Fiscal Year

2022

Military

Retirement

Fund

Audited

Financial

Report

November 10

, 202

2

i

Table of Contents

Management’s Discussion and Analysis ..............................................................................................................1

REPORTING ENTITY ....................................................................................................................................... 1

THE FUND ......................................................................................................................................................... 2

General Benefit Information ........................................................................................................................... 2

Non-Disability Retirement from Active Service ............................................................................................ 3

Disability Retirement ...................................................................................................................................... 6

Reserve Retirement ......................................................................................................................................... 7

Survivor Benefits ............................................................................................................................................ 7

Temporary Early Retirement Authority (TERA) ............................................................................................ 9

Cost-of-Living Increase ................................................................................................................................ 10

FUND RELATIONSHIPS ................................................................................................................................ 10

Department of Veterans Affairs Benefits ..................................................................................................... 10

Interrelationships with Other Federal Service .............................................................................................. 11

Retired Pay to Military Compensation ......................................................................................................... 11

Social Security Benefits ................................................................................................................................ 12

SIGNIFICANT CHANGES.............................................................................................................................. 12

From FY 2021 to FY 2022............................................................................................................................ 12

For FY 2023 and Beyond .............................................................................................................................. 12

PERFORMANCE MEASURES ....................................................................................................................... 13

PROJECTED LONG-TERM HEALTH OF THE FUND ................................................................................ 14

Unified Budget of the Federal Government.................................................................................................. 15

20-Year Projection ........................................................................................................................................ 15

Expected Problems........................................................................................................................................ 17

Investments ................................................................................................................................................... 18

Management Oversight ................................................................................................................................. 18

Anticipated Changes between the Expected and Actual Investment Rate of Return ................................... 18

FINANCIAL PERFORMANCE OVERVIEW ................................................................................................ 20

Financial Data ............................................................................................................................................... 20

Assets ............................................................................................................................................................ 22

Liabilities ...................................................................................................................................................... 23

Analysis of Systems, Controls, and Legal Compliance .................................................................................... 24

LIMITATIONS OF THE FINANCIAL STATEMENTS ................................................................................ 25

DoD Transmittal of Auditor’s Opinion .............................................................................................................26

Independent Auditor’s Report............................................................................................................................29

FY 2022 Military Retirement Fund Principal Financial Statements ..............................................................37

Balance Sheets .................................................................................................................................................. 38

Statements of Net Cost...................................................................................................................................... 39

Statements of Changes in Net Position ............................................................................................................. 40

Statements of Budgetary Resources.................................................................................................................. 41

FY 2022 Military Retirement Fund Footnotes to the Principal Financial Statements..................................42

Note 1. Significant Accounting Policies ........................................................................................................... 43

Note 2. Nonentity Assets .................................................................................................................................. 48

Note 3. Fund Balance with Treasury ................................................................................................................ 48

Note 4. Cash and Other Monetary Assets ......................................................................................................... 49

Note 5. Investments and Related Interest ......................................................................................................... 49

Note 6. Accounts Receivable, Net .................................................................................................................... 51

ii

Note 7. Direct Loan and Loan Guarantees, Non-Federal Borrowers ............................................................... 51

Note 8. Inventory and Related Property, Net .................................................................................................... 52

Note 9. General PP&E, Net .............................................................................................................................. 52

Note 10. Other Assets ....................................................................................................................................... 52

Note 11. Liabilities Not Covered by Budgetary Resources .............................................................................. 52

Note 12. Debt .................................................................................................................................................... 52

Note 13. Federal Employee and Veteran Benefits Payable .............................................................................. 53

Note 14. Environmental and Disposal Liabilities ............................................................................................. 58

Note 15. Other Liabilities ................................................................................................................................. 58

Note 16. Leases ................................................................................................................................................. 59

Note 17. Commitments and Contingencies ...................................................................................................... 59

Note 18. Funds from Dedicated Collections ..................................................................................................... 59

Note 19. Disclosures Related to the Statements of Net Cost ............................................................................ 60

Note 20. Disclosures Related to the Statements of Changes in Net Position ................................................... 61

Note 21. Disclosures Related to the Statement of Budgetary Resources ......................................................... 61

Note 22. Disclosures Related to Incidental Custodial Collections ................................................................... 62

Note 23. Fiduciary Activities ............................................................................................................................ 62

Note 24. Reconciliation of Net Cost to Net Outlays ......................................................................................... 63

Note 25. Public-Private Partnerships ................................................................................................................ 64

Note 26. Disclosure Entities and Related Parties.............................................................................................. 65

Note 27. Security Assistance Accounts ............................................................................................................ 65

Note 28. Restatements ...................................................................................................................................... 65

Note 29. COVID-19 Activity ............................................................................................................................ 65

Note 30. Subsequent Events ............................................................................................................................. 65

Note 31. Reclassification of Balance Sheet, Statement of Net Cost, and Statement of Changes in Net Position

for Compilation in the U.S. Government-wide Financial Report ..................................................................... 65

Other Information ...............................................................................................................................................66

SUMMARY OF FINANCIAL STATEMENT AUDIT AND MANAGEMENT ASSURANCES ................ 67

PAYMENT INTEGRITY ................................................................................................................................. 68

Management’s Discussion and Analysis_________________________________

1

Management’s Discussion and Analysis

Summary of the Military Retirement System

For the Years Ended September 30, 2022 and 2021

REPORTING ENTITY

The reporting entity is the Department of Defense (DoD) Military Retirement Fund (MRF, or “Fund”). The

Military Retirement System (MRS) provides benefits for military members’ retirement from active duty and the

reserves, disability retirement benefits, and survivor benefits. The MRF accumulates funds to finance, on an

actuarial basis, the liabilities of DoD under military retirement and survivor benefit programs. The FY 2021

National Defense Authorization Act (NDAA) requires the U.S. Coast Guard (USCG) be covered by the MRF for

funding purposes no later than the beginning of FY 2023.

Within DoD, the operations of the MRS are jointly overseen by the:

(1) Office of the Under Secretary of Defense (Comptroller) (OUSD(C)),

(2) Defense Finance and Accounting Service (DFAS), and

(3) Office of the Under Secretary of Defense for Personnel and Readiness

(OUSD (P&R)).

DFAS is responsible for the accounting, investing, payment of benefits, and reporting of the MRF. The USCG

retains responsibility for payment of benefits. The DoD Office of the Actuary (OACT) within OUSD (P&R)

calculates the actuarial liability and funding requirements of the MRF, relying on data produced from files

maintained by the Defense Manpower Data Center (DMDC). The Office of Military Personnel Policy within

OUSD (P&R) issues policy related to MRS benefits. While the MRF does not have a designated Chief Financial

Officer (CFO) it is overseen by the MRF Financial Management Committee (FMC), relying upon the diverse

support team to collectively provide input for the efficient and effective operation of the Fund.

The Fund was established by Public Law (P.L.) 98-94 (currently Chapter 74 of Title 10, United States Code

(U.S.C.)) starting October 1, 1984. The Fund is overseen by an independent, three-member Secretary of Defense-

appointed DoD Board of Actuaries (“Board”). The Board is required to review valuations of the MRS, determine

the method of amortizing unfunded liabilities, report annually to the Secretary of Defense, and report to the

President and the Congress at least once every four years on the status of the MRF. The OACT provides technical

and administrative support to the Board.

The Fund receives income from three sources: (1) normal cost payments from the Services and U.S. Treasury;

(2) payment from the U.S. Treasury to amortize the unfunded liability; and (3) investment income.

During Fiscal Year (FY) 2022, the MRF received approximately $26.0 billion in normal cost payments from

DoD, and $125.0 billion payment from the U.S. Treasury consisting of both an amortization and concurrent

receipt payment, and earned approximately $93.1 billion in investment income, net of premium/discount

amortization and accrued inflation compensation. In comparison, in FY 2021 the MRF received approximately

$25.2 billion in normal cost payments, a $108.0 billion payment from the U.S. Treasury consisting of both an

amortization and concurrent receipt payment, and earned approximately $56.9 billion in investment income, net

of premium/discount amortization and accrued inflation compensation (see the Financial Performance Overview

section for an explanation of the changes).

In FY 2022, the MRF paid approximately $71.5 billion in benefits to military retirees and survivors compared to

approximately $63.1 billion in FY 2021.

Management’s Discussion and Analysis_________________________________

2

THE FUND

General Benefit Information

The MRS covers members of the Army, Navy, Marine Corps, Air Force, and Space Force; however, most of the

provisions also apply to retirement systems for uniformed service members of the U.S. Coast Guard (USCG)

(administered by the Department of Homeland Security), the Public Health Service (PHS) (administered by the

Department of Health and Human Services), and the National Oceanic and Atmospheric Administration (NOAA)

(administered by the Department of Commerce). This report applies only to members in plans administered by

the DoD and members of the Coast Guard.

Generally, MRS is a funded, noncontributory defined benefit plan that includes non-disability retired pay,

disability retired pay, survivor annuity programs, and Combat-Related Special Compensation (CRSC). The

Service Secretaries may approve immediate non-disability retired pay at any age with credit of at least 20 years

of active duty service. Reserve retirees generally must be at least 60 years old and have at least 20 qualified years

of service before retired pay commences; in some cases, the age can be less than 60 if the reservist performed

certain types of active duty service. There is no vesting of benefits before non-disabled retirement.

There are distinct non-disability benefit formulas related to four populations within the MRS, per current statute

(see Tables 1 and 2).

1) Final Pay: Military personnel who first became members of a uniformed service before September 8, 1980,

have retired pay equal to final basic pay times a multiplier. The multiplier is equal to 2.5% times years of

service. Retired pay and survivor annuity benefits are automatically adjusted annually to protect the

purchasing power of initial retired pay. Final pay retirees have their benefits adjusted annually by the

percentage increase in the average Consumer Price Index (CPI). This is commonly referred to as full CPI

protection.

2) High-3: If the retiree first became a member of a uniformed service on or after September 8, 1980, the average

of the highest 36 months of basic pay is used instead of final basic pay. The multiplier is also equal to 2.5%

times years of service and High-3 retirees also have their benefits adjusted annually by the percentage increase

in the average CPI.

