Vermont Registration,

Tax & Title Application

OFFICE LOCATIONS

Bennington

Bennington County

530 Main Street

Monday – Friday

Saint Albans

Franklin County

27 Fisher Pond Rd

Monday – Wednesday

Rutland

Rutland County

101 State Place

Monday – Friday

Dummerston

Windham County

AOT District #2 Office

870 US Route 5

Monday – Wednesday

Saint Johnsbury

Caledonia County

Green Mountain Mall

1998 Memorial Drive

Thursdays

White River Junction

Windsor County

226 Holiday Dr

Monday – Wednesday

Montpelier

Washington County - Main Office

Monday – Friday

South Burlington

Chittenden County

4 Market Street

Monday – Friday

To schedule an appointment,

visit mydmv.vermont.gov or

call 888-970-0357

Newport

Orleans County

Monday – Friday

Springfield

Windsor County

100 Mineral St Suite 103

Monday – Friday

dmv.vermont.gov

VD-119i 07/2024 MTC

RECENT NEWS & UPDATES

Registrations

To register a vehicle in Vermont, you must be a Vermont resident with a Vermont-issued credential (Driver’s License or Non-driver

Identification card).

Electric Vehicles

EV Infrastructure fee for battery electric vehicles (EVs) and plug-in electric hybrid vehicles (PHEVs) is in Act No. 148 of 2024, with a

new additional EV Infrastructure fee required as of January 1, 2025.

Titles

Act No. 165 of 2024, Section 26-30, states that when a vehicle is sold to a new owner, a title will be issued to the new owner when

the vehicle is registered. All vehicles previously exempt from obtaining a title remain exempt, and no action is required.

VERMONT LOW EMISSION VEHICLE (LEV) PROGRAM

All new motor vehicles up to 14,000 pounds Gross Vehicle Weight Rating (GVWR) must be California-certified to be sold and registered

in the state of Vermont.

New motor vehicles not certified as California or 50-state vehicles cannot be registered in the state of Vermont. LEV Regulations consider

any vehicle with less than 7,500 miles on the odometer a new vehicle.

Two quick ways to determine if your vehicle qualifies:

1. The Manufacturer Certificate of Origin (MCO) must indicate

“Certified for sale in 50 States” or “Certified for sale in

California”.

2. The label under the hood in the engine compartment must

indicate “California certified,” EPA 50-State, or California-

Only vehicle.

"50-State Vehicle: This vehicle conforms to U.S. EPA and

California regulations applicable to (the vehicle model year)

model-year new motor vehicles."

"California-Only Vehicle: This vehicle conforms to U.S. EPA and

California regulations applicable to (the vehicle model year)

model-year new motor vehicles introduced into commerce only

for sale in California."

Emission statements that DO NOT comply:

• This vehicle meets/satisfies Federal emission standards

• This vehicle is certified/legal for sale in 49 states

• This vehicle is certified/legal for sale in 45 states

• No statement

VERMONT TITLES

All Titles (except ATV) = $42.00, ATV Titles = $27.00. Lien fee = $14.00.

The State of Vermont does not issue titles for the following:

• Trailers with an empty weight of 1,500 lbs. or less

• Motorcycles with an engine size smaller than 300 CCs.

• Motor-driven cycle

• Tractors with a loaded weight of 6,099 lbs. or less

• Road-making appliances (call the Montpelier office for

details)

SUPPORTING DOCUMENTS REQUIRED FOR A VERMONT REGISTRATION & TITLE

New Vehicles:

• Manufacturer’s Certificate of Origin properly assigned.

• If the vehicle was manufactured in Canada, a New Vehicle

Information Statement is required.

• Bill of Sale is required for Purchase & Use Tax purposes.

• Odometer Disclosure Statement required if the vehicle is the

and seller both sign the back of the title.

Used Vehicles which have been titled:

• Original previous Certificate of Title assigned to you by all

parties on the title and bills of sale as necessary to show a

complete chain of ownership. All liens must be released.

• Death certificates and/or probate papers are required when

one or more previous owners are deceased.

• Odometer Disclosure Statement required if the vehicle is the

model year 2011 or newer; use form VT-005 or have buyer

and seller both sign the back of the title.

• If registered out of state to the applicant, section 7 needs to

be completed.

• If registered out of state to the applicant, proof of tax paid is

required, or tax on JD Power value will be collected at

registration.

