Version 8/2020

2020

CITY OF TACOMA

Employee Benefits Guide

Table of Contents

Benefits Program Overview……………………………………………………………………………………………………………….……………2

Eligibility…………………………………………………………………………………………………………………………………….……………….2

Qualifying Life Event Changes…………………………………………………………………………………………………..………………….5

Enrolling for Benefits…………………………………………………………………………………………………………….…….……………….5

Payroll Deductions………………………………………………………………………………………………………………..……………………..9

Termination of Benefits……………………………………………………………………………………………….…………….…………………9

Benefits Video Library…………………………………………………………………………………………………….………….………………..9

Questions/Contact Information………………………………………………………………………………..…………..….………………..10

Medical Plan Options……………………………………………………………………………………………………………………………….……11

Dental Plan Options………………………………………………………………………………………………………………………………………13

Vision Plan Options……………………………………………………………………………………………………………………………………….14

Employee Assistance Program (EAP)……………………………………………………………………………………………………….…….15

Life Insurance Options (Basic)………………………………………………………………………………………………………………….…...16

Life Insurance Options (Voluntary)……………………………………………………………………………………………………….……….17

Disability Insurance Options (Basic)…………………………………………………………………………………………….………….…….18

Disability Insurance Options (Voluntary)………………………………………………………………………………………………….……19

Section 125 Flexible Benefits Spending Plan………………………………………………………………………………………………....20

Health Savings Account (HSA)………………………………………………………………………………………………………………………. 21

Wellness Program………………………….……………………………………………………………………………………………………………..22

Leave Compensation (Holidays)……….……………………………………………………………………………………………………………23

Leave Compensation (Sick Leave)………………………………………………………………………………………………………………….24

Leave Compensation (Vacation)…………………………………………………………………………………………………………………….25

Leave Compensation (Personal Time Off)……………………………………………………………………………………………….……..26

Retirement Programs (Mandatory).……………………………………………………………………………………………………………… 27

Retirement Programs (Voluntary)…………………………………………………………………………………………………………….……28

Commute Trip Reduction Program………………………………………………………………………………………………………………..29

Federally Required Notices………………………………………………………………….………………………………………………………..30

2 | Page

Benefit Program Introduction & Overview

Welcome to the City of Tacoma 2020 Plan Year benefits program. The purpose of this document is to assist you

with enrolling for your benefits package in order to address your personal health and financial well-being. We

encourage you to examine this booklet fully in order to understand the benefits available to you and your family

members. It is designed to provide you general information about your benefit options along with details on the

cost of those options and specific levels of coverage. Please take time to read and understand your options in

order to select the coverage which best meets the needs for you and your family.

This guide is an overview of the benefit plans. This is not a legal document. Please refer to the plan booklet,

certificate, policy, or collective bargaining agreement for more detailed information about the plans offered by

the City of Tacoma. If there are any discrepancies between this document and the plan documents, contracts, or

policies, the plan documents, contracts, or policies will prevail.

Eligibility

Unless otherwise specified under the individual benefit section, the City of Tacoma provides benefit coverage for

eligible employees (permanent, project appointive, temporary pending exam, and temporary), spouses/domestic

partners, and dependent children up to age 26. See below for the City of Tacoma’s eligibility requirements for

employees based on their work status and definition of eligible dependents.

Employees

Full-time Employees have mandatory employee benefit coverage, which is effective the first day of the month

following their date of employment, unless they are hired on the first workday of the month and then their

coverage is effective immediately. Effective January 1, 2017, full-time employees will be allowed to opt-out or

“waive” City provided medical, dental, and/or vision insurance with proof of enrollment in alternative coverage

by completing a “Full-Time Employee Opt-Out/Waiver of Insurance Coverage” form and submitting it to the

Human Resources Benefits Office. Note: Full-time employees who fail to enroll for coverage within the election

period will be default enrolled in the Regence PPO medical plan.

Part-Time Employees who are hired to work at least 20 hours a week may elect employee benefits. Part-time

employees who work (30-39 hours) pay the same cost for their benefits as a full-time employee. Part-time

employees who work (20-29 hours) pay a pro-rated share of the cost. If they do not choose to elect employee

benefits, they must complete a “Part-Time Employee Opt-Out/Waiver of Insurance Coverage” form and submit it

to the Human Resources Benefits Office.*

Temporary Employees have mandatory employee benefit coverage (for medical and dental), which is effective the

first day of the month following 60 days of continuous employment. Effective January 1, 2017, full-time

temporary employees will be allowed to opt-out or “waive” City provided medical, dental, and/or vision

insurance with proof of enrollment in alternative coverage by completing a “Full-Time Employee Opt-

Out/Waiver of Insurance Coverage” form and submitting it to the Human Resources Benefits Office. Note:

Temporary employees who fail to enroll for coverage within the election period will be considered to have

waived coverage for their benefits. (See above under part-time employees if applicable.)

Dependents

The following dependents are eligible for coverage on your benefit plans. When you request to enroll a

dependent on your benefit plan(s), you will be required to complete and submit a City of Tacoma “Dependent

Eligibility Verification” form along with supporting documentation:

Your legal spouse

Your domestic partner (same sex or opposite sex)**

Your, your spouse's, or domestic partner's natural child, adopted child, step child, or child legally placed with you or

your spouse or domestic partner for adoption under the age of 26

3 | Page

A child for whom you or your spouse or domestic partner have court-appointed legal guardianship

Your, your spouse's, or domestic partner's otherwise eligible child who is over the age of 26 and is incapable of self-

support because of developmental disability, physical handicap or mental health diagnosis that prevents the child from

establishing or maintaining consistent employment or independence that began before his or her 26th birthday and the

affidavit of dependent eligibility has been submitted

to and approved by the Plan Administrator

*See the Part-time Employee Benefits section for more details related to the pro-rated cost for your benefit options.

**See the Domestic Partner Benefits section for more details related to the definition of domestic partner, benefits options available, and

the taxability of those benefits for your domestic partner dependents.

Dual Coverage

Effective January 1, 2017, no City of Tacoma employee or eligible dependent may be insured under more than

one City of Tacoma medical, dental, or vision insurance plan. If you have dependents who are also employed by

the City of Tacoma, you will need to follow the below criteria when making your benefit elections. Please contact

the Human Resources Benefits Office with questions.

SPOUSES / DOMESTIC PARTNERS

WHO ARE CITY EMPLOYEES

ADULT CHILDREN UP TO AGE 26

WHO ARE CITY EMPLOYEES

Elect the Same Medical/Dental/Vision Plans

Elect Your Own Coverage

One employee must elect family medical, dental, or vision

coverage paying the family premium (if applicable) and cover

the other City employee as a dependent on that benefit plan.

The other employee must elect to waive that medical, dental or

vision benefit plan.

You may elect your own medical, dental, or vision coverage,

and pay the appropriate employee only or family premium

contribution (if applicable). Your parent(s) may not enroll you

as a dependent on their City medical, dental, or vision plan.

Elect Different Medical/Dental/Vision Plans

Enroll as a Dependent on Your Parent’s Plan

Each employee will elect a different medical, dental or vision

plan and pay the appropriate premium (if applicable)

depending on whether they enroll dependent children on the

plan. You may not provide coverage to your City employee

spouse/domestic partner on your medical, dental, or vision

plan. NOTE: Eligible dependent children may also only be

covered on one City medical, dental, or vision plan.

If you want to be enrolled as a dependent on your parent’s City

medical, dental, or vision plan, you must elect to waive City

medical, dental, or vision coverage and your parent must

enroll you as a dependent under their City medical, dental, or

vision plan.

Part-time Employee Benefits

Eligible part-time employees who work (30-39 hours) electing to enroll for the medical, dental, and vision

insurance will pay the same cost for their benefits as a full-time employee. Eligible part-time employees who

work (20-29 hours) electing to enroll for the medical, dental, and vision insurance will be required to pay a pro-

rated share of the cost of those benefit plans based on the hours the employee is hired to work. A current list of

the pro-rated premium rates for these plan options are provided on the next page of this booklet.

Part-time employees can choose to waive one or more of these benefit plans by submitting a signed “Part-Time

Employee Opt-Out/Waiver of Insurance Coverage” form within 30 days of eligibility to the Human Resources

Note: There are IRS restrictions related to the Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) benefits and using these

funds for qualified expenses for certain dependents. The FSA plans may have restrictions for (domestic partners and children of domestic

partners) and the HSA may have restrictions for (domestic partners, children of domestic partners, and adult children). See the “Section 125

Flexible Benefits Spending Plan” and “Health Savings Account (HSA)” sections of this booklet for more information before electing these

benefit plan options.

