Financial Reporting Manual

for

Maryland Public Schools

Revised 2014

The Maryland State Department of Education does not discriminate on the basis of age, ancestry,

color, creed, gender identity and expression, genetic information, marital status, disability, national

origin, race, religion, sex, or sexual orientation in matters affecting employment or in providing

access to programs. For inquiries related to Departmental policy, please contact:

Equity Assurance and Compliance Branch

Maryland State Department of Education

200 W. Baltimore Street—6th Floor

Baltimore, Maryland 21201–2595

410.767.0433 (voice)

410.767.0431 (fax)

410.333.6442 (TTY/TDD)

Maryland State Board of Education

S. James Gates, Jr.

Madhu Sidhu

Guffrie M. Smith, Jr.

Donna Hill Staton

James H. DeGraffenreidt, Jr.

Sayed M. Naved

Luisa Montero-Diaz

Linda Eberhart

Larry Giammo

Christian T. Hodges,

Student Member

Charlene M. Dukes, President

Mary Kay Finan, Vice President

Lillian M. Lowery

Secretary-Treasurer of the Board

State Superintendent of Schools

Penelope Thornton Talley, Esq.

Chief Performance Ofcer

Dr. Jack Smith

Chief Academic Ofcer

Kristy Michel

Chief Operating Ofcer

Maryland State Department of Education

Martin O’Malley

Governor

State of Maryland

Maryland State Department of Education

Nancy S. Grasmick State Education Building

200 West Baltimore Street

Baltimore, Maryland 21201

410.767.0100

www.marylandpublicschools.org

Financial Reporting Manual

for

Maryland Public Schools

~ Note ~

The following acronyms and terminology are used throughout this Manual:

GAAP: Generally Accepted Accounting Principles

LEA or LEAs: Local Education Agency(s), Maryland’s 23 Counties and Baltimore City

MSDE: Maryland State Department of Education

County (e.g., as in County government) refers to Maryland’s 23 Counties and Baltimore City.

Editor: Kathy Marzola

Maryland State Department of Education

Ofce of Finance & Administration

410.767.0011

SUBJECT PAGE

Introduction i

Financial Accounting 1

Accounting and Reporting Requirements 5

Coding and Reporting Structure 9

Coding by Field 11

Matrices:

Assets, Liabilities, and Fund Balances by Fund 12

Revenue by Fund 13

Expenditure by Fund 17

Object-Subobject by Fund 20

Revenue Source Codes 37

Denitions

Financial Statement Account 39

Revenue and Other Fund Source Account 41

Expenditure Account 47

Object/Subobject Dimension 65

Charter Schools 71

Bi-Annual Report 73

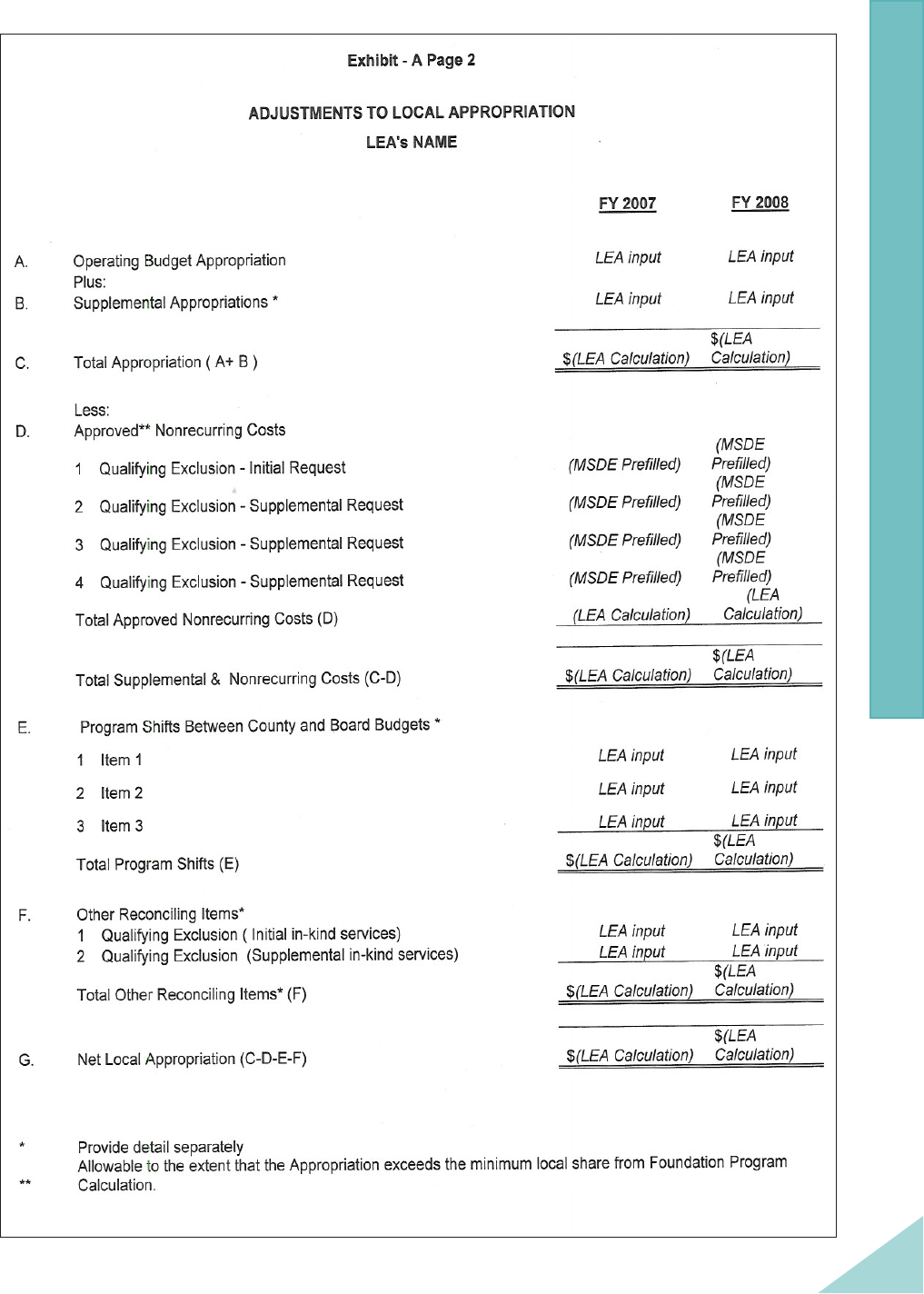

Maintenance of Effort 77

Non-Recurring Cost Waiver Request 81

On-Behalf Payments 89

Table of Contents

Table of Contents - Appendices

SUBJECT APPENDICES

Instructions for Completing the Annual Financial

Report Forms

A

Instructions for Completing the Annual Budget Forms B

The Annual Financial Reporting System C

Supplies and Equipment D

Fund Source Codes and Catalog Numbers E

Cost Principles and State-Funded Grants F

The Financial Reporting Manual for

Maryland Public Schools (Manual) was

developed and adopted by the Maryland State

Board of Education in 1963 in response to the need for

a uniform system of budgeting and reporting Maryland public

school nancial data. To assure uniform reporting at both the state

and federal levels, the Manual was based upon the federal Handbook II,

Financial Accounting for Local and State School Systems, written and produced

in 1957 by the U.S. Ofce of Education.

In 1968, the education laws were reviewed and changes were proposed to limit county government

control of local school budgets. Subsequent passage of Article 77, Section 117 of the Annotated

Code of Maryland (now known as Section 5-101 of the Education Article of the Annotated Code

of Maryland and referred to as the Budget Categories Law) and changes in federal reporting

requirements necessitated revisions to the Manual that were made in 1970.

In the early 1970s, the federal government began working on a new nancial handbook and

distributed discussion drafts to states. The handbook introduced a multi-dimensional expenditure

framework to address the demands for increasingly sophisticated program cost information, and

it reduced the number of major reporting categories from twelve to four. The revised federal

Handbook II was adopted in 1973 and introduced as Handbook II, Revised - Financial Accounting,

Classications and Standard Terminology for Local and State School Systems (HBIIR). Maryland

was then unable to report expenditures to the federal government in accordance with the new

denitions.

