidth up to 10 gigabits per second in speed.

Sierra County Broadband Strategic Plan

Page 7

The fiber network is designed to go primarily on poles where other utilities are on poles but would be

buried underground where other utilities are currently buried. The network design is robust. The fiber

network is designed to provide fiber for every home and business in the county today and well as capacity

for future expansion or growth. The extra capacity could be used for numerous reasons such as supporting

electric smart-grid, supporting smart-city applications, or for providing for new housing and business

growth.

The telecom industry uses the term passing to mean any home or business that is near enough to a network

to be considered as a potential customer. Finley Engineering primarily used the county’s GIS database to

count passings. This is a very robust and expansive system that has data on structures, type, location, etc.

Our engineers settled on the following as the count of potential passings for the study. Note that the two-

cities scenario looks at serving only Truth or Consequences and Elephant Butte.

Total

Passings Rural Two Cities County

Residential Customers 2,756 5,469 8,225

Business Customers 169 730 899

Total 2,925 6,199 9,124

Miles of Fiber Construction

The study contemplated building fiber to every part of Sierra County where there are homes or businesses.

Finley Engineering identified the following road miles of fiber required to bring fiber everywhere:

Miles Cost Cost / Mile

Rural County 563.65 miles $21,121,352 $ 34,572

Two Cities 105.56 miles $12,584,135 $119,213

Total 669.21 miles $33,705,487 $ 50,366

Asset Costs. Below is a summary of the cost of the needed assets to support each primary option that was

studied. It’s worth noting that these costs estimate a customer penetration in the rural areas of 70% and in

the towns of 50%. The investments change as the number of customers change to recognize the cost of

customer drops and electronics.

Total

Rural Two Towns County

Fiber & Drops $23,373,224 $14,825,297 $38,180,705

Electronics $ 1,814,770 $ 3,076,426 $ 4,811,601

Huts/Land $ 0 $ 139,500 $ 139,500

Operational Assets $ 383,185 $ 393,968 $ 731,677

Total $25,571,179 $18,435,191 $43,863,482

Cost per Passing $ 9,278 $2,974 $4,807

Cost per Customer $12,498 $5,937 $8,514

Sierra County Broadband Strategic Plan

Page 8

Our Approach to the Financial Analysis. We used the following approach in estimating the revenues

and costs for operating a new fiber network for each of the three scenarios:

• A base model was created for each operating model. We arbitrarily chose a 50% market

penetration (the percentage of customers using the network) for the scenario of serving Truth or

Consequences and Elephant Butte, and a customer penetration rate of 70% for serving the rural

area. each base model. We don’t have any idea how many customers a new fiber business might

win and chose these penetration rates as typical of other similar fiber markets.

• All financial models cover a 25-year period. All projections include projected financing costs for

borrowing the money needed to build and launch the network.

• We believe the engineering cost estimates are conservatively high.

• All studies include an estimate of future asset costs that are needed to connect future customers

and to maintain and upgrade the network over time. We’ve assumed that electronics wear out and

need to be replaced periodically during the studied time frame.

• Products were priced at a modest discount from the existing prices of products sold in the market

today. The expectation is that the internet speeds offered on the network will be significantly

faster than the speeds available in the county today.

• The estimates of operating expenses represent our best estimate of the actual cost of operating

the fiber business and are not conservative. Most operating expenses are adjusted for inflation at

2.5% per year.

Key Financial Study Results. The assumptions used in creating the various business plans are included

in Section III.C of the report. The results of the financial analysis are included in Section III.E of the

report. A summary of the financial results is included in Exhibit II. Following are the key financial findings

of our analysis.

• To bring fiber broadband to all the rural parts of Sierra County will require substantial grant

funding. For example, at a 70% customer penetration rate we calculated that a grant that covered

65% of the financing would be required. If the rural customer penetration rate climbed as high as

80% the required grant would be smaller, at 54% of total financing, but is still substantial. It’s easy

to understand the need for grants when seeing the cost of the rural network, shown above as $9,278

per passing. Customer revenues alone cannot pay for a network this expensive.

• We note that we have studied other rural counties where the funding needed from grants was as

high as 80% of total financing – so the results of our analysis is not out of line with what we’ve

seen elsewhere.

• It looks feasible to bring fiber broadband to Truth or Consequences and Elephant Butte, with no

need for grant funding. Our analysis shows that a customer penetration as low as 45% of the market

would be adequate to maintain a self-sufficient business in the cities. This is a typical result for

county seat communities.

• The amount of grant money needed to build all of Sierra County is substantially lower than

building just the rural areas. This is due to averaging together the low-cost and the high-cost parts

of the county. The grant needed to build to the whole county is only 28.5% of total financing with

a 70% penetration in the rural areas and a 50% penetration in the two cities. To the extent that the

rural penetration rate would be even higher, the amount of grant funding drops significantly.

• A fiber broadband business in Sierra County will be highly sensitive to a few key variables. The

most important is customer penetration rate, and it would be essential before building fiber in the

county to better understand the number of customers likely to buy broadband. Another key variable

is price, and even shifting broadband prices by a few dollars has a big impact on the bottom line.

Sierra County Broadband Strategic Plan

Page 9

The base studies in the analysis started with a base broadband product priced at $60. Any ISP that

is going to serve the area will need to carefully consider prices. The financial performance is

somewhat sensitive to interest rates on debt, but not nearly to the extent of the other key variables.

Funding Options. As mentioned above, any broadband expansion into the rural areas will require

substantial grant funding. The most likely grant funding is going to come from various federal broadband

grants. At this time there is no consistently available federal grant program and the amount of money

available each year has been determined by Congress. There is a lot of talk in Washington DC about

making more money available for rural broadband, so there is the chance of upcoming substantial

broadband grants. Now that the county has this study in hand, especially the engineering cost estimates

made by Finley Engineering, you are well-positioned to help ISPs consider any future grants.

There is a New Mexico state broadband grant program, but it is currently one of the smaller State grant

programs, funded last year at $5 million. Hopefully the COVID-19 crisis will also prompt the state to find

more money for broadband grants.

We believe there is sufficient loan funding available to any ISPs that find the needed grant funding. We

are seeing ISPs getting funded at commercial banks, getting funded by taking advantage of federal loan

guarantees that lowers the risks of bank loans, and through funding directly from the federal government.