4 | Page

Benefits Office. Employees choosing to waive coverage will not be able to elect that insurance coverage until the

next annual Open Enrollment period or sooner if they experience a qualifying life event.

2020 - Part-Time Employee Benefit Monthly Premium Rates*

Work Schedule Employee Only Employee + Family

20 hours per week (.5 FTE)

Regence BlueShield PPO

$822.86

$862.86

Regence High Deductible Health Plan

$536.30

$576.30

Kaiser Permanente HMO

$725.85

$765.85

Delta Dental

$58.35

$58.35

Willamette Dental

$74.25

$74.25

VSP Vision

$6.88

$6.88

24 hours per week (.6 FTE)

Regence BlueShield PPO

$666.28

$706.28

Regence High Deductible Health Plan

$437.04

$477.04

Kaiser Permanente HMO

$588.68

$628.68

Delta Dental

$46.68

$46.68

Willamette Dental

$59.40

$59.40

VSP Vision

$5.50

$5.50

28 hours per week (.7 FTE)

Regence BlueShield PPO

$509.71

$549.71

Regence High Deductible Health Plan

$337.78

$377.78

Kaiser Permanente HMO

$451.51

$491.51

Delta Dental

$35.01

$35.01

Willamette Dental

$44.55

$44.55

VSP Vision

$4.13

$4.13

*Part-time employees who work thirty (30) or more hours per week will make premium share contributions equal to those of

full-time employees.

Domestic Partner Benefits

In order for a City employee to enroll a domestic partner and their dependents onto the City of Tacoma benefit

plans, they must have a State-registered domestic partnership as established by RCW 26.60.030, and have a valid

Certification of State Registered Domestic Partnership. The City will also recognize domestic partnerships (with

legal documentation) that were validly formed in other jurisdictions, in accordance with RCW 26.60.090. The

Certification of State Registered Domestic Partnership AND the City of Tacoma “Dependent Eligibility Verification

Form” must be submitted to the Human Resources Benefits Office within the election period.

NOTE: There are tax consequences involved with domestic partner benefits. The IRS does not recognize

domestic partnerships and therefore requires the City of Tacoma to tax the employee on the value of the cost

of the coverage the City of Tacoma provides to the employee’s domestic partner and domestic partner

dependent children. The value of the coverage provided to the employee is considered imputed income and is

subject to additional withholding, unless the domestic partner and/or the domestic partner’s children qualify as

the employee’s IRC Section 152 tax dependent. (Below is a table with the value of the benefit plans for domestic

partner benefits. Employees will experience additional Federal Tax, Social Security, and Medicare withholding on

these dollar amounts per month.)

Example: If your federal income tax rate is 20%, you will pay an additional 20% per month on the appropriate amount(s) listed below.

(E.g. Regence Medical Plan - Domestic Partner Only: $835.27 x 20% = an additional $167.05 in taxes each month)

5 | Page

2020 - Domestic Partner Imputed Income

Plan Domestic Partner

Children of Domestic

Partner

Domestic Partner + Children

of Domestic Partner

Medical – Regence (PPO)

$835.27

$636.51

$1,471.78

Medical - Regence (HDHP) $557.16 $424.58 $981.74

Medical - Kaiser Permanente (HMO) $679.19 $624.10 $1,303.29

Dental - Delta Dental $58.96 $49.71 $108.68

Dental - Willamette Dental $53.19 $63.17 $116.35

Vision – Vision Services Plan $6.80 $6.02 $12.50

Qualifying Life Event Changes

The IRS has established rules for your elections, which dictate that once you have made your elections for the

plan year, you must not change them until the next annual Open Enrollment period, unless a qualified life event

occurs. Any change in election must be on account of and consistent with the qualified life event. You must

make your benefit election changes within 30 days of the event and they are effective the first of the month

following the qualified life event. In the case of births and adoptions, election changes must be made within 60

days of the event and are effective the date of birth or placement for adoption. In cases of divorce, you must

remove your spouse and stepchildren, as they will no longer meet the City’s dependent eligibility requirements.

Failure to do so may result in repayment of claims and costs associated with providing coverage to ineligible

dependents.

Please contact the Human Resources Benefits Office immediately if you experience a qualifying life event in

order to update your benefit plans timely. Dependent eligibility verification paperwork and supporting

documentation will be required. There is detailed information on the benefits website regarding qualifying

events with instructions on how to update your benefit enrollment information, as well as information about

other changes you may want to consider depending on the type of qualifying event involved (e.g. enrollment in

other benefit programs, changing beneficiaries, new W-4, etc.). Examples of qualified life events include:

Marriage or establishment of a domestic partner relationship

Divorce or termination of domestic partner

relationship

Birth, adoption, or placement for adoption of a child

Death of a dependent

Change in spouse/domestic partners’ employment or benefit

plans

Child loses or gains eligibility

Loss of other coverage

Change in status of employment

Enrolling for Benefits

All new full-time or part-time employees are required to attend a New Employee Orientation session upon

being hired with the City of Tacoma. These sessions are held the first week of each pay period. During this

session, you will meet with staff from the Human Resources Benefits Office to learn more about your benefits

options and make your benefit elections through the City of Tacoma’s online enrollment portal Employee Self

Service (ESS).

New employees will be provided instructions on how to install and configure the RapidIdentity

Application to a mobile device, to facilitate enrolling in benefits from a computer not connected to the

City’s network.

Existing employees who would like to access to ESS from a computer not connected to the City’ network

should request access from the IT Service Desk at ITServiceDesk@cityoftacoma.org

or 253.591.2057

during business hours (Monday – Friday 7:30 a.m. – 5:30 p.m.).

6 | Page

Steps to Enroll for your City of Tacoma Benefit Plans through ESS on a

Computer Connected to the City’s Network:

To enroll for benefits, employees must first initially set up their network login credentials on a City computer

that is connected to the City’s network. The Benefits Office staff will assist employees with this process

during their benefits orientation. If you have any problems with your log-in/password, contact the IT Service

Desk at I[email protected]

or 253.591.2057 during business hours (Monday – Friday 7:30 a.m.

– 5:30 p.m.).

Once this login set up is established, employees can login to Employee Self-Service (ESS) from any computer

that is connected to the City’s network or login with VPN access to complete their benefit elections at

www.cityoftacoma.org/ess

.

Per the City of Tacoma’s “Information Systems Resources Usage Policy,” employees are not to share their

password information with anyone.

Enter your dependents and beneficiaries first; then enroll in your benefit plans. As you enroll in each

benefit plan, make sure to check the dependents you want covered by each of those plans.

Make sure to review your elections, hit Save at the end of your enrollment process, and then Print out a

“Summary of Benefits Statement” for your records.

If you added dependents onto your medical, dental, and or vision benefits, you must complete a

“Dependent Eligibility Verification Form” and return it to the Human Resources Benefits Office with your

supporting documentation within 30 days of your benefits effective date.

*NOTE: Employees must enroll for their benefit elections within 30 days of their effective date for benefits.

If this information is not submitted in a timely manner, your dependents will be removed from your

benefit plans and you will need to wait to add them during the next annual Open Enrollment period or

sooner if you experience a qualifying life event.

7 | Page

Steps to Enroll for your City of Tacoma Benefit Plans through ESS from a

Computer not Connected to the City’s Network:

