ACCOUNTING FOR LEASES UNDER ASC 842 1

A PRACTICE AID FROM BDO’S PROFESSIONAL PRACTICE GROUP

Accounting for Leases Under ASC 842

UPDATED DECEMBER 2021

ACCOUNTING FOR LEASES UNDER ASC 842 2

Table of Contents

INTRODUCTION ............................................................................................................................. 5

ASC 842 in a Nutshell .................................................................................................................... 6

Lease Classification ...................................................................................................................... 7

Lessee Accounting ........................................................................................................................ 8

Lessor Accounting ........................................................................................................................ 9

Adoption Dates .......................................................................................................................... 10

About the Practice Aid ................................................................................................................. 10

CHAPTER 1 - SCOPE OF ASC 842 ....................................................................................................... 12

Scope and Scope Exceptions ........................................................................................................... 12

Specific Considerations for Land Easements ........................................................................................ 14

Interaction with Other Standards ..................................................................................................... 17

CHAPTER 2 - IDENTIFYING A LEASE .................................................................................................... 18

Overview .................................................................................................................................. 18

Identified Asset .......................................................................................................................... 20

Right to Control Use of Identified Asset ............................................................................................. 27

Other Illustrations ....................................................................................................................... 42

CHAPTER 3 - IDENTIFYING AND SEPARATING COMPONENTS ...................................................................... 48

Overview .................................................................................................................................. 48

Identifying Lease and Nonlease Components ....................................................................................... 52

Separating Components - Lessees .................................................................................................... 60

Separating Components - Lessors ..................................................................................................... 69

Portfolio Approach ...................................................................................................................... 80

Contract Combination .................................................................................................................. 80

CHAPTER 4 - LEASE CLASSIFICATION AND KEY TERMS ............................................................................. 81

Overview .................................................................................................................................. 81

Commencement Date ................................................................................................................... 84

Lease Term ............................................................................................................................... 89

Lease Payments ......................................................................................................................... 95

Initial Direct Costs .................................................................................................................... 101

Discount Rate .......................................................................................................................... 102

Economic Life .......................................................................................................................... 106

Fair Value ............................................................................................................................... 106

Lease Classification ................................................................................................................... 107

ACCOUNTING FOR LEASES UNDER ASC 842 3

CHAPTER 5 - ACCOUNTING FOR LEASES – LESSEES ............................................................................... 111

Overview ................................................................................................................................ 111

Lease Classification by Lessees ..................................................................................................... 112

Summary Accounting Requirements Based on Lease Classification ........................................................... 113

Short-Term Leases .................................................................................................................... 114

Recognition and Initial Measurement .............................................................................................. 119

Subsequent Measurement ............................................................................................................ 123

Remeasurements ...................................................................................................................... 130

Variable Lease Payments that Depend on an Index or a Rate .................................................................. 137

Modifications ........................................................................................................................... 139

Impairment ............................................................................................................................. 152

Derecognition .......................................................................................................................... 158

CHAPTER 6 - ACCOUNTING FOR LEASES – LESSORS ............................................................................... 159

Overview ................................................................................................................................ 159

Lease Classification by Lessors ...................................................................................................... 160

Summary Accounting Requirements Based on Lease Classification ........................................................... 161

Sales-Type Leases – A Deeper Dive ................................................................................................. 163

Direct Financing Leases – A Deeper Dive .......................................................................................... 176

Operating leases ....................................................................................................................... 183

Modifications ........................................................................................................................... 185

Impairment ............................................................................................................................. 191

Other Transactions .................................................................................................................... 195

CHAPTER 7 - OTHER TOPICS .......................................................................................................... 196

Overview ................................................................................................................................ 196

Sale and Leaseback Transactions ................................................................................................... 197

Business Combinations (or Acquisitions by Not-For-Profit Entities) ........................................................... 227

Subleases ............................................................................................................................... 233

Accounting for Income Taxes ........................................................................................................ 238

CHAPTER 8 - PRESENTATION AND DISCLOSURES .................................................................................. 242

Overview ................................................................................................................................ 242

Presentation ........................................................................................................................... 243

Disclosure Requirements ............................................................................................................. 248

CHAPTER 9 - ADOPTING ASC 842 .................................................................................................... 256

Overview ................................................................................................................................ 256

Effective Dates ........................................................................................................................ 258

Transition Methods .................................................................................................................... 260

Transition Disclosures ................................................................................................................ 263

Transition Practical Expedients ..................................................................................................... 264

Transition – Lessees ................................................................................................................... 271

Transition - Lessors ................................................................................................................... 282

Other Transition Requirements ..................................................................................................... 286

Application of the Portfolio Approach in Transition ............................................................................. 289

CONTACTS ................................................................................................................................ 290

ACCOUNTING FOR LEASES UNDER ASC 842 4

THIS PRACTICE AID

The Practice Aid includes detailed guidance and flowcharts on analyzing and accounting for contracts under

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 842, Leases. The graphics

and illustrations in this Practice Aid are provided to assist readers in understanding various aspects of the lease

accounting guidance. Accounting for contracts may vary based on the specific facts and circumstances of each

contract and therefore may differ from the illustrations provided in the Practice Aid.

The Practice Aid focuses on the accounting for lease contracts under ASC 842 only. Additional information on the

accounting for leases under International Financial Reporting Standards (IFRS) is available here

.

ACCOUNTING FOR LEASES UNDER ASC 842 5

Introduction

In February 2016, the Financial Accounting Standards Board (“FASB”) issued new lease accounting guidance in ASU

2016-02, Leases (“ASC 842”). Under its core principle, a lessee recognizes a right-of-use (“ROU”) asset and a related

lease liability on the balance sheet for most leases. The most significant change is on the balance sheet for lessees. For

the income statement, the pattern of expense recognition depends on a lease’s classification but is generally

consistent with current U.S. GAAP (ASC 840, Leases, or “ASC 840”).

The objective for updating lease accounting was to increase transparency and comparability among entities by

recognizing lease assets and lease liabilities on the balance sheet by lessees for most leases and by disclosing key

information about leasing arrangements. This new guidance addressed stakeholder concerns that the previous lease

accounting guidance did not result in a faithful representation of leasing transactions; specifically, that the rights and

obligations associated with operating leases were not recognized on the balance sheet.

Under ASC 840, lessees recognized capital leases on the balance sheet but only disclosed operating leases as off-balance

sheet arrangements. There were no major differences in the accounting treatment for an operating lease versus a service

contract. ASC 842 now changes that and, as such, the key determination will be whether a contract is or contains a

lease as that will drive whether a contract is recognized on the balance sheet.

The leases project began as one of several joint projects between the FASB and the International Accounting Standards

Board (IASB) aimed at converging U.S. GAAP and International Financial Reporting Standards (IFRS). However, after

several years of deliberations and two exposure drafts, the FASB and IASB reached different conclusions on various

aspects of lease accounting (such as classification of leases by lessees), and each of FASB and IASB issued separate

guidance early in 2016. Additional information on the accounting for leases under IFRS is available here

.

ACCOUNTING FOR LEASES UNDER ASC 842 6

ASC 842 IN A NUTSHELL

The following flowchart summarizes at a high level what an entity considers when applying ASC 842, which we will

explore in further details throughout the Practice Aid.

*

Exceptions exist when a lessee or lessor elect a practical expedient not to separate nonlease component(s) from the associated

lease component (see Identifying and Separating Components

).