Used Vehicles which have not been titled and are

not required to be titled:

• Bill of sale must contain sufficient information to identify the

vehicle, including Make, Year, VIN, Purchase Price,

Mileage, Signature of Seller, and Date of Sale

Used Vehicles which have not been titled but are

required to be titled in Vermont:

• Original or certified copy of the last registration certificate

and all bills of sale thereafter. The Bill of Sale must contain

sufficient information to identify the vehicle, including Make,

Year, VIN, Purchase Price, Mileage, Signature of Seller, and

Date of Sale.

• Odometer Disclosure Statement required if the vehicle is the

model year 2011 or newer; use form VT-005 or have buyer

and seller both sign the back of the title.

VD-119i 07/2024 MTC

MISCELLANEOUS TAX INFORMATION

Purchase and Use Tax is due at the time of registration and/or title at 6% of the purchase price or the JD Power value, whichever is higher,

minus the value of any trade-in vehicle or any other allowable credit. A tax credit may be applied towards the tax due at the time of purchase for

a vehicle sold within three months of the vehicle’s registration date.

Purchase: Purchase and Use Tax is due at the time of registration and/or title at a percentage of the purchase price or the JD Power clean

trade-in value, whichever is greater, minus the value of the trade-in vehicle or any other allowable credit.

If the vehicle is registered/titled to you or your spouse out-of-state, tax is based on JD Power clean trade-in book value and is due unless exempt.

Lease: The dealer/leasing company will calculate the tax. A lease agreement or Vermont Dealer worksheet must be submitted with documents.

If the individual purchases this vehicle at the end of the lease, they will pay tax on the "residual/lease end value" of the vehicle.

The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor. A "Purchase and Use Tax

Computation - Leased Vehicle" Form (form #VD-147) may be submitted instead of a copy of the lease agreement and dealer worksheet. Original

Acquisition Cost - Lease End Value = Purchase Price. The Purchase Price is the amount that will be taxed.

Tax paid in another state. Vehicle on which a state tax (Sales, Purchase & Use or Ad Valorem) has been paid in another state by the person

applying for a title/registration in Vermont. If the tax paid in another state is less than the Vermont tax, the tax due shall be the difference. You

will be required to submit proof of tax paid. A copy of the retail installment agreement is not acceptable.

The vehicle was previously registered out of state. You may claim a tax credit for a vehicle registered to you in a jurisdiction that imposes a

state sales or use tax on vehicles. You must provide proof that the vehicle was registered in a qualifying jurisdiction. Examples of proof of

registration are:

• Out-of-state Title.

• Registration Certificate(s) that show the vehicle was registered in your name.

• Bill of sale from the dealer showing your name as buyer and the total tax paid.

• Letter from that state motor vehicle department verifying the vehicle was registered in your name.

Dealer Appraisal: If you believe the vehicle’s value is less than the JD Power value, submit a Vermont Dealer Appraisal Form. Submitting a

dealer appraisal after registration must be received within 30 days of the registered date to be considered for a refund. DMV does not accept

any values determined by online research.

Maximum Tax: A

uto, Antique, Exhibit, Motor Home, Motorcycle, Truck, and off-highway Tractors registered at the 10,099 lb. weight class or

less have no maximum tax. Trucks and off-highway Tractors registered at the 10,099 weight class or more, and trailers have a $2,486 maximum

tax.

Some examples of vehicles exempt from tax are a vehicle owned or leased by a religious or charitable institution, a vehicle transferred to the

spouse, mother, father, grandparent, or child/grandchild of the donor, a vehicle equipped with altered controls and owned and operated or titled

by a permanently disabled person.

80,000 LB TRUCK REGISTRATIONS

To qualify to register for 80,000 lbs., vehicle combinations must have at least five axles. There must be at least 51 feet between the front and

rearmost axle or 36 feet between the first and last axle of two consecutive sets of tandem axles.

DIESEL TAX

Diesel-powered vehicles with a gross, or registered, weight of 26,001 lbs. and over that travel outside the State of Vermont must join the

International Fuel Tax Agreement (IFTA). Fuel decals will be issued for all qualifying vehicles, and diesel tax reports must be filed every quarter.

For further information regarding Diesel Tax and IFTA, please contact the Commercial Vehicle Operations Unit at 802.828.2070.