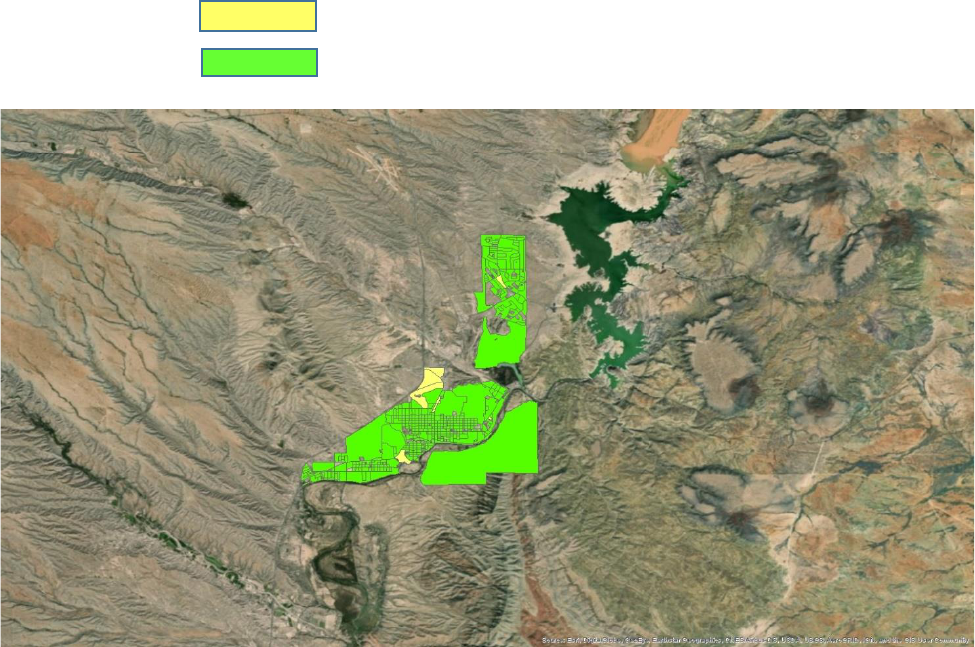

Sierra County Has Been Harmed by FCC Decisions. Two specific actions by the FCC are harming the

county’s ability to get better broadband.

• First, the FCC determines that places that have good broadband through a process of collecting

broadband data from existing ISPs. ISPs report broadband customers and speeds twice a year by

Census block. Census blocks are small geographic areas determined by the US Census Bureau that

normally cover 40-60 homes or businesses (but can cover more). ISPs are supposed to report the

fastest broadband speeds available to customers. There is also an odd rule that says that if even

one customer in a Census block can get a fast speed, say 25 Mbps, then the ISP can claim the

whole Census block as having that speed.

There are several glaring problems with the ISP reporting. First, customers that live close to where

there is good broadband are counted by the FCC as having fast broadband. For example, a customer

just outside the TDS cable network is likely to be classified as being able to buy broadband from

TDS, even though they can’t. The bigger problem is that ISPs routinely overstate the broadband

speeds available, and often report “marketing” speeds rather than actual speeds. Both Windstream

and CenturyLink have overstated rural DSL speeds and often report that DSL speeds of 10/1 Mbps

or 25/3 Mbps are available when actual speeds are slower than that. This report contains maps that

show the speeds as reported by the ISPs to the FCC as well as a map we created that we think is

more accurate and that shows much less rural broadband coverage.

There are significant consequences of the poor FCC data since the FCC uses this information to

decide areas that are eligible for federal broadband grants. There are many areas of Sierra County

that should be eligible for grants, but which have been excluded from consideration to date.

Sierra County Broadband Strategic Plan

Page 10

• The next issue comes as a result of an FCC grant that was awarded in 2018 by a process referred

to as a reverse auction. In that auction, ISPs were invited to bid for receiving grant money that

covered specific rural Census blocks that didn’t have broadband speeds of at least 10/1 Mbps.

Unfortunately, the only ISP that bid for the grants in the county was Viasat, the satellite broadband

company. Viasat is required by the terms of that grant to offer broadband speeds in the grant areas

of at least 25/3 Mbps broadband. This is something that Viasat already offered, so the households

in the grant areas are not going to see any improvement in broadband. Worse, the FCC now

considers those areas as having adequate broadband and is excusing these areas from future FCC

grants.

Because of a faulty grant process, the grants went to a satellite broadband company – something

that never should have been allowed to happen. As a result of that FCC blunder, the homes in those

areas are likely not to be eligible for FCC grants for at least another decade, or perhaps even longer.

Sierra County Broadband Strategic Plan

Page 11

RECOMMENDATIONS / STRATEGIC PLAN

The following recommendations embody a strategic plan for getting better broadband in Sierra County.

The description of each recommendation has been shortened and the full recommendations are included

in Section IV. C. of the report. We view the list of recommendations as a broadband strategic plan for

Sierra County. Following these recommendations will move the county towards achieving your goal of

bringing good broadband to everybody in Sierra County.

Set a Broadband Goal

After reading this report, we recommend that Sierra County establish a specific broadband goal. The goal

could be something simple, such as wanting to get fiber broadband to every home and business. There are

many other possible goals. The goal that Sierra County chooses will then define how you approach the

rest of the recommendations below.

Identify Staffing Resources?

If Sierra County is going to seriously pursue a lot of the recommendations made in this report, you’re

going to need staff resources tackle many of the tasks. This means identifying somebody for whom

broadband is a primary job responsibility. Tasks of this magnitude will not get done if you layer the

workload on somebody who is already full-time busy. This doesn’t necessarily mean creating a full-time

position to oversee broadband, but it does require giving sufficient priority to broadband if you want to

see solutions.

It’s also worth considering finding volunteers from the public to help with the effort. There are different

ways that communities have used volunteers to good effect.

Attracting ISPs to Serve in Sierra County

Since the Sierra County government doesn’t want to be an ISP, your best strategy is to take steps that

make it as easy as possible for one or more ISP to bring better broadband. This might include the following

steps:

Reach Out to Potential ISP Partners. The first step taken is to share this report with ISPs in the region.

One or more of them might find things in this report that convinces them to consider Sierra County. Finley

Engineering and CCG Consulting have seen these studies used to convince ISPs to look harder at

opportunities that they were not considering.