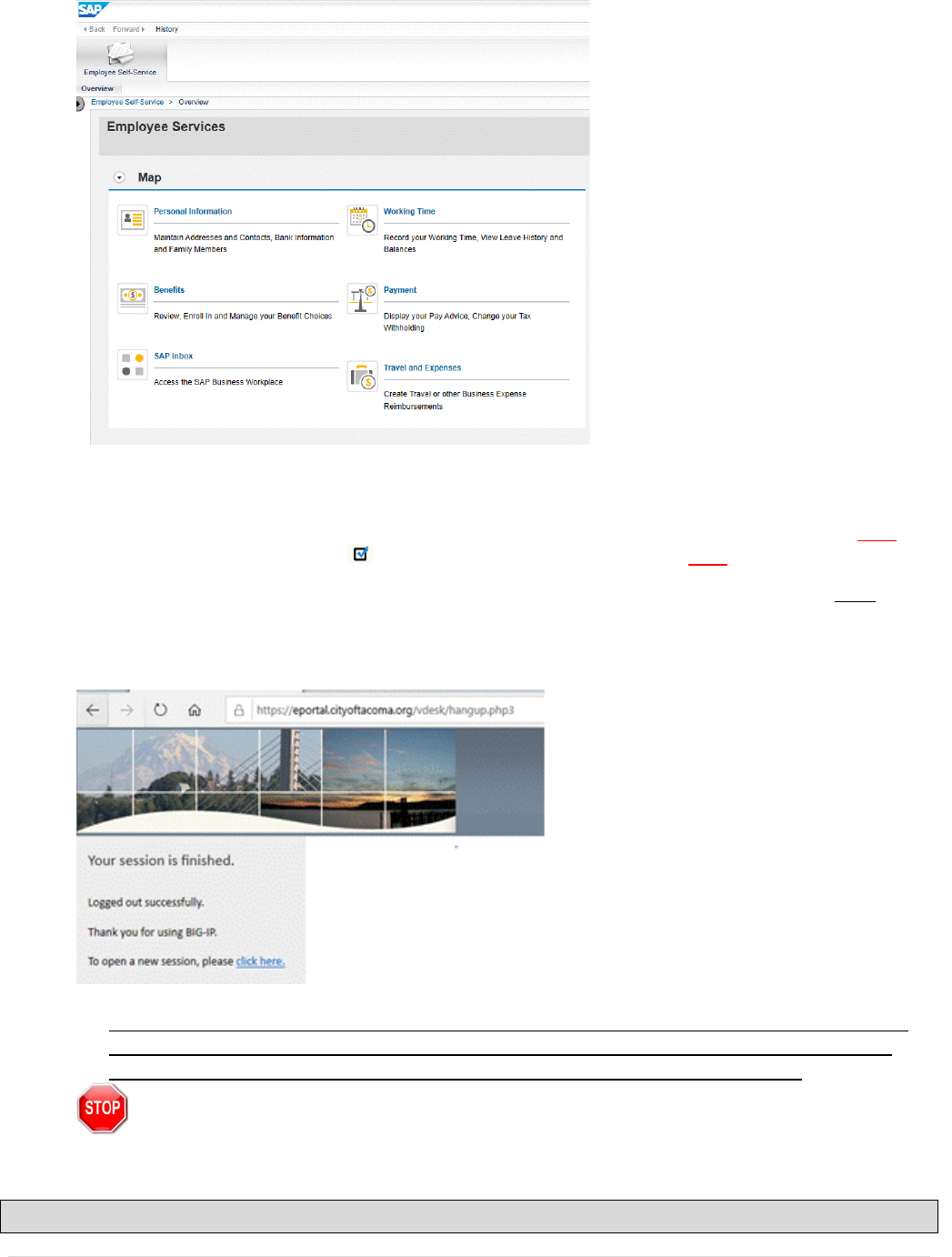

Go to https://access.cityoftacoma.org and enter your user name and password

Click on the ESS box

Open the RapidIdentity App on your mobile device to get current One-Time Password

Enter the One-Time Password from the RapidIdentity App, and logon

8 | Page

Once logged on, select Benefits to enroll, review, and/or update your benefit choices

Per the City of Tacoma’s “Information Systems Resources Usage Policy,” employees are not to share

their password information with anyone.

Enter your dependents and beneficiaries first; then enroll in your benefit plans. As you enroll in each

benefit plan, make sure to check the dependents you want covered by each of those plans.

Make sure to review your elections, hit Save at the end of your enrollment process, and then Print out a

“Summary of Benefits Statement” for your records.

When you have finished, be sure to log off.

Click Logout in the upper right corn, and ensure you see this page

If you added dependents onto your medical, dental, and or vision benefits, you must complete a

“Dependent Eligibility Verification Form” and return it to the Human Resources Benefits Office

with your supporting documentation within 30 days of your benefits effective date.

*NOTE: Employees must enroll for their benefit elections within 30 days of their effective date for benefits.

If this information is not submitted in a timely manner, your dependents will be removed from your

benefit plans and you will need to wait to add them during the next annual Open Enrollment period or

sooner if you experience a qualifying life event.

9 | Page

Payroll Deductions

The City of Tacoma has a bi-weekly payroll. Payroll deductions for benefit premiums will be taken on a pre-tax

basis for all benefit plans, except for the life and disability insurance plans and the deferred compensation Roth

plan. Payroll deductions for all health and welfare benefit programs are taken the first pay period of the month.

Deductions for pension plans, the Deferred Compensation Program, Section 125 Flexible Spending Plan, and

Health Savings Account (HSA) are taken out during each pay period of the month.

Termination of Benefits

Your participation in the City of Tacoma sponsored benefit plans will terminate at midnight on one of the dates

listed below (depending on the benefit plan involved):

The last day of the month you experience a change in employment status that causes the loss of

coverage.

The last day of the month in which you separate employment with the City of Tacoma.

The date of your death.

The last day of the month in which you request termination of a voluntary benefit plan coverage that is

not subject to a qualifying life event change.

The Medical, Dental, Vision, and Section 125 Flexible Benefit Plan (Health Care FSA) benefits can be continued

through COBRA. (See the “Federally Required Notices” section of this booklet for more information on COBRA.)

The employer-provided Basic Life Insurance and voluntary Additional Life Insurance and Dependent Life

Insurance benefit plans can be converted to individual policies with the insurance carrier. Participants enrolled

in the deferred compensation program are able to keep their money in the City of Tacoma plans after separation

of employment and there are many advantages to maintaining funds in a government qualifying 457 Deferred

Compensation program versus rolling the funds over to an Individual Retirement Account (IRA). For more

detailed information on when your benefits end, refer to your summary plan description, benefit booklet, or

policy. For more information on the health and welfare benefits and deferred compensation program contact

the Benefits Office. Please contact the applicable retirement plan administrator with any questions related to

your pension benefits.

Benefits Video Library

There is a series of short videos available to assist you in better understanding the benefit plan offerings located

on the benefits website. Most of the videos are about 5 minutes in length and provide a good overview of how

our benefit programs work and provide a comparison of the plan options

available. You are encouraged to take

time to review these videos to assist you in making an informed decision with your benefit plan elections. The

current video topics include:

Medical Terms & Concepts

Medical Plan Overview

Dental Benefits

Vision Benefits

Wellness

Flexible Spending Account (FSA)

Life and AD&D Insurance

Disability Benefits

How to Use Your HSA

High-Deductible Health Plan with HSA

Disclaimer: People with hearing or speech impairments may request this information in an alternative format

by contacting the City of Tacoma Benefits Office at 253.573.2345 or via email at benefits@cityoftacoma.org.

10 | Page

Questions/ Contact Information

If you have any questions about your City of Tacoma benefit plans or would like to find additional information

and resources, please contact the Human Resources Benefits Office or visit our Benefits website at

www.cityoftacoma.org/benefits

. Some of the information available on the website includes but is not limited to:

Plan booklets, summary of benefits, certificate booklets

Benefit forms

Provider contact information and website links

Benefits video library

CONTACT INFORMATION

253.573.2345

benefits@cityoftacoma.org

www.cityoftacoma.org/benefits

747 Market Street, Room 1420, Tacoma, WA 98402

11 | Page

Medical

Plan

Options

(Traditional

Plans)

Kaiser Permanente

(HMO Plan)

Regence BlueShield

(PPO Plan)

The City of Tacoma provides three health plan options for employees to choose from: two

“traditional plans” and one “high-deductible health plan with a health savings account

(HSA).”

IN-NETWORK PREFERRED PROVIDER

PARTICIPATING

PROVIDER

NON-PARTICIPATING

PROVIDER*

EMPLOYEE RESPONSIBILITY

ANNUAL

DEDUCTIBLE

(Single/Family)

$100/ $200 $250/ $500

OUT-OF-POCKET

MAXIMUM

(Single/Family)

$1,500/ $3,000 $1,500/ $3,000

CO-INSURANCE

(For Most Services)

N/A 10%

40%

50%

OFFICE VISITS

(No Deductible)

$10 Primary, $20

Specialist copay +

Deductible

$20 copay

$20 copay + 40%

coinsurance

$20 copay + 50%

coinsurance

TELEHEALTH

Care Chat and Online

Visits - $0

(MD Live) $10 copay

(Virtual Visit) $10 copay

(Virtual Visit) $10

copay

(Virtual Visit) 50%

PREVENTIVE

(No Deductible)

$0 0% 0% 50%

PRESCRIPTIONS

Retail

(30 day supply)

(30 to 90 day supply)

Generic

$5

$5

Preferred Brand $25 $35

Non-Preferred Brand $50 $60

Specialty Formulary*

N/A

$75

Specialty

Non-Formulary*

N/A $150

Mail-Order

(90 day supply)

(90 day supply)

Two times the drug

co-pay. Available when

dispensed through

Kaiser Permanente’s

mail-order service.

Two times the drug co-pay. Available when dispensed through

Regence’s mail-order service.