ACCOUNTING FOR LEASES UNDER ASC 842 7

LEASE CLASSIFICATION

The following flowchart summarizes classification of a lease by lessees and lessors under ASC 842 (after adoption of

ASU 2021-05):

ACCOUNTING FOR LEASES UNDER ASC 842 8

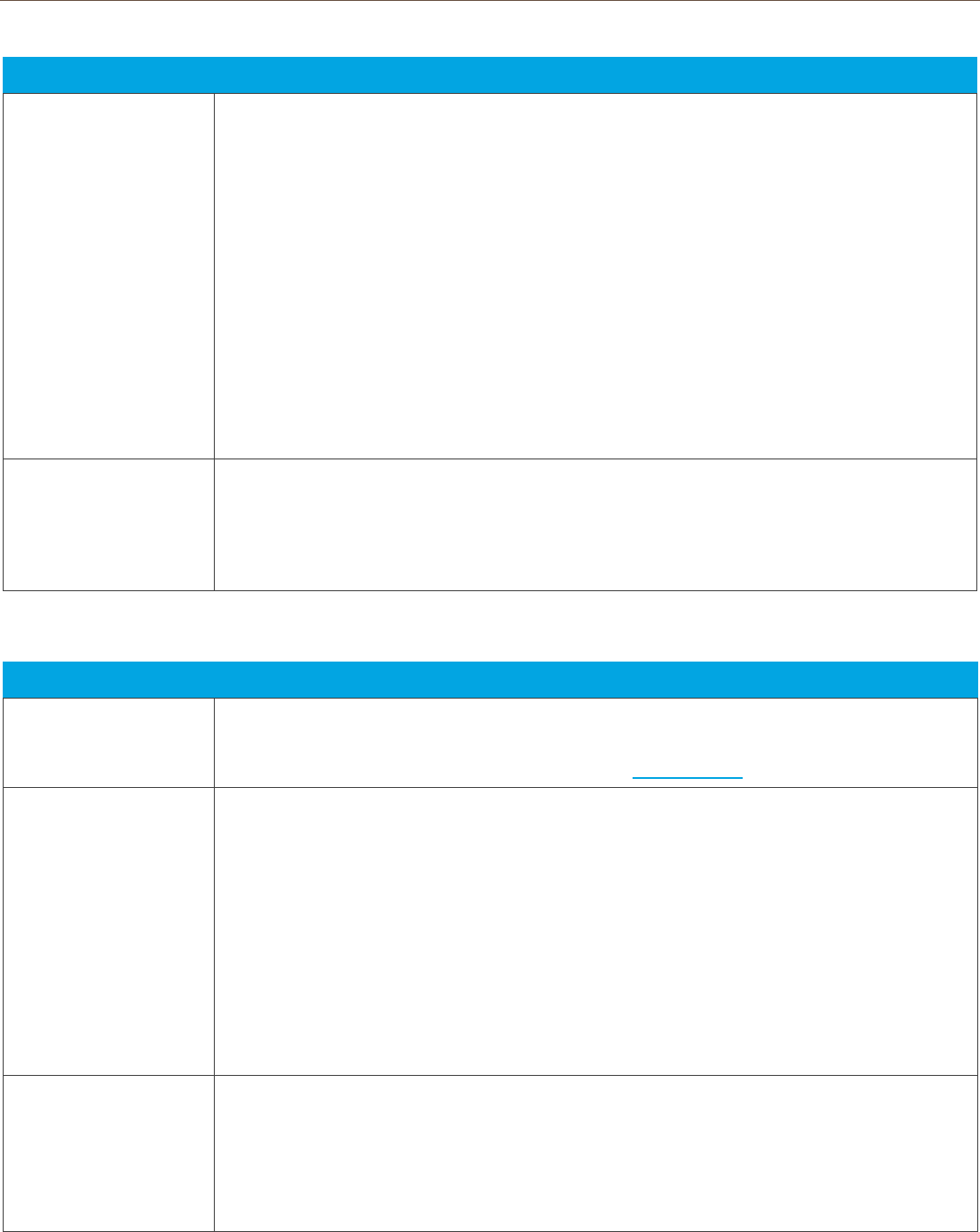

LESSEE ACCOUNTING

As illustrated on the previous page, a lessee classifies a lease as either an operating lease or a finance lease using

classification criteria that are generally consistent with ASC 840. The lease (whether operating or finance) is

recognized on balance sheet at the commencement date unless the practical expedient for short-term leases is elected

(see below). The following table summarizes a lessee’s accounting for leases:

Finance Leases Operating Leases

ROU Asset Lease Liability ROU Asset Lease Liability

Balance

Sheet

ROU asset is initially

measured at the amount

of the lease liability,

plus initial direct costs

and prepaid lease

payments, less lease

incentives received.

Lease liability is

initially measured at

the present value of

the unpaid lease

payments.

Initial measurement is the same as for finance

leases.

Subsequently, ROU asset

is typically amortized on

a straight-line basis to

the earlier of the end of

its useful life or lease

term.

1

Subsequently, lease

liability is increased to

reflect interest using

the effective interest

method and decreased

for lease payments

made.

Amortize based on

difference between

periodic straight-line

lease cost (incl.

amortization of initial

direct costs) and

periodic interest

accretion.

Subsequent

measurement is the

same as for finance

leases.

Income

Statement

Recognize amortization on ROU asset, interest on

lease liability, and recognize variable lease

payments not included in the lease liability when

incurred.

2

Recognize single lease cost (i.e., lease

payments plus initial direct costs) generally on a

straight-line basis, and variable lease payments

not included in lease liability when incurred.

2

Cash Flow

Statement

Classify repayments of principal portion of lease

liability within financing activities and payments

of interest on the lease liability and variable lease

payments within operating activities.

Classify all cash payments for leases within

operating activities.

Once recognized on balance sheet, ASC 842 includes requirements for lessees to update the measurement of leases for

certain lease modifications and other reassessment events. Lessees will need robust processes and controls to timely

and completely identify and account for such events. When the lease liability is remeasured and the ROU asset

adjusted, amortization of the ROU asset is adjusted prospectively from the date of remeasurement.

The FASB also provided lessees with a practical expedient not to recognize short term leases on balance sheet. A short-

term lease is a lease with a lease term of 12 months or less and that does not include a lessee option to purchase the

underlying asset that is reasonably certain of exercise. This election is by asset class and, if elected, a lessee

recognizes lease payments on a straight-line basis over the lease term along with variable lease payments when

incurred, consistent with ASC 840.

1

If the lease transfers ownership of the underlying asset to the lessee or the lessee is reasonably certain to exercise an option to purchase the

underlying asset, the lessee amortizes the right-of-use asset to the end of the useful life of the underlying asset.

2

If the ROU asset is impaired under ASC 360, an impairment loss is also recognized. For operating leases only, recognition in the income statement

post-impairment no longer is on a straight-line basis (but still recognized as a single lease cost).

ACCOUNTING FOR LEASES UNDER ASC 842 9

LESSOR ACCOUNTING

Lessor accounting remains largely consistent with ASC 840, and a lessor will continue to classify leases as either sales-

type, direct financing or operating leases. But lessor accounting has also been updated for consistency with the new

lessee accounting model and with the new revenue standard in ASC 606, Revenue from Contracts with Customers (“ASC

606”).

The following table summarizes a lessor’s accounting for leases under ASC 842.

Sales-Type Leases Direct Financing Leases Operating Leases

Balance

Sheet

Derecognize underlying asset

and recognize net investment

in the lease at commencement

date if collectability of lease

payments and lessee residual

value guarantee is probable.