After reaching out informally, you can also consider more formal ways of reaching out such as issuing an

RFI or RFP to solicit ISPs. Just note that many ISPs are not going to willing to go through a formal

solicitation process and would much prefer to sit and talk off the record about opportunities.

Offer to Help Quantify Demand. One of the biggest concerns for any ISP is that there is enough customer

demand for broadband in order for them to be profitable. This study includes some of the needed research

that ISPs will be interested in. However, ISPs ultimately will want to undertake a more formal process of

understanding customer demand for broadband in the specific area they are considering building. Sierra

Sierra County Broadband Strategic Plan

Page 12

County could offer help at the appropriate time to conduct a statistically valid survey, a canvass, or a

pledge card drive.

Review County / Town Policies Related to Fiber Construction. There may be existing policies in place in

the towns or at the County that ISPs will view as an impediment to construction. We recommend having

all of the government entities within Sierra County review policies for requirements like rights-of-way,

permitting, locating of existing utilities, traffic control, franchise agreements, and inspection requirements

with the goal of making it as easy as possible for ISPs to bring new solutions.

Be Prepared to Support Grant Filings. Most state or federal grant programs require a showing of local

community support. Sierra County should be prepared to help an ISP by gathering government and

resident support for the grant applications. This means soliciting as many letters as possible to support a

fiber grant.

Educating the Public

This can take many different forms. Start by publishing this report online. Hold public meetings to discuss

the findings of this report and to listen to public concerns about lack of broadband. Many communities

create a broadband web site as a place to post informational resources and to keep the public informed

about progress in finding a broadband solution. Other communities have created a broadband newsletter.

One common practice is to hold outreach meetings to discuss broadband with interested groups such as

the PTA or service organizations.

Lobby for Larger State Broadband Grants.

The state broadband grant program is smaller than similar programs in other states. Both the county

government and citizens in the county should regularly lobby the state and state elected officials for more

help to fund broadband solutions.

Be Prepared to Challenge the FCC Broadband Maps.

Many federal grant programs rely on the FCC “maps” that are derived from the Form 477 data that the

FCC gathers from ISPs. We’ve shown in this study that the FCC broadband is lousy in parts of Sierra

County where ISPs claim broadband coverage that doesn’t exist. The only way we know to challenge the

maps is by the use of speed tests.

We helped Sierra County to establish a speed application site that has been placed on the County’s web

page. We recommend that the speed tests remain in perpetuity and that the County periodically encourages

homes and businesses to take the speed test. Accumulating speed test results is the best way we know of

to help challenge the poor FCC mapping data.

Get Creative in Finding Grants.

The big obvious grants are those that help ISPs construct broadband networks, and those grants are

awarded directly to ISPs. There are a number of grants that Sierra County can pursue to help promote

broadband in other ways. For example, there are grants that can be used to expand WiFi hotspots. There

Sierra County Broadband Strategic Plan

Page 13

are grants that can help to get more computers for students. If the County gets creative enough, there may

be grant funds available for addressing many of the items we’ve identified as broadband gaps.

Consider Providing Some County Funding.

We’ve seen that it’s often easier to attract grant funding if a county puts some “skin in the game.” Even

small grants provided by Sierra County can make a big difference. The people who award big grants,

including the giant federal grant programs like to see that there is local dollar support for programs.

Consider Finding Technical Assistance for Businesses.

We observed that there are businesses that are having current problems using their broadband connection

that could benefit greatly with professional computer and networking advice. As an example, we talked

to businesses that had problems holding the connection needed to make credit card payments. Sierra

County might help to identify a local resource that could help such businesses, and you might even

consider assisting them in the name of economic development. It’s also possible to find grant money to

assist businesses in this manner.

Push the Incumbents to do Better.

Asking the incumbent telephone and cable companies to do better often falls on deaf ears – but not always.

It’s sometimes easiest to start with small things like asking for help to create more public WiFi hotspots

for students or to bring broadband to public housing. We’ve seen communities and ISPs work together to

solve specific problems.

Push for More Participation in the FCC Lifeline Program.

Encourage every ISP that offers broadband and telephone service to enroll in and them promote the FCC’s

Lifeline program. This provides a $9.25 discount for broadband to homes that qualify by participating in

various low-income programs. The program is done at no out-of-pocket cost to the ISP which collects the

$9.25 subsidy from the Universal Service Fund.

Find Solutions for the Homework Gap.

The lack of broadband in Sierra County means that many students don’t have broadband at home. This

became abundantly clear during the COVID-19 crisis. Communities are tackling this issue in a number of

ways. It starts with getting computers to students, be that a computer for every student or computers that

students can use occasionally. Many communities have created new WiFi hot spots to provide locations

closer to neighborhoods where students can do homework without the family having to travel.

Be Persistent.

It’s the rare county where one ISP comes forward and provides a broadband solution for the whole county.

That means that even if Sierra County finds a partial broadband solution to cover part of the county that

the effort is not done, and the County will need to continue with the above tasks until everybody in the

county has broadband.

Sierra County Broadband Strategic Plan

Page 14

I. MARKET ANALYSIS

A. Providers, Products, and Price Research

The eastern portion of Sierra County is covered by the White Sands Missile Range, with little or no

existing coverage by telephone companies. The northern two-thirds of the rest of the County is served by

Windstream. The southern portion of the County is served by CenturyLink.

TDS is the incumbent cable TV provider in Truth or Consequences and parts of Elephant Butte. The

company upgraded to digital service in 2016 and offers speeds of up to 100 Mbps.

The FCC 477 data shows that there is some fixed wireless service in the county provided by Wi-Power

(TWN Communications) and Fastwave.

Most rural homes and businesses can buy satellite broadband from Viasat and HughesNet. Rural

customers can also buy cable TV from DirecTV or Dish Networks.

Following is an analysis of the prices being charged in Sierra County today. We know from experience

that prices vary widely by customer for many ISPs. Over the years, customers have purchased bundles or

participated in promotional pricing and might be charged differently than their neighbors. It seems almost

counterintuitive, but the customers paying the most from most incumbents are often those that have been

with them the longest. The wide variance in rates charged in the community means there is no longer

anything that can be considered as a “standard” price in the market. Nevertheless, we wanted to understand

the average prices being charged today for broadband and the other triple play products.