3) Career Status Bonus (CSB)/Redux: Members who first became a member of a uniformed service on or after

August 1, 1986, may choose between a High-3 and CSB/Redux retirement. Those who elect CSB/Redux

receive the CSB outlined below, also have retired pay computed on a base of the average of their highest 36

months of basic pay, but are subject to a multiplier penalty if they retire with less than 30 years of service;

however, at age 62, their retired pay is recomputed without the multiplier penalty. Members make their

election during the fifteenth year of service and may receive the CSB of $30,000 in either a lump sum or

multiple installment payments. Those who elect CSB/Redux must remain continuously on active duty until

they complete 20 years of active duty service or forfeit a portion of the $30,000 (exceptions include death and

disability retirement). CSB retirees have their benefits adjusted annually by the percentage change in the CPI

minus 1% (except when the change in the CPI is less than 1%). When the military member’s age is 62, or

when the member would have been age 62 for a survivor annuity, the benefits are restored to the amount that

would have been payable had full CPI protection been in effect and had there not have been a multiplier

penalty. However, after this restoration, partial indexing (CPI minus 1%) continues for future retired pay and

survivor annuity payments. The National Defense Authorization Act for FY 2016 (NDAA 2016, P.L. 114-

92) sunsets the CSB/Redux benefit tier by not allowing any CSB elections after December 31, 2017.

Management’s Discussion and Analysis_________________________________

3

4) Blended Retirement System (BRS): Members who first become a member of a uniformed service after

December 31, 2017, will be covered under the BRS which was enacted in NDAA FY 2016 and took effect

January 1, 2018. Members who first entered the military before January 1, 2018 and who have served for

fewer than 12 years (as defined in the statute) as of December 31, 2017 had the option to “opt in” to BRS via

an irrevocable election during a one-year (calendar year 2018) open season or remain in the High-3 system.

Members who have served 12 or more years as of December 31, 2017 were not permitted to opt in to BRS

and will receive benefits based on their current plan. As a result of NDAA 2016, members with 12 or more

but fewer than 15 years of service as of December 31, 2017 did not have the opportunity to opt in to BRS or

to elect the CSB and will automatically remain in the High-3 system

1

. The BRS lowers the nondisabled retired

pay multiplier from 2.5% per year to 2.0% and includes automatic and matching government contributions to

member Thrift Savings Plan (TSP) accounts and a mandatory mid-career continuation bonus if the member

agrees to serve additional time. The BRS also provides members the choice of receiving a portion (either

25% or 50%) of their retired pay entitlement from when the member is eligible to begin receiving retired pay

to normal Social Security retirement age (usually 67) as a discounted lump sum instead of an annuity. For

additional information, see table at the end of this section or refer to the DoD Office of Military Compensation

website (http://militarypay.defense.gov/).

Retiree and annuitant pay are automatically adjusted annually by cost-of-living adjustments (COLAs) to protect

the purchasing power of the initial benefit. Members first entering a uniformed service before August 1, 1986,

and those entering on or after that date who do not elect CSB have their benefits adjusted by the percentage

increase in the CPI. This is commonly referred to as “full CPI protection.” Benefits for members who entered

on or after August 1, 1986, and who elect CSB are increased by the CPI minus 1% (except when the CPI increase

is less than or equal to 1%, when it is increased by the full CPI). At age 62, or when the member would have

been age 62 (for a survivor annuity), the benefits are restored to the amount that would have been payable had

the full COLA been in effect. This restoration is in combination with the elimination of the penalty for retiring

with less than 30 years of service; however, after this restoration, partial indexing (CPI minus 1%) continues for

future benefit payments.

The FY 2011 National Defense Authorization Act (FY 2011 NDAA, P.L. 111-383), required that amounts of

retired pay due to a retired member of the uniformed services shall be paid on the first day of each month

beginning after the month in which the right to such pay accrues. This means that when the first day of the month

falls on a non-business day (weekend / holiday), the retired pay must be disbursed the preceding business day.

The law does not apply to survivor annuitant pay and CRSC. It will result in retirees receiving 13 payments in

some fiscal years and 11 payments in others, with 12 payments occurring in most fiscal years.

Non-Disability Retirement from Active Service

The current retirement system allows for voluntary retirement at any age upon completion of at least 20 years of

service, subject to Service Secretary’s approval. The military retiree immediately receives retired pay calculated

as base pay multiplied by the specified benefit formula factor and years of service. “Base pay” is equal to terminal

basic pay if the retiree first became a member of a uniformed service before September 8, 1980; for all other

members, “base pay” is equal to the average of the highest 36 months of basic pay. The number of years of

service is rounded down to the nearest month when computing retired pay. Refer to Tables 1 and 2 on the

following pages for additional details.

1

Because of breaks in service and technical differences in the definition of qualifying years of service under BRS compared to

CSB/Redux, it is not possible to precisely define this group based solely on dates of entry, but generally it will include members who

joined the service after December 31, 2002 and on or before December 31, 2005.

Management’s Discussion and Analysis_________________________________

4

As of September 30, 2022, there were approximately 1.447 million non-disability retirees from active duty

receiving approximately $53.0 billion of annualized retired pay. For comparison, as of September 30, 2021, there

were approximately 1.443 million non-disability retirees from active duty receiving approximately $49.33 billion

of annualized retired pay. Please note that the September 30, 2022 information includes the USCG, while the

September 30, 2021 information does not.