A 1973 report to the State Board of Education recommended the adoption of HBIIR for Maryland

public schools, but the recommendations were too controversial and were not adopted. Over

the next several years, public sentiment shifted in favor of changing the state budget categories

because of the focus on Special Education and the desire by local governments to change the

denitions of some of the categories listed in the Manual. In 1977, Maryland’s Budget Categories

Law was revised to add a new expenditure category for Special Education, to revise the denitions

of the categories of Administration and Instruction, and to make some other less signicant

changes, effective for 1979 scal year. The Manual was revised to incorporate the changes and

was distributed to users in 1980.

In 1983, the Manual was again revised to include a standard chart of accounts to accommodate the

automated reporting of nancial information; to provide a structure to support the 1980 revision of

the federal handbook, Handbook IIR2 - Financial Accounting for Local and State School Systems;

and to provide guidance in areas not previously addressed in the Manual.

The 1996 version of the Manual was precipitated by the growing awareness that the 1983 Manual

was seriously out-of-date. Changes in educational policy, changes in operating practices, changes

in public interest, and the desire for comparable nancial information and greater accountability

created an interest in revising the denitions and account codes. A committee of local nance

ofcers and state education staff reviewed the Manual and recommended changes.

Concurrently with this activity, the State Board of Education granted a three-year waiver beginning

with scal year 1995 to include expenditures for instructional staff development in the category

of Instruction rather than in the category of Administration, as dened in the Manual. It was also

i

Introduction

concluded that school-based curriculum development should be charged to Instruction as these

activities are performed by teachers, usually during summer work sessions.

During the 1996 legislative session, several bills were introduced to modify the state budget

categories. At the conclusion, three budget categories were added to segregate certain instructional

expenditures. This revision conforms to the new budget categories, codies the Board’s waiver,

renes the denitions of expenditure areas, and introduces new concepts.

Since the last revision of the Manual in 1996, there have been major statutory changes affecting

public nancing of public education. These include the establishment of Bridge to Excellence in

2002 that dramatically increased State aid to education and replaced 25 restrictive grant programs

with four new unrestricted funding formulas, increased scal accountability under the Education

Fiscal Accountability and Oversight Act of 2004, and the authorization and establishment of charter

schools as a new type of public school in Maryland.

In addition to legislation, signicant changes have been made in nancial reporting with the

implementation of the web-based Annual Financial Reporting system and in reporting categories.

This Manual is revised to include guidance in interpreting nancial reporting policy and

directives.

Legal Authority

The structure of nancial accountability in Maryland is determined by several references in the

Education Article of the Annotated Code of Maryland. Section 5-101 establishes the budget

categories and references the Financial Reporting Manual for Maryland Public Schools, revised

2009 as the source for identifying additional budgetary details that the county scal authorities

may request of the county board. Section 2-205 requires the State Board to adopt bylaws, rules,

and regulations that govern the administration of the public school systems in Maryland and

empowers the State Board to collect the nancial information. Section 2-303 authorizes the

State Superintendent to withhold State funding if a school system violates the legal requirements

identied in the laws, bylaws, and State Board rules and regulations. Section 5-101 prescribes a

uniform method of reporting receipts, expenditures, and balances of the operations and activities

of the public schools.

The Code of Maryland Regulations (COMAR) 13A.02.01.02, cites as legal authority Section

5-101, Education Article, Annotated Code of Maryland and reads as follows:

C. Annual School Budget. The Annual School Budget shall be submitted by the local board

of education to the board of county commissioners or county council or the city council

according to the form and procedures adopted by the State Board of Education and set

forth in the Financial Reporting Manual Maryland Public Schools, revised 2009, that is

incorporated by reference. The forms and procedures in the Manual shall apply to the

annual school budgets beginning with scal year 2010.

D. Annual School Financial Report. The Annual School Financial Report shall be submitted

by the local board of education to the State Board of Education according to the form and

procedures adopted by the State Board of Education.

ii

Introduction

Distribution

The Manual will be available in .pdf format on the Maryland State Department of Education’s

main webpage. The URL will be provided when the revisions to Manual are nalized and the

Manual is posted. The anticipated path will be:

marylandpublicschools.org

click on Newsroom

click on Publications

scroll to The Financial Reporting Manual for Maryland Public Schools

Compliance

Maryland LEAs are required to adhere to the denitions of accounts contained in this Manual when

submitting expenditure information to the Maryland State Department of Education. Although

LEAs may use a different chart of accounts or unique structures to record expenditures for purposes

of internal control, they are required to report in accordance with the provisions outlined in this

Manual to assure reasonable comparability. “Differences between nancial reports should be due

to substantive differences in the underlying transactions. . . rather than to the selection of different

alternatives in accounting procedures and practices.”

*

Failure to comply with the denitions and other requirements is a violation of State Board

regulations and may be the basis for withholding State Aid (refer to Sections 2-303(b), 5-114, and

5-205(a) of the Education Article of the Annotated Code of Maryland).

* Quoted in National Council on Governmental Accounting, Governmental Accounting, Auditing

and Financial Reporting, published by Government Finance Ofcers Association, Chicago,

1988, p.3.

iii

Introduction

In 1979, the National Council on

Governmental Accounting (NCGA) set forth

twelve basic principles of accounting and nancial

reporting in Statement 1, Governmental Accounting

and Financial Reporting Principles. These principles are the

generally accepted accounting principles (GAAP) for governmental

units as recognized by the American Institute of Certied Public

Accountants and the Association of School Business Ofcials of the United

States and Canada. Maryland local education agencies are required to maintain their

accounts in accordance with GAAP.

GAAP for state and local governments is monitored by the NCGA, a group sponsored by the

Government Finance Ofcers Association. The latter organization has produced a comprehensive

publication entitled Governmental Accounting, Auditing and Financial Reporting (GAAFR),

commonly known as the Blue Book. GAAFR is the premier source of guidance on state and

local government accounting, auditing, and nancial reporting. It does not set GAAP, nor is it the

authoritative source of GAAP, but it does provide practical guidance for implementation of GAAP

standards.

In June 1999, the Governmental Accounting Standards Board (GASB) issued Statement Number

34 entitled Basic Financial Statements and Management’s Discussion and Analysis for State and

Local Governments. This statement signicantly changed the presentation format of nancial

statement information by requiring the inclusion of government-wide nancial statements

presented on the accrual basis of accounting. All Maryland LEAs were required to implement this

statement by the scal year ending June 30, 2003.

Fund Accounting

For accounting purposes, a government entity is a collection of smaller entities, each designed for

a specic purpose. To account for these individual purposes, fund accounting evolved to serve as

the framework for accounting and reporting in the public sector.

A fund is dened as a “scal and accounting entity with a self-balancing set of accounts recording

cash and other nancial resources, together with all related liabilities and residual equities or

balances, and changes therein, which are segregated for the purpose of carrying on specic

activities or attaining certain objectives in accordance with special regulations, restrictions, or

limitations.”

*

Governments and government subunits, such as LEAs, are required to use fund accounting.

GAAFR describes three broad fund categories, subdivided into a maximum of ten fund types, for

accounting and nancial reporting. The funds are described below. The basic nancial statements

should conform to the requirements of Governmental Accounting Standards Board Statement

Number 34 and consist of government-wide nancial statements and fund nancial statements,

and include the following:

• The Government-Wide Financial Statements, consisting of a Statement of Net Assets

* Governmental Accounting Standards Board (GASB), Codication of Governmental Accounting

and Financial Reporting Standards, Section 1100.110.

1

Financial

Accounting

and a Statement of Activities, are prepared using the economic resources measurement

focus and the accrual basis of accounting. These statements should report all of the assets,

liabilities, revenues, expenses, and gains and losses of the government. Each statement

should distinguish between the Governmental Activities and Business-Type Activities of

the primary government and its discretely presented component units by reporting each in

separate sections.

• The Fund Financial Statements consist of a series of statements that focus on information

about the government’s major governmental and proprietary funds, including its blended

component units. Fund Financial Statements also should report information about a

government’s duciary funds and component units that are duciary in nature.

• The Governmental Fund Financial Statements should be prepared using the current

nancial resources measurement focus and the modied accrual basis of accounting, and

they include the following:

(1) General Fund – The chief operating fund used to account for all nancial resources

except those required to be accounted for in another fund.

(2) Special Revenue Fund – A fund used to set apart particular operating revenues that may

be restricted for expenditures of a specic purpose. Examples are federal restricted

programs, state restricted programs, and local restricted programs.