3

Derecognize underlying asset

and recognize net investment

in the lease (which includes

selling profit and initial direct

costs) at commencement

date.

Continue to recognize underlying

asset.

Defer initial direct costs.

Income

Statement

Recognize selling profit or loss.

Expense initial direct costs

(unless fair value of the

underlying asset equals its

carrying amount, in which case

initial direct costs are included

in the net investment in the

lease).

Recognize selling loss, if any.

Recognize lease payments

generally on a straight-line basis

over the lease term if collectability

is probable. Otherwise, lease

income is limited generally to lease

payments collected.

Recognize variable lease payments

in period when changes in facts and

circumstances on which payments

are based occur.

Expense initial direct costs on same

basis as lease income over the

lease term.

Recognize depreciation expense

(and impairment of underlying

asset, if any).

Recognize interest income on net investment in the lease.

Recognize variable lease payments not included in net

investment in the lease in period when changes in facts and

circumstances on which payments are based occur.

Recognize impairment (or credit losses) on net investment in the

lease.

Cash Flow

Statement

Classify all payments received as operating cash flows, except

for entities within the scope of ASC 942, Financial Services—

Depository and Lending, which present principal payments

within investing activities.

Classify all payments received as

operating cash flows.

Also, leveraged lease accounting no longer exists for leases that are entered into or modified after ASC 842’s effective

date. As a result, new or modified leases that previously met the definition of a leveraged lease will be accounted for

as one of the three types of leases described in the above table. But existing leveraged leases are grandfathered even

once ASC 842 is adopted and will continue to be accounted for by a lessor similarly to under ASC 840 until they expire

or are modified.

3

If collectability is not probable at commencement date, a lessor does not derecognize the underlying asset and instead recognizes lease payments

received, including variable lease payments, as a deposit liability until further conditions are met.

ACCOUNTING FOR LEASES UNDER ASC 842 10

ADOPTION DATES

For calendar-year public business entities, certain not-for-profit organizations and certain employee benefit plans, the

new standard took effect in 2019, and interim periods within that year.

For all other calendar-year entities, ASC 842 was initially required to take effect in 2020, and interim periods in 2021.

However, in November 2019 the FASB issued ASU 2019-10 which initially deferred the effective date of ASC 842 for all

other calendar-year entities to 2021 with interim periods in 2022. Also, because of the disruption caused by the

Coronavirus Disease 2019 (also referred to as COVID-19), including resource constraints, dislocation, and other

priorities that entities faced with the COVID-19 pandemic, the FASB decided to further defer the effective date of ASC

842 by an additional year for private companies and certain not-for-profit entities (NFPs). Specifically, for private

companies and private NFPs, ASC 842 will be effective for fiscal years beginning after December 15, 2021, and interim

periods within fiscal years beginning after December 15, 2022. For public NFPs that have not yet issued financial

statements or made financial statements available for issuance as of June 3, 2020, ASC 842 takes effect for fiscal years

beginning after December 15, 2019, including interim periods within those fiscal years.

Early adoption continues to be permitted for all entities.

ABOUT THE PRACTICE AID

The Practice Aid reflects key aspects of the following accounting standards updates (all of which are referred to as ASC

842 in this publication):

ASU 2016-02, Leases (Topic 842)

ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842, which

generally simplifies adoption for entities with land easements that exist or expire before the entity’s

adoption of ASC 842.

ASU 2018-10, Codification Improvements to Topic 842, Leases, which affects narrow aspects of the guidance

in ASC 842 and corrects cross-reference inconsistencies.

ASU 2018-11, Leases (Topic 842): Targeted Improvements, which the FASB issued to reduce costs for entities

in adopting ASC 842 and to ease the application of the separation and allocation guidance for lessors.

ASU 2018-20, Leases (Topic 842): Narrow-Scope Improvements for Lessors, which simplifies lessor’s

accounting for sales taxes, certain lessor costs, and clarifies the recognition of certain variable payments for

contracts with lease and nonlease components.

ASU 2019-01, Leases (Topic 842): Codification Improvements, which clarifies the application of certain

aspects of ASC 842 primarily for financial institutions.

ASU 2019-10, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and

Leases (Topic 842): Effective Dates, which deferred the effective of ASC 842 for certain entities.

ASU 2020-02, Financial Instruments—Credit Losses (Topic 326) and Leases (Topic 842): Amendments to SEC

Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 119 and Update to SEC Section on Effective Date

Related to Accounting Standards Update No. 2016-02, Leases (Topic 842), which clarifies the SEC’s views on

ASC 842’s effective date for certain public business entities

.

ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on

Financial Reporting, which was issued to simplify an entity’s accounting associated with modifications to

agreements related to the reference rate reform, including lease contracts.

ASU 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842): Effective Dates for

Certain Entities, which further defers the effective date of ASC 842 for certain entities due to COVID-19.

ASU 2021-05, Leases (Topic 842): Lessors—Certain Leases with Variable Lease Payments, to address the

recognition of a day-one loss issue by lessors in certain leases.

ACCOUNTING FOR LEASES UNDER ASC 842 11

ASU 2021-09, Leases (Topic 842): Discount Rate for Lessees That Are Not Public Business Entities.

While the Practice Aid does not include all requirements of ASC 842, it summarizes key aspects of ASC 842 that will

commonly arise in applying ASC 842. It also includes practical examples and interpretive guidance to assist companies

and practitioners in their adoption and continued application of ASC 842.

The Practice Aid has been divided into chapters, which address key aspects of the new lease standard. These chapters

are generally organized in the order in which an entity would apply ASC 842, and the questions that an entity would

need to answer as it proceeds through the evaluation. For example, the first chapter discusses whether a contract is

within the scope of ASC 842, and if so, a reader moves to the next chapter

that addresses whether the contract

contains a lease, and so on. Other aspects of ASC 842 related to specific transactions and interactions with other areas

of GAAP have been grouped into one chapter “

Other Topics” which includes accounting for subleases, sale and

leaseback transactions, business combinations, and income taxes. Finally, there is a detailed chapter discussing

effective dates and how to

transition to ASC 842.

The illustration below depicts how the chapters are organized. At the start of each chapter, the flowchart will be

repeated, and your location in the overall flowchart will be identified.

ACCOUNTING FOR LEASES UNDER ASC 842 12

Chapter 1 - Scope of ASC 842

SCOPE AND SCOPE EXCEPTIONS

ASC 842 is limited to leases of property, plant or equipment. Accordingly, it does not apply to any of the following:

LEASED ASSET RELEVANT GUIDANCE AND OBSERVATIONS

Leases of intangible

assets, like licenses

of IP

Apply ASC 350, Intangibles—Goodwill and Other

Leases to explore for

or use minerals, oil,

natural gas, and

similar

nonregenerative

resources

Apply ASC 930, Extractive Activities—Mining, and ASC 932, Extractive Activities—Oil

and Gas

The FASB clarified that the scope exception applies to the intangible right to

explore for those natural resources and rights to use the land in which those

natural resources are contained, unless those rights of use include more than the

right to explore for natural resources. The scope exception does not apply to

equipment used to explore for the natural resources. See Example 1 below for an

illustration.

Leases of biological

assets, like plants and

living animals

Apply ASC 905, Agriculture

Note that this scope exception includes timber to be consistent with ASC 840.