FEDERAL HEAVY VEHICLE USE TAX

The Internal Revenue Service requires vehicles registered at 55,000 lbs. or more (including agricultural) to pay a Heavy Vehicle Use Tax. All

Applications must be accompanied by proof of payment and processed in the Montpelier office.

Acceptable Proof is:

Receipted IRS 2290, Schedule 1 (or copy), or

Form 2290 with Schedule 1 attached and a copy of both sides of the canceled check or

HVUT IRS Form 2290 with payment attached.

Proof of Payment Not Required If:

The tax has already been paid for the taxable period, or

The IRS exempts the vehicle, or

Vehicle was acquired within 60 DAYS and has not been registered to anyone during the taxable period.

VD-119i 07/2024 MTC

Amateur Radio Operator, Firefighter,

Free Masons, Lion’s Club, National

Guard, Rotary, Vermont Ambulance

Association (EMS), Veterans of Foreign

Wars (VFW) and Vietnam Veterans of

America.

Submit DMV form VD-128

along with

proof of eligibility. Available only for

Autos & trucks less than 26,001 lbs.

$21.00 (one-time fee, in addition to other

fees)

Conservation Plate –

Available only for

Autos & trucks less than 26,001 lbs.

$32.00 (additional annual fee)

Vanity Plate – Submit form VD-017. $58.00

(additional annual fee)

Building Bright Futures – Available only

for Autos & trucks less than 26,001 lbs.

$29.00 (additional annual fee)