Incumbent Telephone Company

Windstream Corporation. Windstream is a publicly traded telephone company created in 2006 with the

merger of Alltel and Valor Telecom. The company is headquartered in Little Rock, Arkansas. The

company offers telephone service plus broadband service provided by DSL. The company also offers a

bundle that includes cable TV provided by Dish Networks.

The company operates in 16 states and had $1.27 billion in revenues for the third quarter of 2019, down

from $1.38 billion the year before. At the end of 2019, the company had 1,049,300 broadband customers

and had gained 28,300 broadband customers during the year.

As the incumbent provider, Windstream is considered the “provider of last resort” in its service areas.

This means the company is required to serve all residential and business customers for basic telephone

service, and it must provide facilities to all customers. The rules that govern the way that Windstream

serves customers are embodied in their “General Customer Services Tariff,” which is approved by the

New Mexico Public Regulation Commission. This tariff contains all the regulated products and prices,

along with the terms and conditions under which the company will sell them to customers. The tariff sets

forth rules for such customer service procedures as the manner and amount of customer deposits, the rules

by which they will disconnect service for nonpayment, and the rules by which they will reconnect service.

Sierra County Broadband Strategic Plan

Page 15

Windstream decided in January 2014 to spin off its assets into a REIT, which is a real estate investment

trust, a formal kind of investment vehicle defined by law. Windstream was a traditional, mostly family-

owned regulated telco. Windstream moved its fiber and copper assets to a REIT owned by the newly

formed Uniti. In the split of assets, Robert Gunderman remained as CFO of Windstream while his brother

Kenneth become CEO of Uniti. The Uniti REIT is attractive to investors because Windstream pays

roughly $650 million per year in “rent” to Uniti for use of the network. Since formation, Uniti has added

other assets to the portfolio, but the Windstream assets still represent 70% of its assets.

Windstream filed bankruptcy recently. This was triggered when Aurelius Capital, a lender to Windstream,

filed a lawsuit claiming that the REIT arrangement was a violation of Windstream’s corporate bonds.

Windstream immediately filed for bankruptcy when a judge ruled in favor of Aurelius Capital.

Windstream and Uniti immediately went to mediation to try to resolve the issues raised by the Aurelius

Capital lawsuit. When the two companies could not resolve the issues, they took the dispute to court.

The two parties reached an agreement on the dispute in March 2020. The deal must still be accepted by

the bankruptcy count. In the agreement the Windstream debt is to be reduced by more than $4 billion.

Further, Uniti will provide Windstream with $1.75 billion over 10 years to make capital improvements,

$490 million in cash now, and $285 million to buy unused and underutilized assets. This agreement will

make Windstream stronger financially, but it’s hard at this early stage to understand how the settlement

might translate in improvements for broadband in Sierra County. It’s likely that Windstream will use cash

to improve broadband in larger markets.

Windstream has gotten poor reviews from several firms that rank ISPs. The JD Powers poll gives

Windstream a ranking of 2 out of 5 and said they were the lowest rated telephone company in the South.

Windstream Pricing

Windstream offers 3 DSL speeds. The faster speeds may not be available to rural customers. The products

and prices are as follows:

6/1 Mbps $57.99

10/1 – 25/1 Mbps $67.99

50/1 Mbps $77.99

Modem for first two products $ 9.99

Modem for 50/1 Mbps $11.99

Installation $35.00

Service Activation $50.00

Inside Wire Insurance $ 8.00

There are no data caps on the broadband products

Windstream does not advertise their telephone prices online. We found the following price at noncompany

sites:

Phone with Unlimited Long Distance $44.99

All telephone products are loaded with a number of fees that total to at least $7.50.

Sierra County Broadband Strategic Plan

Page 16

CenturyLink is the third largest telephone company in the country with headquarters in Monroe,

Louisiana. Several years ago, the company purchased Qwest, which was formerly Mountain Bell and US

West, and was part of the Bell Telephone system. At the end of 2019, the company had 4,678,000

broadband customers, having lost 134,000 customers during the year. The company has a small number

of cable TV customers but has announced that it is phasing out that business line. For most of the areas it

covers the company bundles with DirecTV.

As the incumbent provider, CenturyLink is considered the “provider of last resort” in its service areas.

This means that CenturyLink is required to serve all residential and business customers for basic local

services, and it must provide facilities to all customers. The rules that govern the way that CenturyLink

serves customers are embodied in their “General Customer Services Tariff,” which is approved by the

New Mexico Public Regulation Commission. This tariff contains all of the regulated products and prices,

along with the terms and conditions under which CenturyLink will sell them to customers. The tariff sets

forth rules for such customer service procedures as the manner and amount of customer deposits, the rules

by which they will disconnect service for nonpayment, and the rules by which they will reconnect service.

We’d like to note here that a recent trend is to get states to deregulate many services as competitive and

take them out of the tariff.

In 2019 CenturyLink had asked the Commission to deregulate landline telephone services in the state. The

company didn’t want to stop offering the services but wanted to shed the old regulations put in place at

the heyday of the telephone monopolies. Most states have deregulated the big telcos from a lot of the old

telephone rules. The New Mexico Public Regulations Commission rejected the request and said that

CenturyLink had not demonstrated that there was “effective competition” for residential telephone service.

That might sound like a surprising ruling since in most places everybody has shifted to cellular phones.

However, the FCC data shows a lot of areas in the state with little or no 4G coverage for cellular, meaning

a lot of houses still rely on a landline.

In recent years CenturyLink invested significant capital in improving data speeds in metropolitan areas.

For example, in 2016 the company built fiber to pass 900,000 homes in major markets like Seattle,

Phoenix, Denver, and the Twin Cities. Since then the company has merged with Level 3 Communications

and last year the new CEO announced that the company would not be making any future investment in

assets with “infrastructure returns,” meaning it’s not going to build new fiber to residential customers and

is probably not going to invest any more money in its copper networks.

Telephone Rates

CenturyLink’s telephone rates were as follows when last tariffed. This does not mean that these

are the rates any longer and with a de-tariffed rate, CenturyLink is allowed to charge whatever

they want, within reason. The following rates were the last listing of the flat rate option, meaning

a telephone line using these rates can make unlimited local calls. There used to be options available

for customers who wanted to be able to make and pay for fewer local calls.