Leases of inventory

Apply ASC 330, Inventory

Leases of assets

under construction

Apply ASC 360, Property, Plant, and Equipment

Note that transactions in which the underlying asset needs to be constructed or

redesigned for use by the lessee may be in scope of the sale-leaseback guidance if

the lessee controls the asset under construction before the lease commencement

date. See chapter 7, Other Topics

for additional details.

ACCOUNTING FOR LEASES UNDER ASC 842 13

Scope of ASC 842 Consistent with ASC 840

The scope of ASC 842 is generally consistent with the scope of the legacy lease guidance in ASC 840 and applies only

to leases of property, plant or equipment (that is, land and/or depreciable assets). The Board acknowledged in

paragraph BC110 in the Basis for Conclusions of ASU 2016-02 that the conceptual basis for excluding some other assets

such as intangible assets, inventory and assets under construction from the scope of ASC 842 was unclear, but it

nonetheless decided to continue to limit the scope to only property, plant or equipment for pragmatic reasons

including cost-benefit reasons.

Long Term Leases of Land Not Excluded from ASC 842

The scope of ASC 842 includes long-term leases of land, such as a 99-year lease of land. While some may view these

long-term leases of land as economically similar to purchases of land, the Board noted that there is no conceptual

basis for differentiating long-term leases of land from other leases and that any definition of “long-term” would be

arbitrary in nature. Accordingly, those long-term leases of land are in the scope of ASC 842.

Example 1 - Rights to Explore for or Use Natural Resources and Additional Rights

Entity A obtains the intangible right to explore for or use natural resources along with rights to use the land that

contains those natural resources (Land 1). To access Land 1 and explore for those natural resources, Entity A obtains

access rights to an adjacent parcel (Land 2). The following picture summarizes Entity A’s arrangements.

Which of the above rights, if any, are outside the scope of ASC 842?

ASC 842-10-15-1(b) states that the scope exception includes “the intangible right to explore for those natural

resources and rights to use the land in which those natural resources are contained […]”. Accordingly, the intangible

right to explore for or use natural resources along with rights to use Land 1 are outside the scope of ASC 842. This

would be true even if Entity A entered into separate contracts with different parties for the rights to Land 1 and for

the rights to explore for the underlying natural resources (for example, if the surface rights are legally separated

from the mineral rights and are owned by different parties).

However, the scope exception does not apply to the rights to use Land 2 as the scope exception is limited to the

rights to use the land in which the natural resources are contained and for which Entity A has exploration rights (i.e.,

which is Land 1 only). Accordingly, Entity A should determine whether its right to access or use Land 2 meets the

definition of a lease. See also section below on specific considerations for land easements.

Note that if Entity A were also to lease (rather than own) the equipment used for the exploration or use of the

natural resources (such as the drilling rigs in the picture above), those would be in the scope of ASC 842 and Entity A

would need to determine whether its right to use the equipment meets the definition of a lease.

ACCOUNTING FOR LEASES UNDER ASC 842 14

SPECIFIC CONSIDERATIONS FOR LAND EASEMENTS

Land easements (also commonly referred to as rights of way) represent the right to use, access, or cross another

entity’s land for a specified purpose. Easements are used in various industries, such as in the energy, utilities,

transportation and telecom industries. For example:

A midstream energy company might acquire a land easement for the right to pass a pipeline over, under, or

through an existing area of land while allowing the landowner continued use of the land for other purposes

(farming, hunting, etc.) if the landowner does not interfere with the rights of the midstream energy

company.

An electric utility might acquire a series of contiguous easements so that it can construct and maintain its

electric transmission system on land owned by others.

Terms of land easements can vary greatly between agreements. For example, a land easement may be perpetual or

term based, provide for exclusive or nonexclusive use of the land, may be prepaid or paid over a defined term, and so

forth. The grantor (landowner) also may retain rights associated with access and use of the land area, or it may be

restricted in its ability to access and use the land area.

Diversity in practice has historically existed in U.S. GAAP in the accounting for land easements before ASC 842. For

example:

Some entities have accounted for their land easements as intangible assets based on the guidance in Example

10 of ASC 350-30, Intangibles—Goodwill and Other—General Intangibles Other than Goodwill, which refers to

land easements in that example as intangible assets.

Some entities have applied ASC 360 and considered the prepaid land easement as a cost to bring property,

plant or equipment (for example, a pipeline) to the condition and location necessary for its intended use.

Some entities have applied ASC 840 (for example, a cell tower company entering into a land easement for

the right to erect a communication tower).

Because of that diversity, in January 2018, the FASB issued ASU 2018-01, Land Easement Practical Expedient for

Transition to Topic 842, to clarify that land easements are in the scope of ASC 842. However, considering the existing

diversity in accounting and to reduce the cost and complexity associated with assessing whether all existing and

expired land easements meet the definition of a lease for entities transitioning to ASC 842, ASU 2018-01 allows entities

that previously did not account for land easements as leases under ASC 840 to elect a transition practical expedient to

not assess those land easements under ASC 842 when adopting the new standard. Instead, entities will continue to

account for those land easements under other GAAP unless the land easement is modified on or after ASC 842’s

adoption date. An entity that currently accounts for land easements as leases under ASC 840 cannot elect this practical

expedient for those easements.

Because the Board clarified in ASU 2018-01 that land easements are in the scope of ASC 842, once an entity adopts the

new lease standard, it must apply that guidance prospectively to all new or modified land easements to determine

whether those arrangements meet the definition of a lease under ASC 842.

ACCOUNTING FOR LEASES UNDER ASC 842 15

Example 2 - Land Easements in Transition

Electric Company obtained a series of easements years before its adoption of ASC 842. The easements were obtained

so that Electric Company could install poles to which its power lines would be attached. In addition to installing its

poles, Electric Company has the right to access the poles via a corridor leading from the nearest road to the pole.

Electric Company will make payments over time under the easement agreement in return for long-term access

rights. Electric Company has historically accounted for those land easements along with its poles as property, plant

and equipment under ASC 360.

Because Electric Company did not account for those land easements as leases under ASC 840, it can elect the

practical expedient provided in ASU 2018-01. This means Electric Company will continue to account for those land

easements under ASC 360 unless the agreement is modified on or after ASC 842’s adoption date, in which case

Electric Company would need to assess whether those easements meet the definition of a lease under ASC 842. If

elected, the practical expedient must be applied to all Electric Company’s land easements not accounted for as

leases under ASC 840.

Alternatively, if Electric Company does not elect the land easements practical expedient, it should evaluate all of its

existing land easements when adopting the new standard to determine whether those easements meet the definition

of a lease under ASC 842.

Practical Expedient Provided for Cost-Benefit Reasons

Through outreach with stakeholders in industries most involved with land easements, the FASB learned that many

land easements are perpetual (and therefore would not meet the definition of a lease because they are not “for a

period of time”) and that many land easements are prepaid and therefore already recognized on the balance sheet.

The Board therefore did not want entities to incur significant time and effort (considering the volume of land

easements and age of those agreements) to evaluate them under ASC 842, especially considering that adoption of

the new standard was generally not expected to have a material impact for these existing land easements.

While diversity in practice in accounting for land easements exists before ASC 842, it generally would be

inappropriate for an entity to change its accounting policy prior to adoption of ASC 842 from accounting for those as

leases under ASC 840 to accounting for those under ASC 350 or ASC 360.