NURSE LINE

Access 24/7

1.800.297.6877

Access 24/7

1.800.267.6729

CONTACT

INFORMATION

1.888.901.4636

1.855.877.0047

www.kp.org/wa

www.regence.com

PREMIUM

$40 Month Single Coverage (Pre-Tax) $80 Month Family Coverage (Pre-Tax)

*Specialty medications must be registered through AllianceRx Walgreens Prime through Regence BlueShield.

Note: The Regence plan design listed above does not apply to union bargaining unit Local 6. Please see the plan

document on the benefits website for details.

12 | Page

Medical Plan

Options

(HDHP/HSA)

Regence BlueShield

(HDHP Plan)

The City of Tacoma provides three health plan options for employees to choose from: two

“traditional plans” and one “high-deductible health plan with a health savings account

(HSA).”

PREFERRED PROVIDER PARTICIPATING PROVIDER

NON-PARTICIPATING

PROVIDER*

EMPLOYEE RESPONSIBILITY

ANNUAL DEDUCTIBLE

(Single/Family)

$1,500/ $3,000

No Coverage

Participants are responsible for the full cost of all expenses until the annual deductible is satisfied.

Then the below schedule applies up to the annual Out-of-Pocket Maximum.

OUT-OF-POCKET

MAXIMUM

(Single/Family)

$3,000/ $6,000

No Coverage

CO-INSURANCE

(For Most Services)

20% 40% 50%

PREVENTIVE

(No Deductible)

0%

50%

TELEHEALTH

(MD Live) After Deductible 20%

(Virtual Visit) After Deductible

20%

(Virtual Visit) After Deductible 20%

(Virtual Visit) After

Deductible 50%

PRESCRIPTIONS*

Deductible is waived for certain chronic conditions drugs included in the Optimum Value Medication

List. No charge for certain FDA-approved contraceptives and certain preventive drugs and

immunizations at a participating pharmacy.

Retail/ Mail

(30 to 90 day supply)

Generic

20% after the annual deductible is satisfied – member may be balanced billed for

Non-participating pharmacy used.

Preferred Brand

Non-Preferred Brand

HEALTH SAVINGS

ACCOUNT (HSA)

HSA IRS Annual

Contribution Limits

$3,550/$7,100**

(Employee/Family)

Employer Annual

Contributions to

HSA***

Employee Only

Employee + Family

$500 without Wellness

$1,000 without Wellness

$1,250 with Wellness

$2,500 with Wellness

NURSE LINE

Access 24/7 1.800.267.6729

HSA ADMINISTRATOR

(HealthEquity)

Access 24/7 365 days 866.346.5800

www.healthequity.com/HSAlearn

CONTACT

INFORMATION

1.855.877.0047

www.regence.com

PREMIUM

$40 Month Single Coverage (Pre-Tax) $80 Month Family Coverage (Pre-Tax)

These types of medical plans are not the right fit for everyone and not everyone can elect this plan if they are not eligible to establish

a Health Savings Account (HSA). Review the “Health Savings Account (HSA)” section of this booklet, benefit videos, and Frequently

Asked Questions document on the benefits website for more details before electing this plan option.

* Specialty medications must be registered through AllianceRx Walgreens Prime through Regence BlueShield.

** Individuals age 55 and over can make an additional annual $1,000 catch-up contribution. Employer contributions to the HSA are pro-rated

per pay period.

Note: The Regence plan design listed above does not apply to union bargaining unit Local 6. Please see the plan

document on the benefits website for details.

13 | Page

Dental

Plan

Options

Willamette Dental Group

(DHMO Plan)

Delta Dental of Washington

(PPO Plan)

The City of Tacoma provides two employer-paid dental plan options for employees to

choose between.

IN-NETWORK*

DELTA

DENTAL PPO

DENTIST

DELTA DENTAL

PREMIER DENTIST

NON-

PARTICIPATING

DENTIST

EMPLOYEE RESPONSIBILITY

ANNUAL

DEDUCTIBLE

(Single/Family)

None

None $50/ $150 $50/ $150

ANNUAL BENEFIT

MAXIMUM

(Single/Family)

None** $2,000

OFFICE VISIT CO-

PAY

$5 Per Office Visit N/A

DIAGNOSTIC/

PREVENTIVE

BASIC/RESORATIVE

Class I: Exam, Cleaning, X-ray, Fluoride, Sealant and

Periodontal Maintenance

0%

Class II: Restorations, Endodontics, Periodontics, Oral

Surgery Crowns

20%

MAJOR

Class III: Dentures, Partial Dentures, Implants,

Bridges

50%

ORTHODONTIA***

$5 Per Office Visit, $150 Pre-

Treatment copay/ $400

Comprehensive copay

SPECIALTY OFFICE

VISIT

$30 copay N/A

CONTACT

INFORMATION

1.855.433.6825

1.800.554.1907

www.willamettedental.com

www.DeltaDentalWA.com

PREMIUM $0 Month Single Coverage $0 Month Family Coverage

*Members are responsible for charges in excess of $100 for Out-of-Area Emergency Care with Willamette Dental Group.

**Temporomandibular Joint Disorder (TMJ) has a $1,000 annual maximum/ $5,000 lifetime maximum with Willamette

Dental Group.

***$150 pre-treatment co-pay is applied to the full $400 comprehensive co-pay if the member proceeds with the

treatment plan for orthodontia with Willamette Dental Group.

Note: The Delta Dental plan design listed above does not apply to union bargaining unit Local 6. Please see the plan

document on the benefits website for details.

14 | Page

Vision Plan

Options

VSP

Kaiser Permanente

(HMO Plan)*

The City of Tacoma provides two employer-paid vision plan options for employees.

IN-NETWORK

OUT-OF-

NETWORK

IN-NETWORK

(Kaiser Permanente)

EMPLOYEE RESPONSIBILITY

ANNUAL

DEDUCTIBLE

(Single/Family)

None None

EXAM (Primary

Care/ Specialist)

$10 copay

$10 copay +

charges in

excess of $50

$10 copay

PRESCRIPTION

GLASSES

$25 copay $25 copay

Charges in excess of $150 allowance (applies

to all hardware)***

LENSES

(Single/Bifocal/

Trifocal)

$0

(additional copays apply for

lens enhancements)

Charges in

excess of

$50/ $75/

$100

FRAMES

Charges in excess of the

$150 allowance/ $170

featured frame brands

allowance (20% discount

provided above allowance)

$80 Costco© allowance

Charges in

excess of $70

CONTACTS

Up to $60 copay + charges

in excess of $150 allowance

(in lieu of glasses)

Charges in

excess of

$105 (in lieu

of glasses)

LASER VISION

5% - 15% discount provided

No coverage

available

CONTACT

INFORMATION

1.800.877.7195

1.888.901.4636

www.vsp.com

www.wa-eyecare.kaiserpermanente.org/

PREMIUM $0 Month Single Coverage $0 Month Family Coverage

*Employees who enroll in the Kaiser Permanente HMO medical plan have their vision coverage provided through their

medical plan and cannot elect the VSP vision plan.

- Benefits listed above for Kaiser Permanente are provided every 12 months. Benefits listed above for VSP are provided every

calendar year, except for frames, which are provided every other calendar year.

- Kaiser Permanente provides members under age 19 one (1) pair of frames and lenses a year at no charge and deductible

does not apply or contact lenses covered at 50% coinsurance.

- VSP offers members a hearing aid discount up to 60% through TruHearing. Learn more at truhearing.com/vsp or call

877.396.7194.

NOTE: Temporary employees are not eligible for vision benefits, unless they enroll in the Kaiser Permanente (HMO) medical

plan. The VSP plan design listed above does not apply to union bargaining unit Local 6. Please see the plan summary

on the benefits website for details.

15 | Page

Employee

Assistance

Program

(EAP)

First Choice Health

The City of Tacoma provides you an Employee Assistance Program (EAP) benefit,

which provides cost-free, convenient, and confidential consultation and work life

resources for you and your eligible dependents to help manage life’s challenges.

You can access the EAP 24/7 by phone or their website.

CLINICAL SUPPORT

Provides up to 3 face-to-face, live chat, live phone, messaging, and live video sessions, per

incident/unrelated issue with a licensed behavioral health provider for a variety of family,

emotional, and work related issues. Some examples include:

Stress and Anxiety

Couples and Relationships

Alcohol/ Drug Problems

Change and Life Transitions

Crisis Management

Depression

Parenting

Grief and Loss

Sleep Problems

Work Conflict

WORK LIFE

RESOURCES

Provides consultation on a variety of work life issues that can affect you and your family

members. Information is available in a way that best meets your needs: phone, online,

email, fax, or mail. Work life resources available include:

Legal Consultation

Free 30-minute legal consultation. If you decide to retain the

attorney, you will receive a 25% reduction in their normal hourly

fees. Legal forms and templates are also available on the First

Choice website.