Monthly

Flat Rate Residential Phone Line $18 - $22

Flat Rate Business Telephone Line $42 - $45

Sierra County Broadband Strategic Plan

Page 17

Business PBX Trunk Lines $45 - $51

These rates do not include the Subscriber Line Charge which is currently $6.50 for both a business

and a residential line and would be added to the above rates. The rates also do not include the

Access Recovery Fee (ARC), which is an FCC fee that is currently capped at $1 per month, and

CenturyLink could be charging any amount up to and including the $1 rate.

CenturyLink telephone line prices don’t include any features. These features are either sold a la

carte or sold in bundles and packages. Some of the most commonly purchased features are call

waiting, 3-way calling, voice mail, and caller ID. CenturyLink offers dozens of features and they

range in price from $2.95 to $8.50 per feature for residential service. These products are also now

de-tariffed, and CenturyLink can charge whatever it likes for these products.

CenturyLink DSL

CenturyLink sells high speed Internet using DSL technology. They sell both a bundled DSL

product, meaning that you purchase it along with a telephone line, and also a “Pure” product,

meaning a customer can buy just DSL (most of the industry refers to this as naked DSL). As

discussed above, CenturyLink offers a lot of specials, with special rates available on their web site

for new customers. But as typical with most big ISPs, a subscriber’s rates will revert to “normal”

rates at the end of a special promotion. Following are base list prices for residential DSL. Note

that the quoted speeds offered by CenturyLink DSL are “best effort” speeds, meaning they are not

guaranteed. In fact, rural customers typically get speeds significantly slower than the advertised

speeds.

Residential DSL

Pure DSL is CenturyLink’s name for a DSL line that is not bundled with telephone or

DirecTV. There is one price for the first year, a higher price for the second year, and after

that the customer pays the list price:

1

st

Year 2

nd

Year List

1.5 Mbps download, 896 Kbps upload $30.00 $40.00 $42.00

7 Mbps download, 896 Kbps upload $35.00 $45.00 $47.00

12 Mbps download, 896 Kbps upload $40.00 $50.00 $52.00

20 Mbps download, 896 Kbps upload $50.00 $60.00 $62.00

40 Mbps download, 896 Kbps upload $60.00 $70.00 $72.00

Pure DSL also requires a DSL modem. The charge for this seems to be negotiated and

ranges from $1.95 to $6.95.

We don’t expect that there is any DSL in Sierra County faster than 12 Mbps. Generally,

the faster speeds are available only in the metropolitan markets.

Sierra County Broadband Strategic Plan

Page 18

CenturyLink Business DSL

CenturyLink no longer publishes business DSL prices. There are no prices on the website

and no prices listed in any of their sales literature or tariffs. Basically, CenturyLink will

negotiate a price with a business customer based upon both how many other products they

purchase as well as how long they are willing to sign a contract.

When CenturyLink last published rates their slowest business DSL ranged from $40.00 per

month for a 3-year contract up to $62.50 for a month-to-month product and no contract

commitment. But today each customer will negotiate with a salesperson and rates charged

in the market are all over the board for the same product.

Cable TV Providers

TDS is the incumbent cable provider within the city limits of Truth or Consequences. As such they operate

a hybrid/fiber coaxial network that provides traditional cable services including the triple play of cable

TV, broadband, and telephone service. TDS was founded in 1969 and is the seventh largest telephone

company in the country, headquartered in Madison, Wisconsin. Most of the company’s networks are based

upon telephone copper or fiber-to-the-home and the company only owns a few coaxial cable networks

like the one in Truth or Consequences. While the company operates in a few larger cities like Madison,

Wisconsin, most of its properties are rural.

In additional to the typical array of residential services the company also offers business services, such as

business Internet phone bundles, phone and VoIP solutions, Internet and security, managed services, data

networking, and phone systems. In addition, it offers business resource centers. It connects rural and

suburban communities in the United States. TDS Telecommunications Corporation operates as a

subsidiary of Telephone and Data Systems, Inc. TDS had 455,200 broadband customers at the end of 2019

and had added 31,800 customers during the year.

TDS also owns US Cellular, a company that it founded in 1983. Between all of its subsidiaries the

company now has over 6 million customers and had revenues of over $5 billion in 2017, with US Cellular

providing $3.9 billion.

Broadband

TDS offers three broadband products on their coaxial cable networks.

100/10 Mbps $ 62 (Web special - $39.95)

300/10 Mbps $ 82 (Web special - $59.95)

600/20 Mbps $102 (Web special – $79.95)

All broadband products come with a WiFi modem at $10.00 per month.

The web special prices are a reminder that TDS is willing to negotiate with customers. This means that

customers willing to call every few years and negotiate can get prices lower than the list prices. Customers

that don’t negotiate will even be billed at the list prices.

Sierra County Broadband Strategic Plan

Page 19

Telephone

TDS Cable TV can be bundled with telephone service. With cable service telephone rates are:

Phone $15.00 plus $.05 per minute long distance

$35 with unlimited long distance

We couldn’t find if TDS offers a standalone phone product – meaning a customer could buy telephone

service and nothing else.

Cable TV

The survey indicated a small interest for buying cable TV from a new provider. We also know that a new

ISP venture is not going to make any margins from selling cable TV, so we’ve left cable prices out of the

analysis and out of the forecasts.

Dish Network is a large satellite provider and has customers nationwide. The company had around 9.5

million cable customers nationwide at the end of the third quarter of 2019. Dish Network can be bought

as a standalone service and is also available as a bundle for Windstream customers.

Dish Network now also offers an Internet-based cable product branded as Sling TV. This service offers

an abbreviated channel line-up and costs less than traditional cable products.

Dish Network has the same pricing nationwide. The standalone price with no discounts is as follows:

190 Channels $ 79.95

190 Channels + $ 84.99

240 Channels + $ 94.99

290 Channels + $104.99

DirecTV is one of the largest cable providers in the US. The company is now owned by AT&T. The

company had 16.8 million cable customers at the end of 2019, down almost 2.4 million customers during

2019. AT&T has decided to end all discount packages, resulting in significant rate increases for many

customers who were getting various promotional discounts. DirecTV can be purchased in Sierra County

as part of a bundle with CenturyLink.