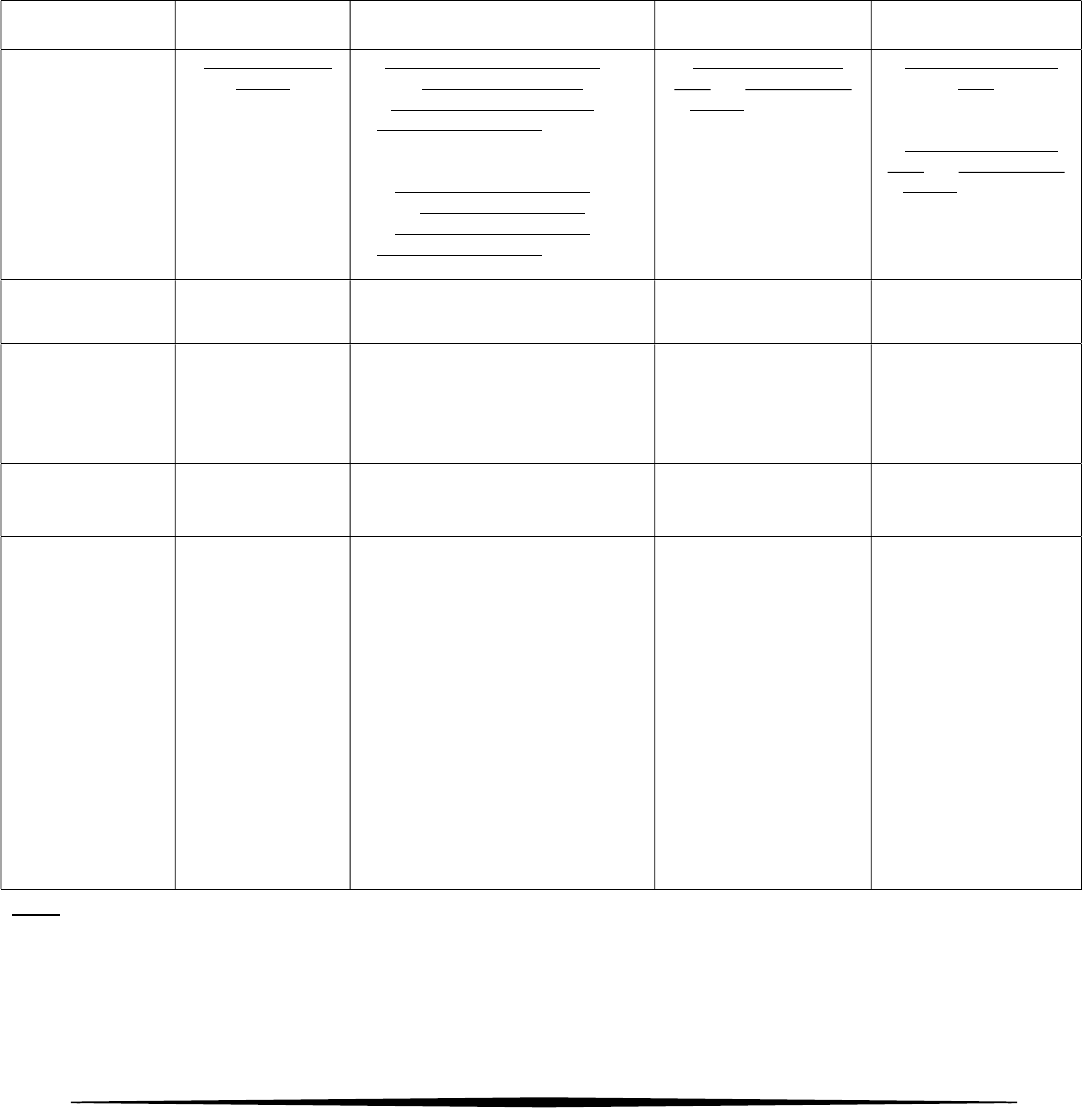

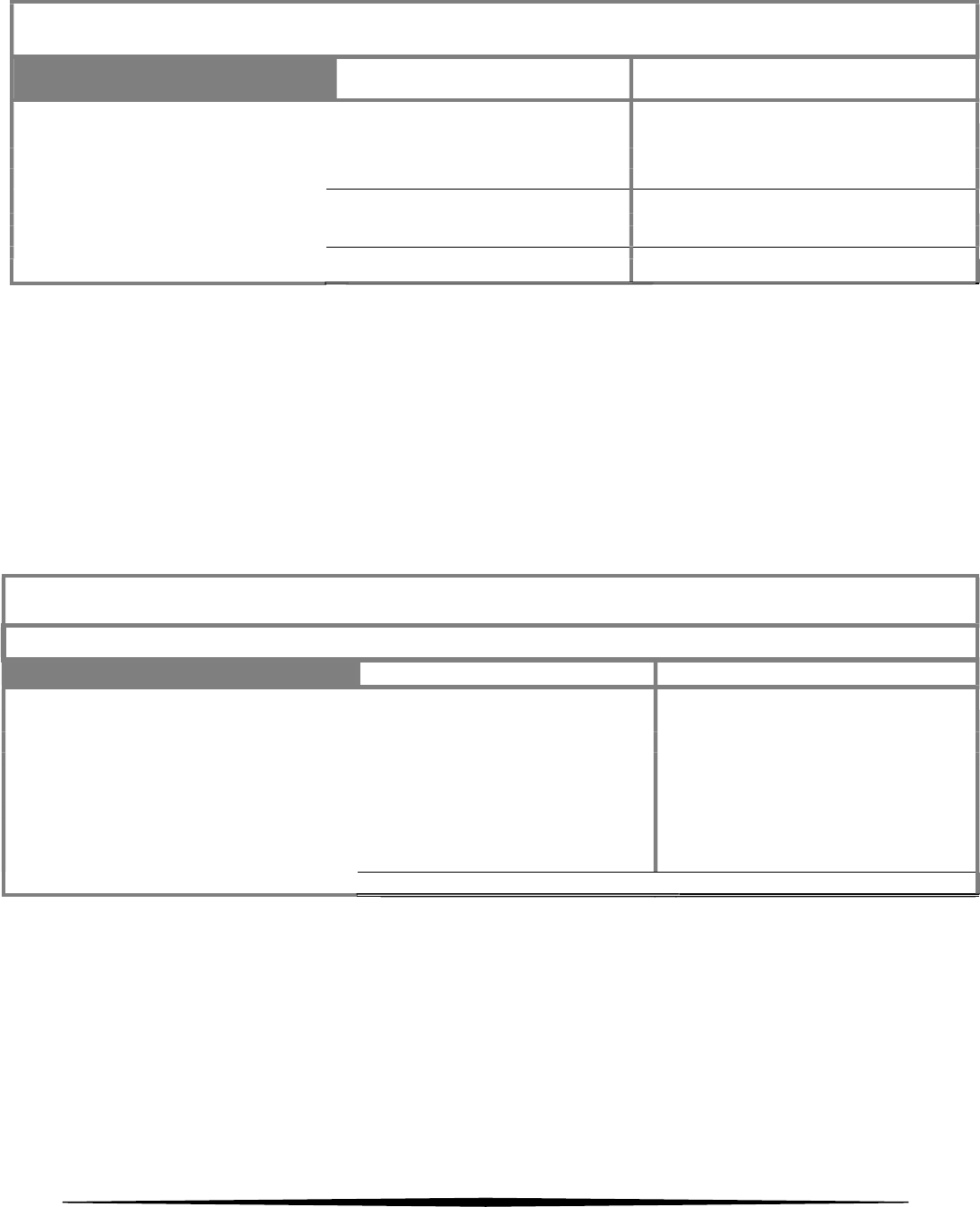

TABLE 1

MILITARY RETIREMENT SYSTEM PROPERTIES

(FOR NONDISABILITY RETIREMENT FROM ACTIVE DUTY)

Benefit System Final Pay High-3 (HI-3)

Career Status Bonus

(CSB)/Redux

Blended Retirement

System (BRS)

Applies to Members

Who Joined a

Uniformed Service:

• before September

8, 1980

• on or after September 8, 1980 and

before August 1, 1986

• on or before August 1, 1986 and

before January 1, 2003 who do not

elect to accept the CSB at the 15-year

anniversary

• on or after January 1, 2003 and

before January 1, 2006

• on or after January 1, 2006 and

before January 1, 2018 who do not

elect to participate in BRS

• on or after August 1,

1986 and before January

1, 2003 who elect to

accept the CSB with

additional 5-year service

obligation

• on or after January 1,

2018

• on or after January 1,

2006 and before January

1, 2018 who elect to

participate in BRS

Retired Pay

Computation Basis

Final basic pay rate Highest 36 months of basic pay rate Highest 36 months of

basic pay rate

Highest 36 months of

basic pay rate

Multiplier 2.5% per year of

service

2.5% per year of service 2.5% per year of service

less 1% for each year of

service less than 30

(restored at age 62)

2.0% per year of service

Cost-of-Living

Adjustment

Mechanism

Full CPI-W Full CPI-W Full CPI-W minus 1%

(one-time catch-up at age

62)

Full CPI-W

Additional

Benefit(s)

--- --- • $30,000 CSB payable at

15-year anniversary upon

assumption of 5-year

obligation to remain on

continuous active duty

• Choice of receiving a

portion (either 25% or

50%) of the retired pay

entitlement from

retirement age to normal

Social Security retirement

age (usually 67) as a

discounted lump sum

instead of an annuity

• Automatic and

matching Government

contributions to TSP

account

• Mandatory mid-career

contribution bonus if

member agrees to serve

additional time

Notes:

- Due to breaks in service and technical differences in the definition of qualifying years of service under different benefit systems,

in some cases above it is not possible to precisely define which benefit systems cover the appropriate members based solely on

dates of entry. The above table does not cover every possibility.

- For additional up-to-date information, refer to the DoD Office of Military Compensation website (http://militarypay.defense.gov/).

Management’s Discussion and Analysis_________________________________

5

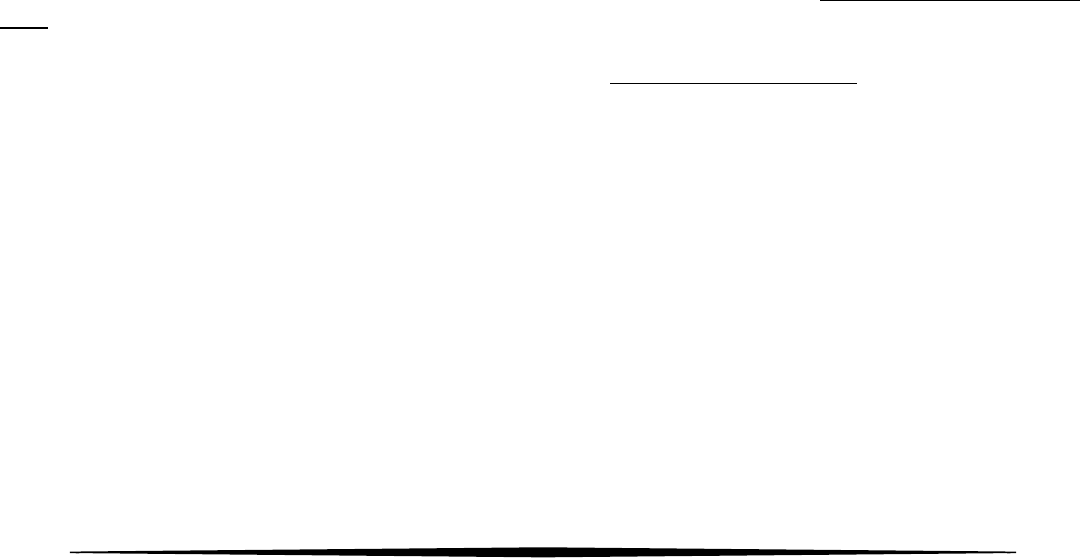

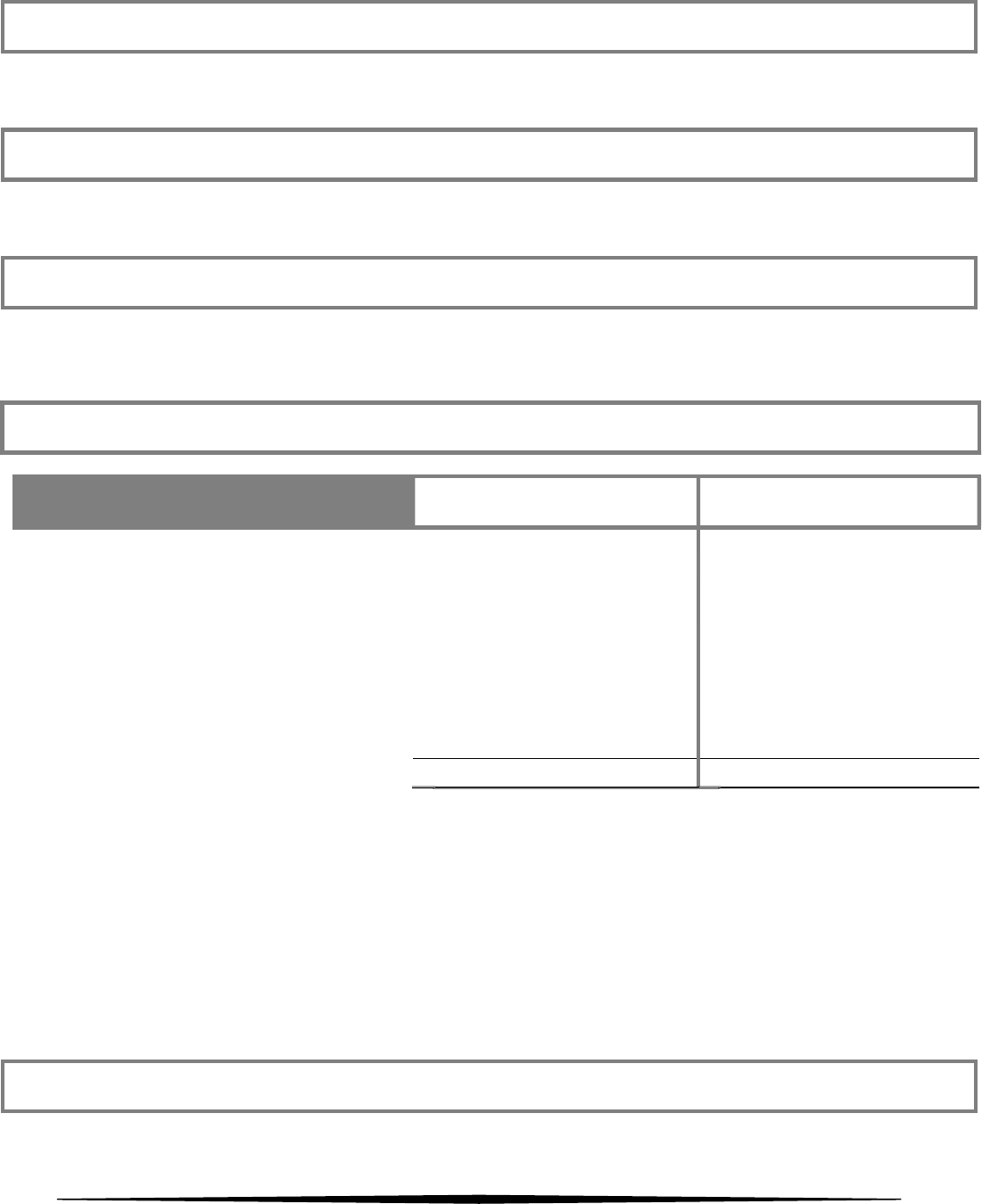

TABLE 2

MILITARY RETIREMENT SYSTEM MULTIPLIERS

(FOR NONDISABILITY RETIREMENT FROM ACTIVE DUTY)

Years of Final Pay/HI-3 BRS CSB/Redux Multiplier

Service Multiplier Multiplier Before Age 62 After Age 62

20 50.0% 40.0% 40.0% 50.0%

21 52.5 42.0 43.5 52.5

22 55.0 44.0 47.0 55.0

23 57.5 46.0 50.5 57.5

24 60.0 48.0 54.0 60.0

25 62.5 50.0 57.5 62.5

26 65.0 52.0 61.0 65.0

27 67.5 54.0 64.5 67.5

28 70.0 56.0 68.0 70.0

29 72.5 58.0 71.5 72.5

30 75.0 60.0 75.0 75.0

31 77.5 62.0 77.5 77.5

32 80.0 64.0 80.0 80.0

33 82.5 66.0 82.5 82.5

34 85.0 68.0 85.0 85.0

35 87.5 70.0 87.5 87.5

36 90.0 72.0 90.0 90.0

37 92.5 74.0 92.5 92.5

38 95.0 76.0 95.0 95.0

39 97.5 78.0 97.5 97.5

40 100.0 80.0 100.0 100.0

41 102.5 82.0 102.5 102.5

42 105.0 84.0 105.0 105.0

: : : : :

Management’s Discussion and Analysis_________________________________

6

Disability Retirement

A military member in an active component or on active duty for more than 30 days who is found unfit for duty is

entitled to disability retired pay if the disability:

1) based upon accepted medical principles, is of a permanent nature and stable;

2) was incurred while entitled to basic pay;

3) is neither the result of the member's intentional misconduct nor willful neglect;

4) was not incurred during a period of unauthorized absence; and

5) either:

a. the member has at least 20 years of service; or

b. the disability is rated at least 30% under the Department of Veterans Affairs (VA) Schedule of

Rating Disabilities and one of the following conditions is met:

i. the disability was not noted at the time of the member’s entrance on active duty (unless

clear and unmistakable evidence demonstrates that the disability existed before the

member’s entrance on active duty and was not aggravated by active military service);

ii. the disability is the proximate result of performing active duty;

iii. the disability was incurred in the line of duty in time of war or national emergency; or

iv. the disability was incurred in the line of duty after September 14, 1978.