Financial Services

Free 30 minutes of financial counseling and education.

Identity Theft

Resolution

Free step-by-step guidance and consultation about identity theft

with a Fraud Resolution Specialist.

Home Ownership

Provides no-cost home ownership coaching, access to a network of

prescreened mortgage and real estate professionals, full service

lending, down payment assistance and grant programs, and

thousands of dollars in savings on closing costs with lender and real

estate commission credits.

Childcare

Consultation

Provides assistance when childcare needs arise. Qualified childcare

professionals help identify resources from prenatal care to college

education.

Eldercare Services

Connects you to eldercare experts and resources to assist with

aging or disabled loved ones.

CONTACT

INFORMATION

1.800.777.4114 or TTY 1.800.777.4969

www.FirstChoiceEAP.com

User Name: cityoftacoma

PREMIUM

$0 Month

NOTE: Library employees are provided a different EAP benefit. Refer to the Human Resources Department at the Tacoma

Public Library for details on this plan offering.

16 | Page

Life

Insurance

Options

(Basic)

The Standard

The City of Tacoma provides you two types of employer-paid Life Insurance

benefits for you and your designated beneficiaries in the event of your death. You

can feel secure with the knowledge that your family will be taken care of should

you die unexpectedly.

EMPLOYER-PAID BENEFITS

BASIC LIFE

INSURANCE

Coverage is 1 times the employee’s annual salary rounded up to the next highest multiple of

$1,000, up to a maximum of $400,000.

Special Features Include:

Travel Assistance

Assist America is available 24/7 to help you cope with emergencies

when you travel more than 100 miles from home or internationally for

trips of up to 180 days. Services include:

Pre-trip Assistance

Medical Assistance

Trip Assistance

Legal Assistance

Emergency Transportation

Services/ Natural Disaster

Evacuation Coordination

Personal Security Services

U.S., Canada, Puerto Rico, U.S. Virgin Islands, and Bermuda

call 800.872.1414. Other locations worldwide, call

1.609.986.1234. Mobile App available through Google Play

and Apple App Store (Reference # 01-AA-STD-5201).

www.standard.com/travel

medservices@assistamerica.com

Conversion Option

Option to continue your life insurance policy if you were to leave

employment with the City of Tacoma.

Accelerated Death

Benefit

Option to receive up to 75% of your insurance policy if you are

terminally ill.

Waiver of

Premium

Option to continue your life insurance policy at no cost if you were

deemed totally disabled.

AD&D INSURANCE

Coverage 1 times the employee’s annual salary rounded up to the next highest multiple of

$1,000, up to a maximum of $400,000 in the instance of an accidental death. Additionally

provides a schedule of benefits in the case of dismembering accident not resulting in death.

Additional Benefit

Features:

Seat Belt Benefit (deceased was wearing seatbelt)

Airbag Benefit (deceased was in a vehicle with an airbag)

Family Benefits Package (career adjustment , child care, higher

education)

Dismemberment

Benefit

Loss

% of Benefit Payable

One hand or one foot or sight

in one eye.

Two or more losses listed

above.

50%

50%

PREMIUM

$0 Month

NOTE: This benefit is not available to Temporary Employees, Full-time members of the Armed Services, or Library Employees.

Library Employees are provided a different life insurance benefit and should refer to the Human Resources Department at

the Tacoma Public Library for details on this plan offering.

17 | Page

Life

Insurance

Options

(Voluntary)

The Standard

In addition to the Basic Life and AD&D insurance policies, the City of Tacoma offers

access to voluntary employee-paid Supplemental Life and AD&D Insurance

benefits at group rates, for you and your family members.

EMPLOYEE-PAID VOLUNTARY BENEFITS

ADDITIONAL LIFE

AND AD&D

INSURANCE

Employee

Elect coverage in units of $10,000 up to maximum of $300,000.

Guarantee Issue: $50,000*

Spouse/Domestic

Partner

Coverage is half the employee’s annual earnings, rounded to the

next lower $1,000, to a maximum of $100,000, not to exceed

50% of the employee’s life insurance (basic and additional

combined).

Guarantee Issue: $25,000*Issue: $50,000*coverage

*Guarantee Issue: An employee and spouse/domestic partner who apply for coverage

within 30 days of initially being eligible can apply for the guarantee issue limit of coverage

without providing health information. If they wish to apply for coverage in excess of these

amounts, or apply for additional life insurance through a late application, they must

complete a health questionnaire and will be subject to medical underwriting through the

insurance carrier.

Age Reduction Schedule: Coverage reduces by 35% at age 70, and 50% at age 75.

PREMIUM

Age Range

Rate (Per $1,000 of Coverage)

<30

$0.070

30 – 34

$0.096

35 – 39

$0.106

40 – 44

$0.115

45 – 49

$0.163

50 – 54

$0.239

55 – 59

$0.430

60 – 64

$0.680

65 – 69

$1.230

70 +

$1.982

To calculate the premium for the employee or spouse/domestic partner:

Amount elected ___________ ÷ $1,000 = __________ x Rate from above Chart = Mo. Premium

Example: 40-Year Old Employee wishes to apply for $50,000 in Additional Life Insurance Coverage

$50,000 ÷ $1,000 = 50 x $0.239 = $11.95 Month

DEPENDENT LIFE

Spouse/Domestic

Partner

$5,000 death benefit

Child

$2,000 death benefit per child through age 25 unless disabled

PREMIUM

$1.95 Month (After Tax)

NOTE: This benefit is not available to Temporary Employees, Full-time members of the Armed Services, or Library Employees.

Library Employees are provided a different life insurance benefit and should refer to the Human Resources Department at

the Tacoma Public Library for details on this plan offering.

18 | Page

Disability

Insurance

Options

(Basic)

The Standard

The City of Tacoma provides you with an employer-paid Long Term Disability (LTD)

Insurance benefit in the event you become disabled. The LTD benefit provides

replacement of some of your income in the event you are not able to work.

EMPLOYER-PAID BENEFIT

BASIC LONG TERM

DISABILITY (LTD)

INSURANCE

Monthly Benefit

Coverage is 60% of the first $1,500 in monthly pre-disability earnings,

reduced by deductible income (e.g., work earnings, workers’

compensation, etc.).

Waiting Period

Before Benefits

Become Available

180 days

Maximum Benefit

Period

Max Benefit Period Begins at Age

Maximum Benefit Period

61 or younger

To age 65, or 3 years 6 months

62

3 years 6 months

63

3 years

64

2 years 6 months

65

2 years

66

1 year 9 months

67

1 year 6 months

68

1 year 3 months

69 or older

1 year

Special Feature

Survivor Benefit: provides a death benefit equal to a lump sum of 3

months of the LTD benefit without reduction by deductible income to

the surviving family.

PREMIUM

$0 Month

NOTE: This benefit is not available to Temporary Employees, emergency personnel employees, or Full-time members of the

Armed Services, or commissioned Public Safety employees, or a belt line employee classified as an engineer, yardmaster,

switchman, or switch supervisor. Public Safety and belt line employees are provided long-term disability benefits through

their union affiliation. Library Employees are provided a different disability insurance benefit and should refer to the Human

Resources Department at the Tacoma Public Library for details on this plan offering.

19 | Page

Disability

Insurance

Options

(Voluntary)

MetLife (STD)

The Standard (LTD)

In addition to the Basic Long Term Disability (LTD) insurance, the City of Tacoma

offers access to voluntary employee-paid Supplemental Short and Long Term

Disability benefits at group rates for you in the event you become disabled. The

Short Term Disability benefit provides replacement of some of your income in the

immediate future and can help bridge the gap to LTD. The Supplemental Long Term

Disability insurance can provide additional LTD income and can shorten the waiting

period for LTD benefit payments to begin.

EMPLOYEE-PAID VOLUNTARY BENEFITS

SUPPLEMENTAL

SHORT TERM

DISABILITY (STD)

INSURANCE

Weekly Benefit $212 per week for a non-work related injury/illness

Waiting Period

Before Benefits

Become Available

Injury: 0 Days

Sickness (Includes Pregnancy): 7 Days

Maximum Benefit

Period

Under Age 60

Up to 26 weeks due to Injury

Up to 13 weeks due to Sickness

Age 60 or Over

Up to 26 weeks in a calendar year due to Injury

Up to 13 weeks in a calendar year due to Sickness

PREMIUM

$4.00 Month

SUPPLEMENTAL

LONG TERM

DISABILITY (LTD)

INSURANCE

Monthly Benefit

Coverage is 60% of the first $6,833 in monthly pre-disability earnings

in excess of $1,500, reduced by deductible income (e.g., work

earnings, workers’ compensation, etc.).