(3) Debt Service Fund – A fund used to account for monies set aside for current and future

debt service requirements. These funds are required if legally mandated and if nancial

resources are accumulated for principal and interest payments maturing in future years.

It is not applicable to all school systems.

(4) Capital Projects (School Construction) Fund – A fund used to account for nancial

resources to be used for the acquisition or construction of major capital facilities that

are not nanced by proprietary or trust funds.

• The Proprietary Fund Financial Statements should be prepared using the economic resources

measurement focus and the accrual basis of accounting and include the following:

(1) Enterprise Fund – A fund used to report any activity for which a fee is charged to

external users for goods and services.

(2) Internal Service Fund – A fund used to report any activity that provides goods or services

to other funds, departments, or agencies of the primary government and its component

units, or to other governments, on a cost-reimbursement basis.

• The Fiduciary Fund Financial Statements should be prepared using the economic resources

measurement focus and the accrual basis of accounting and include the following:

(1) Pension (and Other Employee Benet) Trust Fund – A fund used to report resources

that are required to be held in trust for the members and beneciaries of dened benet

pension plans, dened contribution plans, other post-employment benet plans, or

other employee benet plans.

2

Financial Accounting

(2) Investment Trust Fund – A fund used to report the external portion of investment pools

reported by the sponsoring government.

(3) Private-Purpose Trust Fund – A fund used to report all other trust arrangements

under which principal and income benet individuals, private organizations or other

governments.

(4) Agency Fund – A fund used to report resources held by the reporting government in a

purely custodial capacity (assets equal liabilities).

3

Financial Accounting

4

Maryland local education agency (LEA)

accounting systems shall provide the information

necessary to prepare nancial reports that present

fair and full disclosure of the LEA nancial operations

in accordance with GAAP. The system shall accommodate

adjustments to demonstrate nancial compliance with legal provisions

and reporting requirements of the Maryland State Department of Education

(MSDE).

This Manual presumes adherence to GAAP, but dictates a unique reporting structure for

Maryland LEAs based on federal and state reporting requirements. The design and structure of

the account code facilitates reporting in accordance with Section 5-101 of the Education Article of

the Annotated Code of Maryland and in accordance with the requirements of the National Center

for Education Statistics, as described in Financial Accounting for Local and State School Systems,

2003 edition.

Funds and Report Groups

While Maryland LEAs are encouraged to use any or all of the described funds for management

purposes, they are limited to only those funds identied below when reporting in accordance with

Section 5-101 of the Education Article, Annotated Code of Maryland. Each of these funds is

described in that context:

Funds:

(1) Current Expense - This fund is the composite of the General Fund and all Special

Revenue Funds except the Food Service Fund and Special Revenue funds set up

for capital projects. The Current Expense Fund accounts for the basic education

programs and includes all nancial resources used for the basic operations of the

school system. It may be thought of as the operating fund. The Current Expense

Fund is subdivided into Unrestricted Programs and Restricted Programs. Included

in the Current Expense Fund are the proprietary-type Internal Service Funds that

shall be reported in the appropriate category, program, and object in accordance

with the Public School Laws of Maryland.

(2) [Not Used]

(3) School Construction - This fund is used to account for the nancing of major

construction projects within the LEA, including remodeling and alterations to

existing facilities. This is generally funded with debt proceeds rather than through

operating revenues. Funds available for payment toward the completion of a

school construction project in a subsequent scal year(s) should be recognized as

assets and corresponding deferred revenues in the current scal year.

(4) Debt Service - This fund is used to report the payment of interest and principal on

long-term general obligation debt used to nance LEA capital projects. Although

most Maryland LEAs do not have the authority to issue bonds, they are required

to report the revenue and expenses related to the portion of the county or city debt

that is attributable to the LEA on the Annual Financial Report.

5

Accounting

and Reporting

Requirements

(5) Food Service - This fund is used to account for the operation of the food service

program, including all activities involved in providing food to schools, students,

staff, or the community. The fund may be a government-type special revenue fund

or a proprietary-type enterprise fund.

(6) Student Activities - This duciary type fund is used to account for the operations of

student activities which are owned, operated, and managed by the student body

under the guidance and/or direction of staff members or other adults. Student

payments and fundraisers are the principal revenue sources for the Student

Activities Fund.

(7) Trust/Agency - This fund is used to report nancial resources for which the LEA

is only a trustee, an agent, or a conduit. Expenditures from this fund are in the

form of refunds of previous contributions, pass-through monies to agencies for

whom economic benet will occur, or funds for accumulation of assets to be

liquidated at a future date. When an LEA receives a grant that will benet several

LEAs, it assumes the leading function of doling funds, and collecting revenue and

expenditure reports from all parties involved for the purpose of ling the main

grant Annual Financial Report with MSDE under the Trust/Agency Fund. Each

LEA directly beneting from the grant should report its portion under a locally

created grant number in the Current Expense Fund.

(8) For all Funds, the accounts required for complete reporting are :

• Assets;

• Liabilities;

• Expenditures;

• Revenue (or Income) and Nonrevenue; and

• Fund Balances (beginning and ending).

(9) Fixed Charges Supplemental Report Group - dened as charges of a generally recurrent

nature that are not readily allocable to other expenditure categories. They have

traditionally been included in a separate category under Maryland law. Until there

is a change in the law, it will be necessary to request that these expenditures be

distributed to the appropriate category as supplementary information to comply

with federal reporting requirements. The xed charges supplemental account group

was created to facilitate the reporting of xed charges in the proper expenditure

category.

Basis of Accounting

LEAs must use the accrual basis of accounting for proprietary funds and nonexpendable trust funds

and use the modied accrual basis of accounting for all other funds. The modied accrual basis of

accounting means that expenditures are recognized when the liability is incurred and revenues are

recognized when they are measurable (the amount of revenue can be determined) and available

(realized within 60 days after the end of the scal year).

For Restricted Programs, revenue can be recognized only to the extent of the expenditures.

Expenditures for restricted programs are dened as Cash + Payables + Outstanding

encumbrances.

6

Accounting & Reporting Requirements

Revenue, Expenditure, and Transfer Accounts

The structure of an accounting system is dependent upon the needs of the user. Revenue,

expenditures (or expenses), and transfer accounts provide the basis for tracking the ow of funds.

Revenue is an increase in fund nancial resources that does not increase any liability, does not

represent the recovery of an expenditure, does not represent the cancellation or decrease in assets,

and does not represent contributions of fund capital in proprietary funds. Revenue does not include

interfund transfers, debt issue proceeds, exchanges of property for cash, or expenditure refunds.

Federal program funds applicable to expenditures for the same program in the current scal year,

but expected to be received in the next scal year, are to be accrued as current revenue at the end

of the scal year. Federal revenue is to be recognized when the expenditure has occurred. State

aid entitlements are to be recognized as revenue in the year of entitlement even though some funds

may be received in a subsequent scal year.

Revenue is categorized by source of funds (federal, state, or local) and by funding authority (state

aid category or federal program).

Expenditures or expenses for proprietary funds are decreases in net nancial resources resulting

from charges incurred, whether paid or not paid, that benet the current year. For purposes of

MSDE nancial reporting and the Budget to Actual Statement in the Component Unit Financial

Report (Audit), expenditures are dened as cash + accounts payable + encumbrances. In some

cases, expenditures should be recorded as transfers.

Expenditures are classied by fund and object in all funds. The Current Expense fund has additional

classications by category, program, and activity.

Transfers are distinguished from revenues and expenditures. Transfers are special types of

expenditure and revenue accounts that must be differentiated to avoid duplication or to identify

an expenditure that should not be included when calculating per pupil expenditures. Transfer

accounts allow money to ow between funds or governments without duplicate recording by the

various recipients. Transfers may occur between funds, between units of government, or between

LEAs.

For example, one school system may pay tuition to another school system to educate a child.

The receiving LEA enrolls the student and pays for the services rendered. Both LEAs will have

revenue and expenditures related to the same student. Recognizing and recording the transactions

related to the same student as transfers out or in prevents the overstatement of state and national

expenditures for education.

7

Accounting & Reporting Requirements

8

The structure of the Maryland State

Department of Education (MSDE) account code

is hierarchical and governs the nancial reporting

structure to be followed for the Annual Financial Report.