Under certain conditions, members on active duty for 30 days or less or on inactive-duty training are also entitled

to disability retired pay for disabilities incurred or aggravated in the line of duty.

In disability retirement, the member may elect to receive retired pay equal to either:

1) the accrued non-disability retirement benefit regardless of eligibility to retire; or

2) base pay multiplied by the rated percent of disability.

Except for members with a multiplier under (1) that is greater than 75% (which will equate to different years of

service depending on whether the member is under BRS), the benefit cannot be more than 75% of base pay. Only

the excess of (1) over (2) is subject to federal income taxes if the member had service on or before September 24,

1975. If the individual was not a member of a uniformed service on September 24, 1975, disability retired pay is

tax-exempt only for those disabilities that are combat or hazardous duty-related. Base pay is equal to final basic

pay if the retiree first became a member of a uniformed service before September 8, 1980; otherwise, base pay is

equal to the average of the highest 36 months of basic pay.

Members whose disabilities may not be permanent are placed on a temporary-disability retired list and receive

disability retirement pay just as if they were permanently disabled; however, the member must be physically

examined every 18 months for any change in disability, with a final determination made within five years. For

retirees placed on this list on or after January 1, 2017, the final determination must be made within three years.

The temporary disability pay is calculated like the permanent disability retired pay, except the payment cannot be

less than 50% of base pay.

Members who elected the CSB/Redux retirement option, but who retired for disability, are not subject to the

reduced CSB/Redux retired pay multiplier and are awarded retired pay based on the disability retirement rules

outlined above. However, such members continue to be subject to the reduced CPI (with age 62 restoration) as

CSB recipients. Members who are under BRS and who retire for disability do not have the option of receiving a

portion of retired pay as a discounted lump sum.

Management’s Discussion and Analysis_________________________________

7

As of September 30, 2022, there were approximately 137,000 disability retirees receiving approximately $2.2

billion of annualized retired pay. For comparison, as of September 30, 2021, there were approximately 129,000

disability retirees receiving approximately $1.94 billion of annualized retired pay. Please note that the September

30, 2022 information includes the USCG, while the September 30, 2021 information does not.

Reserve Retirement

Members of the reserves may retire after 20 qualifying years of creditable service. However, reserve retired pay

is not payable until age 60 unless the member performs certain types of active duty or active service specified in

P.L. 110-181 and P.L. 113-291, in which case the age is reduced below 60 by three months for each aggregate of

90 days of certain active duty service served in any fiscal year after January 28, 2008, or in any two consecutive

fiscal years after September 30, 2014. However, the age cannot be reduced below 50, and eligibility for subsidized

retiree health benefits remains at age 60 even if the eligibility age for retired pay is reduced.

For members not under BRS, retired pay is computed as base pay times 2.5% times years of service. For members

under BRS (as explained below) the 2.5% multiplier is reduced to 2.0%. If the reservist was first a member of a

uniformed service before September 8, 1980, base pay is defined as the active duty basic pay in effect for the

retiree’s grade and years of service at the time that retired pay begins. If the reservist first became a member of

the armed services on or after September 8, 1980, base pay is the average basic pay for the member’s grade in the

highest 36 months computed as if he/she was on active duty for the entire period preceding the age at which

retired pay commences. The years of service are determined by using a point system, where 360 points convert

to a year of service. Typically, one point is awarded for one day of active duty service (e.g., active duty training)

or one inactive duty training (IDT) drill attendance. Reservists may perform two IDT periods in one day thereby

receiving two retirement points per day. In addition, 15 points are awarded for completion of one year’s

membership in a reserve component. A creditable year of service is one in which the member earned at least 50

points. A member generally cannot retire with less than 20 creditable years, although points earned in non-

creditable years are used in the retirement calculation. Beginning with years of service that include October 30,

2007, non-active duty points are limited in any year to no more than 130. Lesser limitations have applied in the

past.

Reservists who first joined the service on or before December 31, 2017 and with fewer than 4,320 points (equating

to 360 points per year multiplied by 12 years of service) as of that date are eligible to opt in to BRS. Reservists

who first become a member of the uniformed service after December 31, 2017 are automatically under BRS. For

reserve retirement under BRS, the discounted lump sum option covers the period from retirement age (i.e., 60 or

earlier if certain qualifying service is performed) to normal Social Security retirement age (usually 67).

As of September 30, 2022, there were approximately 442,000 reserve retirees receiving approximately $8.29

billion of annualized retired pay. For comparison, as of September 30, 2021, there were approximately 438,000

reserve retirees receiving approximately $7.64 billion of annualized retired pay. Please note that the September

30, 2022 information includes the USCG, while the September 30, 2021 information does not.

Survivor Benefits

Legislation originating in 1953 provided optional survivor benefits, later referred to as the Retired Servicemen’s

Family Protection Plan (RSFPP). The plan proved to be expensive to the participants and inadequate, since the

survivor annuities were not adjusted for inflation and could not exceed 50% of retired pay. RSFPP was designed

to be self-supporting in the sense that, on average, the present value of the premiums equaled the present value of

the survivor annuity.

Management’s Discussion and Analysis_________________________________

8

On September 21, 1972, RSFPP was replaced by the Survivor Benefit Plan (SBP) for new retirees. RSFPP still

covers those servicemen retired before 1972 who did not convert to the new plan or who retained RSFPP in

conjunction with SBP.

Retired pay is reduced, before taxes, for the member’s cost of SBP. Total SBP costs are shared by the government

and the retiree, so the reductions in retired pay are only a portion of the total cost of the SBP program.

The SBP survivor annuity is 55% of the member’s base amount. The base amount is elected by the member, but

cannot be less than $300 or more than the member’s full gross monthly retired pay, with one exception. If the

member elects CSB/Redux and is subject to a penalty for service under 30 years in the calculation of retired pay,

the maximum base amount is equal to the full retired pay without the penalty. However, the annuity for a survivor

of a CSB/Redux retiree is subject to the reduced COLA.

When SBP started in 1972, survivor benefits for those 62 and older were reduced by the estimated amount of

Social Security for which the survivor would be eligible based on the member’s military pay. In 1985, that

reduction formula was changed so all annuitants 62 and over received a reduced flat rate of 35% of the member’s

base amount. Beginning October 1, 2005, the reduced rate at age 62 was phased out in 5% increments. On April

1, 2008, the survivor benefit reduction at age 62 was fully eliminated and the rate of 55% of the member’s elected

base amount became the standard for all survivors, regardless of age.

Prior to FY 1987, the survivor annuity benefit for a surviving spouse who remarried before age 60 was suspended.

In FY 1987, SBP changed to suspend benefits when the remarriage occurred at the age of 55. If the remarriage

ends in divorce or death, the annuity is reinstated.

Members who die on active duty are generally assumed to have retired with full disability on the day they died

and to have elected full SBP coverage for spouses, former spouses, and/or children. If it is more beneficial for

the survivors to have elected child only because of Dependency and Indemnity Compensation (DIC) offsets, the

family has the option to make that election instead. If the death does not occur in the line of duty, the SBP benefit

is based on the member’s years of service, rather than assuming a full disability retirement. Insurable interest

elections may be applicable in some cases. These benefits have been improved and expanded over the history of

the program.

The surviving spouse (or dependent children, if there is no surviving spouse or if the spouse subsequently dies)

of a reservist who dies in the line of duty while performing IDT service is entitled to an SBP annuity. For

payments prior to December 23, 2016, the annuity is based on the reservist’s years of service. Effective December

23, 2016, the annuity is based on assuming the reservist retired with full disability and elected full SBP on the

day of death.

SBP annuities may be reduced by VA survivor benefits (DIC), and all premiums relating to the reductions are

returned to the survivor. The FY 2008 NDAA enacted, and subsequent legislation extended, a temporary Special

Survivor Indemnity Allowance (SSIA) that pays a monthly amount to survivors with a DIC offset (or the amount

of the DIC offset, if less than the SSIA). The FY 2018 NDAA extended this allowance to a permanent benefit

with annual cost-of-living adjustments. For calendar year 2022, the SSIA paid a monthly amount of $346. The

FY 2020 NDAA repealed the DIC offset, phasing it out over three years starting in calendar year 2021. In 2022,

the offset can be no more than one-third of their DIC award, and effective January 1, 2023, there will not be any

offset to SBP pay from a DIC award.

As a result of the “Sharp Case” ruling, the SBP benefit of survivors with entitlement to both DIC and SBP who

remarry after age 57 is not reduced by DIC benefits received.

Management’s Discussion and Analysis_________________________________

9

As with retired pay, SBP annuities and premiums are increased annually with COLAs. These COLAs are either

full or partial CPI increases, depending on the benefit formula covering the member. If a member who elected

the CSB dies before the age of 62, the survivor’s benefit is subject to partial COLAs and his/her annuity is

increased, on what would have been the member’s 62nd birthday, to the amount that would have been payable

had full COLAs been in effect. Partial COLAs continue annually thereafter.

For reserve retirees, the retired pay reductions applicable under SBP take effect for survivor coverage after a

reservist turns 60 (or earlier if they have certain active service) and begins to receive retired pay. The Reserve

Component Survivor Benefit Plan (RCSBP) provides annuities to survivors of reservists who die before age 60

(or earlier if they have certain active service) provided they attained 20 years of qualified service and elected to

participate in the program (or were within their 90-day election window after receiving a letter confirming 20

years of credible service). However, if the death occurs either on active or inactive duty as described above, the

survivor receives an annuity under SBP. The added cost of RCSBP is borne completely by reservists through

deductions from future retired pay.