Maximum Benefit: Across both the Basic LTD Plan and the

Supplemental LTD Plan is 60% of $8,333 or $5,000 in monthly pre-

disability earnings, reduced by deductible income.

Waiting Period

Before Benefits

Become Available

90 days (If this option is selected, the Basic LTD benefit will change to

90 days)

180 days

Maximum Benefit

Period

Same as Basic LTD Coverage

Special Feature

Survivor Benefit: provides a death benefit equal to a lump sum of 3

months the LTD benefit without reduction by deductible income.

PREMIUM

Waiting Period Benefit Payout % of Monthly Earnings Cap $8,333 (After-Tax)

90 days

180 days

0.303%

0.205%

*Guarantee Issue: An employee who applies for Supplemental STD or LTD benefits within 30 days of initially being eligible

will be enrolled in these benefit programs without providing health information. Employees can apply for these benefits at

any time; however, a late application will require the completion of a health questionnaire and will be subject to medical

underwriting through the insurance carrier.

NOTE: This benefit is not available to Temporary Employees, emergency personnel employees, or Full-time members of the

Armed Services, or commissioned Public Safety employees, or a belt line employee classified as an engineer, yardmaster,

switchman, or switch supervisor. Public Safety and belt line employees are provided long-term disability benefits through

their union affiliation. Library Employees are provided a different long-term disability insurance benefit and should refer to

the Human Resources Department at the Tacoma Public Library for details on this plan offering.

20 | Page

Section 125

Flexible

Benefits

Spending

Plan

Trusteed Plans Service Corporation (TPSC)

The City of Tacoma provides employees a Section 125 Flexible Benefits Spending

Plan, which allows employees to save money on their health and dependent care

expenses through the use of pre-tax dollars. Employees save by setting aside an

amount of money per year before taxes are taken out into an account to reimburse

themselves for out-of-pocket health and dependent care expenses. Under the

Section 125 Flexible Benefits Spending Plan, there are two plan components:

Health Flexible Spending Account (Health FSA) for out-of-pocket health expenses

and Dependent Care Flexible Spending Account (Dependent Care FSA) for out-of-

pocket day care expenses for a child or adult dependent who cannot care for

themselves.

EMPLOYEE-PAID VOLUNTARY BENEFITS

HEALTH CARE FSA

Coverage

Elect up to a maximum deduction of $2,750/ year pre-tax

Type of Covered

Expenses

Health FSA funds can be used to pay for any “qualified medical expense”.

Some qualified expenses include medical care, prescription drugs, dental and

vision expenses. Refer to IRS Publication 502 Medical and Dental Expenses and

Section 213(d) of the Internal Revenue Code (IRC) for more details.

Note: The IRS may not allow the use of a Health FSA to pay for qualified health expenses

for some dependents (e.g. domestic partner and children of a domestic partner), unless

they are claimed on the employee’s tax return and meet the requirements of IRC Section

152.

Deadline for

Incurred Expenses

December 31

st

Grace Period

If an employee and their eligible dependents have not incurred expenses to

submit against their FSA account during the plan year, a grace period allows

for expenses incurred January 1

st

– March 15

th

to be submitted against the

prior year’s FSA account.

Claims Filing

Deadline

April 30

th

– If claims are not submitted by the deadline any funds left in the

Employee’s FSA account will be forfeited to the City of Tacoma to offset plan

operating expenses.

DEPENDENT CARE

FSA

Coverage

Elect up to a maximum deduction of $5,000/ year pre-tax (filing jointly)/

$2,500/ year pre-tax (filing separately)

Type of Covered

Expenses

Qualifying expenses related to care for your child, disabled spouse, elderly

parent, or other dependent who is physically or mentally incapable of self-

care, so you can work, or if you’re married, for your spouse to work, look for

work, or attend school full time. The alternative to using a Dependent Care

FSA is to take a dependent care tax credit when you file your federal income

taxes. Your preferred method depends on your income, number of eligible

dependents, and other factors. See IRS form 2441 for more details about the

dependent care tax credit at the IRS website www.irs.gov.

Deadline for

Incurred Expenses

December 31

st

Grace Period

None

Claims Filing

Deadline

April 30

th

– If claims are not submitted by the deadline, any funds left in the

Employee’s FSA account will be forfeited to the City of Tacoma to offset plan

operating expenses.

CONTACT

INFORMATION

253-564-5611, Ext. 210 or toll-free 1-800-426-9786, Ext. 210

www.tpscbenefits.com and click on the RESOURCES tab

PREMIUM

$0 Month

NOTE: Participants are provided a debit card to use for the Health Care FSA. Reimbursements are provided by check or employees can sign

up for direct deposit through TPSC.

21 | Page

Health

Savings

Account

(HSA)

HealthEquity

The City of Tacoma provides three health plan options for employees to choose from: two

“traditional plans” and one “high-deductible health plan with a health savings account

(HSA).” An HSA is a tax-advantaged savings account that is connected to a qualified high-

deductible health plan. Funds in an HSA allow an individual to pay for current health

expenses and save for future qualified medical expenses on a pre-tax basis.

EMPLOYER-PAID and EMPLOYEE-PAID BENEFITS

ELIGIBILITY

The Internal Revenue Service has established rules for HSAs that restrict who can establish an account

and make contributions:

- The individual must be enrolled in a qualified high-deductible health plan (HDHP).

- The individual cannot be covered by another health insurance plan unless it is a qualified

HDHP.

-The individual cannot be enrolled in a general-purpose flexible spending account (FSA) or have

coverage through a spouse’s FSA.

-The individual cannot be enrolled in a health reimbursement arrangement (HRA) or have coverage

through a spouse’s HRA.

-The individual cannot be covered by other health insurance through Medicare, TRICARE, or Indian

Health Services.

-The individual cannot be claimed as a dependent on someone else’s tax return. They can be listed as

a spouse filing jointly.

COVERAGE

IRS Maximum Annual HSA Contribution Limits for 2018

Self-Only

$3,550

Family

$7,100

Catch-Up Contribution (Age 55-65)

$1,000

Note: Employer and Employee contributions combined cannot exceed the annual IRS limits.

TYPES OF COVERED

EXPENSES

HSA funds can be used to pay for any “qualified medical expense”. Some qualified expenses

include medical care, prescription drugs, dental and vision expenses. Refer to IRS Publication

502 Medical and Dental Expenses and Section 213(d) of the Internal Revenue Code (IRC) for

more details.

Note: The IRS may not allow the use of an HSA account to pay for qualified health expenses for some dependents

(e.g. domestic partners and adult children), unless they are claimed on the employee’s tax return and meet the

requirements of IRC Section 152.

EMPLOYER

CONTRIBUTIONS

Employee Only

Employee + Family

$500/yr. without Wellness

$1,000/yr. without Wellness

$1,250/yr. with Wellness

$2,500/yr. with Wellness

If an employee enrolls in a HDHP, they will be provided employer contributions to their HSA

account (annual figures above prorated per month). The amount provided will depend on

whether the individual participated in the Wellness Program.

(See the Wellness Program section

of this booklet for more details.)

CONTACT

INFORMATION

Access 24/7 365 days 866.346.5800

www.healthequity.com/HSAlearn

PREMIUM

$0 Month

*Review the benefit videos on high-deductible health plans (HDHP) and health savings accounts (HSA) and the Frequently

Asked Questions (FAQ) document on the benefits website for more details before electing the HDHP with HSA plan option.

22 | Page

Wellness

Program

Tacoma Employee Wellness Program

The Tacoma Employee Wellness Program provides the education, motivation, and

tools necessary to help City of Tacoma Employees improve their health and

well-being.

REDBRICK HEALTH

PORTAL

RedBrick’s technology platform blends high-tech with high-touch to deliver the ultimate

health and well-being engagement experience. There are four main components of this

website that City employees are encouraged to participate in:

Health Compass: This is a simple, quick, and engaging health assessment tool that takes 15-

20 minutes to complete. There are approximately 50 questions available to gather

information about several health related areas such as, alcohol, cardiovascular risk, nutrition,

physical activity, stress, tobacco, weight, work productivity, etc. This process provides

employees with personalized information about their strengths, weaknesses, and areas of

risk.