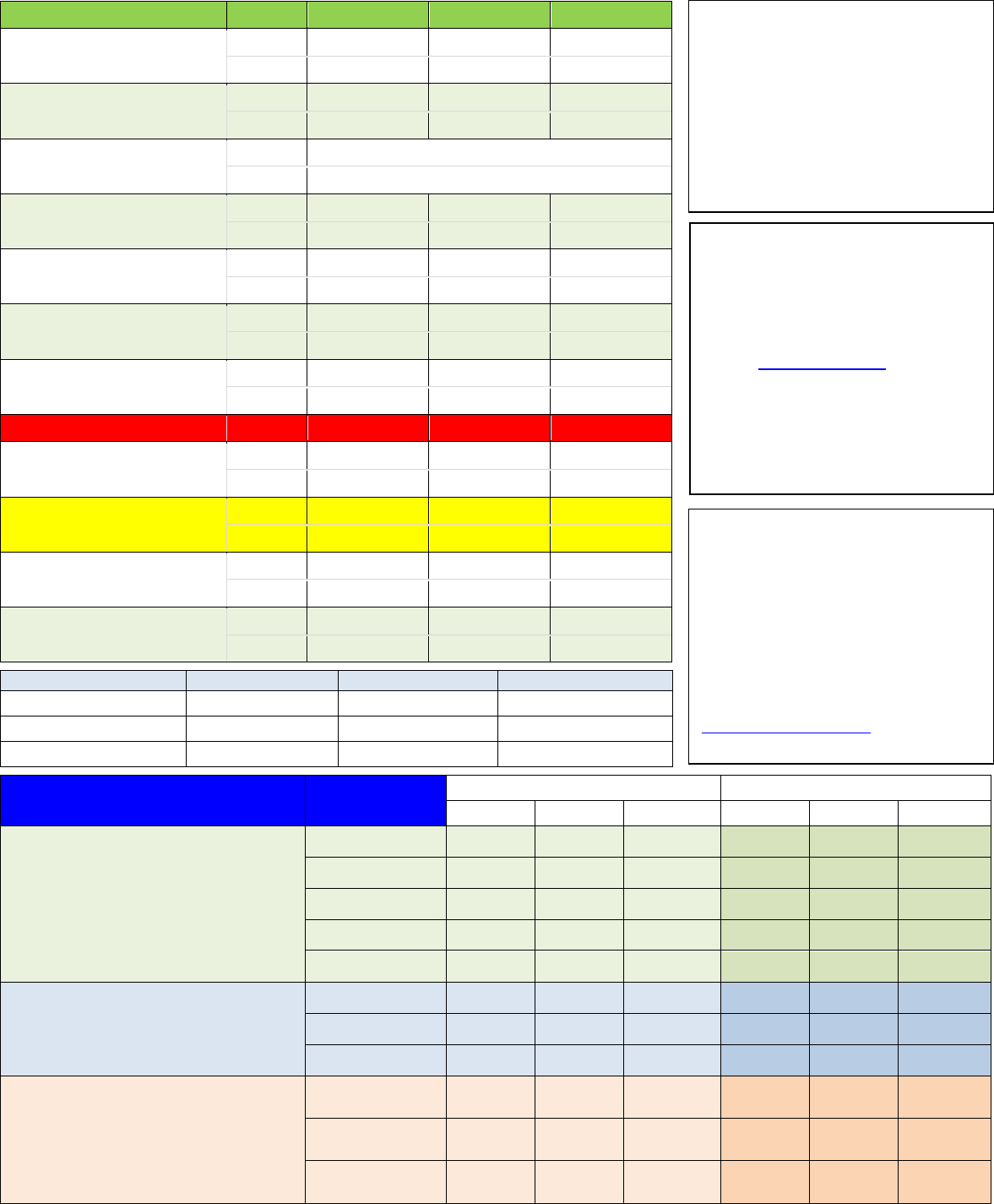

Type

Duration

Gas or Diesel

Electric

Other Fuel

Auto (Car)

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Antique/Exhibition (Limited

Use)

1 Year

$28.00

$26.00

$47.50

2 Years

$56.00 $52.00 $95.00

ATV

1 Year

$45.00

(all fuel types)

2 Years

$90.00 (all fuel types)

Jitney (Up to 7 Passengers)

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Motorcycle

1 Year

$58.00

$56.00

$100.00

2 Years

$116.00

$112.00

$200.00

Motor-Driven Cycle (Moped)

1 Year

$36.00

$34.00

$61.50

2 Years

$72.00

$68.00

$123.00

Motorhome

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Municipal & Volunteer

5 Years

$15.00

$15.00

$15.00

Off-Highway Tractor

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

School Bus

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Street Rod

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Trucks (up to 6,099 lbs.)

1 Year

$91.00

$89.00

$157.75

2 Years

$167.00

$163.00

$287.25

Trailers

One (1) Year

Two (2) Years

Five (5) Years

1,500 lbs. or less $33.00 $62.00 $165.00

1,501 lbs. or more $63.00 $123.00 $315.00

Contractor $237.00 $473.00 $1,185.00

Special Use Weight

One Year Registration

Two Year Registration

Gas

Diesel

Other

Gas

Diesel

Other

Agriculture

used only for the transportation of agricultural

products produced on, and material to be used

in connection with the operation of, a farm or

farms owned,

operated, or occupied by the

registrant

17,999 or less

$42.00 $42.00 $72.00 $84.00 $84.00 $144.00

18,000 – 26,000

$69.50 $63.00 $115.25 $139.00 $126.00 $230.50

26,001 – 34,999

$69.50 $69.50 $115.25 $139.00 $139.00 $230.50

35,000 – 60,000

$123.50 $123.50 $209.75 $247.00 $247.00 $419.50

60,001 – 80,000

$191.00 $191.00 $327.88 $382.00 $382.00 $655.76

Special Purpose Vehicles Category I –

Backhoe, Bucket Loader, Forklift, Grader, Street

Sweeper, Truck Shovel (Wheeled Excavator)

17,999 or less

$216.00 $216.00 $378.00 $432.00 $432.00 $756.00

18,000 – 26,000

$222.50 $216.00 $384.50 $445.00 $432.00 $769.00

26,001 – 80,000

$222.50 $222.50 $384.50 $445.00 $445.00 $769.00

Special Purpose Vehicles Category II –

Bituminous Distributor, Building Mover, Calcium

Chloride Distributor, Concrete Form Truck,

Concrete Pumper Truck, Floatation Applicator,

Permanently Mounted Well Drilling Machine, Road

Oiler, Truckcrane (Wrecker), Water Tanker (dust

control only), Well Driller Tender Truck

17,999 or less $500.00 $500.00 $875.00 $1000.00 $1000.00 $1,750.00

18,000 – 26,000 $506.50 $500.00 $881.50 $1,013.00 $1,000.00 $1,763.00

26,001 – 80,000

$506.50 $506.50 $881.50 $1,013.00 $1,013.00 $1,763.00

Veteran Plates (No additional fee).

Afghanistan, Air Medal, Bronze Star,

Disabled Veteran, Gold Star Family, Gulf

War, Iraq War, Korean War, POW,

Purple Heart, U.S. Veteran, Vietnam

War.