DirecTV now offers an online version of its programming that was called DirecTV Now but which was

recently renamed as AT&T TV.

Current prices after any promotional discounts are:

155 Channels – Select $ 85.00

160 Channels – Entertainment $ 97.00

185 Channels – Choice $115.00

235 Channels – Xtra $131.00

Sierra County Broadband Strategic Plan

Page 20

250 Channels – Ultimate $142.00

330 Channels – Premier $197.00

The above rates include increases effective January 2020 that range from $4 to $8 per month.

WISPs (Wireless ISPs)

WISPs (wireless ISPs deploy a technology called fixed wireless where they mount a transmitter on a tower

or other tall structure like a water tower. They beam broadband to customers which is received through a

dish receiver. The speed that a customer can receive is affected by the distance to the transmitting tower

– the further from the tower, the lower the broadband speeds.

TWN Communications (Wi-Power)

1

is a fixed wireless provider that delivers broadband using radios

on towers that connect wirelessly to homes and businesses. The business started in Indiana in 1988 and

today covers 250,000 square miles in Indiana, Arizona, New Mexico, and Texas. The business partners

with 115 electric cooperatives to offer broadband services. TWN has had a partnership with Sierra Electric

Cooperative. During our work on the study we found that the relationship is coming to an end. We don’t

know if that means that TWN will cease business or else might act directly as an ISP outside the

partnership.

Following is the residential broadband product line:

Wi-5 5 Mbps Down / 2 Mbps Up $ 49.95

Wi-10 10 Mbps Down / 2 Mbps Up $ 79.95

Wi-15 15 Mbps Down / 2 Mbps Up $ 99.95 and Up

Wi-5 with Telephone Line $ 75.00

Wi-10 with Telephone Line $105.00

Wi-15 with Telephone Line $125.00 and Up

The company doesn’t list prices for businesses, but through the surveys and questionnaires we can see

that business prices are higher than residential rates.

Fastwave

2

is a wireless ISP headquartered in Las Cruces. As a WISP they deliver broadband wirelessly

from a tower to homes and businesses. On their web site they claim that the average speeds they deliver

are between 2 Mbps and 5 Mbps. Their broadband allows for unlimited usage.

Basic WISP 3 Mbps Down and Up $50

Premium 6 6 Mbps Down and Up $65

Premium 9 9 Mbps Down and Up $80

Premium 12 12 Mbps Down and Up $95

Public IP Address $15

Installation $50

1

The company’s website is at https://www.twncomm.com/

2

The company’s website is https://fastwave.biz/

Sierra County Broadband Strategic Plan

Page 21

Satellite Broadband.

There are two satellite broadband providers available to homes and businesses in Sierra County. Both

Viasat and HughesNet utilize satellites that are parked at a stationary orbit over 20,000 miles above the

earth.

There are a few problems that customers consistently report with satellite broadband. Customers complain

that satellite costs too much (Viasat claimed in their most recent financial report for June 2019 that the

average residential broadband bill is $84.26). Customers also hate the high latency, which can be 10 to 15

times higher than terrestrial broadband. The latency is due to the time required for the signals to go to and

from the satellites parked at over 22,000 miles above earth – that adds time to every round-trip connection

to the web. Most real-time web connections, such as using voice-over-IP, or connecting to a school or

corporate WAN prefer latency of less than 100 ms (milliseconds). Satellite broadband has reported latency

between 400 ms and 900 ms.

The other customer complaint is about the tiny data caps. As can be seen by the pricing below, monthly

data caps range from 10 gigabytes to 150 gigabytes. To put those data caps into perspective, OpenVault

announced recently that the average US home used 344 gigabytes of data per month in the fourth quarter

of 2019, up from 275 gigabytes in 2018 and 218 gigabytes in 2017. They also reported that the average

cord-cutting home used 520 gigabytes per month in 2019. The small data caps on satellite broadband make

it impractical to use for a household with school students or for a household that wants to use broadband

to work from home.

Viasat (was formerly marketed as Exede or Wildblue) offers broadband from one older and one

newer satellite. Following are the products from Viasat:

Price Speed Data Cap

Liberty 12 $30 12 Mbps 12 GB

Liberty 25 $50 12 Mbps 25 GB

Liberty 50 $75 12 Mbps 75 GB

Unlimited Bronze 12 $50 12 Mbps 35 GB

Unlimited Silver 12 $100 12 Mbps 45 GB

Unlimited Gold 12 $150 12 Mbps 60 GB

Unlimited Silver 25 $70 25 Mbps 60 GB

Unlimited Gold 50 $100 50 Mbps 100 GB

Unlimited Platinum 100 $150 100 Mbps 150 GB

Online reviews say that speeds can be throttled as slow as 1 Mbps once a customer reaches the

monthly data cap.

HughesNet is the oldest satellite provider. They have recently upgraded their satellites and now

offer speeds advertised as 25 Mbps download and 3 Mbps upload for all customers. Prices vary

according to the size of the monthly data cap. Their packages are as follows:

Sierra County Broadband Strategic Plan

Page 22

10 GB Plan $ 59.99

20 GB Plan $ 69.99

30 GB Plan $ 99.99

50 GB Plan $149.99

These packages are severely throttled after meeting the data caps.

Cellular Data

There are four primary cellular companies in the country—AT&T, Verizon, T-Mobile, and Sprint. As this

paper was being written, the courts approved the final challenge to a merger between T-Mobile and Sprint.

Part of the merger conditions was that Sprint would provide spectrum that would allow Dish Networks to

become the fourth cellular nationwide carrier.

The residential surveys showed that some households in Sierra County that use their cellphone data plans

for household broadband. There are several problems with this. First, customer speeds decrease with

distance from a cellphone tower. Speeds for rural cellular data generally are not fast.

Following are the nationwide average 4G data speeds for the four carriers, shown for 2017 and 2019.

Speeds are improving over time. However, these are nationwide averages and rural customers likely get

slower speeds than these averages.