Journeys: A Journey takes a big goal like eating healthier and breaks it down into small

achievable steps. Each Journey starts with a few questions to personalize the experience for

the participant. A Journey is made up of several stages and each stage has many steps for

employees to choose from. When enough experience points in one stage have been earned,

a challenge step will be offered. When a challenge step is completed, the individual can

proceed to the next stage in their Journey.

Track: Track is a health habits tracker, which allows you to track your exercise, healthy eating

habits and wellbeing habits. Participants can also sync their favorite devices and apps to Track

so that they update automatically.

City of Tacoma Health Activities: You are able to earn points towards your wellness

incentive for completing your annual physical, participating in a certified weight management

program, or attending City-sponsored wellness webinars or onsite classes.

WELLNESS

INCENTIVE

By completing certain tasks within the RedBrick Health Portal, employees can earn a Wellness

Incentive, which will vary based on which health plan an employee enrolls in.

Traditional Health

Plan (Regence PPO or

Kaiser Permanente

HMO)

$20 per month credit toward their premium contribution for

medical insurance coverage under the Regence and Kaiser

Permanente Traditional Plans.

High Deductible

Health Plan (Regence

HDHP)

$40 per month credit toward their premium contribution for

coverage under the Regence HDHP/HSA Health Plan option.

AND

Higher employer contributions to the employee’s Health Savings

Account (HSA). (See the “Health Savings Account (HSA)” section of this

booklet for details.)

CONTACT

INFORMATION

Shannon Carmody, Wellness Coordinator 1.253.591.5200

wellness@cityoftacoma.org

wellness.cityoftacoma.org

PREMIUM $0 Month

Note: Union bargaining unit Local 6 has different requirements to earn the annual wellness incentive. Please see the

benefits website for details.

23 | Page

Leave

Compensation

(Holidays)

City of Tacoma

The City of Tacoma pays employees to be away from work for certain

observed holidays.

EMPLOYER-PAID BENEFIT

ELIGIBILITY

To be eligible for holiday pay, an employee must be a regular, probationary, project,

temporary pending exam or appointive employee. Temporary employees must be

employed for 6 months before they are eligible for any paid holidays.

HOLIDAY SCHEDULE

12 days per year (Total of 96 hours)

January

New Year’s Day

January 1st

January

Martin Luther King Day

3

rd

Monday in January

February

Presidents’ Day

3

rd

Monday in February

May

Memorial Day

Last Monday in May

July

Independence Day

July 4th

September

Labor Day

1

st

Monday in September

November

Veterans Day

November 11th

November

Thanksgiving Day

4

th

Thursday in November

November

Day Following Thanksgiving

4

th

Friday in November

December

Christmas Day

December 25th

Anytime

Floating Holiday

Two per Year

Floating Holidays must be scheduled at a mutually agreeable time. In order to be

eligible for the floating holidays, an employee must have been or be scheduled to be

continuously employed for four months during the calendar year of entitlement.

Employees in some departments, depending on shift schedules, have all floating

holidays.

*Employees may have other holiday schedules as may be provided for in a collective bargaining agreement.

**To qualify for a paid holiday, an employee must be in a paid status on both the entire regularly scheduled workday

immediately preceding the holiday and the entire regularly scheduled workday following the holiday. When a holiday

falls on Saturday, the Friday before is observed. When a holiday falls on Sunday, the following Monday is observed.

NOTE: Questions related to Holidays should be directed to your department’s timekeeper.

24 | Page

Leave

Compensation

(Sick Leave)

City of Tacoma

The City of Tacoma pays employees to be away from work for employee

illness or injury, doctor appointments, or the serious illness or injury of a

family member as defined by Washington State law.

EMPLOYER-PAID BENEFIT

ELIGIBILITY

Employees not enrolled in the Personal Time Off (PTO) plan earn sick leave.

BENEFIT

Sick leave is accrued at 3.69 hours (12 days per year) for each bi-weekly pay period in

which an employee has time in a paid status. There is no maximum accrual.

UTILIZATION

Employees may take sick leave after it has been earned and accrued. There is no

waiting period. Sick leave can be taken in one-tenth (1/10) of an hour increments.

BENEFIT PAYOUT

Separation in Good Standing: 10% of a 120-day maximum benefit will be paid,

provided the employee has a minimum of 80 hours accrued.

Termination/Death: 25% of your sick leave balance will be paid.

Retirement: For unrepresented and certain union represented employees who are

retiring, sick leave severance pay is deposited into a VEBA account for post- retirement

medical and dental expenses.

NOTE: Questions related to Sick Leave should be directed to your department’s timekeeper.

25 | Page

Leave

Compensation

(Vacation)

City of Tacoma

The City of Tacoma pays employees to be away from work for vacation.

EMPLOYER-PAID BENEFIT

ELIGIBILITY

Permanent employees not enrolled in the Personal Time Off (PTO) plan earn vacation

each bi-weekly pay period in which they have time in a paid status.

VACATION SCHEDULE

Completed Years of Aggregate Service

No. of 8-Hour Days

Per Year

Hours Earned per

Pay Period

Completion of Years 0, 1, 2, 3

12

3.69

Completion of Years 4, 5, 6, 7

15

4.60

Completion of Years 8, 9, 10, 11, 12, 13

17

5.22

Completion of Years 14, 15, 16, 17, 18

20

6.14

Completion of 19 Years

21

6.45

Completion of 20 Years

22

6.76

Completion of 21 Years

23

7.07

Completion of 22 Years

24

7.38

Completion of 23 Years

25

7.69

Completion of 24 Years

26

8.00

Completion of 25 Years

27

8.31

Completion of 26 Years

28

8.62

Completion of 27 Years

29

8.93

Completion of 28 Years or More

30

9.24

Vacation accruals based on tenure shall be credited at the first of the calendar year in

which any of the above periods of aggregate City service will be completed. Eligibility

for tenure based vacation accruals shall be determined by the length of aggregate

service with the City. The applicable accrual rate shall be determined as of January 1 of

each calendar year and shall be based on the rate applicable to the number of years of

aggregate service the employee will complete within that calendar year.

For example, on January 1, an employee who will complete four years of aggregate

service with the City within that calendar year will begin to accrue vacation leave at a

rate of 4.60 hours per pay period.

UTILIZATION

Employees are authorized to use vacation leave after it is earned and accrued. Vacation

is taken in increments of one-tenth (1/10) of an hour.

BENEFIT PAYOUT

In the event of retirement, separation, or death, 100% of vacation accruals will be paid.

NOTE: Questions related to Vacation should be directed to your department’s timekeeper.

26 | Page

Leave

Compensation

(Personal

Time Off)

City of Tacoma

The City of Tacoma pays employees to be away from work for Personal Time

Off (PTO).

EMPLOYER-PAID BENEFIT

ELIGIBILITY

Employees hired in an unrepresented classification after June 1998 and some union

represented employees if provided for in a collective bargaining agreement, earn PTO.

Permanent employees enrolled in PTO earn time off each bi-weekly pay period in which

they have time in a paid status.

PTO SCHEDULE

Completed Years of Aggregate Service

No. of 8-Hour Days

Per Year

Hours Earned per

Pay Period

Completion of Years 0, 1, 2, 3

18

5.54

Completion of Years 4, 5, 6, 7

21

6.46

Completion of Years 8, 9, 10, 11, 12, 13

23

7.08

Completion of Years 14, 15, 16, 17, 18

26

8.00

Completion of 19 Years

27

8.31

Completion of 20 Years

28

8.62

Completion of 21 Years

29

8.92

Completion of 22 Years

30

9.23

Completion of 23 Years

31

9.54

Completion of 24 Years

32

9.85

Completion of 25 Years

33

10.15

Completion of 26 Years

34

10.46

Completion of 27 Years

35

10.77

Completion of 28 Years or More

36

11.08

PTO accruals based on tenure shall be credited at the first of the calendar year in which

any of the above periods of aggregate City service will be completed. Eligibility for

tenure based PTO accruals shall be determined by the length of aggregate service with

the City. The applicable accrual rate shall be determined as of January 1 of each

calendar year and shall be based on the rate applicable to the number of years of

aggregate service the employee will complete within that calendar year. For example,

on January 1, an employee who will complete four years of aggregate service with the

City within that calendar year will begin to accrue PTO leave at a rate of 6.46 hours per

pay period.

NOTE: Employees may accrue up to a maximum of 960 hours of PTO.

UTILIZATION

Employees are authorized to use PTO leave after it is earned and accrued. PTO is taken

in increments of one-tenth (1/10) of an hour. Class D and E employees must use PTO in

full day (8 hour) increments (TMC 1.12.020).

BENEFIT PAYOUT

In the event of retirement, separation, or death, 100% of PTO accruals will be paid.