The design is multi-dimensional and allows the aggregation of

nancial data within any eld. School systems are encouraged to

adopt a compatible structure with modications based on locally-identied

needs for additional detail. Expansion of the hierarchy will allow more nite

accounting while facilitating extraction of details required by MSDE.

Structure of Accounts/Record Layout

The MSDE account codes are shown below. This structure of accounts allows nancial information

to be submitted via electronic media and/or le transfer. (See Appendix A for le specications

and reporting requirements.)

Column Length Data Element Data Type

1-2 2 LEA Number Numeric

3 1 Fund Numeric

4 1 Class Numeric

5-6 2 Category Numeric

7-8 2 Program Numeric

9-10 2 Activity Numeric

11 1 Object Numeric

12-13 2 Sub-Object Numeric

14-25 10 Dollar Amount Numeric

26-29 4 Fund (Revenue) Source Numeric

30-37 8 Grant Document Number Numeric

See below for numbering non-MSDE issued grants

38-47 10 Local Grant Number Alpha-numeric

48-59 12 Original Grant Amount Numeric

60-71 12 Cash Received Numeric

72-83 12 Cash Expenditures Numeric

84-91 8 Payables Numeric

92-99 8 Encumbrances Numeric

100-109 10 Administration-Federal Numeric

110-119 10 Administration-Nonfederal Numeric

120-129 10 Career & Tech. Maintenance of Program Numeric

130-133 4 Fiscal Year Numeric

134-143 10 Local Contributions Numeric

The rst ve italicized elds (columns 48-99) are inception-to-date data that is indispensable for

MSDE-issued grants requiring Restricted Program Reports. They are optional for non-MSDE

(locally restricted) grants. The Career and Technology elds (columns 120-129) apply exclusively

to MSDE-issued grants under the Carl D. Perkins Act. The Local Contributions elds (columns

134-143) are for local matching funds as the required addition to the grant award.

9

Coding and

Reporting

Structure

How to Assign Grant Numbers to Programs without MSDE Grant Numbers

Using the following numbering scheme for non-MSDE issued grants will assure a unique

number for each restricted report submitted:

First 2 digits - FY (2009 = 09)

Next 2 digits - LEA #

Next 4 digits - Unique number of LEA choice (e.g., sequential, beginning with 0001)

10

Coding & Reporting Structure

11

CODING BY FIELD

LEA Number

The LEA number identies the local education agency for which nancial information is being

submitted. The LEA code numbers are:

01 Allegany 12 Harford

02 Anne Arundel 13 Howard

03 Baltimore 14 Kent

30 Baltimore City 15 Montgomery

04 Calvert 16 Prince George’s

05 Caroline 17 Queen Anne’s

06 Carroll 18 St. Mary’s

07 Cecil 19 Somerset

08 Charles 20 Talbot

09 Dorchester 21 Washington

10 Frederick 22 Wicomico

11 Garrett 23 Worcester

Fund

The fund codes are used to identify the fund types for which revenue, expenditures, assets, liabilities,

and fund balances are reported. The fund codes are:

1 Current Expense

2 [Not Used]

3 School Construction

4 Debt Service

5 Food Service

6 Student Activities

7 Trust/Agency

8 General Fixed Assets

9 Fixed Charges Supplemental Report Group (This account is used to redistribute

expenditures reported in the Fixed Charges category to the category for which the

charge was incurred. It should not be confused with the true fund types and is used

for convenience only.)

Class

The class code describes the type of nominal and real accounts. These account totals are used to

describe the operations and status of each of the major funds identied in the Fund code.

1 Revenue 5 [Not Used]

2 Expenditures 6 [Not Used]

3 Assets 7 Fund Balance

4 Liabilities

Coding & Reporting Structure

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

General

Fixed

Assets

3

Assets

301

Cash (including CDs)

X

X

X

X

X

302

Temporary Investments

X

X

X

X

X

320

Accounts Receivable

X

X

X

X

X

370

Inventories

X

X

X

X

X

383

Land & Land Improvements

X

384

Buildings & Additions

X

385

Furniture & Equipment

X

389

Construction in Progress

X

399

Other Assets

X

X

X

X

X

4

Liabilities

450

Payroll Deductions/Withholding

X

X

X

473

Deferred Revenue-Transportation

X

474

Deferred Revenue-Other

X

X

X

499

Other Liabilities

X

X

X

X

X

7

Fund Balance

701

Opening Balance

X

X

X

X

X

710

Closing Balance-Unreserved

X

X

X

X

X

712

Closing Balance-Reserved

X

X

X

X

X

750

Investment in General Fixed

Assets

X

760

Prior Years’ Adjustments

X

X

X

X

Category/Program/Activity

The category/program/activity elds are dependent upon the class (and fund type) codes. The

number of digits required to completely describe the account varies according to the class code.

With the exception of the revenue and expenditure accounts, coding is required only to the category

level.

Below are three matrix representations showing the linkages of category/program/activity codes to

class codes and the fund types in which these accounts will be reported.

Assets, Liabilities, and Fund Balances by Fund Matrix

Coding for these account groups requires only the category code appended to the fund and class

codes. All LEA Asset accounts that are not shown below are to be reported by Fund in Code 399-

Other Assets. All LEA liability accounts not shown below are to be reported by Fund in Code

499-Other Liabilities.

12

Coding & Reporting Structure

Account

Revenue by Fund Matrix

Coding for the Revenue accounts requires category and program codes appended to the fund type

and class codes. For restricted programs, the revenue (fund) source code eld is also required

to identify the type of federal program or the specic initiative of each major state aid funding

source. Revenue details in the Trust/Agency Fund apply only if one LEA is acting as the agent

for other LEAs.

101

Local Appropriations

X X

X

X X

X

105

Other Revenue

10502

Tuition-Nonresident

X

10503

Tuition-Adult Education

X

10505

Tuition-Summer School

X

10509

Tuition-Other

X

10511

Student Payment/Fees

X

X

X

10512

Other Sales

X

X

X

10520

Transportation Payments

X

10530

Earnings on Investments

X

X

X

X

10535

Rent

X

X X

10591

Locally Donated Commodities

X

10598

Local Revenue For/On-Behalf

of the LEA

X X

X

10599

Other Miscellaneous Revenue

X X

X

X X

X

120

State Revenue

12001

State Share of Current Expenses

1200131 Formula

X

1200191 Supplemental Grant

X X

X

12002

Compensatory Education

1200237 Formula

X

12005

Formula Grants for Specic

Populations

X

1200532 Schools Near County Lines

X

1200534

Out-of-County Living

Arrangement

X

12007

Students with Disabilities

X

1200749

Formula

X

1200750

Nonpublic Placement

X

1200777

Maryland Infants & Toddlers

X

12009

Gifted and Talented

X

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

13

Coding & Reporting Structure

Revenue by Fund

14

1200954

Gifted and Talented Grants

X

12013

Innovative Programs

1201388

School-Based Health Centers

X

1201395

Smith Island Boat

X

12014

Adult Continuing Education

1201466

Formula

X

1201467

External Diploma

X

1201468

Multi-Service Centers

X

1201469

Literary Works

X

12024

Limited English Procient

X

1202435

Formula

X

12025

Guaranteed Tax Base

1202586

Formula

X

12027

Food Services

1202717

State Program

X

1202759

MD Meals for Achievement

Program

X

12039

Transportation

1203978

Formula

X

1203979

Students with Disabilities

X

12052

Science & Math

1205284

Grants

X

12098

State Revenue For/On-Behalf of

the LEA

X

12099

Other State Revenue

X

X

X

X

X

X

NOTE: Any other major aid program will be separately identied and included in the User Guide

Appendix at the Annual Financial Report and Grant Reporting System website.

130

Federal Revenue

X

X

X

13001

Unrestricted-Impact Aid

X

13002

Restricted Through MSDE

X

X

X

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

Coding & Reporting Structure

Revenue by Fund

15

Coding & Reporting Structure

Revenue by Fund

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

Revenue by Fund

13002

Restricted Through MSDE

X

X

X

13003

Restricted Direct

X

X

X

13004

Restricted-Pass Through Other

Agency

X

X

13050

USDA Commodities

X

13098

Federal Revenue For/On-Behalf of

the LEA

X

199

Other Resources

19901

Sale of Equipment (Assets)

X

X

X

19902

Net Insurance Recovery

X

X

19903

Sale of Bonds

X

19904

State Loans

X

19905

Prior Year Balance

X

X

X

X

X

19910

Transfers In-Maryland LEAs

X

19911

Transfers In-OOS LEAs

X

19920

Interfund Transfers

X

X

X

X

X

19999

Other Nonrevenue

X

X

X

X

X

X

16

Coding & Reporting Structure

This page is intentionally blank.