ACCOUNTING FOR LEASES UNDER ASC 842 16

Unit of Account Questions on Land Easements and Subsurface Rights Not Addressed

As part of its project leading to the issuance of ASU 2018-01, the FASB became aware of several unit of account

questions commonly arising with land easements impacting the lease evaluation under ASC 842. For example, a

midstream energy company may acquire a land easement for the right to pass a pipeline under an existing area of

land in which the landowner retains rights associated with the use of the land surface. In this example, a question

arises as to whether the subsurface area represents its own unit of evaluation, or whether the subsurface and

surface should be considered together when evaluating whether the contract contains a lease. This question is

important as it is more likely that the arrangement would contain a lease if the subsurface is considered its own unit

of evaluation. Despite those questions, the FASB decided not to provide additional clarity as it did not view these

issues as being limited to land easements. If an entity determines that an arrangement does not contain a lease, it

applies other GAAP such as ASC 350 or ASC 360 to account for the arrangement.

For arrangements similar to the midstream energy company example above, we believe that it would be acceptable

for the entity to either apply ASC 842 and evaluate whether the arrangement contains a lease, or to analogize the

subsurface rights to air rights (i.e., an intangible asset, which is outside the scope of ASC 842) to the extent the

rights conveyed relate to subsurface (underground) space that cannot be inhabited or otherwise be accessed (which

are characteristics shared with air rights). In the latter situation, the entity would not apply the definition of a lease

in ASC 842 but would apply other GAAP such as ASC 350 to its arrangement. However, we do not believe that an

analogy to air rights is acceptable in all cases. For example, it would be inappropriate for an entity to analogize to

air rights for leases of underground retail space in a subway station, a basement of a commercial office building, or

underground parking garage. Careful consideration should also be given when determining the appropriate

accounting for land easements as terms and conditions may vary greatly between arrangements.

Diversity in Accounting When a Land Easement is Not a Lease Also Not Addressed

When an entity evaluates a land easement under ASC 842 and determines it is not a lease, the diversity in

accounting observed outside of the lease guidance is not addressed in ASU 2018-01. As previously discussed, some

entities have applied ASC 350 while others have applied ASC 360. The FASB noted in paragraph BC11 of ASU 2018-01

that it did not intend to address diversity in the guidance applied when a land easement does not meet the

definition of a lease. For example, consider an entity that accounts for its land easements as intangible assets

before adoption of ASC 842 based on the guidance in Example 10 of ASC 350-30. If that entity enters into a land

easement after adoption of ASC 842 but the contract does not include a lease, the entity’s past practice of

accounting for those arrangements as intangible assets is not affected by ASU 2018-01.

ACCOUNTING FOR LEASES UNDER ASC 842 17

INTERACTION WITH OTHER STANDARDS

DERIVATIVES AND HEDGING

ASC 815-10-15-79 on scope and scope exceptions explains that leases that are within the scope of ASC 842 are not

derivative instruments subject to the guidance on derivatives and hedging. However, a derivative instrument

embedded in a lease may be subject to the requirements of ASC 815-15-25 on recognition of embedded derivatives.

ASC 815-10-15-80 also explains that residual value guarantees that are subject to the guidance in ASC 842 are not

subject to the guidance on derivatives and hedging. However, ASC 815-10-15-80 clarifies that a third-party residual

value guarantor should consider the guidance on derivatives for all residual value guarantees that it provides to

determine whether they are derivative instruments and whether they qualify for any of the scope exceptions in ASC

815-10 on derivatives and hedging.

SERVICE CONCESSION ARRANGEMENTS

ASC 853-10-25-2 notes that the infrastructure that is the subject of a service concession arrangement within the scope

of ASC 853 should not be recognized as property, plant, or equipment of the operating entity and that those service

concession arrangements are not within the scope of ASC 842.

REVENUE FROM CONTRACTS WITH CUSTOMERS

ASC 606-10-55-68 notes that if an entity has an obligation or a right to repurchase the asset (a forward or a call

option), a customer does not obtain control of the asset because the customer is limited in its ability to direct the use

of, and obtain substantially all of the remaining benefits from, the asset even though the customer may have physical

possession of the asset. That paragraph also notes that if the entity can or must repurchase the asset for an amount

that is less than the original selling price of the asset, the entity accounts for the contract as a lease (unless the

contract is part of a sale-leaseback transaction). If the contract is part of a sale and leaseback transaction, the entity

should account for the contract as a financing arrangement and not as a sale and leaseback transaction in accordance

with ASC 842-40.

ACCOUNTING FOR LEASES UNDER ASC 842 18

Chapter 2 - Identifying a Lease

OVERVIEW

The Master Glossary defines a lease as:

“A contract, or part of a contract, that conveys the right to control the use of identified property,

plant, or equipment (an identified asset) for a period of time in exchange for consideration.”

A period of time may be described in terms of the amount of use of an identified asset (for example, the number of

production units that an item of equipment will be used to produce).

A contract is or contains a lease if there is an identified asset and the contract grants the customer throughout the

period of use both:

The right to obtain substantially all of the economic benefits from the asset’s use (the economic criterion),

and

The right to direct the use of the identified asset (the power criterion).

Accordingly, the definition of a lease focuses on three criteria as described in the following flowchart:

If the customer in the contract is a joint operation or a joint arrangement, the entity should consider whether the joint

operation or joint arrangement has the right to control the use of an identified asset throughout the period of use.

ACCOUNTING FOR LEASES UNDER ASC 842 19

Also, for an entity to appropriately evaluate the three criteria in the above flowchart, it is important to understand the

following:

The contract must be for a period of time (See Example 1), and

The evaluation of whether a contract is or contains a lease is performed based on the period of use, which is

the total period of time an asset is used to fulfill the contract with the customer, including the sum of any

nonconsecutive periods of time. That period is not always the same as the contract term (See Example 2).

Once determined, this period of use is applied to evaluate whether supplier substitution rights are

substantive, and whether the economics and power criteria are met. Accordingly, it is a key concept of the

evaluation.

The evaluation of whether a contract contains a lease is performed at contract inception, and an entity does not

subsequently reassess its conclusion unless the terms and conditions of the contract are modified.

Example 1 - Contract Must Be for a Period of Time – Perpetual Land Easement

Electric Company obtained a series of easements from Southern Railroad after its adoption of ASC 842 (see Chapter 1

on scope for a practical expedient available in transition for certain land easements). The easements were obtained

so that Electric Company could install poles to which its power lines would be attached. In addition to installing its

poles, Electric Company has the right to access the poles via a corridor leading from the nearest road to the pole.

Electric Company made an upfront payment under the easement agreement in return for perpetual access rights.

In this example, the agreement does not contain a lease. ASC 842-10-15-3 states that a lease conveys the right to

control the use of identified property, plant or equipment for a period of time in exchange for consideration. The

fact that the contract is perpetual means that it is not for a period of time, and, therefore, the agreement does not

contain a lease. This view is consistent with conforming amendments made to the intangible assets’ guidance in ASU

2018-01. Specifically, Example 10 of ASC 350-30 (paragraph 350-30-55-30) was amended to clarify that the perpetual

easements that the entity owns were “evaluated under Topic 842 and determined to not meet the definition of a

lease under that Topic (because those easements are perpetual and, therefore, do not convey the right to use the

underlying land for a period of time).”

Example 2 - Period of Use – Customer Uses Asset During Nonconsecutive Periods

Calendar Co. sells calendars and holiday merchandise. In order to sell its products, it enters into a contract for the

right to use a storefront in a mall for the months of November and December each year for five years.