NOTE: Questions related to PTO should be directed to your department’s timekeeper.

27 | Page

Retirement

Programs

(Mandatory)

City of Tacoma

The City of Tacoma provides its employees with a mandatory retirement plan

that may vary by collective bargaining unit, in which the City and the

employee will contribute.

EMPLOYER and EMPLOYEE MANDATORY PAID BENEFITS

TACOMA EMPLOYEES’

RETIREMENT SYSTEM

(TERS)

Eligibility

All City of Tacoma employees are required to

become TERS members immediately, except for

those specifically excluded from membership

under Tacoma Municipal Code 1.30.

Employee Contribution

9.66% of eligible compensation, up to $285,000

Employer Contribution

11.34% of covered payroll, up to $285,000

Contact the City of Tacoma

Retirement Office

253.502.8200

www.cityoftacoma.org/Retirement

DEPARTMENT OF

RETIREMENT SYSTEMS

(DRS)

Eligibility

Full-time law enforcement officers and fire fighters

first hired on or after October 1, 1977, are covered

by LEOFF Plan II and are required to become

members of the plan.

Employee Contribution

8.59% of employee compensation up to $285,000

Employer Contribution

5.33% of covered payroll up to $285,000

Contact the Washington State

Department of Retirement

Systems (DRS)

800.547.6657

www.drs.wa.gov

RAILROAD RETIREMENT

Employee Contribution – Tier 1

6.2% of employee compensation up to $137,700

Employer Contribution – Tier 1

6.2% of covered payroll up to $137,700

Employee Contribution – Tier 2

(Supplemental Retirement)

4.9% of their compensation up to $102,300

Employer Contribution – Tier 2

(Supplemental Retirement)

13.1% of covered payroll up to $102,300

Contact the Rail Retirement

Board

877.772.5772

www.rrb.gov

*Retirement beneficiary designations are separate from other benefit plan beneficiary designations; benefits forms must be

completed and returned to the appropriate department.

28 | Page

Retirement

Programs

(Voluntary)

City of Tacoma

In addition to a mandatory employer and employee paid retirement plan, the

City of Tacoma provides its employees with a voluntary deferred

compensation program, which allows employees to supplement their normal

retirement income with a savings plan that is authorized under Section 457 of

the IRS Code. The value of the account is based on contributions made and the

investment performance over time.

A deferred compensation plan can help bridge the gap between what is

available with the City’s pension plan and Social Security, and how much is

needed in retirement. Employees can choose to make Pre-tax contributions

that reduce their taxable income for the year and in turn, those contributions

and all associated earnings are not subject to federal tax until withdrawn.

There is also an option to make After-tax Roth contributions, which allow for

potentially tax-free earnings.

EMPLOYEE-PAID VOLUNTARY BENEFIT

DEFERRED

COMPENSATION

Eligibility

Available to all City employees (except temporary)

Annual IRS Contribution

Limits

Regular Deferral

$19,500

Age 50 Catch-Up

$26,000

Pre-Retirement Catch-Up

$39,000

Plan Options

Regular 457 Plan

Pre-Tax Contributions

Roth 457 Plan

Post-Tax Contributions

CONTACT

INFORMATION

Nationwide (for Fire

Personnel Only)

Mike Ferguson

509.385.7825

www.nationwide.com/457-retirement-plans.jsp

nationwide.com/457-retirement-plans.jsw

ICMA-RC

Scott Berry

800-669-7400

www.icmarc.org/tacomawa

*Eligible sick leave/vacation and/or PTO balances may be deposited into a deferred compensation account at the time of

separation/retirement.

NOTE: Police, Fire, and certain Rail personnel are entitled to matching contributions from the City for deferred compensation.

See the benefits website for more details on the limits and requirements from the collective bargaining agreements.

29 | Page

Commute Trip

Reduction

Program

City of Tacoma

The City of Tacoma's Commute Trip Reduction (CTR) program encourages the

use of alternative ways for employee commuting and business trips to reduce

air pollution through the use of public transportation to assist with the City's

Commute Trip Reduction goals.

With this program, the City subsidizes employees'* monthly public

transportation passes fully and authorized vanpools at 50 percent of the cost,

up to the IRS allowable limits. Employees pay 50 percent of the cost of a

vanpool through pre-tax payroll deductions.

The City currently provides access to public transportation options through the

One Regional Card for All (ORCA) and Intercity Transit.

EMPLOYER and EMPLOYEE PAID BENEFITS

TRANSIT CARDS/

VANPOOLS

Included in this benefit are the following transit systems: Pierce Transit, Sound Transit,

Kitsap Transit, King County Metro, Community Transit, and Intercity Transit (vanpools

only)*. Contact your Commute Trip Reduction Coordinator for more information.

404-6902

Paige Kelling

Environmen

tal Services

Center for Urban

Waters/Sewer

pkelling@cityoftacoma.org

573-2345

Benefits

Office

Tacoma

Municipal

Buildings/

Other

General

Government

Locations

TMB – 14

th

Floor

benefits@cityoftacoma.org

502-8649

Aly Thomas

Tacoma

Public

Utilities

TPU – HR Office

athomas3@cityoftacoma.org

593-7722

Yaisa Criss-

Greenwood

Solid

Waste/Fire

Garage/

Signal Shop

PW – Solid Waste

ycgreenwood@cityoftacoma.org

EMERGENCY RIDE HOME

PROGRAM

The City participates in the Emergency Ride Home Program so that employees can feel

secure in making the choice to use alternative transportation. Please contact the Human

Resources Benefits Office for more information on how to use this program.

573-2345

Benefits

Office

For All Work Locations

benefits@cityoftacoma.org

*Intercity Transit provides public transportation for people who live and work in Olympia, Lacey, Tumwater, and Yelm. On

December 4, 2019, the Authority approved implementation of a five-year “zero-fare” demonstration project, which went

into effect on January 1, 2020. During the demonstration, bus and Dial-A-Lift passengers will not pay fares to use these

services.

NOTE: The ORCA Business Card is for an employee’s own transportation only and cannot be transferred, loaned or provided to

any other person. The Commute Trip Reduction Program benefits are not available to commissioned Police Department

personnel.

30 | Page

Federally Required Notices

The City of Tacoma is required by law to share and post various federally required benefits notices. This

information can also be found at the Benefits website www.cityoftacoma.org/benefits

under Notices.

Consolidated Omnibus Budget Reconciliation Act (COBRA)

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a federal law that allows for the right to

COBRA continuation coverage for employees and family members when group health coverage would otherwise

end due to a qualifying life event. Qualifying life events that can result in a loss of group health coverage include:

Employee loses coverage due to: reduction in hours of employment or termination of employment.

Spouse loses coverage due to: employee dies, employee loses coverage due to reduction in hours of

employment or termination of employment; employee becomes entitled to Medicare benefits,

becoming divorced or legally separated from the employee.

Dependent child loses coverage due to: employee dies, employee loses coverage due to reduction in

hours of employment or termination of employment, employee becomes eligible for Medicare benefits,

parents become divorced or legally separated, stops being eligible for coverage under the plan as a

dependent child.

The City of Tacoma will notify the COBRA Administrator of most qualifying events and to issue notification of

COBRA continuation coverage. However, it is your responsibility to notify the City of Tacoma of certain

qualifying events (divorce or legal separation of the employee or spouse or a dependent child’s losing

eligibility for coverage as a dependent child) within 60 days of the event occurring, in order to have a right for

COBRA continuation coverage. Notification should be provided to: City of Tacoma, Benefits Office, 747 Market

Street, Room 1420, Tacoma, WA 98402 or [email protected]. (See the “Qualifying Life Events

Changes” section of this booklet or more information on how to submit this information timely.)

All new hired employees eligible for benefits are sent a COBRA Continuation Coverage General Notice from the

City’s COBRA Administrator, WageWorks. This notice is addressed to our employee and their eligible dependents

(if applicable) and is meant to inform each person of their individual COBRA continuation rights, in the case they

experience a qualifying event that entitles them to continuing their medical, dental, vision, and Health Flexible

Spending Account benefits.

Under the Affordable Care Act (ACA), participants eligible for COBRA can now also access public exchanges

where they may qualify for tax credits that immediately lower health insurance costs. Additional alternative

health care resources are listed below for your information:

Washington Health Plan Finder: www.wahealthplanfinder.org

or 1-855-WAFINDER (1.855.923.4633)

Washington Basic Health: www.basichealth.hca.wa.gov

Special Enrollment Rights

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health

insurance or group health plan coverage, you may be able to enroll yourself and your dependents in a City plan