17

Coding & Reporting Structure

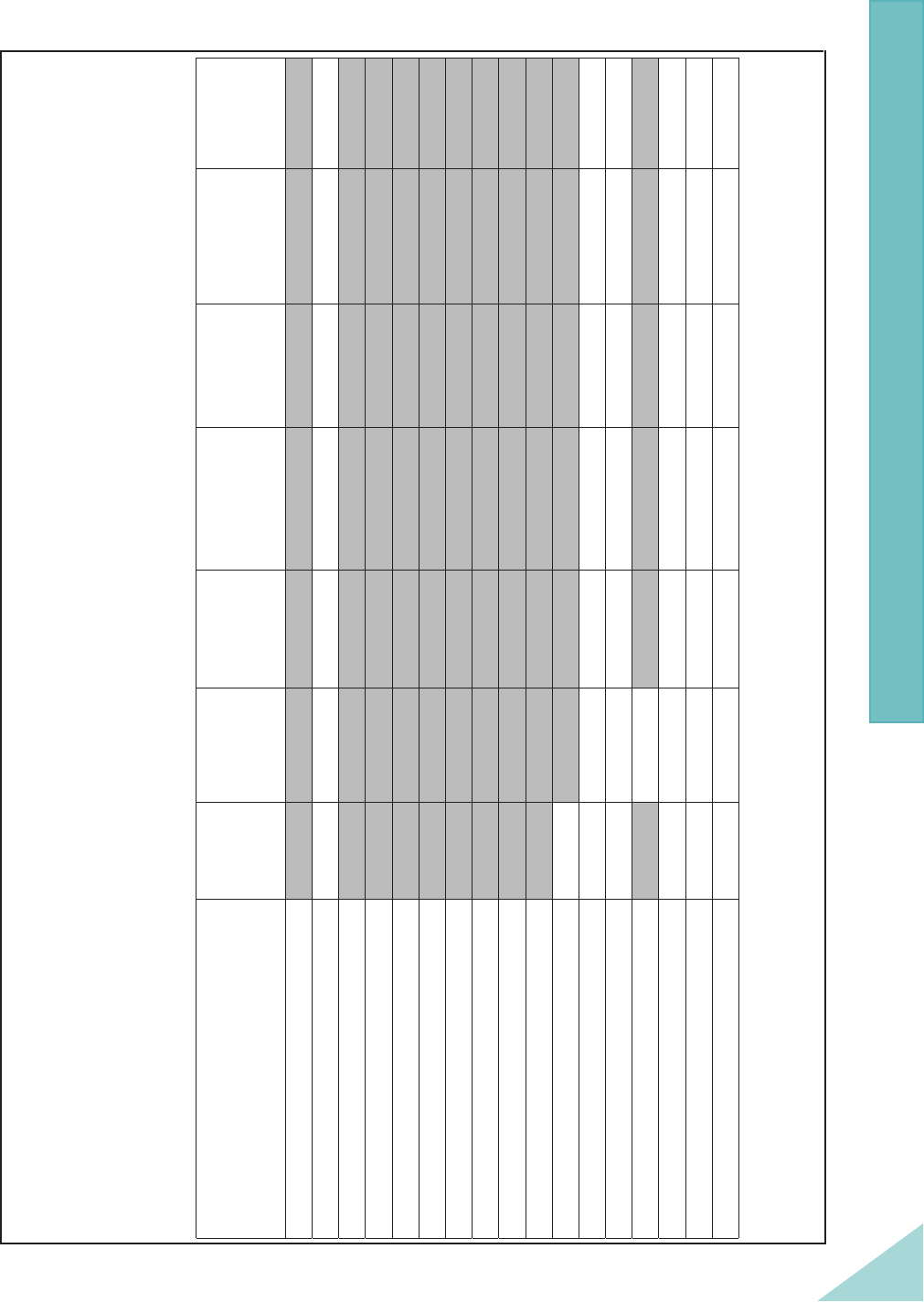

Expenditure by Fund Matrix

Expenditure coding by category and program area is required for Fund 1 – the Current Expense

Fund and Fund 3 – School Construction Fund. Category and Program details are also required for

restricted grants reported in Fund 7 – Trust/Agency Fund. Other Fund types have no category or

program levels of detail and require only object/subobject details.

Expenditure by Fund

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

200

Expenditures

X

X

X

X

201

Administration

X

20121

General Support

X

20122

Business Support

X

20123

Centralized Support

X

202

Mid-Level Administration

20215

Ofce of the Principal

2021501

Basic/Supplemental Programs

X

2021502

Career & Technology Programs

X

20216

Instructional Admin & Supervision

2021601

Basic/Supplemental Programs

X

2021602

Career & Technology Programs

X

2021604

Professional Media Support

X

203

Instructional Salaries and Wages

20301

Regular Programs

X

20302

Special Programs

X

20303

Career & Technology Programs

X

20304

Gifted and Talented Programs

X

20308

School Library Media Programs

X

20309

Instructional Staff/Curriculum

Development

X

20310

Guidance Services

X

20311

Psychological Services

X

20312

Adult Education

X

204

Textbooks and Instructional Supplies

20401

Regular Programs

X

20402

Special Programs

X

20403

Career & Technology Programs

X

20404

Gifted and Talented Programs

X

20408

School Library Media Programs

X

20409

Instructional Staff/Curriculum

Development

X

18

Coding & Reporting Structure

20615

Ofce of the Principal

X

X

207

Student Personnel Services

X

X

208

Student Health Services

X

X

209

Student Transportation

X

X

210

Operation of Plant

20130

Warehousing and Distribution

X

X

20131

Other Operation of Plant

X

X

211

Maintenance of Plant

X

X

212

Fixed Charges

X

X

213

Food Services

X

X

214

Community Services

X

X

215

Capital Outlay

21534

Land & Land Improvements

X

X

21535

Buildings & Additions

X

X

21536

Remodeling

X

X

20410

Guidance Services

X

20411

Psychological Services

X

20412

Adult Education

X

205

Other Instructional Costs

20501

Regular Programs

X

20502

Special Programs

X

20503

Career & Technology Programs

X

20504

Gifted and Talented Programs

X

20508

School Library Media Programs

X

20509

Instructional Staff/Curriculum

Development

X

20510

Guidance Services

X

20511

Psychological Services

X

20512

Adult Education

X

206

Special Education

20604

Public School Instruction

X

20606

Programs in State Institutions

X

20607

Nonpublic School Programs

X

20609

Instructional Staff/Curriculum

Development

X

20616

Instructional Admin & Supervision

X

X

20615

Ofce of the Principal

X

X

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

Expenditure by Fund

19

Coding & Reporting Structure

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

100

Salaries and Wages

X

X

X

X

X

101

Salaries for Temporary/Substi

-

tute Teachers

X

X

102

Other Salaries -- Teachers and

Other

X

X

103

Teachers -- Certied

X

X

104

Aides and Assistants

X

X

200

Contracted Services

205

Rent (including operating leases)

X

X

X

206

Outside Food Service

X

207

Independent Audit Cost

X

X

X

209

Other Contracted Services

(cleaning services, repair/

maintenance, construction,

student transportation, food

service management, and other)

X

X

X

X

X

300

Supplies and Materials

321

Textbooks

X

X

X

322

Library Media

X

X

X

325

Food

X

327

Other Donated Commodities

X

328

Food Supplies

X

329

Other Supplies

X

X

X

X

400

Other Charges

X

X

X

408

Other Purchased Services

(includes non-employee

insurance, communications,

travel, non-energy utilities water

and sewer services, other)

X

X

X

Object-Subobject by Fund

412

Employee Retirement

X X X

413

Security Security

X X

X

414

Other Employee Benets

(tuition reimbursement,

unemployment insurance,

workers compensation, group

insurance

X X X

424

Energy Services

X

X

X

499

Miscellaneous (judgments, dues,

fees, subscriptions, short-term

interest)

X

X

500 Land, Buildings, and Equipment

551

Land

X

X

552

Buildings

X

X

554

Equipment

X X X

X

X

20

Coding & Reporting Structure

Current

Expense

School

Construc-

tion

Debt

Service

Food

Service

Student

Activities

Trust/

Agency

Object-Subobject by Fund

555

Depreciation

X

556

Depreciation (memo only)

X

600 Principal

661

Long-Term Bonds X

662

State Loans

X

700 Interest

761

Long-Term Bonds

X

762

State Loans

X

800

Transfers

X

881

Maryland LEAs

X X

882

Other LEAs

X

X

885

Other

X X

886

Interfund

X X X

X

X

890

Indirect Cost Recovery

X

Coding & Reporting Structure

21

This page is intentionally blank.