Calendar Co. considers the “period of use” as defined in ASC 842-10-20 as “[t]he total period of time that an asset is

used to fulfill a contract with a customer (including the sum of any nonconsecutive periods of time).” Because the

periods of time are not consecutive, Calendar Co. must consider the aggregate term for which it has the right to use

the storefront. In this example, the period of use is ten months (two months per year for five years); it is not the

five-year contract term. Accordingly, the evaluation of whether the contract contains a lease considers the ten-

month period that the storefront is used to fulfill the contract.

ACCOUNTING FOR LEASES UNDER ASC 842 20

IDENTIFIED ASSET

An asset is typically identified when it is either explicitly specified in the contract, or implicitly specified when the

asset is made available for use by the customer. Importantly, paragraph BC128 of ASU 2016-02 notes that “when

assessing whether there is an identified asset, an entity does not need to be able to identify the particular asset that

will be used to fulfill the contract to conclude that there is an identified asset. Instead, the entity simply needs to

know whether an asset is needed to fulfill the contract from commencement. If that is the case, an asset is implicitly

specified.”

A capacity portion of an asset also can be an identified asset if it is physically distinct (for example, a floor of a

building). A capacity or other portion of an asset that is not physically distinct is not an identified asset unless it

represents substantially all of the capacity of the asset and thereby provides the customer with the right to obtain

substantially all of the economic benefits from use of the asset. The following examples illustrate this requirement

(assume for now that there are no supplier substitution rights).

Physically Distinct Asset Capacity Portion of Asset

A customer enters into a 15-year

contract with a supplier for the

right to use 3 of 10 specific

strands of a fiber optic cable

connecting Paris and London.

A customer enters into a 15-year

contract with a supplier for the right

to use a specified amount of capacity

(95%) within a cable connecting Paris

and London. The specified amount is

equivalent to the customer having

the full capacity of 14 fiber strands

within a 15-strand cable.

A customer enters into a 15-year

contract with a supplier for the right to

use a specified amount of capacity

(20%) within a cable connecting Paris

and London. The specified amount is

equivalent to the customer having the

full capacity of 3 fiber strands within a

15-strand cable.

The strands of fiber optic cable

are distinct from one another.

Each strand is an identified

asset.

The capacity specified is not

physically distinct, but it represents

substantially all the capacity of the

cable.

The cable is an identified asset.

The capacity specified is not physically

distinct and does not represent

substantially all the capacity of the

cable.

There is no identified asset.

However, even if an asset is specified, there is no identified asset if the supplier has the substantive right to substitute

the asset throughout the period of use. That is, when a supplier substitution right is considered substantive, the

supplier (rather than the customer) controls the use of the asset.

Supplier substitution rights are considered substantive when the following two conditions are met:

The evaluation of supplier substitution rights is key because if it is determined that the supplier right is substantive,

then there is no identified asset and thus the contract does not contain a lease.

Supplier has the

practical ability

to substitute

alternative

assets

throughout the

period of use

Supplier would

benefit

economically

from

substituting the

asset

Substantive

substitution

right

ACCOUNTING FOR LEASES UNDER ASC 842 21

A supplier has the practical ability to substitute alternative assets when, for example, the customer

cannot prevent the supplier from exercising its right of substitution and the supplier has other

alternative assets readily available (or the supplier could source alternative assets within a

reasonable period of time).

A supplier would benefit economically from substituting the asset if the economic benefits of doing

so exceed the related costs of substitution (e.g., transportation, installation costs, etc.). ASC 842

further states that if the asset is located at the customer’s premises, the costs of substituting the

asset are generally higher than when located at the supplier’s premises, and therefore are more

likely to exceed the related benefits. If the supplier costs to substitute exceed the related benefits,

the substitution right is not substantive and, therefore, there is an identified asset.

ASC 842 provides additional guidance to evaluate whether supplier substitution rights are substantive.

Fact Pattern Conclusion

Supplier can substitute the asset only in circumstances

that are unlikely to occur at contract inception (for

example, an agreement with a future customer to pay

an above-market price for use of the asset).

Substitution right is not substantive.

Supplier can substitute the asset only on or after a

specified future date or specified event.

Substitution right is not substantive because the supplier

does not have the right to substitute the asset

throughout the period of use.

Supplier can substitute the asset for repairs and

maintenance or based on the availability of a technical

upgrade.

Substitution right is not substantive.

Customer cannot readily determine whether a

substitution right is substantive (for example, a

customer may not have information about the supplier’s

costs of substitution).

Customer must presume that the substitution right is not

substantive (that is, there is an identified asset).

Concept of Identified Asset under ASC 842 versus ASC 840

The concept of a lease contract being based on an identified asset is not new and existed in ASC 840. Under ASC

840 an asset could be explicitly specified or implicitly specified (for example, when the supplier owned or leased

only one asset with which to fulfill its obligation to the customer/purchaser and it was not economically feasible or

practicable for the supplier to perform its obligation through the use of alternative property, plant, or equipment).

ASC 842 retains a similar concept on identifying an asset but is more explicit on the evaluation of supplier

substitution rights, now requiring that the supplier benefit economically from substitution. Accordingly, more

contracts may be leases under ASC 842, and this determination becomes more important under the new guidance

due to the balance sheet implications for lessees.

ACCOUNTING FOR LEASES UNDER ASC 842 22

Example 3A (Adapted from paragraph 842-10-55-52 through 55-54) – Concession Space

FACTS

Retailer enters into a contract with Airport Operator for the use of a space in an airport terminal for a

five-year period.

Retailer owns and utilizes a booth that is easily transferrable to different boarding areas.

Airport Operator has many areas in the terminal that are available and would meet Retailer’s

specifications. Airport Operator can at its sole discretion relocate Retailer to different boarding areas in

the terminal throughout the period of use. Airport Operator also would incur minimal costs associated

with changing the space that Retailer uses.

ANALYSIS

Is there an identified asset? No

Although the contract specifies that Retailer will utilize a specific space in the airport to operate its booth:

There are several other similar areas that Retailer may be assigned to, which Airport Operator has the

right to change, without Retailer’s approval, throughout the period of use. That is, Airport Operator has

the practical ability to substitute Retailer’s space.

The costs to move Retailer’s booth are minimal, and substitution allows Airport Operator to use its airport

space in the most effective way, for example by relocating Retailer to other boarding areas to meet

changing circumstances. Those conditions are likely to occur at contract inception considering Airport

Operator’s historical experience, business and operations. That is, Airport Operator would benefit

economically from substituting Retailer’s space.

Accordingly, Airport Operator’s substitution right is substantive.

CONCLUSION

The contract does not contain a lease.

ACCOUNTING FOR LEASES UNDER ASC 842 23

Example 3B (Adapted from paragraph 842-10-55-63 through 55-71) – Retail Space

FACTS

Retailer enters into a contract with Airport Operator for the use of retail unit A for a five-year period.

Retail unit A is part of a terminal with many retail units.

Airport Operator can require Retailer to relocate to another retail unit in the terminal. In that case,

Airport Operator is required to provide Retailer with a retail unit of similar quality and specifications as

retail unit A and to pay for Retailer’s relocation costs, including reimbursement for any leasehold

improvements that cannot be relocated.

Airport Operator would benefit economically from relocating Retailer only if a major new tenant were to

decide to occupy a large amount of retail space at a rate sufficiently favorable to cover the costs of

relocating Retailer and other tenants for the space that the new tenant would occupy. Although it is

possible that those circumstances will arise, at contract inception it is not likely that those circumstances

will arise, and whether such circumstances occur is highly susceptible to factors outside of Airport

Operator’s control.