2017 2019

AT&T 12.9 Mbps 17.8 Mbps

Sprint 9.8 Mbps 13.9 Mbps

T-Mobile 17.5 Mbps 21.1 Mbps

Verizon 14.9 Mbps 20.9 Mbps

All four carriers now offer “unlimited” data plans. The plans for AT&T, Sprint, and Verizon are not

actually unlimited and have monthly data caps in the range of 20 – 25 gigabytes per month of downloaded

data. These plans might provide some relief to homes that rely on cellular broadband, although there have

been reports of Verizon disconnecting rural customers who use too much data on these plans. These plans

allow have limits on how much data can be used when tethering from a cell phone for use in other devices,

so the plans are not much more useful for home broadband than normal cellular plans. T-Mobile claims

to offer unlimited data but begins throttling customers after 50 GB of data usage in a month.

There are two different cellular data standards in use: 3G and 4G. 3G data speeds are capped by the

technology at 3.1 Mbps download and 0.5 Mbps upload. There are likely to still be some 3G cellular

towers in rural parts of the county. The amount of usage on 3G networks is still significant. GSMA

reported that at the end of 2018 that as many as 17% of all US cellular customers still made 3G

connections, which accounted for as much as 19% of all cellular connections. Opensignal measures actual

speed performance for millions of cellular connections and reported the following statistics for the average

3G and 4G download speeds as of July 2019:

Sierra County Broadband Strategic Plan

Page 23

4G 2019

3G 2019

AT&T

22.5 Mbps

3.3 Mbps

Sprint

19.2 Mbps

1.3 Mbps

T-Mobile

23.6 Mbps

4.2 Mbps

Verizon

22.9 Mbps

0.9 Mbps

B. Surveys / Interviews

Residential Survey Results

The survey was conducted online using Survey Monkey. The survey was posted on Sierra County’s

website and was advertised on social media. Unfortunately, an online survey is not easily available to

those with poor broadband. During the survey we talked to a few folks on the telephone while they tried

to take the survey online, and some of them were not able to maintain a connection to the survey for long

enough to complete it. We got 99 homes to take the survey. The survey produced some interesting results.

Broadband Customers

86% of survey respondents have some form of broadband. The ones without broadband took the survey

using their cellphones or used broadband at their office.

The respondents used all of the available ISPs in Sierra County. 21% used Windstream, 27% used TDS,

22% used the fixed wireless WISPs, 17% used satellite broadband, 7% use their cellphones for home

broadband access, and 1% used CenturyLink.

For the homes that don’t have broadband, 50% said they can’t afford broadband. 29% said broadband is

not available at their home, and 7% said they didn’t know how to use the Internet. While this was a small

sample of respondents, these are typical of the responses we’ve seen in rural counties all over the country.

Cable TV Penetration

In an interesting response, only 44% of respondents said they have cable TV at home. That is significantly

lower than the nationwide average, which dipped below 65% at the end of 2019. 35% of respondents are

cord cutters and only watch online content like Netflix. That’s one of the highest percentages we’ve ever

seen in that category, and the nationwide number of cord cutters is thought to be between around 20%

(nobody has figured out how to count it on a national scale).

Telephone Penetration

Only 26% of homes have a telephone landline. The nationwide landline penetration has dropped into the

range of 35% to 40%.

Sierra County Broadband Strategic Plan

Page 24

Customer Bills

The survey asked customers what they pay each month for the triple-play services (Internet access, cable

TV, and telephone). In interpreting the results below it’s important to note that TDS is the only company

in the county that offers the triple play of Internet access, cable TV, and telephone service. That means

that most bundles in Sierra County represent Internet service and telephone service combined. With that

said, here is what customers say they are spending:

Customers buying a bundle of service $89

Customers buying standalone broadband $63

Customers buying standalone cable TV $64

Customers buying standalone telephone $50

Uses of Broadband

68% of respondents say that somebody in their homes uses the Internet to work from home. We note that

the survey was mostly taken before the Covid-19 crisis when that number probably went even higher.

That is made up of those that work at home fulltime (12%), those that work several days per week (31%),

and those that work from home occasionally (25%). These are significantly higher percentages of people

that work from home than we typically see in urban places. 59% of all respondents said they would work

from home more if they had better broadband.

24% of respondents report having school-age children at home. Only 23% of them said the home

broadband is adequate to support homework.

Satisfaction with Existing Broadband

53% of respondents say they are unhappy with their Internet download speeds at home, while 19% are

satisfied.

48% of respondents are not happy with the customer service from their ISP, while 27% are satisfied with

customer service.

62% of respondents say that they are unhappy with the value they get from their ISP compared to the price

they pay. Only 10% of homes are satisfied with the value they are getting.

Support for a Fiber Network

One of the key questions asked in the survey is if respondents support the idea of Sierra County attracting

somebody to build a fiber network. 73% of households support the concept. Another 23% said they might

support the idea but need more information. Nobody said they don’t support pursuing a better broadband

solution.

We asked the reasons why respondents support bringing a new network to the town. 63% said they hope

for more competition. 57% of households hope for lower prices. An overwhelming 89% hope for faster

speeds. 45% hope a new broadband solution would mean better customer service.

Sierra County Broadband Strategic Plan

Page 25

Switching Service to a New Network

In probably the most important question of the survey, we asked households if they would buy Internet

service from a new fiber network. 64% said they would definitely buy. Another 29% said they would

probably buy service and 5% said they would consider buying service. Only 1% said they were unlikely

to buy service.

When asked if respondents would buy a landline telephone, only 15% of the respondents said yes with

another 19% saying probably. 44% said they were unlikely to buy a landline.

Cellular Service

95% of respondents say that they subscribe to cellular service – that’s right at the national average of 95%.

32% of homes said the cellular coverage is not adequate at their homes – one the highest percentages

we’ve ever seen.

Interpreting the Results of the Survey

It’s always a challenge to interpret survey results. It’s first important to recognize that an online survey is

not statistically valid, meaning you can’t take the results from this survey and assume that they are the

same answer you would get if you were to ask the questions to everybody in Sierra County. With that

said, online surveys are considered a good way to understand sentiment, and many of the questions in this

survey are sentiment questions.

Dissatisfaction with the Incumbents. Half of respondents are unhappy with download speeds and

with existing customer service. 62% don’t think they get value for the price they pay. In our

experience these are high results and show widespread dissatisfaction with the existing ISPs.

Support for a New Network. Every respondent was either in favor of attracting a new fiber network

to the community or wanted more information. Nobody opposed the idea. This is the first time I

can ever remember when somebody didn’t oppose the idea.