Beginning October 1, 2008, a “paid-up” provision eliminated the reduction in retired pay for premiums for SBP,

RCSBP, and RSFPP coverage for participants age 70 or older whose retired pay has been reduced for at least 360

months.

SBP premiums for members who elect lump sums under BRS will be equivalent to what they would have been

without the lump sum, and consequently, the survivors' annuities will be equivalent to what they would have been

without the lump sum. The maximum base amount will be equal to unreduced retired pay (i.e., ignoring the lump

sum), premiums will be deducted only from monthly retired pay received, and SBP benefits will commence upon

the retiree's death.

As of September 30, 2022, there were approximately 327,000 survivors of military members receiving

approximately $4.83 billion in annuity and/or SSIA payments. As of September 30, 2021, there were

approximately 323,000 survivors of military members receiving approximately $4.30 billion in annuity and/or

SSIA payments. Please note that the September 30, 2022 information includes the USCG, while the September

30, 2021 information does not.

Temporary Early Retirement Authority (TERA)

The FY 1993 NDAA (P.L. 102-484) granted temporary authority for the military services to offer early

retirements to members with more than 15 but less than 20 years of service. The retired pay was calculated in

the usual way, except that there was a reduction of 1% for every year below 20 years of service. Part or all of

this reduction can be restored at age 62 if the retired member works in a qualified public service job during the

period from the date of retirement to the date on which the retiree would have completed 20 years of service.

Unlike members who leave military service before 20 years with Voluntary Separation Incentives or Special

Separation Benefits, these early retirees are generally treated like regular military retirees for the purposes of other

retirement benefits. This authority originally expired on September 1, 2002.

The FY 2012 NDAA (P.L. 112-81) reinstated TERA from January 2012 through December 2018, but without the

qualified public service provision. The FY 2017 NDAA further extended TERA through December 2025. These

reinstatements of TERA are on a much smaller scale than the FY 1993 authority.

As of September 30, 2022, there were approximately 70,000 TERA retirees receiving approximately $1.42 billion

in annualized retired pay. For comparison, as of September 30, 2021 there were approximately 70,000 TERA

Management’s Discussion and Analysis_________________________________

10

retirees receiving $1.36 billion in annualized retired pay. Please note that the September 30, 2022 information

includes the USCG, while the September 30, 2021 information does not.

Cost-of-Living Increase

All non-disability retirement, disability retirement, and most survivor annuities are adjusted annually for inflation.

COLAs are automatically scheduled to occur every 12 months, on December 1, to be reflected in checks issued

at the beginning of January.

The “full” COLA, effective December 1, is computed by calculating the percentage increase in the average CPI

from the third quarter of the prior calendar year to the third quarter of the current calendar year. The increase is

based on the Urban Wage Earner and Clerical Worker Consumer Price Index (CPI-W) and is rounded to the

nearest tenth of one percent. Many members receive a “partial” COLA on December 1 of their first year of

retirement to reflect the fact that they were not retired for the full year. Members under the Final Pay benefit

system may receive an additional one-time COLA adjustment in the first year of retirement to reflect the fact that

an earlier retirement date would have been beneficial for them.

The benefits of retirees (and most survivors) are increased annually with the full COLA, with one exception for

those first entering the armed services on or after August 1, 1986, who elect the $30,000 CSB. Their benefits are

increased annually with a partial COLA equal to the full COLA minus 1% (except if the full COLA is less than

or equal to 1%). A one-time restoration is given to a partial COLA recipient on the first day of the month after

the retiree’s 62nd birthday. At this time, retired pay (or the survivor benefit, if the retiree is deceased) is increased

to the amount that would have been payable had full COLAs been in effect. Annual partial COLAs continue after

this restoration. Note that the FY 2016 NDAA sunsets the CSB/Redux benefit tier by not allowing any CSB

elections after December 31, 2017.

FUND RELATIONSHIPS

Department of Veterans Affairs Benefits

The VA provides compensation for Service-connected and certain non-Service-connected disabilities. These VA

benefits can be in place of or in combination with DoD retired pay, but through December 31, 2003, were not

fully additive. Since VA benefits are exempt from federal income taxes, it is often to the advantage of a member

to elect them. Through calendar year 2003, retired pay earned from the DoD for military service was offset by

any payment received from VA for a VA-rated disability. Beginning with NDAA 2004 (P.L. 108-136), a series

of legislation has been enacted that increasingly reduces or eliminates the offset to military retired pay due to

receipt of VA disability compensation. Members with a combined VA disability rating of 50% or greater who

have at least 20 years of service have their offset eliminated under the Concurrent Retirement and Disability Pay

(CRDP) program. Members whose disability meets certain combat-related criteria can elect to receive payments

against the offset under the CRSC program. Under CRSC, members are not subject to a phase-in schedule, are

not required to have at least 20 years of service, and are not required to have at least a 50% VA disability rating.

Although CRSC amounts are calculated based on retired pay lost due to offset and are paid from the MRF, CRSC

is not technically considered retired pay. CRSC payments are tax exempt. A member may not participate in both

the CRDP and CRSC programs simultaneously, but may change from one to the other during an annual “open

season.”

For members who elect lump sums under BRS and qualify for VA disability compensation: (1) if the member is

not eligible for CRDP or CRSC, the VA will withhold disability payments until the amount withheld equals the

lump sum amount, after which VA disability payments, as an offset to retired pay, may be paid; (2) if the member

is eligible for CRDP, no withholding of VA disability payments is required, and the retiree may receive VA

Management’s Discussion and Analysis_________________________________

11

disability compensation and retired pay without offset; and (3) if eligible for CRSC, the procedures for

withholding VA disability payments are more complicated and relate to the portion of the total VA entitlement

considered combat-related.

VA benefits also overlap survivor benefits through the DIC program. DIC is payable to survivors of veterans

who die from Service-connected causes. Although SBP annuities are generally reduced by the amount of any

DIC benefit, all SBP premiums relating to the reduction in benefits are returned to the survivor. The FY 2008

NDAA enacted, and subsequent legislation extended, a temporary SSIA that pays a monthly amount to survivors

with a DIC offset (or the amount of the DIC offset, if less than the SSIA). The FY 2018 NDAA extended this

allowance to a permanent benefit with annual cost-of-living adjustments. For calendar year 2022, the SSIA paid

a monthly amount of $346. The FY 2020 NDAA repealed the DIC offset, phasing it out over three years starting

in calendar year 2021. During 2021, SBP benefits for survivors will be subject to an offset equal to the lesser of

their SPB pay and two-thirds of their DIC award. In 2022, the offset will be no more than one-third of the DIC

award, and effective January 1, 2023, there will not be any offset to SPB pay from a DIC award.

As a result of the “Sharp Case” ruling, the SBP benefit of survivors with entitlement to both DIC and SBP who

remarry after age 57 is not reduced by DIC benefits received.

As of September 2022, there were approximately 817,000 CRDP members and 96,000 CRSC members. These

members were receiving an additional annualized amount of $20.07 billion and $1.23 billion,

respectively. Because of the repeal of the DIC offset discussed above, effective January 1, 2023, there will be no

offset to SBP pay from a DIC award. Accordingly, there will only be three payments in FY 2023. As of September

2022, there were 68,000 survivors receiving total SSIA benefits of $70.3 million for the remaining 3 months of

calendar year 2022.

Interrelationships with Other Federal Service

For military retirement purposes, no credit is given for other federal service, except for TERA and where cross-

service transferability is allowed. Military service is generally creditable toward the federal civilian retirement

systems if military retired pay is waived. However, a deposit (equal to a percentage of post-1956 basic pay) must

be made to the Civil Service Retirement and Disability Fund in order to receive credit. Military service is not

generally creditable under both systems (but is for reservists and certain disability retirees). Military retirees may

qualify separately for Civil Service retirement and receive concurrent pay from both systems.

Retired Pay to Military Compensation

Basic pay is the only element of military compensation upon which non-disability retired pay is based and

entitlement is determined. Basic pay is the principal element of military compensation that all members receive,

but it is not representative, for comparative purposes, of salary levels in the public and private sectors. Reasonable

comparisons can be made to regular military compensation (RMC). RMC is the sum of (1) basic pay, (2) the

housing allowance, which varies by grade, location, and dependency status, (3) the subsistence allowance, and

(4) the tax advantages accruing to the housing and subsistence allowances because they are not subject to federal

income tax. Basic pay represents approximately 70% of RMC for all retirement eligible members. For the 20-

year retiree, basic pay is approximately 67% of RMC. Consequently, a member retired with 20 years of service

if entitled to 50% of basic pay, would receive approximately 34% of RMC. Further, such 20-year retirees (except

for those who first entered service prior to September 8, 1980) receive a percentage (50%, or 40% for those under

CSB/Redux or BRS) of their High 36-month average of basic pay, typically less than final basic pay. For a 30-

year retiree, basic pay is approximately 73% of RMC and such members if entitled to 75% of basic pay, would

receive 55% of RMC. Again, note that most members currently retiring with 30 years will actually receive a

Management’s Discussion and Analysis_________________________________

12

percentage (75%, or 60% for those under BRS) of their high 36-month average, rather than of their final basic

pay. P.L. 109-364 allows certain members, who retire on or after January 1, 2007 with sufficient years of service

(greater than 37.5 years under BRS and 30 years under the other benefit formulas), to retire with entitlements

exceeding 75% of their High 36-month average of basic pay. These relationships should be considered when

military retired pay is compared to compensation under other retirement systems.

Social Security Benefits

Many military members and their families receive monthly benefits indexed to the CPI from Social Security. As

full participants in the Social Security system, military personnel are generally entitled to the same benefits and

are subject to the same eligibility criteria and rules as other employees. Details concerning these benefits are

covered extensively in other publications.

Beginning in 1946, Congress enacted a series of amendments to the Social Security Act that extended some

benefits to military personnel and their survivors. These “gratuitous” benefits were reimbursed out of the general

fund of the U.S. Treasury. The Servicemen’s and Veterans’ Survivor Benefits Act brought members of the

military into the contributory Social Security system effective January 1, 1957.

Members of the military are also required to pay the Hospital Insurance payroll tax, with the Federal Government

contributing the matching employer contribution. Medicare eligibility occurs at age 65, or earlier if the employee

is disabled.