ANALYSIS

Is there an identified asset? Yes

Retail unit A is explicitly specified in the contract, and Airport Operator’s substitution right is not substantive

because Airport Operator would benefit economically from substitution only in specific circumstances that at

inception of the contract are not likely to occur. That is, Airport Operator’s substitution right is not substantive

and, therefore, there is an identified asset.

CONCLUSION

The analysis continues to determine whether Retailer has the right to control the use of retail unit A. See Right to

Control Use of Identified Asset section for additional discussion.

ACCOUNTING FOR LEASES UNDER ASC 842 24

Example 4A (Adapted from paragraph 842-10-55-48 through 55-51) – Rail Cars

FACTS

Smith & Company (SmithCo) enters into an agreement with Freight Systems Limited (Freight) to transport

a specified quantity of products by using a specified type of rail car in accordance with a stated timetable

for a period of five years. The timetable and quantity of products specified are economically equivalent

to SmithCo having the use of ten rail cars for five years.

Freight has a large pool of similar rail cars that can be used to fulfill the requirements of the contract.

The rail cars are stored at Freight’s location when not in use.

ANALYSIS

Is there an identified asset? No

The rail cars used to transport SmithCo’s products are not identified assets. Freight has the practical ability to

substitute each rail car throughout the period of use without SmithCo’s approval, and Freight would benefit

economically from substituting each car because the costs to substitute, if any, would be minimal, and substitution

allows Freight to use the cars in the most efficient way for the task, for example because cars are currently at a rail

yard close to the point of origin. Those conditions are likely to occur at contract inception considering Freight’s

historical experience, business and operations. Accordingly, Freight’s substitution right is substantive. Therefore,

although SmithCo has the right to use the equivalent of ten rail cars for five years, Freight directs the use of those

rail cars by determining which cars will be used for each particular delivery.

CONCLUSION

The agreement does not contain a lease.

Example 4B (Adapted from paragraphs 842-10-55-42 through 55-47) – Rail Cars

FACTS

Smith & Company (SmithCo) enters into an agreement with Freight Systems Limited (Freight) under which

Freight provides SmithCo with the use of ten rail cars of a particular type for five years. The contract

specifies the rail cars, which are owned by Freight.

The agreement provides certain limitations on what types of goods SmithCo can transport, such as

hazardous materials or explosives, but otherwise, SmithCo has the right to determine whether the rail

cars are used, and if so, where, when and which products are transported using the rail cars. When the

rail cars are not in use, they are stored at SmithCo’s property.

If a particular car needs to be serviced or repaired, Freight is required to substitute a rail car of the same

type. Otherwise, Freight cannot retrieve the rail cars during the five-year period of the contract other

than on default by SmithCo.

ANALYSIS

Is there an identified asset? Yes

There are ten identified rail cars. Once the cars are delivered to SmithCo, they can only be substituted when they

need to be serviced or repaired, which is not considered a substantive substitution right based on the guidance in

paragraph 842-10-15-14.

ACCOUNTING FOR LEASES UNDER ASC 842 25

CONCLUSION

The analysis continues to determine whether SmithCo has the right to control the use of the rail cars. See Right to

Control Use of Identified Asset section for additional discussion.

Example 5 – Contract for Hosting Arrangement

FACTS

Bank Company (“Bank”) enters into a hosting arrangement with Regional Hosting Co. (“Regional Hosting”)

under which Regional Hosting will provide a specific number of servers on which it will host software

licenses owned by Bank. In addition, Regional Hosting will provide connectivity to allow Bank to access

the software hosted by Regional Hosting.

Because of the number of users in Bank’s environment and the complexity of the software environment,

Regional Hosting must host Bank’s software on dedicated servers with specific security requirements, and

no other customer can be hosted on the same servers. However, Regional Hosting has the right to

rehome Bank’s software onto different servers with similar security requirements without Bank’s approval

so long as access to its software licenses is uninterrupted.

ANALYSIS

Is there an identified asset? No (Regional Hosting), Yes (Bank)

Regional Hosting considers whether its arrangement with Bank contains identified assets (i.e., each server) and

notes that:

It has numerous servers that meet Bank’s security requirements and from which it can host Bank’s

software. Bank cannot prevent Regional Hosting from switching servers so long as access to Bank’s

software is uninterrupted. Accordingly, Regional Hosting concludes it has the practical ability to

substitute Bank’s servers throughout the period of use.

There are minimal costs to substitute servers, and Regional Hosting would benefit economically from

substitution. Specifically, it is common for new hosting customers to be obtained, at which time Regional

Hosting often reconfigures its server space. In addition, to maximize performance on its servers, Regional

Hosting regularly adds or deletes servers and moves customers as needed. Accordingly, Regional Hosting

concludes that its right of substitution is substantive.

Regional Hosting concludes that the contract does not include identified assets and thus is not a lease.

Bank, however, does not have visibility into Regional Hosting’s operations and business (including how many servers

Regional Hosting has with similar security requirements and how many customers it serves). Therefore, it

concludes pursuant to the guidance in paragraph 842-10-15-15 that Regional Hosting’s right of substitution is not

substantive, which means the agreement includes identified assets.

CONCLUSION

Regional Hosting concludes that it does not have a lease.

Bank continues its evaluation to determine whether it has the right to control the use of each identified asset (i.e.,

each server). See Right to Control Use of Identified Asset section for additional discussion.

ACCOUNTING FOR LEASES UNDER ASC 842 26

Example 6 – Contract for Medical Equipment

FACTS

Outpatient Services, Inc. (“OSI”) signs a contract with Medical Equipment Company (“MEC”) under which

OSI will use five chemotherapy machines for a period of three years. The contract does not explicitly

identify specific machines, but instead only requires five machines to be available at all times. The

machines are delivered to OSI’s location, and OSI has the right to use the machines in any way and at any

time it deems appropriate during the three-year term of the agreement, subject to restrictions requiring

the machines to be used pursuant to manufacturer-provided and FDA-approved use guidelines.

Each machine is expected to be able to provide up to 1,000 treatments before needing maintenance, and

each machine has an expected useful life of approximately 5,000 treatments, which normally equates to

five to six years. However, each machine can only be used to provide up to 10 chemotherapy treatments

before being recalibrated pursuant to FDA guidelines, at which time MEC is required to provide the

services necessary to allow OSI to continue providing its chemotherapy services. When OSI contacts MEC

to request recalibration of one of its machines, MEC retrieves that machine and replaces it with a fresh

machine.

MEC maintains a large pool of chemotherapy machines at specified locations (which are within a

reasonable distance from its customers) which have been properly cleaned and calibrated.

MEC also has the right to replace the machines at its convenience, which it regularly does when replacing

other machines in the same geographic area.

ANALYSIS

Is there an identified asset? No

While the machines are housed at OSI’s location, MEC has the right to substitute another equivalent machine

throughout the three-year period and that right is considered substantive because:

MEC has the practical ability to substitute each machine throughout the period of use considering its large

pool of machines and reasonable distance from its customers. MEC also does not need OSI’s approval to

substitute the machines.

MEC would benefit economically because MEC has centralized calibration operations in a single facility

within a reasonable distance from its customers which allows it to reduce costs of calibration (including

transportation) in excess of the costs that it otherwise would incur to calibrate the machines at the

clients’ location, while ensuring constant access to calibrated machines for its customers as required per

the agreement. In addition, MEC would benefit from replacing a machine prior to a customer’s request if

MEC is replacing another machine in that customer’s general vicinity, as that further reduces MEC’s

transportation costs. Those events are likely to occur at contract inception considering MEC’s historical

experience, business and operations.