Additional documentation is required; for

more detail, see

dmv.vermont.gov/military

VD-119i 07/2024 MTC

Truck Registration Fees

Where applicable, the fees below include a $6.50 Non-

Transferable Fuel User Fee and a $2.00 Clean Air Fund Fee.

Loaded Weight Gas Diesel Other

Loaded Weight Gas or Diesel Other

UP TO 6,099 $91.00 $157.75

41,100 - 42,099 $1,436.18 $2,513.32

6,100 - 7,099 $130.00 $227.50

42,100 - 43,099 $1,463.18 $2,560.57

7,100 - 8,099 $148.00 $259.00

43,100 - 44,099 $1,490.18 $2,607.82

8,100 - 9,099 $190.00 $332.50

44,100 - 45,099 $1,517.18 $2,655.07

9,100 - 9,999 $211.00 $369.25

45,100 - 46,099 $1,544.18 $2,702.32

10,000 - 10,099 $253.53 $443.68

46,100 - 47,099 $1,571.18 $2,749.57

10,100 - 11,099 $274.53 $480.43

47,100 - 48,099 $1,598.18 $2,796.82

11,100 - 12,099 $294.53 $515.43

48,100 - 49,099 $1,625.18 $2,844.07

12,100 - 13,099 $343.53 $601.18

49,100 - 50,099 $1,651.18 $2,889.57

13,100 - 14,099 $366.53 $641.43

50,100 - 51,099 $1,690.18 $2,957.82

14,100 - 15,099 $389.53 $681.68

51,100 - 52,099 $1,717.18 $3,005.07

15,100 - 16,099 $412.53 $721.93

52,100 - 53,099 $1,744.18 $3,052.32

16,100 - 17,099 $462.53 $809.43

53,100 - 54,099 $1,772.18 $3,101.32

17,100 - 17,999 $487.53 $853.18

54,100 - 55,099 $1,799.18 $3,148.57

18,000 - 18,099 $494.03 $487.53 $864.55

55,100 - 56,099 $1,826.18 $3,195.82

18,100 - 19,099 $518.03 $511.53 $906.55

56,100 - 57,099 $1,853.18 $3,243.07

19,100 - 20,099 $543.03 $536.53 $950.30

57,100 - 58,099 $1,880.18 $3,290.32

20,100 - 21,099 $591.03 $984.53 $1,034.30

58,100 - 59,099 $1,907.18 $3,337.57

21,100 - 22, 099 $617.03 $610.53 $1,079.80

59,100 - 59,999 $1,934.18 $3,384.82

22,100 - 23,099 $643.03 $636.53 $1,125.30

60,000 - 60,099 $2,104.30 $3,682.53

23,100 - 24,099 $669.03 $662.53 $1,170.80

60,100 - 61, 099 $2,188.30 $3,829.53

24,100 - 25,099 $694.03 $687.53 $1,214.55

61,100 - 62,099 $2,216.30 $3,878.53

25,100 - 25,999 $720.03 $713.53 $1,260.05

62,100 - 63,099 $2,244.30 $3,927.53

26,000 $762.53 $756.03 $1,334.43

63,100 - 64,099 $2,272.30 $3,976.53

26,001 - 26,099 $762.53 $1,334.43

64,100 - 65,099 $2,300.30 $4,025.53

26,100 - 27,099 $788.53 $1,379.93

65,100 - 66,099 $2,328.30 $4,074.53

27,100 - 28,099 $813.53 $1,423.68

66,100 - 67,099 $2,357.30 $4,125.28

28,100 - 29,099 $839.53 $1,469.18

67,100 - 68,099 $2,385.30 $4,174.28

29,100 - 30,099 $865.53 $1,514.68

68,100 - 69,099 $2,413.30 $4,223.28

30,100 - 31,099 $908.53 $1,589.93

69,100 - 70,099 $2,441.30 $4,272.28

31,100 - 32,099 $934.53 $1,635.43

70,100 - 71,099 $2,535.30 $4,436.78

32,100 - 33,099 $960.53 $1,680.93

71,100 - 72,099 $2,564.30 $4,487.53

33,100 - 34,099 $986.53 $1,726.43

72,100 - 73,099 $2,593.30 $4,538.28

34,100 - 35,099 $1,013.53 $1,773.68

73,100 - 74,099 $2,622.30 $4,589.03

35,100 - 36,099 $1,039.53 $1,819.18

74,100 - 75,099 $2,651.30 $4,639.78

36,100 - 37,099 $1,065.53 $1,864.68

75,100 - 76,099 $2,680.30 $4,690.53

37,100 - 38,099 $1,091.53 $1,910.18

76,100 - 77,099 $2,709.30 $4,741.28

38,100 - 39,099 $1,118.53 $1,957.43

77,100 - 78,099 $2,738.30 $4,792.03

39,100 - 39,999 $1,144.53 $2,002.93

78,100 - 79,099 $2,767.30 $4,842.78

40,000 - 40,099 $1,357.18 $2,375.07

79,100 - 80,000 $2,796.30 $4,893.53

40,100 - 41,099 $1,409.18 $2,466.07

90,000 $3,171.30 $5,549.78

VD-119i 07/2024 MTC

If submitting by mail, send to Vermont DMV, 120 State Street, Montpelier, VT 05603. See DMV form# VD-119i for more detailed instructions.

Section 1