Coding & Reporting Structure

22

Administration

General

Support

Business

Support

Central

Support

Current Expense Fund

100 Salaries

101 Temporary/Substitute Teachers X X X

102 Other Salaries X X X

103 Teachers -- Certied

104 Aides and Assistants

200 Contracted Services

205 Rent & Operating Leases X X X

206 Outside Food Service

207 Independent Audit X

209 Other Contracted

Cleaning Services

Repair/Maintenance

Construction

Student Transportation

Food Service Management

Other

X X X

300 Supplies and Materials

321 Textbooks

322 Library

325 Food

327 Other Donated Commodities

328 Food Supplies

329 Other Supplies X X X

400 Other Charges

408 Other Purchased Services:

Travel X X X

Liability/Fidelity Insurance X

Property/Casualty Insurance

Communication

Utilities (not energy)

Other X X X

412 Employee Retirement

413 Social Security

414 Other Employee Benets

424 Miscellaneous

Judgments X

Object-Subobject by Fund/Category

Coding & Reporting Structure

23

Mid-Level

Administration

Instructional Salaries

Ofce

of the

Principal

Inst.

Admin.

and Su-

pervisor

Regu-

lar Pro-

grams

Gifted

and

Tal-

ented ESOL

Career

and

Tech

Adult

Educ

School

Media

Staff

Devel

Gui-

dance

Psych

Ser-

vices

X X X X X X X X X X X

X X X X X X X X X X X

X X

X X

X X

X X

X X

X X

X

X X

Current Expense Fund

Coding & Reporting Structure

Current Expense Fund

Administration

General

Support

Business

Support

Central

Support

Short-Term Interest

Other X X X

500 Land, Buildings, Equipment

551 Land

552 Buildings

554 Equipment--new & replacement X X X

555 Depreciation

556 Depreciation (memo)

600 Principal

661 Long-Term Bonds

662 State Loans

700 Interest

761 Long-Term Bonds

762 State Loans

800 Transfers

881 Maryland LEAs

882 Other LEAs

885 Other

886 Interfund

890 Indirect Cost Recovery X X

Object-Subobject by Fund/Category

24

Coding & Reporting Structure

25

Current Expense Fund

Mid-Level

Administration

Instructional Salaries

Ofce

of the

Principal

Inst.

Admin.

and Su-

pervisor

Regu-

lar Pro-

grams

Gifted

and

Tal-

ented ESOL

Career

and

Tech

Adult

Educ

School

Media

Staff

Devel

Gui-

dance

Psych

Ser-

vices

X X

X X

X X

Coding & Reporting Structure

Regular

Programs

Special

Programs

Career &

Tech

School

Media

Staff

Devel

Gui-

dance

Psych

Services

Adult

Ed

Current Expense Fund

Instructional Textbooks and Supplies

26

300

Supplies and Materials

321

Textbooks

X

X

X

322

Library Media

X

325

Food

X

X

X X

X

X

X

X

327

Other Donated Commidities

328

Food Supplies

329

Other Supplies

Object-Subobject by

Fund/Category

Coding & Reporting Structure

27

200

Contracted Services

205

Rent

X

X

X X X

X

X

X

206

Outside Food Service

207

Independent Audit

209

Other Contracted, Clean

-

ing Services, Repair/Main-

tenance, Construction,

Student Transportation,

Food Service Management,

Other

400

Other Charges

408

Other Purchased Services:

Travel

X

X

X X X

X

X

X

Liability/Fidelity Insurance

Property/Casualty Insurance

Communication

X

X

X X

X

X

X

X

Utilities (not energy)

Other

X

X

X

X

X

X

X

X

500

Land, Buildings, Equipment

551

Land

552

Buildings

554

Equipment--new & replace

-

ment

X

X

X X X

X

X

X

555

Depreciation

556

Depreciation (memo)

800

Transfers

881

Maryland LEAs

X

882

Other LEAs

X

Regular

Programs

Special

Programs

Career &

Tech

School

Media

Staff

Devel

Gui-

dance

Psych

Services

Adult

Ed

Current Expense Fund

Other Instructional Costs

Object-Subobject by

Fund/Category

Student

Personnel

Services

Student

Health

Services

Student

Trans-

portation

Object-Subobject by Fund/Category

Coding & Reporting Structure

Current Expense Fund

100 Salaries X X X

101 Temporary/Substitute Teachers X X X

102 Other Salaries X X X

103 Teachers Certied X X X

104 Aid and Assistance X X X

200 Contracted Services

205 Rent X X X

206 Outside Food Service

207 Independent Audit

209 Other Contracted

Cleaning Services

Repair/Maintenance X

Construction

Student Transportation X

Food Service

Management

Other X X X

300 Supplies and Materials

321 Textbooks

322 Library Media

325 Food

327 Other Donated Commodities

328 Food Supplies

329 Other Supplies X X X

400 Other Charges

408 Other Purchased Services:

Travel X X X

Liability/Fidelity Insurance

Property/Casualty Insurance X

Communications

Utilities (not energy)

Other X X X

412 Employee Retirement

413 Social Security

414 Other Employee Benets

424 Energy Services X

450 State Payment for On-Behalf X X X

451 Other Than State Payments for On-Behalf X X X

28

Current Expense Fund

Special Education

Operation of Plant

Class

Inst

State

Inst

Nonpub

Prog

Staff

Devel

Ofce

of the

Principal

Admin

Superv

Warehs

&

Distrib

Other

tenance

of

Plant

X X X X X X X

X X X X

X X X X

X X X X X X X

X

X X

X X X X X X X

X

X

X X X X X X X

X X X X X X X

X

X X

X

X X X X X X X

X

Coding & Reporting Structure

29

Main-

Student

Personnel

Services

Student

Health

Services

Student

Trans-

portation

Object-Subobject by Fund/Category

Current Expense Fund

499 Miscellaneous

Judgments

Short-Term Interest

Other X X X

500 Land, Buildings, Equipment

551 Land

552 Buildings

554 Equipment--new & replacement X X X

555 Depreciation

556 Depreciation (memo)

600 Principal

661 Long-Term Bonds

662 State Loans

700 Interest

761 Long-Term Bonds

762 State Loans

800 Transfers

881 Maryland LEAs

882 Other LEAs

885 Other

886 Interfund

890 Indirect Cost Recovery

Coding & Reporting Structure

30

Current Expense Fund

Special Education

Class

Inst

State

Inst

Nonpub

Prog

Staff

Devel

Ofce

of the

Principal

Admin

Superv

Warehs

&

Distrib

Other

tenance

of

Plant

X X X X X X X

X X X X X X X

X

X

X X

Coding & Reporting Structure

31

Operation of Plant

Main-

Object-Subobject by Fund/Category

Current Expense Fund

Fixed

Charges

Food

Service

Com-

munity

Service

100 Salaries X

101 Temporary/Substitute Teachers

102 Other Salaries

200 Contracted Services

205 Rent X

206 Outside Food Service

207 Independent Audit

209 Other Contracted

Cleaning Services

Repair/Maintenance

Construction

Student Transportation X

Food Service

Other X

300 Supplies and Materials

321 Textbooks

322 Library Media

325 Food

327 Other Donated Commodities

328 Food Supplies

329 Other Supplies X

400 Other Charges

408 Other Purchased Services:

Travel X

Liability/Fidelity Insurance X

Property/Casualty Insurance

Communications

Utilities (not energy)