SIGNIFICANT CHANGES

From FY 2021 to FY 2022

Changes in the MRF valuation during FY 2022 included:

1) The FY 2021 NDAA requires the USCG be covered by the MRF no later than the beginning of FY 2023. The

USCG actuarial liability is included in the September 30, 2022 MRF financial statements. The USCG will be

included in the September 30, 2022 MRF valuation, and normal cost payments will begin during FY 2023,

and Treasury payments to amortize the initial unfunded liability will start in FY 2024.

2) Updated noneconomic assumptions approved by the Board at their June 2022 meeting for use in the September

30, 2022 MRF valuation, including: (a) updated VA offset parameters, (b) updated retiree death and other loss

rates, and (c) updated mortality improvement scales; and

3) New economic assumptions due to the Federal Accounting Standards Advisory Board (FASAB) financial

reporting Statement of Federal Financial Accounting Standards 33 (SFFAS No. 33), discussed further in Note

13, Federal Employee and Veteran Benefits Payable.

Item (3) is classified as an assumption change in the actuarial valuation. SFFAS No. 33 requires the use of a yield

curve based on marketable Treasury securities to determine the interest rates used to calculate actuarial liabilities

for federal financial statements. Historical experience is the basis for expectations about future trends in

marketable Treasury securities, as well as COLA and salary. The yield curve was provided by the Treasury Office

of Economic Policy. Item (3) is prescribed and therefore the resulting economic assumptions will be different

than those assumed by the Board for statutory funding calculations.

For FY 2023 and Beyond

It is difficult to predict changes for any particular year. In the coming fiscal years, the potential benefit and

assumptions changes with respect to the MRF include:

Management’s Discussion and Analysis_________________________________

13

1) Public Law 117-168 (Honoring our PACT Act of 2022) was signed into law on August 10, 2022. The

PACT Act will significantly increase disability compensation and health care benefits administered by VA

for veterans who have been exposed to toxic substances. While a secondary impact on the MRF is likely (in

terms of increased disability retirements and outlays), we have not reflected it in this year’s liabilities as it is

too soon to tell what the net financial effect will be. We plan to monitor the effect of the law closely and

work with the Board and our counterparts at VA to properly account for it in the coming years.

2) Further BRS legislative and policy refinements;

3) Continued review of economic assumptions pursuant to SFFAS No. 33;

4) Continued review of non-economic assumptions, including the effect of severe acute respiratory syndrome

coronavirus 2 SARS-CoV-2 (COVID-19) on future mortality experience and decrements; and

5) Adding PHS and NOAA to the MRF.

The OACT will propose updates to the actuarial assumptions underlying the valuation of the MRS to more

accurately reflect emerging plan experience as changes are implemented, in addition to the ongoing

assumptions/parameter review conducted annually each year.

PERFORMANCE MEASURES

The MRF made disbursements to approximately 2.379 million retirees and annuitants in September 2022, and to

2.333 million retirees and annuitants in September 2021.

There are many ways to measure the performance of a pension plan. Table 3 depicts a few common measures,

specifically 1) Percent Funded, 2) Asset-to-Annuitant Liability Ratio, and 3) Effective Fund Yield. The last

twelve years are shown below.

Management’s Discussion and Analysis_________________________________

14

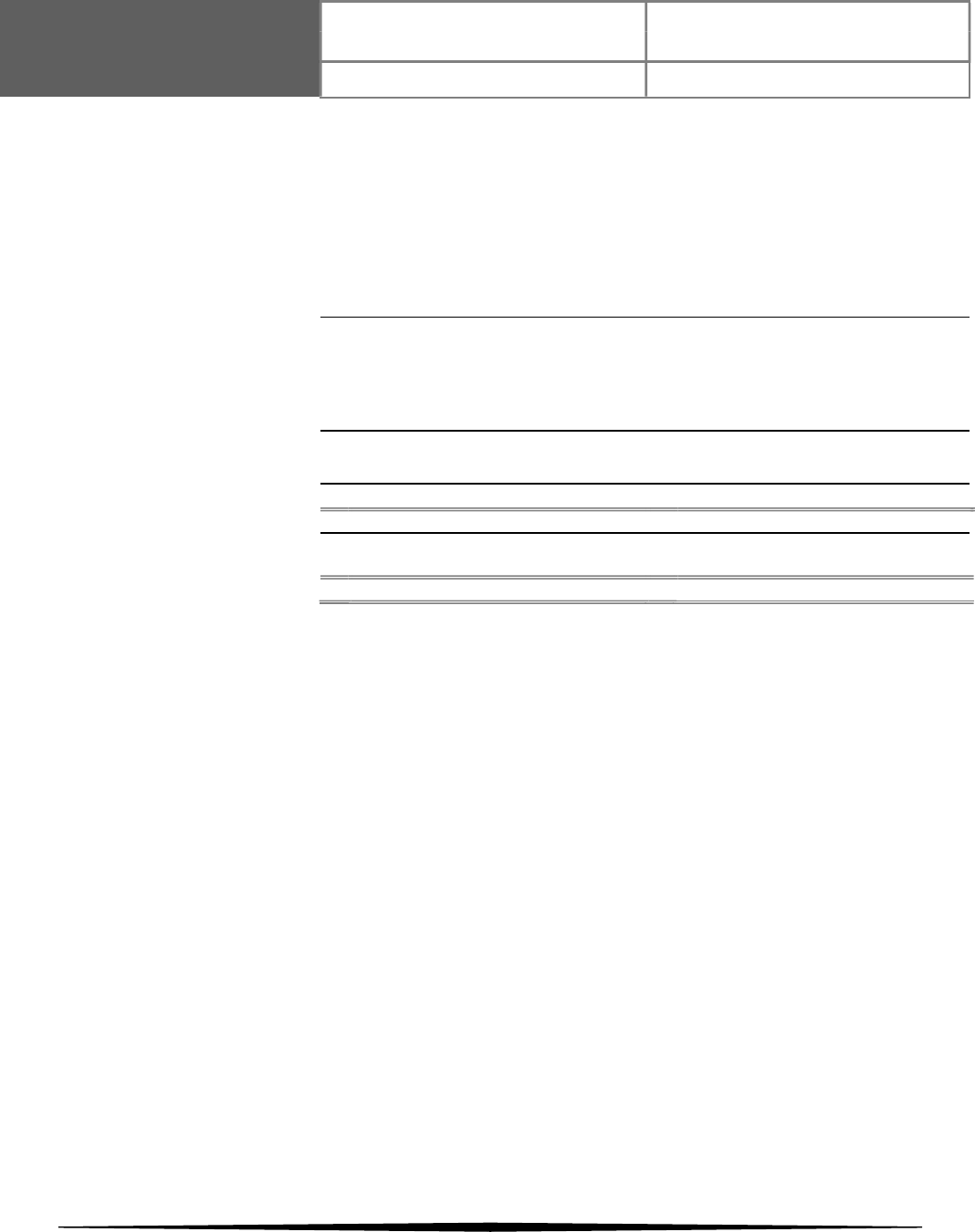

TABLE 3

MILITARY RETIREMENT SYSTEM

PERFORMANCE MEASURES

As of

Sept. 30,

Percent

Funded

Asset-to-Annuitant

Liability Ratio

Effective Fund Yield

2022

50.9%

85.5%

7.7%

2021

57.2

93.4

5.3

2020

54.6

89.5

2.3

2019

51.1

82.6

3.0

2018

50.3

82.2

3.8

2017

46.5

75.8

2.9

2016

44.3

71.8

2.3

2015

38.5

63.6

1.8

2014

34.9

57.9

3.2

2013

31.8

53.5

3.1

2012

29.0

49.2

2.9

2011

27.3

46.2

4.9

Notes:

- Percent Funded computed as total assets (from Balance Sheet) to actuarial accrued liability.

- Asset-to-Annuitant Liability Ratio computed as total assets (from Balance Sheet) to present value of

future benefits for the annuitant population.

- Effective Fund Yield is the approximate fund yield over the course of the associated fiscal year.

- The MRF is invested solely in intragovernmental U.S. Treasury securities, with constraints to hold

securities until maturity and invest with the primary objective of meeting the cash flow needs of the

Fund. Therefore, the above measures should be used with caution when compared with other retirement

funds and cited in the appropriate context.

PROJECTED LONG-TERM HEALTH OF THE FUND

The projected long-term health of the MRF is adequate due to the fact that it has three different sources of funding.

The first two sources are:

1) Annual payments from Treasury to amortize the unfunded liability and pay the normal cost of the

concurrent receipt benefits; and

2) Monthly normal cost payments from the Services to pay for the current years’ service cost.

The third source of funding, earnings on investments, is projected to be an increasing contribution to the MRF

due to an increasing fund balance. All three of these sources can be considered secure sources of funding, backed

by the full faith and credit of the U.S. Government.

The MRF investment policy mandates that securities will be held to maturity. Occasionally, however, securities

in the portfolio are liquidated prior to their stated maturity date. The MRF has the authority to sell all or part of a

security early to meet cash flow/benefit payment requirements. Historically, the MRF holds cash in overnight

securities in an amount equal to approximately 110% of the following month’s benefit. During FY 2022 and FY

2021, all securities were held to maturity.

Management’s Discussion and Analysis_________________________________

15

Unified Budget of the Federal Government

The MRF was created inside the Unified Budget of the Federal Government for the monies of the MRS. All three

sources of fund income are intragovernmental transactions consisting of transfers from one government account

to another. The only transactions in a particular year directly affecting the deficit of the Unified Budget are those

passing in or out of the government, such as tax collections (“in”) and beneficiary payments (“out”). The

intragovernmental transfers are debits and credits within the federal budget, with no direct effect on the deficit.

Just as in the pay-as-you-go method, the only transactions directly affecting the deficit in the retirement system

accounting process are payments to retirees and survivors (i.e. outlays/payments). The purchase of securities by

the Fund does increase the national debt, specifically the portion of the debt held by the government – the portion

held by the public does not change (see Figure 1).

FIGURE 1

UNIFIED BUDGET

TAXES (“IN”)

DOD NORMAL COST

PAYMENTS

INTRAGOVERNMENTAL TRANSFER

MILITARY

RETIREMENT

FUND

TREASURY PAYMENTS

INTRAGOVERNMENTAL TRANSFER

TREASURY PAYMENTS

OF INTEREST PLUS

PAR VALUE AT

MATURITY

INTRAGOVERNMENTAL TRANSFER

TREASURY

SECURITIES

INTRAGOVERNMENTAL TRANSFER

OUTLAYS (“OUT”)

However, funding does have an effect on the DoD budget. With the normal cost payments (except for Concurrent

Receipt) included in the DoD budget, policymakers now consider the impact on future retirement costs when they

make manpower decisions, which could have a significant impact on future federal budgets. For example, if a

decision were made today to double the size of the active duty and reserve forces, the DoD budget would

automatically have an immediate increase in retirement obligations. Under the pay-as-you-go system, the

retirement expenses would not necessarily be considered in the initial decision since they would not show up for

20 years, generally.