Download Speeds. This seemed to be the predominant issue for respondents. 50% of respondents

said they aren’t happy with broadband speeds. An overwhelming 89% said that the primary reason

they would consider moving to a new network is to get faster speeds. In the vast majority of

communities where we’ve done surveys, the primary reason people are interested in a new network

is to save money. I’m sure that is important in Sierra County, but speed is a more important factor

since the quality of existing broadband is so poor.

Price Consciousness. You must read between the lines a bit, but I think price consciousness is still

an important issue in the county. 57% said that lower prices would be a factor in getting them to

change to a new network. It’s likely that price consciousness is a factor for the lower than average

penetration for both traditional TV and landline telephones.

Sierra County Broadband Strategic Plan

Page 26

Potential Customers on a New Network. One of the most important reasons to do a survey is to

get a feel for the number of households that might buy broadband from a new network. This is one

of the questions where it matters that the survey was not statistically valid – meaning that we need

to take the results with a grain of salty. However, even an online survey can give us a feel for the

popularity of a new network.

64% of all respondents said they would definitely buy from a new network. Another 21% said they

would probably buy. 5% said they might buy. We interpret these results as follows:

o Customers who say they will definitely buy probably will. We typically see between 20%

and 30% of customers saying they will definitely change to a new network, so your survey

result of 64% is far higher than what we typically see.

o We’ve always found that around 2/3rds of those that say they will “probably” change will

also do so. Some won’t make the effort to make the change, and some will be lured with

low-priced packages aimed to keep them on the current provider. Overall, such respondents

have indicated a decent interest in changing providers. In your case, 29% of respondents

said they would probably change to a new fiber network.

o The “maybe” respondents are just that. We’ve always seen that a third of these customers

can be gained as customers – but at a cost. This is the part of the market that requires the

marketing budget. These customers can be won if you have products and prices they find

attractive and if you make the effort to explain the benefits of your network.

o In summary, the responses we got indicate that 85% of the folks in the rural area would

buy broadband.

o However, we can’t forget that 99 responses on the survey don’t represent the way that

everybody in Sierra County feels about broadband. Since the survey measures sentiment,

we can take the survey to mean that a lot of folks are unhappy with broadband in Sierra

County. We universally got that same response in every interview we conducted.

However, as mentioned earlier, the online survey is not a statistically valid survey. We

know folks are unhappy with broadband, but we can’t use these results to bravely say that

85% of folks in the rural areas will buy broadband on a new fiber network, because other

issues come into play. In every community there are homes that can’t afford broadband.

There are always homes that don’t use broadband either because they just aren’t interested

or because they don’t know how to use it.

In our studies we used a penetration rate of 50% in Truth or Consequences and Elephant

Butte and a penetration of 70% in the rural areas. We based this upon our experience in the

last two years working in other rural counties. We think the 50% goal for the towns is a

solid goal, but one that we wouldn’t want to predict any higher without first doing a

statistically valid survey. We believe the 70% penetration in the rural areas is

conservatively low. We have never worked in a county where the rural broadband was

universally as poor as it is in Sierra County. It’s conceivable that 85% of household would

buy broadband if it came available – that’s the national average penetration rate of

broadband.

Sierra County Broadband Strategic Plan

Page 27

Business Questionnaire / Interviews

As part of the study, we interviewed a number of businesses in Sierra County. We also circulated a

business questionnaire to businesses that asked them to tell us their broadband stories. Following is what

we learned from the interviews and questionnaires:

Not every business has poor broadband. There are businesses in Truth or Consequences using the coaxial

network from TDS for broadband that find the speeds to be acceptable. The primary complaint about TDS

is that speeds tend to vary a lot during the day, but generally are still adequate.

We also talked to Baquera Grocery in Arrey. The store has a 100 Mbps connection from CenturyLink.

Finley visited the store and they are getting fast broadband because they happen to sit directly across the

street from a school that has a fast broadband connection. We don’t know the technology being used – it

could be paired VDSL circuits emanating from the tower at the school, or G.Fast, which is a superfast

DSL product that is only good for up to 600 feet. The rest of the businesses in Arrey can only buy DSL

from CenturyLink and the home broadband there is described as “very slow.”

However, most of the stories we heard were about inadequate broadband.

• We talked to Bartoo Sand and Gravel. This is a 4-generation old business started in 1957 and that

employs 50 people at their facility. The company specializes in creating “gradation” customer

mixes of materials to be used to create asphalt. The company gets broadband wirelessly through

Fastwave. While the connection is adequate most of the time, the broadband does bog down and

even stop, and when that happens the business can’t function. The plant communicates with the

cloud in determining the right mix of materials, and when that process stops the business can’t

function. The company also uses broadband for other purposes such as measuring the gas used to

fill trucks, reporting to OSHA, taking orders from customers, and participating in auctions to buy

raw materials. The company would do a lot more with better broadband. As one example, they

still use punch card timecards because they don’t have enough bandwidth to automate time

keeping. The business says they feel at times like they are in the dinosaur ages.

• We talked to Animas Creek Nursery that grows hardwood trees, conifers, and ornamentals most

for highway projects. The farm has 4 employees. They business uses Windstream for broadband

and the service is described as very slow. The biggest complaint with the broadband and telephone

service is that it sometimes goes out of service for “days.” The business uses the Internet to

communicate with the main office in Santa Fe, and when the connection is down, they lose all

record keeping, including payroll. They also use the Internet to look up instructions for using

various chemicals and fertilizers. They routinely buy parts and materials from Amazon and other

web vendors around fifteen times per week. They would like to use the Internet to do more

advertising to grow the business, but that isn’t possible today. Interestingly, the manager of the

business owns a second home just across the border in Mexico, where the whole residential

neighborhood is wired with fiber – something that doesn’t exist in Sierra County.

• We talked to Elephant Butte Lake RV and Resort. The business has access to broadband, but the

broadband is expensive and inadequate for their needs. In total the business pays $5,100 per month

for telephone and broadband service with a connection from both Windstream and TDS. This

includes 5 Mbps service to run the business, plus the RV park provides 2 Mbps service to RVs.

The owner would obviously like to pay less for the broadband, but the major concern is that their

speeds are inadequate. The business already loses a lot of customers when they find out the

Sierra County Broadband Strategic Plan

Page 28