Other X

412 Employee Retirement X

413 Social Security X

414 Other Employee Benets X

424 Energy Services

499 Miscellaneous

Judgments

Short-Term Interest X

Other X

32

Coding & Reporting Structure

Coding & Reporting Structure

Capital Outlay

Current Expense Fund

Bldgs &

Additions

Remod-

eling

School

Const

Fund

Debt

Service

Fund

Food

Service

Fund

Student

Activity

Fund

Trust &

Agency

Fund

X X X X X X

X X

X X X X

X

X

X X X

X

X X X X X X

X X

X

X

X

X X X X X X

X X

X X X X X X

X X X X X X

X

X

X

X

X X X X X X

33

Fixed

Charges

Food

Service

Com-

munity

Service

Object-Subobject by Fund/Category

Current Expense Fund

500 Land, Buildings, Equipment

551 Land

552 Buildings

554 Equipment--new & replacement X

555 Depreciation

556 Depreciation (memo)

600 Principal

661 Long-Term Bonds

662 State Loans

700 Interest

761 Long-Term Bonds

762 State Loans

800 Transfers

881 Maryland LEAs

882 Other LEAs X

885 Other X

886 Interfund X X

890 Indirect Cost Recovery X

Coding & Reporting Structure

34

Bldgs &

Additions

Remod-

eling

School

Const

Fund

Debt

Service

Fund

Food

Service

Fund

Student

Activity

Fund

Trust &

Agency

Fund

Current Expense Fund

Capital Outlay

X X

X

X

X

X

X

X

X

Coding & Reporting Structure

35

36

37

Fund source codes are used to identify

the funding source of restricted program

expenditures. Every federally-funded grant issued

by MSDE or other non-federal agency, most direct federal

revenue, and many state-funded programs are restricted. For

these programs, expenditures must be reported independently

on Restricted Expenditure Reports (see Appendix A, Instructions for

Completing the Annual Financial Report Forms, and Appendix C, Annual

Financial Reporting System).

On grants received from MSDE, the fund source code will be shown on the Notice of Grant

Award document. Fund source codes for federal programs funded directly from the federal

government or through another agency must be identied before reporting to MSDE. Fund source

codes will be updated annually in the Appendix to the User Guide at the Annual Financial Report

and Grant Reporting System website including codes for new revenue sources.

Revenue

Source Codes

38

39

The Assets, Liabilities, and Fund Balance

accounts are balance sheet accounts. Those that

are required to be reported on the Annual Financial

Report to the Maryland State Department of Education

are dened below.

300 Assets. Assets and other debits include what is owned and what is

not owned (as of the date of the balance sheet) but is expected to become

fully owned at some future date. Assets may be current or xed (long-term).

Current Assets are cash or anything that can be readily converted into cash and include the

following:

301 Cash and Cash Equivalents. Include all funds on deposit with a bank or savings

and loan institution, currency, coin, checks, postal and express money orders,

bankers drafts on hand or on deposit, petty cash, and cash on deposit with scal

agents. Also included are liquid investments that are both readily convertible to

a known amount of cash and so near maturity that insignicant risk of change in

value is present.

302 Temporary Investments. Include securities held for the production of interest

income, such as treasury notes and certicates of deposit, with maturity dates of

less than one year.

320 Accounts Receivable. Amounts owed on open accounts from private persons,

rms, or corporations for goods and services furnished by an LEA.

370 Inventories. Include cost of supplies and equipment on hand not yet distributed,

and value of goods held by an LEA for resale rather than for use in its own

operations.

399 Other Assets. Include all current assets other than those mentioned above.

Examples are long-term investments, prepaid expenses, and deposits.

Fixed Assets (long-term) are assets that are held or used over a long period of time. After the

implementation of GASB Statement Number 34, xed assets are no longer reported on the Balance

Sheet, only on the Statement of Net Assets.

383 Land and Land Improvements. Include the acquisition value of land and

permanent improvements to land, such as sidewalks, retaining walls, gutters,

pavement, etc. Include the purchase price and additional purchase costs. If land

or improvements are acquired by gift, the value shall reect the appraised value

at the time of ownership transfer.

384 Buildings and Additions. Include the acquisition value of permanent structures

used to house persons or property. If buildings are purchased or constructed,

this account includes the purchase or contract price of all permanent buildings

and the xtures attached to and forming a permanent part of such buildings. If

Financial

Statement

Account Denitions

buildings are acquired by gift, the value shall reect the appraised value at the

time of ownership transfer.

385 Furniture and Equipment. Include tangible property of more or less permanent

nature, other than land, buildings, and improvements. Examples are machinery,

tools, trucks, cars, buses, furniture, furnishings, and all other items meeting the

criteria for equipment.

389 Construction in Progress. Includes the cost of construction work undertaken

but not yet completed.

400 Liabilities. LEA debts or legal obligations that arise out of past transactions and are

payable but not necessarily due. Liabilities may be current or long-term and include the

following:

450 Payroll Deductions/Withholding. Include amounts deducted from employee

salaries for withholding taxes and other purposes. District-paid benets payable

also are included here.

473 Deferred Revenue - Transportation. Includes State aid for transportation

received but not yet expended.

474 Deferred Revenue - Other. Includes all revenue that are collected before earned

except state aid transportation.

499 Other Liabilities. Include all other LEA debts not listed above. Examples

are accounts payable, deposits payable, loans payable, lease obligations, and

unamortized premiums.

700 Fund Balance. Fund balance is the excess of assets over liabilities and reserves.

701 Opening Fund Balance. A restatement of the fund balance as reported at the end

of the preceding scal year.

710 Closing Fund Balance - Unreserved. The excess of assets over liabilities and

reserves at the end of the scal year.

712 Closing Fund Balance - Reserved. The portion of the excess of assets over

liabilities that is reserved for a specic purpose.

760 Prior Years’ Adjustments. An account to record money received as the result

of an abatement of prior year expenditures. The refund of expenditures made in

the same scal year may be recorded in the appropriate expenditure account as a

reduction of the expenditure.

Denitions: Financial Statement Account

40

LEAs receive funding from many sources.

Revenue may be restricted or unrestricted.

Unrestricted revenues are those received without

restriction other than the general restrictions imposed by

the parent government. Most local revenue and State revenue

sources are unrestricted.

Restricted revenues are those for which expenditure authority is maintained

by the grantor. Expenditure authority requires an approved budget, expenditures

are restricted to specic expenditure areas, and additional reporting requirements may be

imposed by the funding organization.

Revenue sources are to be reported as follows:

100 Revenues. Revenues are additions to assets that do not increase any liability, do not

represent the recovery of an expenditure, and do not represent the cancellation of certain

liabilities without a corresponding increase in liabilities or a decrease in assets. Revenues

are classied by category, program, and activity for state revenue only. The two-digit

code in the activity eld corresponds to the middle two digits of the Fund Number code

provided on all Notice of Grant Award documents issued by MSDE.

101 Local Appropriations. Money received from funds set aside periodically by the

appropriating body (city council, county commissioners, or county council) for school

purposes.

105 Other Revenue. Funds received from non-government sources that meet the denition

of revenue. Other revenue is reportable to the following areas:

10502 Tuition - Nonresident Students. Payments by nonresident students, welfare

agencies, or private sources for elementary and secondary education provided by

the LEA.

10503 Tuition - Adult Education. Payments received as tuition for adult continuing

and adult basic education provided by the LEA.

10505 Tuition - Summer School. Payments received as tuition for summer school

programs serving elementary and secondary students.

10509 Other Tuition. Payments received from students as tuition for instruction

programs not classied elsewhere.

10511 Student Payments/Fees. Payments by students for meals, admission to school-

sponsored activities, usage of school equipment, purchase of supplies and

materials, membership in school clubs or organizations, etc.

10512 Other Sales. Payments by persons other than students for meals or other items.

10520 Transportation Payments. Revenue from individuals, welfare agencies, or

private sources for transporting students to and from school or school activities.

41

Revenue

& Other

Fund Source

Account Denitions

10530 Earnings on Investments. Revenue from holdings invested for earnings

purposes, such as certicates of deposit, treasury investments, money markets,

etc.

10535 Rent. Revenue from the rental of either real or personal LEA property.

10598 Local Revenue For/On-Behalf of the LEA. Commitments or payments made

by the local governmental unit or a third party for the benet of the LEA, or

contributions of equipment or supplies.

10599 Other Miscellaneous Revenue. Other revenue from local sources not included

elsewhere; e.g., gifts, bequests, or gains on the sale of investments or assets.