The fact that the MRF costs are recognized in advance provides greater benefit security over the long term. Also,

when there is a retirement fund, the MRS is not as dependent on obtaining the necessary appropriation from

Congress each year in order to pay benefits for that year. This can provide additional benefit security. As such,

the existence of the Fund promotes a high degree of “psychological security” for plan participant

Management’s Discussion and Analysis_________________________________

16

20-Year Projection

Table 4 presents a projection of contributions to and disbursements from the MRF. It includes the dollar amounts

as a percentage of payroll. The Fund is projected to remain solvent over the 20-year projection period. Further,

as long as the funding sources continue making the required payments to the MRF in a timely fashion, the Fund

is projected to remain solvent well beyond the 20-year projection horizon.

The following projections were made for FY 2022:

Basic pay for FY 2022 was projected to be $77.2 billion.

Normal cost payments were projected to be $36.7 billion.

The unfunded liability amortization payment was projected to be $114.5 billion.

Investment income was projected to be $51.0 billion.

Fund disbursements for FY 2022 were projected to be $65.2 billion.

Management’s Discussion and Analysis_________________________________

17

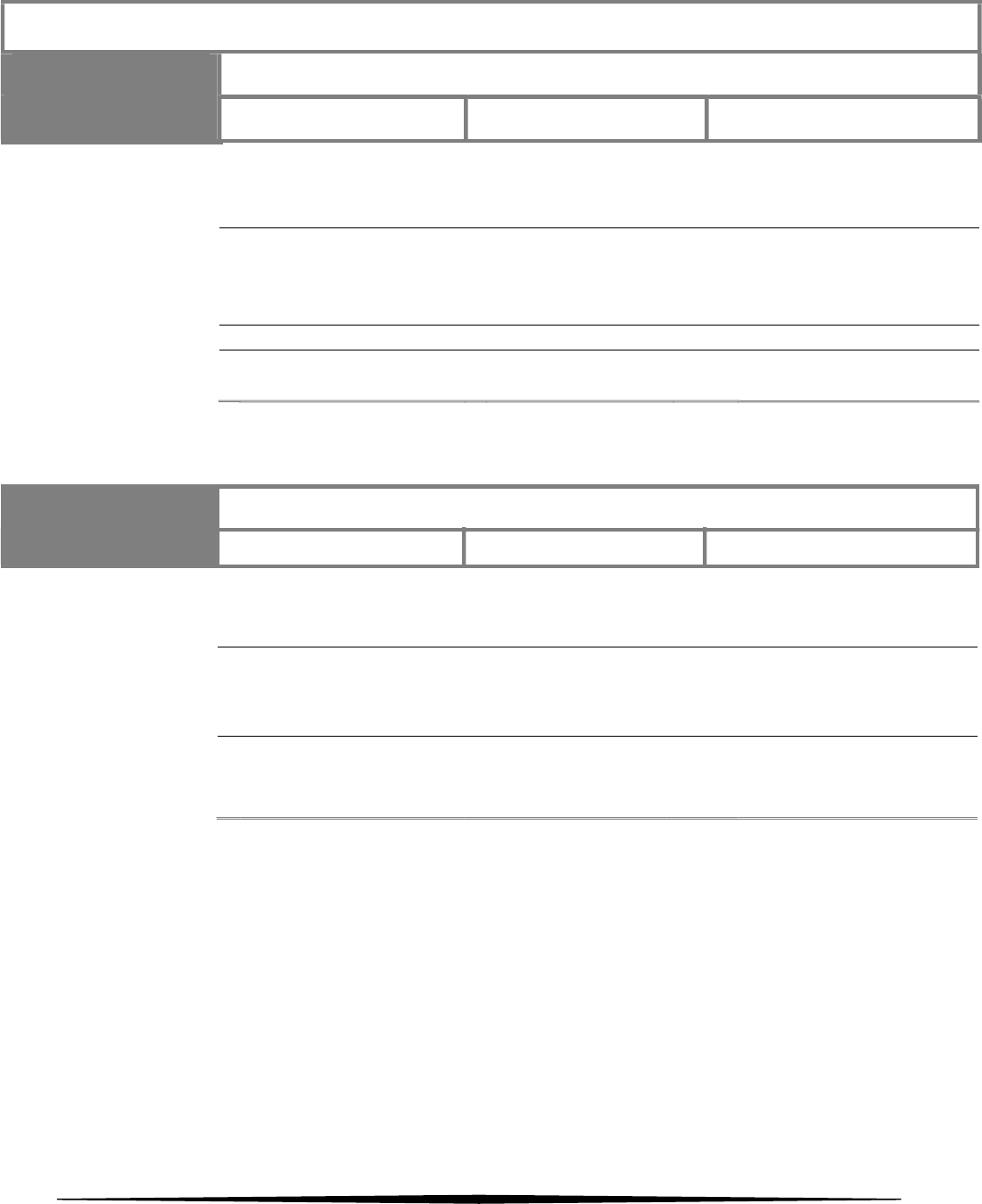

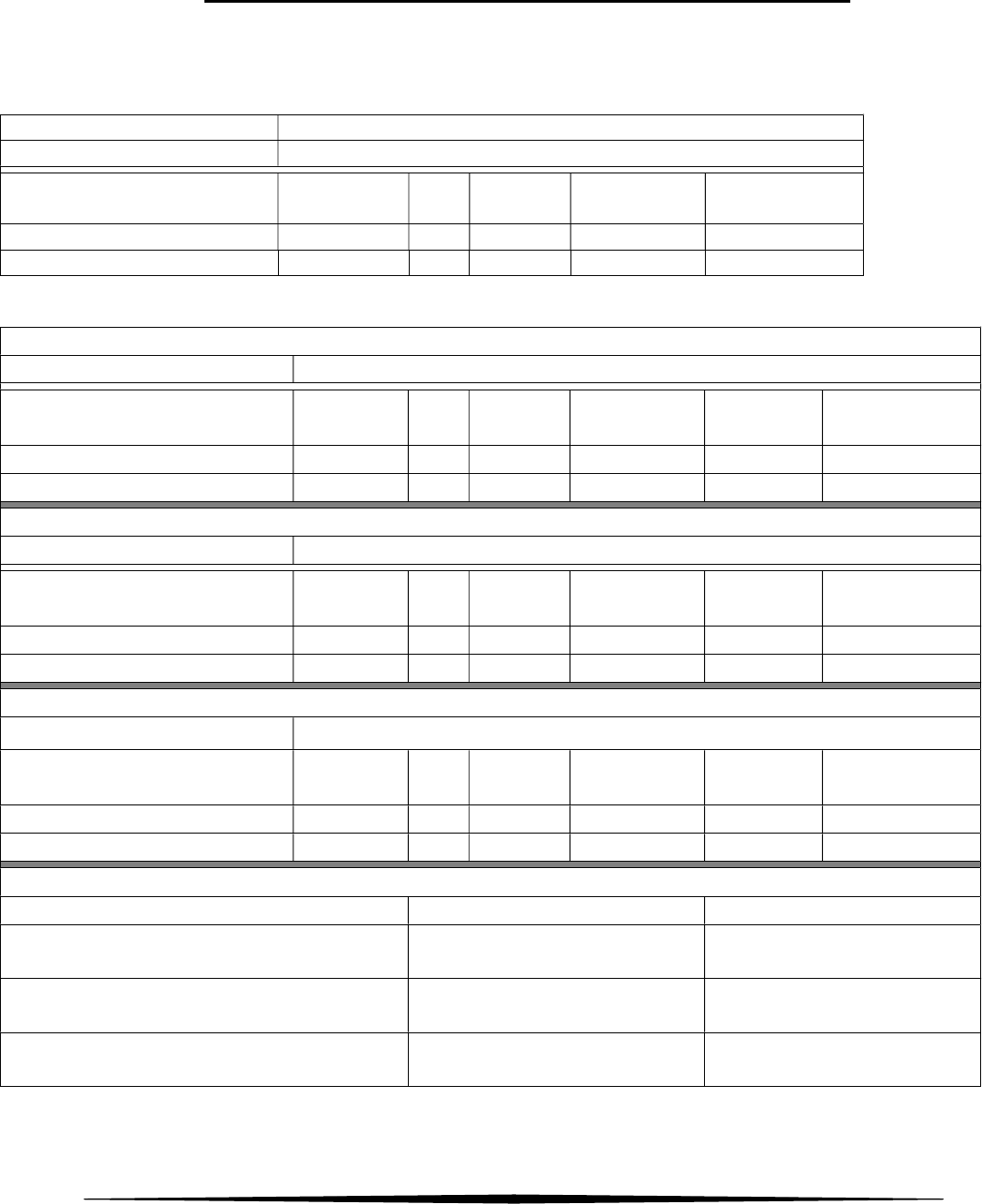

TABLE 4

MILITARY RETIREMENT SYSTEM

PROJECTED FLOW OF PLAN ASSETS

(In Billions of Dollars and as a Proportion of Payroll)

Fiscal

Basic

Normal Cost

Amortization of

Investment

Fund

Fund Balance

Year

Payroll

Payments

Unfunded

Liability

Income

Disbursements

End of Year

2023 $80.8 $39.0 (0.483) $120.4 (1.490) $54.0 (0.668) $70.1 (0.868) $1,382.9 (17.115)

2024 $80.9 $40.4 (0.499) $122.7 (1.517) $59.8 (0.739) $72.3 (0.894) $1,533.5 (18.956)

2025 $82.7 $41.4 (0.501) $126.1 (1.525) $66.0 (0.798) $74.3 (0.898) $1,692.7 (20.468)

2026 $84.6 $42.0 (0.496) $129.6 (1.532) $72.5 (0.857) $76.2 (0.901) $1,860.6 (21.993)

2027 $86.5 $42.5 (0.491) $15.6 (0.180) $74.6 (0.862) $78.2 (0.904) $1,915.1 (22.140)

2028 $88.6 $43.2 (0.488) $16.1 (0.182) $76.8 (0.867) $80.1 (0.904) $1,971.1 (22.247)

2029 $91.0 $43.9 (0.482) $16.5 (0.181) $79.0 (0.868) $82.1 (0.902) $2,028.4 (22.290)

2030 $93.4 $44.7 (0.479) $17.0 (0.182) $81.3 (0.870) $84.1 (0.900) $2,087.3 (22.348)

2031 $95.9 $45.6 (0.475) $17.4 (0.181) $83.7 (0.873) $86.1 (0.898) $2,147.9 (22.397)