Enter all names and contact information. A physical address is required if the mailing address is a PO Box or Private Mailbox (i.e., UPS Store). If more than

two owners include a completed form VT-012 (Multiple Owners on Title).

Section 2

VIN Verification is required (using DMV form VT-010) for

• Vehicles with Salvage Documentation from any state, including

Vermont.

• Vehicles being titled under bond.

• Vehicles with registrations from any foreign country, including

Canada.

Trucks (including pick-up trucks) must include

• Number of Axles

• Brake Type

• Empty Weight (curb)

• Loaded Weight (GVW)

Trailers must include

• Empty Weight

• Length (in feet & inches)

• Width (in feet & inches)

Motorcycles and ATVs must include

• Cylinders

• Number of Wheels

• Power

• Power Type

Section 3

• Tenants by the Entirety/Spouses (TEN ENT) - Married couples (including Civil Unions), where property ownership is treated as though the couple

was a single legal person. Owners have a right of survivorship; if one owner dies, interest in the property will pass to the surviving owner

avoiding probate.

• Joint Tenants (JTEN) - Co-owners have a right of survivorship; if one owner dies, interest in the property will pass to the surviving owner

avoiding probate.

• Tenants in Common (TEN COM) - No right of survivorship; if one owner dies, interest in the property will be part of their estate.

• Business Partners (PTNERS) - No right of survivorship; if one owner dies, interest in the property will be part of their estate.

• Transfer on Death (TOD) – One owner only, DMV form VT-007 required.

Section 4

Enter the current odometer reading. A separate odometer disclosure statement is required if the vehicle is model year 2011 or newer.

Section 5

If the vehicle is financed, enter the lienholder information. If there is no loan, write “None.”

Section 6

Enter the seller details. The seller's signature is only required if no other bill of sale exists.

Section 7

Indicate the transaction type. If there is a current Vermont registration, enter the plate number. For new registrations, enter the desired plate type. Available

plate types include (additional form may be required for some)

• Agriculture (Farm Use)

• Air Medal

• Amateur Radio

• American Legion

• Antique

• ATV

• Bronze Star

• Building Bright Futures

• Conservation

• Disabled

• EMS

• Exhibition

• Firefighter

• Freemasons

• Gold Star Family

• Jitney/Rental

• Lions Club

• Motor Bus

• Motor Driven Cycle

(moped)

• Motor Home

• Municipal

• National Guard

• Off-Highway Tractor

• Pearl Harbor

• POW

• Purple Heart

• Rotary

• School Bus

• Sheriff

• Special Purpose Truck I

• Special Purpose Truck II

• State

• Street Rod

• Transporter

• Veteran

• Veteran, Afghanistan

• Veteran, Disabled

• Veteran, Gulf War

• Veteran, Iraq

• Veteran, Korea

• Veteran, Motorcycle

• Veteran, Vietnam

• Veteran, World War II

• VFW

• Volunteer

• VVA

Section 8

• Purchase Price - Amount paid for the vehicle.

• Credit for Trade - Amount the previous vehicle was sold for, to include trade value at dealer or private sale.

• JD Power Value – Unless sold by a Vermont Dealer or Licensed Out-of-State Dealer, tax is due on JD Power value. Visit mydmv.vermont.gov to

obtain value.

• Purchaser Information – if claiming trade credit, include details on the sale of the previous vehicle.

• ATV - If an ATV is purchased from a Dealer or Vermont-registered business, you must submit proof of tax paid. No tax is due if an ATV is purchased

in a casual sale (person to person).