120 State Revenue. Revenue from any agency of the State that originated within the state,

whether restricted or unrestricted. Restricted State revenues require individual

revenue/expenditure reporting annually. Restricted state revenues will be identied

as such on the notice of grant award. Unrestricted state revenue must be identied in

the revenue accounts by source, but the expenditures of these funds are reportable

along with other unrestricted funds.

State revenue accounts change as new programs are identied and funded.

Beginning in FY 2004, the Bridge to Excellence in Public Schools Act signicantly

changed the structure of state funding for public education. Numerous programs

have been consolidated into ve major funding programs. A few restricted state

programs still remain.

Shown below are the State revenue sources identied to the Major State Aid program.

12001 State Share of Foundation. Funded under the Bridge to Excellence in Public

Schools Act through Section 5-202 of the Education Article of the Annotated

Code of Maryland.

1200131 Formula

1200191 Supplemental Grant

12002 Compensatory Education. Funded under the Bridge to Excellence in Public

Schools Act through Section 5-207 of the Education Article of the Annotated

Code of Maryland.

1200237 Formula

12005 Formula Grants for Specic Populations. Sections 4-121 and 4-122 of the

Education Article of the Annotated Code of Maryland.

1200532 Schools Near County Lines (Tuition Bylaw)

1200534 Out-of-County Living Arrangements (Foster Care)

12007 Students with Disabilities. Sections 5-209, 8-414 and 8-415 of the Education

Article of the Annotated Code of Maryland provide a minimum guarantee for

Denitions: Revenue & Other Source Acct

42

Denitions: Revenue & Other Source Acct

special education funding levels; and for the State and local educational agencies

to fund nonpublic special education programs for students with disabilities for

whom neither the State nor local educational agencies can provide an appropriate

program. Additionally, funding is available for the Maryland Infants and Toddlers

program.

1200749 Formula (including Medicaid [State] IGT payments)

1200750 Nonpublic Placement

1200777 Maryland Infants and Toddlers

12009 Gifted and Talented. Funding for summer programs offering economics,

humanities, social sciences, leadership, science, visual and performing arts,

creative writing, mathematics, foreign languages, environmental studies, and

international studies at summer centers for gifted and talented students from each

of Maryland’s public school systems.

1200954 Gifted and Talented Grants

12013 Innovative Programs. Funding for projects to explore new ways of addressing

education issues and problems.

1201395 Smith Island Boat

12014 Adult Continuing Education. Funding to enable adults to acquire skills and

knowledge leading to a high school credential.

1201466 Formula

1201467 External Diploma

1201469 Literacy Works

12024 LimitedEnglishProcient. Funding in accordance with the Bridge to Excellence

in Public Schools Act, funded through Education Article 5-208 of the Education

Article of the Annotated Code of Maryland.

1202435 Formula

12025 Guaranteed Tax Base. Funding in accordance with the Bridge to Excellence

in Public Schools Act, funded through Education Article 5-210 of the Education

Article of the Annotated Code of Maryland.

1202586 Formula

12027 Food Service. State funds to supplement currently available federal and local

funds that expand and extend food and nutrition programs to needy children

throughout the State.

1202717 State Program

1202759 Maryland Meals for Achievement Program

43

12039 Student Transportation. Sections 5-205 and 8-410 of the Education Article

of the Annotated Code of Maryland provides transportation funding for public

school children and disabled children in nonpublic schools or state institutions.

1203978 Formula

1203979 Students with Disabilities

12052 Science/Math Education. Funding to strengthen science and mathematics

programs through activities such as summer sessions for teachers and equipment

incentive funds.

1205284 Grants

12054 School Quality, Accountability, and Recognition of Excellence. State Grants

for school improvement initiatives and the Challenge Grant program.

1205407 Schools in Improvement – Baltimore City

1205443 Schools in Improvement – Prince George’s County

1205493 Schools in Improvement – Other

12055 Teacher Development. State funding for teacher stipends and bonuses as set forth

in Section 6-306 of the Education Article of the Annotated Code of Maryland

1205555 StipendsforNBPTSCertication

1205558 Stipends for High Poverty Schools

1205560 Signing Bonuses

12057 Transitional Education Program. This program provides funding under the

Judith P. Hoyer Early Child Care and Education Enhancement Program.

1205780 Judith P. Hoyer Grants

12058 Head Start. The focus area is the expansion and improvement of Head Start

services in Maryland. Current grantees received funding under a formula since

FY 2000. Grantees are eligible to receive continuation funds by meeting the

programmatic criteria.

1205881 Head Start State Grants

12098 State Revenue For/On-Behalf of the LEA. Commitments or payments made

by the state for the benet of the LEA or contributions of equipment or supplies.

This represents the State Teachers Retirement and Pension System payments

made on behalf of the LEA to the State Retirement Agency.

12099 Other State Revenue. Other funding from MSDE headquarters budget or other

state agencies.

130 Federal Revenue. Revenue from any agency that originated as a federal program and

was either received direct from the federal government or was passed through another

agency to the LEA. Federal revenue shall be differentiated as follows:

Denitions: Revenue & Other Source Acct

44

13001 Unrestricted Grants-In-Aid (for example, Impact Aid). Revenue received

directly from the federal government as a grant to an LEA that can be used for

any legal purpose desired by the LEA without restriction.

13002 Restricted Through MSDE. Revenue from the federal government passed

through MSDE as a grant to the LEA which must be used for a categorical

purpose. All restricted federal grants passed to LEAs through MSDE require

Restricted Expenditure Reports.

13003 Restricted - Direct. Revenue direct from the federal government as a grant to

the LEA that must be used for a categorical or specic purpose. All restricted

federal grants received direct from the federal government require Restricted

Expenditure Reports.

13004 Restricted Through Other Agency. Revenue from the federal government

passed through an agency other than MSDE to the LEA that must be used for

a categorical purpose. All restricted federal grants passed to LEAs through any

agency require Restricted Expenditure Reports.

13050 USDA Commodities. The value of commodities received from the federal

government and used during the year.

13098 Federal Revenue For/On-Behalf of the LEA. Commitments or payments

made by the federal governmental for the benet of the LEA, or contributions of

equipment or supplies.

199 Other Resources (Nonrevenue). Other sources of funds to the LEA that represent

exchanges of property for cash, transfers between funds, compensation for loss

of property and equipment, or funds that must be repaid. Included are:

19901 Sale of Property/Equipment. Funds from the sale of xed assets.

19902 Net Insurance Recovery. Proceeds from insurance reimbursement for losses to

LEA property.

19903 Sale of Bonds. The proceeds from the sale of bonds.

19904 State Loans. Money received or due from the state as a loan to the LEA.

19910 Transfers In - Maryland LEAs. Money received from another LEA for services

rendered. Include tuition payments made by Maryland LEAs.

19911 Transfers In - Out-of-State LEAs. Money received from a school district in

another state for education services provided to students.

19920 Interfund Transfers. Amounts available from another fund that will not be

repaid. Excess self insurance receipts may be treated as interfund operating

transfers.

19999 Other Nonrevenue. Any other nancing source that does not meet one of the

denitions given above.

Denitions: Revenue & Other Source Acct

45

46

Expenditure details provide information

about the use of LEA resources. All funds

require expenditures to be reported by expenditure

object. The Current Expense Fund must also be reported

by expenditure Category/Program/Service Area. The level of

detail required (program activity level and subobject) is dependent

upon federal and state reporting requirements.

Category/Program/Activity Dimension

Section 5-101(b) of the Education Article requires a local school board to prepare a budget

that includes revenue and expenditure categories. LEAs must track expenditures according to

the purpose of the expenditure and in sufcient detail to meet all reporting requirements. The

accounts shown below include levels of detail that would not be required on MSDE Annual

Financial Reports. Account codes indicate which accounts will be reportable to MSDE. All areas

without a code are given to further explain the categories/programs/activities and may be needed

by LEAs for other reporting purposes. LEAs should review the types of nancial information

that they have been asked to provide and design accounting systems that facilitate all reporting

requirements.

The Category/Program/Activity accounts are required for reporting restricted and unrestricted

expenditures in the Current Expense Fund and restricted expenditures in the Trust/Agency Fund.

Expenditures are also reportable to the program areas identied in Category 15 - Capital Outlay

for the School Construction Fund.

Category 201 - Administration