2032 $98.6 $46.5 (0.472) $17.9 (0.182) $86.1 (0.873) $88.2 (0.895) $2,210.2 (22.416)

2033 $101.4 $47.5 (0.468) $18.4 (0.181) $88.6 (0.874) $90.3 (0.891) $2,274.4 (22.430)

2034 $104.3 $48.5 (0.465) $18.9 (0.181) $91.1 (0.873) $92.3 (0.885) $2,340.6 (22.441)

2035 $107.3 $49.5 (0.461) $19.4 (0.181) $93.8 (0.874) $94.4 (0.880) $2,408.9 (22.450)

2036 $110.4 $50.6 (0.458) $20.0 (0.181) $96.5 (0.874) $96.4 (0.873) $2,479.6 (22.460)

2037 $113.5 $51.6 (0.455) $20.5 (0.181) $99.4 (0.876) $98.5 (0.868) $2,552.6 (22.490)

2038 $116.6 $52.7 (0.452) $21.1 (0.181) $102.3 (0.877) $100.8 (0.864) $2,627.9 (22.538)

2039 $119.8 $53.8 (0.449) $21.7 (0.181) $105.3 (0.879) $103.1 (0.861) $2,705.6 (22.584)

2040 $123.1 $55.0 (0.447) $22.3 (0.181) $108.5 (0.881) $105.2 (0.855) $2,786.2 (22.634)

2041 $126.5 $56.2 (0.444) $22.9 (0.181) $111.7 (0.883) $107.3 (0.848) $2,869.7 (22.685)

2042 $130.0 $57.5 (0.442) $2.2 (0.017) $114.2 (0.878) $109.6 (0.843) $2,934.0 (22.569)

- The preceding projections assume a long-term 4.00% interest rate each year.

- The projections will vary in the short-term depending on the actual economic experience.

- Note that the above projection is based on FY 2021 MRF data, methods and assumptions for funding purposes. It does not include

data from the USCG.

- The above Fund Disbursements do not include the effect of NDAA 2011 (retired pay date change).

Expected Problems

There are no anticipated problems with respect to the MRF that would require disclosure in the Management’s

Discussion and Analysis.

Management’s Discussion and Analysis_________________________________

18

Investments

FIGURE 2

INVESTMENTS

Figure 2 depicts the value (par, net of unamortized discount/premium)

of investment holdings as of September 30, 2022.

Management Oversight

The Fund receives management oversight from the DoD Investment Board established in September 2003. The

members of the Investment Board are the Director, DFAS; the Deputy CFO, OUSD(C); and a senior military

member. The Investment Board meets twice each FY to consider investment objectives, policies, performance,

and strategies with the goal of maximizing the MRF's investment income. The Investment Board reviews the

MRF's law and Department of Treasury guidelines to ensure the MRF complies with broad policy guidance and

public law. At the September 30, 2022 meeting, the Investment Board approved the FY 2023 investments

recommended by the Investment Advisory Committee (a group of military reservists whose civilian expertise is

investing).

Anticipated Changes between the Expected and Actual Investment Rate of Return

The past decade-plus has seen increased volatility in interest rates and equity markets, increasing deficits,

volatility in the markets with regard to energy prices, elevated states of international conflict, increasing sovereign

debt levels, unusual central banking monetary policy, and various levels of economic growth. These items have

been a catalyst in the on-going discussion of implementing strong U.S. fiscal control and monetary policy among

politicians. Active political management of the U.S. debt and annual deficit may create an opportunity to purchase

Treasury market securities at higher rates of interest in the future. Conversely, uneasy equity markets tend to

Investments as of 9/30/22

(1,278.4 billion)

Inflation, $249.5,

19.5%

Interest Receivable,

$6.4, .5%

Overnights, $8.9, 0.7%

Bonds,

$188.3, 14.7%

TIPS, $768.9, 60.1%

Notes, $24.6, 1.9%

Zero Coupon Bonds,

$31.8, 2.5%

Management’s Discussion and Analysis_________________________________

19

push participants toward government securities causing downward pressure on interest rates. There has also been

a movement among pension plan sponsors to increase pension plan investments in lower risk securities, driven

by analysis of risk in relation to liabilities. The current MRF investment strategy is to maintain a portfolio

allocation of 75%-90% U.S. Treasury Inflation-Protected Securities (TIPS) to partially hedge against any future

inflation.

The Fund receives investment income from a variety of U.S. Treasury-based instruments such as bills, notes,

bonds, overnight investment certificates, and zero coupon bonds. U.S. Treasury bills are short-term securities

with maturities of less than one year issued at a discount. U.S. Treasury notes are intermediate securities with

maturities of one to ten years. U.S. Treasury bonds are long-term debt instruments with maturities of greater than

ten years. Overnight certificates are interest-based market securities purchased from the U.S. Treasury maturing

the next business day and accrue interest based on the Federal Reserve Bank of New York survey of Reserve

repurchase agreement rates. U.S. Treasury zero-coupon bonds are fixed-principal bonds having maturities of at

least five years and are purchased at a discount.

The Fund also invests in TIPS. TIPS are fixed-rate instruments designed to protect against inflation, with the

principal amount indexed to the CPI by adjusting the CPI at issuance to the current CPI. As inflation increases,

so does the principal amount.

Management’s Discussion and Analysis_________________________________

20

FINANCIAL PERFORMANCE OVERVIEW

Financial Data

Table 5 presents significant changes in the comparative financial statement information for the MRF.

TABLE 5

MILITARY RETIREMENT FUND

ANALYSIS OF FINANCIAL STATEMENTS

For the Years Ended September 30, 2022 and 2021

($ in Thousands)

2022 2021

Difference %

Increase / (Decrease) Change

BALANCE SHEET

Intragovernmental:

Investments $1,278,373,507

$1,106,264,905

$172,108,602

16%

Liabilities not covered by

Budgetary Resources

1

$1,337,339,629

$920,627,316

$416,712,313 45%

Federal Employee and Veteran

Benefit Payable

$2,513,547,319

$1,933,646,716

$579,900,603

30%

STATEMENT OF NET

COST

Net Cost of Operations $343,642,826 $7,406,893 $336,235,933 4540%

1

included as a component of the line titled “Federal Employee and Veteran Benefits Payable”

BALANCE SHEET

Investments and Related Interest

Intragovernmental Securities

Total Intragovernmental Securities, Net Investments increased $172.1 billion (16%) primarily due to the MRF

purchase of $115.5 billion in additional securities in October of 2021, the purchase of $4.5 billion in April of

2022 and an increase in the value of the securities due to TIPS inflation earnings of $74.2 billion. Offset by the

maturity of $6.6 billion in securities in July 2022, $3.9 billion in August 2022, $6.7 billion in premium

amortization and a change in Overnight Investments of 5.6 billion. The increase is due to normal growth in the

MRF from U.S. Treasury and Military Services contributions. The annual investment of these funds has a

cumulative effect with an expectation that invested balances will continue growing to cover future benefits.

Management’s Discussion and Analysis_________________________________

21

Liabilities Not Covered by Budgetary Resources

Total Liabilities Not Covered by Budgetary Resources increased $416.7 billion (45%). This change is due to an

increase of $579.9 billion in Federal Employee and Veteran Benefits Payable, offset by an increase of $163.2

billion in net receipts that are available to pay future benefits. Net receipts are comprised of contributions,

interest income, and outlays. See Note 13, Federal Employee and Veteran Benefits Payable, for additional

information about these changes.

Federal Employee and Veteran Benefits Payable

The Federal Employee and Veteran Benefits liability, comprised of the actuarial liability plus the liability for

benefits due and payable, increased $579.9 billion (30%). Each year the actuarial liability is expected to

increase with the normal cost, decrease with benefit outlays, and increase with the interest cost, resulting in an

expected increase of $31.5 billion in FY 2022. The September 30, 2022, actuarial liability also included

changes due to revised actuarial assumptions, plan amendments, and experience. The net effect of these

changes was an increase of $553.2 billion. The MRF actuarial liability is adjusted at the end of each fiscal

year. The 4th quarter, FY 2022 balance represents the September 30, 2022 amount that will be effective

through 3rd quarter, FY 2023.

STATEMENT OF NET COST

Net Cost of Operations increased $336.2 billion (4,540%) primarily due to an Earned Revenue increase of $54.1

billion (28%). The Earned Revenue increase is comprised of an increase in Interest Revenue of $36.2 billion, an

increase in contributions received by the fund of $16.4 billion in the unfunded liability amortization payment

from Treasury and $1.4 billion from Treasury concurrent receipts and service contributions. The Treasury

contribution amounts are determined by the DoD Office of the Actuary (OACT), and the contributions made by

the Military Services are a factor of base pay times the normal cost percentage rate determined by the OACT.

Further the change also consists of both increases in Gross Costs and Losses/Gains from Actuarial Assumption

Changes. Gross Costs increased $67.7 billion primarily due to an increase in expenses that are factored into

calculation of the actuarial liability. The largest changes include a $56.6 billion increase to experience and a

$9.0 billion increase to plan due to a revaluation of the U.S. Coast Guard actuarial liability assumed by the

MRF. Losses/Gains from Actuarial Assumption Changes increased 322.6 billion (596%). This was due to a loss

on the change in the Actuarial Assumption. The large increase is due to the newly adopted SFFAS No. 33 long-

term economic assumptions.

Management’s Discussion and Analysis_________________________________

22

FIGURE 3

TOTAL ASSETS

Figure 3 depicts the value of significant assets as of September 30, 2022.

Assets

Assets of $1,279.1 billion shown in Figure 3 represent amounts that the MRF owns and manages. Assets

Investments increased $172.1 billion (16%) primarily due to the MRF purchase of $115.5 billion in additional

securities in October of 2021, the purchase of $4.5 billion in April of 2022 and an increase in the value of the

securities due to TIPS inflation earnings of $74.2 billion. Offset by the maturity of $6.6 billion in securities in

July 2022, $3.9 billion in August 2022, $6.7 billion in premium amortization and a change in Overnight

Investments of 5.6 billion. The increase is due to normal growth in the MRF from U.S. Treasury and Military

Services contributions. The annual investment of these funds has a cumulative effect with an expectation that

invested balances will continue growing to cover future benefits.

Assets as of 9/30/22

($1,279.1 billion)

Accounts Receivable,

$0.1, <0.1%

Investments, $1,278.4, 99.9%

Fund Balance with Treasury

$0.6, <0.1%

Management’s Discussion and Analysis_________________________________

23

FIGURE 4

TOTAL LIABILITIES

Figure 4 depicts the value of significant liabilities as of September 30, 2022.

Liabilities

Liabilities of $2,513.5 billion shown in Figure 4 represent liabilities related to military retirement pension benefits.