CONCLUSION

The contract does not contain a lease.

ACCOUNTING FOR LEASES UNDER ASC 842 27

RIGHT TO CONTROL USE OF IDENTIFIED ASSET

Even if a contract includes an identified asset, a contract does not contain a lease unless the customer has the right to

control the use of that asset, which is met when the customer has throughout the period of use both:

The right to obtain substantially all of the economic benefits from the asset’s use (the economics criterion),

and

The right to direct the use of the identified asset (the power criterion).

Right to Control Use under ASC 842 similar to ASC 606 and ASC 810

Although the right to control the use of an identified asset is not a new concept, the application in ASC 842 is

different than in ASC 840. Specifically, under the guidance in ASC 840, a contract contained a lease if:

(a)

The customer controlled the operation of the asset while obtaining more than a minor portion of the output

of the asset,

(b)

The customer controlled physical access to the asset while obtaining more than a minor portion of the output

of the asset, or

(c)

It was remote that any other party would receive more than a minor portion of the output of the asset and

the price for the output was neither fixed per unit nor equal to the market price at time of delivery.

Accordingly, under ASC 840 a customer could have the right to control the use of an asset solely based on obtaining

substantially all the output from that asset, assuming the contract is priced in a certain way. This criterion defined

control based on a benefits element only. However, ASC 606 on revenue from contracts with customers and ASC 810

on consolidation define control based on a benefits element and a power element. Likewise, ASC 842 now requires a

customer to have throughout the period of use not only the right to obtain substantially all the economic benefits

from use of an asset (the economics criterion), but also the ability to direct the use of that asset (the power

criterion). In other words, a customer must have decision-making rights over the use of the asset that give it the

ability to influence the economic benefits derived from the asset’s use. Without such decision-making rights, the

customer has no more control over the use of an asset than any customer purchasing supplies or services. As a result,

certain contracts that met the definition of a lease under ASC 840 (for example certain power purchase agreements)

may no longer meet the definition of a lease under ASC 842.

ACCOUNTING FOR LEASES UNDER ASC 842 28

RESTRICTIONS AND SUPPLIER PROTECTIVE RIGHTS

Both the economic and power criteria are evaluated within the defined scope of the customer’s right to use the asset.

Terms that limit the use of the asset a certain way (for example, specifying a maximum amount of usage of the asset)

or that protect the supplier’s interest in the asset (such as requiring the customer to follow industry-standard

operating procedures, or requiring notification of changes in how or where the asset will be used) do not, in isolation,

prevent the customer from having the right to direct the use of the identified asset.

Accordingly, the analysis should focus on what the customer can do within that scope of use of the asset. Consider the

following examples:

Corporate Jet Commercial Truck Retail Unit

Contract Contract for the use of a

corporate jet for a two-year

period.

Contract for the use of a

commercial truck for a five-year

period.

Contract for the use of a retail

unit within a larger mall for a

five-year period.

Defines the

scope of

use

Restrictions within the contract

limit the number of hours the

jet can fly and/or which

territories the aircraft can fly

over.

Restrictions within the contract

limit the number of miles the

truck can be driven, and

customer cannot transport

hazardous or explosive goods.

Restrictions within the contract

limit the hours of operations of

the store from 10am to 10pm.

But within

that scope

of use

Customer has exclusive use of

the corporate jet and decides

whether the aircraft flies,

where and when the aircraft

flies (subject to the limits) and

whether to transport passengers

and/or cargo.

Customer has exclusive use of

the truck and decides where

and when the truck will be

used, how many miles (subject

to the limit) and what cargo

(other than explosives) it will

transport.

Customer has exclusive use of

the retail unit and decides when

to open (subject to the limit),

the mix of goods to sell, and at

what price to sell the goods.

In all the above examples, even though the contract includes restrictions or limitations on the use of the asset, the

contracts would include a lease as further explained in the Economic Criterion and Power Criterion sections below.

ACCOUNTING FOR LEASES UNDER ASC 842 29

ECONOMIC CRITERION

A customer can obtain economic benefits from use of an asset directly or indirectly in various ways, including by using,

holding, or subleasing the asset. The economic benefits from use of an asset include its primary output and by-products

(including potential cash flows derived from these items) and other economic benefits from using the asset that could

be realized from a commercial transaction with a third-party.

ASC 842 clarifies that only the economic benefits arising from use of an asset should be considered when assessing

whether a customer has the right to obtain substantially all economic benefits. In many cases, the evaluation will be

straightforward. For example, when the customer has exclusive use of an identified asset, it typically obtains 100% of

the economic benefits from use of that asset. This is true for the corporate jet, commercial truck, and retail unit

examples previously presented in the Restrictions and Supplier Protective Rights section. However, in other situations

this evaluation will require the use of professional judgment.

Economic benefits arising from ownership of an asset (for example, tax benefits from owning an asset) are excluded in

the evaluation. This is because a lease does not convey ownership of an underlying asset, but instead conveys the right

to use that asset. To illustrate this, consider a utility company (customer) that enters into a contract with a power

company (supplier) to purchase all electricity produced by a specific solar farm. Supplier owns the solar farm and will

receive tax credits related to its ownership of the solar farm. Customer will receive renewable energy credits related

to the use of the farm. The following table summarizes the relevant outputs to consider in determining whether the

customer obtains substantially all the economic benefits from use of the asset.

Include Exclude

Electricity produced by the solar farm (customer),

Renewable energy credits because they relate to

the

use

of the solar farm (customer).

Tax credits because they relate to the

ownership

of the asset, not the use of the asset (supplier).

In the above example, the customer receives 100% of the economic benefits from use of the asset, and therefore the

economic criterion is met. If, instead, the supplier was to receive the renewable energy credits, the entity should

determine whether the customer obtains substantially all of the economic benefits from use of the solar farm, which

may require the use of professional judgment.

Also, if a contract requires a customer to pay the supplier or another party a portion of the cash flows derived from use

of the asset, those cash flows paid as consideration are considered economic benefits that the customer obtains from

use of the asset. For example, if a retailer is required to pay a mall owner a percentage of sales from use of retail

space as consideration for that use, that requirement does not prevent the customer from having the right to obtain

substantially all of the economic benefits from use of the retail space. The cash flows arising from those sales are

considered economic benefits that the customer obtains from use of the retail space, a portion of which it then pays to

the mall owner as consideration for the right to use that retail space.

Meaning of Substantially All

In practice, the term “substantially all” is generally interpreted to be at or around 90% or more. This term is also

used in the lease classification test (see paragraphs 842-10-25-2 and 25-3), and paragraph 842-10-55-2c notes that a

reasonable approach is to conclude that 90% or more amounts to substantially all. That threshold also is mentioned in

many other areas of U.S. GAAP and generally has been applied in a similar manner.

ACCOUNTING FOR LEASES UNDER ASC 842 30

Example 3B – Retail Space (Continued)

FACTS

Retailer enters into a contract with Airport Operator for the use of retail unit A for a five-year period.

Retail unit A is part of a larger airport terminal with many retail units.

Retailer is required to use retail unit A to operate its well-known store brand to sell its goods during the

hours that the airport terminal is open.

Retailer pays Airport Operator $50,000 per month plus 6% of monthly net sales.

ANALYSIS

Is there an identified asset? Yes

See Identified Asset section for additional discussion.

Is the economic criterion met? Yes